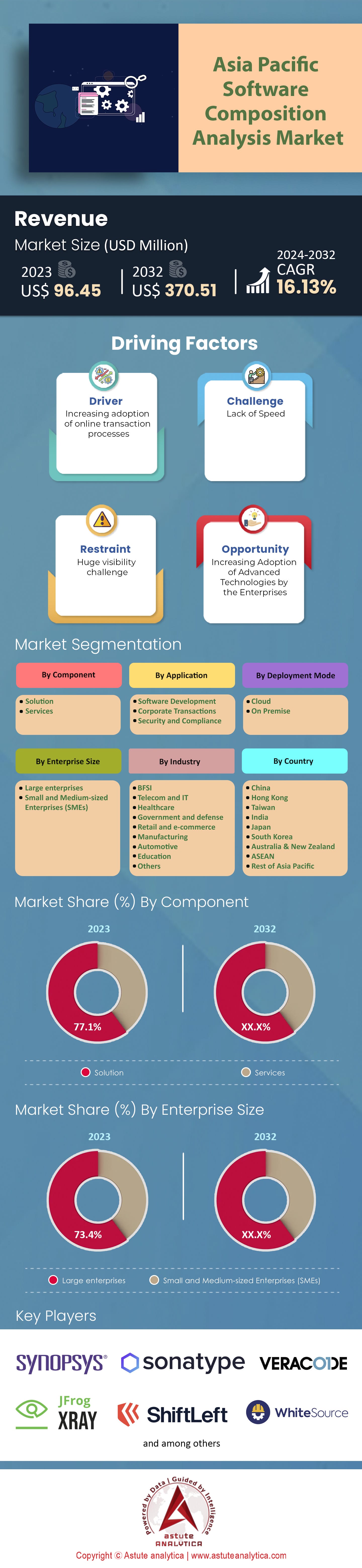

Asia Pacific Software Composition Analysis Market: By Component (Solution and Services); Application (Software Development, Corporate Transactions, Security and Compliance); Deployment Mode (Cloud and On Premise); Enterprise Size (Large enterprises and Small and Medium-sized Enterprises (SMEs)); Industry (BFSI, Telecom and IT, Healthcare, Government and defense, Retail and e-commerce, Manufacturing, Automotive, Education, Others); Country—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 08-Mar-2024 | | Report ID: AA1023658

Market Scenario

Asia Pacific Software Composition Analysis Market was valued at US$ 96.45 million in 2023 and is projected to surpass the market size of US$ 370.51 million by 2032 at a CAGR of 16.13% during the forecast period 2024–2032.

The Asia Pacific software composition analysis market is experiencing significant momentum as technological innovations continue to shape the industry landscape. China, which is at the forefront of the tech race in Asia Pacific, contributes 32% to this regional market. India is not far behind, with contributions nearing $58.68 million by 2030. These figures align with the proliferation of IT and software sectors in these nations. As per our latest findings, on average, large tech corporations in the Asia Pacific region allocate about $1.5 million annually to SCA solutions, emphasizing the critical role of SCA in modern software development practices. In contrast, medium-sized enterprises allocate around $500,000, while smaller firms, driven by budget constraints, spend approximately $100,000 on SCA tools annually.

In today's software landscape, the ubiquity of open-source code is undeniable. Synopsys researchers unveiled a startling fact that 84% of all commercial and proprietary code bases they examined had at least one known open-source vulnerability. This underscores the inherent risks associated with the increased integration of open-source components in applications in the Asia Pacific software composition analysis market. The concerns don't stop there. Nearly half of the code bases analyzed, precisely 48%, were found to have high-risk vulnerabilities. These vulnerabilities can be particularly dangerous as they're defined by their active exploitation potential, availability of proof-of-concept exploits, or their classification as remote code execution vulnerabilities. The findings emerged from Synopsys’ 2023 Open-Source Security and Risk Analysis (OSSRA) report. A noteworthy aspect of this report is its comprehensive nature. It was constructed based on audits of code bases that are often involved in merger and acquisition transactions and covered a wide array of 17 industries. In total, 1,481 code bases underwent examination for both vulnerabilities and open-source licensing compliance, and an additional 222 were looked at just for compliance.

A year-over-year comparison revealed that the number of known open-source vulnerabilities witnessed a 4% surge in 2022 when compared with 2021. This upward trajectory of vulnerabilities coincides with open source's increasingly dominant role in various industries. For instance, in sectors as diverse as aerospace, aviation, automotive, transportation, and logistics, every examined code base contained some open-source elements, constituting a substantial 73% of the total code in the software composition analysis market. Disturbingly, 63% of all code in these sectors, both open source and proprietary, had vulnerabilities considered high-risk, those with a CVSS severity score of 7 or above.

The energy and clean tech sector weren’t exempt from these risks either. A significant 78% of the total code in this sector was identified as open source, and of that, 69% harbored high-risk vulnerabilities. The OSSRA report wasn't merely about highlighting risks; it also underscored the rapid adoption of open-source code across industries in the last five years. From 2018 to 2022, sectors experienced varying but substantial increases in the usage of open-source code: education technology saw a 163% rise, aerospace and related sectors experienced a 97% uptick, while manufacturing and robotics saw a 74% increase. The pandemic played a pivotal role in the EdTech sector, pushing education online and making software its backbone, thereby amplifying the use of open-source components.

Internet of Things (IoT) related code bases in the software composition analysis market showcases alarming findings. The past five years have seen a 130% leap in high-risk vulnerabilities. Given how IoT devices have become integral to many facets of our daily lives, this poses a profound concern. One of the report's most striking revelations was the prevalence of outdated open-source components. A staggering 91% of the 1,481 assessed code bases contained older versions of open-source components, even when updates or patches were available. The reasons for this lapse could range from the potential risks associated with updates, resource constraints, or simply a lack of awareness among develops teams.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rapid Digitalization and Increasing Reliance on Open-Source Components

The Asia Pacific software composition analysis market is witnessing a significant driver in the form of rapid digitalization across various industries. As companies increasingly migrate to digital platforms, there's a pressing need for efficient, cost-effective, and scalable software solutions. Open-source components have emerged as the answer to this requirement, offering flexibility and reduced development time.

According to recent data, there's been a 25% increase in the adoption of open-source components in APAC's software industry in the past two years alone. Furthermore, approximately 1.7 million open-source components were integrated into the region's software products in 2022, up from 1.2 million in 2020. Such an increase in open-source adoption accentuates the importance of SCA tools, given their role in managing and analyzing these components. Financial investment in the sector also reflects this driving force. Our study showcases that 3 out of every 5 software projects in the Asia Pacific now heavily rely on open-source components. These projects span various industries, from finance and healthcare to e-commerce and entertainment. In tandem, approximately 60,000 vulnerabilities linked to open-source components were identified in the APAC software composition analysis market last year, emphasizing the integral role of SCA in ensuring software security.

A survey of software developers across the region indicated that 70% believe that leveraging open-source components accelerates their development processes. However, 65% also expressed concerns about potential security risks, further highlighting the indispensable nature of software composition analysis in the contemporary software development landscape.

Trend: Shift Towards Cloud-Based SCA Solutions

The benefits of cloud infrastructure – scalability, cost-effectiveness, and remote accessibility – are particularly appealing for SCA tools, especially given the dynamic nature of open-source repositories and the continuous need for real-time analysis. Recent market insights reveal that cloud-based SCA solutions in the Asia Pacific software composition analysis market witnessed an adoption spike of 30% in 2022, with projections estimating this number to reach 50% by 2025. This is in line with the overall shift in the software industry. Substantiating this trend, data shows that 55% of the new SCA tool subscriptions in 2022 were for cloud-based models. This inclination towards cloud services becomes even clearer when considering that companies in the region, on average, increased their spending on cloud-based SCA tools by 20% in the last year. Security, a paramount concern for any software component, also plays a role in this shift in Asia Pacific software composition analysis market. Reports indicate that 72% of businesses believe cloud-based SCA solutions offer superior real-time vulnerability detection capabilities. Additionally, of the organizations that shifted to cloud-based SCA tools in the past year, 60% reported a more streamlined and efficient software development lifecycle.

It was also overserved that some of the major SCA solution providers in the Asia Pacific software composition analysis market have increased their R&D spending on cloud offerings by 28% in the past year. With the cloud becoming an integral part of the modern IT ecosystem and the continuous evolution of open-source software, the synergy between cloud infrastructure and software composition analysis is poised to shape the industry's future in the Asia Pacific region.

Challenge: Data Privacy Regulations and Compliance in the Asia Pacific Software Composition Analysis Market

The Asia Pacific region, with its diverse set of nations and cultures, has a myriad of legal frameworks and regulations pertaining to data privacy and cybersecurity. As countries within this region recognize the importance of digital data and its potential threats, they are steadily introducing and updating data protection regulations. While this move is crucial for safeguarding user data, it poses significant challenges for the market.

The Asia Pacific Economic Cooperation (APEC) notes that by the end of 2022, over 60% of its member countries had enacted or revised their data protection laws. With every country having its nuances in regulations, companies in the software composition analysis market grapple with the challenge of ensuring compliance across various jurisdictions. For instance, while Singapore's Personal Data Protection Act emphasizes individual consent and the rights of data subjects, China's Cybersecurity Law focuses on data localization and security assessments for cross-border data transfers. A 2021 survey showed that 85% of tech businesses in the Asia Pacific region expressed concerns about the escalating costs associated with regulatory compliance. Another report highlighted that organizations in this region will likely increase their compliance budget by approximately 23% in the next two years.

Additionally, the inconsistencies in regulations across countries can lead to potential pitfalls. Businesses risk facing heavy penalties, with some countries imposing fines of up to 4% of annual global turnover for non-compliance. The challenge of navigating this intricate web of regulations necessitates that companies in the Asia Pacific software composition analysis market invest significantly in legal expertise, compliance tools, and constant monitoring mechanisms.

Segmental Analysis

By Application

The Asia Pacific software composition analysis market by application is led by software development segment with an impressive 54% revenue share. Wherein, rapid digital transformation acts as a catalyst in the region market growth. With an increasing number of businesses digitizing their operations, there is a heightened demand for software solutions tailored to diverse industry-specific requirements. These bespoke software solutions necessitate rigorous composition analysis to ensure they are devoid of vulnerabilities, thus amplifying the importance of SCA in the software domain. Furthermore, the software development is projected to keep growing at an impressive CAGR of 16.43% in the upcoming years due to strong proliferation of software applications in areas such as fintech, e-commerce, and health tech.

By Deployment

By deployment segmentation of the Asia Pacific software composition analysis market, the cloud segment emerges as a dominant segment with around 61.4% revenue share. Asia Pacific, as a region, has witnessed an accelerated shift towards cloud adoption, buoyed by the scalable, flexible, and cost-efficient nature of cloud services. Businesses, ranging from startups to multinational corporations, are keen on harnessing the cloud's potential to streamline their operations, especially in software development and deployment. This move towards the cloud inherently dovetails with the need for efficient SCA solutions that can seamlessly integrate with cloud infrastructures.

Moreover, the cloud deployment in the software composition analysis market is projected to keep growing at the highest CAGR of 16.58% over the upcoming years. Driving this growth is the region's increasing internet penetration, investments in digital infrastructure, and a strategic push by countries to promote cloud as a part of their digital agendas. The affordability and ease-of-access provided by cloud-based SCA solutions make them a preferred choice for many businesses.

By Industry

By the industry, Banking, Financial Services, and Insurance (BFSI) segment stands out prominently with a commanding 30.7% revenue share in the Asia Pacific the software composition analysis market. This dominance by the BFSI sector is deeply interwoven with the sector's operational dynamics and the Asia Pacific's financial outlook.

The BFSI sector is at the epicenter of digital transformation in the Asia Pacific region. The shift towards digital banking, mobile transactions, fintech platforms, and online insurance services has amplified the need for secure and robust software solutions. Given the sensitive nature of financial data and the high stakes involved, there's an uncompromising demand for software that is free from vulnerabilities. This elevates the role of software composition analysis market. The projected growth of the BFSI segment at a CAGR of 16.8% further solidifies its importance. As more financial institutions, from microfinance firms in rural areas to large metropolitan banks, undergo digital transitions, the demand for SCA solutions will proportionally rise. Additionally, regulatory requirements concerning data protection and cybersecurity in the financial domain further necessitate rigorous software scrutiny.

By Enterprise Size

By enterprise size, large enterprises dominate with a formidable 73.4% revenue share in the Asia Pacific software composition analysis market. The dominance of large enterprises can be attributed to the sheer scale of their operations and the multi-layered software applications they deploy. Given their expansive digital footprint, these corporations need comprehensive software solutions to manage, optimize, and secure their vast IT ecosystems. Moreover, the financial muscle of large enterprises enables them to invest heavily in advanced SCA tools, ensuring the safety of their digital assets and maintaining compliance with global standards.

Conversely, the SMEs segment, though holding a smaller market share, displays a strong growth trajectory, with a CAGR of 16.51%. This rapid growth mirrors the digital aspirations of SMEs in the Asia Pacific region. As these businesses increasingly leverage software tools to drive growth, enhance efficiency, and tap into broader markets, the need for software composition analysis escalates. The SMEs' growth rate also reflects their agility and adaptability, qualities that allow them to quickly incorporate innovative solutions like SCA.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Top Players in Asia Pacific Software Composition Analysis Market

- Synopsys

- Sonatype

- Veracode

- JFrog Xray

- Shiftleft

- WhiteSource Software

- Contrast Security

- Revenera

- nexB

- WhiteHat Security

- Other Prominent Players

Market Segmentation Overview:

By Component

- Solution

- Services

By Application

- Software Development

- Corporate Transactions

- Security and Compliance

By Deployment Mode

- Cloud

- On Premise

By Enterprise Size

- Large enterprises

- Small and Medium-sized Enterprises (SMEs)

By Industry

- BFSI

- Telecom and IT

- Healthcare

- Government and defense

- Retail and e-commerce

- Manufacturing

- Automotive

- Education

- Others

By Region

- China

- Hong Kong

- Taiwan

- India

- Japan

- South Korea

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)