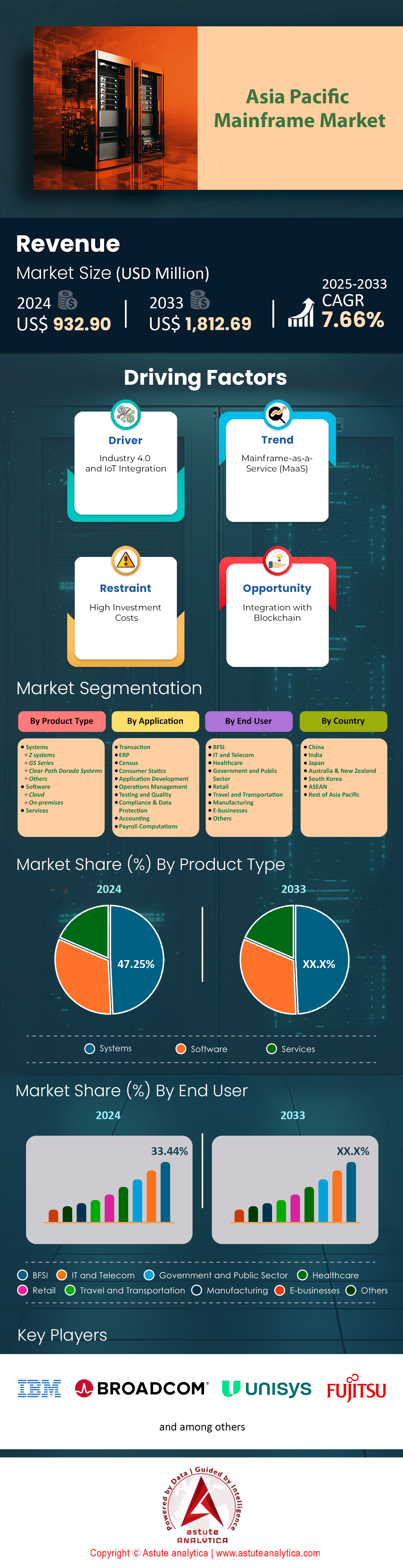

Asia Pacific Mainframe Market: By Product Type (Systems (Z systems, GS Series, Clear Path Dorado Systems, Others), Software (Cloud and On-premises), Services); Application (Transaction, ERP, Census, Consumer Statics, Application Development, Operations Management, Testing and Quality, Compliance & Data Protection, Accounting, Payroll Computations); End Users (BFSI, IT and Telecom, Healthcare, Government and Public Sector, Retail, Travel and Transportation, Manufacturing, E-businesses, Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Dec-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA12241018 | Delivery: Immediate Access

| Report ID: AA12241018 | Delivery: Immediate Access

Market Scenario

Asia Pacific mainframe market was valued at US$ 932.90 million in 2024 and is projected to hit the market valuation of US$ 1,812.69 million by 2033 at a CAGR of 7.66% during the forecast period 2025–2033.

The Asia Pacific mainframe market has recently witnessed a noteworthy upswing in mainframe adoption, driven by complex workloads and a surge in digital transformation initiatives. Organizations in banking, telecommunications, and government sectors increasingly rely on mainframes to handle enormous transaction volumes and ensure seamless data processing. According to an IDC study in 2023, spending on mainframe solutions across Asia Pacific surpassed US$ 3.2 billion, reflecting ongoing commitments toward robust infrastructure. Major players such as IBM, Fujitsu, and Hitachi maintain a strong presence, offering advanced systems that cater to large-scale data requirements. Furthermore, a 2023 survey by BMC identified 2,600 enterprises in the region actively using mainframes for mission-critical workloads.

A key factor supporting this growth of the mainframe market is the need for uncompromised security and high availability. Mainframes are well-suited to meet stringent compliance demands in the financial industry, which constitutes a significant portion of the regional market. In 2023, a KPMG analysis highlighted that 480 major banks and insurance companies across Asia Pacific expanded their mainframe footprints to manage growing data volumes securely. On the macroeconomic side, the steady economic development in emerging nations fosters continuous IT investments, while micro-level factors—like rising mobile transactions and real-time analytics—augment the appetite for reliable mainframe platform expansions. Companies also leverage mainframes to modernize legacy environments, ensuring compatibility between traditional workloads and emerging technologies such as AI-driven analytics.

Demand predominantly arises from high-growth markets, including China, India, and Japan, where large enterprises and government agencies in the regional mainframe market prioritize computing stability for services like e-payments, public distribution systems, and 24/7 customer portals. A 2023 report by Accenture revealed that 220 new projects in these countries focused on mainframe modernization to align with agile development practices. In addition to BFSI, sectors such as manufacturing and retail also rely on mainframes for real-time inventory tracking and large-scale ERP workloads. Lastly, growing cloud integration initiatives—emphasized by 130 hybrid mainframe-cloud deployments documented by NASSCOM in 2023—further illustrate the pivotal role that mainframes continue to play in the Asia Pacific region’s tech ecosystem.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Accelerated legacy modernization efforts demanding resilient, scalable, and secure back-end system architectures

Accelerated legacy modernization is reshaping how large enterprises approach mission-critical computing, particularly in the Asia Pacific mainframe market. With the rapid evolution of application landscapes, mainframes are no longer viewed as rigid systems but as adaptable platforms that can seamlessly align with contemporary development methodologies. Many organizations aim to enhance their back-end systems without completely abandoning trusted mainframe assets, reinforcing the trend toward pragmatic modernization strategies. In 2023, IDC reported 950 major modernization initiatives underway across the region, highlighting a clear industrywide push for updated frameworks and tooling.

One of the key catalysts for this shift is the proliferation of real-time digital services, from mobile banking apps to on-demand insurance claims processing. To support these services, enterprises require resilient infrastructures that can handle unparalleled throughput. In 2023, an Accenture study noted 180 large-scale transformations focusing on extending mainframe capabilities alongside microservices-based architectures. This approach in the mainframe market retains the reliability of mainframes while ensuring better integration with web and mobile platforms for next-generation customer experiences. The security dimension remains vital, as legacy modernization does not imply reduced compliance obligations. According to Capgemini’s 2023 report, 70 financial institutions in the Asia Pacific region enhanced encryption and authentication protocols on their mainframe environments, underlining robust data protection measures during their modernization journeys. Mainframes offer a fortified foundation for stringent data governance frameworks, supporting risk mitigation across different regulatory landscapes. Furthermore, advanced analytics and AI-driven insights are being integrated into these modernized systems, with IBM registering 130 new AI-on-mainframe projects in Asia Pacific in 2023. This underscores how modernization goes beyond lifting and shifting applications—enterprises are actively reimagining how to exploit mainframe speed and reliability for cutting-edge innovation.

Trend: Expanding use of DevOps toolchains optimizing continuous integration and delivery on mainframes

The practice of DevOps has traditionally been associated with distributed systems and cloud-native environments in the mainframe market. However, the Asia Pacific mainframe ecosystem is increasingly adopting DevOps methodologies to streamline software development lifecycles. This trend reflects a broader commitment to agile principles, with teams seeking faster release cycles while maintaining the renowned stability of mainframe platforms. In 2023, Broadcom reported 240 client engagements in the region focused explicitly on implementing DevOps pipelines for mainframe applications, demonstrating the method’s growing foothold. A significant driver of this trend is the push toward improved collaboration and automation. By embracing modern toolchains—ranging from automated testing to continuous integration—development teams minimize bottlenecks and reduce errors, resulting in more reliable and timely application releases. As of 2023, Micro Focus documented 110 large enterprises in Asia Pacific mainframe market that integrated end-to-end DevOps workflows into their mainframe operations. This shift includes the adoption of code repositories like Git, automated build tools, and container-based orchestration strategies, reflecting how mainframes are converging with mainstream development practices.

Beyond software engineering, DevOps on mainframes introduces cultural transformation in long-established IT departments. According to a Deloitte report published in 2023, 35 telecom and banking multinationals in the region noted enhanced collaboration between mainframe specialists and front-end teams, fostering an environment of shared accountability. Furthermore, BMC’s research in 2023 reveals that 85 DevOps-empowered mainframe deployments in Asia Pacific have leveraged advanced debugging and monitoring platforms to detect anomalies in real time. This accelerates the feedback loop and ensures minimal downtime.

Challenge: Limited interoperability between legacy and contemporary ecosystems requiring advanced integration methodologies

Limited interoperability continues to pose a significant challenge for enterprises in Asia Pacific mainframe market striving to merge legacy mainframe environments with contemporary applications and platforms. Mainframes, historically designed for specific workloads, often rely on proprietary protocols and data formats that do not seamlessly interface with modern APIs, container management systems, or microservices frameworks. In 2023, a Gartner study uncovered 140 documented cases within the region where interoperability hurdles stalled digital transformation projects, reflecting a recurring obstacle for CIOs and CTOs. The magnitude of this challenge often escalates in large-scale environments. Legacy applications need to communicate bidirectionally with cloud-native services, ERP solutions, or even IoT-driven data inflows. According to a 2023 Fujitsu report, 55 manufacturing companies in Asia Pacific encountered integration setbacks when adding IoT capabilities to mainframe-based supply chain applications. This underscores how the complexities of bridging on-premises mainframes with cloud-driven analytics or automation systems require sophisticated middleware, high-speed data exchange layers, and specialized expertise.

In response, vendors and service providers in the mainframe market in Asia Pacific are introducing new-generation integration tools, featuring wrappers, adapters, and micro-gateways. These solutions aim to streamline data exchange and enable real-time access to mainframe-hosted records. For instance, IBM documented over 100 enterprise-level deployments in 2023 that utilized z/OS Connect to expose mainframe transactions as RESTful APIs. Yet, despite these advances, skills shortages further complicate integration projects. A 2023 Capgemini survey indicated that 60 organizations in the region reported a scarcity of architects proficient in both mainframe and cloud technologies.

Segmental Analysis

By Product Type

Based on product type, the system segment (z Systems, GS Series, and ClearPath Dorado Systems) is dominating the Asia Pacific mainframe market by controlling over 47.25% market share. This is because they consistently deliver robust performance for mission-critical workloads. Many large organizations in finance, government, and healthcare continue to invest in these systems to handle expansive datasets and maintain high-speed transactional capabilities. Among these platforms, z Systems’ integration with modern frameworks underpins a substantial portion of big data and cloud initiatives across the region, leading to increased adoption in banking applications major driver behind higher demand for these systems is the synergy between mainframes and emerging digital tools like analytics, virtualization, and mobility solutions. End users require fail-safe computing environments capable of running extensive workloads without downtime, which z Systems, ClearPath Dorado Systems, and GS21 Series effectively provide Another factor fueling growth is the evolution of mainframes into hybrid solutions that integrate on-premise infrastructure with cloud services. The Asia Pacific market is expected to reach US$5.6 billion by 2032, partly due to this adaptability, which allows organizations to modernize while retaining mainframe reliability ClearPath Dorado’s long lineage, rooted in the OS 2200 operating system, also sustains its popularity by offering seamless scalability in industries like telecommunications.

The region’s demand for these systems originates primarily from countries with considerable investments in digital infrastructure, including Japan, China, Australia, and India. Large enterprises in these nations’ mainframe market allocate growing budgets to enhance legacy systems, particularly in legacy modernization projects that leverage mainframe strengths to reduce latency in their critical processes Ongoing digital transformation—driven by e-government services, burgeoning online commerce, and the need for real-time analytics—further solidifies the prominence of mainframes, as stakeholders prioritize systems with exceptional stability and throughput to fuel their strategic operations.

By Application

Based on application, transaction segment control over 43% market share as they offer unparalleled reliability, security, and swift processing capacity for mission-critical tasks. Across Asia Pacific, industries with complex operational requirements have shown rising enthusiasm for mainframe-driven transaction processes, as indicated by sustained investments in z Systems and ClearPath Dorado for real-time data handling The global mainframe market reached a value of US$2.9 billion in 2022, supported considerably by applications in sectors that demand secure high-volume processing, including banking and retail The technology’s design for throughput-intensive workloads allows businesses to handle large swaths of data effectively without compromising system stability.

In the Asia Pacific region, transaction-focused deployments are particularly prevalent in countries such as Japan, China, India, and Australia. These four nations represent a major share of the region’s overall transaction volume, given their expansive financial services landscape, rapid e-commerce growth, and digitized government services. Some mainframe workloads in large banks reportedly process billions of transactions annually, underscoring the platform’s reliability in delivering real-time performance even at massive scales In addition, telecommunications operators across these countries increasingly depend on mainframes for billing and customer information management, further augmenting transaction volumes.

The demand stems from enterprises seeking a proven architecture that can preserve data integrity and minimize downtime. Telecommunication billing cycles that leverage mainframe technologies now cover tens of millions of user accounts in Asia Pacific and process significant amounts of data that require high-speed updates. In parallel, global technology vendors continue to enhance mainframe offerings for transaction workloads by enabling seamless integration with analytics tools, ensuring that organizations can meet escalating data demands in a constantly evolving digital ecosystem.

By End Users

BFSI companies with over 33.44% market share in the Asia Pacific mainframe market are the largest end users of mainframe technology today because their operations hinge on real-time, high-volume transaction processing, robust risk management, and stringent data security requirements. The dominance is fueled largely by financial institutions and insurance providers looking for unmatched reliability in managing vast datasets. Within Asia Pacific region, banks and insurance firms have consistently increased investments in IBM z Systems and ClearPath Dorado due to their ability to scale while maintaining low latency for transactional workflows. Such capabilities are essential in a financial environment where any downtime or inconsistency could result in enormous losses.

Key factors that drive BFSI preference for mainframe market are system resiliency, data integrity, and compliance support. IBM z Systems, for instance, allows secure encryption and real-time analytics integration, which enable banks to detect fraudulent activities swiftly without impacting system throughput. Entities leveraging GS21 Series benefit from minimal outages during regulatory audits and end-of-year financial reconciliations, ensuring uninterrupted service even under peak demands. ClearPath Dorado’s proven operating system lineage also offers BFSI organizations a stable platform that supports concurrent transaction loads in the millions, a necessity for large banks dealing with cross-border fund transfers. Another reason these BFSI companies favor mainframes is the support for multi-tenancy, making it easier to integrate a range of solutions—risk assessment modules, mobile banking platforms, and ATM networks—under a single architecture. As BFSI providers prioritize digital transformation, the ability to adapt existing mainframe infrastructures to emerging technologies, such as hybrid cloud, accelerates modernization efforts.

To Understand More About this Research: Request A Free Sample

Country Analysis

China stands as the largest mainframe market with over 36.82% market share in the Asia Pacific region, underpinned by extensive investments in technology infrastructure and unwavering governmental support. One key driver of this dominance is the country’s robust financial sector, which relies heavily on mainframes for core banking, high-volume transaction processing, and stringent data security. As of 2023, IBM reported over 350 banking and insurance installations in China alone, indicating a matured ecosystem that continuously adopts the latest mainframe innovations. The presence of leading global players in the Asia Pacific mainframe market has further solidified China’s position. IBM, Fujitsu, and Hitachi each maintain dedicated research and development centers and strategic partnership programs in China, ensuring local enterprises have direct access to state-of-the-art mainframe technology. In 2023, Fujitsu’s collaboration with a top state-owned bank led to the implementation of 24 newly deployed mainframe systems, showing how major projects often catalyze broader technology rollouts. Meanwhile, Hitachi revealed 45 ongoing modernization initiatives in Chinese telecom and government sectors, highlighting a persistent push for next-generation mainframe solutions. Additionally, local technology giants—such as Inspur—enhance the competitive landscape by offering domestically engineered systems that align closely with China’s performance and data sovereignty requirements.

Beyond the technological front, China’s broader economic climate fosters ambitious infrastructure expansions that favor mainframe-centric architectures. The People’s Bank of China’s focus on consolidating and upgrading its clearing and settlement networks, documented in 2023, has involved multiple high-capacity mainframe deployments in the mainframe market. Similarly, technology-centric free trade zones encourage collaboration between enterprises, academic institutions, and solution providers to develop advanced hardware and software research. According to a 2023 report by Deloitte, at least 70 mainframe-related patents were filed in China, boosting local innovation in areas such as AI integration and microservices-based transaction handling.

Top Players in Asia Pacific Mainframe Market

- IBM

- Fujitsu Limited

- Broadcom

- NEC Corporation

- Unisys Corporation

- DXC Technology

- Other Prominent Players

Market Segmentation Overview:

By Product Type

- Systems

- Z systems

- GS Series

- Clear Path Dorado Systems

- Others

- Software

- Cloud

- On-premises

- Services

By Application

- Transaction

- ERP

- Census

- Consumer Statics

- Application Development

- Operations Management

- Testing and Quality

- Compliance & Data Protection

- Accounting

- Payroll Computations

By End User

- BFSI

- IT and Telecom

- Healthcare

- Government and Public Sector

- Retail

- Travel and Transportation

- Manufacturing

- E-businesses

- Others

By Country

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA12241018 | Delivery: Immediate Access

| Report ID: AA12241018 | Delivery: Immediate Access

.svg)