Airport Baggage Handling Systems Market: By Type (Conveyor and Destination Coded Vehicle (DCV)); Solution (Check-in Systems, Security Screening Systems, Transportation, Sortation and Storage Systems, Reclaim Systems); Airport Class (Class A, Class B, Class C, and Others); Tracking Technology (RFID and Barcode); Check-in Service Type (Assisted Services, and Self Services); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 08-Dec-2025 | | Report ID: AA1023647

Market Snapshot

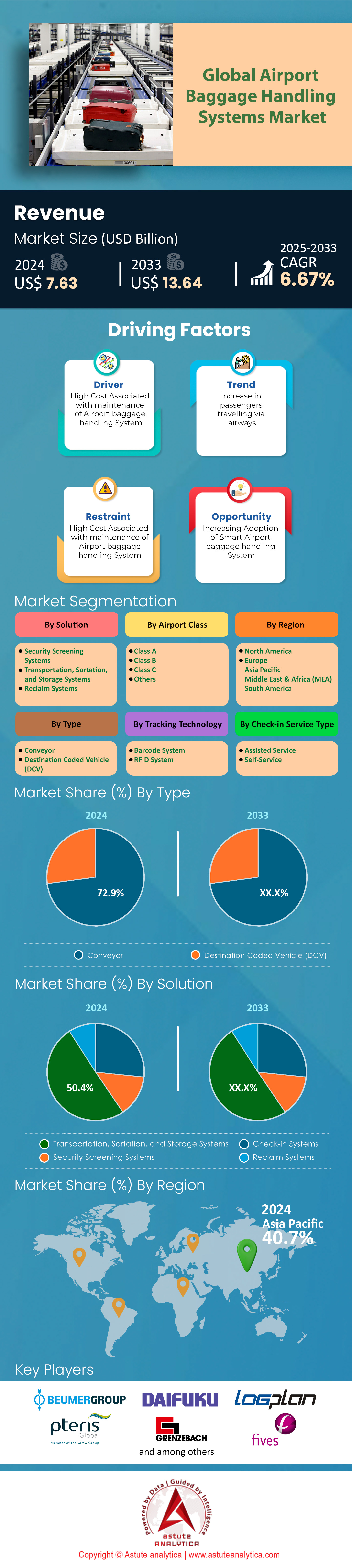

Airport baggage handling systems market was valued at US$ 7.63 billion in 2024 and is projected to attain a market size of US$ 13.64 billion by 2033 at a CAGR of 6.67% during the forecast period 2025–2033.

Key Findings in Airport Baggage Handling Systems Market

- Based on type, conveyor system is holding an impressive 72.9% revenue share of the market.

- By solution, the transportation, sortation, and storage systems solutions stands out prominently, commanding a 50.4% share of the market.

- By airport class, Class A airports, representing the colossal mega-hub category, dominate the market with an whooping 42% share.

- By tracking technology, the market is dominated by barcode technology with over 76.6% market share.

- Asia Pacific set to remain the largest contributor to global market.

The global aviation industry is currently navigating a period of unprecedented operational pressure, where the demand for robust airport baggage handling systems market is no longer driven solely by modernization, but by necessity. The primary catalyst is the relentless surge in global passenger flow. As of 2025, passenger numbers are stabilizing well above pre-pandemic levels, with industry data estimating annual travelers at approximately 4.7 billion. This trajectory in the airport baggage handling systems is set to steepen, with projections indicating a potential doubling of traffic by 2040. This massive influx of humanity brings luggage—billions of checked items that must be screened, sorted, and loaded with precision.

When this volume overwhelms legacy infrastructure, the financial consequences are severe. The industry currently loses approximately USD 5 billion annually due to baggage mishandling. While the global mishandling rate hovers around 6.9 bags per 1,000 passengers, the cost of rectifying these errors—tracing, delivering, and compensating—averages USD 100 per bag in the airport baggage handling systems. This operational bleed is unsustainable for airlines operating on razor-thin margins. Consequently, the demand for BHS is growing rapidly because it is the only physical mechanism capable of decoupling passenger growth from operational failure. Airlines and airports are investing not just to move bags, but to protect their bottom line against this multi-billion dollar liability.

Where Will the Next Wave of Infrastructure Rise by 2035?

To accommodate this passenger surge, the physical footprint of global aviation is expanding, though the growth is unevenly distributed. Currently, there are approximately 4,000 to 5,000 airports handling scheduled commercial traffic globally, within a broader network of over 41,000 airfields in the airport baggage handling systems market. However, the critical metric for the airport baggage handling systems is the construction of "mega-hubs" and regional connectors. By 2035, the number of commercial airports requiring automated baggage systems is expected to grow significantly, driven primarily by emerging markets.

This infrastructure boom is creating a bifurcated demand for baggage systems. In mature markets like North America and Europe, the airport count is relatively stable, so the demand is driven by the complex "brownfield" modernization of existing terminals—ripping out 1990s technology to install modern scanners within tight basements.

In contrast, Asia-Pacific and the Middle East are leading the "greenfield" charge in the airport baggage handling systems market. Countries in these regions are building entirely new cities of aviation, requiring massive, blank-slate BHS installations. This growth in airport numbers directly correlates to BHS demand; every new terminal requires a sorting loop, screening matrix, and makeup carousel, fueling a construction pipeline that extends well into the next decade.

To Get more Insights, Request A Free Sample

Which Nations Are rewriting the Rules of Deployment?

China and India are undisputedly set to lead the airport baggage handling systems market in terms of pure volume and new construction. China’s aggressive "Four-Horizontal and Four-Vertical" airport network plan involves constructing hundreds of general aviation and commercial airports to serve its vast internal population. Similarly, India, driven by the UDAN regional connectivity scheme and the privatization of major hubs, is expected to become the third-largest aviation market globally. The demand here is for high-throughput, scalable systems that can handle rapid double-digit growth rates.

However, the nature of demand changes as we look West. The United States remains the top country for airport baggage handling systems in terms of consumption by value, largely due to the sheer size of its legacy network. The U.S. market is currently undergoing a massive renewal cycle, funded by federal infrastructure grants, to replace aging systems that are upwards of 30 years old. Europe competes on a different axis: regulation. European nations are leading adoption not because they are building new airports, but because strict ECAC Standard 3 security mandates forced a continent-wide hardware upgrade. These distinct regional drivers—expansion in Asia, renewal in America, and regulation in Europe—ensure that the BHS market remains resilient regardless of localized economic downturns.

Who Are the Titans Controlling the Basement?

The competitive landscape of the airport baggage handling systems market is dominated by a few integrated giants who have evolved from simple conveyor manufacturers to high-tech logistics integrators. Vanderlande (owned by Toyota Industries) stands as a market leader, leveraging massive manufacturing scale to serve over 600 airports globally. They compete fiercely with Beumer Group, a family-owned powerhouse that successfully disrupted the market with its "CrisBag" Independent Carrier System (ICS), creating a new standard for high-speed tracking. Siemens Logistics, despite being in a transitional divestiture phase, remains a formidable incumbent with a vast install base that generates steady service revenue. Daifuku, with its stronghold in Asia and North America, continues to secure major contracts by integrating smart security lanes with baggage flows.

Competition among these players in the airport baggage handling systems has shifted away from hardware commoditization. They no longer compete merely on who can sell the cheapest conveyor belt. Instead, the battleground is now software and "lifecycle partnership." Vendors are competing to offer the best High-Level Controls (HLC) that can integrate with airline systems, and the most reliable long-term maintenance contracts. The trend is moving toward "Baggage-as-a-Service" models, where the vendor assumes the risk of the system's performance. This shift locks airports into long-term ecosystems, making the choice of vendor a 20-year strategic marriage rather than a one-time purchase.

What Technologies Are Redefining the Market’s Future?

The most significant opportunity shaping the global airport baggage handling systems is the transition from "blind" conveyance to "intelligent" logistics. The industry is rapidly moving toward Independent Carrier Systems (ICS), where bags are placed in individual totes. This technology solves the tracking problem entirely, as the system tracks the tote (which is rigid and readable) rather than the bag (which is soft and chaotic). Although ICS requires higher upfront capital, it allows for faster speeds and 100% traceability, a trade-off many major hubs are now willing to make.

Furthermore, Artificial Intelligence is revolutionizing maintenance in the airport baggage handling systems market. The era of "break-fix" is ending; the trend is now predictive maintenance using digital twins. Sensors monitor motor vibrations and heat, predicting failures weeks in advance. This capability is becoming a standard requirement in tenders, as airports cannot afford unplanned downtime. Finally, the passenger interface is changing. The explosion of Self-Service Bag Drop (SSBD) units, often equipped with biometrics, is pushing the "entry point" of the BHS out into the check-in hall. This trend reduces reliance on staffed counters and smooths the flow of bags into the system, creating a seamless, automated loop from drop-off to aircraft loading.

Segmental Analysis

Reliability And Cost Benefits Sustain Conveyor Infrastructure Leadership

Traditional belt conveyors command a dominant 72.9% revenue share of the airport baggage handling systems market because they offer the most cost-effective lifecycle for high-volume baggage transport. Unlike complex Destination Coded Vehicles (DCVs), belt conveyors utilize standard components that simplify maintenance procurement for airport operators. The airport baggage handling systems market witnessed Siemens Logistics securing a major contract in 2025 to maintain 140 kilometers of conveyor belts at Adolfo Suárez Madrid-Barajas Airport. Operational data from Chicago O’Hare’s Terminal 3 upgrade confirms the installation of 14,361 linear feet of new conveyor lines to handle increased domestic loads. Facilities prioritize these friction-drive systems because they eliminate the need for managing thousands of individual carrier totes while ensuring continuous flow.

- Siemens VarioBelt systems now feature energy-efficient variable frequency drives to lower power usage.

- Seattle-Tacoma International Airport recently integrated 7 miles of new conveyor infrastructure.

- Alstef Group is currently installing outbound conveyor loops with ATR at Kyzylorda Airport.

Vanderlande’s 2025 project at Poland’s CPK Airport involves a massive network of conveyors stretching over 16 kilometers. The airport baggage handling systems market favors this technology for its ability to manage heavy peaks without the software latency often found in carrier-based systems. Palma de Mallorca Airport renewed maintenance for its 10-kilometer conveyor network to ensure uninterrupted summer holiday operations. Toronto City Airport’s 2025 upgrade specifically utilizes new transfer line conveyors to facilitate U.S. CBP preclearance. Additionally, belt systems allow for immediate manual intervention during jams, unlike enclosed DCV tracks. Daifuku’s recent work at Denver International involved demoing 3,738 feet of old belts to optimize throughput flow.

Connecting Passenger Surges Boost Sortation And Storage Solutions

Transportation, sortation, and storage solutions hold a 50.4% share as airports race to minimize minimum connection times (MCT) for transfer passengers. The rise of mega-alliances requires automated sorting capable of routing thousands of bags per hour with zero error. The airport baggage handling systems market is seeing a spike in Early Bag Storage (EBS) adoption to manage long layovers effectively. Hefei Xinqiao Airport recently integrated a VarioStore EBS with 700 spaces to decongest main terminal make-up carousels. Singapore Changi Airport’s Terminal 2 upgrade includes a CrisStore system with a capacity for 2,300 bags to support early check-ins. High-speed tilt-tray sorters are now essential for accurately diverting luggage at velocities exceeding 2.5 meters per second.

- Hong Kong International Airport’s automated sorters now process over 15,000 bags per hour.

- Doha Hamad International implemented EBS modules specifically for luxury passenger transfers.

- Navi Mumbai International Airport plans to launch the world's fastest baggage claim system in late 2025.

Bodø Airport in Norway awarded a contract in late 2025 for a complete automatic sortation solution to handle complex arrivals. The airport baggage handling systems market relies on these solutions to ensure IATA Resolution 753 compliance at transfer points. JFK’s New Terminal One will feature SITA’s Swift Drop technology to automate the injection of bags into the sortation matrix. Beumer Group installed 1,300 meters of CrisBag infrastructure at Changi to link storage lines with transport loops. Automated Storage and Retrieval Systems (ASRS) allow hubs to store bags vertically, saving valuable footprint in dense terminals. Vanderlande’s Individual Carrier System (ICS) at CPK ensures 100% trackability during the high-speed sorting process.

Mega Hub Construction Projects Solidify Class A Airport Dominance

Class A airports dominate with a 42% share because their sheer operational scale demands billion-dollar infrastructure investments found nowhere else. These mega-hubs, processing over 15 million passengers annually, are the primary buyers of enterprise-grade redundant systems. The airport baggage handling systems market is driven by projects like the King Salman International Airport in Riyadh, which targets 120 million passengers by 2030. Heathrow Airport’s Terminal 2 recently commissioned a replacement system designed to handle 31,000 bags daily. Such facilities require continuous 24/7 operation, necessitating robust backup loops and advanced control software. Toronto Pearson’s "Baggage 2025" initiative aims to support a throughput of 80 million bags per year.

- Seattle-Tacoma International Airport processed a record 36 million bags in 2024.

- JFK’s New Terminal One represents a USD 19 billion transformation for international traffic.

- Palma de Mallorca handles over 29 million passengers requiring intensive baggage logistics.

Beijing Daxing utilizes high-speed transit conveyors to connect its vast concourses efficiently. The airport baggage handling systems market sees Class A airports as the testing ground for hybrid biometric-baggage innovations. Chicago O’Hare awarded a USD 12 million contract in 2025 solely for Terminal 3 baggage optimization. Los Angeles International Airport is overhauling its entire backbone to support the 2028 Olympics influx. These airports operate complex hub-and-spoke models that rely on precise bag-to-flight synchronization. Navi Mumbai’s greenfield project demonstrates the massive capital allocation reserved for Class A baggage infrastructure.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

Legacy Install Base Ensures Barcode Technology Market Supremacy

Barcode technology retains a massive 76.6% market share because it remains the universal language for interline baggage exchange between airlines. While RFID offers read-range benefits, the cost of generating barcode tags is a fraction of a cent, making it economically superior for economy travel. The airport baggage handling systems market focuses on upgrading existing optical arrays with camera-based "Vision" systems rather than replacing tags. JFK’s New Terminal One is deploying "Vision Encoding" to read damaged tags within seconds using AI overlays. Alstef Group’s 2025 project at Bodø Airport integrates standard barcode readers for both arrival and departure lines.

- Handheld barcode scanning rates average 650 bags per hour per agent.

- Manual encode stations are still installed at modern hubs like Toronto City Airport.

- Alstef integrated Automatic Tag Readers (ATR) at Kyzylorda to automate scanning.

SITA’s Smart Path kiosks print standard 10-digit IATA barcodes to ensure compatibility with destination airports globally. The airport baggage handling systems market values barcodes for their ability to be read by low-cost handheld devices at remote stands. Approximately 15-20% of scans require manual intervention, driving the need for redundant scanning tunnels. Legacy infrastructure at major hubs like Heathrow is built entirely around optical line-of-sight architecture. Camera tunnels now capture 360-degree images to decode tags on inverted bags without human aid. The universal availability of barcode printers at check-in desks worldwide secures its continued leadership.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific Configuring Mega Hubs To Manage Fifty Percent Of Global Traffic Growth

Asia Pacific commands the undisputed leadership position in the airport baggage handling systems market, driven by a sheer volume of greenfield construction that dwarfs the rest of the world combined. The region is currently absorbing over 40 percent of global passenger traffic growth, necessitating the construction of high-throughput "aviation cities" rather than simple terminals. China’s relentless push under its "Four-Horizontal" network plan and India’s UDAN scheme are fueling a construction pipeline where scalability is the primary design criterion.

Unlike the West, where retrofitting is common, APAC airport baggage handling systems market offers vendors the lucrative opportunity to install massive, end-to-end Independent Carrier Systems (ICS) in blank-slate basements. Regional dominance is reinforced by the heavy footprint of Daifuku and increasing market penetration by Vanderlande, both competing to service hubs like Singapore Changi and Mumbai, which demand sorting speeds exceeding 10 meters per second to manage unprecedented connection volumes.

North America Investing Billions In Security Compliance And Legacy Brownfield System Replacement

North America retains a stronghold as the second-largest airport baggage handling systems market, fueled by the critical necessity of modernizing aging infrastructure that dates back to the 1990s. The driving force here is not expansion, but the urgent replacement of "end-of-life" assets in live operational environments, known as brownfield projects. These complex retrofits are accelerated by TSA mandates requiring advanced cybersecurity segmentation and the integration of heavy CT screening technology, which legacy conveyor structures cannot support without significant structural reinforcement.

The regional airport baggage handling systems market is characterized by high operational expenditures (OPEX) and substantial federal infrastructure grants aimed at preventing system failures in high-traffic domestic hubs. Key integrators like Brock Solutions and Siemens Logistics are heavily leveraged here, focusing on software overlays and smart-security lanes to extract efficiency from physically constrained terminals that handle the world’s highest volume of origin-and-destination passengers.

Europe Leveraging Regulation And Automation To Counteract Critical Ground Handling Labor Shortages

Europe airport baggage handling systems market remains the global innovation laboratory for the industry, maintaining its strong market position through regulatory compulsion and a desperate need for automation. The region’s spending is dictated by the strict enforcement of ECAC Standard 3 Explosive Detection Systems, which has forced a continent-wide capital renewal cycle to replace X-ray infrastructure.

However, the deeper driver in Europe airport baggage handling systems market is the chronic labor shortage; with ground handling staffing levels still lagging significantly behind 2019 benchmarks, European hubs are aggressively adopting automated bag drops and tote-based systems to minimize human intervention. Home to industry titans Beumer Group and Vanderlande, Europe is also the first region where BHS tenders heavily weight sustainability, pushing for energy-efficient magnetic drives to align with aggressive EU "Net Zero" carbon mandates by 2050.

Top Players in Global Airport Baggage Handling Systems Market

- Beumer Group

- Daifuku Co. Ltd.

- Fives Group

- G&S Airport Conveyor

- Glidepath Group

- Grenzebach Group

- Logplan LLC

- Pteris Global Limited (CIMC Group)

- Siemens AG

- Vanderlande Industries B.V.

- Other Prominent Players

Market Segmentation Overview:

By Type

- Conveyor

- Destination Coded Vehicle (DCV)

By Solution

- Security Screening Systems

- Transportation, Sortation, and Storage Systems

- Reclaim Systems

By Airport Class

- Class A

- Class B

- Class C

- Others

By Tracking Technology

- Barcode System

- RFID System

By Check-in Service Type

- Assisted Service

- Self-Service

By Region

- North America

- The US

- Canada

- Mexico

- Europe

- The UK

- Germany

- France

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia & New Zealand

- Korea

- ASEAN

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 7.63 Billion |

| Expected Revenue in 2033 | US$ 13.64 Billion |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Bn) |

| CAGR | 6.67% |

| Segments covered | By Type, By Solution, By Airport Class, By Tracking Technology, By Check-in Service Type, By Region |

| Key Companies | Beumer Group, Daifuku Co. Ltd., Fives Group, G&S Airport Conveyor, Glidepath Group, Grenzebach Group, Logplan LLC, Pteris Global Limited (CIMC Group), Siemens AG, Vanderlande Industries B.V., Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)