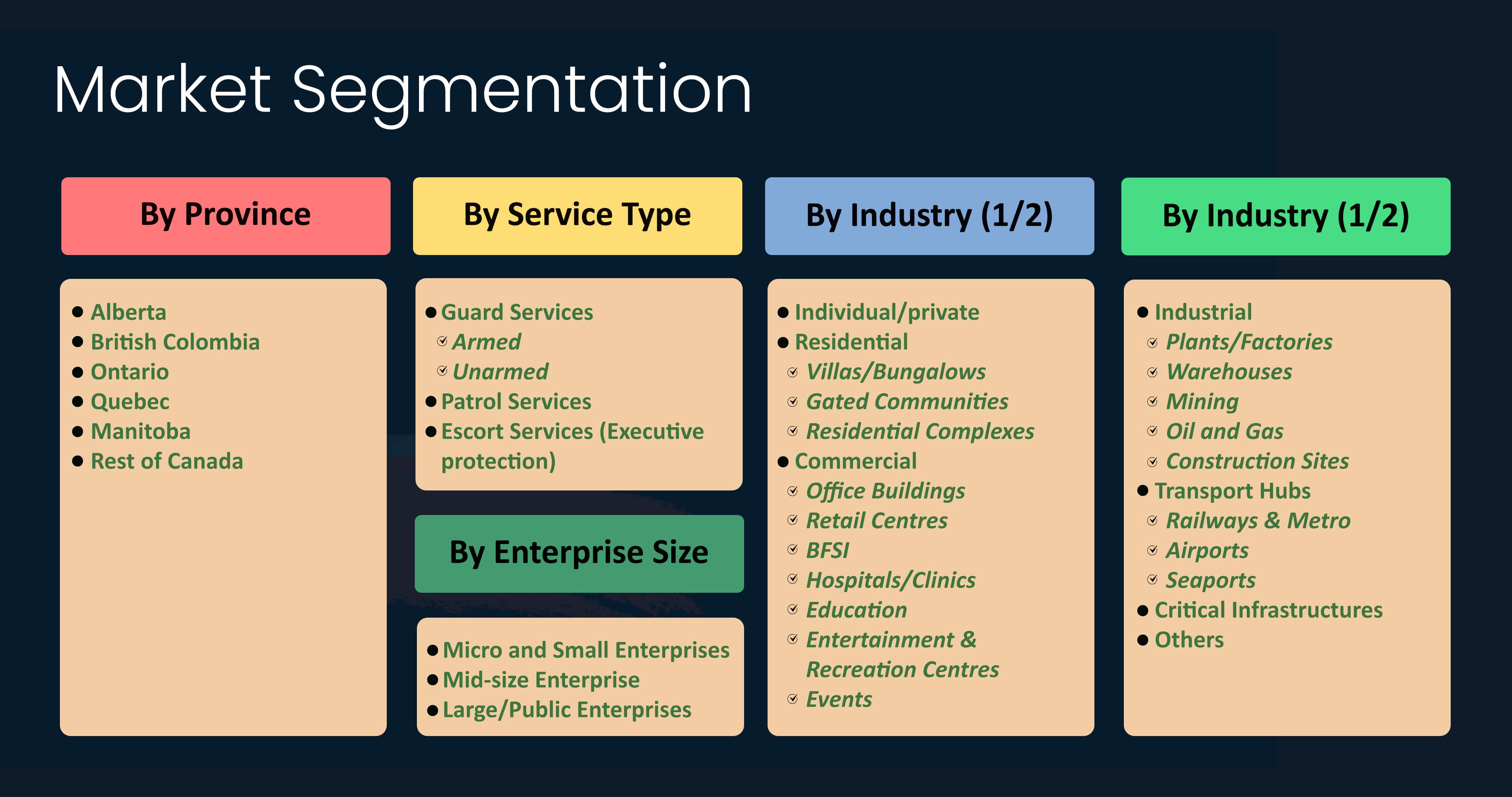

Canada Manned Security Services Market: By Service Type (Guard Services (Armed and Unarmed), Patrol Services, Escort Services (Executive protection)); Enterprise Size (Micro and Small Enterprises, Mid-size Enterprise, Large/Public Enterprises); Industry (Individual/private, Residential (Villas/Bungalows, Gated Communities, Residential Complexes), Commercial (Office Buildings, Retail Centers, BFSI, Hospitals/Clinics, Education, Entertainment & Recreation Centers, Events), Industrial (Plants/Factories, Warehouses, Mining, Oil and Gas, Construction Sites), Transport Hubs (Railways & Metro, Airports, Seaports), Critical Infrastructures and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Dec-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA1224987 | Delivery: 2 to 4 Hours

| Report ID: AA1224987 | Delivery: 2 to 4 Hours

Market Scenario

Canada manned security services market was valued at US$ 3,593.89 million in 2024 and is projected to hit the market valuation of US$ 6,830.5 million by 2033 at a CAGR of 7.60% during the forecast period 2025–2033.

The demand for manned security services in Canada is experiencing a significant surge, driven by escalating concerns over safety and the protection of assets across various sectors. In 2023, the Canadian security industry reported revenues exceeding CAD 7.5 billion, reflecting robust growth in this market. Urban centers like Toronto and Vancouver have witnessed a substantial increase in property crimes, with Toronto documenting over 150,000 incidents last year, prompting businesses and residential communities to invest heavily in manned security solutions. Additionally, the proliferation of critical infrastructure projects valued at over CAD 400 billion nationwide has necessitated enhanced security measures to safeguard these vital assets.

Major manned security services market witnessing growth include on-site guard services, mobile patrol units, and specialized access control management. The deployment of technology-enhanced security personnel is becoming commonplace; over 15,000 security guards are now equipped with real-time communication devices and surveillance support tools. The use of canine units has also expanded, with more than 500 trained teams operating across the country, particularly in transportation hubs and during significant public events. Moreover, executive protection services have seen an uptick, with over 600 new contracts signed in 2023, catering to high-profile individuals and corporate executives concerned about personal safety.

Key factors behind this manned security services market growth encompass increasing urbanization, with over 31 million Canadians now residing in cities, intensifying the need for security in densely populated areas. The legalization and expansion of the cannabis industry, which includes over 4,500 licensed producers and retailers, have heightened demand for compliance and security services. Primary end users of manned security services include commercial enterprises, government institutions, and critical infrastructure operators. Key industries deploying these services are the healthcare sector, where hospitals have invested over CAD 250 million in security enhancements; transportation, managing over 170 million passengers annually across airports and railways; and energy, particularly in protecting over 500 active oil and gas facilities. Educational institutions are also significant clients, with over 1,200 schools employing dedicated security personnel in 2023 to ensure student safety. The retail sector, facing over CAD 5 billion in annual losses due to theft, has invested heavily in loss prevention officers and security guards, further driving demand.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rising Urbanization Increasing Demand for Security in Densely Populated Areas and Public Spaces

The phenomenon of rising urbanization in Canada has become a significant driver for the manned security services market. As of 2023, over 82% of Canada's population resides in urban areas, amounting to more than 31 million people concentrated in cities. Major metropolitan areas like Toronto, Montreal, and Vancouver have witnessed population increases exceeding 500,000 residents in the past five years. This rapid urban growth has heightened the necessity for effective security measures to manage large crowds and ensure public safety in densely populated settings. In addition to population growth, urban centers have experienced a surge in public events and gatherings. Toronto alone hosted over 2,000 large-scale events in 2023, including cultural festivals, international conferences, and major sporting events, collectively attracting millions of attendees. These events demand extensive security personnel deployment; for instance, the Toronto International Film Festival employed over 1,200 security guards.

The expansion of commercial hubs in the manned security services market, with more than 1,200 major shopping malls across the country, has increased the need for manned security to deter theft, manage crowd control, and enhance customer safety. The urban transportation sector further underscores the critical demand for enhanced security services. Canada's public transit systems, including subways, buses, and light rail, recorded over 2 billion passenger trips in 2023. Ensuring commuter safety has led to the employment of over 5,000 transit security officers nationwide. Rising urban crime rates, with metropolitan areas reporting over 200,000 incidents of theft, assault, and vandalism, have amplified public concern. In response, municipal governments have allocated over CAD 1.5 billion toward security and policing enhancements, further propelling the growth of the manned security services market.

Trend: Integration of Technology with Manned Services, Employing Devices Like Body-Worn Cameras and GPS

The integration of advanced technology with traditional manned security services market has emerged as a pivotal trend in Canada's security landscape. In 2023, over 20,000 security personnel are equipped with body-worn cameras, enhancing accountability and providing real-time evidence collection. This technological adoption has led to a measurable reduction in incidents of guard misconduct, with reported cases dropping from 1,200 to 900 annually. Major security firms have invested upwards of CAD 150 million in upgrading their technological infrastructure, incorporating GPS tracking systems for over 25,000 guards to monitor patrol patterns and ensure compliance with assigned duties.

This integration extends to the utilization of sophisticated surveillance systems. More than 5,000 security assignments now incorporate drone surveillance, allowing for aerial monitoring of expansive areas such as industrial sites and large-scale events. Approximately 2,500 security personnel have received specialized training in operating these unmanned aerial vehicles. Additionally, over 1,200 companies are employing artificial intelligence-powered analytics to predict and respond to security threats, processing over 100 million data points annually to optimize guard deployment and patrol routes. Furthermore, mobile applications in the manned security services market have become instrumental in enhancing communication among security teams. In 2023, over 15,000 security guards use dedicated apps for incident reporting, reducing response times by an average of 10 minutes during security incidents. GPS tracking allows companies to monitor personnel across more than 4,000 active sites nationwide. Biometric access controls have been adopted by over 800 security providers, utilizing fingerprint and facial recognition technologies to secure sensitive areas, reducing unauthorized access incidents by over 5,000 cases annually.

Challenge: Labor Shortages Leading to Difficulties in Recruiting Qualified Security Personnel Nationwide

The manned security services market in Canada is grappling with significant labor shortages, making it challenging to recruit and retain qualified security personnel. As of 2023, the industry requires an estimated 150,000 security guards to meet growing demand, but there is a shortfall of over 20,000 positions nationwide. This gap has been exacerbated by the increasing number of new security contracts, with over 5,000 signed in the last year alone, stretching the available workforce. Competition from other sectors contributes to the labor shortage. The logistics and warehousing industry has absorbed over 50,000 workers in 2023, many of whom possess skills transferable to security roles. Additionally, the average age of security personnel is increasing, with over 30% of the workforce being over 50 years old, leading to approximately 5,000 retirements annually. This depletion of experienced guards further strains recruitment efforts.

Challenges in recruitment are compounded by stringent regulatory requirements. Security guards in Canada manned security services market must undergo over 40 hours of training and obtain licenses costing up to CAD 500 per individual, deterring potential candidates. Salary competitiveness is also an issue; the average hourly wage for security guards is CAD 18, compared to the national average wage of CAD 27 across all industries. The labor shortage has led to increased workloads, with many guards working over 50 hours per week, and companies spending over CAD 10 million on overtime pay. Despite investing an additional CAD 5 million in recruitment and training, the industry faces ongoing difficulties in attracting qualified personnel.

Segmental Analysis

By Service Type

Guard services currently dominate the manned security services market in Canada due to the increasing complexity of security threats and the need for immediate human intervention. The segment captured more than 57.75% revenue share in 2023. It has been found that the Canadian security industry employs over 150,000 personnel, including over 140,000 licensed security guards as of 2023. The security services market in Canada has generated revenues exceeding CAD 5 billion annually. Over 1,000 licensed security guard companies operate across the country, indicating a mature and extensive industry. The emphasis on proactive security measures has led businesses and institutions to prefer guard services over patrol and escort services, which are more intermittent in nature.

Key end-users of guard services in Canada manned security services market include commercial establishments, which employ over 60,000 security guards. The retail sector, experiencing over CAD 600 billion in sales annually, relies heavily on guard services to prevent losses and ensure customer safety. Other significant sectors are residential complexes, healthcare facilities, educational institutions, and government properties. The rise in infrastructure projects, with investments totaling over CAD 200 billion in construction as of 2023, has increased the need for guards to secure sites against theft and vandalism. Moreover, major events and public gatherings, attracting thousands of participants, require substantial guard services to ensure safety. The demand for guard services is on the rise due to several factors. The number of property crimes reported in Canada reached over 1.2 million incidents in 2023, heightening the need for on-site security. Regulatory requirements have mandated security personnel in industries such as cannabis production and distribution, which is projected to be worth over CAD 8 billion. The average salary for security guards stands at approximately CAD 35,000 per year, making it an accessible employment opportunity and ensuring a steady supply of personnel.

By Enterprise Size

Large enterprises are the dominant consumers of manned security services market with over 75.08% market share in Canada due to their extensive assets, substantial workforce, and the critical nature of their operations. In 2023, Canada had over 2,500 large corporations with more than 500 employees. These companies contribute over CAD 1 trillion to the national economy annually. The vast scale of assets, including properties valued at billions of dollars, necessitates comprehensive security measures. For instance, a single security breach can cost a large company upwards of CAD 5 million, highlighting the importance of robust security protocols. Sectors such as finance, manufacturing, and technology underscore the reliance on manned security services. The Canadian banking sector, holding assets exceeding CAD 5 trillion in 2023, employs thousands of security personnel to safeguard branches and data centers. Large manufacturing facilities produce goods worth over CAD 500 billion annually, requiring protection against theft and industrial espionage. Technology firms, handling sensitive data for millions of users, depend on physical security to complement cybersecurity measures. The workforce in large enterprises can exceed tens of thousands, necessitating security to ensure employee safety and manage access control.

Large enterprises in the Canada manned security services market employ manned security services on a large scale due to increased regulatory compliance requirements related to security. Companies spend upwards of CAD 10 million annually on security measures to meet regulations and protect against threats. The integration of physical and cyber security has led to increased investment in manned services, with security spending by large enterprises expected to reach over CAD 20 billion annually by 2025. Additionally, these enterprises frequently host high-profile events requiring additional security personnel to protect assets and individuals.

By Industry

Commercial industries are the key consumers of the manned security services market in Canada due to the high value of assets, the need for customer and employee safety, and compliance with regulatory standards. The commercial industry held nearly 33.98% revenue share in 2023. Commercial industries such as retail, banking, hospitality, and real estate require constant security presence to mitigate risks of theft, vandalism, and to ensure a safe environment. In 2023, the commercial sector in Canada accounted for over CAD 1.2 trillion in economic activity, highlighting the significant scale and value of assets requiring protection. Major commercial industries deploying manned security services include the retail industry, which generated over CAD 600 billion in sales annually. Retail establishments employ security guards to prevent losses from shoplifting and to manage crowd control during peak shopping seasons. The banking sector, with assets exceeding CAD 5 trillion, relies on security personnel to protect branches and ATMs. The hospitality industry, comprising over 8,000 hotels and resorts, hires guards to ensure guest safety and asset protection. Commercial real estate, with properties valued at over CAD 700 billion, employs security services to manage access and safeguard premises.

Demand in these industries in the manned security services market is driven by the need to protect high-value assets and ensure customer and employee safety. The increase in property crimes, with over 1.2 million incidents reported in 2023, heightens the need for security. Regulatory requirements mandate certain levels of security in industries like banking and cannabis retail, where compliance can cost individual businesses over CAD 1 million annually. Economic factors such as the growth in commercial construction, with projects exceeding CAD 200 billion in investments, also propel the demand for security services. Additionally, the insurance industry, paying out claims over CAD 30 billion annually, often offers reduced premiums for businesses employing professional security services.

To Understand More About this Research: Request A Free Sample

Canada Province Analysis

Ontario is the most prominent region in Canada's manned security services market due to its large population, economic activity, and concentration of key industries. As of 2023, Ontario's population exceeds 14 million people, making it the most populous province in Canada. The province contributes over CAD 850 billion to the national GDP annually, accounting for nearly 40% of Canada's economic output. The high concentration of businesses and industries in Ontario creates substantial demand for manned security services to protect assets, employees, and the public. Ontario hosts major industries that deploy manned security services extensively. The financial sector is significant in Toronto, home to the Toronto Stock Exchange and banking headquarters, managing assets exceeding CAD 5 trillion. The manufacturing industry in Ontario produces goods valued at over CAD 300 billion annually, with facilities requiring security services. The technology sector is growing rapidly in cities like Ottawa and Waterloo, employing over 250,000 tech workers, necessitating security for data centers and offices. Additionally, Ontario's retail sector, with annual sales over CAD 250 billion, relies on security personnel to prevent losses and ensure customer safety.

Key providers of manned security services market in Ontario include national and international security firms. Notable companies are GardaWorld, Paladin Security, and Securitas Canada, which collectively employ thousands of security guards across the province. GardaWorld, for instance, operates in over 35 offices in Ontario and provides a range of security services, including guard services and risk management. Paladin Security is known for servicing healthcare facilities, commercial properties, and educational institutions throughout Ontario. The abundance of providers ensures that the diverse security needs of Ontario's industries are met, solidifying the province's position as the largest market for manned security services in Canada.

Top Players in Canada Manned Security Services Market

- Canadian Security Professionals

- Commissionaires

- Paragon Security

- G4S Limited

- G Raptors Security

- Garda World Security

- United Security Services

- Allied Universal

- Northwest Security Services Canada

- Marshal Security

- Karas Security

- Paladin Security

- Securitas AB

- World Guardian Inc.

- Other Prominent Players

Market Segmentation Overview:

By Service Type

- Guard Services

- Armed

- Unarmed

- Patrol Services

- Escort Services (Executive protection)

By Enterprise Size

- Micro and Small Enterprises

- Mid-size Enterprise

- Large/Public Enterprises

By Industry

- Individual/private

- Residential

- Villas/Bungalows

- Gated Communities

- Residential Complexes

- Commercial

- Office Buildings

- Retail Centres

- BFSI

- Hospitals/Clinics

- Education

- Entertainment & Recreation Centres

- Events

- Industrial

- Plants/Factories

- Warehouses

- Mining

- Oil and Gas

- Construction Sites

- Transport Hubs

- Railways & Metro

- Airports

- Seaports

- Critical Infrastructures

- Others

By Province

- Alberta

- British Colombia

- Ontario

- Quebec

- Manitoba

- Rest of Canada

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA1224987 | Delivery: 2 to 4 Hours

| Report ID: AA1224987 | Delivery: 2 to 4 Hours

.svg)