Global Apheresis Market: By Product (Apheresis Disposables and Apheresis Devices); Type (Plasmapheresis, Plateletpheresis, Erythrocytapheresis, Leukapheresis, Photopheresis, Other); Procedure (Automated blood collection (Donor Apheresis), Therapeutic Apheresis); Technology (Centrifugation, Membrane Separation, Selective Adsorption); End users (Hospitals and Blood Collection Center); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 23-Apr-2024 | | Report ID: AA0823570

Market Scenario

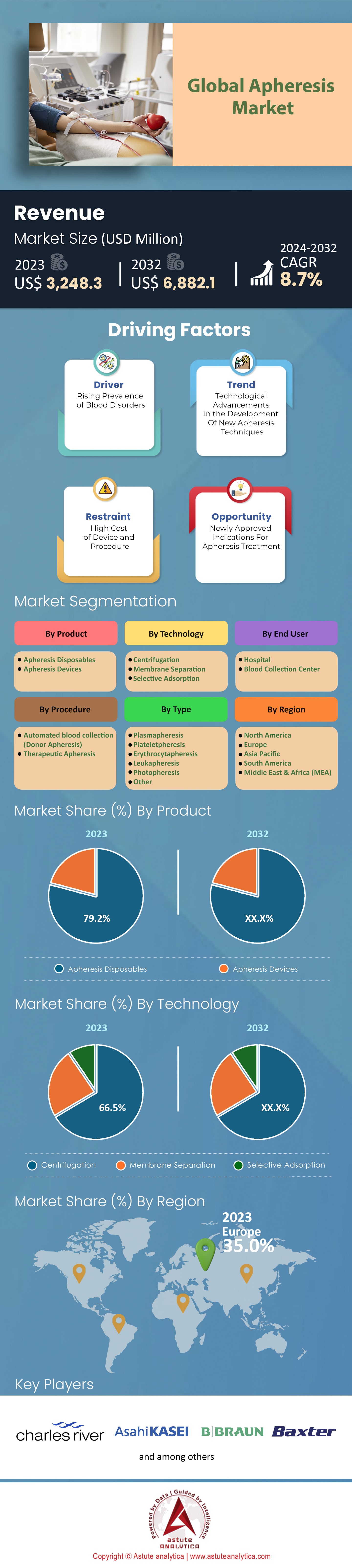

Global Apheresis Market was valued at US$ 3,248.3 million in 2023 and is projected to attain a valuation of US$ 6,882.1 million by 2032 at a CAGR of 8.7% during the forecast period 2024–2032.

The global apheresis market has exhibited impressive growth, spurred by the increasing demand for plasma-derived products, advancements in apheresis technologies, and the rising prevalence of chronic diseases worldwide.

One of the most significant drivers of this growth is the rising demand for plasma-derived products, which accounted for around 60% of the total apheresis market in 2023. With a growing geriatric population, which is expected to reach 1.5 billion by 2050 according to the United Nations, and the increasing healthcare expenditure, which reached $8.7 trillion in 2020 according to the World Bank, the demand for blood products like plasma and platelets is expected to continue its upward trajectory. The market landscape is currently characterized by fierce competition among multinational and regional players, with the top five companies holding a combined market share of around 55% in 2023. These companies have been investing heavily in research and development, leading to recent advancements in automation, data analysis, and integration with electronic health record (EHR) systems, which have become key trends shaping the industry.

Consumers’ awareness about the importance of apheresis in the treatment of various medical conditions have also shifted, impacting the global apheresis market dynamics. Blood banks and hospitals, the primary end-users of apheresis devices, accounted for around 75% of the market share in 2023, driven by the high demand for blood products. Therapeutic apheresis is increasingly accepted as an effective treatment modality for autoimmune diseases, hematologic conditions, and certain infections, further boosting market growth.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Growing Demand for Plasma-derived Products

The growing demand for plasma-derived products is a key driver for the global apheresis market. Plasma-derived products are widely used in the treatment of various medical conditions such as immune deficiencies, bleeding disorders, and certain types of cancers. The global market for plasma-derived products was valued at around $26.2 billion in 2023 and is projected to reach $41.5 billion by 2032. As of 2023, the plasma protein therapeutics market alone is valued at about $24 billion, indicating a strong demand for plasma-derived products.

The primary factor behind this growth is the rising prevalence of conditions that require plasma-derived products. According to the World Federation of Hemophilia, there were approximately 200,000 people with hemophilia worldwide in 2022, and the number is expected to increase due to better diagnosis and population growth. The increasing use of albumin in surgery and emergency medicine is another contributor to the rising demand. This growing demand is driving the need for plasma collection, which is primarily done through apheresis. Plasma apheresis is preferred over whole blood donations for plasma collection as it allows for more frequent donations and provides higher-quality plasma.

Trend: Automation and Technological Advancements

Automation and technological advancements have become a significant trend in the global apheresis market. The incorporation of automation in apheresis machines has enhanced efficiency, accuracy, and safety, leading to increased adoption of these devices. The use of automation reduces the need for manual interventions, minimizing the risk of errors and contamination. Automated apheresis devices also have improved data management capabilities, allowing for seamless integration with electronic health record (EHR) systems. This trend is particularly evident in developed countries with high healthcare IT adoption rates. According to Astute Analytica report, the global healthcare IT market is expected to reach $540 billion by 2032, growing at a CAGR of 15.8%.

Another notable technological advancement is the development of portable apheresis machines. These devices allow for the collection of blood components at the donor's location, increasing convenience and expanding the donor pool. Portable apheresis machines are expected to gain popularity in emerging markets, where healthcare infrastructure is still developing.

Opportunity: Expanding Applications of Therapeutic Apheresis

Therapeutic apheresis has emerged as an effective treatment modality for various medical conditions, creating a significant opportunity for market growth. Therapeutic apheresis is the removal of specific blood components to treat diseases. The procedure is used to treat autoimmune diseases, hematologic conditions, and certain infections, among others. The rising prevalence of autoimmune diseases is a significant contributor to apheresis market growth. According to the American Autoimmune Related Diseases Association (AARDA), approximately 66 million Americans have an autoimmune disease. The number of people with autoimmune diseases is expected to increase due to better diagnosis and an aging population. As of now, 1 in five American have some kind of autoimmune disease.

Therapeutic apheresis has also gained attention as a potential treatment for severe COVID-19 cases. Preliminary studies have shown promising results, with therapeutic apheresis reducing the severity and duration of symptoms in critically ill patients. The increasing interest in therapeutic apheresis as a treatment option for COVID-19 could further drive market growth.

Challenge: High Costs and Stringent Regulations

The cost of a single apheresis session ranges from $2,500 to $5,000, depending on the location, type of apheresis, and the healthcare provider. The high cost is primarily due to the need for specialized equipment, consumables, and trained personnel. The global apheresis market is also heavily regulated, with stringent quality and safety standards imposed by regulatory agencies like the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA). These standards ensure patient safety but also increase the cost and complexity of bringing new products to market. Regulatory approval for apheresis products typically takes 3-7 years, depending on the complexity of the product and the regulatory pathway chosen.

In addition to the high costs and stringent regulations, the apheresis market faces challenges related to donor recruitment and retention. Donor fatigue, discomfort, and the time commitment required for apheresis procedures can deter potential donors. Overcoming these challenges requires significant investment in donor education, outreach, and support.

Despite these challenges, the apheresis market is expected to continue growing, driven by the increasing demand for plasma-derived products, technological advancements, and expanding applications of therapeutic apheresis. However, market players will need to navigate the challenges of high costs, stringent regulations, and donor recruitment and retention to remain competitive in this rapidly evolving market.

Segmental Analysis

By Product Type:

The global apheresis market is segmented by product type into apheresis devices and apheresis disposables. Among these, the apheresis disposables segment holds the highest share, accounting for 79.2% of the total market. This dominance is largely attributed to the recurrent use of disposables in every apheresis procedure, including tubing sets, needles, and filters. The increasing demand for apheresis procedures globally is driving the substantial growth of this segment. Furthermore, the apheresis disposables segment is projected to grow at the highest CAGR of 8.9% during the forecast period, mainly due to advancements in disposables, which have improved safety, efficiency, and user-friendliness. Disposable apheresis kits are gaining popularity as they reduce the risk of contamination, streamline the process, and enhance patient safety. Consequently, the increased adoption of single-use disposables is expected to continue propelling the growth of this segment.

By Type:

By type, the global apheresis market is divided into plasmapheresis, photopheresis, plateletpheresis, leukapheresis, erythrocytapheresis, and others. Among these, the plasmapheresis segment holds the highest share of 36.6%. Plasmapheresis involves the removal of plasma from the blood, and it is used in both therapeutic and donor applications. The segment's dominance is attributed to the growing demand for plasma-derived products, which are used in various medical conditions, including immune deficiencies and bleeding disorders. Moreover, the increasing use of plasmapheresis in the treatment of autoimmune diseases is contributing to the segment's growth.

The plasmapheresis segment is expected to continue dominating the global apheresis market in the coming years, growing at a robust CAGR of 9.9%. The expanding applications of plasmapheresis, advancements in technology, and the increasing prevalence of diseases requiring plasma-derived products are expected to drive the growth of this segment.

By Procedure:

The global apheresis market is segmented by procedure into manual blood collection (therapeutic apheresis) and automated blood collection (donor apheresis). Among these, the automated blood collection (donor apheresis) segment dominates the market, generating over 76.2% of the global revenue. The dominance of this segment is attributed to the increasing demand for blood components such as plasma and platelets, which are primarily collected through automated apheresis. Automated procedures are preferred over manual ones due to their efficiency, consistency, and ability to collect multiple components in a single session. Additionally, automation reduces the risk of errors and contamination, enhancing the safety of the process.

The growing prevalence of chronic diseases, rising healthcare expenditure, and the expanding geriatric population are driving the demand for blood products, further contributing to the growth of the automated blood collection segment. The increasing adoption of automation and technological advancements in apheresis devices are expected to continue propelling the growth of this segment.

By Technology:

The global apheresis market is segmented by technology into centrifugation and membrane filtration. Among these, the centrifugation technology dominates the market, holding over 66.5% of the total revenue. Centrifugation technology separates blood components based on their density and is widely used in both therapeutic and donor apheresis. The segment's dominance is attributed to the efficiency and effectiveness of centrifugation in separating blood components, its suitability for various apheresis procedures, and the wide availability of centrifugation-based apheresis devices.

The centrifugation technology segment is expected to maintain its momentum, growing at a CAGR of 9.1%. The increasing demand for apheresis procedures, advancements in centrifugation technology, and the growing adoption of automated apheresis devices are expected to drive the growth of this segment.

By End User:

The global apheresis market is segmented by end user into blood collection centers, hospitals, and others. Among these, the blood collection center segment holds the lion's share of 68.1%. Blood collection centers are specialized facilities that focus on the collection, processing, and distribution of blood and blood components. The dominance of this segment is attributed to the increasing demand for blood products, the growing prevalence of chronic diseases, and the rising healthcare expenditure. Blood collection centers are equipped with advanced apheresis devices and have trained personnel, making them the preferred choice for apheresis procedures. The increasing awareness about the importance of blood donation, government initiatives to promote blood donation, and the growing adoption of automation in blood collection centers are expected to continue driving the growth of this segment.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Europe holds the largest share of the global apheresis market, accounting for over 35% of the total revenue in 2023. The European market's dominance is primarily attributed to the rise in the number of apheresis centers, especially in Germany. Additionally, the high cost of apheresis equipment and treatment in European countries has contributed to the region's significant market growth. Despite the high costs, the presence of well-established healthcare infrastructure and strong government support has facilitated the adoption of apheresis procedures. Moreover, Europe is projected to experience a CAGR of 8.1% during the forecast period, reflecting continued growth driven by increasing disease prevalence, growing demand for plasma-derived products, and advancements in apheresis technologies.

North America is the second-largest shareholder in the global apheresis market, with the US being the leading country in the region in 2023. The North American market's robust position is mainly due to high disease prevalence and a large number of people who can afford the high cost of apheresis treatment. The region has a high prevalence of autoimmune diseases, hematologic conditions, and certain types of cancers that require apheresis procedures. In addition, North America has a well-developed healthcare system, a strong focus on research and development, and widespread adoption of advanced medical technologies. The increasing demand for blood products, rising awareness about blood donation, and government initiatives to promote apheresis are expected to continue driving the growth of the North American apheresis market.

Asia Pacific is poised to experience the highest CAGR of 10% during the forecast period, driven by rising blood disorders, cancer, and kidney diseases in the region. The growing burden of these diseases has led to increased demand for apheresis procedures for both therapeutic and donor applications. Furthermore, rising awareness about blood donation and plasma therapies is expected to fuel market growth in the Asia Pacific region. China holds the largest share of the Asia Pacific apheresis market, followed by Japan. The significant market growth in these countries is attributed to their expanding healthcare infrastructure, increasing healthcare expenditure, and growing adoption of advanced medical technologies. The increasing prevalence of diseases requiring apheresis, government initiatives to promote blood donation, and advancements in apheresis devices are expected to continue propelling the growth of the Asia Pacific apheresis market.

Top Players in the Global Apheresis Market

- Asahi Kasei Medical Co. Ltd.

- B. Braun Melsungen AG

- Baxter International Inc.

- Cerus Corporation

- Charles River Laboratories International, Inc.

- Haemonetics Corporation

- Kaneka Corporation

- Kawasumi Laboratories Inc

- Nikkiso Co., Ltd.

- Terumo BCT, Inc

- Fresenius Kabi

- Other Prominent Players

Market Segmentation Overview:

By Product

- Apheresis Disposables

- Apheresis Devices

By Type

- Plasmapheresis

- Plateletpheresis

- Erythrocytapheresis

- Leukapheresis

- Photopheresis

- Other

By Procedure

- Automated blood collection (Donor Apheresis)

- Therapeutic Apheresis

By Technology

- Centrifugation

- Membrane Separation

- Selective Adsorption

By End User

- Hospital

- Blood Collection Center

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)