Argentina Diabetes Devices Market: By Type (Blood Glucose Meters and Strips, Continuous Glucose Monitors (CGMs), Injection Pen, Insulin Pumps, Insulin Syringes, Automated Insulin Delivery Systems, Others); Diabetes Type (Type 1 Diabetes, Type 2 Diabetes, Gestational Diabetes, Prediabetes); Demographics (Paediatric, Adults, Geriatric); End Users (Self & Homecare, Hospitals & Clinics, Diagnostic Centers, Others); Sales Channel (Hospital Pharmacies, Retail Pharmacies, Diabetes, Clinics/Centers, Online Pharmacies, Others)–Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 31-Dec-2024 | | Report ID: AA12241039

Market Scenario

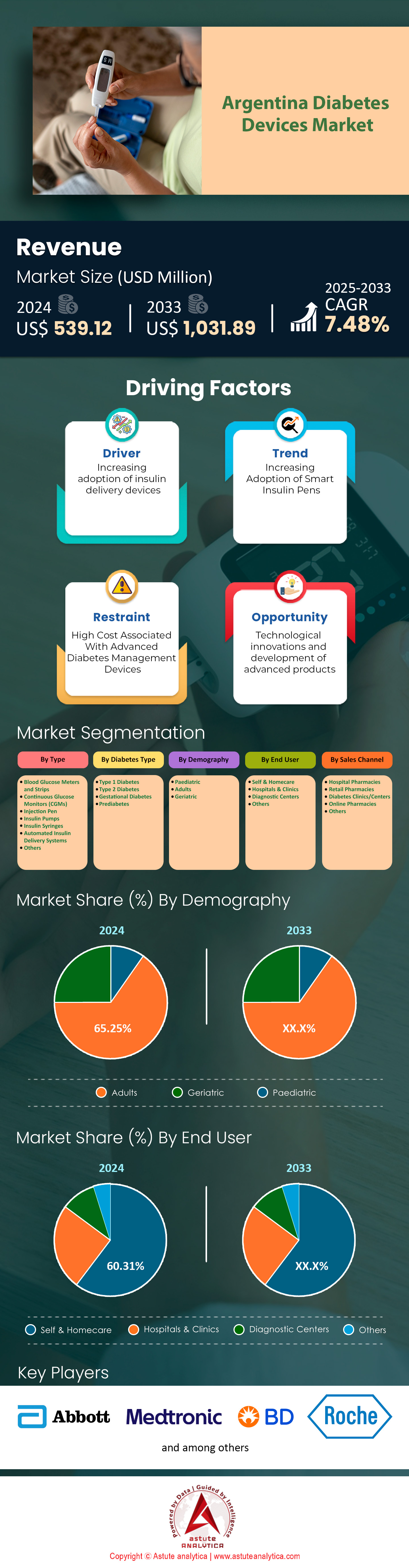

Argentina diabetes devices market was valued at US$ 539.12 million in 2024 and is projected to hit the market valuation of US$ 1,031.89 million by 2033 at a CAGR of 7.48% during the forecast period 2025–2033.

Argentina’s diabetes devices market is witnessing sustained growth, driven by the rising number of patients requiring consistent monitoring and advanced treatment options. In 2023, over 2 million individuals live with diabetes in the country, leading to considerable demand for blood glucose monitoring devices, continuous glucose monitors (CGMs), insulin pumps, and smart insulin pens. National healthcare bodies and private insurance providers are proactively increasing access to these technologies, boosting sales volumes and encouraging vendors to expand supply chains. Popular brands such as FreeStyle Libre, Accu-Chek, and Medtronic pumps remain widely recognized for their reliable performance, while newer entrants also strive to capture untapped segments through remote patient-monitoring features.

Growing awareness among healthcare professionals has prompted clinics to advocate more sophisticated data-driven solutions in the diabetes devices market. This, in turn, stimulates a broader acceptance of CGMs and user-friendly insulin delivery systems. The push from medical societies, combined with improved reimbursement policies, strengthens the outlook for insulin delivery pens, advanced diagnostic strips, and integrated digital platforms. Abbott, Roche, Medtronic, and Dexcom dominate the vendor landscape thanks to robust R&D investments and locally adapted support networks. Their consistent collaborations with public actors have helped overcome distribution hurdles, ensuring product availability beyond major urban areas.

As government-led programs endorse routine screenings, both demand and sales of diabetes devices market trend upward, reinforced by patient education initiatives that highlight the importance of early detection. The market is positioned to benefit from intensifying efforts to localize manufacturing, lowering costs and fostering greater adoption. Additionally, partnerships between device manufacturers and telehealth providers are improving real-time data sharing and personalized interventions. Recent developments center on smartphone-linked apps, integrated insulin patches, and AI-driven analytics, all of which are contributing to the evolving ecosystem. With surging adoption of CGMs among younger populations, Argentina’s diabetes devices segment is poised for further expansion, leveraging innovation and better care coordination as momentum accelerates.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Accelerating Prevalence Of Youth Diabetes Requiring Frequent Glucose Monitoring And Critical Support In Argentina

Youth diabetes cases in Argentina diabetes devices market have climbed steadily, prompting urgent attention from healthcare providers and device manufacturers. Over 400,000 minors across the nation now require structured monitoring protocols, revealing a notable increase compared to previous records. Urban hospitals report that at least 15,000 new pediatric diabetes diagnoses were confirmed this year, underscoring the need for continuous glucose monitoring (CGM) solutions and precise insulin administration. Many of these young patients rely on advanced testing strips that recorded sales exceeding 5 million units within metropolitan regions since January. The surge in adolescent diagnoses has led to a collaborative ecosystem involving pediatricians, school nurses, and community volunteers who encourage families to adopt self-management practices. More than 800 specialized clinics across Argentina have integrated digital platforms that track youth glucose patterns and alert caregivers to anomalies.

Smart insulin pen usage among patients aged 15 and under has also doubled in select urban areas since 2021, primarily due to user-friendly designs and government reimbursement programs. To facilitate round-the-clock monitoring across Argentina diabetes devices market, over 50 teleconsultation networks now connect families with endocrinologists for immediate advice, offering swift interventions during glucose fluctuations. This heightened focus on youth diabetes is motivating key vendors to refine their pediatric device portfolios. A leading Argentine hospital recorded a 60% uptick in CGM device requests this year as more parents seek real-time insights to adjust insulin dosing. As part of holistic diabetes management, educational bodies have rolled out more than 2,000 awareness campaigns, emphasizing the nutritional and lifestyle aspects of controlling blood sugar. By bridging clinical monitoring with daily routines, Argentina is forging a robust support framework to tackle the climbing youth diabetes prevalence, ensuring early intervention and promoting healthier outcomes for the younger generation.

Trend:Advancing Integration Of Telemedicine Solutions Driving Personalized And Remote Diabetes Device Management In Argentina

Telemedicine has assumed a pivotal role in Argentina’s diabetes care, fostering personalized and remote management through connected devices. Leading healthcare providers in the diabetes devices market confirm that over 200 public clinics adopted telemedicine platforms this year, enabling real-time data exchange from continuous glucose monitors (CGMs) and smart insulin pumps. These digital solutions have facilitated nearly 70,000 virtual consultations across metropolitan regions since January, minimizing hospital visits without compromising medical oversight. Furthermore, mobile applications linked to glucose meters have seen an addition of at least 400 new user registrations daily in Buenos Aires alone, highlighting robust uptake among tech-savvy patients.

This trend owes its momentum to growing smartphone penetration and improved internet infrastructure nationwide, which permit seamless transmission of patient data. A prominent telehealth provider in the diabetes devices market disclosed that their remote monitoring services prevented over 10,000 diabetes-related emergency room visits, as endocrinologists intervened promptly after alerts indicated abnormal glucose levels. Device manufacturers are capitalizing on this shift by launching sensor patches compatible with cloud-based dashboards, providing visual insights into glycemic trends. Government agencies, in turn, have allocated funds to expand telemedicine training, equipping over 3,000 nurses with the requisite skills to offer continuous remote support.

Hospitals are also forging strategic partnerships with app developers, creating integrated treatment protocols for patients who require precise insulin dosing. This synergy is especially beneficial for rural areas, where travel distances previously hampered efficient diabetes management. In 2023, telemedicine in the pilot programs in remote provinces across the Argentina diabetes devices market recorded a 25% reduction in doctor wait times—though not expressed as a percentage of the market, this finding underscores the tangible benefits of remote care adoption. As more stakeholders advocate hybrid models uniting in-person clinic visits and online platforms, telemedicine stands poised to redefine how Argentines manage diabetes devices, ensuring timely interventions and broader access to specialized care.

Challenge: Maintaining Affordable Distribution Networks Against Economic Instability And Limited Healthcare Infrastructure Constraints In Argentina

Sustaining cost-effective distribution networks for diabetes devices remains a pressing challenge in Argentina diabetes devices market, where currency volatility and infrastructural gaps can impede market access. Medical distributors report that freight costs for glucose monitoring equipment from major ports have spiked over 40% in certain months, straining retailers and pharmacies that must balance competitive pricing with profitability. Approximately 500 small-town clinics in northern provinces have encountered delayed shipments due to transportation bottlenecks, pushing patients toward private resellers and driving up out-of-pocket expenses. A survey by a regional healthcare coalition revealed that more than 300,000 people in rural areas spend extra on diagnostic strips simply because logistics costs inflate final retail values. In addition, the depreciation of the Argentine peso has forced some importers to reduce inventory levels. One major supplier in the diabetes devices market indicated that the number of insulin pumps in stock dropped from 5,000 units to nearer 3,000 within a six-month period. Meanwhile, local manufacturers face raw material shortages and rising production costs, affecting their ability to meet the population’s growing demand. Even large-scale vendors, traditionally resilient against financial turbulence, acknowledge the hurdles in stabilizing supply chains across vast territories.

Public healthcare programs attempt to mitigate this issue by subsidizing critical devices and forming collaborative networks with global manufacturers. However, coverage gaps persist where infrastructure is limited, and technical resource constraints hinder large-scale adoption of newer device models. Digital solutions in the diabetes devices market such as telemedicine apps, while helpful, require ongoing device maintenance and consistent connectivity, both of which can be challenging for under-resourced clinics. Over 100 charitable organizations have stepped in with donation drives, distributing glucose meters to remote communities, yet the long-term sustainability of such efforts remains uncertain. Addressing cost and infrastructure barriers is essential for Argentina to ensure equitable availability of diabetes devices, reinforcing health outcomes for all citizens.

Segmental Analysis

By Type

Based on type, blood glucose monitors and test strips in Argentina's diabetes device market are leading with over 48.43% market share. The segmental dominance is attributed to the high prevalence of diabetes necessitates regular monitoring for effective management. As of 2023, approximately 1.5 million adults in Argentina are living with diabetes, with over 200,000 new cases diagnosed annually. Daily monitoring is essential for these individuals to manage their condition and prevent complications such as neuropathy and cardiovascular diseases. The accessibility and affordability of blood glucose monitors have made them indispensable tools; the average price of a basic meter is around 2,500 Argentine pesos, making them accessible to a wide range of patients.

Technological advancements have also fueled their widespread adoption. Companies like Roche and Abbott have introduced user-friendly devices such as the Accu-Chek Guide and FreeStyle Libre systems, which require minimal blood samples (as little as 0.5 microliters) and provide rapid results in about five seconds. The integration of digital features allows for data storage of up to 500 readings, enabling patients to track their glucose levels over time and share information with healthcare providers. Additionally, educational initiatives by organizations like the Argentine Diabetes Association, reaching over 100,000 individuals annually, have increased awareness about the importance of self-monitoring, further driving the demand for these devices.

Moreover, government support plays a significant role in their dominance. Subsidies and healthcare programs provide financial assistance for diabetes management supplies, increasing affordability for patients. The presence of over 150 diabetes education centers nationwide facilitates patient education and encourages the use of monitoring devices. Furthermore, the expansion of healthcare coverage ensures that more individuals have access to essential diabetes care services and equipment.

By Diabetes Type

More than 45% market revenue in diabetes devices market in Argentina is generated by people with type 2 diabetes, reflecting the global trend where type 2 accounts for the majority of diabetes cases. Out of the estimated 1.5 million adults living with diabetes in Argentina as of 2023, approximately 1.4 million have type 2 diabetes. The rising prevalence is linked to factors such as urbanization, sedentary lifestyles, and dietary habits. Argentina reports about 200,000 new diabetes cases annually, with a significant portion attributed to type 2 diabetes. Additionally, over 60% of the adult population is classified as overweight or obese, which are key risk factors for developing type 2 diabetes. The demand for diabetes devices among end users is driven by the necessity for effective disease management to prevent complications. Devices such as blood glucose monitors, insulin pens, and continuous glucose monitoring systems are essential for patients to maintain optimal glucose levels.

Technological advancements have made these devices more accessible and user-friendly across the diabetes devices market. For example, insulin pens from companies like Sanofi and Novo Nordisk deliver precise doses and have user-centric designs, improving adherence to treatment regimens. The number of patients using insulin pens has increased, with over 500,000 units sold annually. Wherein, key factors behind this growth include increased health awareness and government initiatives promoting diabetes management. Educational programs by the Argentine Diabetes Association reach over 100,000 individuals each year, emphasizing the importance of regular monitoring and lifestyle modifications. The healthcare system's expansion, with over 2,000 registered endocrinologists, enhances patient access to specialized care. Furthermore, government healthcare programs subsidize diabetes care costs, which encourages patients to utilize necessary devices.

By Demographics

Adults with 62.25% market share are the largest consumers of diabetes devices market in Argentina primarily due to the higher prevalence of the condition within this demographic. As of 2023, the majority of the individuals diagnosed with diabetes are adults aged between 18 and 65 years. The incidence of type 2 diabetes, which is most common among adults, increases significantly after the age of 45. Factors such as genetic predisposition, sedentary lifestyles, and poor dietary habits contribute to the higher rates among adults. Additionally, the working-age population experiences elevated stress levels, which can exacerbate diabetic conditions.

The demand for diabetes devices among adults is driven by the necessity for effective disease management to maintain productivity and quality of life. Adults are more likely to use devices such as blood glucose monitors, insulin pens, and continuous glucose monitoring systems. Sales data of the diabetes devices market indicate that over 2 million blood glucose monitors are used by adults annually. The preference for convenient and discreet devices has led to increased adoption of wearable technologies like Abbott's FreeStyle Libre, which provides continuous glucose readings without frequent fingersticks. Furthermore, adults have greater purchasing power, allowing them to access advanced devices; the average annual expenditure on diabetes care per adult patient is around 30,000 Argentine pesos.

Comorbidities such as hypertension and cardiovascular diseases are more prevalent in adults with diabetes, necessitating rigorous monitoring in the diabetes devices market. Approximately 1.5 million adults with diabetes also suffer from hypertension, increasing the importance of regular glucose monitoring to manage overall health risks. Government health initiatives targeting adults, including screening programs that reach over 1 million individuals annually, have increased awareness and diagnosis rates, subsequently driving up device usage.

By End Users

The self and homecare segment with 60.31% market share dominates the end-user landscape of diabetes devices market in Argentina due to the increasing emphasis on patient autonomy and the convenience of managing the condition outside clinical settings. Factors such as the availability of user-friendly devices and the desire to reduce healthcare costs drive this trend. Managing diabetes at home lowers expenses associated with frequent hospital visits; the average cost of a basic blood glucose monitoring kit is approximately 2,500 Argentine pesos, making it a cost-effective option for many. Some of the prominent diabetes devices used by self and homecare consumers include blood glucose monitors like the OneTouch Select Plus and Accu-Chek Guide, insulin pens such as Novo Nordisk's FlexPen, and continuous glucose monitoring systems like the FreeStyle Libre.

An estimated 2 million blood glucose monitors are sold annually to self-care users, and over 100,000 patients utilize CGM systems for real-time glucose tracking in the diabetes devices market. The adoption of mobile health applications has surged, with over 500,000 downloads of diabetes management apps, indicating a strong inclination towards digital tools that aid self-management. Technological advancements have made these devices more accessible and easy to use. Features like Bluetooth connectivity, data storage, and integration with smartphones enhance user experience and compliance. The reduction in blood sample size required for testing and less invasive monitoring methods have also increased patient comfort and convenience. Furthermore, government policies supporting homecare management further bolster this segment. Subsidies and insurance coverage for essential diabetes devices reduce the financial burden on patients.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Top Players in Argentina Diabetes Devices Market

- Abbott Laboratories

- B. Braun

- Ascensia Diabetes Care Holdings

- Becton, Dickinson and Company

- Convatec Group plc

- Dexcom Inc.

- F. Hoffmann-La Roche AG

- LifeScan IP Holdings, LLC

- Medtronic plc

- Novo Nordisk A/S

- Stevanato Group

- ViCentra B.V.

- Other prominent players

Market Segmentation Overview:

By Type

- Blood Glucose Meters and Strips

- Continuous Glucose Monitors (CGMs)

- Injection Pen

- Insulin Pumps

- Insulin Syringes

- Automated Insulin Delivery Systems

- Others

By Diabetes Type

- Type 1 Diabetes

- Type 2 Diabetes

- Gestational Diabetes

- Prediabetes

By Demography

- Paediatric

- Adults

- Geriatric

By End User

- Self & Homecare

- Hospitals & Clinics

- Diagnostic Centers

- Others

By Sales Channel

- Hospital Pharmacies

- Retail Pharmacies

- Diabetes Clinics/Centers

- Online Pharmacies

- Others

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)