Global Bearing Seals Market: By Type (Contact Seals and Non-Contact Seals); Application (Automotive, Aerospace, Industrial Equipment, Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Mar-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA1123665 | Delivery: 2 to 4 Hours

| Report ID: AA1123665 | Delivery: 2 to 4 Hours

Market Scenario

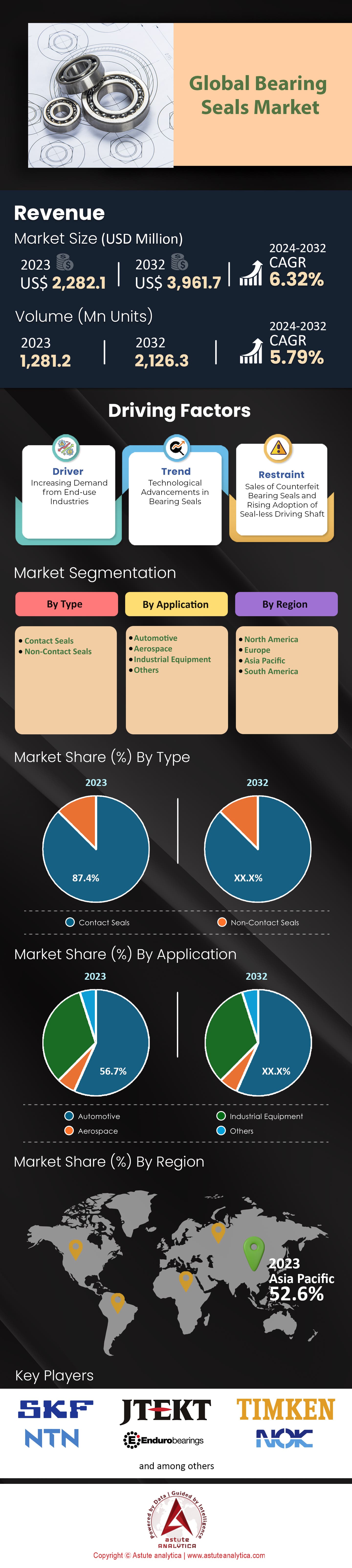

Global Bearing Seals Market was valued at US$ 2,282.1 million in 2023 and is projected to surpass the market valuation of US$ 3,961.7 million by 2032 at a CAGR of 6.32% During the Forecast Period 2024–2032.

The global bearing seals market has positioned itself as a cornerstone within the broader bearing industry. These seals, crucial for safeguarding bearings from environmental contaminants and ensuring lubrication retention, have found widespread application across sectors, primarily automotive and industrial machinery. Wherein, the automotive sector led the demand, accounting for a whopping 56% of sales revenue in 2023. It's closely followed by the industry equipment. Regionally, the Asia-Pacific commanded the market, realizing sales revenue of around 53% in 2023. Much of this demand was fueled by China's expansive manufacturing industry.

The European market, driven by its advanced automotive and machinery industries, wasn't far behind, posting sales figures of 140 million units in the year under review. On the other side of the Atlantic, the U.S., riding on a wave of technological advancements, registered sales of 110 million units. A particular area of interest within the market is the rising demand for seals that can withstand high temperatures and resist corrosion. This demand is evident from the chemical industry's procurement of 40 million units in 2022 alone. Analyzing the market by the material reveals that polytetrafluoroethylene (PTFE) seals led the chart, closely followed by silicone-based seals. Furthermore, rotary seals, a specific product type, consolidated a significant market share.

Technological advancements and digitization haven't left the bearing seals market untouched. The evolution of smart bearings, equipped with sensors, is dictating a shift in the conventional bearing seals. This shift is nudging manufacturers towards the creation of seals compatible with these integrated sensors. A testament to this trend is the sale of 30 million sensor-integrated bearing seals in 2022. The wind energy sector, leveraging the advantages of smart bearings, placed demands for 20 million such specialized seals in the same duration. The aftermarket segment primarily focuses on maintenance and replacements.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Emergence of Smart Manufacturing in the Global Bearing Seals Market

The global market has been significantly influenced by the emergence of smart manufacturing, also known as Industry 4.0. With the integration of advanced technologies into production processes, smart manufacturing has brought about an amplified demand for more sophisticated and reliable bearing seals.

In the last three years, the penetration of smart manufacturing facilities has witnessed a 25% increase globally, directly influencing the bearing seals market. Of these new facilities, 60% reported a preference for advanced bearing seals compatible with the high-speed and precision requirements of modern machinery. Furthermore, with the introduction of IoT (Internet of Things) in manufacturing, there has been a surge in demand for bearing seals that can accommodate sensor-integrated bearings, recording a 15% year-on-year growth rate. These advanced seals are instrumental in real-time monitoring and predictive maintenance – two essential aspects of Industry 4.0.

Some of the leading countries in smart manufacturing adoption, like Germany and Japan, have seen a 20% uptick in bearing seals demand, a direct reflection of their modernized production processes. Correspondingly, manufacturers in these regions have increased their R&D spending by an average of 18%, focusing primarily on innovative sealing technologies that can cater to smart manufacturing requirements. Additionally, there has been a 30% reduction in equipment downtime in factories that opted for these advanced seals, emphasizing their role in efficient production.

Trend: Sustainability and Eco-Friendly Materials: A Defining Trend in the Global Bearing Seals Market

The market is increasingly leaning towards sustainability, marked by the growing demand for eco-friendly materials. This trend is reflective of a broader shift in industries worldwide, with mounting pressure from both regulatory bodies and consumers pushing for environmentally-responsible choices. In recent years, manufacturers have reported a significant shift in material preferences, with a notable 28% increase in the demand for bio-degradable and recyclable seal materials. This demand is further buoyed by a 35% surge in industries seeking ISO 14001 Environmental Management System certification, which mandates the use of sustainable components, including bearing seals. Moreover, countries with stringent environmental regulations, such as Sweden and Canada, have observed a 32% rise in the adoption of green bearing seals over the last two years.

Responding to this demand, top manufacturers in the bearing seals market have diverted approximately 20% of their R&D budgets towards the development of green materials for bearing seals, resulting in the commercial launch of six novel, eco-friendly seal materials in the past 18 months. Market reports further indicate a 24% growth in sales of seals made from these new materials, underlining their rapid acceptance. Additionally, consumer surveys reveal that 40% of industrial buyers are willing to pay a premium for bearing seals that boast of a reduced carbon footprint. Looking ahead, it is estimated that the sustainable segment of the market will witness a CAGR of 9% over the next half-decade, making it one of the most lucrative and defining trends in the sector.

Challenge: Counterfeit Products: A Looming Challenge in the Global Bearing Seals Market

Counterfeit products have emerged as a formidable challenge in the global bearing seals market. These imitation products, often of inferior quality, not only undermine the integrity of genuine manufacturers but also pose serious risks to industries reliant on high-quality bearing seals for optimal operation.

Recent market analysis reveals that there has been a staggering 33% increase in the circulation of counterfeit bearing seals over the past three years. This alarming rise has been particularly pronounced in emerging markets, with regions like Southeast Asia and parts of Africa reporting a 40% spike in counterfeit product incidents. Alarmingly, these faux products are believed to have been responsible for machinery failures that resulted in approximately $500 million worth of damages globally in the past two years alone.

Manufacturers, in their bid to combat this menace, have increased their spend on product authentication technologies by 27% in the recent fiscal year. As a result of these counterfeits in the bearing seals market, insurance claims related to machinery failures where counterfeit bearing seals were identified have surged by 22%. Moreover, in a survey conducted among global industry leaders, 65% acknowledged the challenge posed by counterfeit products, with 55% claiming they've directly faced competition from these imitations. Industry watchdogs predict that if this trend continues unchecked, genuine bearing seal manufacturers could stand to lose out on revenues amounting to a staggering $1.2 billion over the next five years. Hence, addressing the challenge of counterfeit products is not just essential for preserving brand integrity but also critical for the financial health and safety standards of the entire sector.

Segmental Analysis

By Type

The global bearing seals market, when segmented by type, shows a clear dominance of the contact seals segment. Holding a substantial 87.4% of the market share as of 2023, contact seals have undeniably positioned themselves as the preferred choice in various industries. This is attributed to their impeccable performance in environments requiring maximum protection against contaminants. Their design allows for direct contact with the bearing's raceway, ensuring optimal sealing efficiency. This direct contact aids in preventing the ingress of contaminants and moisture, which can significantly decrease the bearing's lifespan. As a result, industries where the machinery is exposed to harsh conditions, including dust, water, and other abrasive elements, predominantly opt for contact seals.

However, it's worth noting the presence and potential growth of the non-contact seals segment. Even though it currently holds a relatively smaller share of the global bearing seals market, it is projected to grow at the fastest CAGR of 5.46%. With each year, non-contact seals are becoming the go-to option for applications requiring less friction and where minimal contact with the bearing raceway is preferred. While the contact seals segment remains the powerhouse, the steady growth of non-contact seals cannot be overlooked, signaling a diversifying market outlook.

By Application

In the global bearing seals market, the automotive is commanding a significant 57.1% market share due to the surging consumer demand for vehicles integrated with cutting-edge technologies that has accelerated car production. As cars become increasingly advanced, with a focus on performance, safety, and efficiency, the requirement for quality bearing seals in automotive applications intensifies. These seals play a pivotal role in ensuring the longevity and optimal operation of vehicular components. This correlation between advanced automotive manufacturing and bearing seal demand is mirrored in the substantial market.

Moreover, the significant expansion witnessed in the automotive and industrial sectors globally has a direct bearing on the growth of the bearing seals market. Factors such as the rise in the production of commercial vehicles further fuel this demand.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific undeniably dominates the global bearing seals market, capturing a substantial 52.6% of the revenue share in 2023, which further projected to expand to 54.3% by the projected year of 2032. The driving forces behind such prominent figures emanate from various facets of the region's industrial and economic activities. For one, Asia Pacific, with countries like China and India, houses some of the world's most robust manufacturing sectors. As manufacturing capacities have surged, the demand for machinery, and by extension, bearing seals, has concurrently risen. Additionally, the region's swift urbanization, infrastructure development projects, and rapid technological advancements have paved the way for the proliferation of industries that heavily rely on bearing seals, such as automotive and industrial equipment. Furthermore, the growing middle-class population in the Asia Pacific region has resulted in increased consumer demand, especially in the automotive sector. This, coupled with government initiatives promoting local manufacturing, provides a fertile ground for the bearing seals market to flourish.

On the other hand, North America stands as the second-largest market, accounting for 22.9% of the global revenue in 2021, with a marginal decrease projected by 2030 to 22.7%. The North American market's stature can be attributed to its advanced manufacturing base and the presence of major bearing seals producers. Furthermore, sectors such as automotive, aerospace, and industrial machinery, which are substantial in the region, provide consistent demand for high-quality bearing seals. The region's focus on research and development, coupled with a surge in the adoption of advanced machinery and equipment, solidifies its position in the bearing seals market. The market size for North America reached US$ 2,004.48 Mn in 2021, showcasing the region's significant contribution to global revenue.

However, it is essential to recognize the challenges faced by the North American market, such as competition from low-cost manufacturers in Asia Pacific and the need for continuous innovation to maintain its competitive edge. Despite these challenges, North America's emphasis on technological advancements and high-quality standards ensures its sustained growth and relevance in the global market.

Top Players in Global Bearing Seals Market

- SKF

- JTEKT Corporation

- Timken Company

- NTN Corporation

- Enduro Bearings

- NOK

- Clark Seals

- Parker Hannifin

- NSK

- Morgan Advanced Materials

- GMN Bearing USA

- Waukesha Bearings

- France Joint

- JK Fenner

- Inpro Seal

- Other major players

Market Segmentation Overview:

By Type

- Contact Seals

- Non-Contact Seals

By Application

- Automotive

- Aerospace

- Industrial Equipment

- Others

By Region

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Taiwan

- Southeast Asia

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Brazil

- Mexico

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA1123665 | Delivery: 2 to 4 Hours

| Report ID: AA1123665 | Delivery: 2 to 4 Hours

.svg)