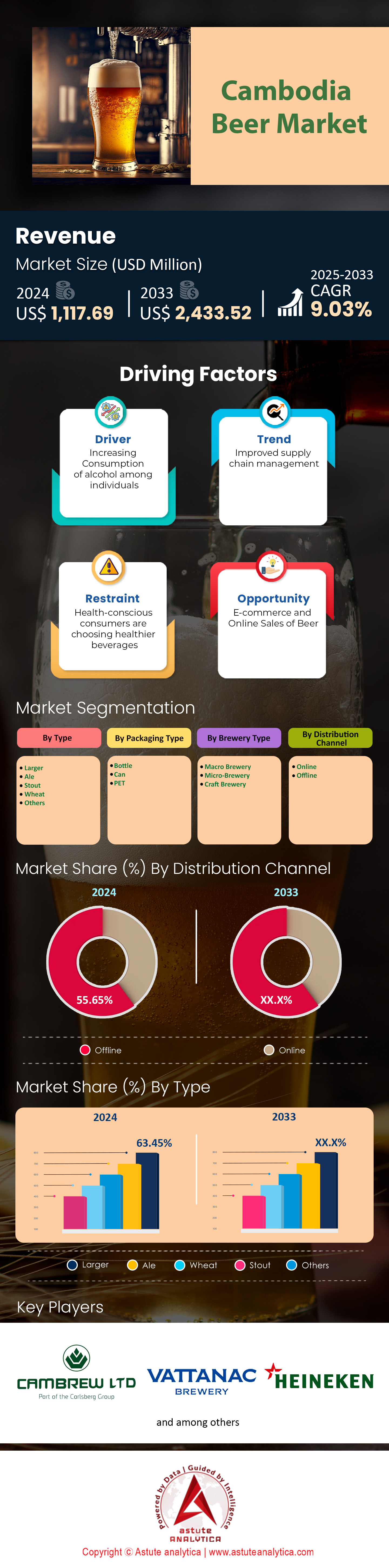

Cambodia Beer Market: By Type (Lager, Ale, Stout, Wheat, Others); Packaging Type (Bottle, Can, PET); Brewery Type (Macro Brewery, Micro Brewery, Craft Brewery); Distribution Channel (Online and Offline)— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Mar-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0124728 | Delivery: 2 to 4 Hours

| Report ID: AA0124728 | Delivery: 2 to 4 Hours

Market Scenario

Cambodia beer market was valued at US$ 1,117.69 million in 2024 and is projected to surpass the market valuation of US$ 2,433.52 million by 2033 at a CAGR of 9.03% during the forecast period 2025–2033.

The Cambodian beer market has emerged as a dynamic and rapidly expanding sector, closely mirroring the country’s broader economic development and evolving consumer preferences. This growth is deeply rooted in Cambodia’s impressive economic trajectory, which has seen an average annual growth rate of 7.6% between 1995 and 2019, driven by key sectors such as tourism, manufacturing, and real estate. This economic momentum has nurtured a thriving beer industry, characterized by a diverse array of both local and international brands that cater to an increasingly discerning consumer base.

Several socio-economic factors are fueling the rising demand for beer in Cambodia. Rapid urbanization has led to a surge in social activities and nightlife, particularly in urban hubs like Phnom Penh, where the proliferation of bars and restaurants has significantly boosted beer consumption. Rising disposable incomes, as Cambodia progresses towards middle-income status, have also enabled more people to spend on leisure activities, including beer. Lifestyle changes have further contributed to this trend, with consumers seeking more diverse and high-quality beer options. This shift is partly driven by the influence of international beer brands and the growing craft beer scene, reflecting a broader trend towards more sophisticated drinking experiences.

Cambodia’s beer market is shaped by distinct consumption patterns, with a growing preference for locally produced and craft beers. This trend is driven by a desire for unique, high-quality products and national pride in supporting local businesses. Lager remains the dominant beer type, favored for its crisp and refreshing taste that aligns with Cambodia’s hot and humid climate. The largest consumer segment driving this growth is the 25-40 age group, which shows a particular inclination towards premium and craft beverages. The 18-24 age group is also emerging as a significant consumer base, especially in urban areas.

Market leaders such as Cambrew Ltd., renowned for its Angkor Beer brand, maintain a strong presence through an extensive distribution network and strategic marketing initiatives. Khmer Brewery, known for its Cambodia Beer brand, has expanded its product line to include premium and craft options, catering to evolving consumer tastes. International players like Heineken Cambodia and Carlsberg, through partnerships with local brands, have also made significant inroads, particularly in the premium beer segment. The rise of craft breweries such as Riel Brewing and Cerevisia Craft Brewery further highlights the competitive and dynamic nature of Cambodia’s beer market, as these smaller players innovate and cater to niche consumer preferences.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Growing middle class and urbanization boosting beer consumption nationwide

Cambodia's beer market is experiencing a significant boost driven by the rapid growth of the middle class and increasing urbanization. As the country progresses towards achieving middle-income status by 2030, a substantial portion of its population is experiencing a rise in disposable income, directly impacting beer consumption patterns. This economic transition has led to a surge in demand for diverse beer products, with the market expanding both in terms of revenue and volume. The non-alcoholic beer segment alone is projected to grow significantly, reflecting the changing preferences of the emerging middle class. In 2023, Cambodia welcomed 5.4 million international tourists, further contributing to the beer market's growth, especially in urban centers like Phnom Penh and Siem Reap.

The impact of this driver is evident in the increasing number of bars and restaurants in major cities. Siem Reap, for instance, has seen the number of such establishments grow to 1,200 in 2024, up from 950 in 2022. This growth is mirrored in beer consumption patterns, with tourist areas experiencing 30% higher beer consumption during peak seasons. The average tourist in Cambodia now consumes 4.2 liters of beer during their stay, highlighting the interplay between tourism, urbanization, and the growing middle class. Beer gardens in Phnom Penh serve an average of 5,000 liters of beer per week during peak tourist season, while Siem Reap's popular Pub Street reports serving over 10,000 beers daily during high season. These figures underscore the significant impact of the growing middle class and urbanization on Cambodia's beer market.

Trend: Rising popularity of craft and premium beers among urban consumers

The Cambodian beer market is witnessing a significant shift towards craft and premium beers, particularly among urban consumers. This trend reflects a growing appreciation for unique, high-quality beer products that offer diverse flavors and brewing techniques. As of 2024, Cambodia is home to 45 local breweries, up from 35 in 2022, indicating a rapid expansion of the craft beer scene. These breweries are catering to the evolving tastes of consumers by producing a wide range of beer styles, with the number of craft beer varieties increasing to 120 in 2024. The largest craft brewery in the country now produces 50 different beer varieties, showcasing the diversity and innovation driving this trend.

The rise of craft beer in the Cambodia beer market is not limited to production; it's also evident in the growing number of beer-focused experiences available to consumers. There are now 150 beer-focused tours and experiences available in Cambodia as of 2024, offering both locals and tourists unique ways to explore the country's beer culture. The number of craft beer taprooms in tourist areas has grown to 35 in 2024, up from 22 in 2022, providing more venues for consumers to experience premium and craft beers. This trend is further supported by the increasing number of beer-themed events, which have risen to 30 annually in 2024. Local breweries have invested $30 million in new equipment and facilities over the past two years, reflecting their commitment to meeting the growing demand for high-quality, craft beers. These developments highlight the significant shift in consumer preferences towards more sophisticated and diverse beer offerings in Cambodia's urban centers.

Challenge: Regulatory environment impacting advertising and distribution strategies for breweries

The regulatory landscape in Cambodia beer market presents significant challenges for breweries, particularly in terms of advertising and distribution strategies. While the country has yet to implement stringent regulations on alcohol advertising, the potential for future regulatory changes creates an atmosphere of uncertainty for industry stakeholders. This unpredictable environment affects strategic planning and investment decisions, as businesses must be prepared to adapt to new regulations that could impact their advertising and distribution practices. The challenge is further compounded by the high taxes on alcoholic beverages, which affect profit margins and pricing strategies for both local and international beer brands.

Despite these challenges, the beer market in Cambodia continues to show resilience and growth. The largest local brewery in the country now has a production capacity of 12 million liters per year, while the average production capacity of a craft brewery stands at 500,000 liters per year. Collectively, local breweries produced 100 million liters of beer in 2023, showcasing their significant contribution to the market despite regulatory hurdles. The average local brewery in Cambodia distributes to 150 points of sale, indicating the development of distribution networks despite regulatory challenges. Local breweries have also made strides in innovation and quality, winning 30 international beer awards in the past two years. These achievements highlight the industry's ability to navigate the complex regulatory environment while continuing to grow and innovate. However, the ongoing challenge of balancing regulatory compliance with market expansion remains a key concern for breweries operating in Cambodia's evolving beer market.

Segmental Analysis

By Type

The lager beer segment continues to reign supreme in Cambodia’s beer market, with a staggering revenue of US$ 711.36 million in 2024. This dominance is deeply rooted in the cultural and climatic preferences of the region, where the light, crisp taste of lagers perfectly complements the tropical climate. The segment’s projected CAGR of 8.54% underscores its sustained growth, fueled by rising disposable incomes and evolving consumer tastes.

In 2024, the lager segment is undergoing a transformation, driven by several emerging trends. Craft-style lagers are gaining traction as consumers seek more diverse and premium options. Health-conscious drinkers are gravitating towards low-alcohol and low-calorie variants, prompting breweries to innovate in this space across the beer market. Flavored lagers, infused with citrus and tropical fruits, are particularly popular among younger demographics. Sustainability is also a key focus, with breweries adopting eco-friendly production and packaging practices. The expansion of e-commerce platforms has made lager beers more accessible, especially in rural areas. Beer festivals and tasting events are boosting consumer engagement, while international brands are entering the market, intensifying competition. Digital marketing campaigns, particularly on social media, are enhancing brand visibility and attracting younger consumers.

By Packaging Type

The bottle packaging segment remains the most preferred in Cambodia’s beer market, generating $ 503.41 million in revenue in 2024. Glass bottles are favored for their ability to preserve beer quality, offering protection from light and oxygen, which can degrade flavor. Additionally, the reusability and recyclability of glass bottles align with the growing environmental consciousness among consumers, further enhancing their appeal. The segment’s projected CAGR of 8.46% underscores its continued dominance, driven by the demand for premium beer products, which are often associated with bottle packaging.

In 2024, the bottle segment is experiencing several key developments. Breweries are increasingly adopting lightweight glass bottles to reduce transportation costs and carbon footprints. Innovative bottle designs and labeling techniques are enhancing brand differentiation and consumer appeal. Limited-edition and collectible bottle packaging is attracting beer enthusiasts and collectors. The growing trend of home beer consumption is boosting the demand for bottled beer, as consumers prefer the premium experience it offers. The expansion of retail chains and supermarkets is making bottled beer more accessible to a wider audience. Beer subscription services are driving the demand for bottled beer, as these services often emphasize premium and craft offerings. Eco-conscious consumers are pushing breweries to adopt sustainable packaging practices, such as using recycled glass. The growing influence of social media is amplifying the visual appeal of bottled beer, with consumers sharing their experiences online.

By Distribution Channel

The offline distribution channel remains the backbone of Cambodia’s beer market, generating US$ 496.54 million in revenue in 2024. Offline channels, including supermarkets, liquor stores, bars, and restaurants, offer consumers the advantage of tangible product experiences and immediate purchase options. The cultural preference for in-person shopping experiences, especially for alcoholic beverages, continues to drive the dominance of this segment. The offline channel’s projected growth is further supported by the social experience associated with purchasing and consuming beer in bars and restaurants.

In 2024, the offline distribution segment is experiencing several key trends. The rise of experiential retail is enhancing the in-store beer shopping experience, with retailers offering tastings and interactive displays. The growing popularity of beer gardens and outdoor drinking spaces is boosting the demand for beer in social settings. The expansion of convenience stores and mini-marts is making beer more accessible to consumers in urban and rural areas. The increasing focus on premiumization is driving the demand for high-end beer products in offline channels across Cambodia beer market. The rise of beer festivals and events is boosting foot traffic to offline retailers and bars. The growing influence of local breweries is leading to the availability of more diverse beer options in offline channels. The increasing use of technology, such as digital menus and contactless payments, is enhancing the offline shopping experience. The rise of beer tourism is driving the demand for beer in offline channels, particularly in tourist-heavy areas.

By Brewery Type

The macro brewery segment continues to dominate Cambodia’s beer market, generating $ 707.17 million in revenue in 2024. Macro breweries, with their large-scale production capabilities and extensive distribution networks, are well-positioned to meet the high demand for beer in the country. The segment’s projected CAGR of 8.42% reflects its robust growth, driven by increasing urbanization, a growing middle class, and rising disposable incomes. Macro breweries have also been successful in appealing to a wide consumer base through extensive marketing campaigns and diverse product offerings.

In 2024, the macro brewery segment is witnessing several significant trends. The introduction of craft-style beers by macro breweries is blurring the lines between traditional and craft beer, attracting a broader audience. The focus on sustainability is leading macro breweries to adopt energy-efficient production methods and reduce water usage. The rise of health-conscious consumers is driving the demand for low-alcohol and non-alcoholic beer variants, which macro breweries are now producing. The expansion of distribution channels in the Cambodia beer market, including e-commerce platforms, is making macro brewery products more accessible, especially in rural areas. The growing popularity of beer tourism is boosting the visibility of macro breweries, with consumers visiting brewery facilities for tours and tastings. The increasing use of data analytics is enabling macro breweries to better understand consumer preferences and tailor their products accordingly. International collaborations are leading to the introduction of new beer styles and flavors in the Cambodian market. The growing influence of digital marketing is enhancing brand engagement, particularly among younger consumers.

To Understand More About this Research: Request A Free Sample

Top Players in Cambodia Beer Market

- Anheuser-Busch InBev

- Carlsberg Breweries A/S

- Heineken International B.V.

- Khmer Beverages

- Molson Coors Beverage Company

- The Boston Beer Company Inc.

- The Brewerkz Company

- Cambrew Ltd.

- Vattanac Brewery

- Other Prominent players

Market Segmentation Overview:

By Type

- Lager

- Ale

- Stout

- Wheat

- Others

By Packaging Type

- Bottle

- Can

- PET

By Brewing Type

- Macro Brewery

- Micro Brewery

- Craft Brewery

By Distribution Channel

- Online

- Offline

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 1,117.69 Million |

| Expected Revenue in 2033 | US$ 2,433.52 Million |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Mn) |

| CAGR | 9.03% |

| Segments covered | By Type, By Packaging Type, By Brewing Type, By Distribution Channel |

| Key Companies | Anheuser-Busch InBev, Carlsberg Breweries A/S, Heineken International B.V., Khmer Beverages, Molson Coors Beverage Company, The Boston Beer Company Inc., The Brewerkz Company, Cambrew Ltd., Vattanac Brewery, Other Prominent players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0124728 | Delivery: 2 to 4 Hours

| Report ID: AA0124728 | Delivery: 2 to 4 Hours

.svg)