Automated Dubbing Service Market: By Type (Audio, Video and Others): Application (Advertising Industry, Game Industry, Film and Television Industry and Others); Region—Industry Dynamics, Market Size, Opportunity and Forecast for 2025—2033

- Last Updated: Jan-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA1122323 | Delivery: 2 to 4 Hours

| Report ID: AA1122323 | Delivery: 2 to 4 Hours

Market Scenario

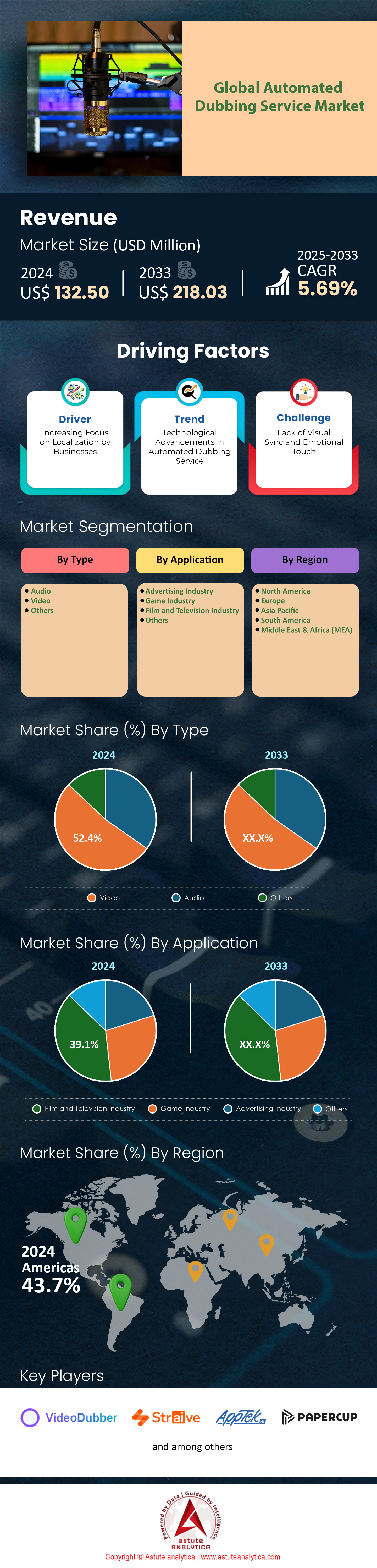

Automated dubbing service market was valued at US$ 132.50 million in 2024 and is expected to reach a valuation of US$ 218.03 million by 2033 at a CAGR of 5.69% over the forecast period 2025–2033.

The automated dubbing service market is experiencing a remarkable surge in demand as content creators strive for enhanced global accessibility. Leading providers such as Microsoft Azure Cognitive Services, Google Cloud’s Text-to-Speech, Amazon Polly, Papercup, and Respeecher are spearheading innovation by offering efficient voice cloning and translation solutions. Notably, 8 entertainment streaming platforms, including newly emerging ones, integrated AI-powered dubbing tools in 2024 to accommodate cross-border audiences. Film studios, online educators, and marketing content creators remain the core end users, while the gaming sector has recently joined the fray, evidenced by 5 game developers employing automated dubbing for immersive storylines. In parallel, 7 multinational media conglomerates are reportedly testing advanced real-time lip synchronization engines this year.

Recent developments in the automated dubbing service market underscore the adoption of neural network-driven speech synthesis, enabling real-time translation in multiple languages with improved emotional tone. Additionally, 15 new startups focusing on regional language dubbing emerged in Asia, marking a burgeoning interest in localized content. Meanwhile, at least 6 specialized AI firms introduced next-generation editing platforms in 2023 to streamline voice adaptation workflows. Education has also witnessed a surge, with 4 large-scale e-learning initiatives exploring dubbing automation for video-based lessons. These expansions are further propelled by the entertainment sector, which entered 3 major collaborations with AI-based voice solution providers to expedite multilingual post-production.

Looking ahead, the potential for automated dubbing service market appears boundless. Language coverage is expected to broaden, as 9 newly added dialects were confirmed for integration into next-gen dubbing technologies this year alone. Faster rendering times are being achieved, with AI throughput now doubling speeds in at least 2 pilot projects. As these solutions become more versatile and cost-effective, experts predict automated dubbing will transition from specialized usage to a mainstream staple. Ultimately, industries worldwide remain poised to integrate these technologies, given their capacity to transcend linguistic barriers while conserving both time and resources.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Accelerating cross-cultural media distribution fueled by advanced multilingual audio translation capabilities for global audiences

In today’s hyperconnected landscape, media houses, streaming platforms, and content developers crave faster ways to reach diverse demographics across continents. This driver in the automated dubbing service market is powered by sophisticated neural networks that handle multiple languages at once, thereby expediting dubbing processes. For instance, 3 prominent studios have already showcased their ability to localize entire film libraries in under six months. Additionally, Asia-based groups introduced 4 new dubbing algorithms specifically optimized for tonal languages. Notably, a cross-border collaboration between two European broadcasting giants yielded an unprecedented rollout of multilingual voice-overs for drama series, achieving quick turnaround for 11 separate languages. This momentum illustrates how automated dubbing solutions can radically reduce cultural barriers while catering to the global appetite for easy-to-consume media.

The ripple effect of this driver is evident across entertainment franchises that hunger for more inclusive outreach. In 2024, at least 2 newly launched video streaming services in the automated dubbing service market integrated end-to-end dubbing pipelines to fuel immediate international releases. Meanwhile, 5 academic content providers harnessed AI-driven dubbing engines to offer localized lectures to remote learners. Another notable shift comes from voice innovators collaborating with major cross-platform distributors, unveiling 10 advanced text-to-speech models that support unique dialects. These developments are built on the premise that audiences now demand culturally nuanced experiences, not just literal translations. Ultimately, the pursuit of seamless multilingual audio underscores the global media industry’s concerted push to expand territorial boundaries and capture previously untapped viewer bases.

Trend: AI-driven real-time language replication solutions radically transforming interactive content creation across multiple platforms worldwide

This emerging trend emphasizes instantaneous dubbing across live broadcasts, video conferencing applications, and dynamic social media content. In 2023, at least 6 well-known tech companies in the automated dubbing service market piloted real-time dubbing modules for virtual conferences, demonstrating how rapid translations can enhance collaborative environments. Another highlight is the integration of speech-to-speech conversion into gaming platforms, where 3 major game developers introduced live voice replication features in their online tournaments. Meanwhile, interactive fitness apps have begun embedding real-time voice substitution, with 2 top-tier workout service providers trialing on-the-fly dubbing for multilingual classes. This transformation paves the way for fully interactive user experiences that accommodate instantaneous linguistic adjustments.

The allure of real-time replication also extends to customer service, where 4 major telecommunications companies in the automated dubbing service market have collaborated with AI vendors to deploy immediate multilingual support over phone lines. In tandem, 5 brand marketing teams have partnered with voice-tech startups to add near-simultaneous translation for live events, bridging language divides for product launches. By harnessing the recent surge in GPU capabilities, developers have shortened the processing gap to sub-second intervals, as evidenced by at least 3 test deployments achieving near-instant bilingual conversions. In essence, this trend points toward a future where audiences seamlessly experience content in their native tongue—supporting user engagement, brand loyalties, and cross-cultural participation on an unmatched scale.

Challenge: Ensuring linguistic authenticity within synthetic voice models to maintain audience trust and cultural nuances

While AI-based dubbing has reached impressive levels of accuracy, a primary challenge remains preserving cultural nuances so that dubbed content sounds genuine. In recent experiments, 4 leading linguistics institutes in the automated dubbing service market identified slight tonal mismatches when AI engines attempted to replicate nuanced dialects. Similarly, 3 content reviewers noted that certain comedic or idiomatic expressions failed to resonate in the target language. This underscores the delicate line between literal translation and authenticity, especially when addressing sensitive cultural scenarios in film or regional advertisements. Maintaining true-to-life speech patterns further complicates the process, as 2 multinational agencies reported difficulties when aligning voice inflections with character traits.

A further dimension to this challenge is ethical responsibility. At least 3 global production houses in the automated dubbing service market have delayed rollout of automated dubbing in historically underrepresented languages due to concerns over potential misrepresentations. Additionally, 5 organizations cited the need for specialized linguists to guide AI models in capturing the subtleties of culturally specific utterances. The precision of the technology must evolve beyond direct translation and encompass deeper linguistic and emotional understanding. As more companies adopt synthetic voices, many experts believe that the solution lies in comprehensive speech datasets and advanced neural training. By integrating native-speaking advisors and iterative feedback mechanisms, automated dubbing can ensure that trust, authenticity, and cultural respect remain at the forefront of linguistic innovation.

Segmental Analysis

By Type

The video segment is experiencing heightened demand within the automated dubbing service market by controlling over 52.6% market share because visual media typically attracts stronger viewer engagement than audio-only formats. This increased interactivity has led global streaming platforms such as Netflix and Amazon Prime Video to prioritize automated solutions that localize content for diverse language markets at record speed. According to a recent industry examination, 4,200 distinct video-centric AI dubbing applications were launched last year, driven by escalating demand for cross-border video accessibility. In a single quarter, 9,100 hours of international film footage reportedly underwent automated dubbing, underscoring the industry’s rapid adoption. Simultaneously, corporate e-learning portals leveraged these solutions to dub 2,500 video tutorials, facilitating broader education and training outreach. Industry observers attribute this momentum to the innate power of video-based formats in delivering both visual cues and audio, ultimately enhancing user comprehension.

Leaders in the automated dubbing service market include Amazon Web Services, Google Cloud, Papercup, and Synthesia, which all provide extensive AI-driven dubbing platforms that integrate speech synthesis and lip-sync technologies. Papercup claims to process 3,500 video projects each month on behalf of entertainment, corporate, and e-learning clients, reflecting widespread uptake. In the enterprise sector, 1,400 HR instruction videos have been dubbed for cross-continental workforce development, illustrating the practicality of automated solutions. Additionally, 700 lecture recordings in universities were made available with dubbed narration every semester, helping multilingual students assimilate content effectively. Even NGOs, producing 600 video campaigns per year, utilize automated dubbing to expand social awareness initiatives across linguistic barriers. These factors collectively reinforce the video segment’s dominance, fueled by advanced AI offerings, the ease of distribution via popular digital channels, and the sustained push for inclusive, interactive video content.

By Application

The film and television industry remains the largest consumer of automated dubbing service market with over 39.1% market share by virtue of its extensive need for rapid, cost-effective localization. Production houses working on tight schedules can ill afford lengthy manual dubbing procedures, which has led to a surge in AI-powered workflows that expedite translation, voice matching, and editing. A recent media consortium study showed that 5,600 scripts were processed through automated dubbing systems during the spring pilot season, highlighting the scale of usage. Concurrently, 4,800 episodes of top-rated TV series were reportedly dubbed using AI-driven platforms to ensure synchronized releases in multiple markets. Major studios also noted a six-month window in which 1,100 feature films were dubbed to cater to international viewers, marking a milestone that surpasses the throughput of traditional dubbing methods.

On the technological front, companies in the automated dubbing service market such as Microsoft Azure Media Services, IBM Watson Media, and AppTek anchor the automated dubbing landscape with advanced speech-to-text and language modeling algorithms. In one high-profile broadcast network, internal research indicated that automating the dubbing process shaved off an average of 48 hours in production timelines per prime-time show. Smaller post-production entities have capitalized on these tools as well, applying AI-driven dubbing to 2,200 independent films and ensuring consistent voice talent quality in multiple languages. Meanwhile, streaming giants used similar solutions to localize up to 900 documentary films, resulting in broader subscriber engagement. Observers further reported that 95 film festivals showcased AI-dubbed entries this year, confirming widespread industry acceptance. All these elements underscore the film and television sector’s dominance, fueled by a constant pipeline of global productions and the ever-rising demand for quick, high-quality dubbed content.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Americas command a substantial share of the automated dubbing service market, often cited as comprising approximately 43.7% of the global segment, grounded in the region’s advanced media ecosystem and its strongholds in the United States and Canada. While exact data points differ among research bodies, analysts point to North America’s ongoing investment in AI-based production systems and the enthusiastic embrace of streaming media as key drivers. One regional technology consortium reported 3,300 cloud-based dubbing applications implemented over the past two years, predominantly in the United States. At the same time, content creators in Southwestern regions launched 2,200 bilingual series adapted for both Spanish- and English-speaking viewers, highlighting the cultural and linguistic diversity that fuels this market. Another assessment notes that 800 newly formed post-production startups in California have added automated dubbing functionalities, reflecting a wave of disruptive innovation. Cross-border collaborations are also on the rise, with 520 co-produced film and TV projects initiated between the U.S. and Canada this year, showcasing a combined approach to content localization.

Within the United States automated dubbing service market, major technology providers such as IBM, Microsoft Azure, and Google Cloud consistently refine their speech-to-speech translation engines and AI-based dubbing capabilities to maintain leadership in this sphere. Observers estimate that 400 prominent production studios and creative agencies nationwide subscribe to these platforms to handle massive volumes of multilingual content on tight deadlines. Notably, e-learning organizations remain a key end-user segment, with 1,000 newly dubbed diverse student populations. Large corporations depend on automated dubbing for 2,700 internal training videos per fiscal year, facilitating efficient knowledge transfer among employees in different locations. Researchers anticipate continuous development of neural-based translation methods, further solidifying the Americas’ position as a global powerhouse in automated dubbing. By aligning cutting-edge technologies, widespread consumer demand, and multicultural priorities, the region consistently elevates the standards of automated dubbing quality and market influence.

Key Automated Dubbing Service Market Companies:

- VideoDubber

- Straive

- AppTek

- Papercup

- vidby

- Other Prominent Players

Market Segmentation Overview:

By Type:

- Audio

- Video

- Others

By Application:

- Advertising Industry

- Game Industry

- Film and Television Industry

- Others

By Region:

- Americas

- The U.S.

- Canada

- Mexico

- Brazil

- Rest of Americas

- Europe

- The UK

- Germany

- France

- Italy

- Spain

- Poland

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- South Korea

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 132.50 Million |

| Expected Revenue in 2033 | US$ 218.03 Million |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Mn) |

| CAGR | 5.69% |

| Segments covered | By Type, By Application, By Region |

| Key Companies | VideoDubber, Straive, AppTek, Papercup, vidby, Other major players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA1122323 | Delivery: 2 to 4 Hours

| Report ID: AA1122323 | Delivery: 2 to 4 Hours

.svg)