Asia Pacific Digital Advertising Market: By Platform (Mobile Ad, In-App, Mobile Web, Desktop Ad, Digital TV & Others); Ad Format (Digital Display Ad, Programmatic Transactions, Non-programmatic Transactions, Internet Paid Search, Social Media, Online Video, Others); Industry Verticals (Media and Entertainment, Consumer Goods & Retail Industry, Banking, Financial Service & Insurance, Telecommunication IT Sector, Travel Industry, Healthcare Sector, Manufacturing & Supply Chain, Transportation and Logistics, Energy, Power, and Utilities, Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Mar-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA1023626 | Delivery: 2 to 4 Hours

| Report ID: AA1023626 | Delivery: 2 to 4 Hours

Market Scenario

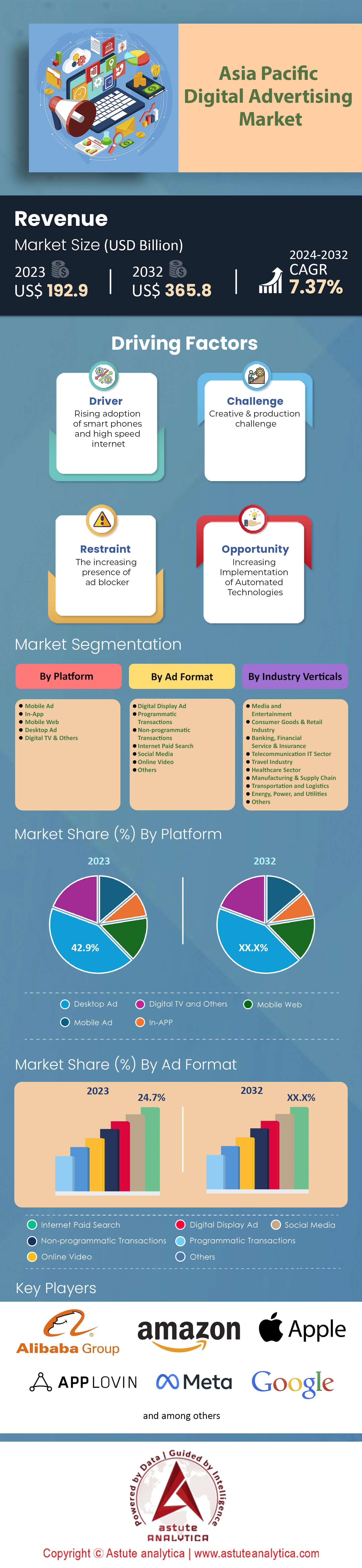

Asia Pacific Digital Advertising Market was valued at US$ 192.9 billion in 2023 and is projected to surpass the valuation of US$ 365.8 billion by 2032 at a CAGR of 7.37% during the forecast period 2024–2032.

The Asia Pacific (APAC) digital advertising market has, over the past few years, emerged as a formidable player in the global advertising landscape. Driven by a burgeoning internet user base, advancements in technology, and an increasingly digital-savvy populace, the APAC region boasts impressive growth numbers that beckon attention from advertisers worldwide. In terms of sheer volume, APAC is home to over 2.6 billion internet users, accounting for more than half of the global online population. This vast digital populace has propelled the region to become one of the fastest-growing digital ad markets globally. As per a 2022 report, APAC's digital advertising spending reached over $174.4 billion, showcasing a compounded annual growth rate (CAGR) of 7.37% from 2018 to 2022.

China, being the largest digital advertising market in the region, contributes significantly to these numbers. With over 900 million internet users, the nation alone accounted for around $78 billion in digital ad spending in 2022. The likes of Alibaba, Tencent, and Baidu dominate this space, harnessing their vast ecosystems to serve a plethora of advertising solutions to businesses. But while China plays a pivotal role, countries like India, Indonesia, and the Philippines are emerging as key growth drivers. India, with its 650 million internet users as of 2022, witnessed a remarkable 52% year-on-year growth in digital advertising spend, reaching nearly $3.5 billion in the same year.

The mobile advertising segment, in particular, has been a catalyst for this growth. With over 80% of APAC's internet users accessing the web via smartphones, mobile ad spend has surged exponentially. In 2023, desktop ads constituted around 42.9% of the total digital ad spend in the region, amounting to approximately $74.69 billion. On the other hand, the proliferation of affordable smartphones, paired with cheap data tariffs, especially in countries like India and Indonesia, has significantly fueled this mobile-first approach. Programmatic advertising, too, has seen a surge in the APAC region. This automated, data-driven method of buying and placing ads is estimated to have captured over 50% of the region's digital ad spend in 2022. The allure of efficiency, precise targeting, and real-time analytics has made it a favorite among advertisers. However, the region also grapples with challenges in this space, including concerns about ad fraud, transparency issues, and a sometimes-fragmented ecosystem.

Another noteworthy trend in the APAC digital advertising market is the growing prominence of video ads. The increasing consumption of video content, especially short-form videos on platforms like Instagram, Tiktok, and YouTube, has led to a surge in video ad spend. It is estimated that by 2023, digital video ads accounted for almost $15.66 billion, or roughly 9% of the total digital advertising spend in the region. As the market matures, several challenges are becoming more pronounced. Alongside concerns over ad fraud and transparency, there's increasing scrutiny over data privacy and regulations. Countries like India and Indonesia are tightening digital ad guidelines, thereby pushing advertisers and platforms to adapt to evolving standards.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: E-commerce Boom Giving Impetus to Digital Advertising

A significant driver of the Asia Pacific digital advertising market's growth is the meteoric rise of e-commerce platforms. In the past few years, e-commerce has transformed the retail landscape of the region, leading to a symbiotic relationship between e-commerce and digital advertising. E-commerce platforms are not only prime advertising platforms but also significant advertisers themselves. E-commerce sales in APAC were estimated to be around $2.4 trillion in 2022, accounting for nearly 60% of global e-commerce sales. This massive figure can be attributed to the penetration of internet-enabled smartphones, competitive data pricing, and the rapid urbanization of several APAC countries. China remains the e-commerce giant, with its online sales accounting for more than $1.6 trillion. However, Southeast Asia, led by countries like Indonesia, Vietnam, and the Philippines, recorded a CAGR of 21% from 2018 to 2022, reaching an e-commerce market value of over $150 billion in 2022.

The growth of e-commerce platforms like Amazon, Flipkart, Alibaba, Shopee, Tokopedia, and Lazada has spurred significant investments in digital advertising market. These platforms spend copiously to capture a more substantial market share and simultaneously open their platforms for other businesses to advertise. For instance, Alibaba's Alimama, its digital marketing arm, recorded a staggering $7 billion in revenues in 2021, which is a testament to the platform's advertising potential. Moreover, the user data amassed by these platforms offers unparalleled targeting precision, making advertisements more effective. In fact, ads on e-commerce platforms have consistently shown higher conversion rates compared to more generic digital ads. In a 2021 study, it was revealed that product listings with targeted e-commerce ads had a 34% higher click-through rate (CTR) and a 26% increase in conversion rate compared to non-targeted listings.

Trend: Growing Focus on Social Commerce

Emerging from the interplay between social media and e-commerce is the trend of social commerce, where purchasing processes are integrated directly into social media platforms, allowing users to purchase without leaving the app. Social media platforms, primarily known for connecting people, are swiftly becoming marketplaces in the Asia Pacific digital advertising market. The rise of platforms like Pinduoduo in China, which leverages social connections for group buying at reduced prices, underlines this trend. By 2022, Pinduoduo boasted over 751 million active users and a GMV (Gross Merchandise Volume) of about $330 billion. Similarly, the live selling phenomenon, particularly in countries like Thailand and Vietnam, is adding a new dimension to social commerce. These "live" sessions, streamed on platforms like Facebook or specialized apps, can garner millions of views. A report from 2022 indicated that in Vietnam alone, over 40% of online shoppers made at least one purchase through live selling sessions.

Furthermore, platforms like Instagram, YouTube, and TikTok, with their "Shop Now" and in-app purchasing features, are blurring the lines between social media and e-commerce. As of 2022, Instagram, with its 'Checkout' feature, had already onboarded over 10,000 brands globally, with APAC brands accounting for nearly 40% of them in the digital advertising market. The integration of social features, like sharing and commenting on products, creates an interactive shopping experience. It also builds trust, as recommendations from friends and family or trusted influencers often hold more weight than standard advertisements. Data from a 2021 survey indicated that over 55% of consumers in APAC were more likely to buy a product endorsed by someone they trust on social media.

Opportunity: Leveraging the Voice-Search Revolution in APAC

The Asia Pacific region, with its vast and diverse internet user base, presents a unique opportunity in the realm of voice search advertising. As smart devices become increasingly prevalent and voice assistants, like Google Assistant, Siri, and Bixby, gain more acceptance, voice search is positioned to be the next frontier in digital advertising. A 2021 report highlighted that approximately 35% of internet users in APAC used voice search at least once a week, a figure that has likely grown since in the digital advertising market. In countries like India and China, rapid technological adoption has catapulted voice search into mainstream use. Specifically, in India, the number of voice-search queries on Google grew by a staggering 270% year-on-year in 2020.

The unique linguistic diversity of APAC intensifies the potential of voice search. For instance, in India alone, with its 22 official languages and hundreds of dialects, the text-based search can often be cumbersome. Voice search, with increasing multilingual capabilities, has made digital access seamless for millions who might not be comfortable typing in English or their native script.

For advertisers in the Asia Pacific digital advertising market, this presents a gold mine of opportunities. With voice searches generally being longer and more conversational, there's potential for more accurate targeting based on the user's intent. Brands that can effectively leverage voice search optimization stand to benefit immensely in terms of reach and engagement. In sum, as voice technology becomes more refined and its adoption spreads across the APAC region, the integration of voice search into digital advertising strategies will undoubtedly yield significant dividends.

Segmental Analysis

By Platform

By platform-based analysis, the desktop segment, despite the worldwide mobile-first approach, continues to play a dominant role in APAC's digital advertising market. Projected to hold more than 42.9% of the market's revenue share, the enduring strength of desktop advertising can be attributed to several factors. The most notable is the extensive use of desktops in corporate settings and businesses, especially in developed APAC economies like Japan, South Korea, and Australia. Moreover, while mobile devices are ideal for brief interactions, desktops still provide a more comprehensive browsing experience, lending themselves better to certain types of in-depth content and advertisement displays.

However, as expected, the tide is turning in favor of mobile. The mobile ad segment, projected to grow at the fastest CAGR of 8.40%, showcases the undeniable shift towards smartphones and tablets. This growth is buoyed by the sheer volume of mobile device users, especially in populous nations like India, China, and Indonesia, where mobile adoption is skyrocketing. Affordable smartphones and competitive data prices are amplifying this trend, enabling a significant portion of the populace to access the internet for the first time via mobile devices.

To Understand More About this Research: Request A Free Sample

By Ad Format

By ad formats, the internet paid search segment is at the forefront of the Asia Pacific digital advertising market, accounting for a significant 24.7% of the market's revenue share. Paid search's dominance can be attributed to its direct approach, measurable ROI, and the inherent user intent behind search queries. In the APAC region, platforms like Baidu in China, Naver in South Korea, and Google in other parts have allowed advertisers to tap into this user intent, driving conversions and brand visibility.

Nevertheless, the online video segment's potential cannot be underestimated. Poised to grow at an impressive CAGR of 8.64%, online video advertising is capitalizing on the changing content consumption patterns of the APAC audience. The increasing popularity of platforms like TikTok, YouTube, and regional players like Hotstar and Viu suggests a growing appetite for video content. Video ads, especially short and engaging ones, are proving to be effective in capturing user attention and driving brand recall. The immersive nature of video, combined with the potential for storytelling, is making it a favorite among brands targeting younger, digitally-savvy demographics.

By Industry Vertical

In the diverse and expansive Asia Pacific digital advertising market, the industry verticals shaping the advertising landscape offer compelling insights. Central to this narrative is the consumer goods and retail industry, which has firmly entrenched its position at the forefront. Capturing more than 24% of the market's revenue share, this industry's dominance highlights its intrinsic connection with digital advertising channels.

The APAC region, with its over 4.5 billion population, has witnessed a surge in consumerism, fueled by growing middle classes, especially in countries like China, India, and Indonesia. As of 2023, the retail e-commerce sales in the APAC surpassed the $1.8 trillion mark. This significant number can be attributed to both the expansion of online platforms and the deepening penetration of internet connectivity across the region. Digital advertising has become the key pin for brands in the consumer goods and retail sector to reach, engage, and convert the vast online populace. The digital ad spend for this industry alone was estimated to be around $22 billion in 2022. From targeted ads based on consumer behavior to influencer collaborations on platforms like Instagram and TikTok, the consumer goods and retail industry is leveraging every facet of digital advertising to its advantage.

Regional Analysis

China's meteoric rise as a digital powerhouse is unquestionably reflected in its dominance of the Asia Pacific digital advertising market. With a contribution of over 45% to the regional market, China not only serves as a ground for emerging trends in digital advertising but also provides a framework that other APAC nations might seek to emulate or adapt from. The numbers coming from China are both astounding and instructive. By the end of 2023, China's digital advertising spend was nearing a mammoth $78 billion. To put this in perspective, this figure is higher than the combined digital ad spends of countries like Japan, South Korea, India, and Australia. Central to this narrative is China's vast internet user base, which surpassed 900 million in 2021. This extensive digital populace has been a fertile ground for domestic tech giants like Alibaba, Tencent, and Baidu, who have capitalized on and driven the digital ad surge.

The mobile sector, in particular, is a linchpin in China's digital advertising market. With over 98% of China's internet users accessing the web through mobile devices in 2021, mobile ad spend in the country accounted for more than $4.5 billion, marking a significant chunk of the APAC's entire mobile ad market. Platforms like WeChat, with its billion-plus user base, have transformed from mere communication tools to comprehensive ecosystems integrating advertising, e-commerce, payments, and more. Furthermore, China's foray into innovative advertising formats and technologies has solidified its leadership position. For instance, the programmatic advertising’s spending in China reached approximately $6.84 billion in 2023. This growth has been powered by the increasing adoption of AI and machine learning, enabling more targeted and efficient ad placements.

China's influence is not limited to sheer spending power or user numbers. The country has effectively cultivated an environment where startups, tech giants, and advertisers coalesce to create innovative advertising solutions. The burgeoning short-video platform in the digital advertising market, led by Douyin (the Chinese counterpart of TikTok), amassed over 600 million daily active users in 2021, opening new avenues for advertisers and pushing the boundaries of interactive and immersive ad formats.

Top Players in Asia Pacific Digital Advertising Market

- Alibaba Group Holding Ltd

- Amazon Inc.

- Apple Inc.

- AppLovin Corp

- Meta (Facebook Inc.)

- Google Inc.

- Nokia Corporation

- Twitter Inc.

- Verizon Communications Inc.

- Microsoft Corporation

Market Segmentation Overview:

By Platform

- Mobile Ad

- In-App

- Mobile Web

- Desktop Ad

- Digital TV & Others

By Ad-Format

- Digital Display Ad

- Programmatic Transactions

- Non-programmatic Transactions

- Internet Paid Search

- Social Media

- Online Video

- Others

By Industry Verticals

- Media and Entertainment

- Consumer Goods & Retail Industry

- Banking, Financial Service & Insurance

- Telecommunication IT Sector

- Travel Industry

- Healthcare Sector

- Manufacturing & Supply Chain

- Transportation and Logistics

- Energy, Power, and Utilities

- Others

By Country

- China

- India

- Australia

- South Korea

- Taiwan

- ASEAN

- Indonesia

- Malaysia

- Vietnam

- Philippines

- Singapore

- Thailand

- Rest of ASEAN

- Rest of Asia Pacific

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 192.9 Bn |

| Expected Revenue in 2032 | US$ 365.8 Bn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 7.37% |

| Segments covered | By Platform, By Ad-Format, By Industry Verticals, By Country |

| Key Companies | Alibaba Group Holding Ltd, Amazon Inc., Apple Inc., AppLovin Corp, Meta (Facebook Inc.), Google Inc., Nokia Corporation, Twitter Inc., Verizon Communications Inc., Microsoft Corporation Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA1023626 | Delivery: 2 to 4 Hours

| Report ID: AA1023626 | Delivery: 2 to 4 Hours

.svg)