Global Boron Carbide Market: By Grade (Abrasive, Nuclear, and Refractory); End Use (Armors & Ballistic Protection, Industrial Abrasives, Neutron Shielding (Nuclear Reactor), Shields & Panels, Refractory Materials, and Others); Physical Form (Powder, Granular, and Paste); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 29-May-2024 | | Report ID: AA0524842

Market Scenario

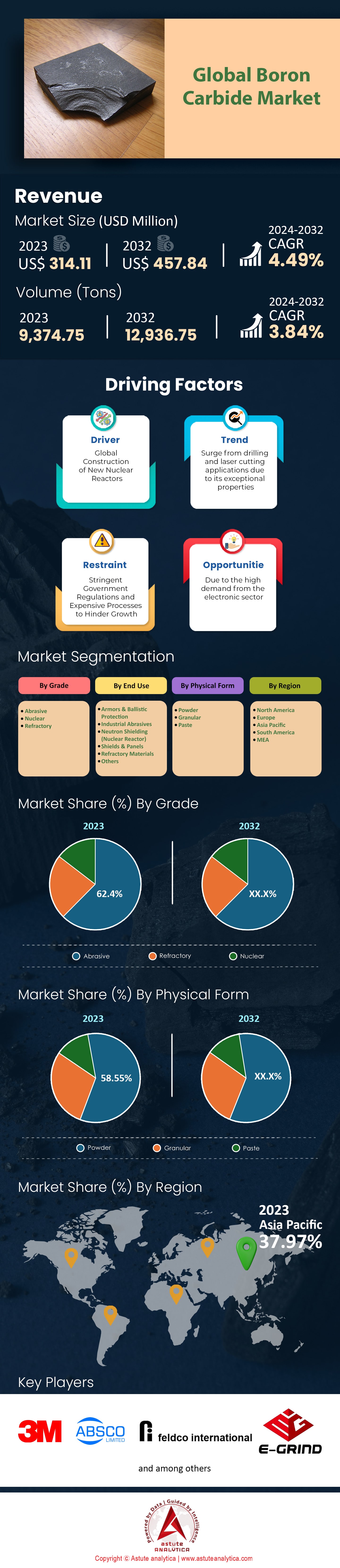

Global Boron Carbide Market was valued at US$ 314.11 million in 2023 and is projected to hit the market valuation of US$ 457.84 million by 2032 at a CAGR of 4.49% during the forecast period 2024–2032.

The exclusive features and wide range of applications of boron carbide have led to an increase in its demand across many sectors. Its cruciality in the nuclear sector is among the main drivers of boron carbide market. The product is highly utilized because of its capability to absorb neutrons, which improves safety and efficiency of reactors. With the growth in global nuclear industry necessitated by rising energy needs; it is projected that there will be higher demands for this element. Primarily its applications are based on nuclear reactors where most markets come from. Additionally, Asia-pacific region has recorded immense numbers of new constructions on nuclear power plants thereby increasing usage further. For example, as of 2025 around 140 operational A-P reactors with another 35-40 under construction and firm plans for additional 55-60.

Defense and aerospace industries often find boron carbide very useful due to its extreme hardness coupled with lightness. In modern military operations body armor materials lightweight nature makes boron carbide perfect for defense and aerospace applications. Countries like Japan increased their defense budgets by 1.1% from previous year as global spending went up approximately 2.8% in 2023. Defense spending’s rise directly corresponds with growing requirements for protection equipment including vehicle armors which also require this particular compound.

The industrial sector contributes significantly towards increasing demand for boron carbide market as well, with rising use of abrasive materials, cutting tools, water jet cutters and grit blasting nozzles among other things. It is able to provide machining processes with high surface quality without changing workpiece geometry thus making itself indispensable for this kind of application too where applicable. Moreover, wear-resistance requirements imposed upon automotive or aerospace industries necessitate employment of such materials like boron.

Another driving force behind growth rates could be seen coming out from construction industry mainly focused on countries located around Asia-Pacific region including China, India, and Japan. These countries have been experiencing rapid urbanization coupled with infrastructure development thus leading to increased demand for quality building materials. This need cannot be met without considering boron carbide applications in glass and ceramics industry used for producing construction materials which can withstand harsh environmental conditions over long periods of time. It is worth noting that this region accounts for nearly 50% share of global consumption volume due to its strong manufacturing base combined with growing defense capabilities.

The future growth prospects within global boron carbide market may also come about as a result of technological advancements in manufacturing processes aimed at improving product quality standards, innovation levels being raised higher than before alongside an increase among end users’ preference towards premium high-strength materials.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Strong Adoption in Defense, Nuclear, and Aerospace Industries Keeps the Boron Carbide Market Floating

The defense, nuclear and aerospace industries are driving the growth of the market through increased adoption of boron carbide. In bulletproof vests and armor production for instance, it is widely used in the defense sector because it has high hardness coupled with low density besides being an excellent shock wave absorbent as well as showing no signs of crack initiation even when subjected to severe impact loads or multiple cycles thereof. Moreover, boron carbide plates, which can resist projectiles moving at a velocity up to three thousand feet per second have been manufactured thus making this material suitable for such applications.

In control rods as well as shielding materials the product is used heavily to absorb neutrons very fast and prevent them from causing any further damage within their immediate environment. Boron carbide serves this purpose among others within the nuclear industry where it is employed primarily as a neutron absorber, adding fuel to the boron carbide market. This is attributed to its high cross section area for absorbing these particles released during fission process. Additionally, up to 10^21 neutrons/cm^2 can be absorbed by one square centimeter area made up entirely out of boron carbide alone under appropriate conditions required by aforementioned applications.

Within the aerospace industry, lightweight yet strong components are needed like nozzles used in rocket engines. Hence, there exists demand for materials having properties similar to those possessed by B4C such as high specific strength (strength-to-weight ratio) which acts an advantage over steel since it is ten fifteen times greater than that of steel. Advanced materials are increasingly being sought after by these sectors on account of safety concerns associated with working environments alongside performance requirements set forth. Therefore, it is leading towards adoption of boron carbide market. This unique combination makes it perfect candidate material for various demanding applications having Mohs Hardness Scale value equal to 9.5 while melting at temperatures ranging from around 2763 degrees Celsius plus thermal conductivity rate estimated between 90-100 W/mK respectively.

Trend: Growing Demand for Advanced Protective Gear

A leading trend in the boron carbide market is the necessity for sophisticated protection. There is an ever-increasing need for advanced protective equipment such as bulletproof vests, helmets, and armor plates due to growing global safety concerns and personal security awareness. Hardness that’s exceptional among other materials used in making these gears lightweight nature of boron carbide makes it a perfect choice because it can resist any form of impact or penetration at higher levels than others too. In addition, while being up to 50% lighter than traditional steel armor Boron Carbide armor plates are able stop fast moving projectiles like 7.62mm NATO rounds fired from assault rifles etc..

The armed forces, police departments and general public establishments have seen a rise in demand for better quality self-defense gear which has led to increased production rates within this industry; military personnel are now equipped with more modernized body armors while vehicles are fitted with stronger types of armor plating hence driving up sales volumes even further thus contributing greatly towards market growth trends concerning boron carbides.

Bulletproof vests and helmets are in high demand among law enforcement agencies due to increasing number of armed conflicts and acts of terrorism, giving a boost to the boron carbide market growth. Bulletproof jackets made from boron carbide can protect wearers against NIJ level-3 threats which include armor piercing rounds fired by rifles. Additionally, civilian populations too have started realizing the need for personal protective equipment (PPE) especially those living or working within dangerous areas or involved in hazardous activities on daily basis such as journalists reporting from war zones or security guards manning checkpoints during times when there is heightened tension between warring parties.

Challenge: Balancing Supply and Demand in Boron Carbide Market

For manufacturers in the boron carbide market, a major problem they face is how to balance supply with demand. Because of its various applications in multiple sectors coupled with the growing need for it, producers must ensure steady supply as well as manage production costs and market forces. The process of making boron carbide usually involves high temperature synthesis methods which may be energy-consuming and expensive. Synthesizing boron carbide commonly requires temperatures above 2000 °C under pressure higher than 1 GPa . However, having said this much; but what if there are no enough raw materials notably boron? It should be noted that Boron is a relatively rare element found at average concentrations of just ten parts per million in earth’s crust.

The fact that different industries such as agriculture, ceramics or glass require more boron can result into supply side bottlenecks thus affecting prices within the borides market including BC5. What needs to happen now according to manufacturers is getting reliable sources where they will get their inputs from. Moreover, they should also try and optimize on how best their products could be made so that there are always enough borides available with them. Again, pricing becomes difficult when demand keeps changing because people do not know what price tag should be placed on different quantities at any given point in time. This due to uncertainty factors associated with this kind of markets like government policies and technological changes especially for those customers who are using these materials for R&D purposes only.

Segmental Analysis

By Grade: Abrasive Grade Boron Carbide are at Forefront

Due to the unique properties and wide range of applications in many fields, the consumption of abrasive grade boron carbide market has kept rising. As a result, abrasive grade segment accounts for 62.4% of the whole market. With the hardness between 9 and 10 on Mohs scale, it is perfect for grinding, lapping and polishing purposes. Utilized in manufacturing processes which need high shock resistance, abrasion resistance, hardness, low thermal conductivity as well as wear resistance; thus, this part will grow at a CAGR of about 4.69% till 2032.

Bulletproof vests and armor greatly demand boron carbide in the defense sector which has been a significant driver of the growth of the industry. The abrasive grade now may witness strong influx of demand from ultrasonic drilling and ceramics plate production. During the forecast period, the abrasive grade segment is projected to keep growing at the highest CAGR of 4.69% in the years to come. Thus, making it become larger than any other parts that make up boron carbide market.

In the construction industry, it is used for slicing and polishing concrete but also finds notable usage in wear-resistant applications such as blasting nozzles or cutting tools where its hardness comes into play. Besides these points, there are some geopolitical factors too like growing defense budgets across countries as well adoption advanced armor materials having contributed towards this trend. Ongoing R&D activities are also adding to demand levels even further through their focus on new applications within areas like advanced ceramics, electronics or neutron shielding among others – all these factors combined could lead us into an era where we will continue seeing higher needs for abrasives grades of boron carbides going forward into future years.

By End Use: Boron Carbide Market Witnesses Strong Demand from Industrial Abrasives

Due to its extreme hardness, boron carbide is often called "man-made diamond" and is becoming more and more popular as an industrial abrasive. To be exact, industrial abrasives account for over 38.6% of the global market revenues. It can maintain sharp angles and high dimensional stability required by some applications due to its durability and wear resistance. This material is particularly advantageous for automotive and aerospace industries where it can produce high-quality surface finishes without changing the shape of workpieces that need accurate smooth flat surfaces.

In addition to this, slurry pumping nozzles; water jet cutting machines; grit blasting equipment; polishers etc., heavily rely on boron carbide market because they involve materials removal process through abrasion. These processes benefit from the fact that this compound has got better abrasion resistance than any other abrasive material besides diamond itself. Thereby, enabling organizations involved in such operations increase efficiency while at the same time saving resources substantially. Boron carbide demand is further boosted by military & defense establishments together with aerospace manufacturers all around the globe who require lightweight armor plates having hardness exceeding or equaling those made from aluminum oxide ceramics but which should possess higher resistance against penetration by bullets fired at supersonic speeds.

The manufacturing sector also plays a significant part in technological advancements. As more industries look towards getting premium quality materials with higher strengths, there will be an increased need for boron carbides hence their production levels will rise accordingly too. Likewise, there shall arise new types of abrasive technologies that are able to withstand industrial shocks as well as wear thus necessitating stronger compounds like boron carbide even more thereby pushing up its demand further again still even much higher yet forever always everlastingly forevermore perpetually until eternity never ending concluding forever lasting throughout endless times.

By Physical Form: Powder Form Takes the Center Stage in Boron Carbide Market

In terms of physical structure, the powder section is at the forefront of the market with more than 58.5% market share and is expected to grow at the highest CAGR of 4.66% in the coming years also. Its demand as a powdered substance is driven by its superior versatility and efficiency over other forms such as paste or granules. One of its main benefits is that it has an even particle size, which ensures uniform performance across different applications. This consistency is important for precision manufacturing where any deviations can result in below par outcomes.

Powdered boron carbide can be controlled very precisely and adjusted according to specific needs. Thus, making it highly sought after in industries that have strict requirements. In abrasive industry, this powder delivers top notch surface finishes while minimizing material wastage. It allows for smoother grinding, lapping and polishing processes due to fine particles that are consistent throughout which means higher global abrasives market valued $39.9 billion (2022) will heavily rely on materials like boron carbide projected to grow by 5.5% (CAGR) till 2032. The ability of achieving desired surface properties through powders’ efficiency and effectiveness makes them widely used across various sectors.

Hardness, resistance to wear and thermal stability are improved in advanced ceramics and refractory materials through the use of boron carbide powder. These properties are important for the global advanced ceramics market which is projected to grow at a CAGR of 6.2%. This is especially crucial in aerospace and defense industries where material performances are strictly required, thus driving boron carbide market.

Boron carbide powder is commonly used in nuclear technology because it is easy to handle and measure accurately. The compound finds extensive application as a neutron absorber; control rods or shielding materials being some of its uses in this area. More than 450 reactors are currently operational worldwide while another 50 units remain under construction thus creating significant demand for reliable neutron absorbers. Fine grain size of boron carbide powders enables better compaction and uniformity necessary for safety and efficiency improvements within reactors themselves at all levels.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Asia-Pacific's Dominance in Boron Carbide Production and Consumption

More than 50% of the world’s boron carbide market volume is held by the Asia-Pacific region which also contributes more than 37.97% market revenue. China’s manufacturing base, which accounts for a 25% of global manufacturing output, and India’s increasing industrial sector are major players in this regional success. Moreover, with 60% of global population residing here as well as rising per capita incomes that lead to demand for consumer goods made with boron carbide such as high-performance abrasives and advanced ceramics – it is no wonder why APAC countries like China (28%), Indonesia (7%) or Japan (6%) have emerged not only as production but also consumption hubs for this industry worldwide. Abundant availability of natural resources coupled with strong economic policies, rapid technological advancements alongside robust industrial growth makes Asia Pacific region particularly attractive when it comes down to boron carbide business opportunities; hence Australia being one of them too.

China and India boron carbide market possess significant reserves of boron minerals necessary for the manufacture of boron carbide. For instance, China alone has about 32% share in global reserves while ensuring continuous supply through self-sufficiency in raw materials thus reducing dependence on imports whereas Indian large amount deposits support these supply chains making production cheaper and more reliable.

Urbanization drives up the demand for advanced materials in APAC where its GDP grew by an average rate over 6.1%, second only after South America. Furthermore, manufacturing output contributes more than four fifths proportionally within total worldwide outputs which stimulates demand within automotive industry especially aerospace defense sectors being among key consumers since transportation is vital component part here – therefore it needs lots amounts thereof such as space shuttles etcetera where boron carbide plays crucial role too.

China launched “Made in China 2025” campaign aimed at increasing self-sufficiency through innovation, with a target of 70% rise in homegrown inventions. Similarly, India wants its manufacturing sector to account for a quarter of GDP by 2025 as part of the “Make In India” initiative. These policies will drive up domestic demand for advanced materials such as boron carbide while also encouraging production and R&D investment within the country itself for boron carbide market growth.

Strong Spending on Defense and Presence of Key Ports Shape APAC’s Dominance in Boron Carbide Market

In APAC region, aerospace and defense sectors are major consumers of boron carbide. Japan increased defense spending by 16% for year 2023 with total value at $47.6bn while India’s defense budget grew by around 4.2% in same timeframe reaching $83.6 bn that year alone; this led both countries to become largest buyers because lightweight armor due lightness hardness properties provide best protection against bullets etc., therefore demanding more product supply from manufacturers who fulfill these orders promptly along with saving lives too which is great achievement indeed.

The Asia-Pacific region has numerous ports and trade routes which make it easier for exportation and importation of goods including boron carbide among others needed across world economies today. For example, China being one biggest supplier globally thanks also having well established networks together with japan which enables efficient supply chain management systems for this industry; thus, last year alone China exported about 1200MT catered global markets.

Infrastructure development in APAC worth $1.7tn per annum drives demand construction materials advanced ceramics both benefiting from properties associated with boron carbide. This is clear indication that these countries have prioritized modernization through massive investments into their economies while ensuring they are sustainable over long periods of time as well.

Top Players in the Global Boron Carbide Market

- 3M Company

- ABSCO Limited

- Dalian Zhengxing Abrasive Co.,Ltd.

- Feldco International

- Henan E-Grind Abrasives Co. Ltd

- United States Electrofused Minerals, Inc

- UK Abrasives, Inc

- Saint Goban S.A

- Washington Mills North Grafton, Inc.

- TRBOR

- Other Prominent Players

Market Segmentation Overview:

By Grade

- Abrasive

- Nuclear

- Refractory

By End Use

- Armors & Ballistic Protection

- Industrial Abrasives

- Neutron Shielding (Nuclear Reactor)

- Shields & Panels

- Refractory Materials

- Others

By Physical Form

- Powder

- Granular

- Paste

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)