ASEAN Automotive Insurance Market (By risk cover – Comprehensive, Liability, Collision, Uninsured motorist, Add-ons; By Policy term – 1 year, 3 years, 5 years; By Channel – Direct, Bank, Agency, Online Marketplaces; By Vehicle type – Diesel, Petrol, Electric Vehicle; By End-user – Individuals, Businesses; By vehicle ownership – New, Used; By Vehicle application – Personal, Commercial; By Country – Malaysia, Singapore, Thailand, Vietnam, Indonesia, Philippines) – Industry Dynamics, Market Size, and Opportunity Forecast to 2027

- Last Updated: May-2022 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0421077 | Delivery: 2 to 4 Hours

| Report ID: AA0421077 | Delivery: 2 to 4 Hours

Report Synopsis

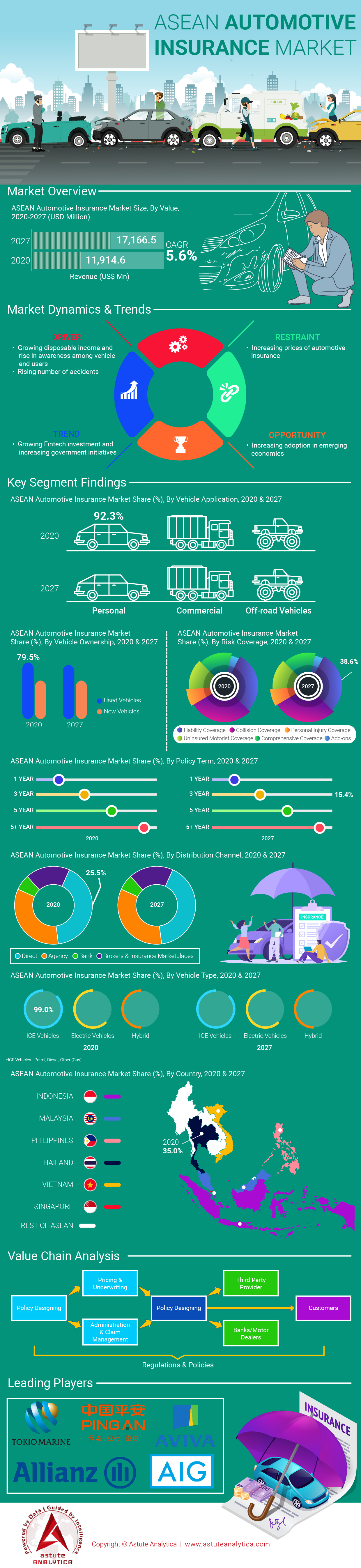

ASEAN auto insurance market is forecast to see a rise in market size to more than US$ 17,166.5 Million by 2027, registering a CAGR of 5.6% over the 6 years forecast term. ASEAN automotive insurance market is analyzed for the period 2017 to 2027, wherein 2017-2020 is the historic data, 2021 is considered as the base year and 2022-2027 are forecast values. The market size here refers to gross written premiums (GWP) by the insurance providers. The growth over the forecast period reflects industry recovery from the Covid-19 pandemic and the subsequent growth trend. The report presents analysis detailed across 19 elucidated chapters totaling 265 pages, with 67 extensive data tables and 135 figures. The report on the ASEAN market for auto insurance provides a detailed analysis of market opportunities, market dynamics, and industry competitive structure.

Automotive insurance or auto insurance is the insurance of motor vehicles (automobiles) against the risk of damage from events those insured. With the rise in the number of motor vehicles on road, accidents have become frequent and may cost a hefty amount to vehicle owners, if not covered under the suitable auto insurance policy. Growing technology complexities of the vehicles have also added to the cost of components which might require a replacement of an upgrade.

Report Scope

The report provides an in-depth and comprehensive analysis of market opportunities in motor insurance across ASEAN countries. The following countries have been extensively analyzed – Malaysia, Thailand, Singapore, Vietnam, Indonesia, Philippines, and the Rest of ASEAN – for growth opportunities in the ASEAN automotive insurance market. The report identifies Thailand as the largest market while the Philippines is the market with the highest CAGR. Malaysia is forecast to see a growth rate below the regional CAGR of 5.6%.

The report includes ASEAN automotive insurance market analysis on basis of the following parameters – Risk Cover, Policy Term, Distribution Channel, and Coverage Term. The additional parameters considered for analyzing the market include – Vehicle type, End-users, Vehicle Ownership, and Vehicle Application. In all report segments market for 41 sub-segments, providing readers with exclusive growth trend for each sub-segment. Considering the growing traction of Electric vehicles, the same has been considered as an exclusive segment for market opportunity analysis. Across ASEAN, it is observed that EV vehicles would see a healthy growth of 6.6% over the forecast term, with market size growing by more than 53%.

Considering the trend of customers opting for add-ons on their policies, the report includes analysis for popular add-ons, viz. road-side assistance, engine replacement, and Nil depreciation. Report scope also includes analyses of automotive insurance for off-highway vehicles, covered under section by Vehicle application. Analysis of the 2-wheeler automotive insurance market is also covered in the report.

The other segments analyzed in the report are shown in the image below. For analysis on any specific segments or customization to segments mentioned, Ask for a sample.

Report Glimpse

Due to the rising number of vehicles on roads and an equally higher number of accidents, the market has seen a rise in penetration of auto insurance across both commercial/ businesses and individual segments. This trend is further strengthened by support from a favorable regulatory environment. Moreover, with vehicles getting more digital and connected, the cost of maintenance has seen a rise, making insurance a viable alternative. The entry of multiple players in the market has allowed customers to leverage their bargaining power and get the best of insurance deals for their vehicles with apt risk cover being taken. Growth in EV vehicles and insurance marketplaces is further expected to drive demand for motor insurance among the customers. Increase in vehicle ownership rate, with used cars sales seeing a surge, ASEAN automotive insurance market is poised to see a healthy growth rate over the forecast period.

Competition Landscape

The competition landscape section of the report covers descriptive profiles of 12 prominent players and readers can request for revising the list or including additional players, as per their research requirements. Details covered for these players include – Business description, company financials, and claims, key details, strategy outlook, list of products, recent developments. The players profiled in the report include the following - AVIVA Ltd., Berkshire Hathaway Inc., China Pacific Insurance Co., Chubb Group, People's Insurance Company of China, Ping An Insurance (Group) Company of China, Ltd., State Farm Mutual Automobile Insurance’ Tokio Marine Group, Admiral Group Plc, AIG (American International Group, Inc.), Allianz, and Allstate Insurance Company.

Segmentation Overview of the ASEAN Automotive Insurance Market

By Risk Coverage

- Collision Coverage

- Comprehensive Coverage

- Liability Coverage

- Personal Injury Coverage

- Uninsured Motorist Coverage

- Add-ons

- Road-side assistance

- Engine replacement

- Nil Depreciation

By Coverage Term

- One year

- 3 Years

- 5 Years

- More than 5 years

By Distribution Channel

- Agency

- Bank

- Brokers and Insurance Marketplaces

- Direct

- Others

By Vehicle Type

- ICE Vehicles

- Petrol

- Diesel

- Other

- Electric Vehicles

- Hybrid

By Vehicle Application

- Personal

- 2 Wheelers

- 4 Wheelers

- Commercial

- Passenger

- Heavy Vehicles

- Off-road Vehicles

By Vehicle Ownership

- New Vehicles

- Used Vehicles

By End-user

- Individuals

- Businesses

- Enterprise

- Logistics

- Retail

- Education

- Energy & Mining

- Construction

- Others

By Region

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of ASEAN

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2020 | US$ 11,914.6 Mn |

| Expected Revenue in 2027 | US$ 17,166.5 Mn |

| Historic Data | 2017-2020 |

| Base Year | 2021 |

| Forecast Period | 2022-2027 |

| Unit | Value (USD Mn) |

| CAGR | 5.6% |

| Segments covered | Risk Coverage, Coverage Term, Distribution Channel, Vehicle Type, Vehicle Application, Vehicle Ownership, End-user, and Region |

| Key Companies | AVIVA Ltd., Berkshire Hathaway Inc., China Pacific Insurance Co., Chubb Group, and other prominent players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

FREQUENTLY ASKED QUESTIONS

ASEAN automotive insurance market in 2020 was valued at US$ 11.9 Billion.

Report provides market size forecast for period 2021-2027, with market estimated to grow at compounded annual growth rate of 5.6%, adding opportunity worth US$ 5.3 Billion.

The report provides market size estimates for period of 2017-2027. Wherein, 2017-2019 is the historic period. 2020 is the base year, and 2021-2027 is the forecast period. In all, forecast is provided for a term of 10 years in the report.

The report provides detailed segment level market size analysis and forecast for multiple parameters. These include: Risk Cover (9 subsegments), Policy Term (4 subsegments), Distribution Channel (4 channels), Vehicle Ownership (2 subsegments), Vehicle Application (7 subsegments), End-user (9 subsegments), Region (6 countries)

Report covers detailed segment level market size breakdown for following 6 countries – Singapore, Indonesia, Malaysia, Thailand, Singapore, and Vietnam.

Report covers in-depth analysis of market dynamics, explaining different factors expected to influence market growth over the forecast period. These are marked as market drivers, restraints, challenges, and trends. The report identifies rise in disposable income, growing awareness among customers, and regulatory changes have been significant in driving market demand. Responsiveness of market players to this shift, in the form of enrichment of policy covers and their premium and ease of availability through multiple channels, has positive impact on market growth.

The report identifies following companies as prominent players in the market - Tokio Marine Life, Ping An Insurance (Group) Company of China, Ltd., AVIVA LTD., Allianz, and AIG.

The report includes descriptive profiles of 12 insurance providers. The list is always customizable for no cost, incase one wishes to add or replace few companies.

Yes, report provides impact analysis of Covid-19 pandemic on market growth trend. 3 different scenarios are described in report depending on how the region responds to pandemic and its effects and subsequent recovery strategies.

Pricing analysis section describes shift in average premium over the forecast period for all 6 countries. We also have options, if you wish to have detailed pricing analysis for a given product, cover, or term or any segment therein.

Yes, report provides estimate for global market size in 2020, and share of Asia pacific in the global automotive insurance market. Share of ASEAN in Asia Pacific automotive insurance market is also provided to help understand how the region fares against the global market.

Report provides analysis of individual consumer behavior as part of insights. Details such as vehicle ownership, average spend on maintenance, preferred policy term, most common subscribed add-ons on standard policy, preferred distribution channel, and other details are analyzed to help understand ASEAN Automotive insurance market growth potential.

Yes, report provides automotive insurance market size for Electric vehicles (EVs) as well in the report, covered under Vehicle type segmentation.

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0421077 | Delivery: 2 to 4 Hours

| Report ID: AA0421077 | Delivery: 2 to 4 Hours

.svg)