Asia Pacific Smart Water Management Market: By Component (Solutions, Water Meters, Services); Application (Commercial, Residential, and Industrial); Country—Market Forecast and Analysis for 2024–2032

- Last Updated: 14-May-2024 | | Report ID: AA0723535

Market Scenario

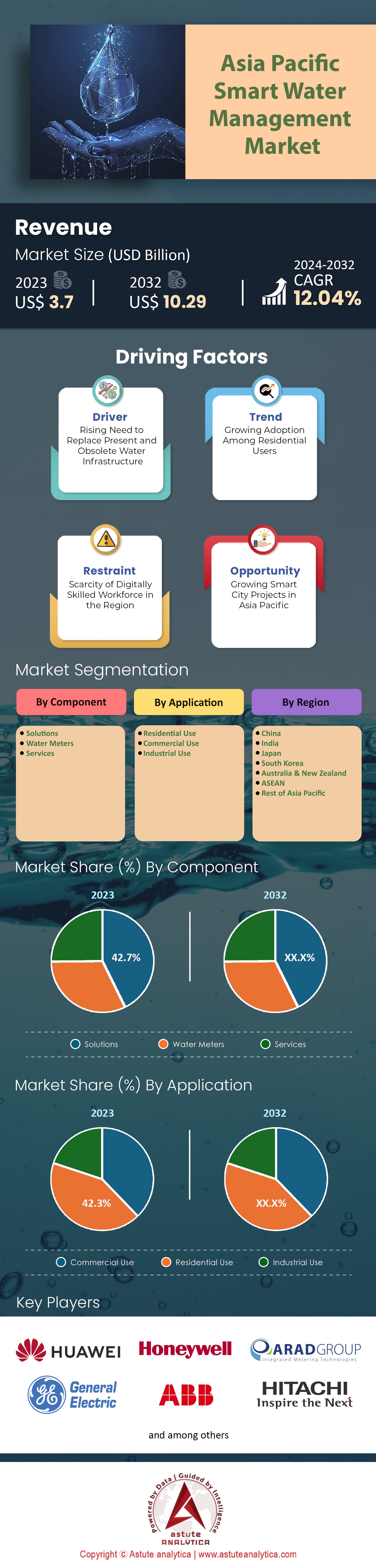

Asia Pacific smart water management market was valued at US$ 3.7 billion in 2023 and is expected to surpass market size of US$ 10.29 billion by 2032 at a CAGR of 12.04% during the forecast period 2024–2032.

The Asia Pacific smart water management market, burgeoning with its varied economic dynamism and technological advancements, is fast becoming the crucible for innovations in smart water management. Given the scale of urban development paired with the water resource challenges, the region has cultivated a ripe environment for advanced technological solutions.

At the macroeconomic level, the rapid urbanization, especially in megacities like Tokyo, Mumbai, Shanghai, and Jakarta, is exerting enormous pressure on the available water resources. Population explosions in specific areas necessitate a more efficient water distribution system, fueling market growth. Furthermore, heightened industrial activities, characteristic of developing economies like India and Vietnam, coupled with expansive agricultural sectors in countries such as China and Indonesia, amplify the need for advanced water treatment and distribution systems.

However, the larger economic trends only tell a part of the story in the smart water management market. On the microeconomic scale, we see intricate dynamics shaping the market. For instance, the rising middle-class population across Asia Pacific has shown increased awareness of sustainability and water conservation. This consumer consciousness, combined with their increasing purchasing power, is driving demand at the grassroots for smart water meters and home water management solutions.

Technological prowess in the region, particularly from tech giants in Japan, South Korea, and China, has been a cornerstone in the development of innovations in IoT and AI. These technologies have been foundational in the recent upswing of real-time data analytics and cloud computing in the water management domain. Their integration into the sector allows for improved efficiency in leakage detection, water quality monitoring, and predictive maintenance.

Yet, it's not just consumer demand and technological advancements pushing the envelope in the Asia Pacific smart water management market. Government regulations and policies are acting as significant catalysts. Incentives, tax rebates, and policy frameworks supporting sustainability are emerging throughout the region. Countries like Singapore and Australia are leading the way with stringent regulations and guidelines that promote the adoption of smart water solutions.

With these combined macro and microeconomic forces, the future trajectory for the Asia Pacific Smart Water Management Market seems steeped in opportunity. However, challenges persist, such as high implementation costs and occasional technological resistance in more rural areas. Still, as economic conditions evolve and technological penetration deepens, the smart water management market in the Asia Pacific is expected to see sustained growth, providing both an answer to the region's water challenges and an avenue for economic prosperity.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Technological Integration and Urbanization

Today, cities like Beijing, Tokyo, Jakarta, and Bangalore are experiencing unprecedented growth in population and infrastructure. This growth often strains existing resources, particularly water. Aging infrastructure, combined with increased demand, often leads to inefficiencies and wastage giving a push to the growth of the smart water management market.

The adoption of IoT (Internet of Things) devices and AI-powered algorithms is revolutionizing how water is managed in these urban settings. Smart meters are not just recording consumption; they are facilitating dynamic pricing, detecting leakage in real-time, and helping in predictive maintenance. Additionally, cloud computing is enabling centralized monitoring of water sources, treatment plants, and distribution networks. Technologies like remote sensing and GIS (Geographical Information Systems) are providing in-depth analytics about water table levels, reservoir capacities, and potential contamination sources. In essence, as cities are growing, they are also becoming smarter in how they manage one of their most crucial resources.

Trend: Increased Consumer Awareness and Participation

The Asia Pacific smart water management market has witnessed a remarkable trend – the rise of the informed consumer. This change isn't limited to purchasing habits related to retail or electronics but has permeated the realm of utilities and resources. With increased global connectivity and access to information, the average consumer in the Asia Pacific is more aware of global water challenges and the importance of conservation. There’s a discernible shift towards sustainable living, which has led to a rising demand for smart water management solutions at the household level.

This trend is evident in the uptake of smart water meters in homes, where consumers can monitor their water usage in real-time. Apps connected to these meters provide insights, set reminders for conservation, and even gamify the experience to encourage reduced consumption. Such consumer behavior further pressures municipal bodies and governments to invest in and adopt sophisticated water management systems, leading to a positive feedback loop promoting the growth of the market.

Restrain: High Initial Investment and Implementation Barriers

Many countries in the Asia Pacific smart water management market, despite their rapid growth trajectories, grapple with budgetary constraints. Investing heavily in new technology, without the guarantee of immediate returns, is a daunting prospect for many governments and municipal bodies.

Besides the monetary aspect, there's the challenge of technological integration. Many parts of the Asia Pacific still rely on decades-old infrastructure. Integrating modern technology with these dated systems can be cumbersome and inefficient. Training personnel, maintaining these hybrid systems, and managing the transition phase can be both time-consuming and resource-intensive. For many cities or regions, especially those not at the forefront of urban development, these barriers can significantly slow down the adoption of smart water management solutions.

Opportunity: Public-Private Partnerships and Regional Collaborations

Amidst the challenges and growth factors in the Asia Pacific smart water management market, there lies a golden opportunity in the form of public-private partnerships (PPP) and regional collaborations. Recognizing the potential of the market and the societal need, many tech giants and startups are diving into the domain of smart water management. Their technological know-how and resources, combined with the public sector's reach and regulatory power, can create a win-win scenario.

PPPs can alleviate some of the financial burdens associated with high initial investments. They can also fast-track technology integration by leveraging the private sector's expertise. We've seen successful examples of such collaborations in sectors like transportation and energy across the Asia Pacific, which can be emulated in the water management domain.

Furthermore, regional collaborations can play a pivotal role. Countries with more advanced technologies and solutions can aid their neighbors, fostering a sense of communal growth. Institutions like the Asian Development Bank (ADB) can act as mediators and facilitators, ensuring the smooth transfer of technology, expertise, and funds.

Segmental Analysis

By Component:

The solution component of the Asia Pacific smart water management market has proved itself as an integral part of the market. In 2023, it commanded a significant share, holding over 42% of the market's revenue share. This dominant presence is not a fleeting trend but is set to endure, as projections show this segment leading the market trajectory with a robust Compound Annual Growth Rate (CAGR) of 12.08%.

The solutions segment, in this context, refer to integrated systems, software, and methodologies tailored to address water management challenges. These might include real-time monitoring software, leak detection algorithms, or cloud-based analytics platforms. Given the pressing need to streamline water consumption, reduce wastage, and manage resources efficiently, these solutions are pivotal. They offer municipalities, industries, and even households the tools to make data-driven decisions, optimizing water usage and reducing overhead costs.

Furthermore, the growth in this segment is backed by constant innovation and R&D. As the Asia Pacific region races towards technological excellence, local startups and established tech giants are churning out advanced solutions that are both efficient and user-friendly, solidifying the segment's growth prospects.

By Application:

The commercial segment, comprising industries, offices, and other commercial establishments, clinched over 42.3% of the revenue share in 2023. Its dominance is also evident in the projected CAGR of 7.5%. Commercial entities, with their vast operational scales, stand to benefit immensely from smart water management. Implementing efficient systems can drastically reduce water-related costs, enhance sustainability profiles, and in some cases, even ensure regulatory compliance. The convergence of economic incentives with environmental responsibility is pushing the commercial segment to the forefront of the smart water management market.

On the flip side, the residential segment, though not leading in terms of market share, showcases immense promise. As urban centers in countries like Japan, South Korea, China, and India swell, residents are not just seeking comfortable homes but smart ones. The modern-day homeowner in the Asia Pacific is technologically adept and environmentally conscious. There's a growing inclination to retrofit homes with smart water management systems – from intelligent faucets that control flow to software that provides real-time consumption analytics.

The appeal of these smart solutions is twofold. Firstly, they allow residents to monitor and reduce their water usage, leading to tangible savings. Secondly, as technology becomes more affordable and accessible, its adoption curve sees an upward trend. With the dual incentives of cost-saving and environmental conservation, the residential segment's embrace of smart water management is poised to grow exponentially.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia Pacific region, given its diversity in terms of economic development, urbanization rates, and technological adoption, presents a fascinating panorama when it comes to the smart water management market. Central to this landscape are three giants: China, Japan, and India, each with its distinct characteristics and contributions.

In 2023, China's towering presence in the market was palpable, with its contribution exceeding a staggering $1.37 billion. urbanization is at the heart of China's evolution. With mega-cities like Beijing, Shanghai, and Shenzhen continuously expanding, there's a pressing demand for efficient, sustainable water management. As the government pushes for more eco-friendly urban development, smart water solutions become not only desirable but essential.

Moreover, China's technological ecosystem is ripe for such innovations in the smart water management market. Home to numerous tech giants and innovative startups, the country has been at the forefront of developing and implementing cutting-edge solutions in IoT, AI, and big data analytics, all crucial components in the realm of smart water management. The amalgamation of governmental support, rapid urban expansion, and technological prowess is what allows China to maintain a CAGR of 12.37% and its dominant position in the market.

Japan, while geographically smaller than China, has long been a hub of technological innovation and precision engineering. Tokyo, with its meticulous urban planning and sophisticated infrastructure, serves as a beacon for what advanced urban centers can achieve with smart water management. The high population density combined with limited natural resources pushes Japan to seek efficiency in every drop. The nation's penchant for technology has given rise to advanced metering solutions, real-time monitoring systems, and cloud-based analytics tools that ensure optimal water distribution, minimal wastage, and efficient consumption patterns.

Furthermore, Japan's corporate sector plays a pivotal role in the growth of the smart water management market. Companies invest heavily in R&D, creating solutions that are not just viable for Japan but have the potential for global adoption. This commitment to innovation cements Japan's position as the second-largest market in the Asia Pacific.

India, with its vast population and contrasting landscapes, offers a unique blend of challenges and opportunities. While urban centers like Mumbai, Bangalore, and Delhi grapple with the pressures of population and industry, they also represent hubs of innovation and technological growth. In recent years, the Indian government has launched numerous initiatives aimed at sustainable urban development and resource management. The 'Smart Cities Mission' is a testament to India's ambitions in this direction. Under such initiatives, cities are equipped with smart meters, real-time monitoring systems, and efficient wastewater treatment plants, driving the smart water management market's growth.

Additionally, India's burgeoning IT sector is increasingly collaborating with municipal bodies and industries, developing bespoke solutions tailored to the country's unique challenges in the smart water management market. While India might currently hold the third position, its vast potential and rapid developmental trajectory suggest that it could soon challenge its counterparts in the region.

Top Players in the Asia Pacific Smart Water Management Market

- ABB Ltd.

- Arad Group

- General Electric Co.

- Hitachi Ltd.

- Honeywell International Inc.

- Huawei Technologies Co. Ltd.

- Siemens AG

- Suez Group

- TaKaDu Limited

- i2O Water Ltd.

- Itron Inc.

- Schneider Electric SA

- Sensus Inc. (Xylem Inc.)

- Other Prominent Players

Market Segmentation Overview:

By Component

- Solutions

- Water Meters

- Services

By Application

- Residential Use

- Commercial Use

- Industrial Use

By Region

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)