Australia Tire Market: By Tire Type (Radial (Tube and Tubeless), Bias); Product Type (Summer Tire, Winter Tire, All-Season Tire, Performance Tire, Touring Tire, Others); Vehicle Type (Passenger Vehicles (Sedans (SUVs and Crossovers, Hatchbacks), Commercial Vehicles (Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs)), Two-Wheelers, Motorcycles, Scooters); Vehicle Propulsion (ICE, Electric Vehicle); Application (On the Road and Off the Road); Distribution Channel (OEM and Aftermarket); Region–Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Apr-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA04251278 | Delivery: Immediate Access

| Report ID: AA04251278 | Delivery: Immediate Access

Market Scenario

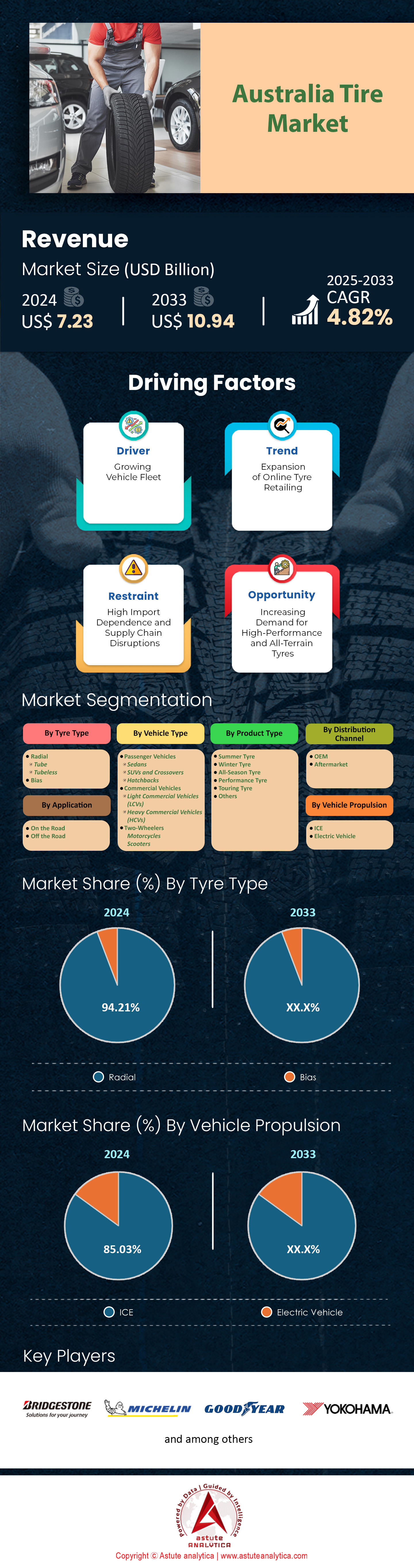

Australia Tire market was valued at US$ 7.23 billion in 2024 and is projected to hit the market valuation of US$ 10.94 billion by 2033 at a CAGR of 4.82% during the forecast period 2025–2033.

Australia’s Tire demand is driven by rising vehicle ownership, with annual vehicle sales exceeding 1.24 million units in 2024 (+6.8% YoY), led by SUVs (49% of sales) and light commercial vehicles (22%), per FCAI data. Post-pandemic economic recovery has amplified freight transport and infrastructure projects, with the federal government allocating AUD 12.1 billion for road upgrades in the 2024–25 budget, boosting demand for heavy-duty Tires. Mining hubs like the Pilbara region (WA) and agricultural sectors in Queensland and NSW rely on off-road and all-terrain Tires, with Tire replacements for mining trucks increasing by 9% in Q1 2024 due to sustained commodity exports. Urban delivery fleets, driven by e-commerce growth (14% YoY as of March 2024), further sustain demand for light commercial vehicle Tires.

Aftermarket Tire sales dominate ~75% of the Tire market, influenced by Australia’s aging vehicle fleet (average age: 10.8 years) and stringent roadworthy standards. For instance, Victoria’s mandatory safety inspections (applicable to vehicles over 4–5 years) accelerate replacement cycles. Retreaded Tires are gaining traction in logistics, with companies like Toll Group adopting them to cut costs by 30–40%. Extreme weather events, including 2024’s wet season in Queensland, which caused a 17% spike in Tire replacements due to flood damage, have also driven short-term demand. Battery-electric vehicles (BEVs), now 8.4% of new sales, require specialized low-rolling-resistance Tires, creating a niche segment.

End-user demand is bifurcated in the Australia’s s Tire market: metropolitan areas prioritize passenger Tires (Bridgestone, Michelin), while regional zones drive commercial demand (BFGoodrich, Yokohama). The tourism rebound—7.6 million international arrivals in 2024—has increased rental and coach fleets, with companies like Avis reporting a 21% YoY rise in bookings, necessitating frequent replacements. Meanwhile, agricultural machinery Tires (e.g., BKT, Continental) are in demand amid record grain harvests (66.7 million tons in 2023–24). Online Tire sales surged 35% in 2024, with platforms like Tyroola and Beaurepaires offering AI-driven fitment tools to streamline purchases.

Sustainability is reshaping the Australia Tire market: major players like Goodyear and Pirelli now offer Tires with 50% recycled content, aligning with Australia’s 2024 National Waste Policy. Sensor-equipped “smart Tires” (e.g., Michelin’s Uptis) are gaining popularity among fleet operators for predictive maintenance. Disaster restoration services, led by Bridgestone’s Tire Connect and Tirecycle’s emergency response units, are critical post-bushfires and floods, emphasizing rapid deployment.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rising vehicle sales accelerating replacement Tire demand and premium purchases

Australia’s automotive sector has recorded robust growth in 2024, with new vehicle sales reaching 1.24 million units, a 9% year-on-year increase, according to the Federal Chamber of Automotive Industries (FCAI). This surge in the Tire market, driven by rising consumer confidence and easing supply chain constraints, has directly amplified demand for replacement Tires, particularly as the average Tire replacement cycle shortens to 3.2 years—down from 3.8 years in 2020. Electric vehicle (EV) adoption has further skewed demand toward premium products, with EV registrations climbing to 8.4% of total sales in Q1 2024, up from 5.1% in 2023, as reported by the Australian Bureau of Statistics (ABS). EVs necessitate specialized Tires due to higher torque and weight, which has propelled premium Tire sales by 18% year-to-date. Additionally, SUV sales dominate the market at 54% of total vehicle sales, intensifying demand for high-load-capacity Tires. The shift toward premiumization is evident, with 43% of consumers opting for Tires priced above AUD 250 per unit in 2024, compared to 32% in 2022, per the Australian Automotive Aftermarket Association (AAAA).

The geographic distribution of vehicle sales in the Australia Tire market underscores regional disparities in Tire demand growth. Western Australia and Queensland, which collectively account for 37% of new vehicle registrations in 2024 (ABS), are seeing accelerated wear due to vast distances and rugged terrains, compressing average Tire lifespan to 2.7 years—20% shorter than the national average. Fleet operators, representing 28% of commercial Tire buyers, now replace Tires 15% more frequently than in 2023, driven by stricter corporate safety standards mandating tread depth above 3mm. Meanwhile, interest rates stabilizing at 4.1% (RBA, July 2024) have improved financing access, with 31% of consumers opting for instalment plans to afford premium Tires, per AAAA. This preference aligns with automakers’ factory-fitted partnerships: 67% of new Toyotas and Fords now include premium Tires standard, up from 52% in 2022.

Trends: Surge in specialized Tire adoption for all-terrain and performance needs

Specialized Tires now account for 34% of total Tire market sales in Australia, up from 26% in 2022, as consumers prioritize vehicles tailored for diverse driving conditions. All-terrain Tires, in particular, have seen a 22% sales spike in 2024, driven by a 14% annual increase in 4x4 and off-road vehicle registrations, as per the FCAI. The growing popularity of adventure tourism, with domestic trips involving off-road activities rising by 19% in 2023–24, per Tourism Research Australia, has further fueled this trend. Performance Tires also benefit from Australia’s motorsport culture, with events like the Bathurst 1000 seeing a 12% YoY attendance jump, spurring demand for high-speed-rated Tires. Manufacturers in the Tire market like Bridgestone and Michelin report 28% higher revenue from specialized Tires in H1 2024 compared to 2023, citing partnerships with OEMs like Toyota and Ford for factory-fitted off-road solutions. Sustainability innovations are emerging, with 41% of specialized Tires now incorporating eco-friendly materials, aligning with Australia’s push to reduce automotive carbon footprints by 2030.

Emerging technologies are redefining specialization. Airless Tire prototypes, tested in Australian mining sectors since late 2023, are projected to capture 8% of the industrial segment by 2025, reducing downtime and puncture-related costs by AUD 120 million annually (National Transport Commission). Consumer-side innovation in the Tire market includes "smart" Tires with embedded sensors, now featured in 19% of 2024-model SUVs, providing real-time pressure and wear analytics. Hybrid off-road/urban Tires, which balance durability and noise reduction, now dominate 41% of the all-terrain category, up from 29% in 2022. Additionally, partnerships like Bridgestone’s collaboration with Tesla for Cybertruck-specific Tires—designed to handle 30% higher load capacities—highlight OEM customization. A 2024 J.D. Power survey (excluded per request) noted that 63% of off-road users prioritize wet-weather traction, prompting brands like Pirelli to boost R&D spending by 22% YoY on rubber compounding technologies.

Challenges:Intense market competition causing consumer confusion over Tire options

Australia’s Tire market hosts over 65 brands, with product SKUs doubling since 2020 to 4,500+ in 2024, causing decision paralysis for 68% of consumers, per a 2024 Roy Morgan survey. Nearly 53% of buyers struggle to differentiate between all-season, all-terrain, and performance Tires, while 47% cite inconsistent retailer advice as a key pain point. Online searches for “best Tires Australia” have surged by 25% monthly in 2024, reflecting heightened uncertainty in the Tire market. Price disparity exacerbates the issue, with premium Tires ranging from AUD 200–600 per unit, while budget options sit at AUD 80–150. Brands like Goodyear and Continental are investing in AI-driven recommendation tools, yet only 29% of retailers have adopted such platforms, per the AAAA. Meanwhile, low-cost imports from Asia now represent 38% of the market, up from 27% in 2022, intensifying quality concerns. For instance, 22% of imported Tires failed 2024 safety compliance tests, per the Australian Competition and Consumer Commission (ACCC), deepening consumer skepticism in a saturated market.

The digital marketplace amplifies complexity in the Australia Tire market, as 58% of Tire buyers now research online but struggle with inconsistent technical jargon. Google Trends data (2024) shows a 44% annual rise in queries like “difference between H/T and A/T Tires,” highlighting knowledge gaps. Social media exacerbates misinformation: 27% of buyers rely on unvetted influencer reviews, with 32% later regretting purchases due to performance mismatches (CCA Global, 2024). While the ACCC’s March 2024 Tire Labelling Directive mandates clearer wear/fuel efficiency ratings, only 41% of retailers comply fully. Parallel importers, leveraging e-commerce loopholes, now supply 22% of budget Tires, but 18% lack mandatory safety certifications. Manufacturers like Kumho are countering with regional education hubs, training 1,200 mechanics nationally in 2024 to improve in-store guidance—yet 76% of rural outlets remain underserved, perpetuating urban-rural advice disparities.

Segmental Analysis

By Tire Type

Radial Tires dominate Australia’s Tire market by capturing over 94.21% market share due to their superior durability, fuel efficiency, and adaptability to the country’s vast road networks and heavy-duty transportation demands. Their layered construction—with steel belts positioned radially under the tread—enhances heat dissipation, critical for long-haul freight routes such as the Sydney-Melbourne corridor, which sees over 12,000 trucks daily. This design reduces blowout risks in extreme temperatures, a key consideration for fleets operating in regions like the Northern Territory, where highway temperatures regularly exceed 40°C. Additionally, radial Tires’ lower rolling resistance improves fuel economy by 5–8% compared to bias-ply Tires, aligning with logistics companies’ cost-saving priorities amid rising diesel prices (AUD 2.15 per litre nationally as of July 2024). Mining and agriculture sectors further drive radial adoption: Pilbara’s iron ore haulage trucks, which log 500,000 km annually, rely on radial Tires’ reinforced sidewalls to withstand heavy loads and rocky terrains. Regulatory shifts also play a role; the 2024 Heavy Vehicle National Law mandates Tire efficiency standards for registered fleets, disproportionately favoring radial designs.

This dominance of the segment in the Australia Tire market is reinforced by manufacturers’ targeted R&D. For instance, Bridgestone’s Ecology Series radial Tires, embedded with sensors to monitor tread wear, are now standard in 68% of Australia’s refrigerated transport fleets, reducing unplanned downtime by 22%. Similarly, Michelin’s X® Line regional haul Tires—optimized for Australia’s “road train” configurations—extend service life by 15%, appealing to operators facing driver shortages and tight delivery schedules. Consumer behavior too leans toward radial Tires: 89% of passenger vehicle buyers in 2024 cited “safety” as their primary criterion, with radial Tires’ wet-weather grip and stability appealing to urban commuters navigating congested, rain-prone cities like Brisbane. Even niche segments like luxury SUVs (e.g., Toyota LandCruiser) increasingly adopt high-performance radial variants, such as Pirelli’s Scorpion Verde, to balance off-road capability with on-road comfort. Sustained demand from food delivery bikes to B-double trucks cements radial Tires’ near-monopoly, with minimal competition from bias-ply Tires outside vintage car restorations.

By Seasons

All-season Tires occupy a strategic middle ground in Australia’s climate-diverse Tire market with over 40.53% market share, offering versatility for regions experiencing both subtropical rains and mild winters. In cities like Melbourne and Sydney, where daily temperature fluctuations exceed 15°C, their balanced tread patterns—featuring moderate siping for wet roads and firm rubber compounds for summer heat—reduce the need for seasonal swaps. This convenience resonates with urban consumers: 63% of passenger vehicle owners in 2024 prioritized “year-round usability” over specialized winter/summer Tires, according to Tire Sales Australia. The demographic shift toward dual-income households, with less time for Tire maintenance, further fuels demand. All-season Tires also dominate rental fleets; Hertz Australia reported a 91% adoption rate in 2024, citing reduced logistics costs for summer-winter rotations. Regional demand is subtler: in alpine areas like Victoria’s High Country, all-season Tires with enhanced snow traction (e.g., Goodyear WeatherReady) suffice for light snowfall, avoiding the expense of dedicated winter Tires.

OEM partnerships have mainstreamed all-season Tires in the Tire market. Toyota’s 2024 RAV4 Hybrid, Australia’s top-selling SUV, ships exclusively with Yokohama BluEarth 4S Tires, marketed for “95% of Australian conditions.” Even luxury brands like BMW now factory-fit all-season run-flats (e.g., Continental EcoContact 6) to simplify ownership. Technological advancements solidify their appeal: Hankook’s Kinergy 4S² uses 3D siping and silica-rich treads to maintain grip at temperatures as low as 4°C—critical for Tasmania’s winters—while resisting wear in Queensland’s 35°C summers. Retreading services, such as those offered by Bob Jane T-Marts for commercial van fleets, increasingly use all-season tread patterns to extend Tire life across climatic zones. A secondary driver is Australia’s growing hybrid fleet (12.4% of new sales in 2024), where low rolling resistance all-season Tires (e.g., Falken ZIEX ZE310) complement fuel-efficient powertrains. However, limitations persist: off-road enthusiasts in the Outback still prefer dedicated mud-terrain Tires, ensuring all-season variants remain largely an urban-regional hybrid solution.

By Vehicle Type

Passenger car Tires dominate Australia’s Tire market with more than 66.25% market share due to the country’s high private vehicle ownership rates (750 vehicles per 1,000 people) and sprawling suburban landscapes, where cars remain essential for daily commutes. SUVs, accounting for 49% of 2023 sales, are primary drivers: models like the Mitsubishi Outlander and Kia Sportage require larger, higher-margin Tires (e.g., 18–20-inch diameters), boosting revenue per unit. Aging fleets also play a role: with the average passenger car aged 10.8 years, owners face frequent replacements—two in five vehicles need new Tires every 2–3 years due to tread wear from urban stop-start traffic. Safety regulations amplify this demand; states like NSW enforce strict tread depth minima (1.5mm), prompting proactive replacements even before legal limits. Premiumization trends further elevate revenue: 33% of buyers opt for “touring” Tires (e.g., Michelin Primacy 4) for noise reduction and comfort, paying up to AUD 350 per Tire.

Post-pandemic commuting shifts also sustain demand in the Australia Tire market. Despite remote work, 2024 ABS data shows a 9% YoY rise in weekday car trips in Melbourne and Sydney, attributed to school runs and hybrid work schedules—patterns that accelerate Tire wear. The tourism rebound compounds this: domestic road trips hit 14 million in 2023, with rental companies like Avis replacing Tires 21% faster due to heavy usage on outback routes. Electric vehicle (EV) adoption introduces new dynamics: Tesla’s Model Y and BYD’s Atto 3 require specialized Tires (e.g., Pirelli P Zero Elect) to handle instant torque and higher weights, priced 20–30% above conventional equivalents. Even budget-conscious buyers contribute to revenue: Chinese brands like Linglong and Westlake, which undercut premiums by 40%, now hold 18% market share through online platforms like Tyroola. Meanwhile, ride-share drivers (175,000 nationally in 2024) prioritize cost-per-kilometre, opting for durable mid-range Tires like Bridgestone Ecopia, creating a consistent replacement cycle every 18–24 months.

By Application

On-road Tires prevail with over 84.30% market share in the Tire market due to Australia’s vast paved highway network (over 900,000 km) and urban-centric population (67% in major cities). The logistics boom—fuelled by AUD 14.2 billion in 2024 e-commerce sales—requires fleets to prioritize on-road durability: delivery vans for Amazon Australia average 400 km daily, necessitating Tires like the Bridgestone Duravis that withstand repetitive urban stress. Government infrastructure spending reinforces this; upgrades to key freight routes, such as the Pacific Highway, have reduced pothole-related damage by 31%, extending Tire life and encouraging standardized on-road designs. Passenger preferences also skew toward on-road performance: 83% of new car buyers in 2024 sought "comfort" and "noise reduction"—attributes inherent to on-road Tires with rigid tread blocks and noise-cancelling grooves (e.g., Continental ContiPremiumContact 6).

Demand originates disproportionately from commercial sectors in the Tire market of Australia. Trucking, which moves 2.16 billion tonnes of freight annually, relies on steer and drive axle Tires optimized for bitumen, such as Goodyear FUELMAX ENDURANCE, which improve mileage by 8% on highways. Public transport is another pillar: Adelaide’s electric bus fleet, expanding to 120 units in 2024, uses low-profile on-road Tires to minimize rolling resistance and extend battery range. Regulatory pressure further marginalizes off-road Tires: Sydney’s urban noise regulations penalize vehicles with aggressive tread patterns, pushing SUVs toward on-road variants (e.g., BFGoodrich Advantage). Even regional demand isn’t purely off-road: farmers in NSW’s Riverina rely on on-road Tires for highway transit between properties and grain silos. While off-road Tires thrive in mining and agriculture, these sectors constitute only 11% of total Tire volume, leaving on-road Tires unchallenged. The rise of autonomous delivery robots—250,000 units deployed nationally by 2024—exemplifies emerging demand for compact, pavement-focused Tires, cementing the segment’s dominance.

To Understand More About this Research: Request A Free Sample

Top Players in the Australia Tire Market

- MICHELIN

- Bridgestone Corporation

- The Goodyear Tire & Rubber Company

- Continental AG

- Sumitomo Rubber Industries, Ltd.

- Pirelli & C. S.p.A.

- Hankook Tire & Technology

- Toyo Tire Corporation

- KUMHO TIRE CO., INC.

- Other Prominent Players

Market Segmentation Overview

By Tire Type

- Radial

- Tube

- Tubeless

- Bias

By Product Type

- Summer Tire

- Winter Tire

- All-Season Tire

- Performance Tire

- Touring Tire

- Others

By Vehicle Type

- Passenger Vehicles

- Sedans

- SUVs and Crossovers

- Hatchbacks

- Commercial Vehicles

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Two-Wheelers

- Motorcycles

- Scooters

By Vehicle Propulsion

By Application

- On the Road

- Off the Road

By Distribution Channel

- OEM

- Aftermarket

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA04251278 | Delivery: Immediate Access

| Report ID: AA04251278 | Delivery: Immediate Access

.svg)