Global Chemical Warehousing Market: Analysis by Type (Specialized Warehouse and General Warehouse); Chemical Class (Explosives, Flammable liquids and solids, Gases, Oxidizers, Poisons, and Corrosives); Product (Petrochemical, Consumer Chemicals, Synthetic Rubber, Agrochemicals, Polymer and Plastic, Construction Chemicals, Textile Chemicals, Other Chemical Types); Service Providers (Third Party and In House); Application (Designing, Remodeling, Equipping, Installation, and Documentation); Industry (Pharmaceutical Industry, Agriculture Industry, Food Industry, Chemical Industry, and Others); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 25-Mar-2024 | | Report ID: AA0324801

Market Scenario

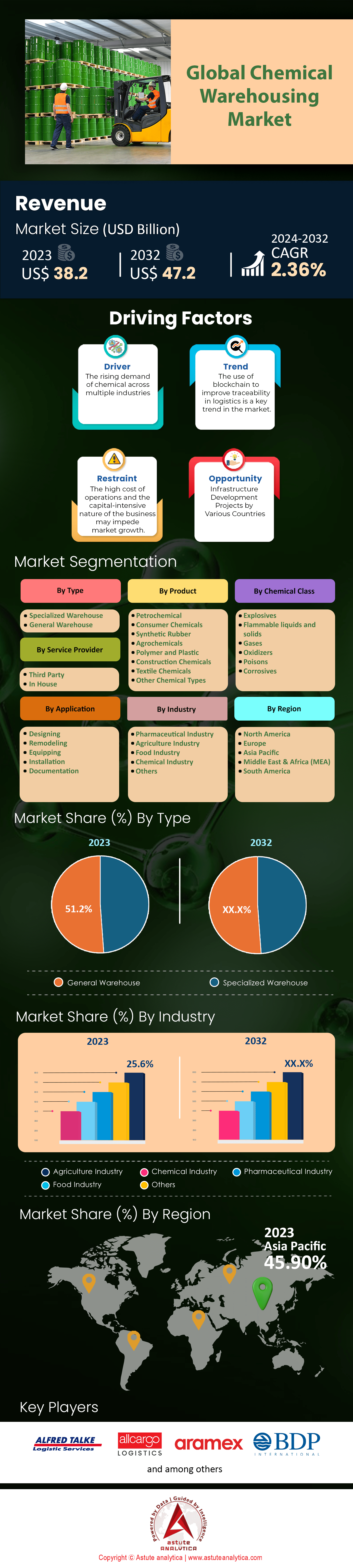

The Global Chemical Warehousing Market was valued at US$ 38.2 billion in 2023 and is projected to hit the market valuation of US$ 47.2 billion by 2032 at a CAGR of 2.36% during the forecast period 2024–2032.

The global chemical warehousing market is a dynamic and complex sector, influenced by a myriad of factors ranging from international trade impacts to regulatory changes. It ranges from impacts made by international trade to changes in regulations over time. This market is broken down into two main segments: general warehouse and specialty chemicals warehouse. As of 2023, the general chemical warehouse segment takes up a large majority of space with a significant share of 51.2% in the global market. However, it’s not the biggest piece of the pie anymore since the specialized segment is projected to grow at an astonishing rate of 3.5%. All this means is that there's an increasing demand for storage solutions for chemicals and these businesses are doing their best to fulfill it. Regulatory bodies like OSHA play a huge role in shaping how these companies can operate and practice their craft safely.

There are several key players contributing to this global chemical warehousing market including ALFRED TALKE GmbH and Co. KG, AP Moller Maersk AS, Aramex International LLC, C.H. Robinson Worldwide Inc., Capital Resin Corp., CMA CGM SA, Deutsche Bahn AG, Deutsche Post AG, DSV Panalpina AS, FedEx Corp., and Goodrich Maritime Services Pvt.

A big driver for growth in this sector has been the need for specialty chemicals and petrochemicals in places like India or China where economies are developing rapidly. With international trades being made daily in these countries there needs to be efficient and safe storage solutions ready on hand when they arrive at their destination so there isn't any delay moving forward with projects. The rise in this type of trading has made way for more necessary spaces for chemical storage throughout many industries besides just pharmaceuticals which are obviously some of the most crucial places for safe storage.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rapid Growth in globalization and e-commerce on the chemical warehousing industry

Globalization has lead to an increase in the trade of chemical products around the world. The demand for logistics, distribution, and warehousing services has skyrocketed with this, causing companies to be resourceful and efficient as possible to make things work. This has expanded supply chains on an international level requiring more space for a wider array of chemicals being traded in the chemical warehousing market. This expansion and requirement for safe storage facilities have not only complicated these operations but also made them more expensive. Alongside this is the need to adhere to government regulations which have caused some companies to seek outside help from warehouse experts who are familiar with these regulations and can ensure safety through compliance.

Aside from the chemical industry, e-commerce has also had its toll on warehouses across the globe. With e-commerce comes faster shipping speeds which requires faster processing times in warehouses. Warehouse managers are turning towards technology solutions such as goods flow automation, digital twin solutions, and leveraging data to replicate asset conditions amongst many others. By implementing these technologies, they aim to reduce costs by improving efficiency throughout their operations. Furthermore, stocking inventory based on actual customer demand rather than anticipated future demand (Just-in-time fulfillment) allows businesses to cut carrying costs and improve cash flow as well as reduce environmental waste by reducing excess inventory sitting in warehouses waiting to be sold.

Trend: 3PLs Becoming the Answer to Complex Chemical Logistics

Chemical warehousing is no easy feat, especially in the age of globalization and e-commerce. So unsurprisingly, companies are starting to outsource their storage and logistics needs to third-party logistics providers (3PLs) more often in the global chemical warehousing market. 3PLs are experts at storing hazardous materials, managing them well can reduce costs and risks for businesses. Safety regulations can be tricky too, but 3PLs know them inside out which makes it easier for companies to stay compliant as they change. That’s not all—these providers optimize transportation using their networks, scales and technology. A recent study found that outsourcing these services resulted in an average of 15% savings in logistics costs for chemical companies.

With the side burdens taken care of by a third party, companies in the chemical warehousing market can focus on what they’re good at again. Not only do they offer this advantage though—they also help businesses expand storage and logistics capacity quickly when trade volumes go up or e-commerce sales spike. For established companies trying to break into new international markets, 3PLs also provide really useful local knowledge that isn’t easy to come by anywhere else. And with the sector growing at a rate of 10% annually over the past five years overall, people seem to be happy with what they have.

Challenge: The High Cost of Compliance in Chemical Warehousing

Constructing and maintaining chemical warehouses is a large expense, given the need for specialized technology and infrastructure to ensure safety. Traditional warehouses don't come close when it comes to handling hazardous materials. There are many factors that go into building a safe warehouse like construction materials resistant to corrosion or chemical leaks, advanced ventilation systems, fire suppression, and containment areas. These can be costly additions. Additionally real-time monitoring systems that measure temperature, humidity and gas detection as well as software designed specifically for inventory management of hazardous materials is crucial for operation.

On top of this, the facilities themselves need regular maintenance and meticulous inspections to ensure everything stays up to code. This only adds to other operational costs throughout the lifespan of the warehouse. The risks associated with storing dangerous materials also leads to higher insurance premiums which can become another burden financially. Lastly there are the location expenses that just add insult to injury; these warehouses need specific industrial zoning where land prices aren’t cheap at all. A recent report found that on average building a new midsize chemical warehouse facility in America cost around $15 million dollars.

Segmental Analysis

By Type

General warehousing presently holds the lion's share of the global chemical warehousing market, responsible for over 51.1% of revenue in 2023. This suggests that a significant portion of chemicals is stored in facilities designed for a broader range of goods, where safety standards may be less tailored to the specific risks posed by hazardous materials. However, the landscape is rapidly shifting in favor of specialized chemical warehousing. This segment is projected to experience the most significant growth with a CAGR of 3.5% through 2032. This accelerated expansion highlights the industry's response to evolving regulations and a heightened focus on safety within chemical supply chains.

The demand for specialized chemical warehousing market is further fueled by the growth of industries reliant on potentially dangerous chemicals, such as pharmaceuticals and agrochemicals. These sectors often require stringent temperature control, advanced monitoring systems, and handling protocols that align with their specific chemical inventory. Additionally, a recent industry analysis revealed that investment in specialized chemical warehousing offers higher returns over time compared to general warehousing, with a projected ROI difference of nearly 8% over a 5-year period. This financial incentive, coupled with the need for compliance and risk mitigation, underpins the strong growth trajectory of the specialized chemical warehousing segment.

By Product

The agrochemical segment is taking the lead when it comes to products in the global chemical warehousing market. It currently holds a 24.02% share and isn't letting go anytime soon. The increasing reliance on these chemicals to enhance crop yield and quality has only made this segment stronger over time. And as long as there's a demand for food, that’ll continue to be the case. As for the future, this segment is expected to grow at the highest CAGR of 2.78%. Its growth shows no signs of slowing. Specialty needs make agrochemical storage more difficult than other segments, but those challenges aren't harming its ability to capitalize on increasing demand. Regulations are strict in this space due to worker safety and environmental contamination concerns, so compliance is crucial moving forward.

The agrochemical segment’s growth relies heavily on advancements in farming practices and precision agriculture adoption too. With these trends on their side, they’re able to provide an even larger range of agrochemicals. Such a wide variety naturally creates the need for safe storage environments. They also have international trade working in their favor — globalization has hit the industry hard (in a good way). This means import and export rates have gone up significantly in some regions with intense agricultural activities. There doesn’t appear to be any force strong enough to slow down agrochemical storage’s reign in the global chemical warehousing market right now — not that any businesses would want that in the first place.

By Chemical Class

Based on chemical class, flammable liquids and solids are donning more than 25.8% market share. These substances are widely used in a plethora of industries including manufacturing, construction, energy, and many others. The growth potential for this segment is also considerable, projected to have a highest CAGR of 2.64% during the forecast period — higher than any other segment.

The reasons for such anticipated growth in the chemical warehousing market are several, but there seems to be a common thread: demand. More industrial activity in developing economies calls for flammable solvents, fuels and raw materials which increases demand across the board. There’s also an uptick in specialized products like paints, adhesives and coatings that require these chemicals. Stricter regulations cranking down on handling and storage further necessitate specialized warehousing with enhanced fire safety systems and spill containment measures among other things. According to an industry survey, over 70% of chemical companies plan on investing more into flammable materials storage infrastructure within the next three years so it seems like demand will only continue to rise.

By Service Providers

Specialized 3PLs hold the throne in the global chemical warehousing market, making up for a generous 66.0% of the pie by 2023. They’re also projected to rapidly expand at a CAGR of 2.41% through to 2032. This rise demonstrates how much the industry has come to rely on outsourced storage and logistics services. These days, Third-party logistics providers have vast knowledge about dealing with hazardous chemicals and mastering complicated safety regulations all over the world. In other words, they’ve grown comfortable with risks and compliance which allows them to offer tremendous peace of mind for companies.

There are several reasons why companies are turning to third-party providers. The first being that they have an unmatched level of expertise in handling dangerous chemicals. This means they can navigate complex safety regulations with ease and mitigate risks more effectively than other companies might be able to. Along with this, their knowledge also ensures compliance is met at all times, leaving companies with peace of mind. Economies of scale are another benefit that third-party providers bring to businesses, particularly when it comes to negotiating rates. By pooling multiple clients together, they can optimize transportation routes and negotiate better rates overall. This also allows them to invest in advanced warehousing technologies which generally result in cost savings across the board.

Flexibility and scalability are key factors for many businesses in the chemical warehousing market looking to partner with third-party providers. With globalization constantly evolving supply chains and e-commerce reshaping business practices, it can be difficult for firms to manage this on their own terms. However, thanks to their ability to adjust storage capacity and transportation networks in response to demand fluctuations, third-party providers make it easier for firms like these. Today, expanding businesses need all hands-on deck — quite literally — when moving into new markets. That’s why established 3PLs who already have a global footprint are so valuable; they provide local knowledge of customs procedures and regulations which can save companies a huge amount of time and money when attempting expansion activities from scratch themselves.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific is the largest chemical warehousing market across the globe and accounts for more than 45.90% of the overall share in revenue. Rapid industrial growth in this region has increased the demand for chemicals used in manufacturing, construction, and automotive industries. The Asia Pacific region was responsible for almost 40% of the global manufacturing value added in 2023, as said by United Nations Industrial Development Organization (UNIDO). That means there’s a lot of chemicals being stored. But it doesn’t stop there. According to International Council of Chemical Associations (ICCA), over 60% of global chemical sales happened in this region with China alone contributing over 35%. Astute Analytica’s recent report says that from 2024 to 2032, the region is likely to witness a growth in the chemical industry at a CAGR of 5.6%, expecting high demand for storing these chemicals safely and efficiently.

Asia Pacific’s lead gets even larger when examined how many facilities are built here compared to other regions globally. This area is also known as a global trade hub because it accounted for over 60% of the world’s seaborne trade volume in 2023 according to The World Trade Organization (WTO). Allowing import and export on a mass scale, increasing chemical storage needs.

China and India two countries within this dominant chemical warehousing market have some of the largest agricultural economies in the world. Food and Agriculture Organization (FAO) estimates that Asia pacific represents over half or roughly 60% of global agriculture.

Top Players in Global Chemical Warehousing Market

- Agility Chemical Logistics

- ALFRED TALKE GmbH and Co. KG

- Allcargo Logistics Ltd.

- AP Moller Maersk AS

- Aramex International LLC

- BDP International

- Bertschi AG

- Bulk Liquid Solutions

- Bulkhaul Limited

- C.H. Robinson Worldwide Inc.

- Capital Resin Corp.

- CEVA Logistics

- CMA CGM SA

- CT Logistics

- Den Hartogh Logistics

- Deutsche Bahn AG

- Deutsche Post AG

- DSV Panalpina AS

- FedEx Corp.

- Goodrich Maritime Services Pvt. Ltd.

- Gruber Logistics

- HAZGO Chemical Logistics

- Howard Tenens

- HOYER GmbH

- HOYER Petrolog - Hoyer Group

- IBC Limited

- InterBulk Group

- KEMITO

- Kuehne Nagel Management AG

- LBC Tank Terminals

- Leschaco Group

- Nijhof-Wassink

- Nippon Express Holdings Inc.

- Omni Logistics LLC

- Rhenus SE and Co. KG

- S.F. Holding Co. Ltd.

- Singapore Post Ltd.

- SolvChem Inc

- Stolt-Nielsen Limited

- Suttons Group

- Tricon Energy Inc.

- Van den Bosch Transporten B.V.

- Van Oordt PortionPack Solutions B.V.

- VTG AG

- Other Prominent Players

Market Segmentation Overview:

By Type

- Specialized Warehouse

- General Warehouse

By Product

- Petrochemical

- Consumer Chemicals

- Synthetic Rubber

- Agrochemicals

- Polymer and Plastic

- Construction Chemicals

- Textile Chemicals

- Other Chemical Types

By Chemical Class

- Explosives

- Flammable liquids and solids

- Gases

- Oxidizers

- Poisons

- Corrosives

By Service Provider

- Third Party

- In House

By Application

- Designing

- Remodeling

- Equipping

- Installation

- Documentation

By Industry

- Pharmaceutical Industry

- Agriculture Industry

- Food Industry

- Chemical Industry

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)