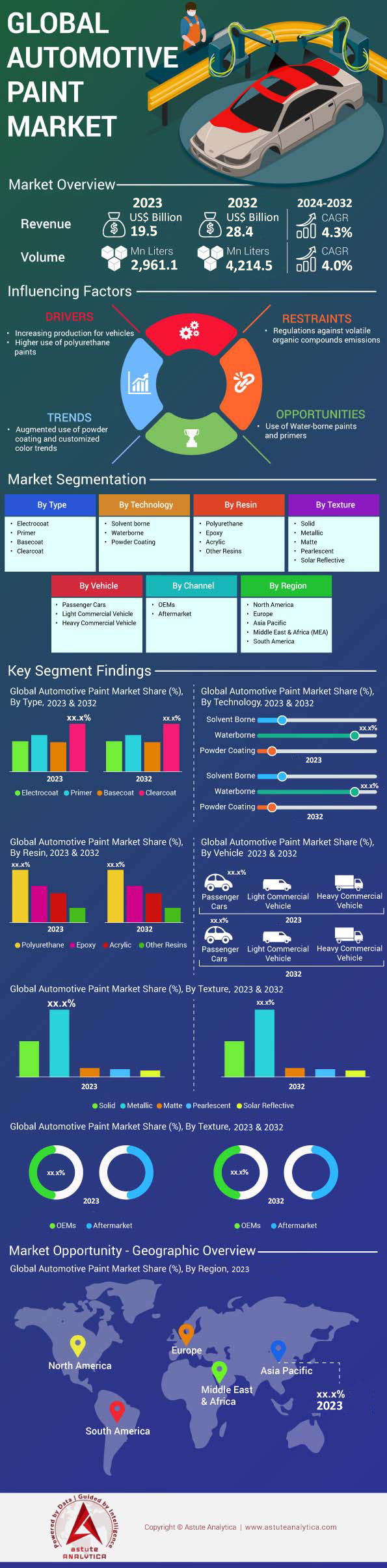

Global Automotive Paint Market: By Type (Electrocoat, Primer, Basecoat, Clearcoat); Technology (Solvent borne, Waterborne, Powder Coating); Resin (Polyurethane, Epoxy, Acrylic, Other Resins); Texture (Solid, Metallic, Matte, Pearlescent, Solar reflective); Vehicle (Passenger Cars, Light Commercial Vehicle, Heavy Commercial Vehicle); Channel (OEMs, Aftermarket)—Market Size, Industry Dynamics, And Opportunity Forecast until 2032

- Last Updated: 29-Jul-2024 | | Report ID: AA1021099

Market Scenario

Global automotive paint market is estimated to attain a valuation of US$ 28.4 billion by 2032, up from 19.5 billion in 2023, at a CAGR of 4.3% from 2024-2032.

The automotive paint market continues to grow due to several factors, including increasing production of vehicles and advancements in paint technology. The usage of polyurethane paints has been increasing due to their superior performance properties and ability to be used in lower VOC formulations. The American Coating Association reports that in 2018, urethane resins accounted for approximately 21% of global demand for resins in coatings. This trend is expected to continue as more stringent regulations are put in place to limit VOC emissions in automotive painting.

Waterborne paints and primers are also becoming more popular due to their ability to reduce VOC emissions and workers' exposure to dangerous air pollutants. This shift toward environmentally friendly coatings is expected to continue as more companies adopt sustainable business practices. Powder coating is another technology that is gaining popularity in the automotive paint market due to its ability to emit no VOC emissions and have very low toxic aspects. Additionally, the operating costs for a powder line are significantly lower than for liquid lines, making it an attractive option for manufacturers.

In the North America region, powder coating has emerged as the fastest-growing finishing technology due to its efficiency and lower costs. The demand for powder coatings is expected to continue to grow as more companies adopt this technology. Overall, the automotive paint market is expected to continue to grow due to the increasing demand for environmentally friendly coatings, advancements in paint technology, and the growing production of vehicles.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver:

Growing Demand for Cars

The automotive industry has seen a significant increase in demand for cars in recent years. With the rise in population and the expansion of the middle class in developing countries, more people are buying cars, which is driving the growth of the automotive paint market. Additionally, increasing disposable incomes and the availability of financing options have made it easier for consumers to purchase vehicles. As a result, the demand for automotive paint has increased, as it is essential for protecting the exterior of the car and ensuring its longevity.

Rapid Technological Advancements

The automotive industry has also seen significant technological advancements in recent years, which have driven the growth of the automotive paint market. Advancements in paint formulations have led to the development of high-performance coatings that offer superior protection against corrosion, UV radiation, and abrasion. Additionally, the use of advanced paint application technologies, such as electrostatic spray and robotic paint systems, has improved the efficiency and quality of the painting process, leading to increased demand for automotive paint.

Restraint:

Stringent Environmental Regulations

One of the major restraints that the automotive paint market faces is the increasing pressure from environmental regulations. Governments across the world are imposing strict regulations on the use of certain chemicals in paint formulations, such as volatile organic compounds (VOCs), which can be harmful to human health and the environment. As a result, paint manufacturers are forced to invest in research and development to create eco-friendly paint formulations, which can increase the cost of production and affect the profit margins of manufacturers.

Fluctuating Costs of Raw Materials

The automotive paint market also faces the challenge of fluctuating costs of raw materials. The prices of key raw materials used in paint formulations, such as resins, pigments, and solvents, can be volatile due to changes in supply and demand and geopolitical factors. As a result, manufacturers may face difficulties in managing their costs and may be forced to pass on the increased costs to consumers, which can lead to a decrease in demand for their products.

Segmental Analysis

By Type:

Clearcoat, with a market share of 37%, is the most popular type of automotive paint. It is preferred for its ability to provide a shiny and deep appearance to the car while also protecting it from the sun and UV rays. Clearcoat not only enhances the visual appeal of the vehicle but also offers robust protection against environmental factors such as acid rain, bird droppings, and road debris, which can cause significant damage to a car's surface. This type of paint acts as a barrier that safeguards the underlying layers, ensuring longevity and maintaining the vehicle's resale value. According to industry reports, nearly 95% of new cars are finished with a clearcoat layer, underscoring its importance in automotive aesthetics and protection.

Other types of automotive paints include basecoat, primer, and electrocoat. The basecoat, which provides the vehicle's actual color, accounts for approximately 30% of the automotive paint market. Primer, essential for ensuring paint adhesion and corrosion resistance, holds about 15% of the market share. The electrocoat segment is expected to have the highest annual growth rate of close to 5% during the forecast period from 2023 to 2031, driven by its superior corrosion protection and uniform application. Electrocoat is particularly crucial in the automotive industry's shift towards sustainable practices, as it supports the reduction of waste and improves the efficiency of the painting process. Additionally, advanced formulations and technological innovations are expected to further boost the demand for electrocoat, making it a key area of interest for automotive manufacturers.

The demand for specialized paints, such as matte and satin finishes, is also on the rise. These finishes, though representing a smaller segment, are becoming increasingly popular among car enthusiasts and luxury vehicle owners for their unique, non-reflective look. Additionally, the automotive paint market is seeing a surge in demand for custom and specialty colors, driven by the growing trend of vehicle personalization. This trend is supported by advancements in paint technology that allow for a broader range of colors and effects, including chameleon paints that change color with the viewing angle.

By Technology:

Waterborne technology holds the highest share in the automotive paint market, exceeding 67% of the global market. It is preferred because it is eco-friendly and emits fewer volatile organic compounds (VOCs) than solvent-borne technologies. Waterborne paints are gaining traction due to stringent environmental regulations and increasing consumer awareness about sustainability. These paints not only help in reducing the carbon footprint but also provide excellent color retention and durability. Other types of technologies used in automotive paint include solvent-borne, powder, and UV-cured. Solvent-borne paints, while still popular in certain regions, are gradually being phased out due to their higher VOC emissions, which account for about 40% of the total emissions in the automotive sector. Powder coatings, known for their high durability and eco-friendliness, hold around 10% of the market share and are expected to grow at a CAGR of 5.2% from 2023 to 2031. UV-cured coatings, though currently representing a smaller segment, are emerging due to their rapid curing times and minimal environmental impact. With advancements in technology and increasing investments in R&D, the UV-cured coatings market is projected to grow at an impressive CAGR of 7% during the forecast period.

The integration of smart coatings and nanotechnology in automotive paints is a notable trend. Smart coatings can respond to environmental changes, such as temperature fluctuations, and provide self-healing properties, making them highly desirable for automotive applications. Nanotechnology, on the other hand, enhances the performance of paints by improving their mechanical properties, UV resistance, and overall durability. The global market for nanotechnology-enhanced automotive paints is projected to grow significantly, driven by ongoing research and development efforts and the increasing demand for high-performance coatings. Additionally, the rise of electric and autonomous vehicles, which require advanced and specialized coatings, is expected to further propel the adoption of innovative paint technologies.

By Resin Type:

In terms of resin type, polyurethane held close to 44% of the global market share, followed by epoxy, acrylic, and others. Polyurethane is preferred because it provides a durable and glossy finish to the car, making it resistant to scratches, chemicals, and weathering. This type of resin is also known for its flexibility and ease of application, which makes it a favorite among automotive manufacturers. In terms of texture, metallic automotive paint held the highest market share in 2020, with approximately 55% of the market, followed by solid (30%) and pearlescent (15%). Metallic paints are favored for their shimmering appearance and ability to highlight the contours and lines of a vehicle. These paints contain tiny metallic particles that reflect light, creating a sparkling effect that is highly sought after by car enthusiasts. Pearlescent paints, though more expensive, are gaining popularity for their unique, iridescent finish that changes color depending on the angle of the light.

Epoxy resins, known for their excellent adhesion and chemical resistance, hold a significant share in the automotive paint market. These resins are commonly used in primers and undercoats to provide a strong foundation for subsequent paint layers. The demand for epoxy resins is expected to grow steadily, driven by their application in both traditional and electric vehicles. Acrylic resins, on the other hand, are valued for their fast-drying properties and UV resistance, making them suitable for topcoats and clearcoats. The acrylic segment is projected to witness moderate growth, supported by advancements in resin technology that enhance their performance characteristics. The ongoing development of hybrid resins, which combine the benefits of multiple resin types, is also gaining traction, offering new opportunities for innovation and differentiation in the automotive paint market.

By Vehicle Type:

Passenger cars hold the highest share in the automotive paint market, exceeding 72% of the global market. This is due to the high demand for passenger cars globally, driven by rising urbanization, increasing disposable incomes, and the growing trend of personal vehicle ownership. In 2023, approximately 75 million passenger cars were sold worldwide, reflecting a robust market for automotive paints. The sales of passenger cars are projected to grow at a CAGR of 3.5% from 2023 to 2032, further bolstering the demand for high-quality automotive paints.

Most of the sales are attributed to OEMs distribution channels, which account for around 50% of the market share. However, aftermarket demand also competes closely with OEM channels, adding up to 50% of the global market share in the same year. Aftermarket sales are driven by the need for vehicle repairs, customization, and maintenance, with approximately 70% of car owners opting for aftermarket services within five years of purchase. Other types of vehicles that use automotive paint include commercial vehicles (20% market share) and two-wheelers (10% market share). The commercial vehicle segment growth is driven by the expansion of logistics and transportation industries. Meanwhile, the two-wheeler segment, particularly in emerging markets, is anticipated to witness a growth rate of 5.2% during the forecast period, supported by increased mobility needs and economic development.

Electric vehicles (EVs) represent a rapidly growing segment in the automotive paint market. With global EV sales reaching over 14.2 million units in 2023, the demand for specialized paints that cater to the unique requirements of EVs is on the rise. These vehicles often feature innovative designs and materials that require advanced coating solutions for optimal performance and aesthetics. Additionally, the increasing popularity of luxury and high-performance vehicles is driving the demand for premium automotive paints that offer superior finishes and durability. The market for automotive paints is also influenced by regional trends, with Asia-Pacific being the largest market due to its booming automotive industry and high vehicle production rates. North America and Europe, with their stringent environmental regulations and focus on sustainability, are also significant markets for advanced automotive paint technologies.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The global automotive paint market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Among these regions, Asia Pacific holds the highest share in revenue terms, accounting for close to 58% of the global market. The region is projected to maintain its dominance in the market due to several factors. The region has experienced a fast pace of economic activity in recent years, which has led to an increase in disposable incomes and the expansion of the middle class. This has resulted in a surge in demand for vehicles, driving the growth of the automotive paint market. Moreover, in the last few years, the region has seen significant technological improvements in the automotive industry. Many countries in the region, such as China and Japan, have made significant investments in research and development, leading to the development of advanced paint formulations and application technologies. This has resulted in the production of high-quality and durable automotive paint, which has further fueled the demand for automotive paint in the region.

The Asia Pacific region is home to several large automotive manufacturers, such as Toyota, Hyundai, and Honda. These manufacturers have a significant demand for automotive paint, which has led to the growth of the market in the region.

Top Players in Global Automotive Paint Market

- Axalta Coating Systems, LLC

- BASF SE

- Clariant AG

- DOW Chemical

- DuPont Coatings & Color Technologies Group

- Kansai Paint Co., Ltd.

- KCC

- Nippon Paint Holdings Co., Ltd.

- PPG Industries

- Sherwin-Williams Company

- Solvay

- The Sherwin-Williams

- Valspar Corporation

- Other Prominent Players

Market Segmentation Overview

By Type

- Electrocoat

- Primer

- Basecoat

- Clearcoat

By Technology

- Solvent-borne

- Waterborne

- Powder Coating

By Resin

- Polyurethane

- Epoxy

- Acrylic

- Other Resins

By Texture

- Solid

- Metallic

- Matte

- Pearlescent

- Solar reflective

By Vehicle

- Passenger Cars

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Channel

- OEMs

- Aftermarket

By Region

- North America

- US **

- Canada

- Mexico

- South America

- Argentina

- Brazil

- Rest of South America

- Europe

- UK **

- Germany **

- Italy

- France

- Spain

- Russia

- Poland

- Rest of Europe

- Asia Pacific

- China **

- Japan **

- India **

- ASEAN

- South Korea **

- Rest of Asia Pacific

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

** In-depth Segment level market analysis included

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 19.5 Bn |

| Expected Revenue in 2032 | US$ 28.4 Bn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 4.3% |

| Segments covered | By Type, By Technology, By Resin, By Texture, By Vehicle, By Channel, By Region |

| Key Companies | Axalta Coating Systems, LLC, BASF SE, Clariant AG, DOW Chemical, DuPont Coatings & Color Technologies Group, Kansai Paint Co., Ltd., KCC, Nippon Paint Holdings Co., Ltd., PPG Industries, Sherwin-Williams Company, Solvay, The Sherwin-Williams, Valspar Corporation, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)