Global Bio-Based Chemicals Market: By Type (Bio-Lubricants, Bio-Solvents (Tetrahydrofuran, Cyclopentanone, Tetrahydropyran, and Others) Bioplastics, Biodegradable Bioplastics, Non-Biodegradable Bioplastics, Bio-Alcohols, 1,3-propanediol, 1,6-hexanediol, 1,10-decanediol, Others) Bio-Surfactants, Bio-Based Acids (Succinic acid, Furfural, Butadiene, 1-4 BDO, Others), Others; Application (Automotive, Personal Care, Food & Beverages, Agriculture, Industrial, Pharmaceuticals, Packaging, Others); and Region - Industry Dynamics, Market Size, Opportunity and Forecast for 2024–2032

- Last Updated: Nov-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0123350 | Delivery: 2 to 4 Hours

| Report ID: AA0123350 | Delivery: 2 to 4 Hours

Market Scenario

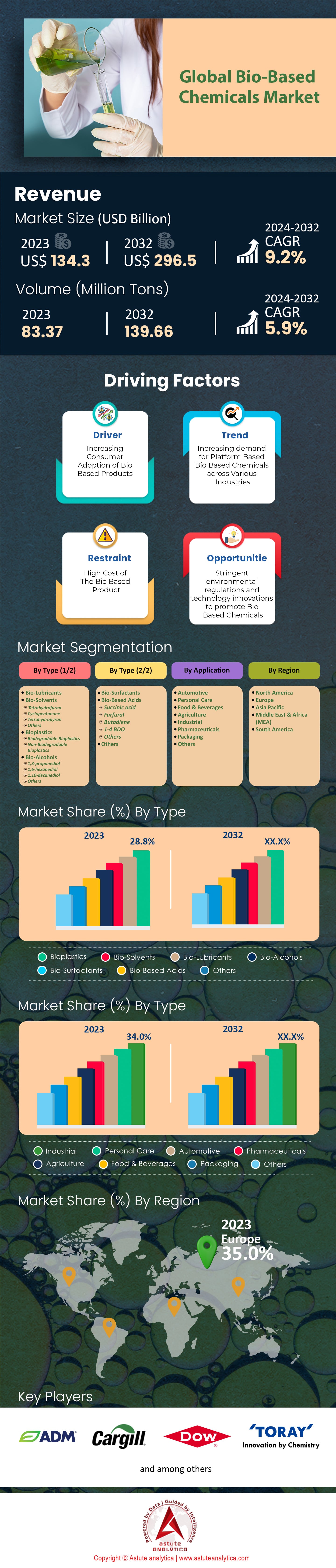

Bio-based chemicals market was valued at US$ 134.3 billion in 2023 and is projected to reach a valuation of US$ 296.5 billion by 2032, at a CAGR of 9.2% from 2024-2032.

Bio-based chemicals are derived from renewable biological resources like plants, animals, or microorganisms, offering sustainable alternatives to petrochemicals by utilizing biomass such as agricultural crops, forestry materials, or organic waste. Key examples include bioethanol, polylactic acid (PLA), bio-based succinic acid, bio-based 1,4-butanediol (BDO), and glycerol, used across various industries for applications in biofuels, packaging, plastics, pharmaceuticals, and cosmetics. The demand for these chemicals is rising due to environmental concerns, regulatory support, advancements in biotechnology, and consumer preference for eco-friendly products. Key consumers span industries like packaging, automotive, textiles, agriculture, personal care, pharmaceuticals, and food and beverages. Bio-based chemicals are growing faster than their counterparts due to sustainability goals, regulatory incentives, technological advances, and market demand. Recent trends include the expansion of bioplastics, investment in bio-refineries, R&D in synthetic biology, and policy initiatives promoting bio-economies. Major breakthroughs include the commercialization of 100% bio-based PET and microbial production of traditional chemicals.

The global bio-based chemicals market has surged to the forefront of sustainable industrial development. This growth is driven by over $4 billion allocated globally for research and development in bio-based technologies. The establishment of more than 60 advanced bio-refineries worldwide has augmented production capacities, enabling a diversified range of bio-based products to enter the market. A notable sector propelling this expansion is bioplastics. Global production capacity for bioplastics surpassed 2.5 million metric tons in 2023, with packaging consuming over 1.5 million metric tons annually. Major corporations are influencing this trajectory; for example, Coca-Cola has distributed over 40 billion PlantBottle™ packages incorporating bio-based PET. Regulatory actions, such as the European Union's Single-Use Plastics Directive, have accelerated the shift towards sustainable packaging solutions.

Despite advancements, challenges remain, particularly in cost competitiveness. Bio-based polymers like PLA have production costs ranging from $2,000 to $3,000 per metric ton, compared to $1,200 to $1,500 per metric ton for conventional plastics. However, governmental incentives are mitigating these barriers. The U.S. Biomass Research and Development Initiative, for instance, awarded over $50 million in grants in 2023 to foster innovation. Asia-Pacific has emerged as a key region, hosting over 45% of global bio-based chemical facilities, indicating a strategic shift in production hubs.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Environmental Sustainability Demands

Environmental sustainability has become a critical global priority, significantly driving the bio-based chemicals market. In 2023, global CO₂ emissions reached an unprecedented 37 billion metric tons, heightening the urgency to adopt sustainable practices. Bio-based chemicals offer a pathway to reduce greenhouse gas emissions, with products like bio-based polyethylene reducing emissions by up to 2 kilograms of CO₂ equivalent per kilogram produced. The market capitalization of bio-based chemicals, valued at over $25 billion in 2023, reflects this environmental imperative.

Corporate sustainability initiatives are reinforcing this driver. Over 1,700 companies worldwide have committed to science-based emission reduction targets. Major chemical producers such as BASF and Dow Chemical have invested more than $1 billion each in bio-based R&D and infrastructure. The transportation sector, emitting around 8.5 billion metric tons of CO₂ annually, is increasingly utilizing biofuels; global bioethanol production exceeded 170 billion liters in 2023. Consumer behavior also underscores this trend, with surveys indicating that 75% of consumers prefer products with a minimal environmental impact.

Governmental policies are amplifying the shift towards sustainability. The European Union's Renewable Energy Directive II mandates at least 14% renewable energy in transportation by 2030. The U.S. federal BioPreferred Program has certified over 16,000 bio-based products, promoting their adoption. China’s investment in bio-based industries surpassed $6 billion in 2023 as part of its commitment to peak emissions before 2030. Globally, over 55 countries have implemented bioeconomy strategies prioritizing bio-based chemicals, expanding production capacity to over 12 million metric tons in 2023.

Trend: Expansion of Bioplastics in Packaging

The expansion of bioplastics in packaging represents a significant trend in the bio-based chemicals market. As of 2023, the global production capacity of bioplastics exceeded 2.6 million metric tons, with packaging accounting for approximately 1.6 million metric tons. Regulatory measures, such as bans on single-use plastics in over 65 countries, have accelerated this shift. The European Union's directive targeting items like cutlery and plates has propelled the adoption of bioplastic alternatives.

Corporate commitments are catalyzing this trend. Companies like Nestlé and Unilever aim for 100% recyclable or reusable packaging by 2025. The Coca-Cola Company has utilized over 40 billion PlantBottle™ packages incorporating bio-based PET. Tetra Pak sold more than 200 billion packages with bio-based caps in 2023. Investments in bioplastics R&D have surged, with global funding exceeding $2.5 billion in the last three years, fostering innovations like enhanced polylactic acid (PLA) with higher heat resistance.

Consumer demand plays a pivotal role. Studies show that 85% of consumers express concern over plastic waste, influencing market trends. Retail giants like Walmart have introduced bioplastic packaging for numerous products. The food service industry is responding, with chains like Starbucks piloting compostable cups. Technological advancements have broadened applications, with new bioplastic grades suitable for high-temperature uses. The bioplastic packaging market is projected to reach $12 billion by the end of 2023, indicating robust growth.

Challenge: High Production Costs

High production costs remain a significant challenge hindering the competitiveness of bio-based chemicals. The production of bio-based polymers such as PLA costs between $2,200 to $3,200 per metric ton, whereas conventional plastics like polyethylene are produced at $1,100 to $1,600 per metric ton as of 2023. This cost disparity poses a barrier, especially in markets where pricing is critical. For example, bio-based succinic acid production costs about $4.50 per kilogram, compared to $2.50 per kilogram for its petrochemical equivalent.

Feedstock costs contribute to elevated expenses. The price of biomass feedstocks like corn and sugarcane fluctuates due to factors like climate change and market demand. In 2022, global corn prices peaked at $260 per metric ton amidst supply concerns. Scaling up production facilities demands substantial investment; establishing a commercial-scale bio-refinery can require upwards of $600 million, presenting financial challenges for companies.

Technological inefficiencies exacerbate costs. Bio-based production processes may achieve yields of 75-80%, lower than the 90-95% typical in petrochemical processes. This inefficiency necessitates higher raw material and energy inputs. Additionally, complex separation and purification steps increase operational costs. Efforts to address these challenges include significant R&D investments; over $3 billion globally has been directed toward improving production efficiencies. Governments are supporting these initiatives, with programs like the U.S. Biomass Research and Development Initiative awarding over $45 million in grants in 2023. Despite these efforts, achieving cost parity remains a critical obstacle for industry growth.

Segmental Analysis

By Type

Bioplastics continue to assert their dominance in the bio-based platform chemicals market, holding the highest market share of 28.8% in 2023, and projected to sustain this lead with the highest CAGR over the forecast period. The surge in demand for environmentally friendly plastics is a key driver, as bioplastics address critical environmental concerns associated with synthetic plastics, such as pollution, non-biodegradability, and landfill accumulation.

The prominence of bioplastics is further reinforced by several recent developments. As of 2023, global investment in bioplastics manufacturing facilities has surpassed $5 billion, indicating strong industry confidence. Moreover, the number of patents filed related to bioplastic technologies has increased to over 3,000 annually, reflecting innovation in the sector. International collaborations, such as partnerships between bioplastic producers and waste management companies, are enhancing the end-of-life solutions for these materials.

Government policies are also playing a substantial role. For instance, China's ban on single-use plastics in major cities by 2025 has accelerated local bioplastics adoption. The global bioplastics market has seen an employment increase, creating over 10,000 new jobs in 2023 alone. Additionally, bioplastics are now being used in high-tech applications, including 3D printing materials and medical devices, expanding their market reach. Agricultural biomass utilization for bioplastics production has allowed for the use of over 5 million tons of agricultural waste, promoting circular economy practices. Finally, consumer goods companies aim to achieve 100% recyclable or compostable packaging by 2025, further boosting the bioplastics segment.

By Application

In terms of application, the bio-based chemicals market is dominated by the Industrial segment, which held the highest 34.0% market share in 2023 and is projected to grow at the highest CAGR of 10.6% in the years to come. This dominance is due to the escalating use of bio-based products in industrial applications, offering sustainable alternatives to traditional petrochemical-based chemicals. The industrial segment includes paints & coatings, adhesives, lubricants, and polymers, all witnessing a surge in demand for biodegradable and eco-friendly solutions.

Key indicators of this dominance include the incorporation of bio-based chemicals in over 50% of new industrial product formulations as of 2023. Major industrial companies have committed to reducing their carbon footprint, with bio-based chemicals playing a pivotal role. The global market for bio-based solvents is projected to reach a volume of 3 million tons by the end of 2023. Furthermore, bio-lubricants are gaining traction in heavy machinery industries, with an estimated usage in over 1 million industrial machines worldwide.

Technological advancements have bolstered the industrial segment's growth. Innovations in enzyme technologies have improved the efficiency of bio-based chemical production. Investment in industrial biotechnology has reached $10 billion globally in 2023. Government regulations, such as the REACH regulation in Europe, are encouraging the use of safer, bio-based chemicals. Moreover, industrial bioplastics have found applications in automotive components, with over 500,000 vehicles incorporating bio-based parts. The industrial segment's emphasis on sustainability is further driven by corporate social responsibility initiatives, with companies aiming for net-zero emissions by 2050. Collaborations between chemical manufacturers and industrial end-users have increased by 20% in 2023, indicating strong market synergy.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Europe has established itself as the global leader in the bio-based chemical market due to its strong commitment to sustainability and innovation. The European Union's bioeconomy boasts an annual turnover of €2 trillion, providing employment to 22 million people and representing a significant portion of the European workforce. The EU chemical industry delivers €673 billion in sales, underscoring its robust market position Key countries at the forefront include Germany, France, and the Netherlands, driven by advanced research infrastructures and substantial investments in biotechnology The industry produces 4.7 million tons per annum of bio-based chemicals, marking a substantial share of global production. Europe's chemical sector supports diverse industries, supplying essential materials to automotive, healthcare, agriculture, and consumer goods sectors.

Factors driving Europe's dominance include strategic initiatives to reduce dependence on fossil fuels and diversify feedstocks through renewable biological resources Revenue opportunities are unfolding as the industry innovates in bio-based products, spurring economic growth and sustainability Recent trends involve the Bio Revolution, where Europe translates scientific strengths into biological innovations impacting multiple industries Economically, the bio-based industry significantly contributes to the EU’s GDP, while environmentally, it aids in reducing carbon emissions and fostering a circular economy. The industry's growth is further supported by policies promoting research and development in sustainable technologies Asia Pacific's position as the second largest bio-based chemicals market.

Asia Pacific has emerged as the second largest market for bio-based chemicals, driven by rapid industrialization and a growing focus on sustainable practices. The demand for bio-based chemicals is fueled by the region's robust agricultural sector, which provides abundant raw materials for bio-based production. Additionally, the Asia Pacific specialty chemicals market highlights the region's expansive chemical industry. Countries like China and India are leading the charge, with China being a major producer and consumer of bio-based chemicals due to its large industrial base and government support for green initiatives. The region's growth is also supported by the increasing adoption of bio-based products in various applications, including agriculture, biofuels, and bioplastics.

Analyst’s View

As per an analyst at Astute Analytica, the bio-based chemical market is undergoing significant growth driven by environmental concerns, technological advancements, and supportive regulatory frameworks. The global shift towards sustainability has increased demand for eco-friendly alternatives to petrochemicals, positioning bio-based chemicals as a pivotal component in reducing carbon footprints. Innovations in biotechnology, such as metabolic engineering and synthetic biology, have enhanced production efficiencies and lowered costs, making bio-based chemicals more competitive. Additionally, government initiatives and funding in regions like the European Union, North America, and Asia-Pacific are incentivizing research and development, further propelling market expansion.

The bio-based chemical market is ripe with opportunities as industries like packaging, automotive, textiles, and pharmaceuticals increasingly incorporate bio-based chemicals into their products to meet consumer demand for sustainable options. Strategic collaborations and investments are accelerating, with numerous companies partnering to scale up production and diversify their bio-based product offerings. Regions rich in biomass resources, such as Southeast Asia and South America, are becoming key players due to their capacity for large-scale bio-refinery operations.

Top Companies in Global Bio-Based Chemicals Market:

- AGAE Technologies

- Archer Daniels Midland Company

- BASF SE

- Braskem SA

- Cargill Incorporated

- Koninklijke DSM N.V

- Dow Chemicals

- DuPont

- Evonik Industries

- GFBiochemicals Ltd.

- IP Group PLC

- Lyondellbasell

- Mitsubishi Chemical Corporation

- Toray Industries Inc.

- Total Energies

- Vertec BioSolvents

- Other Prominent Players

Market Segmentation Overview

By Type

- Bio-Lubricants

- Bio-Solvents

- Tetrahydrofuran

- Cyclopentanone

- Tetrahydropyran

- Others

- Bioplastics

- Biodegradable Bioplastics

- Non-Biodegradable Bioplastics

- Bio-Alcohols

- 1,3-propanediol

- 1,6-hexanediol

- 1,10-decanediol

- Others

- Bio-Surfactants

- Bio-Based Acids

- Succinic acid

- Furfural

- Butadiene

- 1-4 BDO

- Others

- Others

By Application

- Automotive

- Personal Care

- Food & Beverages

- Agriculture

- Industrial

- Pharmaceuticals

- Packaging

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- South Korea

- Japan

- Australia & New Zealand

- ASEAN

- Malaysia

- Myanmar

- Philippines

- Singapore

- Thailand

- Vietnam

- Indonesia

- Cambodia

- Rest of ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 134.3 Billion |

| Expected Revenue in 2032 | US$ 296.5 Billion |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 9.2% (2024-2032) |

| Segments covered | By Type, By Application |

| Key Companies | AGAE Technologies, Archer Daniels Midland Company, BASF SE, Braskem SA, Cargill Incorporated, Koninklijke DSM N.V, Dow Chemicals, DuPont, Evonik Industries, GFBiochemicals Ltd., IP Group PLC, Lyondellbasell, Mitsubishi Chemical Corporation, Toray Industries Inc., Total Energies, Vertec BioSolvents, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0123350 | Delivery: 2 to 4 Hours

| Report ID: AA0123350 | Delivery: 2 to 4 Hours

.svg)