Global Benzyl Chloride Market: By From (Liquid and Solid); Application (Benzyl Alcohol, Benzyl Cyanide, Benzyl Quaternary Ammonium Compounds, Benzyl Phthalate, Benzyl Ester, Other Chemical Intermediates); Industry (Pharmaceutical, Agriculture, Paints & Coatings, Food and Beverage, Plastic and Polymer, Chemical, Others); Distribution Channel (Direct, Distributor, Online); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Jul-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0724873 | Delivery: 2 to 4 Hours

| Report ID: AA0724873 | Delivery: 2 to 4 Hours

Market Scenario

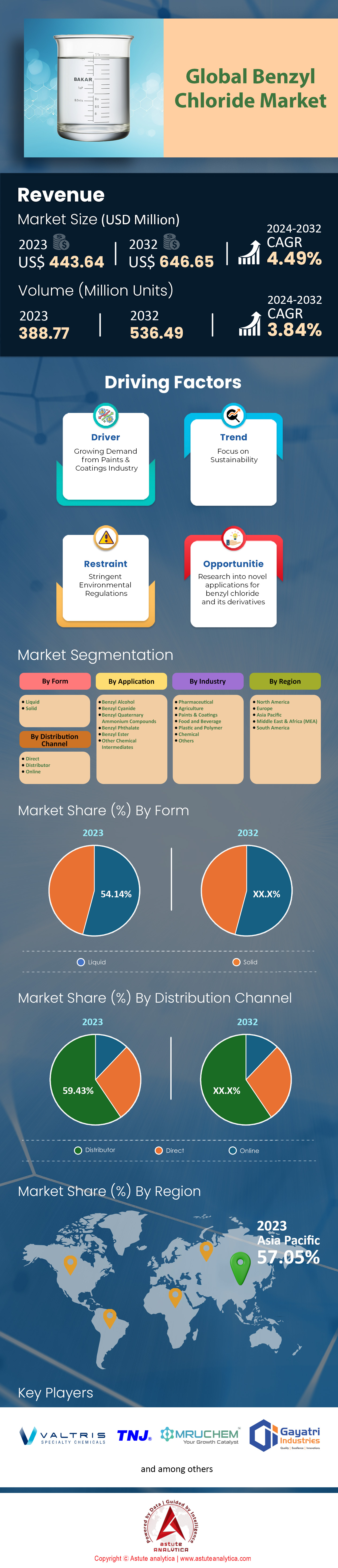

Global benzyl chloride market was valued at US$ 443.64 million in 2023 and is projected to surpass the valuation of US$ 646.65 million by 2032 at a CAGR of 4.49% during the forecast period 2024–2032.

Benzyl chloride is heavily used across several industries as a key intermediate in organic synthesis. This is especially more prominent across, plastic and polymer, pharmaceuticals, agrochemicals and personal care products. Benzyl chloride is an important component for making different types of active pharmaceutical ingredients (APIs) and drug intermediates used in the pharma industy. In agriculture, this chemical compound aids in creating herbicides which assist farmers to protect their crops from pests thereby increasing production. Besides being used as a preservative or fragrance in cosmetics manufacturing processes, personal care industry has also found other uses of benzyl chloride among its various cosmetic ingredients.

Trends in the benzyl chloride market include recent sustainable production method shifts and a growing concern with product purity. Environmental impact reduction and quality improvement are being addressed by manufacturers through investing in new technologies. Among them, China and India have become important centers of production and consumption for this compound because of their fast industrialization rates and expanding end-use sectors which has attracted most players globally. For instance, Lanxess AG, Valtris Specialty Chemicals, Hubei Greenhome Materials Technology Co., Ltd., Wuhan Youji Industries Co., Ltd etc., are increasing their capacities while also investing more on R&D to meet the increased demand as well as retaining market share.

In the next few years, there is expected to be a significant surge in the worldwide benzyl chloride market growth. Wherein, benzyl chloride is most commonly used by the plastic and polymer industry which takes up over 21.33% of all consumption globally. Asia-Pacific is witnessing the highest demand by region and accounts for more than 57% market share worldwide followed by North America and Europe. Additionally, sales for 99.9% pure grade benzyl chloride has been rising faster than any other purity level showing increased need for high-purity benzyl chlorides within this market.

To Get more Insights, Request A Free Sample

Market Dynamics

Trend: Growing Demand for Personal Care Products Containing Benzyl Chloride Derivatives

Worldwide, the market for personal care items has been growing exponentially, especially in the skincare, hair care and cosmetic sectors. In such products, benzyl chloride derivatives (including benzyl alcohol and benzyl benzoate) are increasingly used as preservatives or fragrances. The global personal care market was worth $563 billion in 2023 when skin-care products alone made up $145 billion of it. Concurrently, with this increase, there also was a rise in demand of natural organic offerings that use these same chemicals: +23M units were sold within one year, showing the potential of benzyl chloride market. Moreover, fueled by an expanding middle class coupled with rising disposable incomes, the Asia-Pacific region took over as front runner contributing US$180 billion to its valuation. It was closely followed by premium personal care goods, which saw shipments rise by 45 million units during this same year.

Products with more than one function are now being preferred by consumers hence leading to the development of new formulations having benzyl chloride derivatives for antimicrobial properties. In 2023, 320 million units of multifunctional products were sold worldwide. Men’s grooming commodities also performed well in the market where those containing benzyl chloride derivatives were valued at $55 billion and recorded sales of 110 million units while anti-aging goods recorded $83 billion worth of purchases which is a segment that often utilizes this compound as an ingredient in the benzyl chloride market. In addition to these numbers, there has been a shift towards digital platforms because e-commerce sales alone accounted for $98 billion spent on personal care items but what’s even more interesting about it is how many people have started shopping online for such things – over 65 million new customers made their first-ever online purchase within this category underscoring benzyl chloride derivatives’ growing importance within this industry.

Driver: Rising Global Population Fueling Demand for Pharmaceuticals and Personal Care Products

In 2023, the global population reached 8 billion people. The fastest gains were made in Asia and Africa benzyl chloride market. Woth more people needing health care and hygiene solutions, this boom has affected directly the need for pharmaceutical drugs and personal-care items. In 2023, the global market for prescribed drugs alone was worth $1.2 trillion out of a total pharmaceutical market, which was valued at $1.5 trillion. The over-the-counter drug market sold 42 bn units, representing a wider pool of consumers. While the sales of personal-care products reached 5.3bn units – an indication people are placing greater emphasis on wellness than ever before. Greater demand also comes from longer lives: average global life expectancy hit 73 years in 2023 leading to higher consumption patterns for both medicines and personal care goods.

Urbanization is also a significant factor to the growth of the benzyl chloride market, with cities being home to 4.4 billion people by 2023. This shift in population has brought about the emergence of 1.2 billion new urban consumers of pharmaceutical products and personal care items. Health expenses have also increased as global healthcare spending reached $8.3 trillion in 2023, which stands in line with a growing number of cases involving chronic illnesses – there are currently 1.9 billion individuals living with such conditions who need drugs for long-term treatment and self-care support packages. Alongside them, we have an ageing society where 703 million people are aged over 65 years thereby further fueling demand for these goods and services. At the same time, the global middle class population has reached 4 billion, who priorities healthcare over others, giving a significant boost to the demand for pharmaceutical products. Additionally, the number of healthcare professionals rose to 59 million, supporting the increased demand for pharmaceuticals.

Challenge: Volatile Raw Material Prices Impacting Benzyl Chloride Manufacturing Costs and Profitability

Raw material prices’ volatility is a major challenge for the benzyl chloride market. Toluene, which is derived from petrochemicals and whose price is connected to crude oil markets, is commonly used in the production of benzyl chloride. The year 2023 witnessed fluctuation of crude oil prices between US$70 and US$120 per barrel leading to significant turbulence in toluene costs. Consequently, this affected the prices within benzyl chloride industry with average cost for every metric ton being at $1200 wherefore such a scenario made manufacturing activities less profitable due to increased production expenditure on benzyl chlorides.

The situation was worsened by supply chain disruptions, which caused transportation costs to shoot up. Freight rates around the world rose to $10,000 per container in 2023 alone, affecting benzyl chloride distribution. What’s more, there was a dearth of skilled workers in the chemical industry that forced labor expenses higher by 15%. Regulatory compliance put another twist on things when it came to environmental and safety standards – they cost this sector $200 million every year in the benzyl chloride market. Exchange rates between currencies also fluctuated so much: at times one euro could be exchanged for as little as $1.05 or as much as $1.20; this affected international trade dynamics too! All these factors taken together meant that manufacturers saw their profits cut down by 7% over benzyl chloride. Yet still demand remained strong for the product with a further 5% increase in consumption recorded within pharmaceuticals and personal care sectors alone.

Segmental Analysis

By Form

Liquid benzyl chloride has taken the lead as the most promising form in the benzyl chloride market with more than 54.83% revenue share due to its versatility and application across different industries. It is a colorless liquid with strong smell, which finds its key application in making benzyl alcohol that takes about 50% of all its consumption. By being liquid, it brings about easy handling, storage and use during industrial production hence many end user sectors prefer it over other forms. Apart from this, the liquid Benzyl chloride is popular for producing benzyl alcohol whose demand has grown tremendously over time. Moreover, this growth is driven by personal care and beauty products industry where derivatives of benzyl chloride are used during manufacturing them. In 2023, the Asia-Pacific region alone controlled up to 57% market share. Additionally, India and mainland China accounted for 71% global consumption. Furthermore, pharmaceuticals have also been instrumental in utilizing liquid benzyl chloride as a raw material while making different compounds such as phenylacetic acid among others.

Moreover, the benzyl chloride market is gaining momentum from wider applications of benzyl chloride as alkylating agents in organic synthesis and its role in making quaternary ammonium compounds that find extensive applications as surfactants. he versatility of benzyl chloride is evident in its applications across various industries, including plasticizers, fragrances, flavors, and personal care products, contributing to its strong market position.

By Applications

As a result of its wide use and increasing demand in different sectors, benzyl chloride is mainly consumed heavily in the synthesis of benzyl alcohol. In 2023, benzyl chloride held 52% revenue share of the benzyl chloride market. Hydrolysis of benzyl chloride to produce benzyl alcohol has become the leading utilization for this product globally. Various aspects account for such supremacy: excellent solvent properties exhibited by benzyl alcohol; usage as preservative within personal care goods; acting as an intermediate during other chemical syntheses among others. Benzyl alcohol was particularly sought after in pharmaceuticals where there was a 7.2% YoY growth rate in volumes consumed during 2023 driven mainly by its employment as both local anaesthetic agent and preservative for injectable medicines.

According to estimates, benzyl alcohol in the global benzyl chloride market is still the most likely active ingredient in the market and is set to grow at a CAGR of 4.52% in the years to come. This is partly because the personal care industry has been expanding rapidly over recent years, which led them using more amounts of this component. Although paints and coatings sector also contributed much towards its growth as their consumption rose up by about 4.9% in 2023 even though environmental regulations are said favoring safer solvents. The textile industry has also played a role in this growth, with benzyl alcohol usage in fabric softeners increasing by 5.3% in 2023. As industries continue to seek versatile, safe, and effective chemical solutions, benzyl alcohol's position as the primary application for benzyl chloride is expected to strengthen further in the coming years.

By Industry

The plastic and polymer industry stands as the largest end-user of benzyl chloride market, driven by its versatile applications in the production of various plastics and polymers. In 2023, the segment held over 21.33% market share. Benzyl chloride serves as a crucial intermediate in the synthesis of plasticizers, particularly benzyl butyl phthalate (BBP), which enhances the flexibility and durability of PVC products. In 2024, the global production of PVC reached 56 million metric tons, with a significant portion utilizing BBP as a plasticizer. Benzyl chloride is also essential in manufacturing benzyl alcohol, a key ingredient in epoxy resins and other polymer formulations. The epoxy resin market, valued at US$ 9.3 billion in 2024, heavily relies on benzyl chloride derivatives. Additionally, benzyl chloride plays a vital role in producing phenolic resins, with the global phenolic resin market reaching 4.2 million metric tons in 2024. The automotive industry's demand for lightweight materials has further boosted benzyl chloride consumption, with over 92 million vehicles produced globally in 2024, many incorporating benzyl chloride-derived polymers.

The strong growth in the plastic and polymer industry is adding fuel to the growth of benzyl chloride market. Rapid urbanization and infrastructure development, particularly in emerging economies, have led to increased construction activities, driving the demand for PVC and other plastics. In 2024, the global construction industry was valued at US$ 12.9 trillion, with plastic materials playing a significant role. The packaging industry, another major consumer of plastics, reached a market size of US$ 1.05 trillion in 2024, further fueling benzyl chloride demand. Technological advancements in polymer science have expanded the applications of benzyl chloride-derived products, with the global specialty chemicals market, including advanced polymers, reaching US$711 billion in 2024. The electronics industry, valued at US$ 2.9 trillion in 2024, increasingly utilizes benzyl chloride-based polymers in circuit boards and insulation materials. Moreover, the growing focus on sustainable and bio-based plastics has opened new avenues for benzyl chloride applications, with the bio-plastics market reaching 2.8 million metric tons in 2024.

By Distribution Channel

Predominantly, benzyl chloride is sold through distributor networks as there are many tactical and commercial reasons for this. In 2023, the distributors sector accounted for more than 59.43%share of the benzyl chloride market because they provide a wide market coverage which online and offline channels cannot reach due to lack of logistical capability. They are also good at understanding their way around complex regulatory environments where compliance with strict safety requirements on hazardous substances like benzyl chloride must be met. This is very important considering that benzyl chloride falls under the category of being poisonous and dangerous.

The global chemical distribution industry was valued at US$247.1 bn in 2023 according to a study done by Astute Analytica. Wherein, specialty chemicals such as benzyl chloride market contributed significantly. Additionally, distributors offer value added services like blending, custom packaging and technical support which plays a big role in meeting specific needs from industrial customers. ICIS conducted a survey in 2022 among chemical buyers and it showed that 68% preferred working with distributors because they were best placed to provide solutions that meet unique demands while ensuring reliability across supply chains thereby underscoring their dominance in the marketplace.

Moreover, the relationships developed between suppliers and customers. Often, distributors in the benzyl chloride market work together with producers and consumers for a long time which ensures that there is no break in supply especially when it comes to benzyl chloride dependent sectors such as pharmaceuticals, agrochemicals among others. In fact, according to Chemical Distribution Institute findings of 2023 show that almost three quarters (72%) of chemical purchases in North America were done through dealer networks. Apart from this, distributor usually keep large stocks as well as ability to handle just-in-time deliveries, which, in turn, cuts down on lead time required by critical industrial processes. Additionally, efficient inventory control systems implemented by these intermediaries’ reduced downtime for about two thirds (64%) of their business clients.

To Understand More About this Research: Request A Free Sample

Regional Analysis

With rapid industrialization and strong economic growth, the Asia Pacific region has become the largest benzyl chloride producer and consumer with revenue share of 57%. Wherein, China and India are at the forefront where China accounts for 45% global production while India’s market is expected to increase by a CAGR of 6.8% between 2024-2032. The demand for this versatile chemical precursor comes from diverse manufacturing sectors such as pharmaceuticals, agrochemicals, plastics, dyes and perfumes which are thriving in the region. In 2023 alone, Japan saw imports rise by 12% while South Korean production capacity grew by 15%. Collectively, APAC benzyl chloride market size reached $252.87 million in 2023.

Utilizing a 25% region’s benzyl chloride production, the pharmaceutical industry is very instrumental in increasing demand. Such a direction is made more obvious by an expanding population as well as higher incomes that lead to increased consumption of commodities for end users that rely on derivatives of benzyl chloride. Additionally, this demand is being fueled by new markets found within its territories, where Vietnam recorded a 9.5% growth in the demand for Benzyl Chloride. On the other hand, Thailand took up 28% market share among ASEAN nations. With Australia having leveraged on these demands from neighboring countries across Asia Pacific region; thereby growing its exportation levels by approximately 7%.

Due to its developed industrial sectors and growing demand in key applications, North America is the second-largest benzyl chloride market. This market position is driven by a strong pharmaceutical industry that uses many derivatives of this compound. Moreover, its use in personal care products especially perfumes has also surged up the consumption. Among all other countries falling under this continent, USA has the highest consumption rate and it continues to grow each year by 2%. In addition, there has been an increasing need for biocides as well as water treatment where benzyl quaternary ammonium compounds (benzyl quats) are imperative. Another reason why North America holds such significant share of global markets is because there are already big players established here; furthermore, new products keep getting invented all time so no wonder their current stake stands at around 21.57%.

Top Players in Global Benzyl Chloride Market

- Valtris Specialty Chemicals

- Kanto Chemical Co., Inc.

- Hefei TNJ Chemical Industry Co., Ltd.

- Shri Rajaram Chemicals & Engg

- Mruchem

- Gayatri Industries

- Labdhi Chemicals

- Gujarat Alkalies and Chemicals Ltd.

- Kadillac Chemicals

- Vizag Chemical International

- Other Prominent Players

Market Segmentation Overview:

By Form

- Liquid

- Solid

By Application

- Benzyl Alcohol

- Benzyl Cyanide

- Benzyl Quaternary Ammonium Compounds

- Benzyl Phthalate

- Benzyl Ester

- Other Chemical Intermediates

By Industry

- Pharmaceutical

- Agriculture

- Paints & Coatings

- Food and Beverage

- Plastic and Polymer

- Chemical

- Others

By Distribution Channel

- Direct

- Distributor

- Online

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- U.K.

- Germany

- France

- Spain

- Italy

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0724873 | Delivery: 2 to 4 Hours

| Report ID: AA0724873 | Delivery: 2 to 4 Hours

.svg)