Automotive Telematics Market: By Component (Hardware, Software Platform, and Services); Application (Vehicle Tracking/Recovery (Fleet Management), Navigation, Insurance Risk Assessment, On-Road Assistance, and Others); Vehicle Type (Passenger Car, Light Commercial Vehicles, and Others); Connectivity (Satellite and Cellular); Sales Channel (OEM and Aftermarket); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 13-Aug-2025 | | Report ID: AA0222135

Market Snapshot

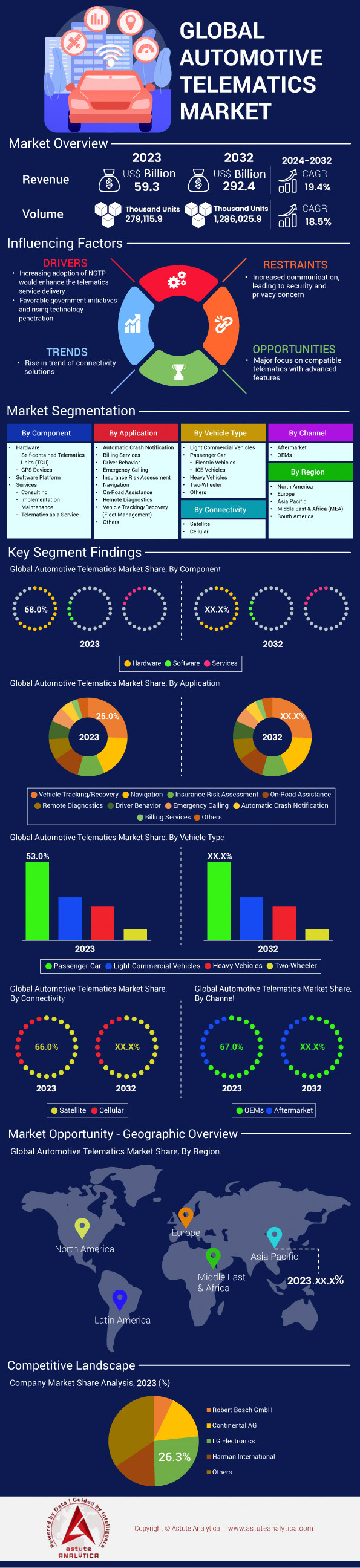

Automotive telematics market size is estimated to grow from US$ 70.8 billion in 2024 to US$ 349.2 billion by 2033 at a CAGR of 19.4% during the forecast period 2025-2033.

Key Findings in Automotive Telematics Market

- Based on component, hardware segment, which has a 68.5% share of the total revenue. What are these hardware and why are they controlling a large chunk of the automotive telematics market.

- Based on application, vehicle tracking or recovery fleet management has taken the lead in the revenue share of market with a whopping 25.3% share.

- Based on connectivity, satellite connectivity accounted for 66.3% market share.

- Based on vehicle type, passenger cars are dominating the automotive telematics market, which account for 52.6% of the total market share.

- Asia Pacific is poised to continue leading the market in the coming years.

- Global automotive telematics market is expected to attain valuation of US$ 349.2 billion by 2033.

The demand shaping the automotive telematics market is multifaceted, driven by compelling financial incentives and operational necessities. The staggering costs associated with vehicle incidents create a powerful demand for risk mitigation tools. A single commercial truck accident averages $334,892 in costs, a figure that escalates to an average of $7.2 million for a fatality. Even a non-fatal, work-related crash carries an average cost of $75,000. Consequently, businesses are investing heavily in preventative solutions. The fact that a single provider like Samsara helped prevent over 200,000 crashes demonstrates the technology's value. Strong market willingness to pay is evident, with industry leaders achieving significant revenue, such as Samsara's $1.1 billion in annual recurring revenue for fiscal year 2024.

Demand is also fueled by a relentless pursuit of operational intelligence and efficiency. Fleet managers in the automotive telematics market overseeing average fleets of 103 trucks are adopting platforms that can digitize over 230 million workflows annually. The sheer scale of data processing, with some platforms handling over 9 trillion data points and 75 billion API calls, underscores the demand for powerful analytical capabilities. The launch of new AI and asset management platforms by major players like Penske and GE in 2024 further signals intense market appetite for sophisticated data interpretation tools.

Looking forward, hardware adoption rates confirm a sustained demand trajectory. Global shipments of embedded OEM telematics systems reached 64.5 million units in 2024, with projections climbing to 82.1 million by 2029. Active subscriptions are forecast to surge from 286.6 million in 2024 to 528.1 million by 2029. The North American commercial vehicle market, set to encompass 10.53 million units in 2025, exemplifies the robust, long-term demand for connected vehicle technologies worldwide.

To Get more Insights, Request A Free Sample

Decoding the Next Wave of Automotive Telematics Market Innovation

- A primary trend is the rapid evolution from isolated in-vehicle systems to a cooperative ecosystem enabled by Vehicle-to-Everything (V2X) communication. V2X technology facilitates real-time data exchange between vehicles (V2V), infrastructure (V2I), and pedestrians (V2P), creating a comprehensive network for situational awareness. A shift is foundational for enhancing road safety, optimizing traffic flow, and enabling higher levels of autonomous driving by allowing vehicles to make more informed decisions. Major automakers are increasingly integrating V2X capabilities as a standard feature in new models.

- The integration of Artificial Intelligence with edge computing is fundamentally transforming data processing within the automotive telematics market. Instead of relying solely on the cloud, complex AI algorithms now run directly on in-vehicle hardware, enabling instantaneous analysis of sensor data. An approach, known as edge AI, is critical for real-time applications like predictive maintenance, in-cabin driver monitoring for fatigue, and immediate threat detection for ADAS, significantly reducing latency and improving system reliability.

- As vehicles become increasingly software-defined and connected, a heightened focus on multi-layered cybersecurity is emerging as a critical, non-negotiable trend. The expanding digital footprint of modern cars, from infotainment systems to over-the-air (OTA) update mechanisms, creates new vulnerabilities. Consequently, there is a powerful market demand for robust cybersecurity solutions, including advanced intrusion detection systems, hardware-level security, and secure OTA update protocols to protect against data breaches and malicious attacks.

Mandatory Safety Regulations Forging a Non-Negotiable Demand for Advanced Telematics

The demand for the automotive telematics market is increasingly defined by government action and stringent safety standards. From July 2024, the European Union's General Safety Regulation II (GSR II) mandates a suite of advanced safety technologies in all new vehicles, fundamentally reshaping automotive manufacturing. A regulation is projected to save an estimated 25,000 lives and prevent 140,000 serious injuries on EU roads. The mandate includes critical systems like advanced emergency braking, emergency lane keeping, and driver drowsiness warnings, all of which rely on the data and connectivity provided by telematics. Beyond the EU, the push for safety is global. For instance, more than 60 countries have adopted or are aligning with UN Regulation 155, which establishes a clear framework for vehicle cybersecurity and requires a certified Cybersecurity Management System.

The established eCall system, designed to automatically alert emergency services after a crash, is estimated to save around 2,500 lives annually in Europe automotive telematics market . In 2024, more than 20 new eCall modules featuring eSIM technology were introduced to enhance cross-border connectivity. Further, advanced driver distraction warning (ADDW) systems will become mandatory for new vehicles in the EU from July 2026. These regulations create a compulsory, baseline demand for telematics hardware and software, compelling every automaker selling in these regions to integrate sophisticated connected safety systems into every vehicle produced.

The Electric Revolution and Shared Mobility Powering a New Demand Ecosystem

The parallel rise of electric vehicles (EVs) and smart mobility services has created a powerful, data-centric demand stream for the automotive telematics market. EVs are inherently data-rich machines. Advanced battery management systems in 2025 models now track over 300 different parameters to optimize health and performance. The global EV telematics market was valued at US$13.5 Billion in 2024, driven by the need for specialized functions like real-time state-of-charge monitoring and charging station routing. An average connected EV now receives between 15 and 20 over-the-air (OTA) software updates annually, a process entirely dependent on robust telematics. Furthermore, a single autonomous test EV can generate up to 4 terabytes of data in just one hour, illustrating the immense data-handling requirements.

Concurrently, the shared mobility sector is exploding rapidly in the automotive telematics market . The global car-sharing market reached a value of approximately $4.83 billion in 2024 and is built entirely on a telematics backbone for vehicle location, access, and billing. In New York City alone, ride-hailing services complete over 600,000 trips daily. Globally, the number of daily trips is well over 100 million. Shared micro-mobility is also a significant driver, with Berlin now hosting over 15,000 shared e-scooters and e-bikes, all tracked and managed via telematics. A synergy between electrification and shared services creates a compounding demand for telematics that goes far beyond traditional fleet tracking.

Segmental Analysis

By Component: Hardware Components are The Foundational Core Of Vehicle Telematics

The hardware segment's commanding 68.5% share of the total revenue underscores its critical role within the automotive telematics market. This dominance is anchored by the Telematics Control Unit (TCU), which functions as the brain of the entire system, processing and transmitting vital data. The value of these systems is significant, with hardware costs per vehicle ranging from $100 to $300, plus installation fees that can add another $50 to $150. Essential hardware like high-performance sensors, antennas, and onboard units form the backbone of advanced applications, including Vehicle-to-Everything (V2X) communication, a segment where hardware commands over 64% of the market share. The increasing integration of these components by leading OEM suppliers such as LG Electronics and Continental is a key factor. As the industry moves towards near-universal connectivity, the demand for these physical components is set to intensify, solidifying their market leadership. A thriving automotive telematics market relies on this robust hardware foundation.

The growth is not just about individual components but also about their increasing sophistication and necessity. As vehicle technology evolves, the hardware becomes more complex and indispensable. The progression towards a 93% telematics attach rate in new cars by 2029 highlights how non-negotiable this hardware is becoming for manufacturers. Furthermore, the anticipated connection of up to 80 billion devices to 5G by 2025 will dramatically enhance the capabilities of telematics hardware, making it faster and more powerful. This constant innovation and the sheer volume of units required—projected to approach 78 million annually by 2029—explain why hardware controls such a large portion of the revenue in the ever-expanding automotive telematics market.

- Advanced Sensors: ADAS functionalities, now common in modern vehicles, are entirely dependent on data collected by telematics hardware like radar and cameras.

- OEM Integration: In 2024, over 80% of TCUs are installed at the factory level by OEMs, making them a standard feature rather than an aftermarket addition.

- V2X Hardware Demand: The specific hardware for V2X systems, which enables vehicles to communicate with their environment, constituted over 64% of its sub-market in 2024.

By Application: Fleet Management Applications Drive Practical Value and Market Growth

Vehicle tracking and fleet management applications have firmly established their leadership in the automotive telematics market with a significant 25.3% revenue share. The reason for this dominance lies in the tangible return on investment these solutions offer. For a monthly subscription fee that typically ranges from $15 to $40 per vehicle, fleet operators gain access to a powerful suite of tools for optimizing their operations. These applications leverage telematics data to enable precise route planning, monitor driver behavior like speeding or harsh braking, and track fuel consumption, all of which lead to substantial cost savings and enhanced safety. The integration of AI for predictive maintenance alerts further minimizes costly vehicle downtime, a critical factor for any commercial fleet. The immense practical benefits make these applications an essential tool for modern logistics and transport.

The evolution of fleet management goes beyond simple location tracking. The use of geofencing provides an essential layer of security by alerting managers to unauthorized vehicle movement. In an increasingly connected world, the Industrial Internet of Things (IIoT) is turning every vehicle into a source of rich, real-time data on everything from engine health to fuel efficiency. This wealth of information allows for proactive, data-driven decision-making. Furthermore, the expansion of automated safety features, such as crash response systems that automatically alert emergency services, adds a crucial layer of driver protection. A focus on operational efficiency and safety ensures that fleet management will continue to be a primary driver of the automotive telematics market.

- Driver Behavior Monitoring: Telematics sensors capture detailed data on driving habits, including aggressive acceleration and tailgating, enabling targeted driver training.

- Proactive Maintenance: Real-time diagnostic data transmitted by telematics systems helps fleet managers identify and resolve potential mechanical issues before they escalate.

- Enhanced Security: Geofencing technology provides instant alerts when a vehicle enters or exits a predefined zone, significantly improving asset security.

By Connectivity: Satellite Connectivity Ensures Ubiquitous Coverage and Market Dominance

With a remarkable 66.3% market share, satellite connectivity is the undisputed leader in the automotive telematics market. Its dominance is rooted in its unparalleled reliability and reach. Unlike cellular networks, satellite communication provides consistent, real-time data transmission from any location on the globe, a feature that is indispensable for industries operating in remote or underserved areas. This capability is vital for managing high-value assets in sectors like logistics, mining, and long-haul transportation, where cellular coverage can be sporadic or non-existent. Leading hardware manufacturers such as Galileosky specialize in satellite monitoring equipment, underscoring the demand for this robust connectivity solution. While the data plans can be more expensive than cellular alternatives, the assurance of uninterrupted connectivity is a premium many are willing to pay.

The market trend is moving towards hybrid systems that intelligently switch between cellular and satellite networks to provide the most cost-effective and reliable connection available. This ensures that critical functions, such as emergency response services that rely on telematics to transmit distress signals, remain operational at all times. The ongoing expansion of Low Earth Orbit (LEO) satellite constellations promises to further enhance satellite telematics by reducing latency and bringing down costs, making it an even more attractive option. For any organization with a global footprint, satellite connectivity offers a seamless, unified solution for vehicle tracking and management, cementing its leading position within the automotive telematics market.

- Global Asset Tracking: For international fleets, satellite connectivity is the only viable option for continuous, cross-border vehicle monitoring.

- Emergency Services: Satellite networks are crucial for eCall and other emergency systems, ensuring a distress signal can be sent from anywhere.

- Remote Operations: Industries such as mining and forestry rely on satellite telematics to monitor vehicles and ensure worker safety in areas without cellular infrastructure.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

By Vehicle Type: Passenger Cars Spearhead Widespread Adoption Of Automotive Telematics

Passenger cars are unequivocally dominating the automotive telematics market, accounting for a substantial 52.6% of the total market share. This leadership is propelled by a confluence of consumer demand and regulatory pressure. Today's car buyers expect a high level of in-car connectivity, including features like real-time navigation, infotainment systems, and seamless smartphone integration. Simultaneously, government mandates, such as the eCall system in Europe which automatically contacts emergency services after a serious accident, have made telematics control units (TCUs) a standard component in new vehicles. Consequently, the passenger car segment was responsible for over 55% of all TCU shipments in 2024. The sheer volume of passenger vehicles produced and sold globally makes it the largest segment by a significant margin.

The momentum in the passenger vehicle space shows no signs of slowing. The number of cars equipped with V2X technology is projected to reach 35.1 million by 2025, enabling a new era of connected safety features. The growing popularity of electric vehicles further fuels this trend, as telematics are essential for critical functions like monitoring battery health and locating charging stations. Leading automakers like Mercedes and BMW are embedding advanced telematics systems across their vehicle lineups, making these features increasingly mainstream. With over 80% of connected car users likely to recommend these services, the positive user experience is creating a powerful cycle of demand, ensuring the passenger vehicle segment continues to lead the automotive telematics market for the foreseeable future.

- Regulatory Push: Government safety mandates like automatic emergency calling have made telematics a required feature in new passenger cars in many regions.

- EV Dependency: Electric vehicles heavily rely on telematics for core functions such as remote battery monitoring and navigation to charging points.

- High Consumer Demand: A 2024 survey revealed that over 80% of drivers are pleased with their connected car services and would recommend them.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific's Unrivaled Scale and Manufacturing Dominating Global Connectivity

The Asia Pacific region cements its lead in the automotive telematics market through immense scale and domestic manufacturing power. China's industrial policy is a primary driver, with the government's MIIT aiming to have over 25 million intelligent connected vehicles on its roads by 2025. Local champions are achieving incredible numbers. Automaker Geely Holding Group reported having over 2.8 million subscribed vehicles by early 2024, while BYD expects its DiLink system to surpass 7 million installations by the start of 2025. State-owned SAIC Motor planned to sell over 3.5 million heavily connected new energy vehicles in 2024 alone. A single connected car in China now generates an average of 10 gigabytes of data daily.

Beyond China, regional automotive telematics market growth is robust. India's regulatory push has resulted in over 1.2 million commercial vehicles being fitted with AIS 140-compliant devices, with a target to add another 500,000 units in 2024. South Korea’s Hyundai Motor Group surpassed 10 million global subscribers for its Bluelink services in 2024. In Japan, V2X corridor projects aim to connect over 5,000 intersections by the end of 2025. Tech giants are also making deep inroads, with Huawei's HarmonyOS for automotive expected in over 500,000 cars in 2024. A confluence of government targets and corporate might defines the region's dominance.

North America's Sophisticated Commercial Fleets and Mature Service Adoption Lead

North America's position in the automotive telematics market is characterized by the deep and sophisticated adoption within its commercial sectors. Market leader Geotab surpassed 4 million global subscriptions in 2024, with over 2.5 million active in North America. Legacy automakers have built massive connected ecosystems. GM's OnStar service boasts a fleet of over 20 million connected vehicles, and Ford Pro reported having over 600,000 paid software subscriptions for its commercial clients in early 2024. The data generated is immense, with a single long-haul truck producing over 500 data points every minute. Samsara’s platform alone recorded over 500 million miles of EV data from regional customers in 2024.

Regulatory mandates and specialized applications further fuel demand in the region’s automotive telematics market. The Canadian ELD mandate has driven installations in over 200,000 commercial trucks. In the U.S., a push for safety will see 15,000 school buses equipped with telematics in the 2024-2025 school year, while federal funding is upgrading over 5,000 public transit vehicles. The future hardware pipeline is also strong. Qualcomm’s automotive design-win pipeline is valued at over $45 billion, and innovators like Tesla pushed over 20 significant OTA updates to their North American fleet in 2024, showcasing a mature and demanding service environment.

Europe's Regulation-Driven Market Creates Massive Demand for Embedded Safety Systems

Europe's leadership in the automotive telematics market is heavily forged by stringent, forward-looking regulations. The EU's General Safety Regulation II, effective from July 2024, mandates approximately 20 advanced driver-assistance systems in every new car. A measure is expected to trigger the installation of over 250 million new safety sensors and control units in vehicles sold in 2025 alone. The established pan-European eCall system received over 200,000 automated crash notifications in 2024, proving its life-saving value. Key suppliers are scaling up production to meet this compulsory demand. Bosch, for example, announced it will produce over 50 million telematics control units in 2024 for the global market.

The commercial sector is equally advanced. Truck manufacturer Scania had over 600,000 connected vehicles in Europe by early 2024, while Daimler Truck connects over 550,000 of its trucks. Fleet solution providers in the regional automotive telematics market operate at a massive scale, with Michelin's services monitoring over 1.3 million vehicles. Specialized markets are also thriving. The UK saw over 150,000 new usage-based insurance policies issued in the first half of 2024. Advanced V2X pilot programs, such as the one on Germany's A9 motorway, now involve test fleets of over 500 vehicles, paving the way for the next generation of connected infrastructure.

Capital Flows and Strategic Deals Reshaping the Global Automotive Telematics Market Landscape

- Samsara made its first acquisition by purchasing telematics provider Servo in March 2024 to enhance its logistics and field services offerings.

- Stellantis, through its Mobilisights division, acquired CloudMade's AI technologies and intellectual property in January 2024 to advance intelligent mobility features.

- Solera acquired Revo in June 2024, a provider of ADAS and vehicle calibration technology, to strengthen its automotive service capabilities.

- Powerfleet completed its acquisition of Movingdots from Swiss Re in February 2024 to expand in the automotive insurance telematics market.

- Bridgestone EMIA acquired a minority stake in German telematics specialist Syniotec in February 2024 to deepen its connected solutions for construction.

- Radius Payment Solutions acquired vehicle tracking and telematics firm Keystone in April 2024 to expand its North American automotive telematics market presence.

- AddSecure acquired Clifford Group in June 2024 to boost its Smart Mobility division with advanced vehicle security and connected car services.

- Hayden AI announced a $53 million Series B funding round in April 2024 to scale AI-powered mobile perception and traffic enforcement technology.

- Cyngn raised $3.9 million in a public offering in February 2024 to further develop and deploy its DriveMod AI platform for autonomous vehicles.

- Michelin acquired Italian telematics and fleet management company M-Live in February 2024 to enhance its connected services portfolio.

Top Players in Automotive Telematics Market

- Robert Bosch GmbH

- Continental AG

- LG Electronics

- Verizon

- Harman International

- Delphi Automotive Plc

- Visteon Corporation

- Magneti Marelli S.P.A.

- Tomtom International BV

- Qualcomm Technologies Inc.

- Intel Corporation

- Trimble Inc

- AT&T

- Octo Telematics

- Airbiquity Inc.

- Masternaut Limited

- The Descartes Systems Group Inc.

- Box Telematics

- Act Soft

- Other Prominent Players

Market Segmentation Overview:

By Component segment:

- Hardware

- Self-contained Telematics Units (TCU)

- GPS Devices

- Software Platform

- Services

- Consulting

- Implementation

- Maintenance

- Telematics as a Service

By Application:

- Automatic Crash Notification

- Billing Services

- Driver Behavior

- Emergency Calling

- Insurance Risk Assessment

- Navigation

- On-Road Assistance

- Remote Diagnostics

- Vehicle Tracking/Recovery (Fleet Management)

- Others

By Vehicle Type:

- Light Commercial Vehicles

- Passenger Car

- Electric Vehicles

- ICE Vehicles

- Heavy Vehicles

- Two-Wheeler

- Others

By Connectivity:

- Satellite

- Cellular

By Sales Channel:

- Aftermarket

- OEMs

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Singapore

- Malaysia

- Indonesia

- Vietnam

- Thailand

- Myanmar

- Rest of ASEAN

- Rest of APAC

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 70.8 Bn |

| Expected Revenue in 2033 | US$ 349.2 Bn |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Bn) |

| CAGR | 19.4% |

| Segments covered | By Component, By Application, By Vehicle Type, By Connectivity, By Sales Channel, By Region |

| Key Companies | Robert Bosch GmbH, Continental AG, LG Electronics, Verizon, Harman International, Delphi Automotive Plc, Visteon Corporation, Magneti Marelli S.P.A., Tomtom International BV, Qualcomm Technologies Inc., Intel Corporation, Trimble Inc, AT&T , Octo Telematics, Airbiquity Inc., Masternaut Limited, The Descartes Systems Group Inc., Box Telematics, Act Soft, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)