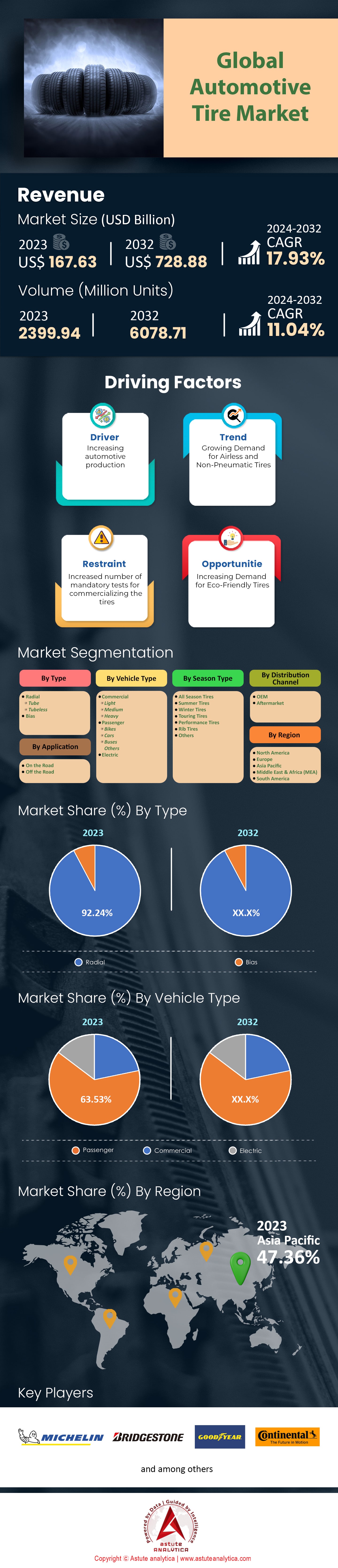

Global Automotive Tire Market: By Type (Radial (Tube and Tubeless) and Bias); Vehicle Type (Commercial (Light, Medium, Heavy), Passenger (Bikes, Cars, Buses, Others) and Electric); Season Type (All Season Tires, Summer Tires, Winter Tires, Touring Tires, Performance Tires, Rib Tires, Others); Application (On the Road and Off the Road); Distribution Channel (OEM and Aftermarket); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Jul-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0724864 | Delivery: 2 to 4 Hours

| Report ID: AA0724864 | Delivery: 2 to 4 Hours

Market Scenario

Global automotive tire market was valued at US$ 167.63 billion in 2023 and is projected to hit the market valuation of US$ 728.88 billion by 2032 at a CAGR of 17.93% during the forecast period 2024–2032.

The automotive tire industry is experiencing a significant surge in demand, which is majorly driven by various factors including the rise in vehicle production, increased consumer spending, and advancements in tire technology. In terms of market distribution, the passenger car segment alone represents more than 65.53% of market share which shows an increase in privately owned vehicles around the world. Furthermore, electric vehicles or EVs also contribute to this rise as sales for EV tires are predicted to hit 50 million units by 2024, largely due their unique need for frequent replacements when compared with conventional cars.

In addition to being a major factor for the growth of the automotive tire market, commercial vehicles are also responsible for other things. By the end of 2024, over 200 million units are estimated to be bought globally due to increased e-commerce and logistics developments. Still, out of all places worldwide it remains true that APAC (Asia-Pacific), where China alone manufactures more than 900 million tires annually, boasts of being the largest market while following closely behind India which has an annual production capacity equaling 150 million tires each year. In Europe, there have been changes towards greener products such high performance ecofriendly tires, which is projected to hit sales of over 40 million units by 2025.

The automotive tire market is growing even faster because of technological progress. Sales of smart tires, which have sensors inside them that constantly monitor their condition, are expected to increase dramatically: they should reach 10 million units by 2025. The retreading tire market is showing signs of life too – it’s already worth an estimated $100 billion annually worldwide and could grow at a CAGR of around 10% over the next few years as people want sustainable products more now than ever before. In North America, there’s demand for over 250 million replacement tires each year mainly driven by vehicles lasting longer and doing more miles but also helped along by higher density urbanization.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Surge in Global Vehicle Production Fuels Escalating Demand for Automotive Tires

There is currently an unprecedented increase in the number of vehicles being produced globally which has a direct impact on the automotive tire demand. The year 2023 alone saw 85 million cars sold worldwide, thus marking a notable hike from previous years’ records. Such escalated figures of vehicle sales have become instrumental in spurring tire demands where every new car needs five tires on average, one being a spare. As a result, this has led to an explosion within the automotive tire market with approximately 425 million fresh ones required for these vehicles. Amongst other countries in Asia-Pacific region, India and China are leading this boom; China alone made 26 million motor vehicles during 2023. Rapid urbanization alongside growing middle class population across these areas has greatly contributed towards increased production of automobiles and subsequently their need for tires too.

Aside from sales of new vehicles, the tire industry is also driven by the global fleet size. Worldwide, there are around 1.5 billion vehicles on the road as of 2023 and all these cars will need replacement tires at some point. The average life expectancy of a tire is between three and five years implying that about 300 million tires should be replaced each year to ensure safe driving conditions and good car performance. The US automotive tire market alone witnessed strong activity with 17 million units sold in 2023 thus contributing greatly towards high demand for tires while closely following behind it was Europe where they recorded 10.5 million sales during that same year. Alongside this ascent, in 2023 around 14.2 million electric vehicles (EVs) were sold worldwide thereby necessitating special tires. In response to this ever-increasing need, the tire sector has increased production output volumes significantly. A record-setting 2.1 billion units are expected to be produced globally by year end 2023.

Trend: Growth in the Aftermarket Segment Driven by Aging Vehicles and Mileage

This trend arises from the increasing average vehicle age, which by 2023 had reached 12.2 years in the United States, and shows that vehicles are being used longer before they are replaced hence need more frequent tire changes. In the US alone, there were registered 284.5 million vehicles in 2023 with a good portion of them requiring regular tire maintenance service or replacement. This is because they covered an average of about 13,500 miles per year, which also contributes to the high demand for after-market tires. Thus, it is leading manufacturers in the automotive tire market to improve their post-production services so as cater for this growing market.

Infrastructure improvements also contribute to this trend, as better roads lead to higher vehicle usage and, consequently, more tire wear. For instance, the U.S. government allocated $1.2 trillion for infrastructure projects, including road improvements in 2023. Apart from this, online tire sales valuation was pegged at $5.5 billion in 2023 as more people have started buying them from online channel to save some money. The advent on of EVs have left a profound impact on aftermarket automotive tire sells as over 14.2 million units were sold worldwide in 2023, which means more need for specialized tires too.

Challenge: Sustainability and Environmental Challenges in Eco-Friendly Tire Material Development

When trying to make tires sustainable, many difficulties arise especially in finding eco-friendly materials that don't affect the performance. The worldwide tire production hit 2.1 billion units mark in 2023, which reflects how much of an environmental concern making tires is. These materials include synthetic rubbers made from petroleum among others. This accounts for most traditional tire components’ ecological footprints in the automotive tire market since they are derived from non-renewable sources like crude oil or natural gas. Almost 70% of all-natural rubber produced globally goes into tire manufacturing alone signifying another reason why this industry needs more sustainability options urgently. Although there has been some effort towards using greener substitutes still typically only about 30% part of a tire has renewable content in it. Currently Michelin plans on having their entire range sustainable by 2050. However, even now this target seems far off according to facts as at 2023

Material sourcing is not the only area where the environment is affected. The production of tires emits about 1.5 million tons of CO2 per year, which adds to global carbon emissions. Furthermore, approximately 1 billion tires are discarded worldwide annually, and their management poses significant difficulties. Although recycling or reusing accounts for 76% of this number, the remaining 24% often finds its way into landfills where it becomes an environmental threat. Moreover, economic challenges also face the automotive tire market as prices for eco-friendly resources range from 20-30% higher than traditional ones. Despite this setback though, strides towards sustainability are being made within the sector; with companies pumping $3bn into R&D investments geared at finding green alternatives.

Segmental Analysis

By Type

Based on type, the automotive tire market is led by radial type with over 92.24% market revenue. In 2023, the global automotive tire market was worth $167.63 billion and it is expected to be valued at around $728.88 billion by 2032. Radial tires are favored for their construction, which includes perpendicular polyester plies and crisscrossed steel belts, enhancing durability and performance. An estimated 65.3 million passenger cars were sold globally in 2023 alone, greatly increasing the demand for radial tubeless tires. Moreover, consumers are more likely to buy them due to reduced fuel consumption caused by lower vibrations. As per the latest report, the tubeless tire segment is projected grow at a robust CAGR of 22% in the years to come.

Many factors fuel the prevalence of radial tires. They are long lasting life, have lower fuel consumption rate, and are safer because they resist heat and can maintain air pressure without a tube. With the aging vehicles, the demand for radial tires to shoot up. Passenger cars in particular are on the rise, especially within Asia-Pacific regions. Additionally, this has led to an increased need for trucking services across borders due partly thanks to these developments causing demand for radial tubeless tires in trucks and buses. Moreover, sustainable development goals set by various governments worldwide including projects like Continental Tire Japan's PROJECT TREE initiative that focuses on ecologically sourced materials used throughout automotive industry supply chains – all contribute towards shaping this sector too. In fact, according to a report released back 2032 forecasts expect that radial tire segment will account for over 93%.

By Vehicle Type

The automotive tire market is predominantly driven by the passenger vehicle segment with 65.53% market share due to several compelling factors. In comparison with 400 million commercial vehicles, there are around 1.4 billion passenger cars worldwide as of 2023. This is a very large number and it consequently creates higher demand for tires than any other type of vehicle does alone. Additionally, passenger cars usually need new sets of tires every three or four years. On average, each owner buys five tires including one spare during every three years, which drives up the demand for about 2.3 billion tires globally. Moreover, the passenger car tires on average goes up to 12,000 miles so their treads wear out more frequently necessitating frequent replacement too. In contrast, commercial vehicles, despite higher mileage, often use more durable, higher-cost tires designed for longer lifespans, thus reducing the frequency of replacements.

Not only this, but passenger vehicles rule urban and suburban areas, which often witness fast tire wear due to poor road conditions and driving habits. For example, in the US and Europe where car ownership is high, there is a large market for replacement tires. This is mainly attributed to over 276 million registered vehicles in the United States alone, most of them being cars for personal use. Market preferences are also important here. Consumers in developed countries usually go for high performance or all seasons’ tires. Thus, adding fuel to demand for premium tire segments.

By Season

All-season tires hold a significant market share of 57.35% in the global automotive tire market due to their versatility and adaptability to various driving conditions. This makes them a popular choice for cost-conscious customers who want convenience too; because these tyres are made to work in different weather conditions all year round. The demand is also fueled by the increase in car sales worldwide, which stood at 90.9 million units in 2023; and the rising number of miles driven per annum – currently averaging 15,000 miles per vehicle in America alone. Besides this, tire technology has seen some improvements like smarter tire design or using sustainable materials during production which have helped expand the market even further.

The great cost of maintaining and replacing regular tires pushes people to buy more lasting and adaptable ones. Also, the increase in disposable income among developing nations has impacted upon the automobile tire market as it has resulted into higher demand for SUVs and crossovers that come fitted with all season tires. Such investments in tire manufacture like Bridgestone’s $250 million expansion project in Costa Rica indicate how much effort is being put by companies to meet this growing demand. Additionally, with 35% market share, Asia-Pacific region is a major driver behind the global growth of automotive tire market. Another factor that contributes largely to dominance of all-season tires is adoption cutting edge technology by OEM, which improves their performance and sustainable features too.

By Distribution Channel

The aftermarket distribution of tires holds over 75% market share of automotive tire market. A main contributor is the longer lifespan of vehicles that leads to more frequent tire changes. The average age of cars in America has grown to 12.1 years, causing a surge in demand for new tires. Furthermore, the increase in annual mileage driven — which reached 3.26 trillion miles last year — is only adding to this need. Aftermarket companies have been helped by tire technology breakthroughs including high-performance and all-season types that meet different customer demands. Also, key is a broad service center and retail network that ensures convenient access to replacements or upgrades; meanwhile, rising popularity among consumers for SUVs and crossovers (which require bigger and sturdier tires) has greatly boosted growth in this sector too.

The aftermarket segment of the automotive tire market grows strong due to many things. For instance, sustainability, durability and affordability have become the main feature of a product through adoption of advanced manufacturing technologies by OEMs which in turn led to differentiation among various products. In addition, demand for high-performance tires has been fueled by an increasing interest in sports and extreme terrain rallies while emergence economies with increased disposable incomes have seen more people buy bigger capacity vehicles hence driving sales further up. Another factor is that retreading saves cost on operation thereby making it popular among users who are looking at reducing costs where possible without compromising safety or quality; this also acts as support to aftermarkets. Furthermore, there is growing focus towards sustainable development and use of environmentally friendly materials such as natural rubber which has impacted greatly on this industry so far.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia-Pacific region holds largest market share of the global automotive tire market. In 2023, the region accounted for 47.36% revenue share and is also projected to keep growing at the highest CAGR, thanks to strong local demand and supportive policies. Moreover, the region has strong manufacturing base including countries such as China that produce more than 900 million tires yearly. India is projected to have sold about 185.42 million units by 2023 fueled by rapid economic growth. Japan is still ahead technologically along with South Korea where they export 70% out of every 120 million produced tires annually while meeting domestic needs too like in Indonesia which sells over 79.5m each year. The region demand for commercial vehicle tires is expected to exceed 200 million units per year due to the ongoing urbanization and industrialization in this area. Another factor that contributes to this growth is the growing middle class of Southeast Asia, which has led an increase in passenger vehicles’ sales thus reaching 150 million units by 2024 while still benefiting from strong OEMs (Original Equipment Manufacturers) and aftermarkets; where OEMs alone account for over 400 million units annually sold throughout the region.

Europe has a well-established automobile industry and a great demand for replacement tires. Germany, which is the largest automotive tire market in Europe produces over 200 million tires each year. United Kingdom comes second after Germany where they produce 80 million tires annually while France follows producing 70 million yearly. In a year, over 50 million environments friendly or eco-friendly tires are bought in the region, which shows that the region gives priority to sustainability and green solutions alone. The market share of Europe in terms of volume sold as replacement exceeds 300 million units every year.

Tire technology keeps on getting better with time making them safer to use while driving. There have been inventions like puncture sealing tires and intelligent tires that have become popular due to their performance levels being higher than average among other things. Economic growth coupled with infrastructure development across Europe has increased demand for commercial vehicle tires hence sales estimation reaching one hundred million units per annum. Regulations differ from country to country in the region. Therefore, compliance affects how things work out within the Europe automotive tire market, with stringent emissions and safety standards driving innovation.

With over 334.2 million tires produced each year, the US is still the biggest market while Canada follows with 40 million and Mexico with 60 million annual productions respectively. It has a large number of vehicles; only in America, there are registered more than 270 million cars so it should not be surprising that demand for replacement tires is strong. The US tire industry is gaining momentum as customers seek necessary auto care thus leading to more than 150 million units being purchased per annum for maintenance alone.

Top Players in Global Automotive tire market

- Bridgestone Corp.

- Goodyear Tire & Rubber Company

- Continental AG

- Michelin

- Sumitomo Rubber Industries

- Pirelli

- Cooper Tire & Rubber Company

- Hoosier Racing Tire

- Titan Tire Corp.

- Vogue Tyre

- Yokohama Tire Corp.

- Dunlop Tires

- Toyo Tires

- Hankook

- CEAT Specialty

- Apollo Tyres

- Kumho Tires

- Other Prominent Players

Market Segmentation Overview:

By Type

- Radial

- Tube

- Tubeless

- Bias

By Vehicle Type

- Commercial

- Light

- Medium

- Heavy

- Passenger

- Bikes

- Cars

- Buses

- Others

- Electric

By Season Type

- All Season Tires

- Summer Tires

- Winter Tires

- Touring Tires

- Performance Tires

- Rib Tires

- Others

By Application

- On the Road

- Off the Road

By Distribution Channel

- OEM

- Aftermarket

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0724864 | Delivery: 2 to 4 Hours

| Report ID: AA0724864 | Delivery: 2 to 4 Hours

.svg)