Carbon Fiber in Wind Turbine Rotor Blade Market: By Type (Regular Tow Carbon Fiber and Large-Tow Carbon Fiber); Blade Size (<27 meter, 27-37 meter, 38-50 meter, 51-75 meter, 76-100 meter, and 100-200 meter); Application (Spar Cap, Leaf Root, Skin Surface, and Others); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 03-Nov-2025 | | Report ID: AA0623474

Market Snapshot.

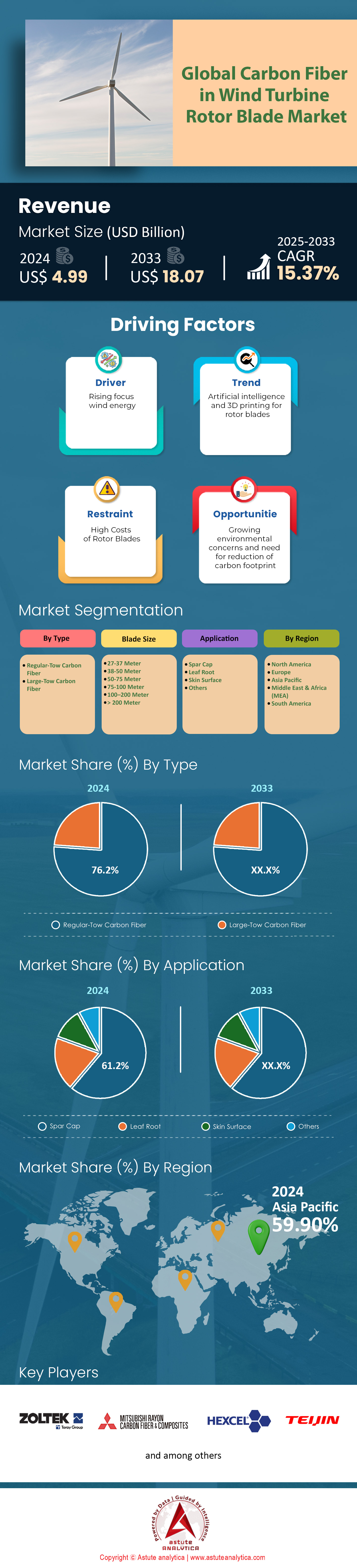

Carbon fiber in wind turbine rotor blade market was valued at US$ 4.99 billion in 2024 and is projected to attain a market valuation of US$ 18.07 billion by 2033 at a CAGR of 15.37% during the forecast period 2025–2033.

Key Findings

- Based on type, regular-tow carbon fiber accounted for over 76.2% of the market revenue.

- By blade size, the 51–75-meter blade size dominates the global carbon fiber in wind turbine rotor blade market.

- Based on application, carbon fiber in wind turbine rotor blade is heavily used in spar cap and accounted for more than 61.2% of the market revenue.

- Asia Pacific is controlling the lion’s share of over 61.60% in global market.

A significant surge in requirements for advanced composites is directly linked to the unprecedented growth in global wind installations. In fact, the sector achieved a record 121.6 GW of new capacity in 2024, comprising 109.9 GW onshore and 11.7 GW offshore. Consequently, the average turbine capacity rose to 4.5 megawatts, necessitating longer and more efficient blades. Designs now regularly exceed 80 meters, a scale where lightweight materials are absolutely critical. Utilizing carbon fiber, for example, saves about 15 tons in a 100-meter blade. Moreover, the U.S. offshore pipeline alone had 4,097 MW under construction as of mid-2024, signaling robust future material needs.

In response, industry suppliers in the carbon fiber in wind turbine rotor blade market are rapidly scaling up to meet these escalating requirements. Global carbon fiber production surpassed 140,000 metric tons in 2024, while the PAN-based carbon fiber market volume is forecast to reach 104,400 tons. Specifically, key players like Toray are increasing their annual capacity to 35,000 metric tons starting in 2025. Furthermore, new projects are coming online, including a Chinese facility with an annual capacity for 12,000 tons of large-tow carbon fiber. Stakeholders must, however, navigate volatile raw material costs, with PAN prices in the USA projected to reach 2423 USD per metric ton in Q2 2025.

Simultaneously, the end-of-life market is creating a secondary demand cycle for recycling and repurposing solutions in the carbon fiber in wind turbine rotor blade market. An estimated 25,000 tons of blades will be retired annually in Europe by 2025, with over 40,000 turbines globally reaching their operational end by 2030. To address this, dedicated facilities are emerging, such as a Spanish plant with the capacity to process 10,000 tons of blades per year. A project in South Africa, which is set to create 20,000 jobs, further underscores the significant global investment occurring across the entire wind energy lifecycle.

To Get more Insights, Request A Free Sample

Pioneering Materials And Processes Redefine The Future Of Wind Blade Manufacturing

- A transformative opportunity is emerging with the industry’s shift towards thermoplastic carbon fiber composites. Unlike traditional thermoset materials, thermoplastics can be welded and reformed, which, in turn, enables far more effective recycling processes. This innovation directly addresses the critical end-of-life challenges and facilitates a circular economy for wind blades. Furthermore, thermoplastic composites offer significantly faster manufacturing cycles and lower energy consumption during production. Consequently, their adoption presents a clear path to more cost-effective operations and enhanced blade durability for players in the Carbon fiber in wind turbine rotor blade market.

- In addition, advanced pultrusion techniques for manufacturing carbon fiber spar caps are creating another major growth pathway. Pultrusion allows for the continuous production of composite profiles with an exceptionally high and consistent fiber volume fraction. As a result, the final components exhibit superior stiffness and fatigue resistance. This automated process is also substantially faster and more reliable than conventional resin infusion methods. Therefore, investing in pultrusion technology offers a distinct competitive advantage, enabling the production of longer, stronger, and more aerodynamically efficient blades at a higher throughput within the carbon fiber in wind turbine rotor blade market.

Demand-Defining Aspects Analysis

Colossal Offshore Turbines Drive Unprecedented Demand For High-Strength Carbon Composites

The relentless pursuit of greater energy output from offshore installations is fundamentally shaping material requirements in the Carbon fiber in wind turbine rotor blade market. Specifically, next-generation turbines, such as the Vestas V236-15.0 MW, now feature rotor diameters exceeding an immense 236 meters. Moreover, the individual blades for these massive structures can span over 115 meters in length. These colossal dimensions, in turn, necessitate materials that offer an exceptional stiffness-to-weight ratio. Indeed, the swept area of a single 15 MW turbine can now cover more than 43,000 square meters. Consequently, managing the immense aerodynamic and gravitational loads becomes a primary engineering challenge.

Furthermore, the operational and logistical requirements for these turbines underscore the critical need for advanced composites. Blade tip speeds on these models, for instance, can exceed 300 kilometers per hour, while the supporting towers reach heights of over 150 meters. The enormous monopile foundations alone can weigh up to 2,000 metric tons. In addition, installation requires specialized vessels with crane capacities now exceeding 3,000 tons. The sheer scale is evident in projects like Dogger Bank, which will feature nearly 277 of these massive turbines. Ultimately, achieving a high capacity factor, often targeted above 50 percent, depends entirely on the reliability and lightweight performance of carbon fiber-reinforced blades.

Intelligent Automation Is Reshaping Blade Manufacturing And Operational Lifecycle Management

Demand in the Carbon fiber in wind turbine rotor blade market is also being profoundly defined by the rapid integration of intelligent automation. In manufacturing, for instance, Automated Fiber Placement (AFP) systems can now lay down carbon fiber at speeds reaching 60 meters per minute. These systems work in tandem with laser projection tools that guide the layup process with an accuracy of less than 1 millimeter. An automated blade finishing process can now be completed in a cycle time of under 8 hours. Furthermore, automated ultrasonic inspection systems can scan composite laminates for defects at a rate of 10 meters per minute, thereby ensuring stringent quality control.

Beyond the factory floor, intelligent systems are becoming critical for the operational maintenance of these high-value assets in the carbon fiber in wind turbine rotor blade market. A single advanced wind blade may now be embedded with over 1,000 fiber optic sensors to monitor structural health in real-time. Similarly, a drone can complete a detailed blade inspection in just 45 minutes. Each turbine can generate over 20 gigabytes of operational data daily to continuously update its digital twin. Predictive maintenance models then analyze millions of data points to forecast potential failures. Additionally, emerging robotic systems are being deployed for in-situ blade repairs, completing complex laminate patching autonomously and efficiently.

Segmental Analysis

Regular-Tow Fiber Asserts Unrivaled Dominance in Wind Blade Manufacturing

Regular-tow carbon fiber decisively commands the carbon fiber in wind turbine rotor blade market. It accounts for over 76.2% of total revenue. This leadership stems from its optimal balance of cost and performance. Moreover, its production processes are highly scalable. Major suppliers are therefore aggressively expanding their output. Toray Group, for instance, aims for a production capacity of 35,000 metric tons by 2025. This expansion includes adding 6,000 metric tons of new capacity. These additions are spread across its facilities in South Carolina and South Korea. The mature manufacturing of the material ensures a steady supply for the growing Carbon fiber in wind turbine rotor blade market.

The manufacturing ecosystem for regular-tow fiber is fine-tuned for industrial-scale demand. A new production line requires a minimum lead time of 2.5 years. Consequently, this encourages large-scale, continuous operations. A single supplier like ZOLTEK can integrate over 40,000 tons into global turbines. In addition, the material offers high stability. It has a long shelf life of up to 10 years when stored properly. Such logistical advantages solidify its critical role in the Carbon fiber in wind turbine rotor blade market.

- Pre-expansion capacity for standard tow fiber was 29,000 metric tons in early 2024.

- The Spartanburg, South Carolina plant is receiving a 3,000 metric ton capacity increase.

- The essential precursor material for these fibers is typically polyacrylonitrile (PAN).

The 51-75 Meter Blade Segment Defines Global Carbon Fiber In Wind Turbine Rotor Blade Market Standards

The 51–75-meter blade size segment overwhelmingly leads the global market by generating more than 38.40% market revenue in 2024. It offers the best mix of energy capture, manufacturing cost, and logistical viability. Blades in this range, when using carbon fiber, can increase annual energy production by 25 percent. This efficiency gain is vital as new turbines average 4.5 megawatts in capacity. Carbon fiber's strength-to-weight ratio, which is five times that of steel, makes these large structures possible. As a result, the global wind sector, which recently added 73 GW to reach a capacity of 1,008 GW, depends on this blade class for the Carbon fiber in wind turbine rotor blade market.

The operational and economic advantages are significant. Blades in this category can achieve a 20 percent longer service life. They can also reduce lifecycle costs by a notable 15 percent. This provides a strong return on investment for wind farm developers. These blades are engineered to withstand immense operational stress, including forces of nearly 200,000 newtons from wind gusts. The industry's move away from the sub-40-meter benchmark shows the material's success. This segment's leadership highlights a strategic focus on maximizing output and financial returns in the Carbon fiber in wind turbine rotor blade market.

- This specific blade size is the new benchmark for modern onshore projects.

- The total installed global wind power capacity has now exceeded the 1,000 GW mark.

- Lightweight carbon fiber properties are indispensable for manufacturing blades of such lengths.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

Spar Cap Application Solidifies Its Position as the Leading Market Driver

The spar cap is the most critical application for carbon fiber. It accounts for more than 61.2% of market revenue. As the blade's primary structural backbone, the spar cap dictates its overall stiffness. Using carbon fiber here allows engineers to design much longer blades. In fact, average blade length has increased by 30 percent over the last decade. Furthermore, it reduces the blade's total weight by up to 25 percent. A lighter blade lessens the strain on the entire turbine structure. This can boost overall performance by as much as 20 percent for the Carbon fiber in wind turbine rotor blade market.

Carbon fiber spar caps also offer superior durability. Blades with these components can see their operational lifespan increase by 30 percent. At the same time, related maintenance costs can be cut by 25 percent. Such resilience is crucial, particularly for new offshore wind farms, which added 20 GW in 2023. Pultruded carbon fiber spar caps represent a key manufacturing innovation for next-generation blades. Ultimately, the spar cap is where the material delivers its greatest value. It empowers the industry to build larger, more efficient turbines, thereby steering the Carbon fiber in wind turbine rotor blade market.

- The spar cap functions as the main load-bearing beam, providing essential rigidity.

- Its immense strength is vital to prevent blades longer than 40 meters from hitting the tower.

- The material’s resilience enables blades to endure extreme weather and impact events.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific Commands The Market With Unmatched Manufacturing Scale And Ambition

The Asia Pacific region decisively leads the global carbon fiber in wind turbine rotor blade market. It currently holds a commanding 61.60% share of the market. This dominance is overwhelmingly driven by China's vast industrial capacity. For instance, Sinopec recently completed the first phase of a massive carbon fiber plant in Shanghai. This single facility added 12,000 tons of new capacity in 2024. Subsequently, this manufacturing power enables the production of colossal turbines. Mingyang's new MySE 18.X-28X model, for example, features an unprecedented 280-meter rotor diameter. Similarly, CSSC Haizhuang's H260-18MW turbine boasts a 260-meter rotor. In addition, Goldwind's GWH252-16MW turbine uses individual blades that are 123 meters long.

The industrial ambition is not confined to China. It is creating significant opportunities across the entire regional carbon fiber in wind turbine rotor blade market. In South Korea, for example, the 532 MW Anma offshore wind project secured critical financing in early 2024. Meanwhile, Japan’s 16.8 MW Goto floating offshore farm became fully operational this year. Further south, Vietnam’s La Gan project is aiming for an enormous 3.5 GW capacity. Concurrently, India’s Suzlon is securing major 2024 orders for its new 3 MW turbine series, which can feature rotor diameters up to 144.7 meters. Finally, China Three Gorges' 400 MW Zhangpu Liuao Phase 2 offshore farm also began full operations in 2024, cementing the region's unparalleled market leadership.

North America Accelerates Domestic Production To Support An Offshore Wind Boom

North America’s strategy is sharply focused on building a domestic supply chain. The region is preparing for a significant expansion in its offshore wind sector. As a key example, GE Vernova is investing 50 million USD in a new blade manufacturing facility in New York. This strategic investment is directly supported by offtake from major projects like Revolution Wind, which will install 65 powerful 11 MW turbines. The market saw a major proof of concept in March 2024, when the 132 MW South Fork Wind farm became fully operational.

Furthermore, blade manufacturer TPI Composites signed a multi-year supply agreement in 2024 for GE Vernova's onshore 6.1 MW turbines. The immense scale of the opportunity within the Carbon fiber in wind turbine rotor blade market is highlighted by projects like the Coastal Virginia Offshore Wind farm, which will require 176 monopile foundations for its turbines.

Europe Drives Innovation In Blade Technology And Advanced Circular Economy Solutions

Europe's mature market is characterized by its focus on technological superiority and sustainability. In 2024, for instance, Siemens Gamesa began testing its massive 108-meter-long B108 blades at its advanced facility in Denmark. In a similar vein, LM Wind Power’s French factory produced its 1,000th 107-meter blade. This cutting-edge manufacturing is essential for powering enormous projects. A prime example is the 1.5 GW Hollandse Kust Zuid wind farm, which became fully operational in 2024.

Alongside this innovation, Europe is also leading on end-of-life challenges. A new blade recycling facility with a 6,000-ton annual capacity, for example, began operations in Spain this year. In parallel, the ZEBRA consortium produced a 62-meter recyclable thermoplastic blade prototype. This achievement signals a major step toward a circular economy within the Carbon fiber in wind turbine rotor blade market.

Recent Developments in Carbon Fiber in Wind Turbine Rotor Blade Market

- Vestas Announces €2 Billion Polish Blade Factory Investment: Underscoring massive confidence in the offshore market, Vestas announced plans in February 2024 for a new factory in Szczecin, Poland. This major investment will produce blades for its flagship V236-15.0 MW offshore turbine, which heavily utilizes carbon fiber in its design.

- TPI Composites Secures $75 Million Strategic Investment: Leading independent blade manufacturer TPI Composites announced a significant $75 million investment from Oaktree Capital Management in February 2024. This infusion of capital is earmarked to enhance liquidity and directly support the company's advanced composite blade manufacturing operations.

- Syensqo and Trillium Partner for Bio-Based Carbon Fiber: Materials company Syensqo announced a strategic partnership with Trillium in February 2024 to develop a supply chain for bio-based acrylonitrile. This investment aims to create a sustainable pathway for producing carbon fiber used in wind blades.

- Teijin Invests in New Carbon Fiber Intermediate Plant: Carbon fiber giant Teijin announced an investment in March 2024 to build a new facility for carbon fiber-based intermediate materials. Set to become operational in 2025, the plant will support growing demand from industrial applications, including wind energy.

- Toray Expands High-Performance Prepreg Production: Toray Advanced Composites announced a significant expansion of its prepreg production capabilities in February 2024. This investment aims to meet growing demand for these essential intermediate materials from high-performance markets, including wind blade manufacturing in the carbon fiber in wind turbine rotor blade market.

- U.S. DOE Launches $20 Million Blade Recycling Center Initiative: In February 2024, the DOE announced a funding opportunity of up to $20 million to establish a new R&D facility. The center will focus on developing a circular economy for wind turbine blades, including those made with carbon fiber.

- Solvay to Double Large-Tow Carbon Fiber Capacity: In a move to support industrial market growth, Solvay announced in March 2024 that it will double its large-tow carbon fiber production capacity in South Carolina. This expansion is timed to meet anticipated demand from sectors like wind energy.

List of Key Companies Profiled:

- ZOLTEK Corporation

- Mitsubishi Rayon

- Hexcel

- Teijin

- SGL Carbon

- Formosa Plastics Corp

- Dow Inc

- Hyosung Japan

- Jiangsu Hengshen

- Taekwang Industrial

- Swancor Advanced Material Co

- China Composites Group

- Other Prominent Players

Key Market Segmentation:

By Type

- Regular Tow Carbon Fiber

- Large-Tow Carbon Fiber

By Blade Size

- <27 meter

- 27-37 meter

- 38-50 meter

- 51-75 meter

- 76-100 meter

- 100-200 meter

By Application

- Spar Cap

- Leaf Root

- Skin Surface

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The UK

- Germany

- France

- Italy

- Spain

- Poland

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)