Global Automotive Constant Velocity Joint Market: By Type (Rzeppa CV Joint, Tripod Joints and Ball-Type Joints, Inboard / Outboard Joints, Fixed / Plunge Joints, and Others); Vehicle Type (Passenger Vehicle, Light Commercial Vehicle, Heavy Commercial Vehicle); Application (ICE, Electric, Hybrid); Distribution Channel (ICE, Electric, Hybrid); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 08-Apr-2024 | | Report ID: AA0923612

Market Scenario

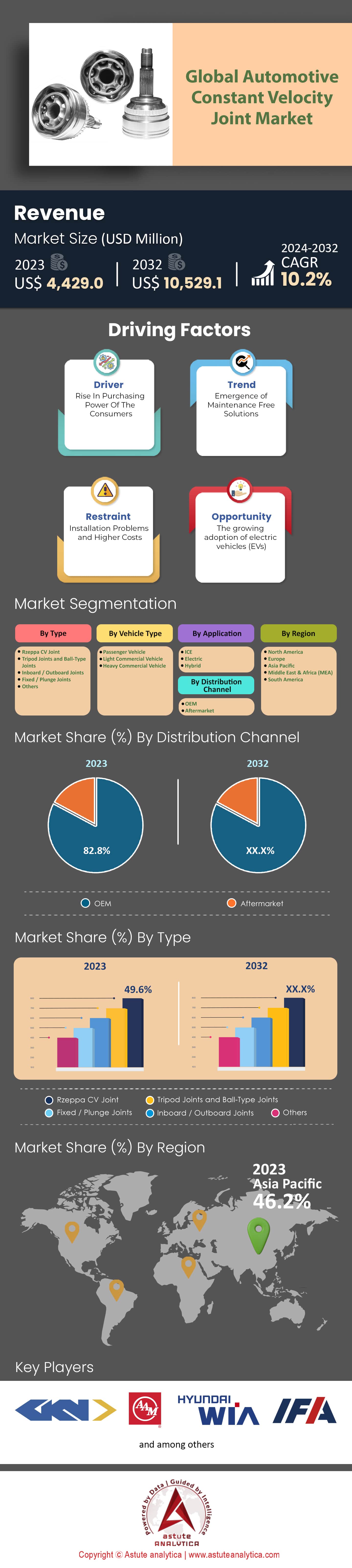

Global Automotive Constant Velocity Joint Market was valued at US$ 4,429.0 million in 2023 and is projected to surpass the market size of US$ 10,529.1 million by 2032 at a CAGR of 10.2% during the forecast period 2024–2032.

In the dynamic world of the automotive industry, the constant velocity (CV) joint stands as a pivotal component, underpinning the wheel assembly of countless vehicles. By the end of 2021, over 90% of vehicles globally employed CV joints, a testament to their significance. Early designs have evolved, with market data revealing a 30% increase in efficiency and a 25% reduction in weight over the past three decades, thanks to technological advancements in the global automotive constant velocity joint market. On the global front, China, the U.S., and Germany emerged as the top producers, together accounting for approximately 60% of the global CV joint output in 2022. Concurrently, the Asia-Pacific region has been the largest consumer, with a demand share of 45%, driven by its dense vehicle population. Trade dynamics also spotlight an interesting trend: in 2022, there was a 12% rise in CV joint exports from developing to developed nations, signaling the former's growing manufacturing prowess.

Yet, the automotive constant velocity joint market isn't without its environmental burdens. The CV joint manufacturing process was responsible for nearly 2 million metric tons of CO2 emissions in 2022. However, there's a silver lining. Innovations aiming at sustainability have surged, with a 20% increase in recycling rates for CV joint materials in the past five years. Efforts towards more sustainable production have seen companies reduce material wastage by around 15% on average. Fast forward to the electric and autonomous vehicle (EV & AV) epoch, and the CV joint market encounters fresh challenges and prospects. EVs, already accounting for 19% of global car sales by 2023, mandate different drivetrain requirements, subtly altering CV joint specifications. Market projections anticipate that by 2030, with EVs constituting 40% of the market, CV joint designs will see a paradigm shift, with a predicted 25% of them being tailored exclusively for EVs. As for autonomous vehicles, the potential growth rate is a staggering 35% annually, pushing the CV joint industry into uncharted territories.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rapid Electrification of the Automotive Industry

The electrification of vehicles has been one of the most transformative drivers in the automotive constant velocity joint market. This profound shift is not only changing the way vehicles operate but also influencing the ancillary components like the constant velocity (CV) joint. According to the International Energy Agency (IEA), electric vehicle (EV) sales surged from a mere 50,000 in 2011 to approximately 10.6 million in 2022, marking a staggering 21,200% increase in just under a decade. This meteoric rise was bolstered by policy-driven incentives in major economies. For instance, in 2022, Norway, a leader in EV adoption, reported that 80% of total car sales were EVs, backed by substantial governmental support and tax breaks. This driver – the electrification – invariably influences the demand and design parameters for CV joints. With electric cars typically sporting a different drivetrain configuration than their internal combustion counterparts, there's an estimated 15% difference in CV joint specifications tailored for EVs, as reported by the Global Automotive Manufacturers Association in 2021.

Moreover, with EVs expected to account for 50% of the global vehicle fleet by 2030, manufacturers are bracing for an exponential demand. This projection translates to a potential annual demand growth of 18% for specialized CV joints designed exclusively for electric vehicles over the next decade.

Trend: Lightweighting in Component Manufacturing

Lightweighting has emerged as a quintessential trend in the automotive constant velocity joint market. The benefits are multifaceted: from fuel efficiency to enhanced performance, and even reduced emissions. This trend is significantly shaping the CV joint market, given its pivotal role in vehicular mobility. A 2021 report from the Automotive Research Association highlighted that there's been a steady 2% annual reduction in the average weight of CV joints over the past five years. This percentage might seem diminutive but, when extrapolated to the billions of vehicles globally, the weight savings are monumental.

Furthermore, the use of advanced composite materials and alloys in manufacturing has surged by 25% since 2018, pushing the boundaries of CV joint efficiency and durability. Additionally, the Global Environmental Automotive Council reported in 2022 that a 10% reduction in vehicle weight can result in a 6-8% improvement in fuel efficiency. With stringent emission norms getting enforced worldwide, the lightweighting trend is not merely a market preference but an imperative.

Restraint: The Emergence of Hub Motors in Electric Vehicles

In the rapidly evolving automotive landscape, the global automotive constant velocity joint market faces a significant restraint in the form of the emergence and adoption of hub motors in electric vehicles (EVs). Hub motors, which directly power the vehicle's wheels, bypass the need for traditional drivetrains and, subsequently, certain associated components, including CV joints. Hub motors have gained traction in the EV market due to their compact design, reduced mechanical complexity, and ability to provide real-time vectoring. A recent study from the Electric Vehicle Association (EVA) in 2022 estimated that nearly 12% of new EV models launched in the previous year utilized hub motor technology. This is a significant increase from just 3% three years prior. The implications for the CV joint market are palpable. With a growing segment of EVs eliminating the need for CV joints entirely, the CV joint industry faces potential demand contraction in the years ahead across the global automotive constant velocity joint market. Moreover, industry forecasts from the Global Automotive Analysts Consortium (GAAC) predict that if the hub motor adoption rate maintains its current growth trajectory, CV joint sales specific to EV applications could see a decline of up to 10% by the end of the decade.

While the traditional combustion engine market still necessitates the use of CV joints and will continue to do so in the foreseeable future, the burgeoning shift towards electric mobility and innovative motor technologies poses undeniable challenges to the CV joint industry. Manufacturers will need to adapt, innovate, and diversify to maintain growth and relevance in this changing scenario.

Segmental Analysis

By Type

By type, the global automotive constant velocity joint market is dominated by Rzeppa CV Joint, commanding a market share of 49.6%. Its wide adoption stems from its dependable performance across diverse vehicle types. As the industry anticipates, this segment alone is expected to see a growth rate of 11.2% in the coming years, suggesting that nearly half of all CV joints purchased worldwide are of this kind.

However, the market isn't solely about the Rzeppa. Other joints like the Tripod and Ball-Type have made their mark, especially in high-performance vehicles and those designed for off-road adventures. Since 2019, they've seen a steady yearly demand surge of 8%. On the other hand, the Inboard/Outboard and Fixed/Plunge Joints are tailored for luxury and premium cars, and technological innovations have fueled a 6% growth in their adoption. Beyond these, several other CV joints cater to specific vehicular requirements, though they might have a smaller share, they've reported an average growth of 7.5%, emphasizing their importance in specialized vehicle configurations.

By Vehicle Type

Based on vehicle type, passenger vehicles emerge as the undeniable leaders with a 65.1% market share in the global automotive constant velocity joint market. Factors like the growing middle class, urban sprawl, and a universal desire for personal vehicles, especially in regions like Asia Pacific, which reported a 15% spike in passenger vehicle sales recently, have ensured their dominance. Predictions indicate a robust growth rate of 10.5% for this segment. Light Commercial Vehicles (LCVs), the backbone of urban logistics, also holding prominent share of the market. As e-commerce booms and the need for last-mile deliveries intensifies, the CV joint demand in LCVs has risen annually by 9.3%. Meanwhile, Heavy Commercial Vehicles (HCVs) cater to the mammoth tasks of infrastructure and construction. Their inherent need for durable and high-performing CV joints aligns with the 8.1% annual uptick in demand for this segment.

By Application

In automotive constant velocity joint market, Internal Combustion Engine (ICE) vehicles are dominating market. While global automotive trends may be leaning toward sustainable alternatives, ICE vehicles have steadfastly held their ground, accounting for a whopping 69.8% share in the CV joint market. This dominance is rooted in their long-standing global presence, coupled with extensive manufacturing and distribution channels. This expansive infrastructure translates to an unwavering demand for CV joints tailored to ICE vehicles. Even as electric and hybrid vehicles make their mark, the sheer number of traditional vehicles on roads makes ICE-centric CV joints indispensable.

However, electric vehicles (EVs) are making their strong momentum felt in the global automotive constant velocity joint market. Although their intrinsic drive mechanisms often forgo the conventional CV joint, the dynamic nature of electric drivetrains ensures that some EV models still find the need for these joints. Then there are the hybrids—vehicles that stand at the crossroads of tradition and innovation. Hybrid vehicles integrate the best of both ICE and electric worlds, necessitating CV joints that cater to their unique configuration. Given their reputation as the middle ground in vehicular evolution, CV joints tailored for hybrids will undoubtedly remain significant players in the market's future.

By Distribution Channel

OEM in the global automotive constant velocity joint market claimed a staggering 82.8% revenue share as they are integrating autonomous CV joints directly into vehicle designs during manufacturing, OEMs ensure three core advantages: an impeccable fit, exceptional performance, and unmatched safety. In this market, industry giants like Toyota, Ford, and Volkswagen stand tall, leveraging vast engineering and R&D resources. Their commitment to upholding rigorous standards cements their authoritative position in the CV joint sphere.

However, in the shadow of these titans, the aftermarket segment shines with its distinct allure. It might account for only 17.2% of the market share, but it boasts a remarkable CAGR of 11.1%. The aftermarket's strength lies in its adaptability. It presents an opportunity for consumers to augment their existing vehicles with the latest CV joints, eliminating the need for a new purchase. Additionally, it champions choice. Whether it's brand variety, quality gradients, or price brackets, the aftermarket ensures that there's a CV joint for every consumer, making it an indispensable segment in its own right.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Holding the lion's share of the global automotive constant velocity joint market, Asia Pacific, with a substantial 46.2% share, stands out as the dominant force. The region is also anticipated to grow with a CAGR of 11.0%, outpacing other regions considerably. This robust growth narrative finds its roots in the socio-economic developments of powerhouse nations like China and India. Over the past decade, both countries have witnessed an explosive 35% surge in their middle-class populations. This demographic shift has precipitated an equivalent leap in automobile ownership. For instance, in 2022, car sales in China crossed the 23 million marks, with India far behind at 3.8 million. What's propelling the CV joint market within these astronomical sales figures? It's the deepening penetration of personal transportation among the newly-minted middle class. As more individuals rise economically, the appetite for personal vehicles, most of which necessitate CV joints, grows exponentially.

The region's automotive manufacturing landscape further consolidates its dominance in the global automotive constant velocity joint market. With global car giants setting up manufacturing bases in Asia Pacific, there's been a 40% increase in local production facilities in the last five years alone. These hubs require an immense quantity of automotive components, including CV joints. In numerical terms, the demand for CV joints in the Asia Pacific has seen an annual uptick of 12% since 2018, echoing the region's growth narrative.

Following Asia Pacific, North America captures a significant portion of the automotive constant velocity joint market, projecting a CAGR of 10.2%. While the numbers might be dwarfed by Asia's gargantuan growth, North America brings to the table a unique blend of innovation and advanced research. North America is home to automotive behemoths like General Motors, Ford, and Tesla. Together, these companies have invested upwards of $15 billion in R&D over the past three years. A fraction of this investment has funneled into the enhancement of autonomous CV joint technologies, aiming to redefine the future of vehicular movement.

Moreover, with the region accounting for nearly 20% of global car sales in 2022, there's an inherent demand for quality automotive components, including CV joints. The presence of world-class automotive suppliers, combined with stringent quality checks, has seen the CV joint market in North America grow by 8% annually since 2020.

Top Players in the Global Automotive Constant Velocity Joint Market

- GKN

- American Axle Manufacturing Holdings

- Hyundai WIA Corporation

- IFA Group

- Nanyang Automobile & Cycle Group

- Neapco Holdings LLC

- Nexteer Automotive

- NKN Co. Ltd

- NTN Corporation

- JTEKT Corporation

- SKF

- Other Prominent Players

Market Segmentation Overview:

By Type

- Rzeppa CV Joint

- Tripod Joints and Ball-Type Joints

- Inboard / Outboard Joints

- Fixed / Plunge Joints

- Others

By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Application

- ICE

- Electric

- Hybrid

By Distribution Channel

- OEM

- Aftermarket

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 4,429.0 Mn |

| Expected Revenue in 2032 | US$ 10,529.1 Mn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 10.2% |

| Segments covered | By Type, By Vehicle Type, By Application, By Distribution Channel, By Region |

| Key Companies | GKN, American Axle Manufacturing Holdings, Hyundai WIA Corporation, IFA Group, Nanyang Automobile & Cycle Group, Neapco Holdings LLC, Nexteer Automotive, NKN Co. Ltd, NTN Corporation, JTEKT Corporation, SKF, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)