Atrial Fibrillation Market: By Type (Paroxysmal Afib, Persistent Afib, Chronic/Permanent Afib); By Technology (Microlife AFIB Technology, Hybrid Surgical-Catheter Ablation, Cryotherapy); By Treatment (Diagnosis, Medication); By End User (Hospitals, Care Centers, Outpatients, Ambulatory Services); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 29-Oct-2025 | | Report ID: AA1222338

Market Snapshot

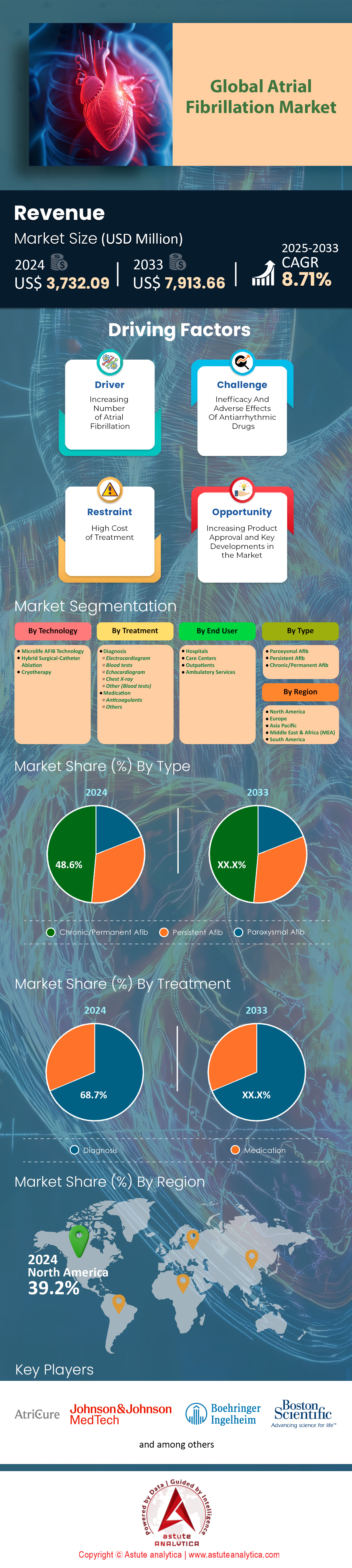

Atrial fibrillation market generated revenue of US$ 3,732.09 million in 2024 and is estimated to reach a valuation of US$ 7,913.66 million by 2033 at a CAGR of 8.71% during the forecast period, 2025–2033.

Key Findings Shaping the Market

- Based on type, Chronic/Permanent Afib segment is anticipated to experience the most significant growth and capturing more than 48.6% market share.

- Based on technology, cryotherapy is projected to dominate, capturing a significant 53.7% share of the market.

- Based on treatment, diagnosis segment maintaining a leading position in the market with over 68.7% market share.

- By end-user, hospitals takes the lead and remain dominant in the atrial fibrillation market.

- North America to remain the largest regional contributor with over 39% market share.

An expanding patient base fundamentally shapes lucrative opportunities within the atrial fibrillation market. For instance, in March 2025, about 5 million Americans were living with the condition, and forecasts show this number will exceed 12.1 million by 2030. Consequently, this growth drives a significant economic burden, creating urgent demand for cost-effective solutions. The mean unadjusted annual healthcare expenditure for an individual with AFib was $25,451 in 2024, while the incremental annual expenditure directly attributable to the condition was $6,185 per person. Moreover, for patients with concurrent cancer, this incremental cost skyrockets to $12,052, signaling a clear need within the atrial fibrillation market for efficient management strategies.

In addition, demand for interventional treatments is robust, as evidenced by high procedural volumes. A recent registry report included data from 70,296 first-time ablation procedures, setting a high watermark for the sector. Correspondingly, performance benchmarks are now being established, with data suggesting an annual hospital volume of 190 procedures is ideal for optimal outcomes. Clinical trial activity further underscores future demand shaping the market. Large-scale studies like the OPTION trial enrolling 1,600 patients and the OPTIMAS trial randomizing 3,600 patients are actively refining future care protocols and product pipelines.

Furthermore, a powerful technological shift toward Pulsed Field Ablation (PFA) is redefining the competitive landscape of the atrial fibrillation market. Post-approval safety data from the MANIFEST-17K survey, involving over 17,642 patients, is building crucial clinical confidence. Similarly, companies are validating their systems through rigorous trials, such as Kardium's PULSAR study which involved 183 patients. The efficiency of PFA is a key driver, with average ablation times as low as 25.5 minutes being reported. As a result, innovative research models, like decentralized trials successfully enrolling 513 participants, are accelerating the path to commercial success for new devices.

To Get more Insights, Request A Free Sample

Emerging Avenues Propel Atrial Fibrillation Market Growth Forward

- A major opportunity lies in the rapid consumer adoption of wearable technology for health monitoring. Devices from companies like Apple and Samsung now incorporate sophisticated sensors and AI-driven algorithms capable of early AFib detection. This trend empowers patients with real-time data, fostering proactive engagement with clinicians and creating a massive new market for integrated digital health platforms and associated data analytics services that connect patients directly to providers.

- Another key trend is the intensified clinical focus on holistic, upstream risk factor modification to prevent AFib onset and progression. Recent research highlights how lifestyle factors have a profound impact on cardiovascular health. This creates a burgeoning atrial fibrillation market for specialized nutritional programs, digital therapeutics, and patient education platforms designed to manage conditions like hypertension and obesity, thereby reducing the lifetime risk of developing atrial fibrillation.

Left Atrial Appendage Occlusion Devices Are Reshaping Stroke Prevention

A key driver in the atrial fibrillation market is the rapid adoption of Left Atrial Appendage Occlusion (LAAO) devices for non-pharmacological stroke prevention. This trend is quantified by an estimated 100,000 LAAO procedures performed in 2024. Robust clinical data from large-scale trials fuels this growth. The landmark Amulet IDE trial, the largest of its kind with 1,878 patients, is yielding crucial five-year outcomes. Similarly, the OPTION trial randomized 1,600 patients to compare LAAO against anticoagulants post-ablation. This clinical validation is expanding indications and boosting physician confidence.

The competitive landscape of the atrial fibrillation market is also intensifying as next-generation devices prove their value. Five-year data from the Amulet IDE trial showed the Amulet device resulted in fewer fatal or disabling strokes (22 vs. 39) and fewer device-related precursor events (31 vs. 63) compared to the Watchman device. Meanwhile, new competitors are advancing, with Conformal Medical’s CONFORM trial enrolling 500 of its 1,600 patients by April 2025 and its European GLACE study enrolling 80 patients. Future data flow is assured, with massive trials like LAAOS-4 planned to enroll 4,000 participants, ensuring sustained market expansion.

Artificial Intelligence Is Revolutionizing Atrial Fibrillation Diagnostics And Patient Management

Artificial intelligence is revolutionizing the Atrial fibrillation market by enabling proactive prediction and management. AI algorithms are gaining regulatory validation, shifting the paradigm from reaction to prevention. For instance, Tempus secured FDA 510(k) clearance in June 2024 for its ECG-AF tool that predicts AFib risk. Likewise, OMRON received FDA authorization in November 2024 for home blood pressure monitors with AI-based AFib detection. This technology is already being implemented, with Vektor Medical’s Vmap AI mapping system used in over 1,000 procedures across 20 U.S. hospitals.

Beyond detection, AI delivers significant procedural efficiencies and personalization in the atrial fibrillation market. A 2024 study found an AI ECG mapping system cut total procedure duration by 233 minutes. Furthermore, a 2025 study showed the DeePRISM AI model could accurately predict AF termination sites. The power of AI in risk stratification is also growing. One model, detailed in September 2025, was trained on data from 1.8 million patients and 1.2 billion data points to personalize treatment. A separate 2024 machine learning study involving 18,388 patients with AFib and cancer also predicted ischemic stroke with high accuracy, showcasing AI's transformative potential.

Segmental Analysis

Aging Demographics and Comorbidities Propel Chronic AFib Segment Dominance

The Chronic/Permanent Afib segment is on a trajectory to capture a commanding 48.6% of the atrial fibrillation market. This dominance is fundamentally tied to an aging global population, as the progression from intermittent to permanent atrial fibrillation is strongly age-dependent. For instance, the average age of patients with nontransient atrial fibrillation is approximately 76 years. Consequently, as populations age, the pool of patients requiring continuous, long-term management expands significantly, fueling demand for a broad spectrum of pharmacological and device-based interventions. The sheer scale is staggering, with projections indicating that 12.1 million people in the U.S. will have atrial fibrillation by 2030. This trend is further amplified by the rising prevalence of comorbidities like heart failure and chronic kidney disease, which complicate patient management and necessitate more intensive, ongoing care, thereby solidifying the segment's market leadership within the atrial fibrillation market.

The clinical and economic burden of managing advanced atrial fibrillation further cements this segment's value. A crucial finding reveals that about one in three patients are first diagnosed in an emergency room setting, often leading to costly hospitalizations. One study from 2024 identified a massive cohort of 4,834,977 patients with nontransient atrial fibrillation in the United States, quantifying the extensive existing patient base. These individuals often present with a higher prevalence of comorbidities, demanding more comprehensive and expensive treatment regimens. With a lifetime risk of developing atrial fibrillation as high as 1 in 3, the future pipeline of patients transitioning into the chronic stage is immense, ensuring sustained growth and investment focus.

- A notable treatment gap exists, with a 2024 study finding that roughly 30% of individuals with atrial fibrillation did not receive anticoagulant medication.

- Recent data indicates that the number of U.S. adults with atrial fibrillation is around 10.55 million, a figure three times higher than prior estimates.

- The growing number of patients with complex health profiles increases the average cost of care per patient annually.

Procedural Efficiency and Safety Cement Cryotherapy's Market Leadership

Cryotherapy is set to dominate the technology landscape of the atrial fibrillation market, capturing a significant 53.7% market share due to its compelling value proposition of procedural efficiency and enhanced safety. Electrophysiologists and hospital administrators increasingly favor cryoballoon ablation because it involves significantly shorter procedure times compared to traditional radiofrequency methods. This efficiency allows for greater patient throughput, a critical economic driver for cardiac labs. The technology's "single-shot" capability simplifies the complex process of pulmonary vein isolation, lowering the learning curve for physicians and promoting wider adoption. Continuous innovation, evidenced by ongoing clinical trials like the one initiated in 2024 for the CoolCryo System and another for the POLARx Cardiac Cryoablation System, reinforces market confidence and signals a robust product pipeline in the atrial fibrillation market.

Furthermore, the technology's superior safety profile is a key differentiator that attracts both clinicians and patients. As of 2024, accumulating data continues to validate cryoablation as a highly effective treatment with low complication and recurrence rates. Clinical studies have demonstrated that cryoablation is associated with less atrial structural change and a reduced risk of critical complications such as cardiac perforation. This improved safety translates into fewer rehospitalizations, lowering the overall cost of care for healthcare systems. The significant number of patients achieving freedom from atrial arrhythmia recurrence in clinical trials provides tangible proof of its efficacy, making it a preferred choice for treatment and justifying its projected dominance in the atrial fibrillation market.

- A prospective study updated in September 2025 is evaluating a new cardiac cryoablation system's safety and effectiveness.

- Lower procedural risks associated with cryoablation lead to shorter patient recovery times.

- The technique's predictability and reproducible outcomes are driving its standardization in treatment protocols.

Early Detection Imperative Fuels Diagnostic Segment's Unwavering Market Hold

Maintaining its leading position, the diagnosis segment commands over 68.7% of the atrial fibrillation market, a share driven by the healthcare industry's strategic pivot towards preventative care. Early and accurate detection of atrial fibrillation is paramount for preventing debilitating and costly complications like stroke. This has created a massive demand for a range of diagnostic tools, from traditional Holter monitors to advanced wearable technologies. The impact of these modern tools is profound; for example, a 2024 study showed that screening with a 14-day wearable heart monitor led to a 52% increase in diagnosis. The economic scale of this segment is substantial, with the global long-term ECG monitor market alone projected to reach $2802.4 million in 2025, underscoring its foundational role in the patient journey.

The segment's growth is also propelled by the expansion of systematic screening programs and the integration of sophisticated technologies. While community screening programs may require screening 129 individuals to find one new case, the long-term economic benefit of preventing even a single stroke makes such initiatives highly valuable. Additionally, the development of artificial intelligence-powered algorithms is revolutionizing ECG analysis, making diagnosis faster, more accessible, and highly accurate. As telemedicine and remote patient monitoring become standard practice, the demand for connected diagnostic devices will continue to surge, ensuring the diagnosis segment remains the largest and most critical component of the atrial fibrillation market.

- Community screening programs have demonstrated success in identifying new atrial fibrillation cases in 0.8% of participants.

- The rise of consumer-grade wearables with ECG functionality is increasing public awareness and incidental findings.

- Implantable loop recorders are seeing greater use for detecting infrequent atrial fibrillation episodes in high-risk patients.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

Complex Procedures and Integrated Care Solidify Hospitals' Market Primacy

Hospitals are set to remain the dominant end-user in the atrial fibrillation market, firmly positioned to meet the vast majority of atrial fibrillation treatment demand. Their primacy is rooted in the fact that they are the exclusive setting for the most complex and lucrative interventions, particularly catheter ablation procedures. The patient journey frequently begins in the hospital, with data showing that one in three atrial fibrillation patients are initially diagnosed in an emergency room. This high volume of acute cases, drawn from over 3.8 million annual ER visits for various conditions, naturally feeds patients into the inpatient system for advanced care. Hospitals possess the essential capital-intensive infrastructure, including specialized electrophysiology labs and imaging equipment, that is impossible to replicate in smaller clinical settings.

Beyond procedural capabilities, hospitals offer the integrated, multidisciplinary care model essential for managing complex atrial fibrillation patients who often suffer from multiple comorbidities. The collaboration between cardiologists, electrophysiologists, cardiac surgeons, and other specialists ensures comprehensive treatment planning and improved patient outcomes, a level of care that reinforces the hospital's central role. Favorable reimbursement policies for hospital-based procedures further strengthen their financial position. Projections indicating that hospitals will account for 60.4% of treatment demand in 2025, coupled with a rise in both inpatient admissions and specialized outpatient visits, confirm their unshakable leadership position within the atrial fibrillation market.

- The increasing number of dedicated, hospital-based atrial fibrillation centers is expanding patient access to specialized care.

- Hospitals serve as the primary sites for clinical trials, giving them early access to novel therapies and technologies.

- Post-procedural management and cardiac rehabilitation programs are typically hospital-affiliated, ensuring continuity of care.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America’s Dominance Is Fueled By High Procedural And Economic Costs

North America commands the Atrial fibrillation market, holding over 39% of the global share, a position sustained by high healthcare spending and robust procedural volumes. The economic impact is substantial, with a 2024 analysis revealing the average unadjusted total healthcare expenditure for a U.S. patient was $25,451. Another study from 2024 calculated the incremental annualized cost directly attributable to the condition to be $12,789 per patient. For working-age ischemic stroke patients between 18-64 years old, a co-diagnosis of AFib added an extra $4,905 to their hospital costs. This high-cost environment creates a powerful incentive for the adoption of advanced, cost-effective technologies.

The region's leadership in the Atrial fibrillation market is also defined by its advanced healthcare infrastructure and skilled workforce. In 2024, there were fewer than 6,000 board-certified electrophysiologists in the U.S., a specialized group driving the adoption of complex procedures. The high demand is reflected in clinical trial activity, with one U.S. registry in 2024 evaluating over 12,000 patients treated with a new device across more than 700 sites. Investment in research is also significant. For instance, U.S. cardiac and vascular disorder companies raised $1.83 billion across 69 rounds in 2024. In 2025, investment continued to be strong, reaching $1.86 billion across 51 rounds by October, fueling a continuous pipeline of innovation that reinforces the region's market dominance.

Europe Grapples With A Rising Patient Burden And A Fragmented Market

Europe’s Atrial fibrillation market is characterized by a significant and growing patient population alongside varied healthcare system capacities. In Germany, a 2025 study of a population-based cohort revealed 152 out of 4,814 participants were identified with AFib at baseline. Of those with an ECG-confirmed diagnosis at the study's start, 13 participants were previously unaware they had the condition. Over the long-term follow-up, an additional 640 of the 4,662 initially healthy participants developed AFib. A separate 2024 study in Germany confirmed the high prevalence, noting that AFib affects about 1.8 million people in the country. The clinical and economic consequences are substantial. In the UK, the National Health Service faces considerable wait times, with thousands of patients on waiting lists for catheter ablation procedures in 2025, highlighting systemic capacity constraints that drive demand for more efficient treatment solutions.

Asia Pacific Emerges As A High Growth Market Driven By Healthcare Transformation

The Asia Pacific atrial fibrillation market is defined by its massive patient population and rapidly evolving healthcare infrastructure. Projections from a 2025 study estimate that the number of prevalent cases in China could reach 23.04 million by 2045, with 1.93 million new cases expected annually. A separate 2025 analysis highlighted that by 2021, China already had 10.78 million prevalent cases and 920,000 incident cases. To manage this escalating burden, the region is embracing innovative healthcare delivery models. A 2024 study in rural China involving 1,039 adults demonstrated the success of a telemedicine-supported care model.

In that trial, there were 24 cardiovascular deaths in the intervention group compared to 47 in the usual care group. Investment in research and infrastructure is also growing, Australia awarded AU$7 million in 2025 to establish a national atrial fibrillation (AF) ablation registry, and an additional AU$3 million grant to create a new Centre of Research Excellence for Atrial Fibrillation.

Strategic Investments and Acquisitions are Reshaping Competitive Landscape of Atrial Fibrillation Market

- Johnson & Johnson Acquires Shockwave Medical (April 2024): Johnson & Johnson finalized its acquisition of Shockwave Medical for approximately $13.1 billion, significantly expanding its cardiovascular intervention portfolio with innovative intravascular lithotripsy technology.

- Kardium Secures Major Funding (July 2025): Medical device company Kardium announced it raised an additional $250 million in a new funding round to advance the commercial launch of its Globe Pulsed Field System for treating atrial fibrillation.

- Kestra Medical Raises Significant Capital (July 2024): Kestra Medical Technologies secured $196 million in a funding round co-led by several prominent investors to expand the commercialization of its ASSURE Wearable Cardioverter Defibrillator system.

- Johnson & Johnson Acquires V-Wave (October 2024): Expanding its heart failure portfolio, Johnson & Johnson completed its acquisition of V-Wave Ltd. for an upfront payment of $600 million, with potential for future milestone payments.

- Capstan Medical Closes Funding Round (December 2024): Structural heart surgical robot developer Capstan Medical secured $110 million in a funding round to advance its catheter-delivered implants for mitral and tricuspid valve replacement.

- Boston Scientific Acquires Cortex Inc. (January 2025): To enhance its electrophysiology offerings, Boston Scientific completed the acquisition of Cortex, Inc., a company with a differentiated cardiac mapping solution for complex AFib cases.

- FIRE1 Secures $120 Million (January 2025): Ireland-based heart failure device company FIRE1 closed a $120 million financing round with participation from new and existing investors, including Medtronic, to advance its novel sensor technology.

- Conformal Medical Nets New Funding (August 2025): Conformal Medical raised $32 million in a new financing round to further the clinical development and regulatory submission of its innovative left atrial appendage occlusion device.

- Field Medical Raises Additional Capital (July 2025): Field Medical, a company developing a pulsed field ablation system for ventricular tachycardia, brought in an additional $35 million to support its ongoing clinical studies and product development.

- Reprieve Cardiovascular Gains Funding (August 2025): Reprieve Cardiovascular announced a $61 million financing round to advance the development of its intelligent fluid management system designed for patients with acute decompensated heart failure.

Top Companies in Global Atrial Fibrillation Market

- Atri Cure Inc.

- Biosense Webster Inc.

- Boehringer Ingelheim GmbH

- Boston Scientific Corporation

- Bristol-Myers Squibb Corporation

- CardioFocus Inc.

- Endoscopic Technologies Inc.

- Johnson & Johnson Ltd.

- Koninklijke Philips N.V.

- MicroPort Scientific Corporation

- Sanofi-Aventis

- Siemens AG

- St. Jude Medical Inc.

- Other Prominent Players

Market Segmental Overview:

By Type

- Paroxysmal Afib

- Persistent Afib

- Chronic/Permanent Afib

By Technology

- Microlife AFIB Technology

- Hybrid Surgical-Catheter Ablation

- Cryotherapy

By Treatment

- Diagnosis

- Electrocardiogram

- Blood tests

- Echocardiogram

- Chest X-ray

- Other (Blood tests)

- Medication

- Anticoagulants

- Others

By End User

- Hospitals

- Care Centers

- Outpatients

- Ambulatory Services

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The U.K.

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)