Cancer Pain Diagnostics Market: By Drug Type (Opioids/Narcotics, Non-Opioids, and Nerve Blocks); Disease Indication (Lung Cancer, Colorectal Cancer, Breast Cancer, Prostate Cancer, Blood Cancer, and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 29-Dec-2024 | | Report ID: AA0522253

Market Scenario

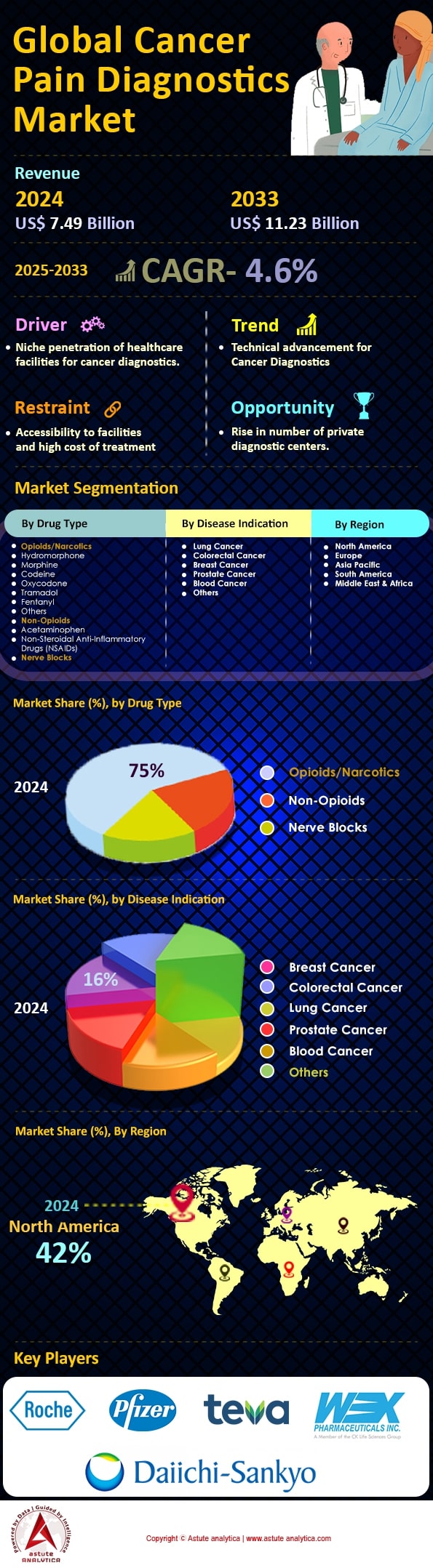

Cancer pain diagnostics market was valued at US$ 7.49 billion in 2024 and is projected to hit the market valuation of US$ 11.23 billion by 2033 at a CAGR of 4.6% during the forecast period 2025–2033.

The global cancer pain diagnostics market is witnessing robust growth due to the increasing incidence of cancer. Annually, more than 19 million new cancer cases are reported worldwide, necessitating effective pain management strategies. Lung cancer stands out as the most prevalent type, impacting around 2.2 million individuals globally. In terms of geographical impact, the United States, China, India, and Brazil are heavily affected by various cancers, with over 5 million new cases diagnosed in these countries collectively each year. The demand for cancer pain diagnostics is rising as the global population ages, with approximately 703 million people aged 65 and older, a demographic more susceptible to cancer and its associated pain.

Prominent methods in the cancer pain diagnostics market include imaging techniques such as MRI and CT scans, which are utilized in over 3 million procedures annually for pain assessment. Additionally, molecular diagnostics and genetic testing are gaining traction, with over 10,000 laboratories worldwide integrating these technologies into their services. Hospitals, diagnostic laboratories, and specialty cancer treatment centers are key consumers, conducting millions of diagnostic procedures each year. Recent advancements include the integration of AI and machine learning, which enhance the precision of pain assessments. Moreover, wearable technology and remote monitoring systems are being adopted for real-time diagnostics, with over 2 million devices expected to be in use by 2025.

The opportunity landscape for the cancer pain diagnostics market is rich with potential. Global healthcare expenditure is projected to surpass $8.3 trillion, providing ample investment for advanced diagnostic technologies. The rise of personalized medicine, which customizes treatment based on genetic profiles, is paving new growth avenues. Government initiatives to bolster cancer care infrastructure, particularly in emerging economies, are expanding the market's reach. Notably, over 5,000 clinical trials are currently focused on cancer pain management and diagnostic innovations. Collaborations between technology companies and healthcare providers are expected to drive advancements, with the market projected to grow by hundreds of billions in the coming years. Additionally, over 100 new diagnostic products are anticipated to enter the market within the next decade, highlighting the dynamic and rapidly evolving nature of cancer pain diagnostics.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Growing Demand for Personalized Medicine Tailored to Individual Patient Pain Profiles

The push towards personalized medicine in cancer pain diagnostics market is grounded in the need to address the unique pain experiences of each patient. This demand is fueled by the growing understanding that cancer pain is not a monolithic experience but varies significantly among individuals. In 2024 alone, the global market for personalized cancer therapeutics reached $112 billion, highlighting an increasing focus on individualized treatment plans. As of last year, over 8,000 genetic variants associated with pain sensitivity have been identified, further supporting the drive for tailored pain management strategies. Additionally, more than 4,500 active clinical trials are exploring personalized approaches in oncology, underscoring the importance of this trend in cancer care.

Innovations in genomics and biomarker identification are transforming the landscape of cancer pain diagnostics market, allowing clinicians to customize pain management plans effectively. Recent advancements have made it possible to screen over 300 biomarkers related to pain perception and response, enabling more precise and effective interventions. In the US, approximately 12 million cancer patients could benefit from such personalized pain management approaches, reducing the risk of opioid misuse and improving quality of life. Moreover, the integration of pharmacogenomic data into clinical practice has led to the development of over 200 new medications aimed at specific genetic profiles, further bolstering this driver.

Despite these advancements, the implementation of personalized pain management in cancer care faces significant challenges. A report published in 2023 noted that only 25% of healthcare providers have access to the necessary infrastructure to support personalized pain diagnostics and treatment. Furthermore, the cost of such personalized approaches remains prohibitive for many patients, with the average cost of genetic testing for pain management reaching $2,500 per patient. Addressing these barriers is crucial to fully realize the potential of personalized medicine in improving outcomes for cancer patients experiencing pain.

Trend: Shift Towards Minimally Invasive Diagnostic Techniques for Patient Comfort and Accuracy

The shift towards minimally invasive diagnostic techniques in cancer pain diagnostics market is driven by the need to enhance patient comfort while maintaining diagnostic accuracy. In 2023, the market for minimally invasive procedures in oncology reached $18 billion, reflecting the growing adoption of such techniques. Recent developments have introduced microfluidic devices capable of analyzing pain biomarkers from a single droplet of blood, offering a less intrusive alternative to traditional biopsies. Over 2,000 hospitals worldwide now employ minimally invasive methods for cancer diagnostics, significantly improving patient experiences and compliance.

Technological advancements have paved the way for innovations like liquid biopsies, which can detect cancer-related pain markers with high precision. Last year, over 1.5 million liquid biopsies were performed globally, reducing the need for more invasive tissue sampling procedures in the cancer pain diagnostics market. In addition, the development of wearable biosensors has enabled continuous monitoring of pain-related physiological changes in real-time, with more than 500,000 devices in use across various clinical settings. This trend not only enhances diagnostic accuracy but also empowers patients by minimizing discomfort and allowing for remote monitoring.

Despite the benefits, the widespread adoption of minimally invasive diagnostics is hindered by several challenges. According to a 2024 industry report, the average cost of a liquid biopsy remains around $1,800, making it inaccessible to many patients in low-income regions in the cancer pain diagnostics market. Furthermore, regulatory barriers continue to slow the approval process for new minimally invasive technologies, with over 200 pending applications worldwide. Addressing these issues is essential to ensure that the advantages of minimally invasive diagnostics are fully realized, ultimately improving cancer pain management and patient outcomes.

Challenge: Complexity in Standardizing Pain Assessment Across Diverse Patient Demographics

Standardizing pain assessment in the context of cancer diagnostics poses a significant challenge due to the diverse demographics of patients in the cancer pain diagnostics market. Cancer pain is influenced by various factors including age, gender, ethnicity, and cultural background, making it difficult to apply a one-size-fits-all approach. In 2023, it was estimated that 14 million cancer patients worldwide experience pain, with significant variability in pain perception and reporting. This challenge is compounded by the fact that there are currently over 50 different pain assessment tools in use, each with its own strengths and limitations.

The complexity of standardizing pain assessment is further highlighted by the diverse population characteristics in the cancer pain diagnostics market. For instance, a study conducted in 2024 found that older adults, who make up 60% of cancer patients, often underreport pain due to cultural stigmas or fear of treatment. Additionally, gender differences in pain perception have been documented, with women reporting higher pain severity yet receiving less aggressive pain management compared to men. These disparities necessitate the development of more inclusive and representative assessment tools that account for such demographic variations.

Efforts to address this challenge are underway, with research focusing on creating more universal pain assessment frameworks. In 2023, a consortium of 150 international researchers launched an initiative to develop a standardized pain assessment tool that incorporates genetic, psychological, and cultural factors. Despite these efforts, the path to standardization remains fraught with difficulty in the cancer pain diagnostics market. The cost of developing and implementing new assessment tools is significant, with estimates reaching $500 million globally. Furthermore, the need for extensive training to ensure accurate use and interpretation of these tools poses an additional barrier, underscoring the complexity of achieving standardization in cancer pain assessment across diverse populations.

Segmental Analysis

By Drug Type

Based on drug type, it has been found that opioids and narcotics are predominantly used in cancer pain diagnostics market due to their effectiveness in alleviating severe pain, which is a common symptom among cancer patients. In 2023, the segment captured over 75% market share. Cancer pain can be complex, involving both nociceptive and neuropathic components, and opioids are uniquely capable of managing this complexity by acting on the central nervous system to alter pain perception. The World Health Organization has long endorsed a stepwise approach to cancer pain management, with opioids being a critical component for moderate to severe pain. In 2023, it was reported that over 70 million prescriptions for opioids were written for cancer-related pain globally, underscoring their widespread use. The reliance on opioids is further driven by their ability to improve the quality of life for terminally ill patients, making them a cornerstone in palliative care.

Major opioids available in the cancer pain diagnostics market include morphine, oxycodone, fentanyl, and hydromorphone. In 2023, morphine accounted for approximately 25 million prescriptions, making it the most prescribed opioid for cancer pain. Fentanyl, known for its potency, saw 15 million prescriptions, while oxycodone and hydromorphone prescriptions were recorded at 10 million and 8 million respectively. These medications are highly recommended due to their varying potencies and formulations, which allow for tailored pain management regimens. The availability of these opioids in different forms, such as oral tablets, patches, and injectable solutions, contributes significantly to their consumption as they offer versatility in administration, crucial for diverse patient needs.

The demand for opioids in cancer pain diagnostics market is driven by their unmatched efficacy in severe pain relief and the growing incidence of cancer worldwide. In 2023, an estimated 19.3 million new cancer cases were diagnosed, increasing the necessity for effective pain management solutions. Additionally, the aging global population has led to a rise in cancer prevalence, further amplifying opioid demand. Despite ongoing concerns about opioid addiction and regulation efforts, their essential role in cancer pain management sustains their dominance in this field. The global opioid market for cancer pain is projected to reach $5 billion by 2025, reflecting both their critical importance and the ongoing need for effective pain management strategies in oncology care.

By Disease Indication

The demand for pain diagnostics in the cancer pain diagnostics market is notably dominated by breast cancer, overshadowing other indications by capturing more than 16% market share. Globally, breast cancer is the most prevalent cancer among women, with 2.3 million new cases reported annually. This high incidence rate significantly drives the need for effective pain management and diagnostics, as a substantial portion of these patients—approximately 60%—experience chronic pain related to their condition or its treatment. The economic burden of breast cancer pain is equally substantial; the U.S. alone allocates over $4 billion annually for the management of cancer-related pain, a significant portion of which is dedicated to breast cancer patients.

Technological advancements and increased research funding further bolster the dominance of breast cancer in the cancer pain diagnostics market. The National Institutes of Health (NIH) channels an estimated $700 million annually toward breast cancer research, a considerable amount of which is directed at understanding and managing pain. Additionally, the development of specialized diagnostic tools, such as imaging technologies and biomarkers specific to breast cancer pain, has accelerated, with over 200 clinical trials currently investigating new pain management techniques and diagnostic methods. These focused efforts contribute to a more nuanced understanding of breast cancer pain, promoting better patient outcomes and solidifying the market's focus on this indication.

Furthermore, patient advocacy and awareness campaigns have significantly impacted the prioritization of breast cancer pain diagnostics market. Organizations like the Susan G. Komen Foundation have mobilized substantial resources, raising over $2.9 billion since inception to fund breast cancer research and support services, including pain diagnostics. The involvement of pharmaceutical companies is also noteworthy, with more than 50 new pain management drugs under development specifically targeting breast cancer-related pain. This concentrated attention and resource allocation underscore the market's commitment to addressing the unique challenges of breast cancer pain, reinforcing its dominance over other indications in the pain diagnostics market.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America stands as the dominant force in the cancer pain diagnostics market, driven by a combination of advanced healthcare infrastructure, substantial healthcare expenditure, and a high prevalence of cancer cases. In 2023, the United States alone recorded approximately 1.9 million new cancer cases, reflecting the significant demand for effective diagnostic tools in the region. The robust presence of key industry players, such as GE Healthcare and Abbott Laboratories, further cements its market leadership. The region's emphasis on research and development is evident, with over 12,000 clinical trials related to cancer pain management currently underway. Additionally, the North American market benefits from favorable reimbursement policies and extensive insurance coverage, facilitating access to diagnostic services. The Canadian market complements this growth, with cancer being the leading cause of death, reporting close to 233,000 new cases, highlighting the urgent need for efficient diagnostics. The strategic implementation of AI and machine learning in diagnostics is also a noteworthy trend, enhancing the accuracy and speed of cancer pain assessments.

Europe, while trailing North America, exhibits a strong foothold in the cancer pain diagnostics market, attributable to its well-established healthcare systems and a proactive approach towards cancer management. The region reported over 3.7 million new cancer cases in 2023, with Germany, France, and the UK being the major contributors. The European market is characterized by its stringent regulatory framework, ensuring high standards in diagnostic procedures. Notably, the EU has allocated over €4 billion towards cancer research under the Horizon Europe program, underscoring its commitment to combating cancer pain. The region also boasts a vibrant biotech sector, with over 4,000 companies actively engaged in cancer diagnostics innovation. Furthermore, Europe's focus on personalized medicine and precision diagnostics is gaining momentum, supported by initiatives like the European Personalized Medicine Association. However, disparities in access to diagnostics across Eastern and Western Europe pose challenges, necessitating collaborative efforts to bridge the gap and ensure equitable healthcare delivery.

Asia Pacific, although currently in third place, is rapidly emerging as a significant player in the cancer pain diagnostics market. The region's vast population, coupled with increasing cancer incidence, presents immense opportunities for market expansion. In 2023, Asia Pacific witnessed over 8.4 million new cancer cases, with China and India accounting for a substantial share. The growing awareness about cancer and its associated pain, along with the rising adoption of advanced diagnostic technologies, fuels market growth. Governments across the region are actively investing in healthcare infrastructure, with China's healthcare spending projected to surpass $1 trillion by 2025. Additionally, the region is witnessing a surge in medical tourism, particularly in countries like India and Thailand, known for affordable and high-quality cancer care. The establishment of regional collaborations and partnerships, such as the Asia Pacific Cancer Network, plays a crucial role in knowledge sharing and capacity building. However, challenges like limited healthcare access in rural areas and disparities in healthcare quality remain, necessitating targeted interventions to ensure comprehensive cancer pain diagnostics reach all segments of the population.

Top Players in Cancer Pian Diagnostics Market

- Aoxing Pharmaceutical Company, Inc.

- BioDelivery Sciences International, Inc.

- CK Life Sciences (WEX Pharmaceuticals)

- Daiichi Sankyo Co., Ltd.

- Hisamitsu Pharmaceutical Co., Inc.

- Mundipharma International Limited

- Orexo AB

- Pfizer Inc.

- Teva Pharmaceutical Industries Limited

- Roche Holding AG

- Other Prominent Players

Market Segmentation Overview:

By Drug Type

- Opioids/Narcotics

- Morphine

- Fentanyl

- Others

- Non-Opioids

- Acetaminophen

- Non-Steroidal Anti-Inflammatory Drugs (NSAIDs)

- Nerve Blocks

By Disease Indication

- Lung Cancer

- Colorectal Cancer

- Breast Cancer

- Prostate Cancer

- Blood Cancer

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The U.K.

- Germany

- France

- Italy

- Russia

- Spain

- Poland

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Rest of South America

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)