Bioanalytical Services Market: By Test Type (Cell-based Assays, Virology Testing, Species-specific Viral PCR Assays, Method Development Optimization and Validation, and Others); Molecule Type (Small Molecule Bioanalysis, Large Molecule Bioanalysis, and Others); Application (Oncology, Neurology, Infectious Diseases, and Others); End User (Pharma & Biotechnology Companies, Contract Research Organizations, and Others)–Industry Dynamics, Market Size and Opportunity Forecast for 2024–2032

- Last Updated: Oct-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA1024952 | Delivery: 2 to 4 Hours

| Report ID: AA1024952 | Delivery: 2 to 4 Hours

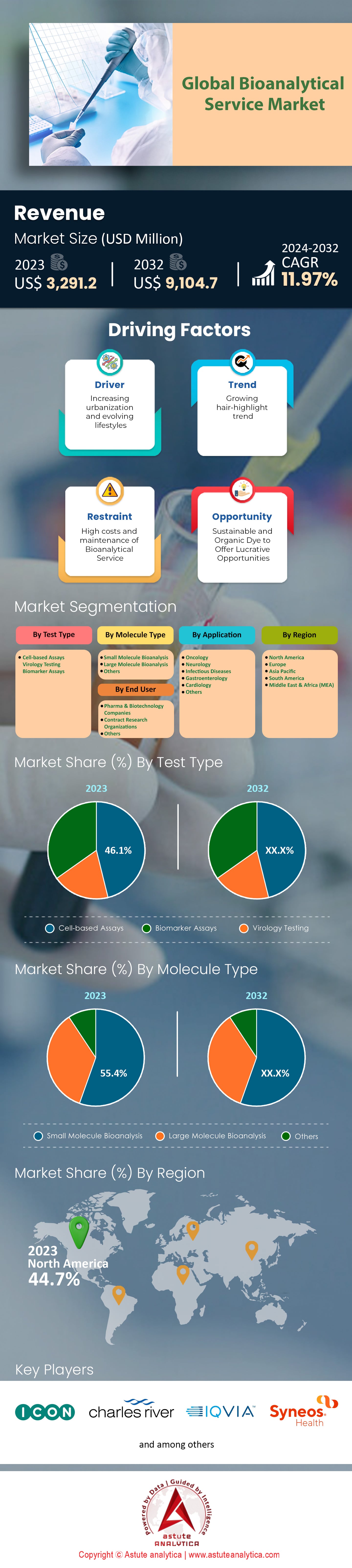

Bioanalytical services market is projected to make a forward leap in its revenue from US$ 3,291.2 million in 2023 to US$ 9,105.4 million by 2032 at a robust CAGR of 11.6% over the forecast period 2024-2032.

Bioanalytical services are a supporting function within the drug development process that is critical to compliance with regulators for activities in the pharmaceutical and biotechnology sectors. The most prominent bioanalytical services include method development and validation, pharmacokinetic (PK) and pharmacodynamic (PD) studies, bioequivalence and bioavailability testing, and biomarker analysis. Such services are mainly used for quantitative determination of the drug and its metabolites in various biological matrices to maintain the credibility and integrity of clinical trial data. For example, over 8,500 Clinical trial procedures conducted all over the world in 2022 needed bioanalytical assays for drug quantification and bioavailability monitoring. The number of drugs approved by the U.S FDA has fully relied on bioanalytical services, with 55 new drugs coming into the market in the year 2023.

The main contract research organizations, or CROs, as well as labs that utilize modern bioanalytical technologies are at the forefront of the bioanalytical services market. Charles River leads market with revenue in excess of US$4.12 billion in 2023 and LabCorp Drug Development (previously known as Covance) comprehensively services clients in over 60 countries. PPD has also been taken over by Thermo Fisher in 2021 for nearly $17.4 billion and its claim has been that it maintains a network of laboratories providing drug development support across pipelines. Eurofins scientific has about 900 labs situated globally-in the year 2023,and so can boast of its reach cutting across LCMS and immunoassays and other sophisticated analytic strategies.

The bioanalytical services market is witnessing a surge in its demand as the number of biologics and biosimilars such as biologic therapeutics is growing. As of 2023, there are over 1,200 biologic therapies in development around the world. The rise in the number of biologics also means that there are more stringent FDA regulations and processes to go through, which further expands the bioanalytical market. Over 30 documents on Bioanalytical method validation have been issued by the FDA since the year 2020 to show the need for additional guidance. According to reports, the number of new cases of cancer in 2022 was 19.3 million, and with such a rise in the number of chronic diseases – the market of the therapeutics of such diseases grows. The incorporation of high-resolution mass suite (HRMS) mark has enabled laboratories to easily use over 5,000 HRMS instruments thanks to enhanced detection capabilities. The trend of outsourcing is also notable. In 2022, pharmaceutical companies outsourced 50% of their bioanalytical functions to CROs in a bid to save on operational costs while shortening the duration of the development period.

Findings:

Some of the prominent testing types in bioanalytical services market include ligand binding assays. This assay has been used in more than 3,000 studies annually for protein and peptide detection, cell-based assays that are necessary for more than 1,500 immunogenicity studies and chromatographic techniques such as HPLC and GC-MS which are standard and employed in over 4,500 studies annually for small molecules. They are mainly service providers to pharmaceutical and biotechnology companies that poured over 200 billion US dollars in 2022 for research and development, academic research institutes that carry out over 100,000 biomedical research projects, and government agencies that approve thousands of applications for the drug every year. The main molecules which are examined include small molecule drugs about 60% of all therapeutics sold on the market, monoclonal antibodies which have over a hundred approved therapies by FDA, peptides, oligonucleotides and important biomarkers in the study for determining the efficacy and safety of a drug.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Need for Advanced Analytics for Complex Biologics and Biosimilars

The share of biologics and biosimilars in the global pharmaceutical portfolio, especially in the bioanalytical services market, seems to be increasing. Bioanalysis in the context of biologics modern therapeutics is expected to be much more sophisticated and is legally enforced as of 2023. Biologics alone account for over $512 billion of the net global sales in pharmaceuticals, alongside just above 1,500 biologic drugs being developed around the world. Biologics drugs were some of the leaders in foreign investments, as biologic and biological products now cover over 100 drugs approved, with 35 naturals approved by the FDA in the US. The increase in these biologic products, fell into a spiral further increasing the need for high-level bioanalytical methods in ensuring that biologics are safe and protecting important information that relates to these drug substances. As part of this puzzle, bioanalytical services assist in the characterization of these structurally complex macromolecules such as monoclonal antibodies that received over 80 approvals from FDA alone from between 2018 and 2023.

In 2023, the worldwide market for Mass Spectrometry Instruments grew to US$ 7.2 billion, showing the growing trend of focusing on expanding one’s biopharmaceutical portfolio. Furthermore, the number of biotechnology clinical trials in the bioanalytical services market grew to reach above 200. Out of these 200 trials, more than 100 were gene therapy trials, which led to a larger pool of investment aimed at meeting the growing demand for gene therapy. Agencies including the FDA have adopted the policy to carefully assess biologic products, as even China has announced its proposed guidelines on biosimilar biological products development. Over 20 guidance papers have been developed and released, since 2020, focusing on the development of biosimilars, further exposing how much the FDA has been focused on regulating biologics products. Adherence to these directives is critical since it is important to note that the costs associated with bringing a biologic drug to market are usually more than US$ 2.5 billion, which clearly shows the need to avoid wastage of time through delays by having accurate and dependable analytical data.

Trend: Integration of High-Resolution Mass Spectrometry in Bioanalytical Workflows

Today, high-resolution mass-spectrometry has become an essential tool in bioanalytical processes due to its high sensitivity and specificity. For example, in 2023, more than 5,500 high-resolution mass-spectrometers were sold worldwide showing strong adoption in the bioanalytical services market. This clearly shows that the penetration of the bioanalytical market in HRMS is high. The HRMS are equipped with a lot of features with the most predominant being resolution which can reach 100,000 FWHM. This, in turn, enables the tracing down of metabolites and impurities in the biomolecule structures making the system effective for pharmacokinetic studies. Enormous growth of this market would also encompass leveraging biological mass analyses as well, which appears to be strongly emerging, with the early adoption of drug candidates as peptides and oligonucleotides epitomized by around 600 of such molecules being under investigation through HRMS techniques. Due to the level of detail allowed by the details we are able to quantify over 1,200 of the drugs, or at least drug metabolites through various platforms thus enhancing the understanding of human anatomy more so the toxicity levels of drugs.

It is estimated that in 2022, the HRMS–related services spending by pharmaceutical organizations stood at $1.5 billion which shows the broadening scope of the bioanalytical services market in terms of funding for advanced analytical capabilities development. HRMS providers are extending their networks of the availability and utilization of HRMS due to clients’ requests. Some of the Contracts Research Organizations (CROs) injected more than $15 million each in 2023 to enhance their analytical laboratories with new HRMS equipment. According to industry estimates, the introduction of HRMS systems cut the turnaround time for reporting bioanalysis by between 5% and 15% over pre-HRMS system levels. In addition, there are critical elements in defense of regulatory submissions which are HRMS where 70% of the bioanalytical data in new drug applications that were submitted to the FDA for appraisal in 2023 included HRMS analyses which highlights its increasing importance in the scope of bioanalysis techniques.

Challenge: Shortage of Skilled Professionals Proficient in Advanced Analytical Techniques

The bioanalytical services market is facing a human resource crisis and is crippled by a scarcity of professionals who have been trained on modern advanced bioanalytical techniques. For 2023, there were, in fact, over 5,000 unfilled positions for analytical scientists within pharma and biotech’s globally. Institutions are graduating about 2,500 students in a year with the required skill set, which is too low for the expanding industry. This gap is claimed to be broader by the advanced techno bioanalytical elements as more than 60% of labs struggled to hire applicants who are trained in HRMS, NMR, and other such techniques. Experienced professionals and scientist who tend to retire are further making this gap more dire, with about 1,200 estimated retiring annually. The Association of Analytical Communities (AOAC) in the bioanalytical services market pointed this out as an issue in their report in 2022 stressing the need for creating a wider workforce.

Lack of skilled workforce creates problems with time and quality as delays in employing the qualified workforce add up to an average of three to six months to the projects resulting in additional expenses and a potential income loss that is calculated to be $500,000 for each postponed project. Therefore, between 2020 and 2023, more than $120 million were used by organizations on educational programs in order to create internal talent pools. However, the shortage of skilled bioanalytical scientists continues to be the most serious challenge for the development of bioanalytical service providers fueling both internal and external industry growth.

Segmental Analysis

By Test Type

Cell-based assays have captured more than 46.1% of the bioanalytical services market and are now at the forefront. The ability of these assays to provide physiologically relevant data, which is paramount in drug discovery and development, further explains their strong support. There has been a growing trend in the use of cell-based assays with over 2,000 new assay kits launched in 2023 across the globe. Incorporating these assays in measuring efficacy and toxicity of the new therapeutics, more than 1,000 pharmaceutical and biotechnology companies have been using them in their research and development works.

Cell-based assays’ growth is chiefly dependent on pharmaceutical and biotechnology companies, academic and research institutions, as well as contract research organizations (CROs). Therefore, specialization in such services has seen the number of CRO’s escalate to over 800 around the globe in a bid to fulfill the growing demand in drug development. In addition, more than 2,000 academic and research institutions employ the use of cell based assays in a wide range of basic and translational research. With over 1 billion patients suffering from chronic illness, the need for new and advanced drugs has put cell-based assays at the forefront of drug development processes that have over 8,000 compounds in each of its pipelines.

By Molecule Type

The bioanalytical services market has been dominated by small molecules with more than 55.4% of the share, mainly due to its vast significance in the development and regulation of a large number of biological medicaments. Estimates suggest that in the year 2023, the worldwide small molecule bioanalytical services hit about US$ 1.83 billion, exemplifying the significance of this service segment within the pharmaceutical sector. To date, there are more than 1,800 small molecule therapeutics that are undergoing clinical evaluation across the globe, hence the movement towards reliable and accuracy driven bioanalytical testing are on the rise. In 2023, regulatory bodies such as FDA have sanctioned the marketing of over 45 new small molecule therapeutics signifying the growing dependence on the medical for the performance of several functions.

The bioanalytical services market is mainly characterized by the prevalence of small molecule bioanalysis. Small molecules tend to have relatively low weight, typically less than 900 Daltons and as such are permeable to cells and target intracellular compartments and hence their therapeutic application is broad. In 2023, small molecule drugs accounted for as much as 70% of all pharmaceuticals available further underlining their popularity. The pharmacokinetics and metabolism of small molecules drugs is quite complex and more than 2500 bioanalytical methods are in use because of this. It is also appealing to note that small molecule production is not only cost-effective but can also be scaled and this explains the over US$ 120 million funding allocated to small molecule R&D in 2023 alone.

The introduction of new technologies has definitely expanded the ability of small molecules bioanalysis. The High resolution mass spectrometry as well as Liquid Chromatography In the context of the bioanalytical services and core facilities markets, more than 1 300 new instruments were put into labs around the globe in 2023 which allows obtaining limits of detection in the order of picograms. The number of Contract Research Organizations (CROs) started mushrooming which offer small molecule bioanalytical services and there are more than 850 now across the world which means that outsourcing activity is on the rise. The strengthening drug development pipeline off new drug targets also meant that over 350 small molecules drug specifically targeted for these therapy has been developed which requires advanced bioanalytical techniques.

By End Users

Pharmaceutical and biotechnology firms are the primary consumers of bioanalytical services market, constituting approximately 52.9% of the total market share due to very high scope and significance of bioanalytical services within most of their institutions. In the year 2023, these companies together allocated $200 billion in R&D expenditures which prompted the need for advanced bioanalytical approaches. Considering the fact that the global market has more than 8,000 drug candidates at various stages of development, accurate, reliable, and meaningful bioanalytical services are required to guarantee safety and effectiveness. In 2023 alone, pharmaceutical companies launched more than 5000 drug candidate’s clinical trials that requires bioanalytical strategies in evaluating the pharmacokinetic and pharmacodynamic models.

A number of issues explain the willingness of the major users of bioanalytical services market to be led by pharma and biotech companies. The regulatory framework provides for a strong legal-policing regime characterized by advanced testing methods. According to the publication, more than 100 drugs and biologics were newly approved by FDA alone or in association with EMA, almost all of them were subjected to detailed bioanalytical studies. Challenges in developing new therapeutic agents include variations among the more than 400 gene and cell therapies in various stages of clinical development. Furthermore, the quest for tailored medicines has resulted in more than 600 therapies that are more targeted being developed thus increasing the demand for bioanalytical services to formulate medicines according to the bio characteristics of the patients.

For these companies in the bioanalytical services market, it is also necessary to save on drug development timelines and to simultaneously improve success rates to make greater use of bioanalytical services. The estimated average expense to develop and market a new drug is slightly higher than US$ 1.5 billion, with period from 10 to 15 years. By outsourcing bioanalytical testing to specialist Contract Research Organizations (CRO), the companies are able to take advantage of specialist knowledge and sophisticated technology. In 2023, pharma and biotech have already spent more than US$800 million to CROs for bioanalytical testing services, which once again tackles the issue of outsourcing.

By Application

In 2023, the oncology segment held more than 32% market share of the bioanalytical services market. Cancer is still one of the prime causes of death with almost 10 million deaths in the year 2023 as a report by the World Health Organization indicates. It is also reported that over 19 million cases of new cancer in 2023 were diagnosed globally. Due to the large number of cancer cases backend research and development activities are needed to be large, therefore this drives the usage of bioanalytical services in relation to life science and biotechnology for oncology drugs.

As per the latest WHO data, breast cancer stands at the top, with nearly 2.03 million affected patients a year, aiding in the expansion of oncology departments across the globe. Following is lung cancer, which is estimated to have around 2.2 million lung cancer patients surviving every year and it continues to be amongst the highest cancer killing disease with more than 1.84 million deaths occurring due to it every year. By cancer burden, this includes approximately 1.9 million new cases of colorectal cancer diagnosed each year and around 1.4 million males suffering from prostate cancer worldwide. Combined, these four types of cancer form a major part of the cancer burden around the world confirming the critical focus to place on treatment and preventive methods which for such types of diseases would be few and should be undertaken as soon as possible.

Bioanalytical services market witnesses demand for oncology applications owing to the advanced and complex nature of cancer therapeutics development. As per estimates, during the year 2023, the global oncology drugs development pipeline included more than 5,000 drugs at different stages and hence bioanalytical testing was essential in ascertaining the efficacy and safety of these drugs. Furthermore, there were more than 1,200 targeted therapies and immuno-oncology treatments under development which evidence the fact that there are more than one sophisticated analytical methods required to assess biological markers and drug interactions. Also, increased requirement for bioanalytical services can be linked with the application of targeted therapy in oncology which has resulted in upwards of 500 biomarkers based clinical trials conducted. The total expenditure in the field of oncology research was slightly over $50 billion in 2023.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America accounts for nearly 45% of the global bioanalytical services market due to extensive healthcare structure, ample amounts of R and D spending, as well as a competent pharmaceutical industry in the US. In total, there are more than 3,500 bioanalytical laboratories in the region with almost 2,800 of these facilities in the United States. For instance, approximately US$ 50 billion were spent by the American government on biomedicine in the year 2022, which was a major contributing factor towards market expansion. However, the country accounts for over 6,500 pharmaceutical and biotech companies, which in turn, increases the demand for bioanalytical testing services. On the other hand, in the year 2023 over 7,000 clinical trial all across North America were conducted which did require advanced bioanalytical evaluation. Furthermore, there was a very substantial turnover of new compounds, as evidenced by the fact that the Food and Drug Administration provided marketing authorization of 55 new molecular entities in 2023.

On the other hand, it is clear that Europe bioanalytical services market is ‘the next best’ destination owing to the strong pharmaceutical industry within the region, cooperative research projects and good regulatory policies. The region has around 2,500 bioanalytical outsourcing companies, most of them in Germany, the United Kingdom, and France. In the year 2023, $15 billion was set aside by the European Union for life sciences and health projects through the Horizon Europe program, which encourages the development of novel bioanalytical techniques. The European market of the pharmaceutical business reached over euros 310 billion in the year 2022, creating great need for bioanalytical services. European Union has supported well over 5,000 clinical trials in 2023 out of which a large number were concerned with biologics and advanced therapies, which need bioanalytical tools and techniques. Based on the region’s inclination towards the production of biosimilars, it is worthy to note that over 80 biosimilar products have been approved for marketing since the year 2006 which justifies the robust bioanalytical testing standards.

Both regions in the bioanalytical services market are well placed to sustain their market share for the foreseeable future. In the North America, United States occupies the most prominent position since the country has the largest share by having a substantial pipeline of more than 9,000 drugs already in different stages of development in the year 2023. The collaboration between education, researches and the industry stimulates the development of new solutions and expansion of the markets. As for Europe, it also takes advantage of the Innovative Medicines Initiative which is an allied network bringing together the public and private sectors. In total, North America and Europe spend well over 150 billion dollars on pharmaceutical R&D each year which illustrates their relevance in the development of new and more efficient bioanalytical solutions. With the increased complexity of drug molecules and the trend of the shift to personalized medicine, both regions possess the infrastructure and know how to remain competitive in the global bioanalytical services market.

Top Players in Global Bioanalytical Services Market

- PPD, Inc.

- ICON Plc

- Charles River Laboratories International

- Covance, Inc.

- IQVIA

- Syneos Health

- SGS SA

- Toxikon

- Intertek Group Plc

- Pace Analytical Services LLC

- NorthEast BioLab

- CD BioSciences

- Eurofins Scientific SE

- Other Prominent Players

Market Segmentation Overview:

By Test Type

- Cell-based Assays

- Virology Testing

- Biomarker Assays

By Molecule Type

- Small Molecule Bioanalysis

- Large Molecule Bioanalysis

- Others

By Application

- Oncology

- Neurology

- Infectious Diseases

- Gastroenterology

- Cardiology

- Others

By End User

- Pharma & Biotechnology Companies

- Contract Research Organizations

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA1024952 | Delivery: 2 to 4 Hours

| Report ID: AA1024952 | Delivery: 2 to 4 Hours

.svg)