Anatomic Pathology Market: By Product & Services (Services, Consumables, Instruments); Application (Disease Diagnostics and Medical Research); End Users (Hospital Laboratories, Clinical Laboratories, and Other Laboratories); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 06-Apr-2025 | | Report ID: AA0224790

Market Scenario

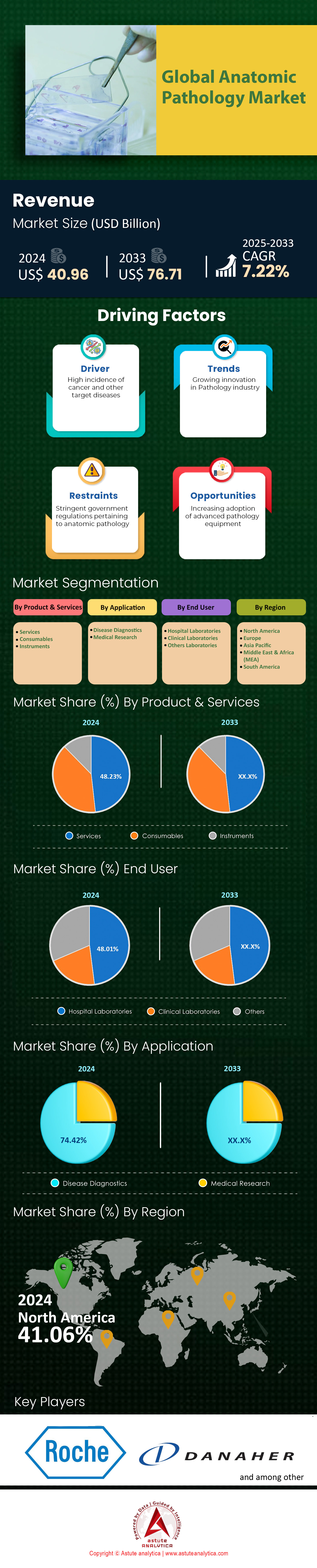

Anatomic pathology market was valued at US$ 40.96 billion in 2024 and is projected to hit the market valuation of US$ 76.71 billion by 2033 at a CAGR of 7.22% during the forecast period 2025–2033.

The demand for anatomic pathology is driven by the escalating global burden of chronic diseases, such as cancer, which affects over 20 million individuals annually worldwide, and the expanding aging population, projected to exceed 1.5 billion people aged 65+ by 2050. These demographics necessitate precise diagnostics, as aging populations are more susceptible to complex conditions requiring tissue-based evaluations, adding fuel to the anatomic pathology market growth. Additionally, the rise of personalized medicine has amplified reliance on advanced techniques like molecular diagnostics and digital pathology to tailor treatments, particularly for oncology, which accounts for over 60% of anatomic pathology applications. Medical research, including biomarker discovery and drug development, further fuels demand, as pharmaceutical firms depend on pathology services to validate therapeutic targets in clinical trials.

Some of the key products in the anatomic pathology market witnessing higher demand include automated tissue processors, microtomes, and digital scanners, alongside consumables like immunohistochemistry reagents and biopsy cassettes, which collectively dominate 70% of laboratory workflows. Hospitals remain the largest end-users due to their central role in surgical and diagnostic procedures, while diagnostic labs are increasingly adopting niche applications like liquid biopsy and next-gen sequencing for precision oncology. Disease diagnostics, particularly cancer detection and grading, account for nearly 80% of anatomic pathology applications, driven by the need for early detection to improve outcomes in high-mortality conditions. Research institutes leverage these tools to analyze disease mechanisms, with cancer research alone contributing to 40% of pathology-based studies.

The anatomic pathology market’s expansion is propelled by AI-driven image analysis and automation, which enhance diagnostic accuracy and reduce turnaround times by 30%. Decentralized testing models and specialized labs are broadening access, particularly in emerging regions with rising cancer incidence rates. While hospitals remain primary consumers, diagnostic labs are witnessing 25% faster adoption of advanced techniques like multiplex staining and spatial genomics. The growing emphasis on early detection and the complexity of chronic diseases ensures sustained demand, positioning anatomic pathology as a cornerstone of both clinical care and biomedical innovation.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rising Cancer Cases Globally Drive Demand for Anatomic Pathology Diagnostics

The global surge in cancer incidence is a primary driver of demand for anatomic pathology market growth. According to the World Health Organization (WHO), over 20 million new cancer cases were diagnosed globally in 2022, with lung, breast, colorectal, and prostate cancers accounting for nearly 40% of all diagnoses. The International Agency for Research on Cancer (IARC) projects this number to rise to 30 million cases annually by 2040, emphasizing the urgent need for scalable diagnostic solutions. Anatomic pathology, which involves the microscopic examination of tissues to diagnose malignancies, remains the gold standard for cancer confirmation. The Centers for Disease Control and Prevention (CDC) reported that more than 85% of cancer diagnoses in the U.S. rely on histopathological evaluations, underscoring its irreplaceable role in oncology. In low- and middle-income countries (LMICs), where cancer mortality rates are 70% higher than in high-income regions, limited access to advanced diagnostic tools exacerbates late-stage diagnoses and poor survival outcomes.

To address this burden in the anatomic pathology market, healthcare systems are investing in pathology infrastructure, particularly in regions with high cancer disparities. For instance, the WHO’s Global Breast Cancer Initiative has prioritized improving access to biopsy and histopathology services in Sub-Saharan Africa, where breast cancer mortality exceeds 50% due to delayed diagnoses. Similarly, India’s National Cancer Grid has established 160 molecular pathology hubs to reduce turnaround times for cancer reporting. The integration of anatomic pathology with molecular diagnostics is also gaining traction, enabling clinicians to identify actionable mutations, such as EGFR in non-small cell lung cancer or HER2 in breast cancer. These advancements align with the growing emphasis on precision oncology, where treatment decisions hinge on comprehensive pathological insights. Despite progress, workforce shortages and uneven resource distribution continue to challenge scalability in LMICs, highlighting the need for sustained global collaboration.

Trend: Digital Integration and Workflow Automation Improve Pathology Laboratory Operational Efficiency

The adoption of digital pathology and laboratory automation is transforming anatomic pathology market workflows. Laboratories are transitioning from manual, slide-based processes to digitized systems that integrate whole-slide imaging (WSI), cloud-based data storage, and artificial intelligence (AI)-powered analytics. For example, the U.S. Food and Drug Administration (FDA) cleared the first WSI system for primary diagnosis in 2017, enabling pathologists to review and annotate high-resolution digital slides remotely. This shift gained momentum during the COVID-19 pandemic, as remote diagnostics became critical. The National Institutes of Health (NIH) reported that over 60% of U.S. pathology labs now use some form of digital imaging, reducing diagnostic turnaround times by 30–50%. Automation tools, such as robotic tissue processors and AI-driven specimen tracking systems, further minimize human error and streamline pre-analytical steps.

However, successful implementation requires addressing interoperability challenges in the anatomic pathology market. A 2023 study published in The Lancet Digital Health found that 45% of labs using multiple digital platforms face compatibility issues, leading to data silos. To overcome this, organizations like the Digital Pathology Association (DPA) are advocating for standardized imaging formats and vendor-agnostic software. AI algorithms are also being validated for specific use cases; for instance, Paige.AI’s prostate cancer detection tool, which achieved 98% accuracy in clinical trials, received FDA Breakthrough Device Designation in 2021. Meanwhile, Labcorp and Quest Diagnostics have deployed automated staining platforms that standardize immunohistochemistry workflows across their global networks, ensuring consistent results for biomarkers like PD-L1 in immunotherapy. Cybersecurity remains a critical concern, as the FDA issued warnings in 2022 about vulnerabilities in connected medical devices, urging labs to adopt encryption protocols. These advancements underscore the role of digital integration in enhancing diagnostic reproducibility, scalability, and collaboration across multidisciplinary teams.

Challenge: Regulatory Barriers and Compliance Requirements Delay New Technology Market Entry

Stringent regulatory frameworks and evolving compliance mandates pose significant hurdles for anatomic pathology market innovations. For example, AI-based diagnostic tools must undergo rigorous validation under the FDA’s Software as a Medical Device (SaMD) guidelines, which require proof of clinical efficacy across diverse patient populations. A 2023 analysis by the European Medicines Agency (EMA) revealed that 30% of AI pathology applications fail to meet regulatory standards due to inadequate training data or algorithmic bias. In emerging markets, where regulatory pathways are less defined, delays are even more pronounced. The WHO’s 2021 survey of 90 countries found that only 35% had established clear guidelines for digital pathology, causing prolonged approval timelines for technologies like WSI systems. Compliance with data privacy laws, such as the EU’s General Data Protection Regulation (GDPR), adds complexity, particularly for cloud-based platforms handling sensitive patient information.

Small and medium-sized laboratories face disproportionate burdens due to high compliance costs in the anatomic pathology market. A 2024 study in JAMA Network Open estimated that U.S. labs spend an average of $2.4 million annually to meet Clinical Laboratory Improvement Amendments (CLIA) and College of American Pathologists (CAP) standards, limiting their ability to adopt novel technologies. Additionally, harmonizing global standards remains a challenge. While the International Organization for Standardization (ISO) released guidelines for AI in pathology (ISO/TS 22391) in 2023, adoption has been slow, with only 18% of labs reporting full compliance. Collaborative efforts, such as the FDA’s Pre-Cert Pilot Program and the Global Diagnostic Imaging, Healthcare IT, and Radiation Therapy Trade Association (DITTA), aim to streamline approvals through mutual recognition agreements. However, disparities persist, exemplified by the FDA’s 2022 clearance of Paige’s AI tool for breast cancer detection, which took 18 months longer to receive CE marking in Europe. Until regulatory frameworks align with technological advancements, innovation in anatomic pathology will remain constrained by fragmented oversight and compliance inefficiencies.

Segmental Analysis

By Product & Services

The services segment’s leadership in the anatomic pathology market with over 48.23% market share is underpinned by the complexity of diagnostic workflows and the growing reliance on specialized expertise for accurate disease interpretation. With over 20 million new cancer cases globally as of 2024, pathology laboratories face escalating demand for high-volume biopsy analysis, molecular profiling, and consultation services. Key services driving dominance include histopathology interpretation, immunohistochemistry, and next-generation sequencing (NGS), which are critical for diagnosing cancers like breast and lung malignancies, which account for 30% of global cancer-related biopsies annually. Third-party diagnostic service providers, such as Quest Diagnostics and LabCorp, dominate this segment due to their integrated networks, offering end-to-end solutions from specimen collection to AI-powered diagnostic reporting. Hospitals and independent labs outsource ~40% of their pathology workflows to these providers to reduce operational costs and leverage advanced technologies like multiplex staining and spatial transcriptomics, which require significant upfront investments.

The revenue contribution of services segment in the anatomic pathology market surpasses products due to their recurring, high-margin nature. For instance, routine services such as HER2/ER/PR testing for breast cancer are performed on over 4 million patients annually in the U.S. alone, creating sustained demand. In contrast, product sales (e.g., automated stainers) are one-time purchases with longer replacement cycles. Academic medical centers and reference labs also contribute to service demand by offering subspecialty expertise in areas like neuropathology and hematopathology, which require rare skill sets. Furthermore, telepathology services are expanding access in rural regions, where 25% of U.S. hospitals lack in-house pathology teams, driving partnerships with centralized service hubs. This structural shift toward outsourcing, combined with increasing insurer reimbursement for molecular diagnostics, solidifies services as the market’s revenue engine.

By Application

The disease diagnostics segment’s 74.42% revenue share in the anatomic pathology market reflects its central role in managing surging chronic and infectious disease burdens. Cancer alone drives this demand, with 1.9 million new cases diagnosed annually in the U.S. and over 4.8 million in China, necessitating histopathology for tumor grading and staging. Globally, hospitals perform ~120 million biopsies yearly, with 60% linked to cancer diagnostics, underpinning the need for rapid, accurate pathology services. Chronic conditions like cardiovascular diseases and diabetes also contribute, as biopsies for renal or liver complications are critical for managing advanced cases. Diagnostic spending is amplified by personalized medicine protocols, where biomarker testing (e.g., PD-L1 for immunotherapy) is required for ~70% of newly diagnosed lung cancer patients, creating dependency on advanced pathology workflows.

In contrast, medical research applications, though growing, remain niche in the anatomic pathology market due to their project-based nature and reliance on grant funding. While academia and pharma firms use anatomic pathology for drug development (e.g., validating targets in 45% of oncology trials), these activities account for less than 20% of total pathology volume. Disease diagnostics also benefit from standardized reimbursement pathways—for example, Medicare covers ~90% of clinically necessary cancer tests—whereas research applications face inconsistent funding. Additionally, public health initiatives, such as India’s National Cancer Grid screening 5 million individuals annually, prioritize diagnostic capacity over experimental studies. The rise of early-detection protocols, including liquid biopsies for high-risk populations, further entrenches diagnostics as the dominant application, with over 500,000 such tests performed monthly in major markets.

By End Users

Hospital laboratories lead the anatomic pathology market by capturing over 48.01% market share due to their integrated role in patient care, where diagnostic speed directly impacts treatment outcomes. Over 65% of cancer patients in the U.S. are diagnosed and treated within hospital systems, requiring in-house pathology teams to manage surgical specimen processing, intraoperative consultations, and urgent molecular tests. Hospitals also handle ~80% of complex cases, such as sarcomas or lymphomas, which demand multidisciplinary coordination between pathologists, surgeons, and oncologists. Their dominance is further reinforced by investments in digital pathology infrastructure; for instance, 40% of U.S. hospitals now use AI-assisted image analysis to reduce diagnostic errors in breast cancer margins by 25%.

Smaller clinics and independent labs struggle to match hospitals’ scale in the anatomic pathology market, particularly in emerging markets where 60% of pathology services are centralized in urban hospitals. Additionally, hospitals benefit from bundled payment models, where pathology costs are integrated into episode-based reimbursements for surgeries or oncology care. Training programs for specialized techniques, such as cytogenetics or flow cytometry, are also concentrated in academic hospitals, attracting referrals for rare cases. Partnerships with diagnostic firms, like Phillips’ digital pathology integrations in 300+ U.S. hospitals, enhance efficiency, enabling same-day reporting for 50% of routine biopsies. This operational synergy, combined with aging infrastructure in low-resource settings, ensures hospitals remain the primary end-users, even as decentralized models gain traction.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America: Advanced Infrastructure and High Cancer Burden Drive Market Leadership

North America’s dominance in the anatomic pathology market with over 41% market share comes from its robust healthcare infrastructure, high prevalence of chronic diseases, and intensive adoption of cutting-edge technologies. The U.S., contributing over 85% of the regional market, accounts for 1.9 million new cancer cases annually, necessitating precise diagnostic workflows like immunohistochemistry and molecular profiling. The region’s aging population—projected to include 75 million adults over 65 by 2030—intensifies demand for complex diagnostics to manage age-related cancers and degenerative diseases. Advanced healthcare expenditure, exceeding US$ 4.7 trillion in 2023, supports investments in automation, AI-driven digital pathology, and predictive analytics, which enhance diagnostic accuracy and operational efficiency. Additionally, partnerships between academic institutions and private players accelerate R&D in precision oncology, solidifying North America’s innovation-driven leadership.

Europe: Aging Demographics and Regulatory Frameworks Sustain Steady Growth

Europe’s anatomic pathology market’s second position in the world is driven by aging populations and stringent regulatory standards, prioritizes quality and reproducibility in diagnostics. With over 20% of the population aged 65+ in countries like Germany and Italy, demand surges for cancer diagnostics and chronic disease management, particularly for breast and colorectal malignancies. The region’s emphasis on standardized pathology practices under EU-wide guidelines ensures consistent adoption of advanced techniques like liquid biopsy and next-gen sequencing. Meanwhile, centralized healthcare systems in nations such as the U.K. and France streamline reimbursement for molecular tests, incentivizing labs to integrate automated stainers and digital scanners. However, fragmentation in Eastern Europe’s infrastructure limits growth compared to Western counterparts, though cross-border collaborations aim to bridge this gap through technology transfers and training programs.

Asia-Pacific: Rapid Healthcare Modernization Expands Diagnostic Access

Asia-Pacific’s anatomic pathology market is fueled by healthcare modernization, rising cancer incidence, and cost-effective service models. China, representing 40% of regional demand, reports over 4.8 million new cancer cases yearly, driving investments in histopathology labs and telepathology networks. India’s National Cancer Grid initiative connects 300+ centers, centralizing diagnostic services to address disparities in rural-urban access. While digital pathology adoption lags behind the West, countries like Japan and South Korea prioritize automation to counter workforce shortages, deploying AI tools for tumor grading. Medical tourism hubs in Thailand and Malaysia further stimulate demand, offering high-volume, low-cost biopsies for international patients. However, fragmented reimbursement policies and uneven regulatory enforcement across Southeast Asia hinder scalability, despite growth opportunities in precision oncology research.

Top Companies in the Global Anatomic Pathology Market

- F. Hoffman La Roche Ltd

- Danaher Corp

- PHC Holdings Corp

- Abcam Ltd

- Hologic Inc

- Agilent Technologies Inc

- Becton Dickinson and Co

- Sakura Finetek USA Inc

- BioGenex

- Milestone Medical

- Histo-Line Laboratories

- Diapath S.p.A.

- Slee Medical Gmbh

- Merck KGAA

- Bio SB Inc.

- Other Prominent Players

Market Segmentation Overview:

By Product & Services

- Services

- Consumables

- Instruments

By Application

- Disease Diagnostics

- Medical Research

By End User

- Hospital Laboratories

- Clinical Laboratories

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)