Asia Pacific Continuous Glucose Monitoring Market: By Component (Sensors, Transmitters & Receivers, Integrated Insulin Pumps, and Others); Demographics (Child Population (<14 years) and Adult Population (>14 years)); End Users (Diagnostics/Clinics, ICUs, and Home Healthcare); and Country—Industry Dynamics, Market Size and Opportunity Forecast until 2031

- Last Updated: Mar-2023 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0522220 | Delivery: 2 to 4 Hours

| Report ID: AA0522220 | Delivery: 2 to 4 Hours

Market Scenario

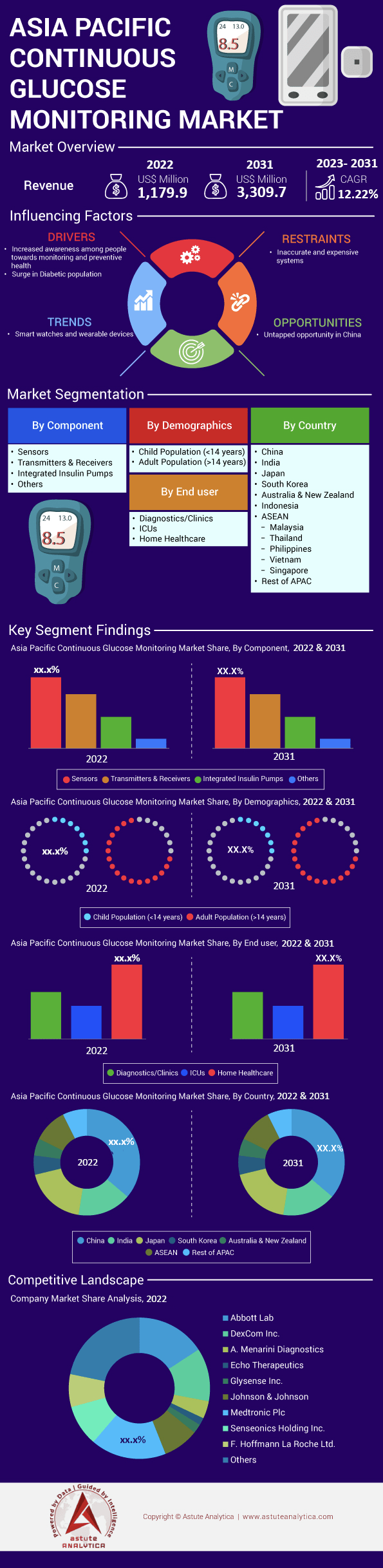

Asia Pacific Continuous Glucose Monitoring Market is expected to witness a major rise in its revenue from US$ 1,179.9 Mn in 2022 to US$ 3,309.7 Mn by the end of 2031. The market is registering a CAGR of 12.22% over the forecast period 2023-2031.

The International Diabetes Federation (IDF) estimates that the majority of individuals with diabetes, about 80%, reside in low- and middle-income countries. In Asia, more than 60% of the diabetic population lives with almost one-third of them located in China. The device majorly finds demand among people with insulin-requiring diabetes, such as type I, type II diabetes or other types of diabetes, as it allows the user to check their glucose levels anytime with ease. CGM systems can help in better management of glucose levels every day, resulting in fewer low blood glucose emergencies and the need for fewer finger sticks.

The Asia Pacific continuous glucose monitoring market is driven by various factors such as increased awareness among people towards monitoring and preventive health and a surge in diabetic populations. The rising disposable income in Asia Pacific countries followed by the growing awareness about the advantages of good healthcare systems and healthier lifestyles is accelerating market growth.

Additionally, the increasing prevalence of diabetes in Asia is propelling the market growth. The IDF estimated that 463 million people had diabetes worldwide in 2019, and this is predicted to rise to 700 million by 2045. 80% of these individuals live in low- and middle-income countries, with more than 60% in Asia and almost one-third in China continuous glucose monitoring market. The prevalence of both type 1 and type 2 diabetes has increased significantly during recent decades due to rapid urbanization, sedentary lifestyles, unhealthy diets, tobacco use, and increasing life expectancy. India is also facing the challenge of diabetes, with an estimated 8.7% diabetic population in the age group of 20 and 70 years. However, CGM devices can be expensive, and the results might not be as accurate as a fingerstick check.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Technological Advancements in Continuous Glucose Monitoring

Advancements in technology have significantly improved the accuracy and reliability of continuous glucose monitoring systems, making them an essential tool for diabetes management. The development of smaller, more comfortable devices with longer-lasting sensors and better connectivity has also made CGMs more accessible and user-friendly. Furthermore, the integration of CGMs with insulin pumps and artificial pancreas systems is transforming the treatment of diabetes, allowing for better glucose control and reducing the risk of hypoglycemia.

Trend: Personalized diabetes management

One trend in the continuous glucose monitoring market is the shift towards personalized diabetes management. Advances in technology have allowed for more precise and individualized approaches to diabetes care, with continuous glucose monitoring playing a key role. By providing real-time data on glucose levels, continuous glucose monitoring allows healthcare providers to tailor treatment plans to the specific needs of each patient, rather than relying on a one-size-fits-all approach. This trend is expected to continue as more sophisticated algorithms and artificial intelligence systems are developed to analyze and interpret the vast amounts of data generated by continuous glucose monitoring.

Challenge: Cost and accessibility

One challenge in the continuous glucose monitoring market is the cost and accessibility of these devices. While continuous glucose monitoring has the potential to revolutionize diabetes care, the high cost of devices and limited insurance coverage can make them inaccessible to many patients. This is particularly problematic in developing countries where access to healthcare is limited. Addressing these challenges will require a concerted effort from healthcare providers, device manufacturers, and policymakers to increase affordability and accessibility.

Opportunity: Integration with other healthcare technologies

One opportunity in the continuous glucose monitoring market is the integration of these devices with other healthcare technologies. For example, combining continuous glucose monitoring with insulin pumps or artificial pancreas systems could provide a more comprehensive and automated approach to diabetes management. Additionally, integrating continuous glucose monitoring with electronic health records could provide a more seamless and coordinated approach to diabetes care, with real-time data being shared between healthcare providers and patients. As more healthcare technologies are developed and integrated, the potential benefits of continuous glucose monitoring are likely to expand even further.

Segmental Analysis of Asia Pacific Continuous Glucose Monitoring Market Report:

By Component:

The sensors segment currently holds the highest market share in the CGM market in 2022, and is expected to register the highest compound annual growth rate (CAGR) over the forecast period from 2022 to 2030. This is due to the fact that CGM works through a tiny sensor that is inserted under the skin, and measures interstitial glucose levels - the glucose found in the fluid between cells - every few minutes. The sensor provides detailed glucose level data, is user-friendly, and is also affordable, which has led to the growth of this segment.

By Demographics:

In terms of demographics, the adult population currently holds the highest share in the Asia Pacific continuous glucose monitoring market in 2022, and is expected to continue its dominance over the forecast period. Adults aged 45 to 64 years are the most prone to diabetes, and require regular CGM monitoring, which has led to this segment holding the highest market share.

By End Users:

Home health care currently has the highest market share in the CGM market in 2022, and is expected to continue to register the highest annual growth rate over the projection period. This is due to the fact that CGM provides dynamic information that gives patients timely check on their nutrition, activity, and insulin requirements, which can be easily tracked and managed at home, thereby reducing hospital costs.

To Understand More About this Research: Request A Free Sample

Regional Analysis

China is the highest shareholder country in the Asia Pacific continuous glucose monitoring market in 2022, accounting for a significant portion of the market share. This is due to the fact that one third of the diabetic patients in the Asia Pacific region are located in China, making it a major market for continuous glucose monitoring devices. Additionally, with an aging population and changing lifestyles, the prevalence of diabetes is rapidly increasing in China, leading to a growing demand for continuous glucose monitoring devices.

India, on the other hand, records the highest compound annual growth rate (CAGR) over the projection period. This is mainly because diabetes is the fastest-growing health condition in India, with an estimated 77 million adults living with diabetes. Moreover, the country has a significant population with high diabetes condition due to genetic predisposition, urbanization, and lifestyle changes, leading to a growing need for continuous glucose monitoring devices.

The Asia Pacific continuous glucose monitoring market is expected to witness significant growth during the forecast period due to rising healthcare expenditure, increasing awareness about diabetes management, and technological advancements in continuous glucose monitoring devices. With China and India being the largest contributors to the market, the region is poised to be a major growth driver for the continuous glucose monitoring market in the coming years.

List of Key Companies profiled:

- Abbott Laboratories

- DexCom, Inc.

- A. Menarini Diagnostics

- Echo Therapeutics, Inc.

- GlySens Incorporated

- Johnson & Johnson

- Medtronic plc

- Senseonics Holdings, Inc.

- F. Hoffmann-La Roche Ltd.

- Other Prominent Players

Segmentation Overview

The following are the different segments of the Asia Pacific Continuous Glucose Monitoring (CGM) Market:

By Component:

- Sensors

- Transmitters & Receivers

- Integrated Insulin Pumps

- Others

By Demographics:

- Child Population (<14 years)

- Adult Population (>14 years)

By End user:

- Diagnostics/Clinics

- ICUs

- Home Healthcare

By Country:

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- Indonesia

- ASEAN

- Malaysia

- Thailand

- Philippines

- Vietnam

- Singapore

- Rest of Asia Pacific

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2022 | US$ 1,179.9 Million |

| Expected Revenue in 2031 | US$ 3,309.7 Million |

| Historic Data | 2018-2021 |

| Base Year | 2022 |

| Forecast Period | 2023-2031 |

| Unit | Value (USD Mn) |

| CAGR | 12.22% |

| Segments covered | By Component, By Demographics, By End-User, By Country |

| Key Companies | Abbott Laboratories, DexCom, Inc., A. Menarini Diagnostics, Echo Therapeutics, Inc., GlySens Incorporated, Johnson & Johnson, Medtronic plc, Senseonics Holdings, Inc., F. Hoffmann-La Roche Ltd., Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

FREQUENTLY ASKED QUESTIONS

Continuous glucose monitoring automatically tracks blood glucose levels, also called blood sugar, throughout the day and night on a continual basis by insulin-requiring people with diabetes.

A continuous glucose monitor consists of three parts: a small electrode placed under the skin, a transmitter sending readings at regular intervals (ranging from every 5 to 15 min), and a separate receiver.

China has the highest prevalence of diabetes in Asia Pacific.

The Asia Pacific Continuous Glucose Monitoring Market was valued at US$ 1,179.9 Mn in 2022.

The Asia Pacific CGM market is projected to expand at a CAGR of 12.22% over the forecast period 2023-2031.

The market is majorly driven by factors such as increased awareness among people towards monitoring and preventive health and surge in diabetic population.

CGM devices can be expensive, and the results might not be as accurate as a fingerstick check.

Sensors dominate the market in 2022.

Home healthcare segment are the highest end-users in the Asia Pacific Continuous Glucose Monitoring Market in 2022.

China dominates the Asia Pacific CGM market.

India records the highest CAGR in the Asia Pacific CGM market.

The key players in the Asia Pacific CGM market are Medtronic Plc, Abbott Lab, DexCom Inc., Senseonics Holding Inc., and Johnson & Johnson among others.

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0522220 | Delivery: 2 to 4 Hours

| Report ID: AA0522220 | Delivery: 2 to 4 Hours

.svg)