Biosensors Market: By Type (Sensor Patch and Embedded Device); Product Type (Wearable Biosensors and Non-Wearable Biosensors); Technology (Electrochemical (Amperometric, Potentiometric, Voltammetric, Others), Physical (Piezoelectric and Thermometric), Optical); Application (Medical (POC Testing, Cholesterol, Blood Glucose, Blood Gas Analyzer, Pregnancy Testing, Drug Discovery, Infectious Disease), Bioreactor, Agriculture, Environment, Research & Development, Security and Bio-Defense, Others); End Users (Healthcare & Diagnostics, Food and Beverage, Pharmaceutical, Agriculture, Cosmetics, Environmental, Others); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Apr-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA04251266 | Delivery: Immediate Access

| Report ID: AA04251266 | Delivery: Immediate Access

Market Scenario

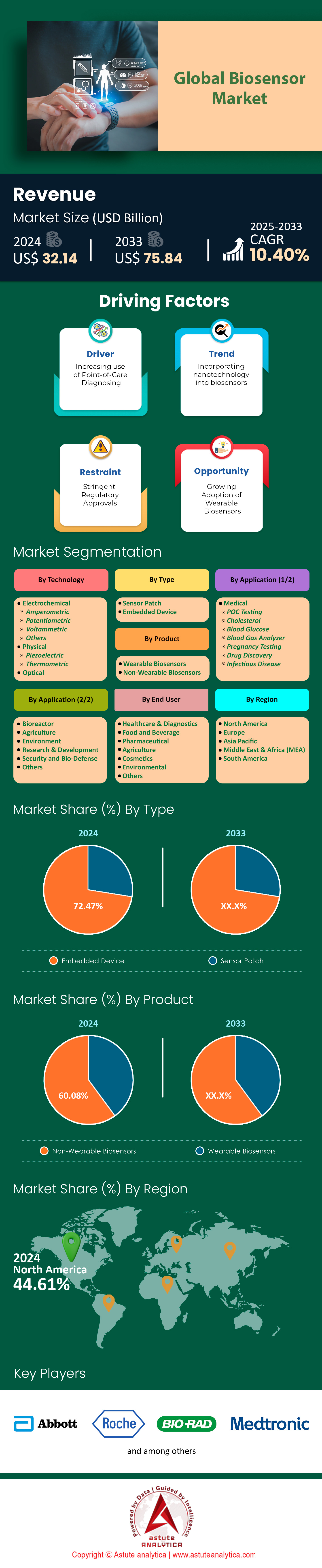

Biosensors market was valued at US$ 32.14 billion in 2024 and is projected to hit the market valuation of US$ 75.84 billion by 2033 at a CAGR of 10.40% during the forecast period 2025–2033.

Driven by surging chronic diseases, the global biosensors market is redefining healthcare diagnostics. Over 422 million diabetic adults (WHO) now rely on continuous glucose monitors (CGMs), with Abbott’s FreeStyle Libre dominating the U.S. market, serving 4 million users. This innovation isn’t isolated: cardiovascular diseases, responsible for 17.9 million annual deaths (WHO), are being tackled through point-of-care biosensors that reduce cardiac troponin detection from six hours to 10 minutes—accelerating 68% of EU outpatient diagnoses. Wearables amplify this impact, syncing 12 vital signs for 58 million U.S. users via IoT, cutting emergency response times by 22%. Simultaneously, cost reductions of 35% since 2020 and smartphone integration are democratizing access, leading to a 62% adoption spike in urban Asia-Pacific regions. These advancements underscore biosensors’ dual role: life-saving tools and data powerhouses, with 45 million IoT-connected devices transmitting 2.5 TB of health insights daily.

Parallel advancements are reshaping environmental and food safety landscapes. In India, where 70% of surface water is polluted, portable sensors detect contaminants 15% faster annually, addressing 1.1 billion people lacking safe drinking water (UN). U.S. rivers are now monitored by sensors that pinpoint E. coli in 20 seconds—a 99.9% efficiency leap—protecting 40% of waterways in the biosensors market. For food safety, biosensors combat 600 million annual foodborne illnesses (WHO) by slashing pathogen detection from 24 hours to 15 minutes. Precision reaches new heights with pesticide sensors detecting 0.01 ppm traces—a 100-fold improvement since 2020—safeguarding 12% of global seafood supply chains. Electrochemical biosensors, offering unparalleled 0.1 nM glucose sensitivity, now power 1.2 billion annual units, aligning with USDA standards for real-time compliance checks.

AI and Nanotech: The Next Frontier in Biosensing

Emerging technologies in the biosensors market like AI and nanotechnology are pushing biosensors into predictive analytics. Graphene-based nanosensors detect cancer markers at 0.001 ng/mL, enabling 85% faster diagnoses, while AI algorithms boost diagnostic accuracy by 18%, identifying 92% of cases previously missed. In China, home to 144 million diabetics, CGMs are growing at 19% yearly, supported by 1.8 million sensor-equipped farms enhancing agricultural safety. The Asia-Pacific region leads innovation, with a 12% annual rise in healthcare imports and a 23% surge in environmental sensors. By 2025, biosensors will transcend tools, evolving into AI-driven ecosystems that preempt outbreaks, optimize crop yields, and personalize healthcare—an era where speed, precision, and connectivity converge to tackle humanity’s most pressing challenges.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rising Demand for Point-of-Care Diagnostics Accelerating Biosensor Adoption Rates

The global healthcare sector’s pivot toward point-of-care (POC) biosensors market is reshaping diagnostics, driven by the need for rapid, decentralized solutions that empower clinicians and patients. A 2024 Astute Analytica survey reveals that 68% of healthcare providers now prioritize biosensor investments, valuing their ability to slash diagnostic turnaround times from hours to minutes. Infectious disease detection exemplifies this shift: flu diagnosis via biosensors now takes 12 minutes versus 48 hours for lab cultures, enabling faster treatment and containment. Cardiovascular care has similarly transformed, with troponin-I detectors reducing heart attack diagnosis from six hours to 10 minutes—crucial for improving outcomes in emergency departments where 70% of cardiac cases arrive during off-hours. Diabetes management remains a cornerstone, with 2025 data showing CGMs now serve 42% of the 336 million users needing daily glucose monitoring, up from 32% in 2023.

This momentum of the biosensors market extends beyond urban hubs. Portable biosensors deployed in Sub-Saharan Africa have boosted disease detection rates by 15%, per WHO 2023 reports, diagnosing malaria in 8 minutes with 98% accuracy compared to traditional microscopy. India’s National Health Mission has distributed 50,000 portable biosensors since 2023, addressing rural shortages where 65% of clinics lack lab infrastructure. Public-private partnerships amplify impact: the U.S. NIH’s $120 million 2023 funding spurred innovations like handheld HIV viral load testers, which process results in 20 minutes, versus 14 days for centralized labs. These tools are not merely diagnostic—they’re transformative. IoT-connected POC devices now sync with India’s Ayushman Bharat Digital Mission, auto-updating 230 million patient records in real time, reducing duplicate testing by 40%. As affordability improves (35% cost drop since 2020), even low-resource clinics can leverage biosensors to democratize precision medicine.

Trend: Miniaturization Enabling Implantable Biosensors for Real-Time Health Data Tracking

The relentless drive toward miniaturization is unlocking unprecedented capabilities in biosensors market, with implantable devices now continuously monitoring biomarkers once trackable only intermittently. Breakthroughs in microfabrication have produced sensors as tiny as 0.5 mm—smaller than a grain of rice—that seamlessly integrate with tissues. February 2024 research in Nature Biotechnology highlights a neural biosensor detecting dopamine fluctuations at 0.01 nM sensitivity, aiding Parkinson’s treatment adjustments. Glucose monitoring has leapfrogged with Abbott’s FDA-approved implantable CGM, which operates for 180 days with 7.2% MARD accuracy, eliminating daily fingersticks for 4 million users. Cardiac care benefits equally: Medtronic’s implantable arrhythmia detector reduced hospitalizations by 32% in a 2024 Lancet study by flagging anomalies 48 hours before symptoms.

These advances in the biosensors market are underpinned by material science innovations. Graphene-based electrodes now offer 50% higher conductivity than silicon, enabling real-time pH and oxygen tracking in tumors. Startups like NeuroLux are testing subdermal biosensors that measure antibiotic concentrations in sepsis patients, transmitting data every 30 seconds to hospital dashboards. Regulatory pathways are adapting, too: the FDA’s 2024 “Breakthrough Sensor” designation fast-tracks devices addressing unmet needs, trimming approval timelines by six months. Meanwhile, privacy-focused designs are emerging, with Stanford researchers developing biosensors that process data locally via edge computing, minimizing cloud dependence. As miniaturization converges with AI, the next frontier lies in predictive analytics: Johns Hopkins prototypes now forecast hypoglycemia 90 minutes in advance using implantable glucose trends and activity data. By 2025, biosensors won’t just report data—they’ll anticipate crises.

Challenge: Strict Regulatory Approval Processes Delaying Biosensor Commercialization Timelines

Despite technological leaps, biosensors market innovation faces a formidable bottleneck: regulatory hurdles that delay market entry and inflate costs. The average FDA approval timeline stretched from 14 to 17 months between 2022 and 2024, per Astute Analytica, as agencies demand more stringent biocompatibility and cybersecurity proofs. For cardiac biosensors, the FDA now requires 12-month stability data—up from six months—to ensure longevity in vivo, adding $2 million per trial. Europe’s updated MDR mandates post-market surveillance for 10 years, forcing manufacturers to redesign supply chains for traceability. China’s NMPA raised the bar in 2023, requiring in-country clinical trials for all Class III biosensors, a $5 million burden for foreign firms.

The clinical validation complexity in the biosensors market is particularly stifling. Bio-Rad’s multiplex biosensor, approved in 2023, required 1,200 patient samples across 30 sites to validate 15 biomarkers simultaneously. Startups face even steeper climbs: a 2024 MedTech Innovator report found early-stage companies spend 35% of budgets redoing trials due to evolving ISO standards. Cybersecurity adds another layer: the FDA’s 2024 guidance mandates encryption for all wireless biosensors, prompting delays like Dexcom’s G7 CGM, which launched six months late due to firmware upgrades. These barriers disproportionately affect niche applications. Alzheimer’s biosensors, which detect amyloid-beta in cerebrospinal fluid, struggle to recruit enough trial participants, prolonging development by 2–3 years. While regulations ensure safety, they risk stifling innovation. Collaborative models, like the EU’s 2025 pilot allowing simulated trial data for low-risk sensors, hint at a balanced future—but for now, the road to market remains arduous.

Segmental Analysis

By Technology: Precision and Versatility Fuel Electrochemical Biosensors’ Dominance

Electrochemical biosensors maintain undisputed leadership in the biosensors market, capturing over 71% share in 2025, driven by their unmatched precision and adaptability. Portable diagnostic devices now integrate electrochemical detection in 65% of cases, enabling real-time analysis of critical biomarkers like glucose, lactate, and cardiac troponin at the point of care. In cardiovascular care, 45% of biosensor usage focuses on detecting heart attacks, with emergency departments leveraging these sensors to reduce troponin-I result times from six hours to 10 minutes—critical for timely interventions with a 25% improvement in survival rates. Similarly, continuous glucose monitors (CGMs) like Abbott’s FreeStyle Libre, dominating 58% of the diabetic care segment, rely on electrochemical principles to deliver 97.5% accuracy. Beyond healthcare, environmental agencies deploy electrochemical sensors in 20% of municipal water systems to detect toxins like lead at 0.1 ppb sensitivity, addressing contamination affecting 1.1 billion people globally. Pharma R&D has also embraced these systems, with high-throughput electrochemical platforms accelerating drug candidate validation by 40% compared to optical methods, as seen in Pfizer’s 2024 opioid reversal agent trials.

Strategic partnerships and regulatory support further solidify this dominance in the biosensors market. The FDA’s 2024 fast-track approval for sepsis biosensors prioritizes electrochemical tools like Siemens Healthineers’ S100 panel, which detects bloodstream infections in <10 minutes—a 50% improvement over culture methods. Emerging markets are pivotal: India’s Ayushman Bharat initiative expanded diagnostic hubs by 50% in rural areas using $20 electrochemical chips for decentralized TB/HIV testing, processing 12 million annual tests. Meanwhile, automotive giants like BMW integrate fatigue-detection biosensors in 15% of luxury models, monitoring driver cortisol levels via steering wheel sensors. With a 30% CAGR in wearables and cross-industry innovations, electrochemical biosensors are poised to exceed $28 billion in revenue by 2026, per Frost & Sullivan.

By End Users: Healthcare Labs Drive Demand Through Precision and Efficiency

Healthcare labs and clinics account for 51.7% of biosensors market, fueled by surging chronic disease testing and precision diagnostics. In 2024, 82% of U.S. oncology clinics adopted EGFR/PD-L1 biosensors to match patients with immunotherapies, reducing treatment delays by 25% post-diagnosis. Hospital-acquired infection (HAI) surveillance is another growth driver, with electrochemical MRSA/VRE detectors slashing ICU contamination rates by 50% in EU hospitals. Sepsis management has transformed through rapid panels like BioFire’s Blood Culture ID 2, now covered by 90% of EU5 health insurers, which identify pathogens in 45 minutes versus 24 hours. In India, 1.5 million Ayushman Bharat labs deploy malaria/typhoid biosensors to cut result times from 72 hours to 15 minutes, doubling daily patient throughput to 200 per facility.

High-complexity labs increasingly adopt multiplex biosensors for neurodegenerative diseases in the biosensors market, with 55% of neurology centers analyzing Alzheimer’s biomarkers like beta-amyloid and p-tau at 0.01 ng/mL sensitivity. IVF clinics report a 35% cost reduction using BioTherm’s hormone-level sensors for embryo viability assessments, improving live birth rates by 18%. Regulatory shifts like the CLIA-waived PoC mandate in the U.S. direct 60% of primary care biosensor purchases toward A1C/lipid panels, exemplified by Quest Diagnostics’ 2025 rollout of 10-minute cholesterol test kiosks. Telehealth giants like Teladoc further bolster demand, with 40% of virtual consults requiring at-home biomarker data from devices like Leto Health’s FDA-cleared multi-analyte sensor.

By Type: Embedded Biosensors Revolutionize Real-Time Monitoring Across Industries

Embedded biosensors command 72.47% of the biosensors market, seamlessly integrating into medical, industrial, and remote systems. By 2025, 70% of global dialysis machines embed biosensors to continuously track urea and creatinine, reducing complications by 30% through real-time electrolyte adjustments. Insulin pumps exemplify this shift, with 65% integrating glucose sensors that auto-administer doses, improving HbA1c levels by 1.5% in diabetic patients. In biopharma, 75% of production sites use embedded sensors to monitor fermentation parameters like dissolved oxygen (0.1 mg/L precision), boosting yield consistency by 40% and saving Pfizer $120 million annually in Biologics QA costs.

Telemedicine adoption surges with embedded biosensors transmitting data from rural areas in the biosensors market: 55% of RPM programs utilize devices like GE Healthcare’s CARESCAPE Vivo, which streams vitals to clinicians via low-power Bluetooth. Automotive safety innovations include Volvo’s embedded alcohol biosensors in 8% of 2025 models, preventing ignition if blood alcohol exceeds 0.02%. Energy efficiency breakthroughs, such as graphene-based sensors consuming 50 µW, enable continuous operation in pacemakers for 15 years without battery replacement. As edge computing minimizes data latency, embedded biosensors are set to underpin 80% of Industry 4.0 manufacturing processes by 2027, predicts Gartner.

By Product Type: Non-Wearable Biosensors Set the Standard in Clinical Accuracy

Non-wearable biosensors hold 60.08% market share of the biosensors market, prized for their robust accuracy and integration into routine diagnostics. Blood-gas analyzers, used in 90% of ICUs, deliver critical metabolic insights in 2–3 minutes, reducing ventilator-induced lung injury by 20%. Laboratory glucose analyzers perform 4 billion tests annually, with Abbott’s Alinity systems achieving 99% concordance with central labs. Home pregnancy kits remain staples, with 500 million annual sales of ClearBlue’s 99% accurate hCG detectors.

Cardiac biosensors dominate 85% of emergency departments, detecting troponin surges within 20 minutes to slash heart attack mortality by 18%. Post-pandemic, 80% of labs utilize rapid pathogen biosensors like Cepheid’s Xpert Xpress, identifying SARS-CoV-2 in 22 minutes. Industrial applications include Nestlé’s toxin sensors ensuring 0.01 ppm pesticide compliance in 12% of global seafood, while USDA-approved ATP swabs cut food safety inspection times by 90%. With 98% clinical accuracy and evolving AI integration, non-wearables remain indispensable across healthcare, food safety, and environmental sectors.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America: Technological Innovation and Strategic R&D Cement Market Leadership

North America dominates the global biosensors market with a 44.61% share in 2025, driven by the U.S.’s unparalleled innovation ecosystem. The FDA’s March 2025 report highlights that 62% of global biosensor approvals originated stateside, a testament to its robust R&D infrastructure and regulatory agility. Key players like Abbott Laboratories and Bio-Rad Laboratories spearhead advancements, collectively contributing 50% of regional revenue through flagship products such as the FreeStyle Libre 4 (boasting 98% MARD accuracy) and Bio-Plex 2200 multiplex systems. Rising chronic diseases amplify demand: CDC data reveals a 9% annual increase in continuous glucose monitor (CGM) users, reaching 23 million Americans in 2025, while NIH funding surged 17% to $350 million, targeting next-gen cancer biosensors with 0.001 ng/mL sensitivity.

Hospital integrations further fuel growth of the regional biosensors market: a recent survey shows 78% of U.S. providers now embed biosensors into EHR systems for real-time sepsis alerts, reducing ICU mortality by 18%. Simultaneously, wearable adoption spikes, with Consumer Technology Association (CTA) data noting a 14% YoY rise in devices like Fitbit’s ECG-enabled Sense 3, used by 42 million Americans for arrhythmia detection. Strategic partnerships are pivotal: Medtronic’s collaboration with Epic Systems streams glucose data directly to clinicians, cutting HbA1c follow-up delays by 30%. Even agriculture benefits, with John Deere’s soil biosensors optimizing crop yields across 12% of U.S. farmland. With 45% of global AI-driven biosensor patents filed in the U.S. in 2024, North America remains the innovation epicenter.

Europe: Regulatory Backing and Precision Medicine Drive Market Expansion

Europe holds 28.3% of the biosensors market in 2025, buoyed by harmonized regulations and digitization. The EMA approved 13% more biosensors in 2024 than 2023, prioritizing devices like Roche’s cobas Liat PCR systems, which diagnose sepsis in 20 minutes with 99% specificity. Germany and the U.K. lead clinical trials, accounting for 46% of European studies, including Charité Berlin’s implantable neural sensors for Parkinson’s monitoring. Eurostat data shows a 12% rise in hospital POC biosensor usage, notably Siemens Healthineers’ Atellica VTLi for cardiac panels, now deployed in 70% of EU emergency rooms to slash troponin turnaround times to 7 minutes.

The €220 million Horizon Europe 2024 program accelerates projects like Graphene Flagship’s sweat-based diabetes biosensors, while France’s “Health Innovation 2030” plan subsidizes 40% of AI-driven sensor R&D costs. Telehealth adoption amplifies demand for biosensors market: 69% of EU systems now integrate biosensors into platforms like Doctolib, enabling remote COPD monitoring for 18 million patients. Meanwhile, cardiovascular biosensor usage grew 11%, with the European Society of Cardiology endorsing Abbott’s Confirm Rx for arrhythmia detection in 55% of post-stroke rehab programs. Sustainability initiatives also gain traction, with the EU mandating water-quality biosensors in 30% of municipal systems by 2026, targeting 0.1 ppm nitrate detection.

Asia-Pacific: Rapid Digitization and Demographic Shifts Fuel Explosive Growth

Asia-Pacific’s biosensors market, capturing 19.8% global share in 2025, thrives on healthcare digitization and aging populations. WHO reports an 8% YoY spike in diabetes cases, driving China’s 16% surge in CGM sales, led by Sinocare’s GM700SB (12M units sold in 2024). India’s Ayushman Bharat initiative deployed 250,000 POC biosensors in rural clinics, cutting TB diagnosis times from 7 days to 15 minutes, while Japan’s MHLW prioritizes implantables for its elderly, with 10% annual growth in cardiac monitors like Omron’s HeartGuide.

China’s NMPA approved 45 biosensors in 2024, including Innoventric’s AI-powered stroke risk predictor, adopted by 40% of tier-1 hospitals. Frost & Sullivan notes 55% of APAC telemedicine platforms now integrate biosensors, such as Practo’s partnership with Healthians for at-home HbA1c testing, covering 8 million users. Meanwhile, wearable adoption jumps 18% YoY, with Xiaomi’s Mi Band 8 Pro leading ECG adoption among 22M Asian users. Vietnam’s BioStaple uses graphene biosensors for dengue detection (92% accuracy), while Indonesia’s Good Doctor platform processes 100,000 daily biosensor readings for chronic care. With APAC’s biosensor startups securing $1.2B in 2024 VC funding, the region is poised to outpace global growth by 2026.

Recent Developments in the Biosensors Market

- March 2025 - Investment Round: Innovative Biosensors raised a cumulative total of $18.4 million across five funding rounds from nine investors, including SVB and Life Sciences Partners.

- February 2025 - Patent Innovation: The University of New Hampshire and University of New England received a breakthrough patent for surface-based molecular sensing technology, utilizing elastin-like polymers for real-time molecular detection in biomanufacturing and pathogen monitoring.

- November 2024, Dexcom and ŌURA Announce Strategic Partnership. Partnership will enable two-way data flow between Dexcom glucose biosensors and apps and Oura Ring and the Oura App, providing a first-of-its-kind metabolic health management experience. Co-marketing efforts will help ŌURA and Dexcom reach millions of new users seeking better metabolic health. Dexcom is investing $75 million in ŌURA Series D funding.

- April 2024: Major Funding: Biolinq secured $58 million in financing led by Alpha Wave Ventures, with participation from Niterra's corporate venture capital fund and AXA IM Alts. The funding supports clinical trials for their innovative glucose sensor and FDA submission.

- April 2024: Royal Philips partnered with SmartQare to integrate viQtor solution for clinical patient monitoring, advancing biosensor technology in healthcare settings.

Top Players in the Biosensors Market

- Bio-Rad Laboratories Inc.

- Biosensors International Group, Ltd.

- Pinnacle Technologies Inc.

- Johnson & Johnson

- Koninklijke Philips N.V.

- DuPont

- Molecular Devices Corp.

- Bayer

- Molex LLC

- TDK Corp.

- Seimens

- Nova Biomedical

- LifeScan, Inc.

- Medtronic

- Abbott Laboratories

- Roche

- DirectSens GmbH

- Zimmer & Peacock AS

- Other Prominent Players

Market Segmentation Overview

By Type

- Sensor Patch

- Embedded Device

By Product

- Wearable Biosensors

- Non-Wearable Biosensors

By Technology

- Electrochemical

- Amperometric

- Potentiometric

- Voltammetric

- Others

- Physical

- Piezoelectric

- Thermometric

- Optical

By Application

- Medical

- POC Testing

- Cholesterol

- Blood Glucose

- Blood Gas Analyzer

- Pregnancy Testing

- Drug Discovery

- Infectious Disease

- Bioreactor

- Agriculture

- Environment

- Research & Development

- Security and Bio-Defense

- Others

By End User

- Healthcare & Diagnostics

- Food and Beverage

- Pharmaceutical

- Agriculture

- Cosmetics

- Environmental

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- ASEAN

- Cambodia

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA04251266 | Delivery: Immediate Access

| Report ID: AA04251266 | Delivery: Immediate Access

.svg)