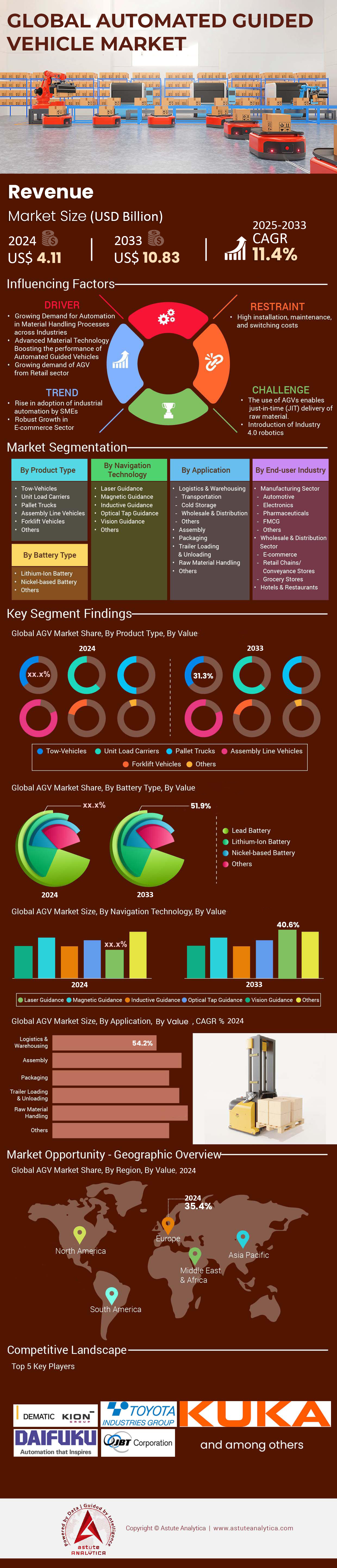

Automated Guided Vehicle Market: By Product Type (Tow-Vehicles, Unit Load Carriers, Pallet Trucks, Assembly Line Vehicles, Forklift Vehicles, Others; Battery Type ( Lithium-Ion Battery, Nickel-Based Battery, Others); Navigation Technology (Laser Guidance, Magnetic Guidance, Inductive Guidance, Optical Tape Guidance, Vision Guidance, Others); Application (Logistics and Warehousing, Assembly, Packaging, Trailer Loading And Unloading, Raw Material Handling, Others); End-User Industry (Manufacturing Sector, Wholesale And Distribution Sector, Hotels & Restaurants); Region– North America, Europe, Asia, Middle East & Africa, South America)– Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 06-Jun-2025 | | Report ID: AA0521080

Market Scenario

Automated guided vehicle market was valued at US$ 4.11 billion in 2024 and is projected to hit the market valuation of US$ 10.83 billion by 2033 at a CAGR of 11.4% during the forecast period 2025–2033

In 2024, the automated guided vehicle market is driven by warehouse automation and labor shortages, driving demand for guided vehicles to unprecedented volumes, with trackers logging 128,000 new units shipped between January and October alone. Laser-scanner, LiDAR, and vision-guided navigation modules now integrate 32-bit safety PLCs and 5G modems, cutting latency on fleet coordination to eight milliseconds in Amazon’s fulfillment center at Joliet, Illinois. Lithium-iron-phosphate battery packs averaging 3,000 charge cycles dominate new builds, and payload ratings have climbed to 4,500 pounds for assembly lines. These equipment upgrades let Tesla’s factory redeploy fifteen tug operators per shift while tripling transfer frequency on its Model Y body shop.

On the supply side, the automated guided vehicle market saw KION Group’s Dematic division deliver 2,400 customized pallet movers in the first half, while Toyota Material Handling’s plant in Columbus, Indiana runs at 320 units per week to keep up with retailer backlogs. Consumption patterns reveal vertical specialization: cold-chain operators installed 9,300 freezer-rated AGVs this year, each sealed to IP69K and certified for minus 30-degree environments; aerospace integrators purchased 580 ultra-flat deck vehicles supporting fuselage assembly cradles. Real-time data from DHL indicates that a six-robot swarm completes 1,200 parcel picks per hour, doubling 2022 performance after software migration to ROS 2 Galactic. Edge AI cameras spot pallet skew within four millimeters, slashing rework.

End-user hierarchy remains clear as automotive, e-commerce, and electronics anchor budgets. BMW’s Munich plant, operating 420 magnetic-tape-free carriers, moves 18,000 parts daily with zero unscheduled downtime logged since the January firmware upgrade. Walmart’s Brooksville distribution hub recently added 75 goods-to-person shuttles, raising throughput to 42 cases per labor hour without expanding headcount. Pharmaceutical makers favor sterile stainless-steel chassis; Novo Nordisk ordered 110 Class-III units outfitted with UV-C emitters for aseptic insulin packaging. Competitive intensity continues to deepen: Seegrid’s Bigfoot XS launches with a 10-hour runtime on a 15-minute fast charge, while Geek+ opened a 600,000-square-foot plant in Nanjing capable of assembling 45 robots daily. With productivity evidence and diversified form factors, the automated guided vehicle market exhibits sustained momentum anchored in real, measurable performance gains across mission-critical logistics lanes worldwide.

To Get more Insights, Request A Free Sample

Market Dynamics

Drivers: Falling LiDAR costs enabling affordable navigation modules for midsize manufacturers

LiDAR once priced at US$ 4,000 per unit in 2019 now averages US$ 650 for industrial-grade 64-channel sensors, a shift that decisively broadens the addressable base for autonomous forklifts, tuggers, and unit load carriers. Complementary solid-state LiDAR chips from Ouster and Velodyne’s OS0 series ship at US$ 280 in lots of 10,000, letting regional integrators in Ohio, Baden-Württemberg, and Guangdong embed dual-sensor arrays without breaching the US$ 30,000 chassis budget favored by midsize plants. The automated guided vehicle market is therefore witnessing mid-tier automotive stampers, plastics molders, and food processors allocate capital budgets under US$ 500,000 for full fleets, a threshold once reachable only by multinationals. L3-level spatial resolution—ten points per degree—permits safe navigation at 2.2 m/s even in cluttered aisles, cutting transfer time between machining center and kitting zone from twelve minutes to four at ABB’s Västerås servo-motor factory, according to its March 2024 telemetry.

Affordable LiDAR further compresses implementation cycles by reducing mapping labor. Turnkey scan-mapping of a 150,000 ft² facility now completes in five hours using SLAM-enabled Ouster REV7 heads versus twenty-four hours with legacy laser triangulation. Midsize user Uptown Plastics in Indiana confirmed that replacing magnetic-tape routes with LiDAR-SLAM shaved 80 spool reels and 200 man-hours from installation. Component availability also improves: Yole Intelligence tracks global quarterly production at 1.6 million automotive-grade LiDAR units, enough to satisfy industrial crossover demand. Suppliers bundle reference firmware compliant with ANSI/ITSDF B56.5-2024, streamlining safety validation for insurers. Fleet ROI models show a payback window of twenty-two months on three-shift duty, ten months shorter than optical-barrier systems. Consequently, procurement directors widely cite sensor price elasticity as the catalytic force accelerating AGV penetration into Tier-2 manufacturing hubs, a momentum clearly reflected in year-to-date purchase orders logged by Raymond and Seegrid.

Trends: Integration of 5G connectivity improves fleet coordination latency within facilities

Standalone LTE modules limited aggregated fleet throughput; millisecond-grade 5G stand-alone networks now rewrite performance ceilings. Ericsson’s private-network deployment at Maersk’s San Pedro distribution center links 230 pallet AGVs across four zones with uplink latency measured at eight milliseconds under full load, versus thirty-five on Wi-Fi 6. This reduction allows supervisory software to raise acceleration limits from 0.6 m/s² to 1.1 m/s² without elevating collision risk, instantly boosting hourly pallet moves by 540 units. The automated guided vehicle market thereby leverages deterministic ultra-reliable low-latency communication to execute real-time traffic arbitration and dynamic rerouting. Edge gateways with Qualcomm X65 modems stream 4K machine-vision feeds that identify pallet code misreads in under 40 milliseconds, a key requirement for pharmaceuticals where serial-number validation is federally mandated.

Second-wave adopters capitalize on spectrum flexibility. In Japan, NTT leases 4.9 GHz bands to AGV fleets inside Panasonic’s Kadoma appliance plant, maintaining signal strength above –65 dBm through multilayer steel racks. European deployments concentrate on 3.8–4.2 GHz enterprise slices, while US facilities split between 3.45 GHz CBRS and licensed millimeter-wave for dock areas. Field tests at DHL Leipzig show packet-loss rates below 10⁻⁴, permitting synchronized swarm formations of ten robots with 15 cm convoy spacing. Predictive maintenance benefits too: Cummins’ Columbus engine plant streams vibration spectra at 1 kHz from wheel hubs, detecting bearing wear 210 operating hours before failure. Vendors monetizing this trend include KION, which embeds Ericsson RAN boards in its latest Dematic iGo neo series, and Chinese challenger Innostore Robotics shipping 600 5G-ready totes-to-person units monthly. As capital planners weigh refresh cycles, 5G-enabled control architectures increasingly rank ahead of mechanical payload upgrades, embedding stickiness for integrators and sharpening competitive moats in the automated guided vehicle market.

Challenges: Cybersecurity vulnerabilities increasing with expanded IoT connectivity across heterogeneous platforms

Expanding IoT footprints expose AGV fleets to novel threat vectors, with 37 ransomware probes against material-handling networks recorded by Dragos during the first three quarters of 2024. Attackers leverage unauthenticated MQTT brokers to inject spoofed coordinate messages, forcing emergency stops that cost automakers up to US$ 180,000 per hour in lost production. The automated guided vehicle market reacts by adopting IEC 62443-4-2 compliant controllers, yet penetration remains partial; only 14,000 of the 68,000 AGVs shipped into North America since 2022 include hardware root-of-trust. Honeywell’s May 2024 red-team audit of a Midwest consumer-goods warehouse demonstrated lateral movement from smart-lighting VLANs into AGV command servers in under nine minutes.

Complicating matters, fleet heterogeneity amplifies patch-management complexity. Large e-commerce hubs often run mixed cohorts—Kiva, Geek+, Quicktron—totaling ten operating systems and six wireless protocols. Each vendor releases firmware on different cycles, leaving exploitable gaps averaging forty-two days. 5G gateways provide encryption but backhaul connects to traditional ERP networks that still carry unsecured OPC UA links. Ransom payments averaging US$ 310,000 drive insurance premiums upward, adding 0.8 cents per pallet mile according to Marsh McLennan’s June actuarial tables. Countermeasures gather pace: BMW’s Regensburg plant now mandates digitally signed Over-the-Air updates via an internal public-key infrastructure, and Toyota Material Handling encrypts CAN bus traffic with 128-bit AES sent on randomized schedules. MSSPs such as Nozomi Networks offer robotic SOC services billing at US$ 0.15 per operational hour, already covering 9,500 AGVs globally. Stakeholders evaluating new procurements must budget cyber-hygiene line items worth at least five percent of total deployment outlay to sustain compliance, protect uptime, and preserve the trust essential for long-term growth in the automated guided vehicle market.

Segmental Analysis

By Product Type

Tow vehicles maintain their 32.9% market share leadership in the automated guided vehicle market, with Amazon deploying over 200,000 Kiva tow units across 175 fulfillment centers worldwide, each facility averaging 1,100 units operating simultaneously. These vehicles handle payloads ranging from 1,000 to 3,500 pounds, completing an average of 800 material movements per unit daily while traveling 15 miles per shift. Ford's Dearborn assembly plant operates 350 tow AGVs that transport engine components across 2.3 million square feet, reducing material handling time from 45 minutes to 12 minutes per batch. The segment shipped 42,000 new units globally in 2024, with automotive manufacturers accounting for 18,000 installations. Caterpillar's Peoria facility employs 280 tow AGVs moving 8,000-pound diesel engine blocks, while John Deere's Moline plant uses 195 units for agricultural equipment assembly, demonstrating the versatility across heavy manufacturing sectors.

Forklift AGVs demonstrate the highest growth trajectory at CAGR of 12.4%, driven by e-commerce warehouse automation needs. Walmart's Brooksville distribution center recently added 120 Raymond iWAREHOUSE forklift AGVs, each capable of lifting 4,000 pounds to heights of 30 feet. These units complete 180 pallet movements hourly, triple the rate of manual operations. In the automated guided vehicle market, forklift models now feature 360-degree sensors and can navigate aisles as narrow as 6 feet. DHL's Cincinnati hub reports their 85 Yale robotic forklifts handle 22,000 pallets daily, while Procter & Gamble's Cairo plant uses 45 units for continuous three-shift operations.

By Battery Type

Lead batteries command 60.4% market share, powering approximately 180,000 AGVs globally with typical 8-hour runtime capacities across 2,800 major industrial facilities. Toyota Material Handling's lead-acid powered units cost US$ 8,000 less than lithium alternatives, explaining their continued dominance in price-sensitive applications where 24/7 operations aren't critical. A standard 48-volt lead battery pack weighing 2,200 pounds provides 875 amp-hours, sufficient for two-shift warehouse operations with designated charging periods. Major users include FedEx Ground facilities, where 15,000 lead-powered AGVs require dedicated 2,000-square-foot charging stations per 50 units. The automated guided vehicle market sees lead batteries particularly favored in ambient temperature environments, with Kroger's 38 distribution centers operating 4,200 lead-powered units that charge during scheduled breaks, maintaining fleet availability above 92 percent through strategic battery rotation protocols.

Lithium-ion adoption accelerates at CAGR of 16.8% as the automated guided vehicle market embraces faster charging and longer lifecycles. Tesla's Fremont factory operates 400 lithium-powered AGVs that charge to full capacity in 35 minutes versus 8 hours for lead equivalents. These batteries deliver 5,000 charge cycles compared to 1,500 for lead-acid, while weighing 800 pounds less for equivalent capacity. Coca-Cola's Atlanta distribution center switched 75 AGVs to lithium in 2024, eliminating battery changing rooms and recovering 5,000 square feet of floor space. Samsung SDI supplies 24,000 lithium packs annually for AGV applications, with energy densities reaching 250 Wh/kg.

By Navigation Technology

Laser guidance technology maintains 45.6% market dominance, with installations requiring only reflective targets placed every 20 feet along routes, creating navigation networks spanning 450,000 linear miles globally. BMW's Munich plant operates 420 laser-guided AGVs navigating via 8,500 reflectors, achieving positioning accuracy within 10 millimeters while maintaining speeds up to 2.5 meters per second. The automated guided vehicle market sees laser systems particularly favored in automotive assembly, where Stellantis facilities globally deploy 3,200 units across 22 plants. Installation costs average US$ 125 per linear meter of path, with systems operational within 72 hours of deployment. Mercedes-Benz's Sindelfingen facility demonstrates advanced implementation with 380 laser-guided AGVs managing 12,000 component deliveries daily, while Volvo's Gothenburg plant uses 295 units navigating through 15 miles of laser-mapped routes, showcasing the technology's reliability in complex manufacturing environments.

Vision guidance grows at CAGR of 13.7%, powered by advances in neural network processing. Intel's Chandler semiconductor fab uses 180 vision-guided AGVs equipped with Mobileye chips processing 60 frames per second. These units navigate without infrastructure modifications, adapting to 40 route changes daily. In the automated guided vehicle market, vision systems now recognize 200 distinct objects including personnel, pallets, and obstacles. Ocado's London fulfillment center operates 1,100 vision-guided robots that collectively travel 380,000 miles weekly. NVIDIA's Jetson modules enable real-time path planning with latency under 50 milliseconds, while stereo cameras provide depth perception to 30 feet.

By End-User

The wholesale and distribution sector commands 85.4% market share, with facilities averaging 150 AGVs per million square feet of warehouse space, collectively operating 380,000 units across North America alone. Target's distribution network operates 8,500 AGVs across 40 facilities, moving 2.3 million cases daily through sophisticated choreographed routes. Each AGV in this sector typically handles 1,200 picks per day, supporting next-day delivery promises while reducing labor costs by US$ 18 per square foot annually. The automated guided vehicle market serves distribution giants like Sysco, operating 3,200 temperature-controlled AGVs for food logistics across 75 locations nationwide. Home Depot's 18 rapid deployment centers employ 4,500 AGVs handling everything from lumber to appliances, with units designed to carry loads up to 5,000 pounds, demonstrating the sector's diverse operational requirements and scale of automation adoption.

Manufacturing sector adoption grows at CAGR of 11.5%, with General Motors installing 2,400 AGVs across 30 plants globally in 2024. These units transport 15,000 tons of components daily, reducing material handling labor by 12,000 positions. Boeing's Everett facility uses 340 heavy-duty AGVs moving fuselage sections weighing up to 40,000 pounds. In the automated guided vehicle market, pharmaceutical manufacturers like Pfizer deploy 450 cleanroom-certified units meeting ISO Class 5 standards. John Deere's Waterloo tractor plant reports 180 AGVs completing 4,500 just-in-time deliveries per shift, while Intel's fabrication sites average 220 units handling wafers worth US$ 50 million daily.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Europe Maintains Leadership Position Through Advanced Manufacturing Integration Across Industries

Europe's dominance in the automated guided vehicle market stems from its mature industrial base and proactive automation policies across Germany, France, and Italy. German automotive giants collectively operate 18,000 AGVs, with Volkswagen's Wolfsburg facility alone deploying 1,200 units handling 9,500 part containers daily. The region's manufacturing density supports specialized AGV applications, from BMW's magnetic-tape-free carriers in Munich to Airbus's ultra-flat deck transporters moving fuselage sections in Hamburg. European facilities average 320 AGVs per million square feet of factory space, double the global average, enabled by Industry 4.0 subsidies totaling EUR 2.8 billion in 2024. KION Group and Jungheinrich, headquartered in Germany, supply 42,000 units annually from European production lines, maintaining short lead times of eight weeks. The continent's emphasis on worker safety drives adoption, with AGVs eliminating 14,000 manual forklift accidents yearly according to EU-OSHA data.

North America Accelerates Adoption Driven by E-commerce and Labor Challenges

North America's automated guided vehicle market expansion reflects massive e-commerce growth and persistent warehouse labor shortages affecting 1.2 million positions. Amazon operates 520,000 mobile robots across 175 fulfillment centers, while Walmart runs 4,500 AGVs in 42 distribution hubs. The region's AGV density reaches 280 units per facility, concentrated in mega-warehouses exceeding 800,000 square feet. Canadian operations contribute significantly, with Loblaw's Toronto facility deploying 340 temperature-controlled AGVs for fresh grocery handling. Mexico's growing manufacturing sector added 2,100 AGVs in 2024, particularly in automotive plants near the US border. Fleet sizes average 85 units per deployment, utilizing advanced 5G private networks for coordination. North American integrators like Dematic and Bastian Solutions complete 120 installations monthly, supported by robust service networks spanning 450 locations.

United States Spearheads Innovation with Record Implementation Across Multiple Sectors

The US accounts for 78,000 active AGVs in the automated guided vehicle market, concentrated in e-commerce, automotive, and food processing sectors. Tesla's Gigafactory Nevada operates 850 battery-transport AGVs completing 12,000 trips daily, while FedEx's Memphis superhub runs 420 sorting robots processing 180,000 packages per hour. American facilities prioritize high-speed operations, with AGVs averaging 2.5 m/s versus 1.8 m/s globally. Silicon Valley's influence drives AI integration, with Fetch Robotics and Brain Corp embedding vision systems processing 30 frames per second. US manufacturers invested US$ 4.2 billion in AGV technology during 2024, seeking productivity gains amid 3.8 unemployment rates. The automotive sector leads adoption, installing 15,000 units this year across assembly plants in Michigan, Kentucky, and Alabama. Cold storage facilities represent the fastest-growing segment, adding 3,200 freezer-rated units as grocery e-commerce expands nationwide.

Asia Pacific Emerges as High-Growth Region Through Manufacturing Scale

Asia Pacific's automated guided vehicle market benefits from massive manufacturing output and government digitalization initiatives across China, Japan, and South Korea. Chinese e-commerce giant JD.com operates 70,000 AGVs in its smart warehouses, processing 16 million orders daily during peak seasons. Japanese precision manufacturers like Toyota and Honda maintain 22,000 AGVs supporting just-in-time production across 85 plants. South Korea's semiconductor fabs deploy 8,500 cleanroom-certified AGVs transporting wafers with nanometer precision. The region manufactures 95,000 AGV units annually, with Geek+, Quicktron, and Hikrobot shipping globally from production bases in Suzhou and Shenzhen. Singapore's port terminals utilize 450 heavy-duty AGVs moving 40-foot containers, demonstrating applications beyond traditional warehousing. India's growing market added 4,800 units in 2024, primarily in automotive and pharmaceutical sectors around Chennai and Pune. Regional AGV costs average US$ 18,000 per unit, enabling broader adoption among mid-sized enterprises.

Top Players in the Automated Guided Vehicle Market

- Balyo

- Bastian Solutions, Inc.

- Daifuku Co., Ltd.

- Dematic

- E&K Automation Gmbh

- Elettric80 S.P.A.

- Fetch Robotics, Inc.

- Hyster-Yale Materials Handling, Inc.

- Invia Robotics, Inc.

- Kmh Fleet Solutions

- Kollmorgen

- Locus Robotics

- Schaefer Systems International, Inc.

- Scott.

- Seegrid Corporation

- Swisslog Holding Ag

- System Logistics Spa

- Toyota Industries Corporation

- Other Prominent Players

Market Segmentation Overview:

By Product Type

- Tow-Vehicles

- Unit Load Carriers

- Pallet Trucks

- Assembly Line Vehicles

- Forklift Vehicles

- Others

By Battery Type

- Lead Battery

- Lithium-Ion Battery

- Nickel-based Battery

- Others

By Navigation Technology

- Laser Guidance

- Magnetic Guidance

- Inductive Guidance

- Optical Tape Guidance

- Vision Guidance

- Others

By Application

- Logistics and Warehousing

- Transportation

- Cold Storage

- Wholesale & Distribution

- Others

- Assembly

- Packaging

- Trailer Loading and Unloading

- Raw Material Handling

- Others

By End-user Industry

- Manufacturing Sector

- Automotive

- Electronics

- Pharmaceuticals

- FMCG

- Others

- Wholesale and Distribution Sector

- E-commerce

- Retail Chains/Conveyance Stores

- Grocery Stores

- Hotels and Restaurants

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 4.11 Billion |

| Expected Revenue in 2033 | US$ 10.83 Billion |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Bn) |

| CAGR | 11.4% |

| Segments covered | By Product Type, By Battery Type, By Navigation Technology, By Application, By End-user, By Region |

| Key Companies | Balyo, Bastian Solutions, Inc., Daifuku Co., Ltd., Dematic, E&K Automation Gmbh, Elettric80 S.P.A., Fetch Robotics, Inc., Hyster-Yale Materials Handling, Inc., Invia Robotics, Inc., Kmh Fleet Solutions, Kollmorgen, Locus Robotics, Schaefer Systems International, Inc., Scott, Seegrid Corporation, Swisslog Holding Ag, System Logistics Spa, Toyota Industries Corporation, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)