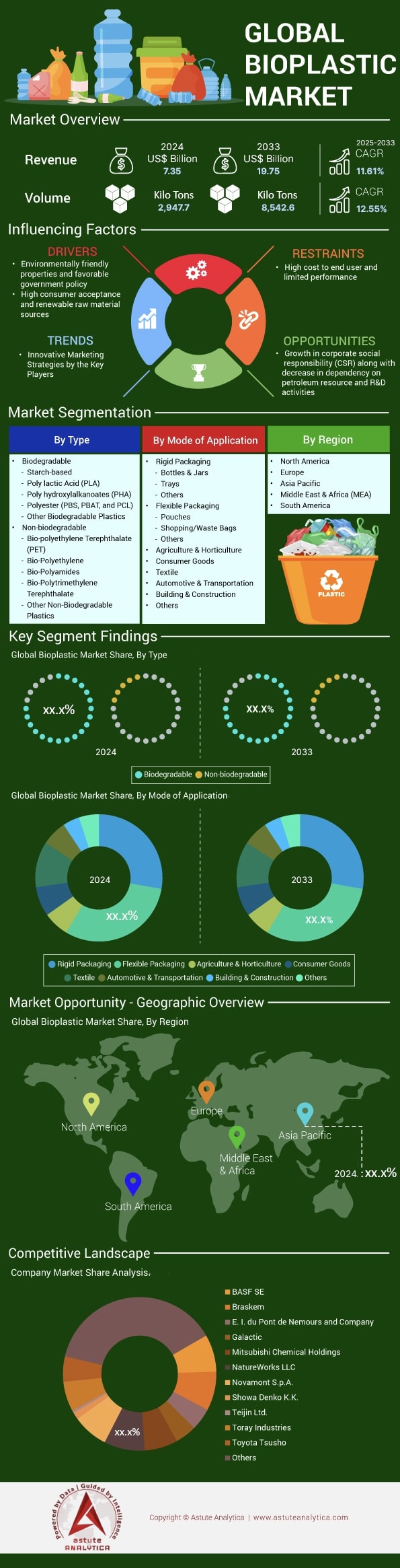

Bioplastics Market: By Type (Biodegradable and Non- biodegradable); Mode of Application (Rigid Packaging, Flexible Packaging, Agriculture & Horticulture, Consumer goods, Textile, Automotive & Transportation, Building & Construction and Others); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 07-Jul-2025 | | Report ID: AA0322165

Market Scenario

Bioplastics market is expected to experience a significant increase in revenue, projected to jump from US$ 7.35 billion in 2024 to US$ 19.75 billion by 2033 at CAGR of 11.61% during the projection period of 2025-2033.

The global bioplastics market is experiencing robust growth, with production capacity reaching approximately 2.18 million metric tons in 2023. This figure is set to surge, as projections indicate a capacity of 5.73 million metric tons by 2029, reflecting a remarkable CAGR of 11.61% between 2024 and 2033. However, actual production in 2024 was estimated at 1.44 million metric tons, which corresponds to a utilization rate of 58%. This gap between capacity and production highlights both the sector’s rapid expansion and the potential for further market penetration as demand and infrastructure catch up.

A significant trend within the bioplastics sector is the dominance of biodegradable plastics, which account for 56% of total bioplastic production. The packaging industry remains the largest consumer, representing 45% of the bioplastics market—equivalent to 1.12 million metric tons in 2024. This underscores the critical role of sustainable packaging solutions in driving bioplastics adoption, as brands and consumers increasingly prioritize eco-friendly alternatives to conventional plastics.

Regionally, Asia Pacific leads the global bioplastics market with 45% of production capacity in 2024, followed by North America at 20% and Europe at 16.9%. This geographic distribution highlights Asia’s pivotal role in scaling bioplastic manufacturing. Looking ahead, the global market is signaling strong investor confidence and ongoing innovation in sustainable materials. As production scales and utilization rates improve, bioplastics are poised to play a transformative role in the global transition toward a circular, low-carbon economy.

Global Plastic Waste Shows Stark Need for Alternatives Like Bioplastics

- In 2024, global plastics production reached approximately 460 million metric tons.

- Less than 10% of plastic waste is recycled globally; the majority is landfilled or mismanaged.

- By 2040, over 300 million metric tons of mismanaged plastic waste could accumulate in rivers and oceans if current trends continue.

- Plastic waste degrades into microplastics, causing harm to wildlife and human health.

- Bioplastics are seen as crucial for achieving United Nations Sustainable Development Goals (SDGs) related to waste reduction.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rising consumer demand for sustainable packaging across food and beverage industries

The bioplastics market is experiencing unprecedented growth driven by consumer pressure on food and beverage companies to adopt sustainable packaging solutions. Major brands like Coca-Cola and Nestlé have committed to transitioning significant portions of their packaging portfolios to bio-based materials, with Coca-Cola's PlantBottle initiative already producing over 60 billion bottles using bio-PET since its launch. Consumer surveys indicate that 8 out of 10 shoppers actively seek products with eco-friendly packaging, pushing retailers to stock more bioplastic-packaged goods. This demand surge has led to US$ 2.5 billion in new contracts for bioplastic packaging manufacturers in 2024 alone, with companies like NatureWorks reporting order backlogs extending into 2026.

The food service industry represents a particularly dynamic segment within the bioplastics market, with quick-service restaurants replacing traditional plastic containers with PLA and starch-based alternatives. Starbucks' transition to bioplastic cold cups across 35,000 stores globally requires approximately 75,000 metric tons of bioplastic materials annually, creating substantial demand pressure. Similarly, grocery chains including Whole Foods and Kroger have mandated bioplastic packaging for private label products, affecting over 15,000 SKUs. This shift has prompted packaging converters to invest US$ 850 million in new extrusion and thermoforming equipment specifically designed for bioplastic processing in 2024, demonstrating the infrastructure transformation underway to meet consumer expectations.

Trend: Rapid adoption of bioplastics in automotive, electronics, and consumer goods

The automotive sector's embrace of bioplastics market marks a significant expansion beyond traditional packaging applications, with manufacturers incorporating bio-based materials into both interior and exterior components. Mercedes-Benz's latest S-Class features 120 kilograms of bioplastic components per vehicle, including door panels made from hemp-reinforced PLA and center consoles utilizing wood fiber-filled bio-polyamides. This adoption extends across the industry, with global automotive bioplastic consumption reaching 450,000 metric tons in 2024, valued at US$ 1.8 billion. Major tier-one suppliers like Continental and Magna have established dedicated bioplastic research facilities, investing US$ 320 million collectively to develop high-performance bio-composites that meet stringent automotive specifications while reducing vehicle weight by up to 30 kilograms.

Electronics manufacturers are increasingly integrating bioplastics into product designs, driven by corporate sustainability commitments and consumer preference for eco-conscious devices. Samsung's 2024 flagship smartphone series incorporates ocean-bound bioplastic components, requiring 15,000 metric tons of specialized bio-compounds annually. The bioplastics market for electronics applications has expanded to include laptop casings, headphone housings, and television frames, with companies like Dell and HP sourcing US$ 450 million worth of bio-based materials in 2024. Consumer goods giants Procter & Gamble and Unilever have reformulated product lines to include bioplastic packaging, affecting 2,500 products globally and creating demand for 180,000 metric tons of drop-in bio-PE and bio-PP resins that maintain identical processing characteristics to conventional plastics.

Challenge: Competition with food-based feedstocks raises sustainability and supply chain concerns

The bioplastics market faces mounting criticism over its reliance on food crops as primary feedstocks, with corn, sugarcane, and cassava accounting for 1.2 million metric tons of agricultural output diverted to plastic production in 2024. This competition intensifies during periods of agricultural stress, as evidenced by the US$ 340 per metric ton increase in PLA prices following the 2024 Midwest drought that reduced corn yields by 15 million bushels. Environmental groups highlight that producing one metric ton of corn-based PLA requires 2.5 hectares of farmland that could otherwise produce food for 50 people annually. Major food manufacturers including General Mills and Kellogg's have expressed concerns about feedstock competition driving up raw material costs, with corn prices rising US$ 45 per metric ton in regions with concentrated bioplastic production.

Second-generation feedstock development remains technically challenging and economically uncompetitive, despite US$ 2.3 billion in research investment since 2020. Agricultural waste-based bioplastics cost US$ 2,800 per metric ton compared to US$ 1,500 for first-generation alternatives, limiting commercial viability. The bioplastics market struggles with supply chain vulnerabilities, as demonstrated when Thailand's cassava shortage in 2024 disrupted 120,000 metric tons of planned bioplastic production. Companies like BASF and DuPont have delayed expansion plans worth US$ 670 million pending clearer feedstock sustainability frameworks. Industry initiatives to certify non-food feedstock sources have gained limited traction, with only 85,000 metric tons of verified sustainable bioplastics produced in 2024, highlighting the complex balance between environmental benefits and potential food security impacts.

Segmental Analysis

By Mode of Application

Based on application, flexible packaging is poised to control over 33% market share. The bioplastics market have emerged as a preferred choice in flexible packaging because of their reduced environmental footprint, versatile material properties, and compatibility with evolving consumer expectations. As of 2023, global demand for flexible packaging surpassed 33 million metric tons, a figure spurred by the rapid growth of e-commerce and convenience-driven lifestyles. Within this segment, over 800,000 metric tons of bioplastic-based films have been deployed worldwide, offering compostable or bio-based alternatives to conventional plastics. Their lightweight nature drastically cuts down on shipping costs and retains product freshness, making them popular among food and beverage producers. Furthermore, brand owners are turning to biopolymers like PLA and PBAT to meet sustainability targets and align with consumer values.

Recent trends in the bioplastics market include the incorporation of barrier-enhanced coatings that preserve product quality, thus elevating bioplastics’ competitive advantage. In 2023, more than 200 new flexible packaging formulations featuring bio-based materials were introduced globally, many of which demonstrated improved thermal stability and clarity. Developments in advanced extrusion and lamination techniques also granted bioplastic films better tensile strength. Automotive and healthcare industries have embraced flexible pouches and wraps, pushing total bioplastic usage in flexible packaging beyond US$ 1.5 billion in annual revenues. Fueling further momentum is the newfound emphasis on post-consumer waste reductions and producer responsibility initiatives in regions like the European Union. With the confluence of consumer demand, legislative impetus, and ongoing material innovations, bioplastics are positioned to remain a driving force within flexible packaging for years to come.

By Type

Biodegradable plastics command a 71% share of the bioplastics market because they align cleanly with escalating demands for truly eco-friendly solutions. Comprised of starch-based materials, polylactic acid (PLA), polyhydroxyalkanoates (PHA), and certain biodegradable polyesters (PBS, PBAT, and PCL), these plastics decompose faster under controlled conditions. As of 2023, the global production of biodegradable plastics has exceeded 1.5 million metric tons, buoyed by rising environmental regulations, heightened consumer mindfulness, and corporate commitments to sustainable packaging. Their inherent capacity to break down into non-toxic byproducts reduces the burden on landfills, positioning them as an attractive option across industries such as food service and agriculture.

Key drivers of this growth in the bioplastics market include an upswing in green procurement practices, active policy support in regions like Europe and parts of Asia, and corporate initiatives aimed at curtailing reliance on petroleum-based plastics. In 2023, more than 40 countries enforced stringent single-use plastic ban, which drove manufacturers and retailers to adopt biodegradable alternatives. Furthermore, investments in advanced research heightened the performance of PLA and PHA, enabling improved thermal and mechanical properties. Biodegradable plastics also benefit from resource availability: for example, starch-based resins derive from widely cultivated corn or cassava, ensuring a steady raw material supply. In 2023, leading brands introduced over 120 new biodegradable packaging solutions globally, a testament to the pervasive demand.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific Leads Through Agricultural Abundance and Government Investment Strategies

Asia Pacific's dominance in the bioplastics market with over 45% market share stems from its vast agricultural resources and strategic government initiatives. Thailand's cassava production of 32 million metric tons annually provides feedstock for PLA manufacturing, while Indonesia's palm oil industry generates 19.8 million tonnes of waste fruit bunches converted into bioplastic films. Major investments like NatureWorks' US$ 600 million facility in Thailand's Nakhon Sawan Bio complex, producing 75,000 tons of Ingeo PLA annually, demonstrate the region's manufacturing scale Government support proves crucial, with Thailand offering 25% tax exemptions for bioplastics businesses and designating itself as ASEAN's bioplastics hub.

Companies like PTT MCC Biochem and AN PHÁT BIOPLASTICS leverage the region's cost advantages, with production costs averaging US$ 1,200 per metric ton compared to US$ 2,100 in Western markets. Southeast Asian nations collectively invested US$ 3.8 billion in bioplastics infrastructure during 2023-2024, establishing 15 new production facilities across Indonesia, Malaysia, and Vietnam.

North America Capitalizes on Technology Innovation and Corporate Sustainability Commitments

North America maintains its position as the second-largest bioplastics market through advanced technology development and strong corporate demand. The region hosts 47 bioplastics research facilities, with companies investing US$ 2.3 billion in R&D activities focused on next-generation biopolymers. Major corporations including Coca-Cola, PepsiCo, and Procter & Gamble drive demand, collectively purchasing 380,000 metric tons of bioplastics annually for packaging applications. The region's sophisticated waste management infrastructure, with 1,200 industrial composting facilities, supports biodegradable plastics adoption. Canadian agricultural output contributes 8.5 million metric tons of wheat and corn residues for second-generation bioplastics production.

Mexico's growing manufacturing sector adds 65,000 metric tons of bioplastics consumption annually, primarily in automotive applications. The North American bioplastics market benefits from established polymer processing capabilities, with 230 facilities retrofitted for bioplastic production since 2022. Regional production capacity reached 850,000 metric tons in 2024, supported by US$ 4.2 billion in venture capital and private equity investments targeting sustainable materials innovation.

United States Drives Regional Growth Through Innovation and Market Demand

The United States leads North America's bioplastics market through its robust innovation ecosystem and massive consumer market demanding sustainable solutions. American companies hold 1,850 bioplastics patents, representing 38% of global intellectual property in this sector. The nation's 125 million metric tons annual corn production provides abundant feedstock, with 2.8 million metric tons allocated to bioplastics manufacturing. Major retailers including Walmart and Target mandated bioplastic packaging for 15,000 private label products, creating demand for 285,000 metric tons annually.

The US Department of Agriculture's BioPreferred Program covers 3,100 bioplastic products, driving federal procurement worth US$ 680 million yearly. California's stringent environmental regulations accelerated adoption, with the state consuming 180,000 metric tons of compostable bioplastics in 2024. American startups raised US$ 1.7 billion in bioplastics funding during 2024, with companies like Danimer Scientific and Mango Materials scaling production. The nation's 45 pilot-scale bioplastics facilities enable rapid technology commercialization, reducing time-to-market from laboratory to industrial production.

Start-Ups Landscape and Innovation in Bioplastics Market

- BUYO Bioplastics (Vietnam) develops 100% nature-based, biodegradable plastics from bio-waste.

- BIOVOX (Germany) specializes in medical-grade bioplastics with reduced CO2 emissions.

- Green Whale Global (South Korea) produces cassava starch-based plastics that biodegrade in 42 days.

- Biolive (Turkey) uses olive pits to create bioplastics, reducing carbon emissions.

- Natrify (Egypt) produces Adigide, a bioplastic for packaging, using biotechnology.

- Traceless (Germany) raised significant funding to transform agricultural residues into biodegradable plastics.

Top 7 Developments in Bioplastics Market

- In May 2025, Lignin Industries secured €3.9 million (approximately US$4.2 million) in funding to scale up production of its Renol® bioplastic, aiming to significantly increase its output capacity and promote carbon-negative materials in the plastics industry.

- In March 2025, Applied Bioplastics raised US$400,000 in a funding round with participation from Greentown Labs and MassChallenge, supporting the company’s plans to expand its bioplastic production and accelerate commercialization.

- In Oct 2023, PlantSwitch opened a new facility in Sanford, North Carolina, investing an undisclosed sum to convert at least 13,600 tons (30 million pounds) of agricultural waste into 22,700 tons (50 million pounds) of bioplastic pellets annually, marking a significant capacity addition.

- In 2025, the Circular Bio-based Europe Joint Undertaking (CBE JU) announced funding for 30 new projects, with a combined investment of over €200 million (approx. US$215 million), a portion of which is dedicated to expanding bioplastics production and innovation across Europe.

- In 2025, the U.S. Department of Agriculture (USDA) continued its Bioproduct Pilot Program with a new round of US$9.5 million in grants, supporting the scale-up of bioplastic manufacturing from agricultural feedstocks in the United States.

- In 2025, Unilever invested an undisclosed sum (previously reported at over US$50 million annually) in bioplastic packaging innovation, with the goal of increasing the share of bioplastics in its product packaging portfolio and reducing reliance on fossil-based plastics.

- In 2025, the European Union, through its Green Deal and Horizon 2025 programs, allocated significant funding (part of a multi-billion euro package) to support research, development, and scaling of bioplastics, including grants and subsidies for capacity expansion in member states.

Key Bioplastics Market Companies:

- BASF SE

- Biome Technologies plc

- Braskem

- Corbion N.V.

- Danimer Scientific.

- E. I. du Pont de Nemours and Company

- Eastman Chemical Company

- Futerro SA

- Galactic

- M& G Chemicals

- Mitsubishi Chemical Holdings

- NatureWorks LLC

- Novamont S.p.A.

- Plantic

- PTT Global Chemical Public Company Ltd.

- Showa Denko K.K.

- Solvay SA

- Teijin Ltd.

- Toray Industries

- Toyota Tsusho

- Other Prominent Players

Market Segmentation Overview

By Type:

- Biodegradable

- Starch-based

- Polylactic Acid (PLA)

- Poly hydroxy alkanoates (PHA)

- Polyester (PBS, PBAT, and PCL)

- Other Biodegradable Plastics

- Non-biodegradable

- Bio-polyethylene Terephthalate (PET)

- Bio-Polyethylene

- Bio-Polyamides

- Bio-Polytrimethylene Terephthalate

- Other Non-Biodegradable Plastics

By Mode of Application:

- Rigid Packaging

- Bottles & Jars

- Trays

- Others

- Flexible Packaging

- Pouches

- Shopping/Waste Bags

- Others

- Agriculture & Horticulture

- Consumer goods

- Textile

- Automotive & Transportation

- Building & Construction

- Others

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Poland

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 7.35 Bn |

| Expected Revenue in 2033 | US$ 19.75 Bn |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Bn) |

| CAGR | 11.61% |

| Segments covered | By Type, By Mode of Application, By Region |

| Key Companies | BASF SE, Biome Technologies plc, Braskem, Corbion N.V., Danimer Scientific., E. I. du Pont de Nemours and Company, Eastman Chemical Company, Futerro SA., Galactic, M& G Chemicals, Mitsubishi Chemical Holdings, NatureWorks LLC, Novamont S.p.A., Plantic, PTT Global Chemical Public Company Ltd., Showa Denko K.K., Solvay SA, Teijin Ltd., Toray Industries, Toyota Tsusho, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)