Global Augmented Reality Software Development Kit Market: By Deployment (Cloud, On Premise, Web Based/Saas); By Platform (Linux, MAC, Windows); By Mobile (Android, iOS); By Enterprise Size (Large Enterprises, SMBs); By End User (Retail, Automotive, Manufacturing, Healthcare, Education, Gaming & Entertainment, Aerospace & Defense, Others); By Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 25-Nov-2024 | | Report ID: AA1222337

Market Scenario

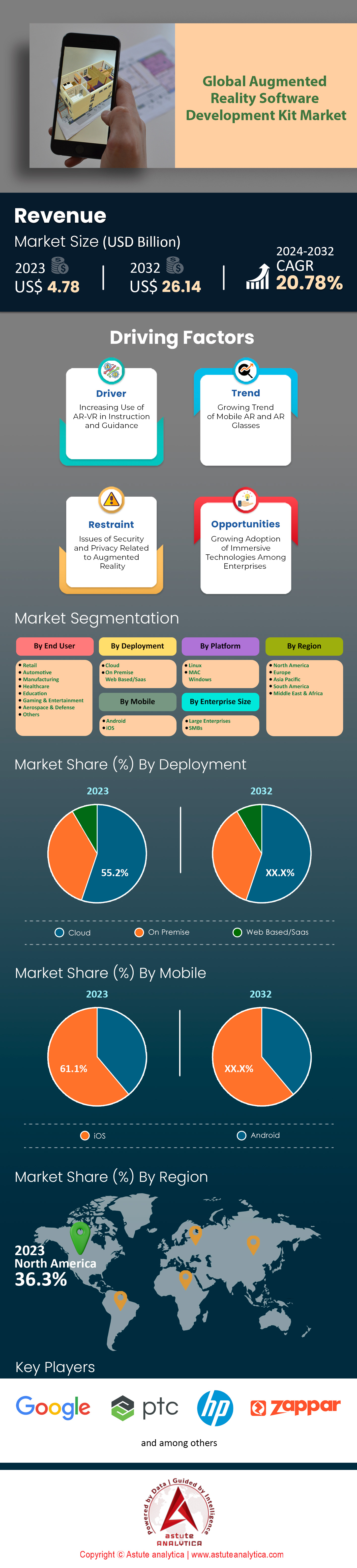

Global augmented reality software development kit market generated a revenue of US$ 4.78 billion in 2023 and is estimated to reach a valuation of US$ 26.14 billion by 2032 at a CAGR of 20.78% during the forecast period, 2024–2032.

To develop powerful AR applications, developers use Augmented Reality Software Development Kits (AR SDKs) which include ready-made code, libraries, frameworks and tools necessary for implementing such features as e.g. recognition, AR tracking and rendering. As a result, the AR development process has become much more efficient and the layers of abstracted digital material can be placed within the real time context. Considering the steadily increasing number of smartphone owners (6.8 billion as of 2023), AR SDKs have become much more available today than they were a few years ago and this has expanded the capabilities of developers across different platforms.

The world’s increasing uptake of augmented reality software development kit market among different industries such as gaming, education, healthcare, and retail has led to a corresponding rise in demand for AR SDKs. For example, it was estimated that the AR gaming market made revenues worth around $9 billion in 2023, and few AR games like Pokemon Go have amassed over 1 billion downloads since its launch. Potential end-users of AR SDKs are these software developers who want to design interesting AR experiences, widening the scope of the gaming experience, educational institutions within the scope of the creation of advanced learning instruments, and companies aiming at utilizing AR for training and operations. Such acceleration is attributed to the increased mobile device processing power which is exhibited by sales of more than 1.5 billion AR-enabled smartphones in the world and positive consumer sentiments ready to embrace advanced technologies that drive demand to another level.

There are wide ranging uses of the augmented reality software development kit market, such as in the medical field, where AR is already being harnessed for medical training simulators that are expected to swell the global medical AR market to approximately $1.5 billion by 2025. In the retail industry, AR integrations allow customers to virtually see how products will fit them and adopt what some companies such as IKEA whose AR application has managed over 10 million downloads. Some of the prominent emerging trends and growth drivers for the augmented reality software development kit market are:

- Combining AR with Artificial Intelligence to make interactions more pro-active;

- Building AR cloud services that enable social experiences, with more than US$500 million in AR cloud startup investment in 2023;

- Identifying AR for use with remote assistance and collaboration tools, where remote workers were estimated at 300 million globally growing out of the COVID-19 pandemic.

The AR SDK market is taking form in a fairly competitive space with the likes of Apple (ARKit) and Google (ARCore) having over 1 million active developers updating their SDKs to more advanced features such as environmental understanding and persistent augmented reality technology to meet the demands of developers and end-users.

To Get more Insights, Request A Free Sample

Key Dynamics of Augmented Reality Software Development Kit Market

Drivers

Increasing Requirement to Enhance Decision Making Solutions Among Businesses

Organizations are already starting to use technology to their advantage to revolutionise the product life cycle, educate and train field technicians, increase customer happiness, and improve strategic decision-making. By gathering enormous amounts of data to produce clear, understandable 3D modules that are placed on the real world, augmented reality provides "hyper visualisations." The value of data visualisation in business decision-making, particularly for large and complicated datasets, cannot be overstated.

AR has established itself as a must for managers and supervisors in the augmented reality software development kit market. For instance, it enables them to quickly read real-time performance data. They'll identify precisely who isn't performing to their full potential, ascertain why, and put new tactics into place. AR can indicate the issues that employees are having and the areas where managers need to focus their efforts and adjust to get the desired results.

Increasing Adoption of AR-VR in Instruction and Guidance

Instruction, training, and coaching are important tasks that augmented reality is already reinventing. They are essential to raising worker productivity and, when carried out well, can free management from additional duties. However, they often cost a very high amount, require a lot of work, and yield little profit.

By allowing students to learn and professors to instruct in a more immersive, technological setting, augmented reality technology is introducing new methods of education. For instance, biology students can interact with plants, mammals, birds, insects, and amphibians through computer simulations, while medical school students can perform experimental procedures in virtual reality settings in the augmented reality software development kit market. However, not every university has equal access to these and other cutting-edge technologies. As a result of a lack of financial and networking resources to use new technologies, some students will be at a disadvantage during their preparation and while applying for jobs.

Users can interact with virtual items that appear in their actual surroundings using augmented reality (AR), also known as mixed reality (MR). The scenarios where users must engage with virtual items while also keeping situational awareness of their physical environment benefit the most from this. For example, students might use digital overlays to follow instructions for challenging tasks like learning how to fix a tricky machine or administering a procedure.

Restraint

Issues of Security and Privacy Related to Augmented Reality and High Cost of Implementation

Security and privacy issues hinder the augmented reality software development kit market. These issues have emerged because of ineffective augmented reality programming, as well as the disregard and supervision displayed by both end users and creators of AR apps and devices. The ability to safeguard the user's identity and privacy is only present in a select few AR applications. The fundamental issue is that there are no rules outlining the proper ways to do business in an AR environment. This implies that the exploitation of users' personal information is a possibility when AR technology is employed for evil. Numerous AR systems also rely on shady third-party integrations or apps.

The system may cache data on a local computer or network server, like other collaboration programmes. These data may need to be safeguarded, which could entail encryption. The rest of the consumers’ network can be accessed by using the same systems as a launching pad. Additionally, a DDoS attack might have unanticipated outcomes in an AR system, so if a system is crucial for a business process or classroom, be ready with a business continuity and disaster recovery plan. Although it may be challenging to predict how compliance and legal standards will affect these new contexts, sensitive data still needs to be securely protected.

Trend

Growing Trend of Mobile AR and AR Glasses

A favourable environment for growth is being created over the predicted period by the ongoing improvements in augmented reality (AR) technology and the growing use of mobile phones in the augmented reality software development kit market. The ongoing efforts to provide consumers with a better and more immersive experience are another element fuelling industry expansion.

As a result of their capacity to smoothly combine the user's vision with the virtual environment, smart glasses are gaining pace and popularity. These glasses have a display, sensors, accelerometers, intelligent software, and internet connectivity that enhance the user's view with contextual information. Smart glasses with augmented reality capabilities are being employed in daily home and business settings. The growing head-mounted display industry is the main market driver for augmented reality glasses.

Segmental Analysis

By Deployment Mode Analysis

The augmented reality software development kit market grew significantly over the past five years delivering complex business demands and other transformations. With over 55% market share, cloud-based deployments are now the most dominant model on the market. Owing to the shift, more than 15,000 AR technology (AR) apps now support cloud platform-based infrastructures for rapid Real Time Operating System (RTOS) update and distribution of information. This has been driven by advances in technology and the ability to provide seamless updates and cater for large scale user interaction irrespective of their location. The possibility for harnessing a wealth of backend hardened with the Internet, give rise to the development of multiplayer AR applications where users can interact online simultaneously.

Physical deployments are still essential for companies where defining factors are data security and privacy. So far, over 7 500 AR applications are collectively deployed by health and defence industries on the local servers in order to adhere to the strict regulatory provisions. Such on-premises systems in the augmented reality software development kit market support the use of AR in critical applications such as internal systems for secure data presentation or remote help. The management of the hardware and software environment also increases the operational self-sufficiency.

However, web based or SaaS models are becoming popular among the small and mid-size businesses. In the year 2023, around 5,000 small and medium-sized companies implemented SaaS based AR’s in their business activities as a means of improving efficiency and customers prospects. Lower position entry points which include low initial investments and the need for little infrastructure make SaaS appealing. These platforms allow users access AR applications through browsers and many of these applications are web-based leading to over a million end-users who accessed AR content via the SaaS model.

By Platform Analysis

For the development of cross AR applications, the selection of Mac development platforms in the augmented reality software development kit market continues to be a key factor for developers in 2023. More than 20,000 developers creating AR applications developed AR over the macOS, which holds more or less 40.3% of the total market share. These developers started to codify with superior micro motive structural characteristics incorporated in AppleMac’s M1 & M2 chips. Now, this includes high breeze lifting features that provide high-fidelity object rendering and advanced motion tracking. Hence, the total number of AR applications on the macOS platform has exceeded 5,000 applications designed for activities like education, professional design, and more.

On the other hand, Windows platforms in the augmented reality software development kit market still are a stronghold particularly in enterprise settings. In 2023, more than 15,000 developers were building AR applications for Windows with the help of the Microsoft Mixed Reality Toolkit. The use of a wide range of hardware, in particular HoloLens devices, has contributed to the establishment of more than 2,500 corporate AR solutions. These applications are already widely used in the areas of engineering and even in manufacturing where they help more than 500,000 professionals in maintaining equipment and even virtual prototyping.

Cross-platform development tools are becoming increasingly vital to enhance the outreach. Such frameworks like Unity and Unreal Engine allow more than 50,000 AR developers to design applications which are cross-platform compatible with macOS, Windows and Linux. This approach has also enabled the launch of up to 8,000 cross-platform AR applications in the year 2023, all of which offer the same experience to more than 100 million users across the world.

By End User Analysis

The augmented reality software development kit market caters to a wide range of end users meaning their impact is felt across a number of industries. Wherein, more than 30% of revenue comes from the gaming and entertainment sector which continues to be a stronghold. As of now, there are more than 35,000 AR games integrated across various platforms. For instance, a franchise “Pokemon Go” has been able to retain more than 100 million active users around the globe, generating annual revenues surpassing $1.2 billion. Moreover, investments in AR gaming startups have exceeded US$ 500 million in the year 2023 alone and the trend is owed to the success of such games in the market.

AR Technology in the augmented reality software development kit market has also arisen as crucial as the education sector has started to embrace and use it. It is estimated that more than 20 million students worldwide use augmented reality in the curriculum, which has been adopted by over 4,000 educational institutions worldwide. Applications such as AR anatomy are used in the course of more than 500,000 medical students and anatomical models interact in 3D allowing medical students to understand complex subjects easily. In healthcare, AR is changing the way patients are treated and professionals are trained. AR-assisted surgical systems have been used in over 1,500 hospitals and reduced surgery time by 30 minutes on average. AR-based training simulation has been used by over 2,500 medical professionals, rendering measurable improvements in skill efficiency and results of patient care.

By Mobile Analysis

In 2023, mobile segment in the augmented reality software development kit market bifurcated into iOS and Android. Wherein, iOS dominates the market with around 61.1% market share. It has been found that over 25,000 AR Apps are available on the apple app store alone. Apple has a solved ecosystem: manufacturers build devices based on AR developer standards and optimizations, resulting in over 500 million AR content usage active users on iOS alone. Ever since ARKit 5 was released, it became possible not just to add simple features such as face tracking, but to create entire scenes, resulting in over 5000 AR apps.

On the other hand, Android’s ecosystem is rich but complex, where opportunities co-exist side by side with challenges. The Google play application store has more than 20,000 AR applications which serve the growing global Android population of more than 1 billion devices. After which applications have been developed for more than 500 Android devices maximising any software. This had the potential to optimise hardware and cross many barriers. Due to the launch of ARCore Depth API, over 4000 Android apps were able to have occlusion and use environmental interaction in a much more realistic way.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The augmented reality (AR) software development kit market in North America is expanding at a fast rate and dominating with over 36.3% market share thanks to technological developments and increased utilization around the globe. The United States takes the lead in the region and in Silicon Valley, there are over-600 companies that are developing AR solutions. In particular, more than 50 AR projects have been implemented by the U.S. Department of Defense for training and increasing operational efficiency. Such governmental support is essential for advancing the market. As well, Canada is significant with Toronto being known as the tech center. The total number of startups focusing on AR in the city surpasses 100 and a major focus is on retail and e-commerce enhanced by AR in the customer experiences. Such local innovation ecosystem is fueled by significant venture capital which has surpassed US$ 1 billion in 2023 alone.

According to a report provided by Cider Smart Management, the launch of the application in Asia-Pacific countries’ augmented reality software development kit market was rapid last year, with overwhelming contributions from China, Japan and South Korea. China, as the first technology adopter, has more than 1,000 companies that specialize in developing AR based applications majorly for e-commerce and manufacturing industries of the economy. Due to the promotion of digitization by the Chinese Government, yar has been deployed in smart city development programs in major Chinese metropolitans. Japan has employed AR in the automotive and gaming industries for extended periods, and it is famous for high technologies. More than 200 AR applications were added in Japan this year, it was offered by companies in hopes of increasing user interactivity and participation in the AR applications. South Korea, backed by robust telecommunication networks, is improving how AR is seen in education and entertainment and over 150 educational centres have integrated AR technologies into their syllabus enhancing learning processes.

Even on such a promising trajectory, North America and APAC regions have certain constraints that may dampen the augmented reality software development kit market growth. In North America, the primary issue is the absence of competent AR developers with two jobs available against one qualified person. This deficiency points out that the educational institutions should make reforms in their programs for graduates to meet the challenge of finding work. In the case of the APAC, worries regarding data protection still exist, especially in China where laws and supervision are still under development. But the quick pace in the region’s technological growth and effective government support should help ease the challenges. In the longer term, the AR software development kit market in both regions has bright prospects with many opportunities for growth thanks to constant advances in technology and cross-industry integrations. With the AR technologies drawing more attention from businesses and consumers , the AR applications are expected to be more sophisticated and easy to use, then North America and APAC are likely to remain the dominant players in the AR arena.

List of Key Companies Profiled:

- Apple, Inc.

- PTC, Inc.

- HP

- Zappar Ltd.

- AWS

- EON Reality

- MAXST

- Zudan

- Vision Star Information Technology

- Other Major Players

Market Segmentation Overview:

By Deployment

- Cloud

- On Premise

- Web Based/Saas

By Platform

- Linux

- MAC

- Windows

By Mobile

- Android

- iOS

By Enterprise Size

- Large Enterprises

- SMBs

By End User

- Retail

- Automotive

- Manufacturing

- Healthcare

- Education

- Gaming & Entertainment

- Aerospace & Defense

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The U.K.

- Germany

- France

- Italy

- Spain

- Poland

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 4.78 Billion |

| Expected Revenue in 2032 | US$ 26.14 Billion |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 20.78% |

| Segments covered | By Deployment, By Platform, By Mobile, By Enterprise Size, By End-User, By Region |

| Key Companies | Google, Apple, Inc., PTC, Inc., HP, Zappar Ltd., AWS, EON Reality, MAXST, Zudan, Vision Star Information Technology, Other Major Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)