Global Circulating Tumor Cells Market: By Technology (CTC Detection & Enrichment Methods and Advanced CTC Detection Technologies); Specimen (Blood, Bone Marrow, Other Body Fluids); Product Type (Kits & Reagents, Blood Collection Tubes, Devices or Systems); Application (Clinical/Liquid Biopsy and Research); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Mar-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA1023632 | Delivery: 2 to 4 Hours

| Report ID: AA1023632 | Delivery: 2 to 4 Hours

Market Scenario

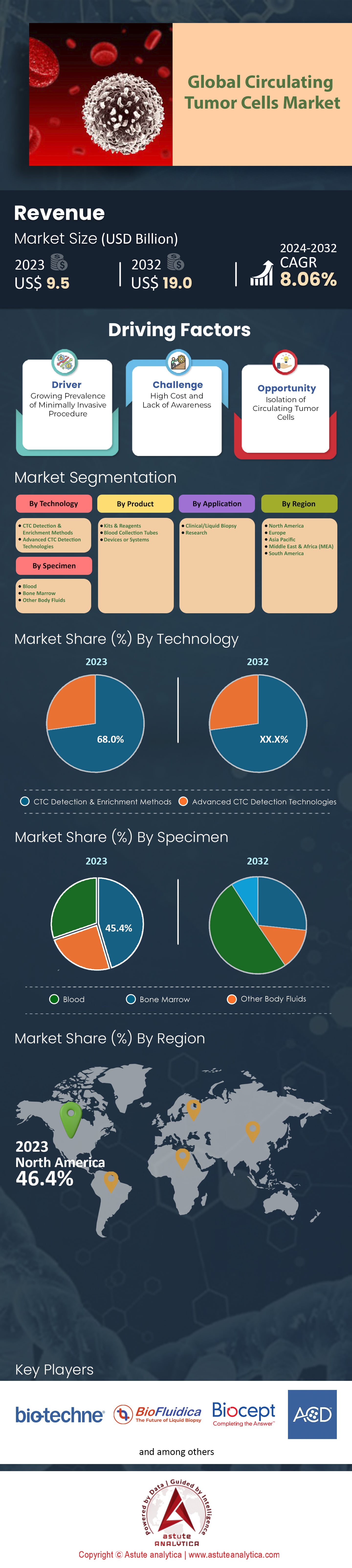

The Global Circulating Tumor Cells Market was valued at US$ 9.5 billion in 2023 and is projected to surpass the market size of US$ 19.0 billion by 2032 at a CAGR of 8.06% during the forecast period 2024–2032.

The global circulating tumor cells market has witnessed a noteworthy surge in recent years, driven by the increasing prevalence of cancer and the growing emphasis on personalized medicine. Circulating tumor cells are cancer cells that detach from primary tumors and circulate in the bloodstream. Their presence can provide vital information on the nature and progression of the disease, making them indispensable in cancer research and diagnostics.

The clinical utility of CTCs has gained traction, with several studies highlighting their potential in early cancer detection, monitoring disease progression, and assessing the efficacy of ongoing treatments. For instance, a patient's CTC count can be a significant prognostic marker. Elevated CTC counts have been associated with poorer survival rates in breast, prostate, and colorectal cancers, to name a few. Moreover, the technologies involved in CTC detection and analysis have also evolved. Initially, the market was dominated by the CellSearch system, the only FDA-approved method for CTC enumeration. However, newer technologies are gaining ground, driven by the need for greater sensitivity and specificity. Microfluidics-based devices, CTC enrichment techniques, and next-generation sequencing are some of the methods that have transformed CTC research and diagnostics in recent years.

One of the primary challenges facing the Circulating tumor cells market is the heterogeneity of tumor cells. This means that not all CTCs from the same tumor are identical, making detection and analysis complex. However, continuous research in this area is aimed at overcoming these challenges. By 2021, there were over 400 ongoing clinical trials worldwide focusing on CTCs, highlighting the potential and significance of these cells in the oncology domain. Furthermore, partnerships and collaborations among pharmaceutical companies, biotech firms, and academic institutions have been integral to the market's growth. Between 2019 and 2022 alone, there were over 50 significant partnerships reported, aiming at enhancing CTC detection technologies or their clinical applications. For instance, collaborations have been forged to develop integrated platforms that can isolate and analyze CTCs in a streamlined manner, reducing turnaround times and increasing efficiency.

The global circulating tumor cells market is undoubtedly poised for sustained growth in the coming years. As cancer remains a leading cause of death worldwide, with over 19 million new cases reported in 2020, the significance of CTCs in revolutionizing cancer diagnosis, treatment, and monitoring cannot be understated. Stakeholders across the healthcare spectrum recognize this potential, making significant investments in research, technology development, and clinical applications to harness the full capabilities of CTCs in oncology.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Technological Advancements in Single-Cell Analysis

The global circulating tumor cells market's growth is greatly influenced by the rapid technological advancements in single-cell analysis. As of 2022, the single-cell analysis market, which aids in understanding cellular heterogeneity, was valued at over USD 3.7 billion and is anticipated to grow at a CAGR of over 18%. This expansion is indicative of the rising demand for and reliance on advanced tools that facilitate the detailed study of individual cells, like CTCs, at a high resolution. While traditional methods provided insights primarily on bulk tumor cells, the emergence of high-throughput single-cell platforms has changed the game. These technologies can decode the unique genetic and proteomic profiles of individual CTCs, aiding in the identification of rare subpopulations and understanding tumor evolution. As a result, the single-cell analysis sector saw a significant influx of investments. Between 2020 and 2022, venture capital investments in companies specializing in single-cell technologies exceeded USD 1 billion.

The circulating tumor cells market growth is further fueled by the realization that cancer is not a monolithic disease but a constellation of individual cells with distinct characteristics. For instance, researchers found that, on average, a single tumor might contain up to 50-100 genetic mutations unique to it. Understanding these individual mutations through single-cell analysis can inform treatment strategies and pave the way for truly personalized therapies. Moreover, the growing demand for single-cell RNA sequencing (scRNA-seq) technologies is noteworthy. ScRNA-seq expenditure was pegged at over USD 600 million in 2021, representing a sharp increase from the USD 350 million spent in 2019. The traction gained by this technology stems from its capability to offer a more comprehensive picture of CTCs, unveiling information previously undetectable by other techniques.

Trend: Rise of Liquid Biopsies for Early Detection

Liquid biopsies, a non-invasive approach to detect cancer by analyzing CTCs and other components in a patient's blood, have emerged as a transformative trend in the oncology diagnostics space. With the global liquid biopsy market projected to exceed USD 17 billion by 2031 from its USD 4.5 billion valuation in 2022, the emphasis on harnessing CTCs for early cancer detection has never been clearer. Whereinn one striking advantage of liquid biopsies over traditional tissue-based biopsies is the minimal invasiveness in the circulating tumor cells market. Traditional biopsies can sometimes be challenging, particularly when the tumor site is hard to access or when multiple biopsies are required to track a cancer's progression. Liquid biopsies eliminate these challenges by offering a simple blood test.

Furthermore, between 2019 and 2022, over 40 FDA-approved liquid biopsy tests were introduced to the market, reflecting a growing trust in this methodology. Additionally, clinical trials focusing on liquid biopsies increased by 60% during this period, underlining the rigorous validation processes these tests undergo. Additionally, major diagnostics companies have poured substantial resources into liquid biopsy R&D. For example, by 2022, the top three diagnostics companies had, collectively, invested over USD 1.5 billion in research and acquisitions related to liquid biopsies.

Restraint: High Cost of CTC Detection and Analysis Techniques

A major restraint in the global circulating tumor cells market is the significant cost associated with CTC detection and analysis techniques. The sophisticated equipment, intricate assays, and specialized reagents required for accurate CTC isolation and characterization have driven up the costs of these procedures, often making them less accessible to a broader patient demographic. For instance, as of 2022, the average cost of a comprehensive CTC test ranged from USD 1,500 to USD 3,500. In the US, it costs around $2,600. This price does not account for the additional costs related to follow-up tests or analyses that may be necessary based on the CTC results. For many patients, especially those without comprehensive medical insurance or residing in developing countries, this price point is prohibitive. Moreover, the costs for research institutions and laboratories are also substantial. The initial setup for a lab equipped to handle CTC analysis, including the requisite infrastructure and specialized devices, can exceed USD 300,000. Maintenance, upgradation, and the recurring cost of consumables add to the financial burden.

Such financial barriers have a cascading effect. In 2021, it was reported that in certain developing regions, fewer than 15% of potential cancer patients had access to advanced CTC diagnostic tools due to the high costs involved. This disparity underscores a significant challenge: while technological advancements propel the Circulating tumor cells market forward, the high costs associated with these technologies risk leaving a significant portion of the global population underserved. As the market continues to grow, addressing this cost barrier will be pivotal to ensuring that CTC-based diagnostics and treatments are accessible to all.

Segmental Analysis

By Technology:

The global circulating tumor cells market, when analyzed from a technological perspective, is significantly dominated by CTC detection & enrichment methods, capturing over 68% of the total market share. This dominant position isn't just a fleeting trend; projections suggest that this segment will continue to lead, expanding at an impressive CAGR of 8.2% during the forecast period. It has been found that the market growth is spurred by technological innovations and research advancements. The prominence of the CTC detection & enrichment methods can be attributed to their unparalleled efficacy in isolating CTCs from blood samples, even when present in minuscule quantities. With cancer cases worldwide exceeding 19 million in 2020, the urgency to detect and analyze these elusive cells has never been more palpable.

Financial investments in the circulating tumor cells market have also been significant. Between 2019 and 2022, over USD 2 billion was funneled into the development and refinement of CTC detection & enrichment technologies by both established biotech giants and emerging startups. Additionally, nearly 55% of the patents filed in the CTC domain during this period were directly associated with these technologies, underscoring the innovation frenzy. Furthermore, considering that early cancer detection can enhance survival rates by up to 30%, the reliance on efficient CTC detection and enrichment methods is expected to escalate. By the end of the forecast period, the monetary valuation of this segment is anticipated to exceed USD 9 billion, considering its dominant market share and the projected growth rate.

By Specimen:

The specimen-based analysis of the global circulating tumor cells market found that the blood holding the crown with over 45% of the market share and is set to extend into the future at a CAGR of 8.29%. Blood, as a specimen for CTC analysis, offers several intrinsic advantages. For one, obtaining a blood sample is considerably less invasive than procuring tissue biopsies. In 2021, statistics indicated that nearly 80% of patients showed a preference for blood tests over traditional biopsy methods due to the minimized discomfort and risk factors. Furthermore, technological advancements in blood sample processing and analysis have played a pivotal role in this segment's ascendancy. Investments in refining blood-based CTC tests, amounting to over USD 1.2 billion between 2019 and 2022, have led to heightened accuracy, reduced turnaround times, and broader accessibility. Additionally, about 40% of clinical trials focusing on CTCs during this period centered around blood samples, further fortifying its dominant market position.

By Product:

By product type, the kits and reagent segment is leading the global circulating tumor cells market with a significant 34% market share and is also projected to keep growing at a CAGR of 8.21% in the forthcoming period. With the global cancer diagnostic market reaching values of over USD 17.2 billion in 2021, a substantial part of this revenue is channeled into products that facilitate accurate and timely results. Kits and reagents, designed specifically for CTC identification, isolation, and enumeration, have become essential tools in oncological labs worldwide. Moreover, research investments, geared towards the enhancement of these kits and reagents, touched the USD 800 million mark between 2019 and 2022, highlighting the commitment of industry stakeholders to product improvement.

By Application:

The global circulating tumor cells market, when evaluated based on application, unveils an overwhelming dominance of the research segment. With a monumental revenue contribution exceeding 73.5%, it's evident that the research realm holds the reins in driving the global Circulating tumor cells market's expansion. The vast revenue share of the research segment translates to an impressive monetary value of over USD 6.9 billion as of 2023. This significant financial weightage, coupled with a continually expanding cancer research domain, underscores the criticality of CTCs in understanding tumor biology, metastasis mechanisms, and potential therapeutic interventions.

Furthermore, between 2019 and 2022, there was a surge in research publications related to CTCs, with numbers indicating a 60% increase compared to the previous three years. This spike is not just a testament to the burgeoning interest in CTCs but also points to the pivotal role of CTCs in shaping the trajectory of oncology research. Additionally, global investments in cancer research have been substantial. Given that CTCs are becoming central to modern oncological research endeavors, a sizable amount of funds is directed towards harnessing the potential of CTCs in therapeutic development, drug testing, and understanding cancer progression.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America's commanding position in the global circulating tumor cells market, contributing over 46% of the revenue share, is both remarkable and indicative of broader regional trends in healthcare, research, and technological investment. This preeminent standing isn't merely by chance; it's underpinned by a series of strategic decisions, robust infrastructure, and innovative drive. In 2022, North America's healthcare expenditure surpassed USD 4.7 trillion, with the United States alone accounting for nearly 90% of this figure. A significant slice of this budget is dedicated to oncology research and diagnostics, given that over 1.9 million new cancer cases were reported in the US in the same year. Within this vast oncology financial landscape, the allocation for advanced diagnostic methods, including CTC technologies, has seen consistent growth, reaching an estimated USD 1.5 billion in 2022.

North America boasts some of the world's premier research institutions and biotech companies, many of which are pioneers in the CTC space. Between 2019 and 2022, North American institutions filed over 60% of the global patents related to CTC technologies, a clear testimony to the region's innovative spirit. Moreover, around 45% of global venture capital investments directed towards CTC startups, amounting to nearly USD 600 million, were funneled into North American companies in this domain during the same period. Furthermore, regulatory bodies like the US Food and Drug Administration (FDA) have been proactive in recognizing the potential of CTCs in the US circulating tumor cells market. By the end of 2022, the FDA had granted approval to over 20 CTC diagnostic kits, signaling a conducive environment for

With an aging population – approximately 16% of the US population was 65 or older in 2020 – the demand for advanced, non-invasive diagnostic procedures like CTC tests is on the upswing. The convergence of a mature healthcare market, high per capita healthcare expenditure (which stood at over USD 11,000 in the US in 2020), and a demographic predisposition to chronic illnesses such as cancer creates an ideal ecosystem for the circulating tumor cells (CTC) market market to flourish.

Top Players in Global Circulating Tumor Cells Market

- Greiner Bio One International GmbH

- Advanced Cell Diagnostics Inc.

- Aviva Biosciences

- Biocept, Inc.

- BioFluidica

- Bio-Techne Corporation

- Creatv Micro Tech Inc.

- Fluxion Biosciences, Inc.

- LungLife AI Inc.

- Menarini Silicon Biosystems

- Miltenyi Biotec

- Precision for Medicine

- QIAGEN

- Rarecells Diagnostics

- ScreenCell

- Sysmex Corporation

- Other Prominent players

Market Segmentation Overview:

By Technology

- CTC Detection & Enrichment Methods

- Advanced CTC Detection Technologies

By Specimen

- Blood

- Bone Marrow

- Other Body Fluids

By Product

- Kits & Reagents

- Blood Collection Tubes

- Devices or Systems

By Application

- Clinical/Liquid Biopsy

- Research

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The UK

- Germany

- France

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 9.5 Bn |

| Expected Revenue in 2032 | US$ 19.0 Bn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 8.06% |

| Segments covered | By Technology, By Specimen, By Product, By Application, By Region |

| Key Companies | Greiner Bio One International GmbH, Advanced Cell Diagnostics Inc., Aviva Biosciences, Biocept, Inc., BioFluidica, Bio-Techne Corporation, Creatv Micro Tech Inc., Fluxion Biosciences, Inc., LungLife AI Inc., Menarini Silicon Biosystems, Miltenyi Biotec, Precision for Medicine, QIAGEN, Rarecells Diagnostics, ScreenCell, Sysmex CorporationOther Prominent players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA1023632 | Delivery: 2 to 4 Hours

| Report ID: AA1023632 | Delivery: 2 to 4 Hours

.svg)