Aluminum Casting Market: By Product (Silicon, Iron, Copper, Magnesium and Zinc); Methods (Die Casting, Permanent Mold Casting, Investment Casting, and Sand Casting); Industry Application (Aerospace, Construction & Architecture, Site Furnishings (Removable Bollard Applications), Food and Beverage (cans), Electrical and Electronics Equipment, Automotive, Agriculture, and Others) ; Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 15-Jan-2025 | | Report ID: AA0522250

Market Scenario

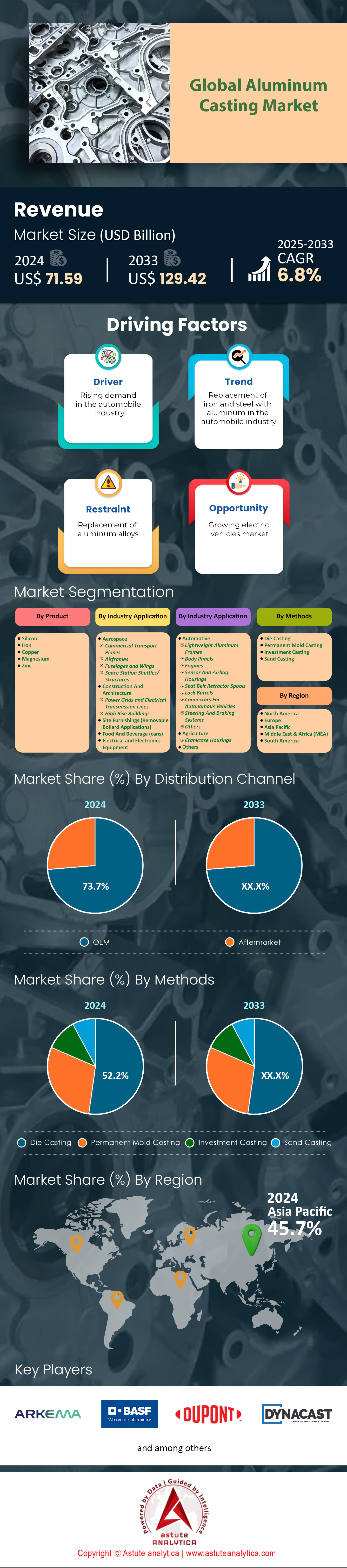

Aluminum casting market was valued at US$ 71.59 billion in 2024 and is projected to generate revenue of US$ 129.42 billion by 2033, at a CAGR of 6.8% during the forecast period of 2025-2033.

Aluminum casting is reflecting unstoppable demand from automotive and aerospace sectors. Wherein, die casting continues to take center stage, contributing 54 million aluminum components annually, thanks to its precision and rapid throughput. Meanwhile, over 8,000 foundries worldwide are now engaged in aluminum casting activities, exemplifying the aluminum casting market’s diverse geographical footprint. The appetite for lightweight yet robust materials has made aluminum an indispensable choice, especially in the automotive sector, which is poised to consume 14.2 million metric tons of cast aluminum components in 2024 alone. This surge stems from heightened requirements for engine blocks, transmission housings, and the quest for greater efficiency in electric vehicles.

Significant capacity expansions have also propelled global aluminum casting output to 22 million metric tons, with China leading the scene by producing 41 million metric tons of primary aluminum in 2024. India and the United States follow suit in the aluminum casting market, as the latter opened 27 new foundry facilities in 2024 to cater to budding sectors such as electric mobility and consumer electronics. Concurrently, the aerospace domain is forecast to absorb 1.6 million metric tons of cast aluminum, a clear indicator of the material’s relevance in reducing aircraft weight while upping fuel efficiency. Coupled with stringent quality requirements, permanent mold casting remains favored for structural components, while sand casting’s flexibility still captures a niche for smaller-scale production.

On the European aluminum casting market front, production volumes have reached 3.8 million metric tons, a testament to the region’s continued emphasis on precision engineering and the surging automotive demand. A major driver of demand lies in electric vehicle segments, which poured US$3.9 billion into advanced die-casting lines for battery housings and structural frames this year. Such investments underscore an ongoing trend toward complex part consolidation, tighter environmental regulations, and evolving consumer preferences for sustainable mobility. Notably, automotive, aerospace, and consumer electronics remain the dominant end users, but emerging domains like renewable energy and robotics are opening fresh avenues. With further innovations in alloy design and increased adoption of automation, the aluminum casting market stands poised for steady growth, meeting global needs for lightweight, high-performance solutions across diverse applications.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Surging automotive R&D demanding lightweight yet robust aluminum-cast vehicle components worldwide for advanced mobility

Automotive research initiatives have intensified efforts to integrate high-strength, low-weight aluminum components, particularly in next-generation vehicle platforms. In 2023, several global automakers in the aluminum casting market launched 14 new prototype programs focused on testing aluminum-cast chassis structures, reflecting heightened emphasis on cutting fuel consumption and emissions. Many of these technical centers now evaluate real-time gating systems, with 45 pilot projects aimed at refining molten metal flow to mitigate voids and cracks in finished parts. Meanwhile, at least 12 specialized casting foundries have ramped up their in-house R&D labs to enhance mechanical properties in advanced alloys. In Japan, five top-tier automotive manufacturers collectively tested more than 60 variations of aluminum alloy compositions for crash-critical zones. Across Europe, eight new EV platforms each incorporate specialized aluminum-cast battery enclosures, underscoring the sector’s push toward safer, more efficient electrified mobility.

This quest in the aluminum casting market for superior aluminum-cast vehicle components aligns with the strategic pivot to electric and hybrid drivetrains. In Germany, three major automotive players have co-developed vacuum-assisted casting lines capable of producing up to 1,000 structurally complex parts daily. Simultaneously, at least six of the largest global foundry equipment manufacturers reported a doubling of client orders for robotic casting cells in 2023. These automated systems not only speed production but also reduce error margins to negligible levels, leading to fewer rejected parts. Further across Asia, four new alloy formulations have been patented in 2023 to handle higher impact thresholds without increasing overall component mass. India, known for its frugal engineering prowess, has seen two major automotive consortiums invest in high-pressure die-casting research to achieve optimal strength-to-weight ratios. Each development illustrates the growing determination within vehicle R&D circles to harness aluminum’s remarkable balance of toughness and lightness.

Trend: Implementing real-time sensors enabling predictive maintenance in aluminum casting lines for next-level efficiency goals

Real-time sensor technology has emerged as a transformative force within aluminum casting market, offering unprecedented insights into process parameters. In 2023, industry specialists documented over 70 pilot installations that incorporate in-mold thermal probes capable of interpreting metal flow dynamics in real time. Six major die-casting companies demonstrated that continuous data collection drastically minimizes defects, with some reporting fewer than ten flawed parts per 10,000 produced. Engineers in Italy deployed 20 advanced ultrasonic sensors in high-pressure casting cells to detect micro-inclusions and porosity before solidification completed. Meanwhile, three leading manufacturers integrated infrared imaging devices on pouring lines, spotting inconsistent fill patterns that historically went unnoticed. By year’s end, eight research institutes had collaborated on sensor-fusion protocols, ensuring a unified digital thread from furnace to final inspection.

Predictive maintenance leverages these sensor arrays to forecast equipment downtime and preempt failures, leading to highly efficient production cycles. In the United States aluminum casting market, a consortium of five foundries implemented cloud-based analytics platforms collecting millions of data points daily. These systems notify operators of impending mechanical wear in real time, preventing abrupt halts and costly rework. Among smaller job shops, at least 16 facilities introduced centralized dashboards correlating vibration analysis and metal temperature gradients to schedule proactive part replacements. In Sweden, four engineering teams validated algorithms that recommend optimal gating recalibration to mirrored casting machines, cutting cycle times by up to 15 percent. Simultaneously, an aluminum wheel manufacturer in Mexico introduced sensor-linked robotic arms that autonomously adjust pour angles, achieving near-perfect fill rates. Each advancement underscores how real-time sensor integration is reshaping the casting landscape, where agility and consistency are more abundant than ever before.

Challenge: Complex alloy compositions requiring specialized metallurgical expertise and proprietary processes across aluminum casting initiatives

As product designs grow increasingly sophisticated, casting houses confront the challenge of formulating and processing intricate aluminum alloys in the aluminum casting market. In 2023, at least nine newly patented alloy variants demanded narrower temperature windows during melt to maintain uniform grain structures. Chinese researchers published findings on 40 micro-additive elements that bolster corrosion resistance but often complicate weldability. This balancing act has led five global metallurgical institutes to launch cross-border collaborations on composition testing, aiming to standardize crucial properties. In France, two aerospace firms co-developed an alloy series specifically for high-load turbine assemblies, each requiring carefully staged cooling over a 24-hour cycle. Outside automated lines, a consortium of three foundries in Canada utilized vacuum induction melting to maintain chemical purity during small-batch production.

Proprietary processes also arise from the need to handle these advanced compositions without sacrificing throughput. Six of the world’s largest equipment suppliers revealed newly tailored furnaces in 2023, designed to preserve trace element ratios within tight tolerances. In Japan aluminum casting market, a research team used electron-beam refining on seven prototype alloys, eliminating embedded impurities that reduced final part strength. Meanwhile, a major aerospace contractor in the United Kingdom introduced a real-time spectroscopy system that verifies melt composition 20 times during a single casting run. Three leading automotive OEMs also underscored the necessity of specialized gating methodologies when dealing with alloy recipes prone to hot tearing. By late 2023, four university labs established a shared research hub to investigate thermal treatment schedules across these complex alloy groups. Meticulous attention to composition and process synergy ensures these cutting-edge materials fulfill their promise in demanding service environments.

Segmental Analysis

By Type

Iron’s projected ability to generate over 52% of the revenue in the aluminum casting market underscores its remarkable dominance in a setting often associated with aluminum’s lightweight benefits. Several industries, from large-scale construction projects to advanced machinery manufacturing, trust iron for its unmatched strength, high tensile capacity, and cost efficiency. Even though aluminum excels in reducing material weight and improving energy efficiency, there are numerous critical applications where iron’s ruggedness and tolerance to wear remain indispensable. This enduring preference extends to the automotive sector, where iron’s robustness ensures safety-critical components can withstand intense mechanical stress. Moreover, the inherent magnetic properties of iron solidify its role in electrical systems and electronic equipment, further strengthening its presence across multiple industrial domains.

One of the key reasons iron continues to command such a significant share lies in its versatility. Traditional casting processes accommodate iron easily, enabling manufacturers to produce components of various sizes without compromising on durability or performance in the aluminum casting market. Additionally, iron’s cost advantage becomes evident when large volumes of cast parts are required, as this metal remains widely available and relatively straightforward to process. Industries that prioritize reliability—particularly in infrastructure and high-load machinery—find iron’s consistent mechanical properties invaluable for maintaining operational stability. In an increasingly competitive landscape, iron casting’s ability to deliver robust parts with less risk of failure remains highly attractive. As the market evolves with newer materials and innovative casting methods, iron’s proven track record in meeting stringent industry standards indicates it will sustain its dominance, bolstered by an unwavering demand for dependable and enduring cast solutions.

By Industry

Automotive’s contribution of over 39% of the aluminum casting market’s revenue highlights the sector’s commanding influence on global demand. This leadership stems from the automotive industry’s urgent pursuit of lighter, more sustainable vehicles, where aluminum die casting has become integral in producing essential parts. Engine blocks, wheels, and transmission housings are just a few examples of components that benefit from aluminum’s lightweight properties, helping to reduce overall vehicle mass and carbon emissions. The resilience and formability of aluminum allow manufacturers to meet strict safety and performance standards without sacrificing design flexibility. As consumer demand for fuel-efficient cars continues to rise, automakers increasingly turn to aluminum casting to create solutions that balance environmental regulations with market pressures.

Beyond weight reduction, the automotive sector’s steadfast reliance on aluminum casting market also stems from performance enhancements in electric and hybrid vehicles. In these advanced powertrains, optimal heat dissipation and reliable drivetrain components are critical for maximizing efficiency and battery life. Aluminum’s high thermal conductivity and corrosion resistance make it indispensable in the design of battery housings, electronic control units, and cooling systems. Additionally, emerging trends such as vehicle electrification and autonomous driving continue to broaden the scope of applications where aluminum’s combination of strength, versatility, and sustainability is necessary. While other industries—including consumer electronics, aerospace, and construction—also capitalize on aluminum casting for various structural and functional components, the automotive sector’s commitment to innovation and mass production cements its role as a powerhouse within the market. This ongoing demand for lightweight, high-performance cast parts ensures that the automotive industry will remain a driving force in shaping the future of aluminum casting.

By Method

Die casting’s projected contribution of over 52.2% of the revenue in the aluminum casting market reflects its consistent track record for high-quality, precision-engineered products. This method’s popularity stems from its ability to produce complex geometries in large volumes at relatively low costs, which appeals to industries like automotive, aerospace, and consumer electronics. By injecting molten aluminum under high pressure into metal molds, die casting yields intricate components with smoother surfaces and tighter tolerances compared to many other casting methods. These advantages translate into superior product uniformity, reduced machining requirements, and minimal material wastage—factors that significantly influence manufacturers’ bottom lines.

The dominance of die casting also relies on its adaptability to a broad array of component sizes and functionalities. As industries continue to innovate and demand more lightweight yet structurally sound parts, die casting offers the responsiveness needed to keep up. This method excels in producing heat sinks, intricate housings, and internal structures vital to electronic devices, protecting sensitive components while ensuring efficient heat dissipation. In the automotive sector, die casting enables the fabrication of lightweight yet durable parts, such as engine blocks and transmission casings, required to enhance fuel efficiency and reduce emissions. By providing a stable process that consistently delivers high-throughput production, die casting remains an industry stalwart. As manufacturers look to optimize efficiency and quality, die casting’s proven ability to meet rigorous standards cements its standing as the leading method in aluminum casting markets worldwide.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific stands out as the largest aluminum casting market with over 45.7% market share due to its expansive industrial base, robust research efforts, and growing demand for advanced manufacturing solutions China, India, Japan, and Indonesia lead this dominance, as each country brings distinct strengths in production output, consumption patterns, and technological development Steered by cost-effective labor and efficient infrastructure, China invests heavily in advanced aerospace manufacturing, fueling the demand for structural aluminum parts as of 2024 Simultaneously, India is witnessing substantial advancements in permanent mold casting lines, which have grown in sophistication and capacity due to increased automotive and construction-related investments.

Across the region, foundries incorporate integrated manufacturing solutions to minimize downtime and boost yield rates, particularly as electric vehicle production surges. This transition in the aluminum casting market has significantly amplified the consumption of aluminum cast battery housings, offering lightweight yet durable components for next-generation transportation Japan’s adoption of robotic automation in foundries continues to increase production efficiency and product consistency, helping local plants meet stringent export demands Indonesia, meanwhile, is deploying more modular aluminum casting solutions to enhance building projects and reduce labor costs, with new industrial parks dedicated to metal manufacturing coming online in 2024

Notably, China elevates Asia Pacific’s standing in the aluminum casting market further by exporting large volumes of engine chassis parts to over 50 international destinations, reinforcing its role as a global manufacturing hub India focuses on boosting fuel economy in vehicles through the widespread use of cast aluminum cylinder blocks, connecting its thriving automotive sector with sustainability goals Japan’s high-grade die casting processes have ushered in expansions of advanced foundry equipment, which fosters a competitive edge in complex surface finishing techniques Indonesia, for its part, benefits from the millennial-driven housing boom, prompting local developers to embrace cast aluminum frames and structural fittings to cut construction times. The synergy of these four countries contributes to Asia Pacific’s remarkable dominance in the aluminum casting market, with consumption sustained by automotive, aeronautical, and construction segments that seek the metal’s impressive strength-to-weight ratio and corrosion resistance. This fusion of diverse end-use industries, coupled with ongoing improvements in manufacturing precision, cements Asia Pacific’s preeminent position in aluminum casting well into 2024.

Top Companies in Aluminum Casting Market

- Alcast Technologies Ltd

- Arkema SA

- Arrmaz

- BASF Corporation

- Dupont De Nemours Inc.

- Dynacast Deutschland GmbH

- Honeywell International Inc.

- Huntsman Corporation

- Ingevity Corporation

- Kao Corporation

- Kraton Corporation

- MartinreaHonsel Germany GmbH

- Nouryon

- Nouryon

- Other Prominent Players

Market Segmentation Overview:

By Product:

- Silicon

- Iron

- Copper

- Magnesium

- Zinc

By Method:

- Die Casting

- Permanent Mold Casting

- Investment Casting

- Sand Casting

By Industry Application:

- Aerospace

- Commercial Transport Planes

- Airframes

- Fuselages and Wings

- Space Station Shuttles/Structures

- Commercial Transport Planes

- Construction and Architecture

- Power Grids and Electrical Transmission Lines

- High Rise Buildings

- Site Furnishings (Removable Bollard Applications)

- Food and Beverage (cans)

- Electrical and Electronics Equipment

- Automotive

- Lightweight Aluminum Frames

- Body Panels

- Engines

- Sensor and Airbag Housings

- Seat Belt Retractor Spools

- Lock Barrels

- Connectors for Autonomous Vehicles

- Steering and Braking Systems

- Others

- Agriculture

- Crankcase Housings

- Others

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)