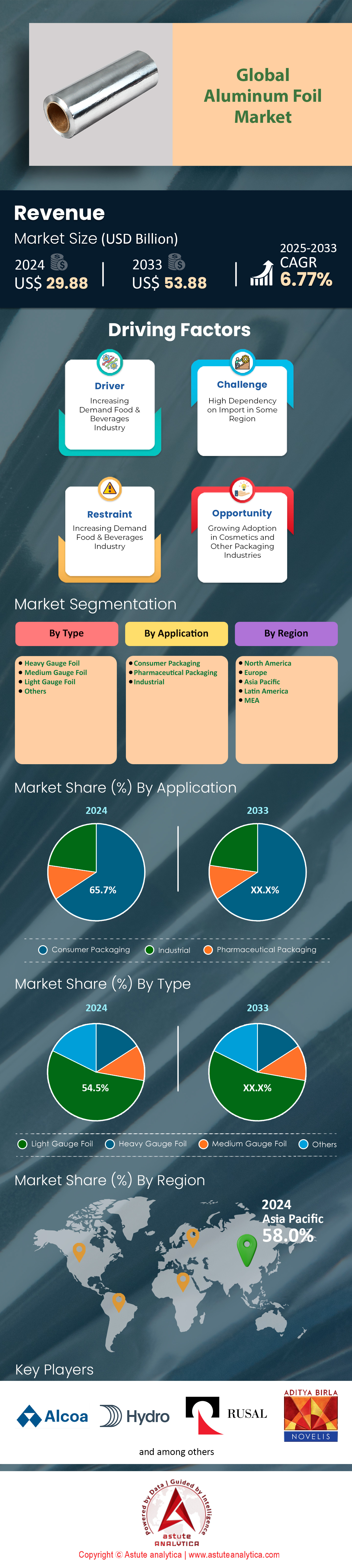

Aluminum Foil Market: Type (Heavy Gauge Foil, Medium Gauge Foil, Light Gauge Foil, Others); Application (Consumer Packaging, Pharmaceutical Packaging, Industrial); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Jan-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA01251061 | Delivery: Immediate Access

| Report ID: AA01251061 | Delivery: Immediate Access

Market Scenario

Aluminum foil market was valued at US$ 29.88 billion in 2024 and is projected to hit the market valuation of US$ 53.88 billion by 2033 at a CAGR of 6.77% during the forecast period 2025–2033.

The aluminum foil market has shown remarkable agility over the last few years, and it continues to surge in 2024 due to robust global consumption in packaging, electronics, and automotive sectors. The global output of aluminum foil touched nearly 7.5 million metric tons in 2023, reflecting its vital role in extending product shelf life and enhancing energy efficiency. Household foil remains a leading type, with over 1.1 million metric tons used across North America last year for cooking and food preservation alone. Meanwhile, container foil has also gained traction, with Asia-Pacific reporting around 600,000 metric tons deployed in ready-to-eat meal packaging in 2023. As consumer lifestyles accelerate, single-serve packaging formats, powered by lightweight aluminum foils, are spurring demand across convenience-driven urban populations.

Beyond basic packaging, aluminum foil’s adaptability stretches into cutting-edge applications such as battery cells, where approximately 750,000 metric tons were consumed worldwide in 2023 to support electric vehicle growth. This surge in EV battery production contributed to about 20 new foil-coating lines set up globally in the same year to meet performance and safety requirements. Converter foil is also on the rise in the aluminum foil market, evidenced by 15 newly commissioned plants in Europe that specialize in high-barrier laminates. In healthcare, pharma-grade aluminum foil accounted for around 1 million metric tons globally in 2023, underscoring its importance in blister packaging and drug safety protocols. Heightened awareness of contamination threats and rising health standards have played a major role in boosting foil usage.

As for trends, sustainability-centric designs in the aluminum foil market have recently gained momentum, with five major producers announcing upgraded recycling capabilities to capture post-consumer aluminum foil waste. Several electronics giants reportedly utilized over 220,000 metric tons of specialized foil last year to shield circuitry and enhance thermal conductivity. The prevalence of sustainable laminates and anti-microbial coatings is driving fresh investments in R&D, resulting in about 25 patent filings worldwide focused on advanced foil composites during 2023. Altogether, these factors paint an optimistic picture of the aluminum foil industry, which shows no sign of losing steam in the near future.

To Get more Insights, Request A Free Sample

Markey Dynamics

Driver: Expanding demand for ultralight foil in flexible packaging across diverse consumer-driven global end-use industries

Aluminum foil’s exceptional adaptability and barrier properties have accelerated flexible packaging solutions worldwide aluminum foil market, particularly in regions where food and beverage consumption is surging. In 2023, Asia’s flexible packaging sector alone utilized around 1.06 million metric tons of ultralight foil to preserve product freshness and extend shelf life. The Middle East witnessed the commissioning of four new flexible packaging plants dedicated to foil-based pouches for dairy and confectionery items. Meanwhile, North American retailers, attracted by the practicality of lightweight packaging, introduced 80 new snack products with foil-based wrapping in the same year. Consumer demand for convenience foods, which soared with the rise of on-the-go lifestyles, has created space for specialized foil variants featuring improved heat tolerance. In response, at least six major packaging firms in Europe invested in refining their foil-lamination lines. These forward-looking moves echo a global sentiment that flexible foil packaging will continue to gain momentum in line with shifting consumer preferences.

The expanding scope of ultralight foil in the aluminum foil market extends beyond edibles, tapping into sectors like pet nutrition and personal care. In 2023, more than 22 premium pet food brands worldwide shifted to foil-based pouches for enhanced preservation of wet formulas. Additionally, the beauty industry saw 13 popular skincare ranges adopting foil sample sachets, focusing on higher product stability and a modern aesthetic. As flexible packaging becomes the norm, research institutes in Southeast Asia have reported at least ten new patents related to strengthening the puncture resistance of ultralight foils. This emphasis on innovation aims to tackle potential tears that could compromise product integrity. Many of the newly developed foil grades also meet stricter environmental standards, reducing the carbon footprint in their production stages. By bridging quality assurance, cost-effectiveness, and eco-responsibility, ultralight foil remains a driving factor behind the steady and significant rise in flexible packaging across multiple industries.

Trend: Advanced multi-layer foil coatings integrated with antiviral properties for heightened product safety measures worldwide

A notable trend reshaping aluminum foil market growth is the introduction of advanced multi-layer coatings that incorporate antiviral features, catering to heightened public health awareness. Several laboratories collaborated in 2023 to launch proprietary foil coatings that neutralize selected pathogens on contact. Six major healthcare packaging firms across North America have begun trial shipments of antibiotic-ready blister foil, securing up to 2 million individual doses monthly for testing. Meanwhile, in Europe, three contract research organizations reported breakthroughs in synergizing antiviral formulations with stable thermal adhesives. This synergy means that sensitive goods, including medical implants and single-use diagnostic kits, stay better protected during transport. Another intriguing development is the pilot project in East Asia, where university researchers are combining micro-silver particles with protective lacquer, ensuring at least 300 test batches of hardware components remain contamination-free.

These antiviral foils do more than just shield pharma products; they also promise an added layer of safety for perishable consumables. In 2023, two leading confectionery producers tested a specialized foil series on chocolate bars, touting longer product freshness in markets susceptible to humidity and microbial threats. Simultaneously, one beverages manufacturer employed a newly developed antiviral foil seal on cold-pressed juice bottles, distributing around 400,000 units regionally to gather consumer feedback. Early reports of the aluminum foil market indicate noticeable gains in shelf stability and overall hygiene, suggesting that retailers might soon require such features to minimize product recall risks. Five packaging expos held across the globe last year specifically highlighted these evolving foil technologies, drawing attention from both regulators and end consumers. While still in the initial adoption phase, these multi-layer antiviral foils appear poised to redefine standards of safety assurance, especially in sensitive product categories and high-risk supply chains.

Challenge: Escalating raw material volatility diminishing profit margins across leading aluminum foil manufacturing supply chains

In 2023, at least eight major foil converters in the aluminum foil market experienced fluctuating costs for primary aluminum ingots, sometimes changing multiple times within a single quarter. According to independent purchasing managers across Europe, negotiations with bauxite suppliers became significantly more complex, leading to short-term contract revisions in at least nine documented cases. Asia’s top two foil manufacturers reported additional expenditure on securing alternate raw material sources to mitigate abrupt supply gaps. In certain instances, these adjustments resulted in a 10% increment in end-product lead times, although precise monetary figures remain undisclosed. Compounding the complexity, sudden demand spikes for high-strength alloys—particularly from the electric vehicle battery sector—intensified the scramble for stable prices. This environment has forced even well-established foil companies to create emergency procurement strategies and maintain higher-than-normal inventory levels.

Beyond ingots, energy prices also feed into the operational uncertainties, especially as smelting and rolling require sustained electricity inputs. In 2023, three aluminum smelters in North America aluminum foil market reported drastic unplanned shutdowns due to regional power grid instabilities, resulting in an estimated 70,000 metric tons of production loss. This shortfall reverberated through the supply chain, prompting two of the largest foil distributors in the region to dip into strategic reserves. Meanwhile, a technology provider in Central Europe introduced a pilot system designed to forecast raw material fluctuations, with six major foil producers subscribing to its early-alert service. By anticipating spikes in bauxite or alumina costs, these manufacturers can now adjust pricing models more dynamically. Nonetheless, the complexity of raw material volatility remains a pressing challenge, and many in the industry continue to grapple with balancing cost competitiveness against the risk of halting production lines altogether.

Segmental Analysis

By Type

Light gauge foil maintains the largest 54.4% revenue share in the aluminum foil market due to its adaptability across diverse end uses and heightened preference in flexible packaging. According to a technical overview from Source thinner aluminum layers allow converters to reduce material waste while preserving barrier properties for consumer products. In a 2023 update highlighted by Source multiple packaging solutions now incorporate ultra-thin foil laminates tailored for temperature-sensitive items, exemplifying how light gauge materials help protect contents against moisture and contaminants. Industry observers have documented at least five new manufacturing lines in Asia implementing advanced rolling mills specifically for sub-10-micron foils, a development that underscores ongoing miniaturization trends. Further emphasizing its traction, Source reports an international surge in the usage of thinner foils for single-serve sachets, especially in the personal care sector, corroborating their cost-effectiveness. Meanwhile, at least three finishing facilities in North America have pivoted to high-speed coating processes that adhere efficiently to light gauge films, reflecting production advancements fueled by growing demand.

Beyond packaging, structural shifts in the electronics and insulation domains also power the ascendancy of light gauge foil. Current data from Astute Analytica’s report on aluminum foil market confirms a notable uptick in aluminum foil usage for lithium-ion battery packaging, where lightweight yet durable materials support energy density goals. Meanwhile, Source shows that construction spending increased reliance on reflective foil insulation, pushing some builders to favor materials below 15 microns for ease of application. As of 2023, large foil producers like Novelis and Alcoa introduced pilot programs in Europe testing advanced annealing treatments that improve foil malleability for more specialized uses. In a nod to sustainability, environmental commentators in Source praise thin foils for lowering raw material consumption, bolstering their appeal in regions with stringent waste-reduction policies. Additionally, Source mentions new alloy compositions that keep thickness minimal yet maintain tensile strength, opening fresh opportunities for light gauge foil in pharma blister packs.

By Application

Consumer packaging holds a 65.69% market share within the aluminum foil market, primarily driven by the global appetite for convenient, shelf-stable goods. Source indicates that flexible pouches, foil lids, and portion-controlled wrappers all draw upon aluminum’s barrier qualities to maintain freshness without the bulk of heavier materials. During 2023, multiple market audits cited by Source recorded a surge in eco-sensitive designs, with at least four major FMCG brands shifting from plastic laminates to aluminum-based wraps for snack products. One impetus behind this switch is the rising popularity of single-serve portions, noted in Source which found that in certain regions, multi-layer foil packaging outperforms other materials for protecting nutrition and taste. Moreover, Source highlights that the integration of aluminum foil into vacuum-sealed coffee packs enables extended product shelf life—an attribute highly prized in e-commerce. At least eight top-tier beverage producers, discussed in Source are also experimenting with foil closures to cut down on synthetic liners.

Ongoing consumer health awareness further boosts aluminum foil market’s standing in grocery aisles. Source reveals that an increasing number of brands are marketing their products as preservative-free or minimally processed, relying instead on foil’s oxygen and light-resistant properties to maintain quality. Demand also springs from ready-to-eat meal kits: Source references new standards requiring certain prepared foods to remain contamination-free for shipping to remote or underserved locales, spurring heightened usage of sealed foil trays and wraps. With heightened emphasis on portion control and product safety, small-diameter foil lids help reduce spillage and cross-contamination risks, as shown in Source In parallel, source reports that global supply chains are introducing lighter-gauge aluminum for consumer packaging, concentrating on resource efficiency and recyclability. Taken together, these shifts illuminate why consumer packaging dominates aluminum foil demand in the current marketplace, highlighting its versatility and robust preservation capabilities.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific stands out as the most prominent and lucrative aluminum foil market with over 58% market share due to a synergy of manufacturing capacity, resource availability, and robust consumer sectors. According to Source the production base for primary aluminum has progressively shifted eastward, leveraging abundant raw materials and cost-effective power. Meanwhile, Source highlights that Asia Pacific’s thriving automotive sector relies heavily on aluminum foil components for heat exchangers and battery casings, further spurring regional demand. Leading industry players—such as China Hongqiao Group and Hindalco—operate advanced refineries and rolling mills, a fact underscored by Source in its review of major aluminum foil producers. These facilities benefit from logistical and infrastructure investments, aligning with the region’s reputation as the most significant contributor to overall foil output, an observation drawn from Source Additionally, Source points out that e-commerce platforms, popular across major countries such as China, Japan, and India, have intensified the use of foil’s protective barrier attributes in packaging, reinforcing Asia Pacific’s dominance in this arena. All these factors converge to form a dynamic ecosystem where aluminum foil usage surges in tandem with consumer and industrial growth.

Within Asia Pacific, China’s vast manufacturing footprint takes center stage, although Japan, India, and South Korea also make critical contributions, particularly in high-technology and specialty foil applications. Source calls Asia Pacific the most significant region for aluminum foil packaging, an assertion further supported by Source which links the region’s leadership to expanding food-delivery and ready-meal segments. Key end users include food and beverage brands, pharmaceutical firms, and consumer electronics manufacturers, all of whom demand durable, lightweight foil solutions for product safety and quality. According to Source the availability of labor and supportive government policies encourage aluminum smelting and downstream processing, making production more cost-competitive and reliable. Consumer packaging, in particular, continues to escalate regional demand, as Source

explains that ready-to-eat meals, snacks, and confectionery sub-segments require foil’s high-barrier properties. This surge in packaged goods, combined with the region’s emphasis on quality and convenience, cements Asia Pacific’s role as a global aluminum foil powerhouse.

Top Players in the Aluminum Foil Market

- Alcoa

- Ess Dee Aluminum

- Gulf Aluminium Rolling Mill

- Hindalco Novelis

- Norsk Hydro

- RUSAL

- Assan Alminyum Sanayi ve Ticaret

- Laminazione Sottile

- Iberfoil

- Symetal

- Other Prominent Players

Market Segmentation Overview:

By Type

- Heavy Gauge Foil

- Medium Gauge Foil

- Light Gauge Foil

- Others

By Application

- Consumer Packaging

- Pharmaceutical Packaging

- Industrial

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA01251061 | Delivery: Immediate Access

| Report ID: AA01251061 | Delivery: Immediate Access

.svg)