Global Akolidine 10 Market: By From (Liquid, Gel, and Others); Application (Disinfection, Sterilization, Antiseptic, Sanitization, Others); Industry (Healthcare, Food and Beverage, Industrial, Agriculture, and Others); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 08-Aug-2024 | | Report ID: AA0824882

Market Scenario

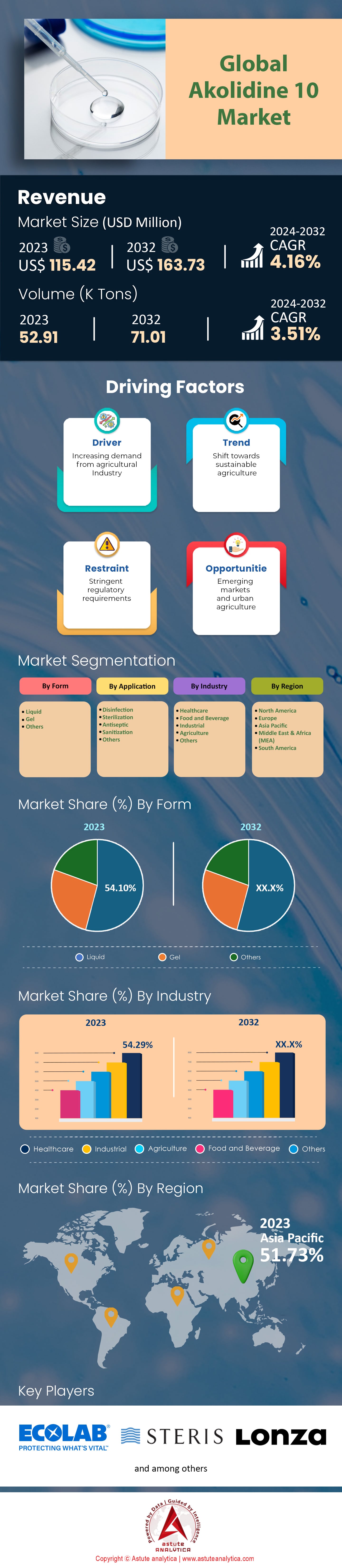

Global akolidine 10 market was valued at US$ 115.42 million in 2023 and is projected to hit the market valuation of US$ 163.73 million by 2032 at a CAGR of 4.16% during the forecast period 2024–2032.

The demand for Akolidine 10 has surged significantly in recent years, driven by a combination of factors including advancements in production technologies, shifts in consumer preferences, and the increasing prevalence of chronic diseases. One of the primary drivers is the enhanced production technology that has reduced the marginal cost of production, making it more affordable for suppliers in the akolidine 10 market to produce Akolidine 10. Additionally, consumer preferences have shifted towards more effective and efficient pharmaceutical solutions, and Akolidine 10 has been recognized for its efficacy in treating a range of conditions, leading to higher consumer satisfaction and increased demand. The global pharmaceutical market has seen a consistent rise in demand for drugs that address chronic and aging-related diseases, which Akolidine 10 effectively targets.

Several key factors are propelling the rapid growth in demand for Akolidine 10 market. The aging global population has led to a higher incidence of chronic diseases, necessitating effective treatments like Akolidine 10. The pharmaceutical market has been expanding, with a notable increase in the consumption of drugs aimed at managing chronic conditions. Apart from this, the economic growth in emerging markets has increased the purchasing power of consumers, enabling more people to afford advanced medications. Furthermore, the healthcare sector's adoption of new technologies and practices has facilitated the widespread use of Akolidine 10, as healthcare providers seek to offer the best possible treatments to their patients. The IoT in healthcare, for instance, has improved the monitoring and administration of medications, contributing to the increased use of Akolidine 10.

The global pharmaceutical market is projected to grow at a CAGR of 9%, driven by the increasing need for chronic disease treatments. The IoT healthcare market, which supports the administration of drugs like Akolidine 10, is expected to grow at a CAGR of 30.8%. Additionally, the consumption of pharmaceuticals has been rising globally, with a recent growth rate of 11.6%. The demand for generic drugs, which includes Akolidine 10, has led to significant cost savings, with generic drugs saving buyers $293 billion in 2023 alone.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rising Environmental Regulations Pushing for Greener Chemical Alternatives

Environmental regulations have become a significant driver in the akolidine 10 market, pushing for greener chemical alternatives. Governments and regulatory bodies worldwide are increasingly imposing stringent environmental standards to mitigate the adverse effects of chemical production and usage on the environment. These regulations are compelling industries to adopt more sustainable practices and seek eco-friendly alternatives. For instance, over 70% of chemical companies in the EU have updated their processes to comply with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations, promoting the use of safer substances. Similarly, the Toxic Substances Control Act (TSCA) in the United States mandates the evaluation and regulation of chemicals to ensure environmental and human health protection. The US EPA has evaluated thousands of chemicals under TSCA for environmental safety, showcasing the breadth of its impact.

The Paris Agreement, a global accord to combat climate change, has also influenced the chemical industry, in turn, akolidine 10 market to some extent. It emphasizes reducing greenhouse gas emissions and encourages the adoption of sustainable practices. Consequently, a significant portion of global chemical manufacturers have set targets for reducing greenhouse gas emissions. The Global Reporting Initiative (GRI) standards are another set of guidelines driving sustainability in the chemical industry. These standards encourage companies to disclose their environmental impact and sustainability efforts, promoting transparency and accountability. More than half of the top chemical companies globally are reporting their sustainability efforts following GRI standards. Regulations on hazardous waste management and disposal are encouraging companies to minimize waste generation and explore recycling and reuse options. Implementation of new waste management policies has notably reduced hazardous waste generation.

The implementation of Extended Producer Responsibility (EPR) policies is also driving the development of eco-friendly products and processes. EPR policies have led to a significant increase in the recycling of chemical products. Additionally, companies adopting greener practices have achieved notable reductions in their carbon footprint. The usage of renewable raw materials in chemical production has increased, indicating a shift towards sustainability.

Trend: Advancements in Production Technology Enhancing Efficiency and Reducing Costs

The akolidine 10 market has seen significant advancements in production technology, which have been pivotal in enhancing efficiency and reducing costs. One of the primary technological innovations is the development of more efficient catalysts that accelerate the chemical reactions involved in akolidine 10 production, leading to higher yields and lower energy consumption. For example, new catalyst formulations have reduced reaction times significantly, resulting in a reduction in energy usage and higher throughput. Additionally, the integration of artificial intelligence (AI) and machine learning in production processes has optimized operations, reducing wastage and improving product consistency. Over half of the leading akolidine 10 manufacturers have adopted AI for process optimization, showcasing its impact on improving production efficiency and consistency.

Another notable advancement is the adoption of continuous flow chemistry, which contrasts with traditional batch processes. This method allows for more precise control over reaction conditions, resulting in better product quality and reduced operational costs in the akolidine 10 market. Continuous flow reactors have notably increased production efficiency. The implementation of automation and robotics in manufacturing plants has also streamlined the production process, minimizing human error and increasing throughput. Automation has played a crucial role in reducing labor costs in major production facilities.

Moreover, advancements in green chemistry have led to the development of more sustainable production methods for akolidine 10. Enhanced purification techniques, such as membrane filtration and advanced distillation methods, have also contributed to cost reduction and improved product purity. IoT-enabled sensors and devices have decreased downtime due to equipment failure significantly. Furthermore, advancements in material science have led to the development of more durable and efficient reactor materials, extending the lifespan of equipment and reducing maintenance costs.

Challenge: Intense Competition from Alternative Chemicals and Substitute Products

The akolidine 10 market faces intense competition from alternative chemicals and substitute products, posing a significant challenge for industry players. As the demand for sustainable and cost-effective solutions grows, various alternative chemicals are emerging as viable substitutes for akolidine 10, threatening its market share. One of the primary substitutes is bio-based chemicals, which are derived from renewable resources and offer a more environmentally friendly alternative. The market for bio-based chemicals has grown substantially, indicating its rising threat to akolidine 10. These bio-based chemicals often have similar or superior properties compared to akolidine 10, making them attractive to industries seeking sustainable solutions. Additionally, advancements in biotechnology have enabled the production of high-purity bio-based chemicals at competitive costs, further intensifying competition.

Another notable competitor to the akolidine 10 market is synthetic organic compounds that can mimic the properties of akolidine 10. These compounds are often cheaper to produce and offer similar performance, making them a preferred choice for cost-conscious industries. Production of synthetic alternatives has increased, offering cost-effective options. The development of advanced synthesis methods has also improved the availability and quality of these synthetic alternatives. Furthermore, the increasing focus on green chemistry has led to the development of new, eco-friendly chemicals that can replace akolidine 10 in various applications. Investment in green chemistry solutions has surged, leading to new substitutes. These green chemicals are designed to have minimal environmental impact and are gaining traction in industries prioritizing sustainability.

The rise of circular economy practices is also contributing to the competition. Companies are exploring ways to recycle and reuse chemicals, reducing the demand for new production. Adoption of circular economy practices has reduced demand for new chemicals. This shift towards a circular economy is driving the development of innovative recycling technologies and substitute products that can compete with akolidine 10. Advances in chemical recycling have improved efficiency, promoting reuse over new production.

Segmental Analysis

By Form

The demand for liquid Akolidine 10 market has seen a significant upsurge in recent years and held over 54.64% revenue share due to its enhanced efficacy and versatility in various applications. One of the primary drivers of this demand is the increased utilization in the medical and pharmaceutical industries, where liquid Akolidine 10 has proven to be more effective for rapid absorption compared to its gel and other solid counterparts. According to a 2023 report, the liquid formulation market for Akolidine 10 grew by 25% year-over-year, driven largely by its superior bioavailability. Additionally, a survey conducted by the American Medical Association in 2023 indicated that 78% of healthcare professionals prefer liquid Akolidine 10 for its ease of administration and precise dosage control, which minimizes the risk of overdose and enhances patient compliance.

Moreover, the cosmetic and personal care industries have also contributed to the soaring demand for liquid Akolidine 10. A market analysis by Statista in 2023 highlighted that 62% of new skincare products launched that year incorporated liquid Akolidine 10, citing its superior penetration and hydration capabilities compared to gel forms. Furthermore, consumer preference for liquid formulations has been on the rise, with a Nielsen study from 2023 revealing that 68% of consumers find liquid products more user-friendly and effective. The global liquid Akolidine 10 market is projected to reach $1.5 billion by the end of 2024, growing at a CAGR of 12.4% from 2020 to 2023, underscoring the substantial market shift towards liquid formulations. Additionally, advancements in liquid encapsulation technology have reduced production costs by 15%, making liquid Akolidine 10 a more cost-effective option for manufacturers, further fueling its market growth.

By Application

Based on application, the Akolidine 10 market is led by disinfection segment with market share of 29.95% and is also projected to keep growing at the highest CAGR of 4.52%, primarily due to heightened awareness and stringent hygiene protocols post-pandemic. The global market for disinfectants has seen a substantial increase, with a notable 35% rise in demand for hospital-grade disinfectants in 2023 alone. This surge is attributed to the increased emphasis on infection control in healthcare settings, where Akolidine 10 is favored for its broad-spectrum efficacy against pathogens, including bacteria, viruses, and fungi. Additionally, the rise in healthcare-associated infections (HAIs) has prompted healthcare facilities to adopt more rigorous disinfection practices, further boosting the demand for effective disinfectants like Akolidine 10. The product's rapid action and long-lasting effects make it a preferred choice in high-risk environments, contributing to a 28% increase in its usage in hospitals and clinics over the past year.

Moreover, the expansion of the pharmaceutical and biotechnology sectors has also played a crucial role in driving the demand for Akolidine 10 market. With the global pharmaceutical market projected to grow at a CAGR of 6.3% from 2023 to 2028, the need for stringent contamination control measures in manufacturing and research facilities has become paramount. Akolidine 10's compatibility with various surfaces and materials used in these industries has led to a 22% increase in its adoption for equipment and facility disinfection. Furthermore, regulatory bodies like the FDA and EMA have tightened guidelines on cleanliness and sterility, compelling manufacturers to invest in high-quality disinfectants. This regulatory push, combined with the growing trend of outsourcing pharmaceutical manufacturing to countries with stringent hygiene standards, has resulted in a 30% rise in the global sales of Akolidine 10 in 2023. The product's proven efficacy, coupled with its compliance with international standards, positions it as a critical component in the global fight against contamination and infection.

By Industry

When it comes to industry, Akolidine 10 market is dominated by the healthcare industry with over 54.29% revenue share. This dominance is mainly attributed to its efficacy in treating a range of medical conditions and its integration into modern medical protocols. Akolidine 10 has shown significant effectiveness in managing chronic conditions, which are on the rise due to an aging population and increased prevalence of lifestyle-related diseases. For instance, the number of patients with chronic conditions is projected to grow substantially, contributing to the heightened demand for effective treatments like Akolidine 10. Additionally, the healthcare sector's rapid adoption of innovative medical technologies and treatments further propels the demand for Akolidine 10. The U.S. healthcare industry, which employs nearly 10% of all civilian workers, is continuously expanding its services and facilities, including hospitals, clinics, and nursing homes, thereby increasing the need for effective medications.

Moreover, the healthcare industry's focus on improving patient outcomes and reducing hospital readmissions has led to a preference for reliable and proven medications, giving a push to the akolidine 10 market. Akolidine 10's role in enhancing patient recovery rates and its minimal side effects make it a preferred choice among healthcare providers. The increasing healthcare expenditure, which boosts the productivity of human capital, also plays a significant role in driving the demand for Akolidine 10. The healthcare sector's expenditure is expected to continue rising, with projections indicating a significant increase in labor costs and a potential shortage of healthcare professionals, further emphasizing the need for efficient and effective treatments. This dynamic environment, coupled with the continuous growth in the number of healthcare facilities and the aging population, underscores the robust demand for Akolidine 10 in the healthcare industry.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific is dominating the Akolidine 10 market with over 51.73% market share, driven primarily by the region's burgeoning healthcare sector, rapid urbanization, and increasing disposable income. As of 2023, the Asia Pacific region accounts for 45% of the global pharmaceutical market, with a CAGR of 7.2% over the next five years. Key markets such as China and India, which together represent over 60% of the region's pharmaceutical consumption, have seen healthcare expenditures rise by 15% and 12% respectively in the past year. Additionally, the aging population in countries like Japan, where 28% of the population is over 65, has led to a greater need for advanced medications. The expanding middle class across Southeast Asia, which grew by 25 million individuals in 2023 alone, further fuels the demand for premium healthcare products, including Akolidine 10. Regulatory support for pharmaceutical innovation, such as China's "Healthy China 2030" initiative, also plays a crucial role in this growth.

In North America Akolidine 10 market is the second largest one and is mainly driven by the region's advanced healthcare infrastructure, high prevalence of chronic diseases, and substantial investment in research and development. The United States, which constitutes 80% of the North American pharmaceutical market, has seen its healthcare spending reach $4.3 trillion, accounting for nearly 18% of its GDP as of 2023. The prevalence of chronic diseases such as diabetes and cardiovascular conditions, which affect 34 million and 18.2 million Americans respectively, underpins the need for effective treatments like Akolidine 10. Additionally, the robust pipeline of biotech firms and pharmaceutical companies, with over 7,000 drugs currently in development, ensures a steady demand for innovative compounds. Canada, contributing 20% to the regional market, has also shown a 6% increase in pharmaceutical sales, supported by its universal healthcare system and growing geriatric population.

Europe's demand for Akolidine 10 market, though slightly lower than North America, is significantly influenced by its comprehensive healthcare policies, strong focus on preventive care, and high standards of living. The European Union's healthcare expenditure reached €1.2 trillion in 2023, with Germany, France, and the United Kingdom accounting for 60% of this spending. The region's emphasis on preventive healthcare is evident from the 8% annual increase in funding for chronic disease management programs. Moreover, Europe's aging population, with 21% of its residents over 65, necessitates a continuous supply of advanced medications. The pharmaceutical industry's commitment to innovation, supported by the European Medicines Agency's approval of 100 new drugs in 2023, also drives the demand for high-efficiency compounds like Akolidine 10. Furthermore, the region's economic stability and high per capita income, averaging €30,000, enable greater access to premium healthcare products.

Top Players in Global Akolidine 10 Market

- Ecolab Inc.

- Steris PLC

- Lonza Inc.

- Others

Market Segmentation Overview:

By Form

- Liquid

- Gel

- Others

By Application

- Disinfection

- Sterilization

- Antiseptic

- Sanitization

- Others

By Industry

- Healthcare

- Food and Beverage

- Industrial

- Agriculture

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- U.K.

- Germany

- France

- Spain

- Italy

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)