Asia Pacific Stem Cell Therapy Market: By Therapy Type (Autologous Stem Cell Therapy and Allogeneic Stem Cell Therapy); Product (Adult Stem Cells (ASCs), Human Embryonic Stem Cells (HESCs), Induced Pluripotent Stem Cells (iPSCs) and Very Small Embryonic Like Stem Cells); Cell Source (Adipose tissue-derived MSCs, Bone marrow derived MSCs, Placental/umbilical cord derived MSCs and Other Cell Sources); Technology (Cell Acquisition, Cell Production, Cryopreservation, Expansion and Sub-Culture; By Application- Musculoskeletal Disorders and others); End User (Hospitals, Research institutes and Others); and Country—Industry Dynamics, Market Size, and Opportunity Forecast for 2025–2033

- Last Updated: Jan-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0223362 | Delivery: 2 to 4 Hours

| Report ID: AA0223362 | Delivery: 2 to 4 Hours

Market Scenario

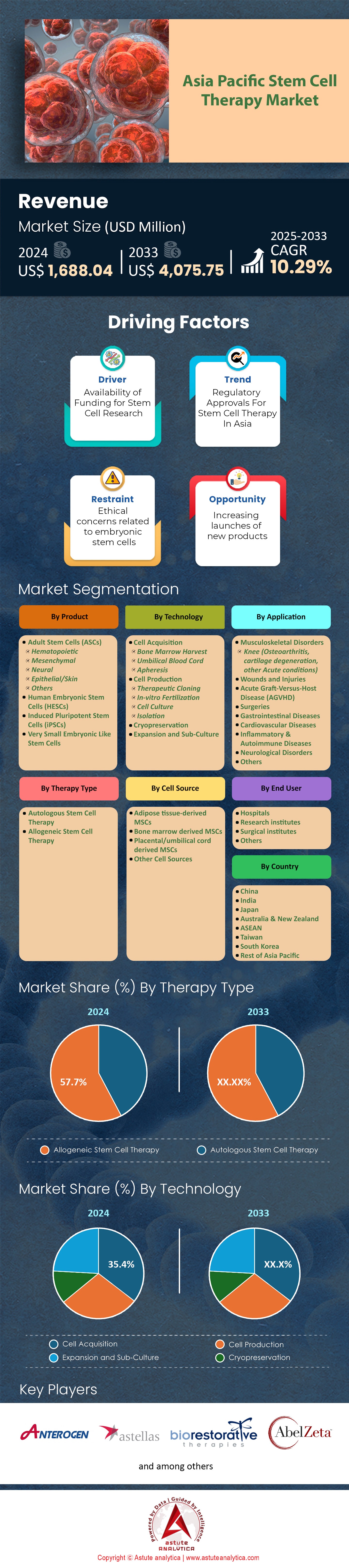

Asia Pacific stem cell therapy market was valued at US$ 1,688.04 million in 2024 and is poised to reach valuation of US$ 4,075.75 million by 2033, growing at a CAGR of 10.29% during the forecast period 2025–2033.

Asia Pacific is experiencing a robust surge in stem cell therapy adoption, driven by diverse treatments addressing orthopedic, neurological, and cardiovascular conditions. Rising prominence of exosome research—particularly in diagnostics and targeted drug delivery—further propels the stem cell therapy market. Among the most notable exosomal technologies are advanced isolation methods that yield higher purity vesicles, while prominent sources range from bone marrow and adipose tissue to umbilical cord blood. Five leading applications gaining considerable traction include regenerative cardiology, orthopedic tissue reconstruction, neurodegenerative disease management, immune modulation, and aesthetic medicine. In 2023, 290 new exosome-based research initiatives were documented in the region, with hospitals, specialized biotech firms, and academic research centers emerging as key end users. Top companies like MEDIPOST, FujiFilm Cellular Dynamics, Cynata Therapeutics, and Nipro are heavily invested in advancing stem cell and exosome-based therapies.

Within stem cell therapy itself, induced pluripotent stem cells (iPSC), mesenchymal stem cells, and hematopoietic stem cells rank as the most sought-after types. In 2023, Japan recorded 35 newly launched clinical collaborations for iPSC-driven treatments, reflecting an appetite for personalized and off-the-shelf regenerative solutions. Meanwhile, the Asia Pacific stem cell therapy market witnessed 75 fresh patent filings around mesenchymal stem cell applications, focusing on cartilage and bone regeneration. Funding has kept pace with these developments: in 2023 alone, Singapore’s leading research bodies injected 110 million USD into stem cell innovation grants, while China’s biotech sector secured 25 major partnerships to accelerate commercial-scale manufacturing. Another highlight is the emergence of 40 specialized cellular manufacturing facilities in China expected to open by 2024, ensuring a more streamlined pipeline for clinical translation.

Key stem cell therapy markets in the Asia Pacific region fueling accelerated demand include Japan, China, South Korea, India, and Australia, energized by rising chronic disease cases, technological breakthroughs, and favorable policies. In 2023, over 50 advanced clinical trials targeting neurological disorders tapped exosome-based delivery for precise treatment outcomes, signifying a strong trend toward specialized therapies. Additionally, the year witnessed 20 new dedicated research labs in South Korea focusing on scalable 3D bioprinting technologies for cell therapy. These expansions, coupled with a growing geriatric population and corporate-academic partnerships, continue to transform stem cell therapy into a pivotal healthcare frontier across Asia Pacific.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Growing synergy between advanced cell technologies and personalized medicine strategies accelerating Asia Pacific developments

The convergence of advanced cell technologies with personalized medicine is shaping a dynamic new horizon for stem cell therapy market in Asia Pacific. Clinical teams are harnessing tools like high-throughput gene editing, CRISPR-based modifications, and robotic bioreactors, ensuring greater accuracy in cell expansion. In 2023, 65 newly established biotech ventures in Singapore began collaborating with academic institutions to refine these novel approaches. Meanwhile, South Korea’s Biopharma Alliance listed 28 fresh consortium agreements, focusing on tailoring cell lines for patient-specific treatments. Supported by robust infrastructure investments, Japan introduced 12 new GMP facilities dedicated to iPSC-derived therapeutics, reinforcing quality and safety standards. Across China, 18 government-backed innovation hubs emerged to integrate personalized medicine within nationwide healthcare initiatives. Hong Kong’s biggest stem cell symposium in 2023 featured 40 breakthrough abstracts on gene-edited cell applications, reflecting growing momentum in targeted regenerative solutions.

This driver gains additional traction from an evolving ecosystem where private players, public research bodies, and hospital networks coordinate seamlessly. Australia’s top medical research agency in the stem cell therapy market recently announced 105 ongoing projects that unify cell engineering with immunomodulatory strategies, signifying mounting confidence in merging technology and patient-centricity. Biotech investors, seeing promise in data-driven personalization, funded 33 specialized AI-based labs across Malaysia in 2023, each focusing on predictive analytics for tailored cell therapies. Another milestone is India’s establishment of 19 pilot programs that test patient genomes against custom-engineered stem cell lines, underscoring translational potential for complex diseases. These collaborative frameworks not only accelerate scientific breakthroughs but also enhance clinical availability across populous regions. Increasing synergy is evident as more hospitals integrate on-site cell processing units. Consequently, patients are benefitting from faster turnaround times and therapies tailored to genetic profiles—hallmarks of a more precise and potent treatment environment in Asia Pacific.

Trend: Heightened utilization of artificial intelligence optimizing personalized cell therapy outcomes

Heightened utilization of artificial intelligence optimizing personalized cell therapy outcomes in the stem cell therapy market has opened a new realm of possibility in Asia Pacific’s regenerative medicine landscape. By harnessing deep learning models and big data analytics, research teams have discovered more efficient strategies for pinpointing ideal stem cell lines and tailoring interventions to individual patient profiles. In 2023, 31 specialized labs across China integrated sophisticated neural networks that predict cell viability with higher accuracy, smoothing out production bottlenecks. That same year, 22 computational pipelines were introduced in South Korea to accelerate immunomodulatory profiling, which has improved clinicians’ ability to refine therapeutic dosage. In Japan, 14 new AI-based clinical trials for cartilage repair commenced, revealing the region’s emphasis on data-driven evaluations of cellular repair capabilities. Singapore also made strides when 12 local biotech companies adopted image-based sensors powered by machine learning to monitor iPSC growth in real time, boosting consistency in final cell quality.

Across the regional stem cell therapy market, data sharing initiatives and collaborative research platforms have soared, enhancing synergy among biotech startups, hospital-based labs, and established pharmaceutical entities. Australia’s leading research council reported that 16 prominent medical universities launched AI-driven cell characterization studies in 2023, capturing advanced gene expression patterns to guide personalized therapies. India’s Innovation Network announced 10 cross-disciplinary agreements this year, integrating computational biology experts with immunologists to explore new gene targets for robust cell function. Meanwhile, South Korea’s Biotechnology Forum documented 19 approved AI algorithms now utilized by clinical teams to detect early-stage graft-versus-host complications. Furthermore, Taiwan saw 28 advanced AI prototypes demonstrated at its largest biomedical conference, focusing on rapid genome interpretation and stem cell batch tracking. Cumulatively, these breakthroughs are transforming the precision and scalability of cell therapy solutions by leveraging AI’s predictive power to reduce trial-and-error, minimize waste, and facilitate pioneering interventions targeted uniquely to each patient’s genetic blueprint.

Challenge: Bottlenecks in scaling production processes and ensuring consistent quality hamper emerging stem cell initiatives

While Asia Pacific emerges as an innovation hotbed for stem cell therapy market, scaling up production remains a persistent barrier. In 2023, 26 labs across India reported difficulties moving from pilot-scale to full commercial manufacturing due to complex equipment demands. Meanwhile, South Korea’s regulatory agency recorded 14 instances where inconsistent product quality halted clinical trial progress. These manufacturing chasms are further compounded by limited integration of automated bioreactors, as only 31 advanced systems were deployed across Japan in 2023. Companies attempting to address this challenge often face material sourcing constraints: 9 biotech facilities in China noted delayed raw material shipments that stalled product rollouts. Another hurdle is ensuring consistent viability of expanded cells: 18 Malaysian research centers flagged variation in final cell counts after batch processing. Each of these instances challenges the industry’s ability to standardize and streamline.

Quality control frameworks are equally complex in the Asia Pacific stem cell therapy market. In 2023, 22 new identification markers for cardiosphere-derived stem cells were proposed, but calibration across multiple facilities has proven difficult. Taiwan’s largest medical research institute spent six months verifying these markers against pre-existing cellular descriptors, highlighting the time-intensive nature of standard harmonization. Singapore’s top quality assurance forum discussed 16 hurdles tied to scaling from small-batch pilot lines to robust commercial pipelines, pinpointing the need for uniformed compliance. Even the best-funded hubs, such as those in Japan, took extended cycles to refine validation protocols for cross-border product export. Some biotech innovators are remedying these issues through novel closed-system bioreactors, of which 7 advanced prototypes were introduced at an international symposium in Hong Kong in 2023. Ultimately, ensuring high-volume production meets stringent standards remains an ongoing test of technical prowess, resource allocation, and collaborative problem-solving.

Segmental Analysis

By Therapy Type

Allogeneic stem cell therapy with over 57.7% market share has steadily gained traction within the Asia Pacific stem cell therapy market, owing to its robust potential in treating a wide array of complex conditions. Unlike autologous approaches, which utilize a patient’s own cells, allogeneic stem cell therapy uses donor cells. This distinction significantly expands donor availability, offering broader therapeutic avenues and the possibility of treating genetic disorders that might be unsuitable for patient-derived cells. In 2024, this segment is set to dominate with a marke partly due to enhanced stem cell banking infrastructures across the region. Additionally, fewer complications during transplant, driven by improved donor matching and immunosuppression protocols, have further solidified the prominence of allogeneic therapies. As a result, cell therapy companies across the Asia Pacific stem cell therapy market are pouring resources into advancing preclinical research, clinical trials, and regulatory approvals specifically tuned to allogeneic solutions.

The increasing dominance of allogeneic therapy in the Asia Pacific stem cell therapy market aligns with rising regional investments in regenerative medicine, as policymakers recognize the necessity for innovative treatment paradigms that go beyond traditional pharmaceuticals. Cell therapy firms are also supporting industry-academic collaborations, ensuring that novel methods for large-scale donor cell expansion and cryopreservation are researched and refined consistently. These partnerships accelerate the commercialization process for allogeneic products, while reducing manufacturing costs through standardized protocols. Moreover, growing interest in hematopoietic stem cell transplantation for conditions like leukemia has spotlighted the advantages of using healthy donor cells. This has motivated researchers to optimize donor selection criteria, lowering graft rejection risks. As scientific understanding of immunomodulation deepens, the Asia Pacific stem cell therapy market is expected to see further breakthroughs in allogeneic transplant outcomes. Ultimately, allogeneic therapy stands poised to redefine treatment strategies, delivering more accessible, off-the-shelf solutions to patients across this dynamic region.

By Product

In the Asia Pacific stem cell therapy market, Adult Stem Cells (ASCs) occupy a critical role, having captured roughly 80% market share in 2024. Their prominence is largely attributed to favorable ethical considerations and relative ease of extraction from tissues like bone marrow and adipose tissue. Additionally, clinicians and researchers favor ASCs for their immunomodulatory capabilities and reduced tumorigenic risk compared to pluripotent counterparts. With a projected CAGR of 10.53% over the forecast period, the ASC segment is primed for a notable expansion. This growth is being driven by an influx of industry-sponsored trials investigating the therapeutic applications of ASCs in chronic diseases, including cardiovascular and orthopedic conditions. Thanks to the rising number of positive clinical outcomes, regulatory bodies are increasingly open to reviewing advanced ASC-based therapies, contributing to a faster pace of market entry in the Asia Pacific stem cell therapy market.

A significant factor cementing ASCs as a dominant product category is the availability of well-established techniques for isolating and culturing these cells. Laboratories and medical centers throughout the Asia Pacific market have honed standardized protocols, enabling more consistent yields and higher purity levels. Collaborative networks of hospitals, biotech firms, and academic institutions further bolster this segment by spearheading specialized programs in tissue engineering and ex vivo expansion. The high success rate of ASC-based transplantation, particularly in orthopedic and inflammatory conditions, bolsters clinician confidence and drives patient demand. Moreover, the financial incentives provided by government authorities in countries like Japan and South Korea have fostered a conducive environment for scaling up research and development. Fueled by continuous technological advances and streamlined regulatory frameworks, Adult Stem Cells are set to remain a cornerstone in the Asia Pacific stem cell therapy market, meeting the needs of an ever-growing patient population.

By Cell Source

Adipose tissue-derived Mesenchymal Stem Cells (MSCs) currently command a 49% share of the Asia Pacific stem cell therapy market in 2024 and are anticipated to grow at a CAGR of 10.74%. This dominance stems from the relative simplicity and minimally invasive nature of adipose tissue extraction, often via liposuction, yielding abundant cell sources with minimal discomfort to patients. Researchers value adipose tissue-derived MSCs for their potent regenerative properties and immunomodulatory efficacy, making them suitable for treating wound defects, autoimmune disorders, and even certain cardiac pathologies. Furthermore, advancements in processing methods—such as enzymatic digestion and ultrafiltration—have streamlined the path from tissue isolation to final product, reinforcing the feasibility of large-scale clinical applications. These factors collectively underscore why adipose tissue has become a cornerstone cell source in the Asia Pacific market.

Another key driver is the expanding portfolio of adipose-derived MSC clinical trials investigating new therapeutic applications, from acute sports injuries to neurodegenerative diseases. With the Asia Pacific stem cell therapy market increasingly emphasizing personalized healthcare, adipose-derived cells have drawn particular interest for their potential use in autologous procedures. At the same time, standardization efforts for donor screening and tissue processing bode well for allogeneic use, ensuring robust quality control across multiple therapy pipelines. Biomanufacturing firms in the region are investing in advanced bioreactor systems tailored to adipose-derived MSCs, signaling an attractive balance between high yield and consistent potency. Notably, the improved reproducibility of isolation and culture protocols makes it easier for regulatory authorities to assess safety profiles, accelerating approvals. As clinical evidence mounts and multinational corporations partner with regional research hubs, adipose tissue-derived MSCs stand poised to push the Asia Pacific stem cell therapy market into new frontiers of regenerative medicine.

By Technology

Within the Asia Pacific stem cell therapy market, cell acquisition occupies the spotlight, accounting for a 35.4% revenue share. This segment is further projected to experience the highest CAGR of 10.73% through the forecast period, reflecting the increasing importance of robust, efficient methods for harvesting viable cells. Central to the segment’s success are advancements in minimally invasive techniques, such as percutaneous bone marrow extraction, which reduce patient discomfort while enhancing cell yields. The bone marrow harvest sub-segment, in particular, holds the largest revenue share due to heightened awareness efforts, rising prevalence of blood cancers, and accessibility to specialized therapy centers across the region. With continuous improvements in imaging-guided procurement and automation, medical professionals can isolate higher-quality mesenchymal and hematopoietic stem cells, boosting overall therapeutic outcomes.

The Asia Pacific stem cell therapy market has witnessed significant investment in technology that simplifies and accelerates the cell acquisition stage of regenerative therapies. This includes the introduction of portable aspiration devices, single-use harvest kits, and closed-loop systems that minimize contamination risk. Moreover, academic institutions are actively participating in research initiatives to refine cell extraction from other sources like adipose tissue and placental tissue, broadening the scope of available therapies. Collaboration between clinical research organizations and healthcare facilities helps standardize protocols, which, in turn, shortens hospital stays and reduces costs for patients. Mobile stem cell collection units are another nascent trend, delivering on-site acquisition services in remote or underserved areas. These developments collectively amplify the cell acquisition segment’s role as a foundational pillar of the Asia Pacific market, ensuring a reliable supply of high-quality stem cells that feed both existing treatments and new possibilities in regenerative medicine.

To Understand More About this Research: Request A Free Sample

Country Analysis

China’s leadership position with over 36.7% market share in the Asia Pacific stem cell therapy market is intricately tied to its aggressive pursuit of innovation across the most dominant segments: allogeneic therapy, Adult Stem Cells, adipose tissue-derived MSCs, and cell acquisition. As of 2023, China hosts more than 120 active clinical trials that specifically evaluate allogeneic stem cell therapies for indications ranging from hematological malignancies to degenerative joint diseases. In parallel, at least 70 Intellectual Property (IP) filings related to Adult Stem Cells have been submitted by Chinese companies and research institutes this year, signifying a robust pipeline of next-generation treatments. Reflecting its dedication to adipose tissue-derived MSCs, over 20 well-established academic centers in Beijing alone have initiated specialized laboratories to standardize processing methods for this cell type, ensuring quality and safety. The bone marrow harvest infrastructure in tier-one cities like Shanghai and Guangzhou has also expanded—currently, more than 60 advanced facilities support cell acquisition, catering to both local and international trials.

Such rapid progress reflects broader policy support in the stem cell therapy market. In 2023, the Chinese government awarded upward of 40 public research grants specifically targeting allogeneic stem cell therapies, solidifying public sector commitment. During the same period, more than 10 newly formed alliances emerged in Guangdong Province, uniting hospitals, biotech firms, and technology centers to coordinate large-scale cell acquisition projects. At leading hospitals in Shanghai, at least 12 new adipose-derived stem cell clinical trials were launched in early 2023, showing tangible momentum in this dominant cell source. China’s National Medical Products Administration (NMPA) has also granted at least 15 recent Investigational New Drug (IND) approvals for advanced stem cell therapies, boosting prospects for rapid commercialization. These collective efforts shape China into a premier destination for industry investment, making it a cornerstone of the Asia Pacific stem cell therapy market. By integrating cutting-edge R&D, state-backed incentives, and a vast healthcare delivery network, China is poised to reinforce its dominant position in the market for years to come.

Top Companies in Asia Pacific Stem Cell Therapy Market:

- AlloSource

- Anterogen Co. Ltd.

- Arce Therapeutics

- Astellas Pharma Inc

- Biogend Therapeutics

- Biorestorative Therapies Inc.

- Brainstorm Cell Limited.

- Cellular Biomedicine Group

- CORESTEM

- Fujifilm Holding Corporation

- Holostem Terapie Avanzate Srl

- JCR Pharmaceuticals Co. Ltd.

- Kangstem Biotech

- MEDIPOST Co. Ltd.

- Mesoblast Ltd

- Personalized Stem Cells

- PELL Biotech Co., Ltd.

- Pluristem Inc.

- RTI Surgical

- Sartorius AG

- Sewon Cellontech

- Smith+Nephew

- STEMPEUTICS RESEARCH PVT LTD.

- Takeda Pharmaceutical Company Limited

- Vericel Corp

- Other Prominent Players

Market Segmentation Overview:

By Therapy Type

- Autologous Stem Cell Therapy

- Allogeneic Stem Cell Therapy

By Product

- Adult Stem Cells (ASCs)

- Human Embryonic Stem Cells (HESCs)

- Induced Pluripotent Stem Cells (iPSCs)

- Very Small Embryonic Like Stem Cells

By Cell Source

- Adipose tissue derived MSCs

- Bone marrow derived MSCs

- Placental/umbilical cord derived MSCs

- Other Cell Sources

By Technology

- Cell Acquisition

- Cell Production

- Cryopreservation

- Expansion and Sub-Culture

By Application

- Musculoskeletal Disorders

- Wounds and Injuries

- Acute Graft-Versus-Host Disease (AGVHD)

- Surgeries

- Gastrointestinal Diseases

- Cardiovascular Diseases

- Inflammatory & Autoimmune Diseases

- Neurological Disorders

- Others

By End User

- Hospitals

- Research institutes

- Surgical institutes

- Others

By Country

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Taiwan

- South Korea

- Rest of Asia Pacific

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0223362 | Delivery: 2 to 4 Hours

| Report ID: AA0223362 | Delivery: 2 to 4 Hours

.svg)