Argentina Enteral Nutrition Market: Type (Standard Protein Diet, High Protein, Supplement, Protein for Diabetes Care Patient, and Others) and Application (Hospitals Sales, Retail, Online)— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 15-Mar-2024 | | Report ID: AA0324797

Market Scenario

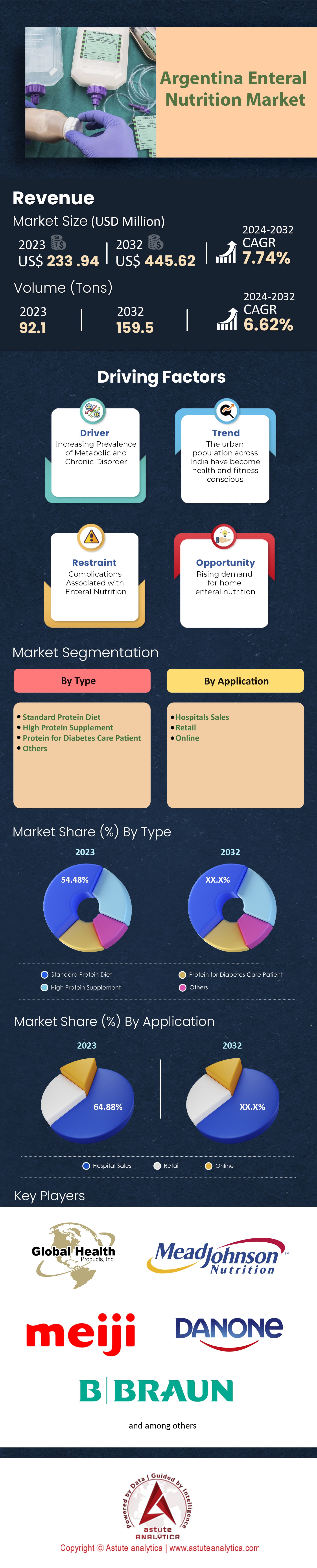

Argentina Enteral Nutrition Market was valued at US$ 233.94 million in 2023 and is projected to hit the market valuation of US$ 445.62 million by 2032 at a CAGR of 7.74% during the forecast period 2024–2032.

Argentina has a lot going on when it comes to nutrition. The country is dealing with both undernutrition and overnutrition, making the whole thing pretty complex. It’s scary but children in the country are suffering from childhood stunting (8.7%) and wasting (1.7%). However, adults also have a high rate of obesity, with about 31.7% of women and 30.2% of men in Argentina being obese. Even worse, so do kids- about 41.1% of them are considered overweight or obese.

Despite all these challenges, there’s a silver lining: a positive trend is emerging. 61% of Argentinians are starting to think they eat healthier than their parents do. This openness to new diets presents the perfect opportunity for the enteral nutrition market. With evidence of both malnutrition and obesity-related diseases - especially in vulnerable populations - it’s clear that nutritional interventions are needed. When oral intake is insufficient or impossible, enteral nutrition swoops in with crucial nutrients. The more this segment becomes known throughout Argentina, the bigger chance for expansion there will be.

To Get more Insights, Request A Free Sample

Market Dynamics

Increasing Cases of Chronic Diseases, Such as Diabetes, Cancer, and Gastrointestinal Diseases

With the rising prevalence of chronic diseases in Argentina comes a booming market for enteral nutrition. Diabetes alone affects around 10.5% of women and 10.6% of men in the country, and cancer puts a heavy burden on the healthcare system as well (although finding precise incidence numbers specifically for Argentina can be challenging; check GLOBOCAN or PAHO for regional reports). These conditions up the risk of malnutrition, which is already a major concern in Argentina. Enteral feeding replenishes lost weight, nutrients and supports healing among these patients. Cancer treatments, neurological conditions, and some gastrointestinal diseases also cause dysphagia (difficulty swallowing); this kind of nutrition offers a safe alternative to oral intake when necessary. When the digestive system becomes impaired because of surgery or illness, enteral feeding bypasses it altogether and delivers nutrients straight to the stomach or small intestine.

The surge in chronic diseases does not bode ill for enteral nutrition sales. In fact, it’s quite the opposite: demand is likely to skyrocket as more patients turn to this treatment option. Consequently, formulas specific to diabetes or certain kinds of cancer will start hitting shelves alongside other innovations tailored for each chronic issue.

Trend: Safe Enteral Nutrition Practices Gaining Focus

In the field of enteral nutrition, a growing trend is emerging that puts the spotlight on safety. The emphasis is focused primarily on preventing contamination and reducing nosocomial infections. Patients who undergo enteral nutrition are especially vulnerable to any form of infection since they are already immunocompromised. Therefore, healthcare professionals have taken it upon themselves to prevent further complications from these practices. Once awareness spread throughout the industry, the healthcare sector decided to respond accordingly. So far we have seen them shift towards closed enteral feeding systems as they minimize potential contamination points. They are also implementing strict protocols for all aspects of enteral nutrition such as equipment handling and formula preparation to patient administration and monitoring. Furthermore, education and training programs for healthcare providers are being updated so that safe practices take higher priority.

This push for heightened safety has had a huge influence on how manufacturers approach their methods when it comes to creating these products. For one, they were driven to innovate in areas such as closed systems that are more resistant to contamination and technologies that minimize risk. However, this may come at a cost since production will be more expensive in the short-term; however, patient outcomes should increase overall while expenditures decrease due to fewer infections. In addition to this, regulatory bodies may establish stricter standards which would further shape this evolving trend by developing stronger protocols for both products and services in relation to enteral nutrition.

Cost and Accessibility: A Key Challenge for Enteral Nutrition in Argentina

The biggest stumbling block to Argentina adopting widespread enteral nutrition is cost and accessibility. Although the treatment is a lifeline for some patients, many people can’t afford it, especially since enteral formula and specialized equipment are so expensive. Not everyone in Argentina can afford private health insurance that covers the cost of feeding tubes, either. In addition, public healthcare centers might not have enough funds to supply their own formulas — leaving people who live in underserved areas particularly vulnerable. But even if the initial costs don’t seem too steep, ongoing expenses related to supplies and potential complications could deter patients or their families from continuing with the regimen. In extreme cases, some patients won’t be able to buy the equipment at all.

Numerous strategies could help make this therapy more accessible in Argentina. The government could fund discounts on enteral nutrition for low-income populations. Health experts and NGOs could find ways to collaborate on systems that deliver food effectively and efficiently. And teaching doctors about the benefits of early intervention could reduce complication rates down the road - meaning lower expenses overall.

Opportunity: Home Based Enteral Nutrition Offers Lucrative Opportunity

Argentina's population is growing older. The rate of chronic diseases is also rising. And this means the need for home-based enteral nutrition systems is skyrocketing alongside it. Medical conditions like these often tigger oral intake issues, making home-based enteral nutrition a support mechanism that patients desperately need to maintain their health and stop from getting worse. There’s another reason why this type of care has been gaining popularity recently too - it's now cheaper and more feasible than ever before to do certain treatments at a patient's house. HEN aligns well with this trend aiming to reduce the burden on hospital systems and potentially improve patient quality of life. While you might see some costly initial setups involved with HEN, long-term use could become a solution for expensive hospital stays, which would benefit both patients financially as well as the healthcare system overall.

That being said, despite clear economic benefits and strong demand, the growth of HEN in Argentina likely faces challenges. These include limited access to specialized equipment and formulas outside major urban centers, possible gaps in healthcare professionals' knowledge of HEN, and the need for robust patient and caregiver education. Addressing these hurdles would unlock all of its potential. While concrete numbers on HEN growth might be elusive, the confluence of factors in Argentina makes a strong case for this segment's increasing importance. Investment in infrastructure, education for both healthcare providers and patients, and potential policy initiatives facilitating HEN could greatly accelerate the adoption and improve access to this life-changing nutritional support.

Segmental Analysis

By Type

Within Argentina's enteral nutrition market, the Standard Protein Diet segment plays a dominant role, holding the highest market share of 54.48%. These diets contain a good blend of all required nutrients, making them suitable for various patient groups in Argentina. Due to economic factors, specialized formulas may not be readily available in some areas of the country, and versatile diets like these will come to their aid. They also tend to be less expensive than highly specialized ones, which makes it more cost-effective for patients. In addition to this, as Argentina's healthcare system continues to grow and improve, standard protein diets are expected to remain indispensable due to their adaptability and ease of use. The country’s growing elderly population will also drive demand for these solutions as they have increased nutritional needs and potential swallowing difficulties.

By Application

The hospital segment stands as the most dominant within the enteral nutrition market. In 2023, the segment was responsible for generating more than 64.88% share of the market. when it comes to aiding patients with critical illnesses, surgical interventions or injuries, hospitals are the first line of defense. Such conditions make it difficult for people to consume food normally and can also lead to significantly higher nutritional needs, which makes enteral nutrition vital in their recovery process. Hospitals are also often where malnutrition is first detected and treated. Research conducted in Argentina back in 2003 revealed a high prevalence of malnutrition within hospital environments. So there’s no doubt that we need enteral feeding solutions.

Enteral nutrition is commonly used in post-surgery care, specifically after gastrointestinal procedures. In the early stages of recovery when a patient can't eat enough or at all orally yet, enteral feeding provides essential nutrients still. Hospitals also staff specialized professionals like gastroenterologists and dieticians who can monitor these types of patients closely and adjust their regimens accordingly for optimal results. The aging population seen not just in Argentina but elsewhere plays a big role in why hospitals take up most of this market share. Older adults get sick more easily than do younger ones; they are hospitalized more frequently and have trouble swallowing things more frequently too — all of which create an increased necessity for enteral nutrition support within the walls of clinics and key medical buildings everywhere.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Top Players in the Argentina Enteral Nutrition Market

- Abbott Laboratories

- B. Braun Melsungen AG

- Danone SA

- Fresenius Kabi AG

- Global Health Products, Inc.

- Grifols, S.A.

- Hormel Foods Corporation

- Kate farms

- Mead Johnson Nutrition Company

- Meiji Holdings Co., Ltd

- Nestlà Health Science

- Victus, In.

- Other Prominent players

Market Segmentation Overview:

By Type

- Standard Protein Diet

- High Protein Supplement

- Protein for Diabetes Care Patient

- Others

By Application

- Hospitals Sales

- Retail

- Online

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)