Global Bedroom Linen Market: By Product (Pillows , Pillow protector, Pillow case, Pillow sham, Bed Skirt/ Dust Ruffle, Bottom sheet / Fitted sheet, Top sheet / Flat sheet, Duvet / Comforter, Blanket, Coverlet / Quilt , Bed spread / bed scarf, Others); Material (Cotton, Polyester, Linen, Silk, Others); Price (Low, Medium, Premium); End-User (Residential, Commercial); Distribution Channel (Online, Offline); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Nov-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0423399 | Delivery: 2 to 4 Hours

| Report ID: AA0423399 | Delivery: 2 to 4 Hours

Market Scenario

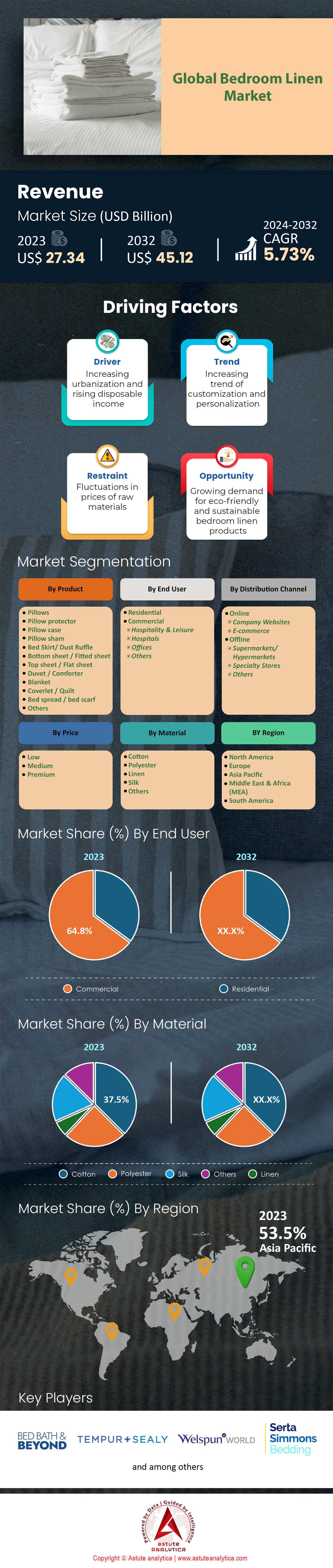

Bedroom Linen Market is forecast to see demand surge to US$ 45.12 billion by 2032, growing at a CAGR of 5.73%. The market was valued at US$ 27.34 billion in 2023.

The bedroom linen market is expanding at an unprecedented rate in the year 2023. This broad sector encompasses products that are sold on a large scale worldwide, such as sheets, pillowcases, comforters and bedspreads, with annual global sales exceeding 1.5 billion units. The market expansion is aided by modernization, which sees 500 million people change their bedding annually to meet new designs and colors. Also, there has been an emergence of 200 bedsheets with innovative properties such as temperature control and breathability as a result of the introduction of advanced materials and textile technologies.

With the growth of online sales, bedroom linen market has notably expanded, where e-commerce sales alone reached US$ 30 billion in 2023. As people have preferred to do most of their shopping online, over 300 million bedding units sold though this channel in 2023. There has also been a rise in the popularity of beddings with specific domains (20 million units made to fit specific styles) and embroidery. In addition, the uptake of hypoallergenic and antimicrobial sheets has also been boosted as a result of the present health and fitness trends. About 100 million units have been sold with these attributes added features.

Sustainability and Luxury Trends

Developing and using eco-friendly materials has been a key aspect of bedroom linen market trends. The sale of organic cotton, bamboo, and other renewable products amounted to more than $15 billion, with 120 million pieces sold worldwide in the year 2023. In response, manufacturers launched 350 new eco-friendly lines of products as a form of commitment to environmental concerns. Sustainability efforts also fit into the consumer landscapes whereby nearly the 80 million buyers want green bedding.

The high-end bedroom linen market is currently valued at $20 billion and continues to grow at a robust pace. Those people purchasing high thread count sheets and comforters produced a demand of over 25 million pieces. Silk and satin along with Egyptian cotton have been used to make high end sheets and comforters. Some 50 million pieces of products with cooling fabrics have also been sold. The spending trend towards a luxuriant spread also explains as average consumers spend about $500 on high-end bedding per year.

Macroeconomic Factors Influencing Market Growth

Macroeconomics continues to have a considerable influence on the development of the bedroom linen market. Increase in global income has resulted in increased purchasing power for the average consumer which has helped raise average household spend on bedding to US$ 150 per year. Urbanization has led to an additional 3 million new residential units being constructed globally which has fueled growth in the demand for the bedroom linens. The downsizing of living areas has also enhanced the sales of space efficient bedding, with 15 million futons and sofa beds sold in 2023.

As the population ages, the demand for products will change. At this time there are 10 million old persons looking for specific bedding to make them comfortable during sleep. Alongside this, the increasing knowledge regarding sleep allows 50 million consumers to purchase sleep enhancing products. The market is also responding to the increase in remote work, as 30 million consumers changed their bedding in household to make living activities more pleasant.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Growing Consumer Demand for Eco-Friendly, Sustainable Bedroom Linens Due to Environmental Awareness

In 2023, environmental concern has emerged as an essential factor influencing purchasing activities, more so in the bedroom linen market. Consumers want value products that not only enhance beauty and comfort but are also environmentally friendly. As a result, manufacturers and retailers have been forced to focus on green materials and processes. As of 2023, the value of the worldwide organic bedding market is estimated to be US$ 1.3 billion. Organic cotton production exceeded 250,000 metric ton this year to support demand in the industry. The sales of bamboo beddings increased dramatically to $600 million. Among the existing certified eco-friendly bedroom linens there are more than 4,000 companies around the globe. More than 25 millions of users have joined online platforms such as overstock who specialize in eco-friendly home items.

Most consumers in the bedroom linen market spend an average of $170 per purchase of environmentally friendly bedding. In 2023 date Global Organic Textile Standard (GOTS) was awarded to more than 6,000 products . By the end of 2023, the only green bedding market in the United States would worth US$ 400 million. The quantity of Tencel lyocell fibers made increased to 160,000 tons. It is claimed to be more environmentally friendly. Plus, polls show that 8 out of 10 consumers favor brands exposing heavy environmental campaign.

As a result, businesses are throwing resources into radical sourcing and production processes to meet the consumer expectations. This extends to the use of renewable energy in manufacturing, the use of biodegradable packaging and fair trade. Retailers have started to widen their lines of green products and promotion nowadays often emphasizes the ecological effects. This trend not only changes the current market environment but also stimulates creativity as the representatives of various firms are looking for more environmentally friendly methods of production to satisfy consumers.

Trend: Increased Adoption of Online Retail Channels for Purchasing Bedroom Linens Among Consumers Worldwide

In the year 2023, a remarkable increase has been observed in the use of online retail outlets for buying bedroom linens. Consumers in the global bedroom linen market have been attracted by the ease, range of choice, and low costs of the goods and services available on e-commerce platforms. This trend is a result of technological development, the growth of internet usage, and the change of shopping habits caused by the effects of the pandemic. The global market for E-commerce sales for bedding linens amounted to US$ 15 billion in the year 2023. The number of companies based solely on the online sale of bedroom textiles stands at more than 5000.

The sale of bedroom linen through mobile commerce constituted US$ 7 billion, which demonstrates the great inclination to shopping on smartphones and tablets. Buying bedroom linens online has an average order value of US$ 120. On e-commerce sites such as Amazon and Alibaba, over 50 million bedding products were sold within the year. The total number of reviews written by customers about bedroom linen products exceeded 10 million, which shows how actively consumers participated in the process. Out of all, 65% of purchases in that category were made up to free delivery offerings

This development has been forcing conventional retailers in the bedroom linen market to boost their online coverage by investing in easy to use websites and applications. Companies are using data analysis to comprehend consumers’ taste and tailor their shopping experience. Supply chains are being reconfigured for reduced response times whereas customer interactions are becoming more or less entirely web-based. The shift towards greater reliance on e-commerce is transforming competition, driving firms to be more creative and responsive to the need of an online market.

Challenge: High Competition and Market Saturation Creating Pressure on Bedroom Linen Manufacturers' Profit Margins

In 2023, the players in the bedroom linen market are poised to face important challenges such as market saturation and stiff competition from other players in the industry. Brand saturation has given rise to price wars thereby bringing profit margins down. This situation makes it practically impossible for such companies to operate in a profit friendly environment and also engage in marketing and development.

The number of manufacturers engaged in making bedroom linen crosses the 20,000 marks globally. In 2023, the competition has become fiercer as nearly 2,000 new firms have come up. Based on estimates, profit margin for manufacturers now stands at 5% which is considerably lower than the 7% or 8% recorded in the previous years. The demand for lower wholesale prices among major retailers is impacting more than 70% of suppliers. The large conglomerates that dominate the bedroom linen market, only account for 30% share of the market, this indicates a lot of fragmentation. Moreover, the top discount retailers have sold over 100 million sleeves which has put a squeeze on premium lines. Mid-sized businesses are spending an average of $2 million in marketing activities, and the company is incurring losses through beddings.

For addressing these challenges, the producers are pursing strategies such as market segmentation in terms of sustainable or luxurious products. The companies are spending serious money in marketing for any hope of creating or inciting brand loyalty among customers in order to charge higher prices. To cut costs and increase market reach, alliances and joint ventures are being developed.

Segmental Analysis

By Product

The bedroom linen market is an ever changing, which is attributed to the shift in the tastes and preferences of the consumers that greatly varies across the product huddle. The most common product has, however, stayed true as pillow accounting for over 17.3% of the overall revenue. This is attributed to the core role pillows play in bedding according to the growing consumers’ needs for premium quality high thread count materials. Pillow covers follow them closely since they are an integral part of the bedding. The pandemic added fuel to this rise as more consumers spent on home products, leading to a growth of 8% in high end pillows and pillowcases in 2023.

The report anticipates that the segment of pillows will have the highest CAGR of 7.3% between the years of 2024 to the year 2032, this is attributed to the increased knowledge about the benefits of pillows in the bedroom linen market. This is aided by the increase in sales of the pillows and especially the memory foam pillows, which increased by 12% in the year 2023, which indicates that more and more consumers are looking for specialized bedding. Consumers are also looking for better and more effective ways to sleep and relax, this is evident when looking at the sales figures of weighted blankets which increased by 15% within the last 12 months. Alongside which, there has also been a modest increase in the in the total sales of comforters and duvets which have been an added revenue jump estimating around 5.7% in this case. There has also been an upward trend for seasonal comforters during the warmer months as well as winter duvets increasing the total sales of duvets by 10%. This also answers the concern of the consumers by catering different and better quality bedding throughout the year.

By Price

In regard to pricing, the segmentation of the bedroom linen market is done in low, medium and high price segments. The medium price segment is expected to garner more than 24% of the revenues in the bedroom linen market and still come second only after the low price segment. In 2023, the share of low priced segment in total sales was pegged at about 63%. The growth of demand for the medium price segment is driven by the growth in income of consumers who are ready to buy such quality products. A survey conducted in 2023 suggested that 35% of respondents do not mind paying a premium for better bedding in terms of comfort and durability. The medium priced segment has realized a whopping 7% growth in sales in the past year since everyone is out trying to balance on price and quality. It is clear that there has been a growing trend in the tendency of the average consumer to spend more than a budget to purchasing goods, combining low and low cost goods to general clothing stores as more such purchases are made from general stores to suit their means.

Also, with the influx of online stores offering competitive rates in the bedroom linen market, media priced bedroom linen has become easy to find, making this segment increase by 10 % from online sales. With the changing spending behavior, the value of the average consumer purchasing bedroom linen has risen by 6% in 2023.

The second segment encompasses high-priced segment luxury and designer bedding, which is accounted for about 12% of the market revenue. This segment has been growing at an average rate of 5% per annum as the affluent class is willing to spend on such premium materials and designs. In addition the demand for premium beddings such as Egyptian cotton silk and linen has shown an increase of 8%. Also orthodox and individually made bedding solutions have witnessed an increase in demand of about 12% aiming at the customization of home decor.

By Material

In 2023, it appears that cotton continues to dominate the global bedroom linen market with more than 37.5% of the revenue share. Cotton has all the breathing spaces as consumers’ interests because of its natural state, it is also considered valuable for its low cost and for being durable. The rise in the demand for cotton bedding products is substantiated in the report by an increase of 9% in sales volumes in the year 2023. Also, there is a 15% increase for the organic cotton bedding as the consumers do care for the environment and are integrating such options. However, other materials are starting to pick up. Due to its softness and eco-friendliness, bamboo bedding has been growing as well with a 12% growth in sales witnessed in 2023. Linnen, which is well regarded for its quality and luxury features, has also had a sale increase of 7% owing to the high-price range segment. Besides, the demand for silk bedding also increased by 5% because of the consumers who are looking for hypo allergenic and luxury goods. Microfiber materials, on the other hand, tend to appeal to the low to medium-price segments because of their price and the care that they require.

With the growing demand for sustainable and environmentally conscious products, the manufacturers in the bedroom linen market have started to come up with new and innovative materials. Sales of Tencel, a fabric derived from eucalyptus trees, have increased by 10% owing to its environmental advantages as well as comfort factors. The share of the market of recycled bedding products has also increased by 8%, which is in tandem with worldwide trends in sustainability. Further, the sales of bedding products that possess antimicrobial properties, such as those with silver ions fused, have grown by 6% due to increased concern for hygiene among consumers.

By Distribution Channel

The offline channel captures more than 71.8% of the share of the global bedroom linen market. This is attributed to most of the consumers’ desire to touch and feel the product, and especially for items like beddings. 55% of the offline sales are made through department stores and specialty stores which provide a full range of merchandise and have a higher degree of customer care. Nonetheless, in regards to the e-commerce penetration, there is a remarkable increase gain, accelerating with a CAGR of 6.49% from 2023 to 2032. The ease of purchasing online together with the variety of items and price competition has resulted in an increase of online sales of beddings by 15% last year. The percentage of the total market sales attributed to e-commerce growth is 31% as opposed to only 20% in 2019. This transition was hastened during the COVID pandemic, as 2020 saw a 25% increase in year-over-year online purchases involving beddings.

Mobile aided commerce is changing consumer habits, as 40% of bed linens selected for purchase over the internet are done through a mobile device. Furthermore, social media emerged as effective advertisement platforms as 60% of respondents claimed to have heard of new bed linens companies from social networks ads. The policies of free transportation and easy returns offered by e-commerce vendors increased customer satisfaction levels by 12%. In order to be in the race, the firms are employing multi-channel strategy which fuses on-line and off-line modes and this increase the sales by 7% for those adopting the strategy. In general, although the offline channel is still the predominant mode of business, the online channels’ rapid expansion is revolutionizing how the distribution of t the Bedroom linen market operates.

To Understand More About this Research: Request A Free Sample

Regional Analysis

According to the research findings, North America claims the position of a second critical stakeholder in the bedroom linen market, accounting for more than 22.4% of the market share. This region is dominated by the United States that has an estimated population of 330 million and a high level of income per capita. In line with this, over 200 million bedding units are sold in the U.S. market on an annual basis and each American spends on average two years before getting new bedding. In concern for home accessories and even interior decor fashions, there are 50 million people opted to change their bedroom decor. The growth of online shopping platforms has transformed the landscape, as US$8 billion of bedding were sold by e-commerce in the United States alone. The number is relatively small because only 25 million bedding were bought through mobile phones.

Apart from the US, Canada’s cold climate leads to the sale of roughly 12 million units of thermal bedding items every year. When it comes to beddings, Canadians take comfort seriously, as demonstrated by the 8 million who use flannel and fleece. Sustainable bedding has a huge presence in Canada with the sales in organic cotton and bamboo reaching a billion and selling over 5 million units. This focus on green products is consistent with the values of Canadians who wish 70% of such options. The bedroom linen market in Canada is similarly affected by the tourism and hospitality markets whereby hotels buy around 2 million units of bedding a year in order to host visitors.

List of Key Companies Profiled:

- Acton & Acton Ltd.

- American Textile Co.

- Beaumont & Brown Ltd.

- Bed Bath & Beyond Inc.

- Boll & Branch LLC

- Bombay Dyeing

- Crane and Canopy Inc.

- Pacific Coast Feather Company

- Serta Simmons Bedding, LLC

- Tempur Sealy International, Inc.

- Trident Ltd.

- Welspun India Ltd

- Other Prominent Players

Market Segmentation Overview

By Product:

- Pillows

- Pillow protector

- Pillow case

- Pillow sham

- Bed Skirt/ Dust Ruffle

- Bottom sheet / Fitted sheet

- Top sheet / Flat sheet

- Duvet / Comforter

- Blanket

- Coverlet / Quilt

- Bed spread / bed scarf

- Others

By Material:

- Cotton

- Polyester

- Linen

- Silk

- Others

By Price:

- Low

- Medium

- Premium

By End-User:

- Residential

- Commercial

- Hospitality & Leisure

- Hospitals

- Offices

- Others

By Distribution Channel:

- Online

- Company Websites

- E-commerce

- Offline

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The UK

- Germany

- France

- Italy

- Spain

- The Netherlands

- Denmark

- Sweden

- Belgium

- Finland

- Poland

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Thailand

- Singapore

- Malaysia

- Vietnam

- Indonesia

- Rest of ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0423399 | Delivery: 2 to 4 Hours

| Report ID: AA0423399 | Delivery: 2 to 4 Hours

.svg)