Global Breast Cancer Screening Market: By Testing Type (Imaging Tests (Ultrasound, MRI, Mammogram, Film mammography, Digital mammography, Digital breast tomosynthesis (DBT)), Genetic Tests, Other screening Tests (Breast Exam, Thermography, Tissue sampling)); End User (Research Labs, Cancer Institutes, Diagnostics Centers, Others); Region—Market Forecast and Analysis for 2024–2032

- Last Updated: 24-May-2024 | | Report ID: AA0723520

Market Scenario

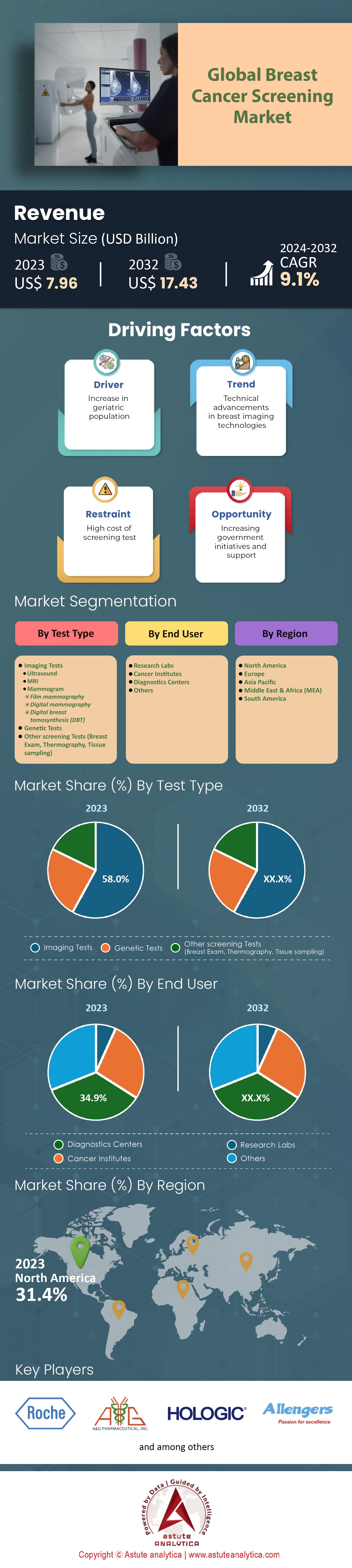

Global Breast Cancer Screening Market was valued at US$ 7.96 billion in 2023 and is projected to surpass the market size of US$ 17.43 billion by 2032 at a CAGR of 9.1% during the forecast period, 2024–2032.

Breast cancer continues to be a significant global health concern, with an increasing prevalence and the potential for devastating consequences if not detected early. In recent years, the demand for breast cancer screening has been steadily rising, driven by factors such as growing awareness, improved screening technologies, and government policies aimed at encouraging early diagnosis.

Breast cancer is the most common cancer in women worldwide, accounting for a significant number of cancer-related deaths. According to recent statistics, breast cancer currently affects approximately 2.3 million women globally, with an estimated 685,000 new cases diagnosed each year. In fact, in the US women the rate has reached 12%, which translates to over 1 in 8 women are likely to diagnose with breast cancer. These figures highlight the urgent need for effective screening measures to detect breast cancer at its earliest stages in the breast cancer screening market.

Breast cancer prevalence varies across regions, with some areas experiencing higher incidence rates. The largest region grappling with breast cancer is Asia, accounting for nearly 40% of new cases globally. Within Asia, countries such as China and India have seen a significant increase in breast cancer cases due to lifestyle changes, aging populations, and urbanization.

Technological advancements have revolutionized breast cancer screening, enhanced early detection and improved survival rates. Mammography remains the gold standard for breast cancer screening, but advancements such as digital mammography, tomosynthesis, and contrast-enhanced mammography have improved diagnostic accuracy. Additionally, other screening modalities across the global breast cancer screening market like ultrasound, magnetic resonance imaging (MRI), and molecular breast imaging (MBI) offer complementary tools for specific patient populations or high-risk individuals.

Governments worldwide are taking proactive measures to encourage early diagnosis of breast cancer. This includes implementing screening programs, increasing public awareness campaigns, and reducing financial barriers to screening. Many countries have introduced legislation mandating insurance coverage for mammograms, ensuring that women have access to regular screenings. These policies aim to detect breast cancer at its earliest stages, improving survival rates and reducing the burden of treatment.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Awareness and Adoption of Breast Cancer Screening

Breast cancer is one of the leading causes of cancer-related deaths among women worldwide. However, early detection through regular screening can significantly improve survival rates. The global breast cancer screening market is being driven by the increasing awareness and adoption of screening programs, coupled with advancements in screening technologies.

Today, governments, healthcare organizations, and advocacy groups have been actively promoting breast cancer awareness campaigns, highlighting the benefits of early screening. These initiatives aim to educate women about the significance of regular mammograms and clinical breast examinations, leading to increased participation in screening programs.

Moreover, technological advancements in breast cancer screening have contributed to the breast cancer screening market growth. Traditional screening methods, such as mammography, are being enhanced with digital imaging technologies, including 3D mammography, which provides higher-resolution images and improved accuracy. This has resulted in increased detection rates and reduced false positives, leading to better patient outcomes. Furthermore, the development of minimally invasive techniques, such as breast magnetic resonance imaging (MRI) and automated breast ultrasound (ABUS), has expanded the options available for breast cancer screening, particularly for women with dense breast tissue.

Trend: Growing Emphasis on Personalized Medicine and Genetic Screening in Breast Cancer

Breast cancer is a highly heterogeneous disease, with various subtypes that exhibit distinct molecular characteristics and responses to treatment. As a result, there is a growing trend towards personalized medicine and genetic screening in breast cancer diagnosis and treatment. This trend is reshaping the global breast cancer screening market and has the potential to revolutionize patient care.

Genetic screening plays a crucial role in identifying individuals who are at higher risk of developing breast cancer. Genetic mutations, such as BRCA1 and BRCA2, are known to significantly increase the risk of breast and ovarian cancers. Advances in genetic testing technologies have made it easier and more affordable to identify these mutations, allowing for early intervention and preventive measures. Genetic screening enables healthcare providers to tailor screening protocols and treatment plans based on an individual's genetic profile, leading to more personalized and targeted approaches.

Another significant trend in breast cancer screening is the integration of multi-gene panel testing. Rather than focusing solely on BRCA1 and BRCA2, multi-gene panel testing examines a broader range of genes associated with an increased risk of breast cancer. This approach provides a more comprehensive assessment of an individual's genetic predisposition and enables healthcare professionals to offer personalized risk management strategies and screening recommendations.

Opportunity: Emerging Markets and Technological Advancements to Offer Lucrative Revenue Opportunity

The global breast cancer screening market presents significant opportunities for growth, particularly in emerging markets and through technological advancements. These factors are reshaping the landscape of breast cancer screening, creating new avenues for market players and improving access to screening services.

Emerging markets, such as Asia-Pacific and Latin America, offer substantial growth potential in the breast cancer screening market. These regions have witnessed an increase in healthcare infrastructure development, rising disposable incomes, and a growing emphasis on women's health. As a result, there has been a greater focus on breast cancer awareness and screening programs, leading to increased demand for screening services. Market players have an opportunity to expand their presence in these regions by establishing partnerships with local healthcare providers, investing in awareness campaigns, and introducing cost-effective screening technologies.

Furthermore, technological advancements continue to drive innovation in breast cancer screening. The development of novel imaging techniques, such as molecular breast imaging (MBI) and tomosynthesis, holds promise for improving the accuracy and early detection rates. MBI, in particular, offers advantages for women with dense breast tissue, where traditional mammography may yield false-negative results. Additionally, artificial intelligence (AI) and machine learning algorithms are being integrated into screening processes, aiding in the interpretation of imaging results and providing decision support tools for healthcare professionals.

Segmental Analysis

By Test Type:

In terms of test type, imaging tests are expected to dominate the global breast cancer screening market. Imaging tests include mammography, breast ultrasound, breast MRI, and molecular breast imaging (MBI). These tests play a crucial role in the early detection and diagnosis of breast cancer, leading to better patient outcomes.

The market value of imaging tests in the breast cancer screening market is projected to reach US$ 9,093.1 million by 2030, occupying a significant share of 58.0% in the same year. Imaging tests are widely utilized due to their effectiveness in detecting abnormalities in breast tissue, such as tumors or masses. Mammography, in particular, is a commonly used imaging technique that uses low-dose X-rays to produce detailed images of the breast.

Technological advancements in imaging tests have further contributed to their dominance in the market. Digital mammography and 3D mammography (tomosynthesis) have revolutionized breast imaging by providing higher resolution and more accurate detection of abnormalities. These advancements have led to increased adoption of imaging tests for breast cancer screening, particularly in developed regions with well-established healthcare infrastructure.

Moreover, the growing prevalence of breast cancer globally has also contributed to the dominance of imaging tests. As breast cancer rates continue to rise, there is a greater emphasis on early detection and regular screening. Imaging tests offer a non-invasive and relatively low-cost method for screening large populations, making them a preferred choice for breast cancer screening programs.

By End User:

Diagnostic centers are the leading end users of the global breast cancer screening market. In 2023, the diagnostic centers segment generated over 34.9% of the total revenue in the market. This segment is projected to grow at a compound annual growth rate (CAGR) of 9.2% during the forecast period.

The increasing number of breast cancer patients seeking early detection and consultation is a key factor driving the growth of diagnostic centers. These centers serve as the first point of contact for individuals who require breast cancer screening and subsequent consultations with healthcare professionals. Diagnostic centers offer a comprehensive range of services, including mammography, breast ultrasound, biopsy, and other imaging tests, allowing for accurate diagnosis and prompt treatment planning.

The significance of diagnostic centers lies in their ability to provide accurate and timely results, reducing the risk of trial-and-error treatments. Patients who visit diagnostic centers in the global breast cancer screening market benefit from specialized equipment and expertise, ensuring reliable and precise diagnostic outcomes. Additionally, diagnostic centers often collaborate with other healthcare facilities, such as hospitals and oncology clinics, to ensure seamless patient care and continuity of treatment.

Furthermore, diagnostic centers offer a convenient and accessible option for patients, especially in urban areas where these centers are readily available. Today, many diagnostic centers also participate in breast cancer awareness campaigns, partnering with organizations to promote screening programs and educate the public about the importance of early detection.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America, renowned for its advanced healthcare system and comprehensive research initiatives on breast cancer, is a preeminent player in the global breast cancer screening market. In 2023, the region accounted for over 31.4% market share and is projected to expand its revenue generation capacity to over 32.6% by the end of the forecast period 2030. In the vibrant landscape of healthcare, North America stands out as a beacon of innovation and progress. Its large-scale research programs, robust healthcare facilities, and considerable market share in the global battle against breast cancer underpin its leading position.

The National Cancer Institute (NCI), a pivotal North American institution, underscores the region's commitment to fighting breast cancer. It is currently financing a groundbreaking study, the Tomosynthesis Mammographic Imaging Screening Trial (TMIST). This trial contrasts the detection rates of advanced cancers in women undergoing five years of 3-D mammography screening versus 2-D mammography. Such high-stake initiatives reflect North America's relentless pursuit of cutting-edge breast cancer research and treatment modalities.

The grim reality is that cancer is the second-leading cause of death in the US, following heart disease. Therefore, the breast cancer screening market witnessing a significant inflow of the revenue in this country. The American Cancer Society anticipates about 1.9 million new cancer diagnoses and approximately 609,360 deaths due to cancer in the US in 2022 alone. That's a staggering average of about 1,670 deaths every day. As per Globocan 2020, North America reported more than 281,591 new breast cancer cases in 2020, outpacing South America's 156,472 cases. These sobering statistics illustrate the urgent need for continuous improvement and investment in cancer research and treatment in the region.

While North America retains the largest share of the breast cancer screening market, Europe is not far behind. With a unique blend of diverse countries, Europe represents a significant portion of the global market. According to Globocan 2020, over 327,724 new cases of breast cancer were reported across central, eastern, and western Europe. A critical factor behind Europe's robust position is its utilization of digital mammography for screening programs. This technique exhibits high sensitivity, even in dense breasts, leading to its widespread adoption. It has completely supplanted film-screen mammography in 64% (16/25) of EU states, exemplifying Europe's dedication to deploying the most effective diagnostic tools.

Key Players in the Global Breast Cancer Screening Market

- Siemens Healthcare

- Hologic, Inc

- Myriad Genetics

- Metabolomic Technologies Inc

- Biocrates Lifesciences AG

- A&G Pharmaceuticals

- Provista Diagnostics Inc

- Roche Diagnostics

- Lineage Cell Therapeutics, Inc. (Biotime Inc.)

- General Electric Company

- Quest Diagnostics

- Agendia NV

- Oncocyte Corporation

- Allengers Medical Systems Ltd.

- Other Prominent Players

Market Segmentation Overview:

By Test Type

- Imaging Tests

- Ultrasound

- MRI

- Mammogram

- Film mammography

- Digital mammography

- Digital breast tomosynthesis (DBT)

- Genetic Tests

- Other screening Tests (Breast Exam, Thermography, Tissue sampling)

By End User

- Research Labs

- Cancer Institutes

- Diagnostics Centers

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)