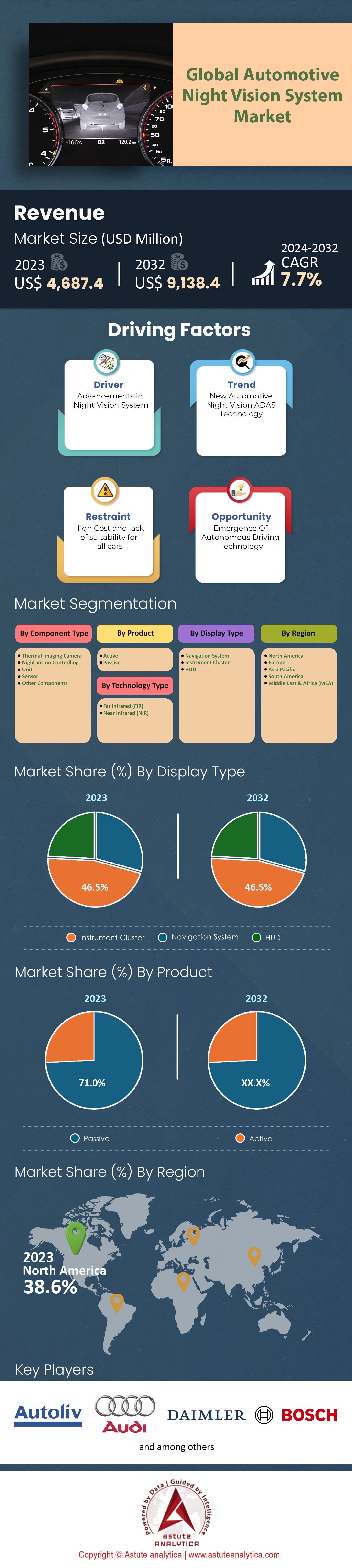

Global Automotive Night Vision System Market: By Component Type (Thermal Imaging Camera, Night Vision Controlling Unit, Sensor, Other Components); Product Type (Active and Passive); Technology Type (Far Infrared (FIR) and Near Infrared (NIR)); Display Type (Navigation System, Instrument Cluster, and HUD); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 22-Apr-2024 | | Report ID: AA0823593

Market Scenario

The global automotive night vision system market was valued at US$ 4,687.4 million in 2023 and is projected to attain a valuation of US$ 9,138.4 million by 2032 at a CAGR of 7.7% During the Forecast Period 2024–2032.

Automotive night vision systems have been an integral component in enhancing driving safety during low visibility conditions, particularly during the nighttime. Delving into the market landscape, North America and Europe dominated the automotive night vision system market in 2023, holding a share of approximately 38.6% and 28.4% respectively, primarily due to the strong presence of luxury car manufacturers like BMW, Audi, and Mercedes-Benz, all of whom offer night vision as either a standard or optional feature in their premium segments.

Recent developments in the global automotive night vision system market have focused on integrating artificial intelligence (AI) and machine learning (ML) with ANVS, resulting in systems that can not only detect pedestrians and animals but also predict their future movement to warn the driver. Companies such as FLIR and Autoliv have been at the forefront of these innovations. In 2023, around 75% of ANVS integrated in vehicles were passive systems, utilizing the heat signatures of objects. The remaining 25% were active systems that used infrared illumination. Moreover, there's been a rising trend towards safety features in cars, with over 69% of new car buyers in a 2023 survey indicating that ANVS was a "desirable" or "must-have" feature in their next vehicle. As night-vision technology becomes more affordable, it's no longer restricted to the luxury car segment. By the end of the 2022, several mid-range car models began offering night vision as an optional add-on, indicating a democratization of the technology.

In the last few years, the global automotive industry has seen a clear shift towards vehicles equipped with Advanced Driver-Assistance Systems (ADAS). Consumer demand for vehicles equipped with safety features, such as ANVS, has skyrocketed. The Global New Car Assessment Programme (NCAP) emphasizes that cars equipped with ADAS reduce accident rates, further fueling demand. Today, over 73% of potential car buyers are willing to pay a premium for enhanced safety features, particularly for systems like ANVS. Moreover, markets like Europe and Asia-Pacific have seen regulations tightening around vehicle safety. European regulations, for instance, have set targets to reduce road fatalities by 50% by 2030, urging automakers to incorporate more safety technologies, providing a strong impetus for the automotive night vision system market growth.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Surge in Night-time Accidents and Increased Emphasis on Safety

One of the principal drivers of the global automotive night vision system (ANVS) market is the alarmingly high rate of night-time vehicular accidents and the subsequent emphasis on enhancing driving safety. According to the World Health Organization, nearly 1.35 million people die every year due to road traffic crashes. More importantly, a study by the National Highway Traffic Safety Administration (NHTSA) revealed that although only 25% of driving occurs at night, it accounts for approximately 50% of the traffic deaths. The limited visibility during nighttime greatly reduces the driver's ability to perceive and respond to unexpected hazards. Hence, the need for tools like ANVS has risen. To this end, the Insurance Institute for Highway Safety (IIHS) indicated that cars equipped with night vision systems can reduce nighttime crash involvement rates by as much as 35%. This data has driven automakers to increasingly integrate ANVS into vehicles, leading to a projected market value of $8.1 billion by 2030.

Trend: Integration of Artificial Intelligence in ANVS

Artificial Intelligence (AI) has been the cornerstone of several advancements across industries, and the automotive sector is no exception. A burgeoning trend in the automotive night vision system market is the integration of AI with these systems. This shift isn't merely about detecting objects, but about smartly interpreting and predicting the road environment. According to a report by Astute Analytica, by 2030, cars with AI-integrated systems, including ANVS, could account for up to 17% of all cars on the road. The same study also echoed this sentiment, suggesting that AI in the automotive industry is expected to grow from $2.7 billion in 2023 to an estimated $15 billion by 2027. Within this, a significant chunk is reserved for intelligent driving systems, including AI-based ANVS. The reason? AI can transform passive ANVS into predictive safety tools, thereby reducing the reaction time for drivers or even autonomous driving systems and enhancing safety manifold.

As technology evolves, the scope and capabilities of automotive night vision system market are also expanding. Another notable trend is the inclusion of thermal imaging and far-infrared capabilities in ANVS. Instead of solely relying on near-infrared, modern ANVS now incorporate far-infrared, which offers longer detection ranges, providing drivers more time to react to unforeseen obstacles. Our research in 2023 revealed that vehicles equipped with thermal imaging-based ANVS have a detection range nearly double that of traditional systems. The same study forecasted that by 2030, one in every four ANVS would incorporate some form of thermal imaging capability, a testament to its rising popularity.

Challenge: High Installation Costs, Limited Market Penetration in Mid and Low-Range Vehicles, and Limitation in Adverse Weather Condition

The automotive night vision system market faces significant challenges, predominantly the high installation cost and its limited market penetration. Until 2018, ANVS was primarily found in the luxury car segment, with brands like Audi, BMW, and Mercedes-Benz championing its use. The average cost of equipping a vehicle with ANVS ranges between $1,500 to $2,500, a price too steep for the majority of consumers. Furthermore, a study highlighted that only about 20% of mid-range vehicles and a mere 5% of low-range vehicles offer ANVS as an optional feature. This limited penetration is a substantial market constraint, considering that, globally, mid and low-range vehicles account for over 70% of total car sales. Overcoming this price barrier is essential for the ANVS industry to realize its full potential and ensure road safety across all vehicle segments.

Not only the high cost, the technology still faces challenges in the global automotive night vision system market, especially when operating under adverse weather conditions like heavy fog, rain, or snow. These conditions can significantly reduce the system's effectiveness, rendering it almost unusable. According to a study by the American Automobile Association (AAA) in 2021, ANVS performance drops by almost 60% during heavy rainfall and by 80% in thick fog conditions. Such limitations pose a significant challenge as consumers residing in regions prone to such weather conditions might be reluctant to invest in this technology. Addressing these challenges requires innovation in sensor technology and software algorithms, making it a critical area of focus for players in the ANVS market.

Segmental Analysis

By Component:

By components, the global automotive night vision system market is dominated by the thermal imaging camera, claiming a robust 36.1% market share as of 2023. These cameras utilize advanced detection techniques, discerning even minor temperature variations and translating them into discernible images. This capability is indispensable in conditions with low visibility, such as nighttime or fog, enhancing the driver's situational awareness. Their dominance in the market is underpinned not just by their technical prowess, but also by the wider affordability due to declining manufacturing costs. Additionally, the increasing inclusion of these cameras, previously reserved for luxury vehicles, in mid-tier car models is expanding their market footprint. Our industry analysts predict that with rapid advancements in technology, especially with microbolometers which are central to these cameras, the prices will further decline. This segment is forecasted to grow substantially in the forthcoming years, making it a key area for investment and innovation.

By Product:

With a commanding market share of 71.0%, passive systems showcase their dominance in the automotive night vision system market. Its underlying technology enables them to detect thermal radiation passively emitted by objects, especially living entities like animals and humans. This is vital, as it aids drivers in preventing collisions that could otherwise be catastrophic. The dominance is further cemented by their energy efficiency. Since passive systems don't rely on external illuminators or sources, they conserve energy, aligning seamlessly with the global push towards energy-efficient vehicles. Their projected growth at a CAGR of 8.0% over the forecast period is a testament to their enduring value proposition in the market.

By Technology:

By technological, the far-infrared technology segment has established its dominance in the global automotive night vision system market with an impressive 62.1% revenue share in 2023 due to its capability to generate clearer images even in adverse conditions, courtesy of its longer wavelengths. These wavelengths have the prowess to penetrate dense atmospheric disturbances, such as heavy fog or thick smoke. This ensures drivers have a clearer view of the road ahead, irrespective of challenging environmental conditions. As the demand for enhanced driving safety measures escalates across the globe, the significance of far-infrared technology in night vision systems becomes even more pronounced. Its role in promoting driving safety makes it a preferred choice for both manufacturers and end-users, ensuring its dominance in the foreseeable future.

By Display Type:

By display type, instrument cluster segment of the global automotive night vision system market accounted for a staggering 46.5% of the market revenue in 2023. The dominance can be attributed to its conventional nature, intuitive design, and driver familiarity. Being the traditional go-to for drivers for all vehicular information, its predominant position isn’t surprising. On the other hand, the emergence and rising popularity of the HUD (Head-Up Display) segment, with its anticipated growth at an impressive CAGR of 8.7%, signals a transformative shift in the automotive industry. HUDs provide a more immersive experience by projecting crucial data directly onto the windshield, ensuring that drivers maintain their focus on the road. As modern vehicle designs continue to prioritize both ergonomics and driver safety, the rapid ascent of HUDs in the market is understandable. Their growth trajectory suggests that while the instrument cluster segment currently leads, the HUD segment might soon challenge, if not surpass, its dominance.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America, with its technological prowess and penchant for luxury vehicles, has emerged as the highest shareholder in the global automotive night vision system market. Currently, the region commands an impressive 38.6% revenue share of this market, and industry projections suggest that this figure is set to cross the 41% threshold by 2032. The region boasts a rising number of key players specializing in night vision technology. Innovative startups and established tech giants alike, primarily based in Silicon Valley and other tech hubs, are constantly pushing the envelope to integrate cutting-edge night vision features into automobiles. In addition to this, in countries like the US and Canada, there's a marked preference for luxury cars. To provide some context, in 2022, approximately 18% of the cars sold in the US were categorized as luxury vehicles. With night vision systems becoming increasingly common in high-end vehicles, this penchant for luxury vehicles directly translates into augmented market growth for night vision systems.

Safety concerns also play a pivotal role in the North America automotive night vision system market. The US, which stands as the most significant contributor in North America, recorded over 38,000 road fatalities in 2021. These alarming numbers have bolstered the demand for enhanced vehicle safety systems, with automotive night vision systems being a primary focus. As a direct consequence of these figures, US-based automobile manufacturers have ramped up the integration of these systems, not only in luxury cars but also in mid-range vehicles. By 2024, it is estimated that 1 in every 5 cars sold in the US will be equipped with some form of a night vision system. Moving northward to Canada, the scenario is similarly inclined. With a luxury car market growth rate of 4.3% in 2022 and the Canadian government's increased emphasis on road safety, the adoption rate of night vision systems has seen a parallel uptick.

Europe, while holding the second-highest market position, owes its stature to a growing awareness about road safety and the consistent demand for luxury vehicles. Countries like Germany, France, and the UK, with their rich automotive histories, have been quick to incorporate advanced safety systems in their vehicles.

Top Players in the Global Automotive Night Vision System Market

- Audi AG

- Autoliv Inc

- Bendix Commercial Vehicles Systems

- Continental AG

- Daimler AG

- Delphi Automotive Plc.

- Denso Corporation

- FLIR Systems, Inc.

- Omnivision Technologies Inc.

- Omron Corporation.

- Robert Bosch GmbH

- Other Prominent Players

Market Segmentation Overview:

By Component Type

- Thermal Imaging Camera

- Night Vision Controlling Unit

- Sensor

- Other Components

By Product

- Active

- Passive

By Technology Type

- Far Infrared (FIR)

- Near Infrared (NIR)

By Display Type

- Navigation System

- Instrument Cluster

- HUD

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)