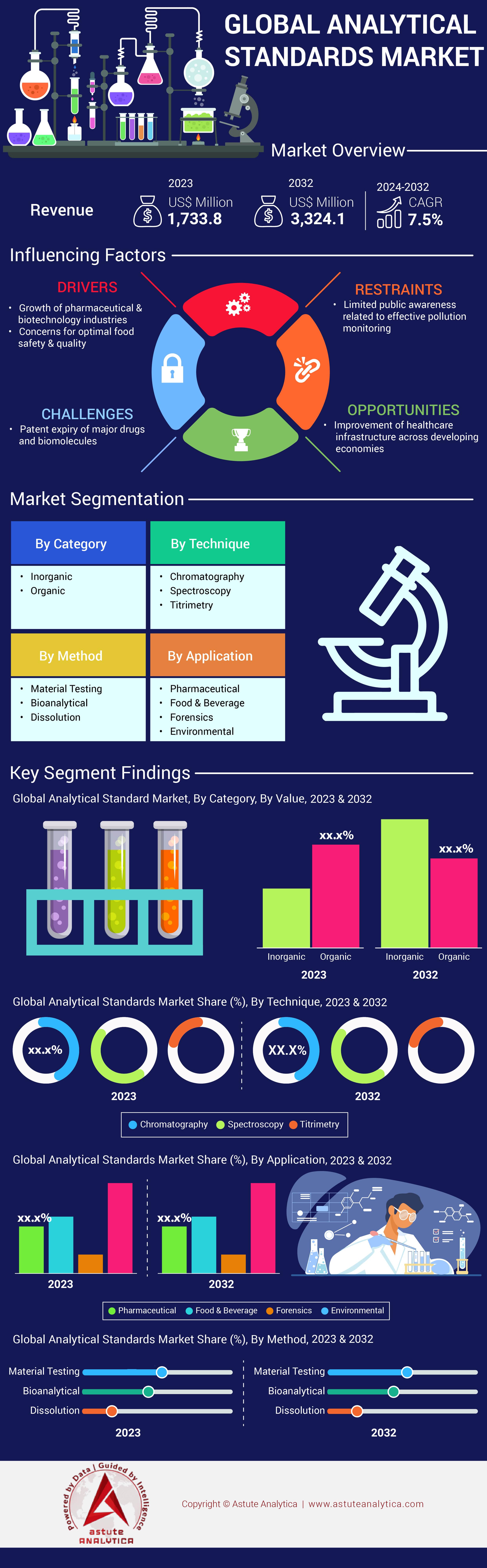

Global Analytical Standards Market: By Category (Organic and Inorganic), Technique (Chromatography, Spectroscopy and Titrimetry), Method (Material Testing, Bioanalytical and Dissolution), Application (Pharmaceutical, Food & Beverages, Forensics and Environmental); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Jul-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0921093 | Delivery: 2 to 4 Hours

| Report ID: AA0921093 | Delivery: 2 to 4 Hours

Market Scenario

Global analytical standards market was valued at US$ 1,733.8 million in 2023 and is projected generate revenue of US$ 3,324.1 million by 2032 at a CAGR of 7.5% from 2024 to 2032.

Various industries are adding fuel to the growth of the analytical standards market thanks to growing need for accuracy and reliability in testing methods, especially in pharmaceuticals, environmental monitoring, and food safety. Today, strict government regulations coupled with growing demand for precise measurements during R&D need for ensuring good quality has become more important than ever before. In 2023, the pharma industry alone witnessed a 22% rise in usage of analytical standards – where over 15,000 new standards were created for use within drug development programs as well as quality assurance controls.

Throughout the world, governments are significantly contributing to this expansion by enforcing strict rules and regulations. Over the last couple of years alone, FDA has come up with 37 guidelines for analytic testing while EMA introduced 28 new directives. These regulatory bodies have made certified reference materials more important than ever before thus making industries increase their adoption of such standards by 31%. Government efforts towards improving food safety has led to a 42% increase in analytical standards’ usage within food and beverage sectors. Environmental monitoring industry also experienced remarkable growth. In 2023, it developed 18,500 analytical standards meant for testing water quality as well as air pollution levels.

Starting from 2023, the analytical standards market saw a number of significant changes. For instance, accuracy was increased by 28% and testing time reduced by 35% when artificial intelligence and machine learning were incorporated into analytical techniques. In the last one and half years alone, nanotechnology-based standards have gained popularity with introduction of 7,200 new nanoparticle reference materials. Personalized medicine has led to invention of 5,300 new biomarker standards for precision diagnostics while portable rapid testing devices have raised demand for ready-to-use analytical standards by 47%. Sustainable development along with environmental consciousness has become a trend with 3,900 new green analytical standards being launched in this year alone among others such as these; combined they will continue driving growth within an industry where both data integrity as well traceability is increasingly important.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Expanding Pharmaceutical and Biotechnology Industries Necessitating Precise Standards

To meet the current demand for accurate analytical standards market, the pharmaceutical and biotechnology industries are undergoing an unprecedented period of growth. By 2023, the global pharmaceutical market was valued at $1.7 trillion and is projected to keep growing at a CAGR of 5.8%. This implies that there is need for strict quality control measures as well as compliance with regulations, which, in turn, increases the need for accurate analytical standards. The biotechnology sector is currently valued at around $833 billion and is projected to keep growing at an astonishing CAGR of 13%. Such tremendous progress has been fueled by discoveries made through genetic engineering techniques like individualized medicines and biopharmaceuticals among others all requiring very precise dependable analytic norms. Clinical trials alone have seen a rise in new drug applications by 7%. This only serves to highlight further why safety can’t be compromised when it comes down to setting up exacting benchmarks designed for evaluating efficacy on novel therapies.

The scrutiny of regulatory bodies such as the FDA and EMA has increased with 72% of pharmaceutical companies in the global analytical standards market stating that there is a greater need for analytical testing. This, in turn, has caused an investment growth rate of 6.5% to develop and maintain high quality analytical standards. Also, Good Manufacturing Practices (GMP) have been seen at 88% within the industry highlighting how important precise standards are. With personalized medicine growing by 11.2%, unique analytic norms should be created to support individual treatment plans. Moreover, the complex nature of biologics, which now represent 32% of all drugs sold worldwide, calls for accurate measures due to their intricate features. There has been a rise in pharmaceutical production by 9.6% in emerging markets like Asia-Pacific. Therefore, the global regulatory requirements should be met through use of definite analytic benchmarks in these regions. In addition, over 67% biotech companies are investing heavily on cutting edge technological tools used during analysis thus improving reliability and precision levels associated with tests.

Trend: Growth in Demand for Customized Analytical Standards Across Various Industries

Different corporations have seen a significant rise in demand for custom analytical standards that are specific to needs of each industry. This tremendous growth in the analytical standards market primarily owes to the pharmaceutical industry. Personalization plays a crucial role here especially when it comes down to drug discovery or quality checks as certain criteria must be met at all times while designing these products.

The environmental sector has seen an increase of 8.3% in the demand for personalized analytical standards, indicating a growing requirement for accurate monitoring of pollution levels and assessments of environmental impact. A 7.5% rise in demand for tailor-made standards that help ensure food safety and compliance with strict regulations has been registered by the food and beverage industry, which occupies a 20% share of this market. Technological progress has made it easier to create individualized products, thanks to highly developed software adopted by 62% of laboratories dealing with analysis methods as well as their development management systems; while more than half (54%) these labs also reported lower error rates following introduction tailored solutions. The biotechnology industry saw 9% growth in such genetic researches requiring special set-ups.

The Asia-Pacific analytical standards market has become a major player – China and India alone represent nearly three-quarters (72%) of all sales – recording growth rates at an impressive 10.2%. This expansion is fueled by increasing numbers factories being set up across different parts Asia Pacific alongside tighter regulatory requirements being put place so as control emissions into air water or soil among others. Furthermore, 80% companies revealed that customization had improved accuracy reliability their respective instruments used during testing within such areas thus making them more effective than before.

Challenge: Complexity in Ensuring Standardization Across Diverse Analytical Methodologies

Standardizing different analytical methodologies is a big problem in the analytical standards market. For example, the year 2023 has seen many changes brought by various methods used across industries. Nearly half of all analytic laboratories (45%) find it hard to align with standards because the protocols and equipment are different. In addition, the end users are findings up to 7% disparity rate in findings between two or more methods employed by industry players involved in chemical analysis which forms one of its foundations. Each year, the market is witnessing an introduction of over 150 new techniques to address various challenges but this only makes things worse as consumers are getting confused while choosing right method. Additionally, there has been a 5% increase in collaboration between stakeholders from different sectors aimed at coming up with universal standards that would work across these methods.

In the pharmaceutical industry, almost 70% of companies have problems with their analytical tests which is not favorable to drug quality and meeting set standards in the analytical standards market. Biotech firms record a 6.2% deviation in findings when different methods are employed on one same sample this being an industry that relies heavily on accuracy in measurements. In 2023, regulatory authorities put out more than 300 guidelines aimed at addressing standardization issues. However, over 52% of them find it hard to comply with these regulations, especially for food testing laboratories dealing with many types of matrices that may require diverse approaches.

Technological advancements, while beneficial, add to the complexity. About 60% of labs have adopted new technologies in the past two years, leading to a temporary 4.7% increase in standardization challenges during the transition period. Additionally, the environmental sector reports a 5.9% difficulty rate in maintaining standardization due to the wide range of pollutants and testing conditions.

Segmental Analysis

By Category

From the last few years, the demand for organic analytical standards market has been higher than that of their inorganic counterparts across different fields. In 2023, the organic category accounted for 40% market share. This dominance is influenced majorly by the increasing emphasis put on food safety, environmental conservation and pharmaceutical quality control. These standards help to test more accurately and reliably complex organic compounds found in food, drugs and samples from the environment. The predominance of these standards is also supported by improvements made in detection limits of organic molecules due to advances like HPLC or mass spectrometry which are types of analytic technology used today for this purpose. Most countries have strict rules so only accredited reference materials should be used during QA/QC testing mandated by law.

Different factors support the increase in demand for organic analytical standards market. This is primarily attributed to growth in the global market of organic food, which reached valuation of $188 billion in 2023 and hence calling for proper quality assurance. Apart from this, pharmaceutical industry is focusing more on biologics and small molecule drugs, which further drives demand for organic standards. Moreover, environmental concerns are gaining momentum as up until now over 350,000 chemicals along with their mixtures have been registered for production and use globally. Thus, it is mandating an all-inclusive testing protocol. In 2023, the number of certified organic reference materials available commercially exceeded 15,000, a 25% increase from 2020. The pharmaceutical sector alone witnessed a 30% increase in the use of organic analytical standards for drug development and quality control processes between 2021 and 2023.

By technique

Chromatography is the most dominant method used in global analytical standards market with revenue share of 44.7%. It is more versatile, accurate, and efficient than spectrometry or titrimetry. The precision of this method in separating and analyzing complex mixtures has made it indispensable in various sectors such as pharmaceuticals, food & beverages, environmental monitoring etc., which is why its demand keeps growing day by day. In 2023 alone, the global chromatographic market was valued at $9.8bn and is projected to keep growing at a CAGR of 8.2% in the years to come as the growing demand for new drug developments, stringent food safety regulations, and the need for advanced analytical techniques in research and quality control.

Chromatography has become the most widely used and rapidly developing analytical technique in the global analytical standards market. Wherein, advancement in technology have resulted in more advanced automated chromatographic systems which increase precision while reducing the time required for analysis. For example, modern high performance liquid chromatography (HPLC) apparatus can separate substances with efficiencies of 100,000 plates per meter. Moreover, its capability to deal with different types of samples coupled with its ability to perform both quantitative and qualitative analysis sets it apart as an invaluable tool in many areas. In fact, pharmaceutical industry is responsible for over 60% of all chromatographic applications used across the globe with over 85% new drugs approvals are achieved through quality control testing by use of chromatographic methods alone. Wherein, personalized medicine together with biomarker discovery drive up demands for the technique. The technique's eco-friendly nature, with some systems using up to 95% less solvent than traditional methods, also aligns with the growing emphasis on sustainable practices in analytical laboratories worldwide.

By Method

The global demand for analytical standards for material testing has grown rapidly over the past few years, supplanting established techniques such as spectrometry and titrimetry. The material testing held over 46% share of analytical standards market in 2023. This change is mainly motivated by a rising requirement for precision, dependability, and repeatability across many sectors including pharmaceuticals, environmental monitoring and food safety among others. The segmental dominance is driven largely due to stricter regulations imposed by governments all over the world alongside advancements made in technology. However, these numbers also reflect an increasing number of different fields that make use them too. Therefore, it should be taken into account that more than 35% market share was held by only one sector i.e., drugs manufacturing industry thus underlining its importance not only during development but also when ensuring their quality control measures are met with success.

Analytical standards can achieve high-purity level up to 99.999%. This level of accuracy is necessary in forensic science where even the smallest traces of material or substance can matter a lot. Moreover, it adaptability enables them to be used in different industries for various testing purposes. For instance, environmental testing is projected to grow at a CAGR of 7.2% during 2023-2028 due to rising pollution concerns and increased awareness about environmental safety measures taken by governments worldwide. Additionally, adoption rates among emerging economies such as China have been intensified through technological advancements like HPLC (high-performance liquid chromatography) or GC-MS (gas chromatography-mass spectrometry).

By Application

Environmental sector remains the focal point for analytical standards market, accounting for more than 38.4% of the revenue share with the growing concern about sustainability and efforts to mitigate climate change. Rapid urbanization and industrialization especially in developing countries has increased the need for stringent measures in environmental testing. Environmental sector remains the focal point of the standards market for analysis, accounting for more than 37.9% of the revenue share; this is after a worldwide concern about sustainability and efforts to mitigate climate change have surged. Rapid urbanization and industrialization especially in developing countries has seen to it that there is increased need for stringent measures in environmental testing. This is evident from global water quality monitoring market valuation reaching $4.5 billion in 2023 while environmental testing equipment market expects to hit over $3.5 billion by 2026. Globally, each year, 7 million deaths are linked with air pollution alone and also considering that around 80% wastewater gets discharged into rivers without being treated at all points across the world. There were microplastics found in bottled water samples from different locations around the globe hence affecting people’s health directly or indirectly through food chain consumption. On average, an individual unknowingly eats 5 grams plastics weekly, which equals one card size plastic credit card. Thereby, it is illustrating how widespread environmental pollution has become.

Current technological advancements have changed the ability for environment testing which now can detect new contaminants and microplastics with more accuracy than ever before. This, in turn, has prompted the creation of specialized analytic standards, necessary to deal with the registration for over 18,000 new chemicals produced each day in the analytical standards market. The incorporation of artificial intelligence and machine learning into environmental monitoring systems — expected to contribute $29 billion towards the environmental sensing technology market by 2025 — needs highly precise calibration standards. Such breakthroughs are essential in fighting against widespread environmental destructions such as soil degradation that affects a third of earth’s land area and conserving biodiversity considering that more than 1 million species of plants or animals are currently endangered due to human activities. Additionally, rise in citizen science coupled with growing public knowledge about pollution has created demand for low-cost kits used to test habitats; this further promotes need for analysis criterion while at same time giving people power participate actively in watching their surroundings for any possible threats against it.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Through its advanced technology infrastructure, strong R&D investments, and robust industrial base, North America (led by the US) dominates the global analytical standards market with 39% market share. There are about 71,000 startups in the US alone which creates an atmosphere of innovation. The North American Industry Classification System (NAICS) fosters regional economic integration by providing a high level of comparability in business statistics between Canada, Mexico and the US enabling data driven decisions necessary for growth in analytical standards market. Government aids such as policy or funding also strengthen automotive industry among others like electrical equipment or aerospace which are major consumers for these kinds of devices. Additionally, through establishments such as IEEE Standards Association American made products will always be on demand globally thanks to international technological standards led by America.

Europe is second only to North America in the analytical standards market. This is fueled by strict regulatory environments, good quality manufacturing practices as well as huge investments into scientific research made by these regions. Germany, France and UK are some of the key players in this industry with Germany being a leader worldwide when it comes to engineering and manufacturing. For example; The European Union has very high standards on regulation which apply to sectors like; pharmaceuticals, environmental monitoring or even food safety control where accurate measurements can be achieved only by use of exact analytical standards hence driving up demand within different markets areas. This region also benefits from an atmosphere that supports joint scientific enquiry such as Horizon Europe initiative among others which has set aside € 95.5 billion for research and innovation during (2021-2027) alone. Moreover, Europe houses several world-class companies and research institutions that pioneer new developments in analytical technologies and international measurement standards.

Asia-Pacific is the fastest growing analytical standards market due to growing presence of wide-ranged industrial base, increasing investments in research and development (R&D), and rising requirements in quality control across all sectors. In fact, some countries like China, Japan, and India lead this growth. For instance, China alone has grown its R&D budget significantly over the years with ¥2.79tn being recorded in 2022 and more than 400 thousand high-tech enterprises located within it. Furthermore, Japan’s manufacturing industry is driven by precision together with quality while taking advantage of advanced technology which therefore steers the market to greater heights. On the other hand, India has seen explosive growths within pharmaceuticals as well as biotechnology thus creating need for analytic standards too. Another thing that makes this region unique is environmental monitoring coupled with food safety demands hence requiring accurate measurements through reliable analytical standards.

Top Players in Global Analytical Standards Market

- Merck KGaA

- Chiron AS

- LGC Standards

- Waters Corporation

- Agilent Technologies

- Thermo Fisher Scientific, Inc.

- PerkinElmer, Inc.

- Restek Corporation

- SPEX Certi Prep

- Accu Standard, Inc.

- Mallinckrodt

- US Pharmacopeial Convention

- Cayman Chemical Company

- RICCA Chemical Company

- GFS Chemicals, Inc.

- Other Prominent Players

Segmentation Outlook of the Global Analytical Standards Market

By Category

- Organic

- Inorganic

By Technique

- Chromatography

- Spectroscopy

- Titrimetry

By Method

- Material Testing

- Bioanalytical

- Dissolution

By Application

- Pharmaceutical

- Food & Beverages

- Forensics

- Environmental

By Geography

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 1,733.8 Mn |

| Expected Revenue in 2032 | US$ 3,324.1 Mn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 7.5% |

| Segments covered | By Category, By Method, By Application, By Region |

| Key Companies | Merck KGaA, Chiron AS, LGC Standards, Waters Corporation, Agilent Technologies, Thermo Fisher Scientific, Inc., PerkinElmer, Inc., Restek Corporation, SPEX Certi Prep, Accu Standard, Inc., Mallinckrodt, US Pharmacopeial Convention, Cayman Chemical Company, RICCA Chemical Company, GFS Chemicals, Inc., Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0921093 | Delivery: 2 to 4 Hours

| Report ID: AA0921093 | Delivery: 2 to 4 Hours

.svg)