Automotive Bioethanol Market: By Feedback (Corn-based, Sugarcane-based, Cellulosic Biomass, Other Feedstocks); Application (Passenger Vehicles and Commercial Vehicles); End Users (Individual, Commercial Fleet Operators, Industrial & Agricultural Sector, Government & Municipal Authorities); Distribution Channel (Direct Sales and Distributors); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Mar-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA03251233 | Delivery: Immediate Access

| Report ID: AA03251233 | Delivery: Immediate Access

Market Scenario

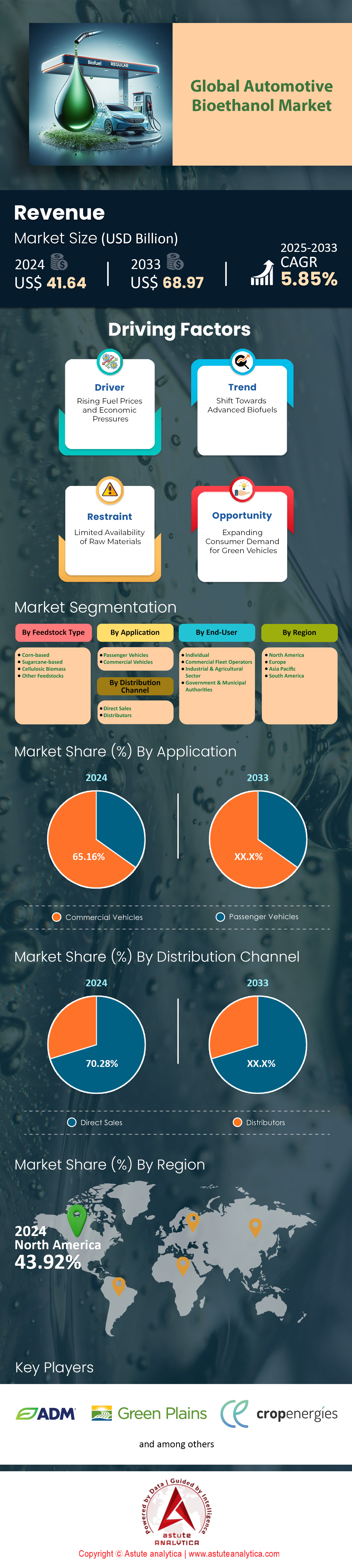

Automotive bioethanol market was valued at US$ 41.64 billion in 2024 and is projected to hit the market valuation of nearly US$ 68.97 billion by 2033 at a CAGR of 5.85% during the forecast period 2025–2033.

The automotive bioethanol market has undergone significant transformation in recent years, driven by environmental concerns, regulatory support, and technological advancements. As of 2025, the demand for automotive bioethanol has reached new heights, reshaping the global energy landscape and offering a promising alternative to conventional fossil fuels. As of 2025, global bioethanol production has seen substantial growth. In the United States, a leading producer, the total fuel ethanol production capacity as of January 1, 2024, was approximately 18.01 billion gallons per year (1,175 thousand barrels per day). The majority of this capacity is concentrated in the Midwest region (PADD 2), accounting for 16.996 billion gallons per year.

In Brazil, another major player in the automotive bioethanol market, production reached a record 36.83 billion liters (9.73 billion gallons) of ethanol in 2024, marking a 4.4% increase compared to the previous year. This significant increase reflects the growing demand and production capacity in one of the world's largest bioethanol markets. Latin America, led by Brazil, continues to be a major player in the bioethanol market. Brazil's extensive sugarcane industry provides a robust feedstock for bioethanol production, and the country's commitment to biofuel usage is reflected in its mandatory blending policies.

The demand for automotive bioethanol market is characterized by regional variations and global trends. In North America, particularly the United States, robust government mandates and incentives aimed at reducing carbon emissions have bolstered bioethanol consumption. The U.S. Department of Energy's initiatives, including substantial funding for sustainable biofuel projects, have played a pivotal role in driving market growth. Apart from this, in Europe, the demand for bioethanol is primarily driven by stringent environmental regulations and the European Union's directives on renewable energy. The EU Renewable Energy Directive (RED) sets targets for renewable energy use in transport, which has significantly increased the consumption of bioethanol in the transportation sector. Apart from this, the Asia-Pacific region is experiencing rapid growth in bioethanol demand, primarily due to the large populations and agricultural bases in countries like India, China, and Thailand. India's government, in particular, has been proactive in promoting bioethanol as part of its energy strategy, with policies aimed at increasing ethanol blending in fuels.

To Get more Insights, Request A Free Sample

Top Bioethanol Producers in the US Automotive Bioethanol Market

POET LLC

- Operates a network of state-of-the-art biorefineries across the Midwest

- Recent investments include carbon capture initiatives and acquisitions, increasing output by 40%

Valero Energy Corporation

- Operates 13 ethanol plants in the Mid-Continent region of the U.S.

- Recent projects include carbon capture and storage initiatives and sustainable aviation fuel production

Green Plains Inc.

- Operates multiple ethanol facilities across key U.S. agricultural states

- Recent ventures include a joint venture for sustainable aviation fuel development

Koch Industries

- Fifth-largest ethanol producer in the United States

- Strategic acquisitions and investments in renewable energy have expanded their production capabilities

Government Roles in Driving Automotive Bioethanol Market Growth

United States: The Renewable Fuel Standard (RFS) mandates the blending of renewable fuels, including bioethanol, into the national fuel supply. The Inflation Reduction Act has allocated USD 9.4 billion for biofuel production and investment through 2031. These policies have significantly boosted bioethanol production and consumption in the country, creating a stable automotive bioethanol market for producers and encouraging further investment in the sector.

Brazil: Brazil has implemented mandatory blending requirements, currently at 27% for ethanol in gasoline, with plans to increase the ethanol blend to 30% by 2025. These measures have solidified Brazil's position as a global leader in bioethanol production and consumption, creating a robust domestic market and supporting the country's agricultural sector.

European Union: The updated RED III aims to double the renewable content in transportation fuels by 2030. The EU's approach to bioethanol adoption is primarily driven by environmental goals, with various incentives implemented by member states, such as tax exemptions and subsidies, supporting the growth of the bioethanol market.

India: India's Ethanol Blending Program (EBP) aims to achieve a 20% ethanol blend in gasoline by the end of 2025 from 15% in 2024. Despite challenges in the automotive bioethanol market, India's government continues to push for increased bioethanol adoption through incentives and infrastructure development, recognizing its potential to reduce oil imports and support the agricultural sector.

Market Dynamics

Driver: Government Policies Supporting Bioethanol Adoption and Mandating Renewable Fuel Standards

Government policies and mandates have been the cornerstone of bioethanol adoption globally, with countries implementing aggressive targets to reduce carbon emissions and promote renewable energy. As of 2025, these policies have significantly shaped the automotive bioethanol market, driving both production and consumption. For instance, in the United States, the Renewable Fuel Standard (RFS) mandates the blending of renewable fuels, including bioethanol, into the national fuel supply. The Environmental Protection Agency (EPA) has set biofuel volume requirements for 2023-2025, with total renewable fuel volumes increasing from 20.94 billion gallons in 2023 to 22.33 billion gallons by 2025. Similarly, India’s Ethanol Blending Program (EBP) aims to achieve a 20% ethanol blend in gasoline by 2025-26, requiring an estimated 1,016 crore liters of ethanol annually. Brazil, a global leader in bioethanol, has maintained a mandatory blending requirement of 27% ethanol in gasoline, with plans to increase this to 30% by 2025

These policies not only reduce greenhouse gas emissions but also enhance energy security by reducing dependency on imported fossil fuels in the automotive bioethanol market. For instance, India’s ethanol blending initiative is expected to save approximately $4 billion annually in oil imports. In Brazil, the RenovaBio program incentivizes bioethanol production by setting decarbonization targets for the fuel sector, further strengthening the domestic market. In line with this, Dr. Jane Smith, a renewable energy policy expert, states, “Government mandates are the backbone of the bioethanol industry. They provide the necessary market stability and encourage investments in production and infrastructure.” Similarly, a senior official from the EPA remarked, “The RFS has been instrumental in reducing emissions and fostering innovation in renewable fuels.”

Trend: Increased Use of Higher Bioethanol Blends in Flex-Fuel Vehicles

The adoption of higher bioethanol blends, such as E15 and E85, is a growing trend in the automotive sector. Flex-fuel vehicles (FFVs), which can run on blends containing up to 85% ethanol, are at the forefront of this shift. In the United States automotive bioethanol market, E15 (15% ethanol blend) is now available at over 2,500 fueling stations across 31 states, a significant increase from previous years. Brazil, a pioneer in ethanol usage, has over 40% of its vehicle fleet as FFVs, capable of running on any blend of ethanol and gasoline. Argentina has also seen a rise in ethanol blend rates, with a projected 11.8% blend in 2024, supported by domestic production of 1.12 billion liters of ethanol.

The shift towards higher blends is driven by environmental benefits and cost savings. Ethanol blends reduce greenhouse gas emissions by up to 50% compared to gasoline, making them a preferred choice for environmentally conscious consumers. Additionally, higher blends like E85 are often cheaper than regular gasoline, providing economic incentives for adoption in the automotive bioethanol market. The availability of FFVs has further facilitated this trend, offering consumers the flexibility to choose their preferred blend based on price and availability. Professor Brent Mittelstadt from the Oxford Internet Institute notes, “The adoption of higher ethanol blends is a win-win for consumers and the environment. It reduces emissions while offering cost savings, making it a practical choice for many.” A representative from a leading automotive manufacturer adds, “The development of FFVs has been a game-changer, enabling the widespread use of higher ethanol blends.”

Challenge: Limited Feedstock Availability and Competition with Food Crops

Feedstock availability remains one of the most pressing challenges in the bioethanol market. The reliance on first-generation feedstocks like corn, sugarcane, and wheat has raised concerns about land use and competition with food production. As of 2025, first-generation feedstocks account for the majority of global bioethanol production, covering approximately 6% of arable land worldwide. In Brazil, sugarcane-based ethanol production reached 36.83 billion liters in 2024, but this has led to debates about the impact on food prices and land use. Similarly, in the United States, corn-based ethanol production has been criticized for diverting resources from food production, with over 40% of the U.S. corn crop used for ethanol.

The competition between bioethanol and food crops is a critical issue, particularly in regions with food security concerns. The diversion of crops like maize and sugarcane to bioethanol production can lead to increased food prices and reduced availability. Additionally, the inefficiency of bioenergy in terms of land use intensifies this challenge. For instance, sugarcane and maize convert only a small fraction of solar energy into bioethanol, making them less efficient compared to other renewable energy sources like solar photovoltaics. As per Astute Analytica’s findings, the competition between food and fuel is a delicate balance. Policymakers must ensure that bioethanol production does not compromise food security.” Dr. Jane Smith adds, “The future lies in second-generation biofuels, which utilize non-food biomass and can be grown on marginal lands.”

Segmental Analysis

By Feedstock Type

Sugarcane-based feedstock's 47.12% market share in the automotive bioethanol market is a testament to its efficiency and economic viability. This dominance is rooted in sugarcane's exceptional ethanol yield, with the ability to produce 80-90 gallons of ethanol per ton, significantly outperforming other crops. Global sugarcane production has been steadily increasing, with recent estimates indicating a rise to 186.6 million tons in 2024, a 2.8 million ton increase from the previous year. This growth is primarily driven by major producers like Brazil, India, and China. Brazil, in particular, allocated 65% of its sugarcane production to ethanol in 2019, underscoring the crop's pivotal role in the biofuel sector. The high sugar content of sugarcane, coupled with its adaptability to tropical and subtropical climates, ensures a stable and abundant supply for bioethanol production.

Sugarcane's position as the largest feedstock for automotive bioethanol production is further solidified by its environmental benefits and established infrastructure. The crop's ability to reduce greenhouse gas emissions by up to 90% compared to gasoline aligns with global sustainability goals, making it attractive to policymakers and environmentally conscious consumers. Moreover, the integration of sugarcane cultivation with ethanol processing facilities, particularly in countries like Brazil, has created a highly efficient supply chain. This integration minimizes production costs and enhances the competitiveness of sugarcane-derived ethanol in the automotive bioethanol market. The combination of high yield, environmental benefits, and optimized production processes makes sugarcane the preferred choice for bioethanol production, securing its dominant market share in the automotive sector.

By Application

The dominance of commercial vehicles in bioethanol consumption, accounting for over 65.16% of the automotive bioethanol market, is driven by a confluence of economic, regulatory, and operational factors. Commercial fleets, including trucks, buses, and other heavy-duty vehicles, operate on a large scale with high fuel consumption rates, making them prime candidates for alternative fuel adoption. The cost-effectiveness of bioethanol, often priced lower than traditional fossil fuels due to government subsidies and renewable energy mandates, translates to significant savings for fleet operators. This economic advantage is particularly appealing in the commercial sector, where fuel costs constitute a substantial portion of operational expenses. Additionally, the availability of flex-fuel vehicles, capable of running on various ethanol-gasoline blends, has facilitated the seamless integration of bioethanol into commercial fleets without requiring extensive vehicle modifications.

Regulatory pressures play a crucial role in driving automotive bioethanol market among commercial vehicles. Stringent emissions regulations, such as the European Union's Renewable Energy Directive and the U.S. Renewable Fuel Standard, mandate the use of renewable fuels in transportation. These policies create a stable demand for bioethanol and incentivize commercial fleet operators to transition to cleaner fuel options. Furthermore, the corporate sustainability goals of many companies align with the use of bioethanol, as it offers a tangible way to reduce carbon footprints and enhance corporate social responsibility profiles. The combination of regulatory compliance, cost savings, and environmental benefits makes bioethanol an attractive fuel option for commercial vehicle operators, explaining their dominant share in bioethanol consumption.

By End Users

Commercial Fleet Operators' 42.28% market share in the automotive bioethanol market is driven by several key factors that leverage their unique position in the transportation sector. The scale of operations is a primary driver, as fleet operators manage large numbers of vehicles, allowing them to benefit from economies of scale when purchasing and implementing bioethanol fuel systems. This scale not only reduces the per-unit cost of bioethanol but also provides significant negotiating power with suppliers, ensuring favorable long-term contracts and stable pricing. Additionally, the structured nature of fleet operations facilitates the systematic adoption of new technologies and fuels across entire vehicle fleets, making the transition to bioethanol more manageable and cost-effective compared to individual vehicle owners. The dominance of Commercial Fleet Operators is further reinforced by their ability to capitalize on government incentives and regulatory compliance requirements. Many governments offer substantial incentives, including tax breaks and subsidies, for businesses that adopt cleaner fuels like bioethanol.

Fleet operators, with their large-scale operations, are well-positioned to maximize these benefits, offsetting the initial costs of transitioning to bioethanol-compatible vehicles in the automotive bioethanol market. Moreover, the pressure from stakeholders and consumers for businesses to adopt sustainable practices has pushed many fleet operators to prioritize environmental initiatives. Bioethanol adoption serves as a visible and quantifiable way for these companies to demonstrate their commitment to sustainability, enhancing their corporate image and potentially attracting environmentally conscious customers and partners. This combination of economic advantages, regulatory alignment, and sustainability benefits solidifies Commercial Fleet Operators' position as the largest end users in the automotive bioethanol market.

By Distribution Channel

The prevalence of direct channel distribution, accounting for over 70.28% of automotive bioethanol market, is a reflection of the industry's focus on efficiency, cost-effectiveness, and quality control. Direct distribution channels allow bioethanol producers to sell their products directly to end-users or retailers, bypassing intermediaries and streamlining the supply chain. This approach significantly reduces distribution costs, which is crucial in maintaining the competitive pricing of bioethanol against traditional fossil fuels. The direct channel also enables producers to maintain tighter control over the quality and consistency of their product, ensuring that the bioethanol meets the specific requirements of automotive use. This quality assurance is particularly important in an industry where fuel standards and specifications are stringent and directly impact vehicle performance and emissions.

Furthermore, the direct distribution model in the automotive bioethanol market facilitates stronger relationships between bioethanol producers and their customers, particularly large-scale consumers like commercial fleet operators. These relationships allow for customized service agreements, bulk pricing, and more responsive supply management, which are essential in meeting the specific needs of major bioethanol consumers. The direct channel also benefits from technological advancements, with digital platforms and mobile apps enabling seamless ordering, tracking, and delivery processes. This technological integration enhances the efficiency of the distribution process, reducing lead times and improving inventory management for both producers and consumers. Additionally, government initiatives promoting renewable fuels often encourage direct relationships between producers and consumers, further supporting the dominance of direct distribution channels in the automotive bioethanol market. As the market continues to evolve, the direct channel is likely to remain the preferred distribution method, offering the flexibility and efficiency needed to support the growing demand for bioethanol in the automotive sector.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America: Powerhouse of Bioethanol Production Driven by U.S. Corn Industry

North America remains the dominant region in the global automotive bioethanol market, capturing 43% of the total share thanks to its robust agricultural sector and supportive government policies. The United States, as the key contributor, plays a pivotal role in this leadership.

- Corn Production as the Cornerstone

The U.S. boasts extensive corn cultivation—especially concentrated in Iowa, Nebraska, and Illinois—providing a cost-effective and readily available feedstock. This accounts for a significant portion of total bioethanol production capacity (up to 50%). Thanks to this agricultural advantage and a well-established infrastructure, the United States maintains a production capacity of 17.7 billion gallons per year (Until 2022). According to the Crop Production report issued today by USDA's National Agricultural Statistics Service (NASS), corn production is forecast at 15.2 billion bushels in 2024.

- Government Policies and Industry Support

Prominent programs such as the Renewable Fuel Standard (RFS) mandate biofuel blending, creating a consistent market for bioethanol. The standardization of E10 (10% ethanol, 90% gasoline) in most U.S. vehicles further cements its pervasive use. Meanwhile, federal support—through measures like the Bipartisan Infrastructure Law and the Higher Blends Infrastructure Incentive Program—encourages ongoing research, development, and innovation, ensuring North America’s preeminence in the sector.

- Climate Goals and Future Outlook

The United States in the automotive bioethanol market prioritizes greenhouse gas reduction and energy independence, thus driving additional investment in bioethanol. With a strategic focus on clean energy, the region positions itself for long-term growth, reinforcing North America’s dominance in the global automotive bioethanol landscape.

South America: Brazil’s Sugarcane Revolution Fuels Regional Bioethanol Dominance

South America’s prominent stance in the global automotive bioethanol market stems mainly from Brazil’s production capabilities and pioneering government initiatives. Brazil’s bioethanol industry, anchored by extensive sugarcane cultivation, accounts for over 90% of the country’s ethanol market share.

- Vast Sugarcane Cultivation

Brazil’s advantageous climate fosters high-yield sugarcane growth. Supported by decades-long government programs—dating back to Proálcool in the 1970s—this well-established framework underpins Brazil’s leadership. Significant agricultural output ensures a steady bioethanol supply for both domestic use and export.

- Mandatory Blending and Flex-Fuel Vehicles

Brazil’s mandatory higher blending requirements, which exceed those of many other nations, firmly embed ethanol in everyday fuel consumption. The wide availability of flex-fuel vehicles in the automotive bioethanol market, capable of running on any ethanol-gasoline blend, drives consistent domestic demand. As a result, these vehicles form a significant portion of the Brazilian automotive market.

- Global Exports and Sustainability Initiatives

Beyond meeting local needs, Brazil aggressively exports renewable bioethanol to satisfy rising international demand. To address environmental concerns—particularly around water usage in semi-arid areas—Brazil continues investing in low water footprint technologies and improving infrastructure. These efforts, coupled with strong government backing and a time-tested sugarcane-ethanol production chain, ensure that South America remains a formidable player on the global stage, second only to North America in market share.

Top Players in the Automotive Bioethanol Market

- Archer Daniels Midland Company

- Cropenergies AG (Südzucker)

- POET LLC

- Valero Energy Corporation

- Green Plains Inc.

- Bunge

- Bharat Petroleum Corporation Limited

- Indian Oil Corporation

- Greenfield

- Other Prominent Players

Market Segmentation Overview:

By Feedstock Type

- Corn-based

- Sugarcane-based

- Cellulosic Biomass

- Other Feedstocks

By Application

- Passenger Vehicles

- Commercial Vehicles

By End User

- Individual

- Commercial Fleet Operators

- Industrial & Agricultural Sector

- Government & Municipal Authorities

By Distribution Channel

- Direct Sales

- Distributors

By Region

- North America

- The U.S.

- Canada

- Europe

- Germany

- France

- Austria

- Belgium

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- South Korea

- Japan

- New Zealand

- ASEAN

- Indonesia

- Thailand

- Philippines

- Rest of ASEAN

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA03251233 | Delivery: Immediate Access

| Report ID: AA03251233 | Delivery: Immediate Access

.svg)