Agricultural Tractors Market (By Tractor Type - Utility Tractors, Row Crop Tractors, Garden Tractors, Orchard Tractors, Rotary Tillers, and Implement Carrier Tractors; By Fuel - Internal Combustion Engine and Electric Motor; By Wheels - 2-wheeler, 3-wheeler, and 4-wheeler; By Engine Power - <20 Horsepower, 21-35 Horsepower, 36-50 Horsepower, 51-90 Horsepower, 91-120 Horsepower, 121-150 Horsepower, 151-180 Horsepower, 181-250 Horsepower, and >250 Horsepower); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 25-Nov-2024 | | Report ID: AA0722284

Market Scenario

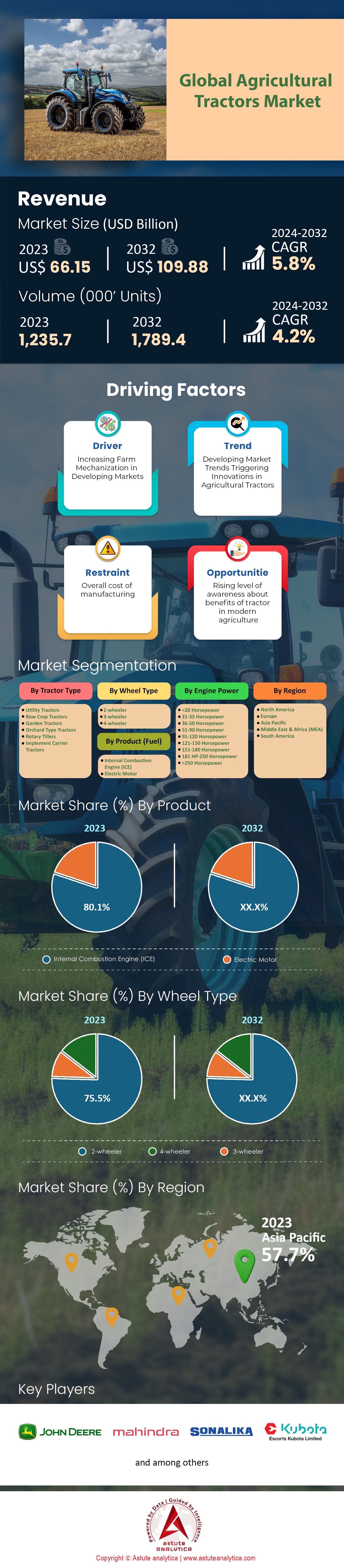

Agricultural tractors market was valued at US$ 66.15 billion in 2023 and is projected to surpass the valuation of US$ 109.88 billion by 2032 at a CAGR of 5.8% during the forecast period 2024–2032.

Development of the global agricultural tractors market remains stable owing to the growing need for farm mechanization to boost productivity. By 2023, it is estimated that world annual sales of agricultural tractors stand at approximately 1,230,000 units. On the whole, India is the biggest producer and consumer of agricultural tractors which is attributed to the fact that it has a large agricultural industry, scattered land ownership, and government policies supportive of agricultural mechanization. Indian tractor manufacturers, for example, Mahindra & Mahindra, manufacture 390,000 tractors annually for both internal and external markets. Other major producers include: The United States, China, Germany and Japan. Major corporations in the market: John Deere (Deere & Company), CNH Industrial (Case IH, New Holland), AGCO Corporation (Massey Ferguson, Fendt) and Kubota Corporation. The United States of America and Germany are major countries involved in the trade, and their exports are worth billions of dollars every year. For instance, the value of agricultural tractor exports from the United States was over $ 5 billion dollars in 2023.

Some tangible factors propelling current sales in the agricultural tractors market include the need to increase food production to feed the world population that the United Nations forecasts is to grow to 9.7 billion by the year 2050. Advanced technology is another major trend that drives tractor sales around the world. The usage and installation of GPS, telematics, and precision farming tools resulted in the development of smart tractors. Significant trends include the development of fully autonomous tractors and electric tractors. For instance, john deere has introduced a fully autonomous tractor which is equipped with advanced sensors and artificial intelligence technology. Other factors include government grants and financial schemes that allow farmers easy access to buying tractors. Several countries have generous programs that include tax deductions and low-interest loans for farmers who purchase agricultural equipment. In addition, large tractor usage on farms has been shorter because there has been an influx of the urban population into agriculture due to dual employment opportunities. Leading players in the market concentrate on broadening their technical and innovative capacities in order to cater to varied agricultural demands.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Demand for Enhanced Agricultural Productivity

The United Nations has predicted that the global population will cross the mark of 9.7 billion by the year 2050. The rise in population calls for increased agriculture productivity, which results in need for increased food production at the least possible land area. In this case, the role of agricultural tractors is crucial as they allow the farmers to increase the areas under cultivation. India, for example, has more 6 million operating tractors assisting in the countries grain production that is more than 300 million metric tons per year. In the same spirit, China has more than 20 million operating tractors designed to ensure that the country’s grain production is more than 650 million metric tons per year.

Rural labor shortages in rural areas exacerbate the need for mechanization. Above 1 million of farmworkers are believed to be in the US, increasing the dependence on machines such as tractors. However, the agricultural tractors market is vast, standing at an estimation of US$ 66 billion with yearly sales of more than 1.23 million units around the globe. For instance, Brazil has tractor sales exceeding 50,000 units each year, which supports them in yield of 240 million metric tons of crops. Policies and initiatives of the government are also significant as the EU has set aside a huge budget under its Common Agricultural Policy for the mechanization of the farms, and in India, there are grants for up to 50% of the cost of tractors to make it easier for the farmers.

Trend: Adoption of Precision Farming and Autonomous Technologies

A transformative trend in the agricultural tractors market is the adoption of The global emergence of precision farming and autonomous technologies is changing how agricultural tractors and equipment are used. Managed under an estimated value of more than $7 billion, the ability of precision farming to utilize both data analysis and tools like GPS and sensors to supervise the field is a component of enhanced resource and yield efficiency. As Mahindra Group, John Deere, and a few others are doing, many major manufacturers are incorporating precision tech into their models, putting the John Deere 8R series among the most sophisticated models with GPS, real-time data monitoring, etc. With precision agritech employed to more than 70 million acres in the United States, aspects of economic growth and output growth are likely to be positively impacted.

There has been increased demand for autonomous tractors in the agricultural tractors market with 100% autonomous operation without human assistance and many players such as Kubota and CNH Industrial are trying to cater the same. There are over 500 autonomous tractors at different testing phases seeking to lessen the reliance on human power and average operational costs. Subsequently, this sector is expected to grow, wherein its expected attain a valuation of US$ 10 billion by 2032, which significantly exceeds today's valuation. For instance, autonomous tractors targeting the older farming population in Japan with more than 1000 units would be ready within a brief period such that they can overcome the population gap. These forms of improvement are changing how agricultural processes have functioned by addressing long-term issues.

Challenge: High Cost of Advanced Tractors

The profound price range of advanced tractors has, according to some estimates, been a significant challenge in the agricultural tractors market specifically to small and medium-sized farmers which begs the question of what potential benefits they offer. Considering the current market price, it is easy to presume that many factors influence the price of a tractor but an average small scale new tractor retails between $25,000 - $50,000, whilst the larger scale precision farming equipped models float around the astonishing price of $150,000. A good example would be the John Deere 8RX series, which charges customers around US$ 300,000 while adding additional costs to an already exorbitant price tag. If we consider that the average farming size across Africa is around 2 hectares with a minimal annual income around US$ 2,000 dollars, subsidized support would be a prerequisite to achieving such assets.

The problem is further aggravated by the narrow scope for financing. On a global scale, roughly one in every ten smallholder farmers in the agricultural tractors market who satisfy certain eligibility criteria, according to the World Bank. Financially, high-end tractors impose an operational burden; annual operational costs for these tractors may range between US$ 5,000 and 10,000. The depreciation of the tractors is also a problem. Within the first few years of ownership, a tractor will lose a significant amount of its value; premium model may lose up to US$ 20,000 a year. In nations such as India, where more than 80% of the farmers are cultivating less than 2 hectares of land, even government interventions in the form of subsidies may not encourage such purchases. These economic conditions are impediments to the penetration of tractors into poor economies thereby impacting the growth of the markets as well as the prospects for enhanced technological advancement benefits smallholder farmers.

Segmental Analysis

By Tractor Type

In 2023, the utility tractors segment remains a powerhouse in the agricultural tractors market with more than 21.6% market share Such high percentages in the utility agricultural tractors market are attributed to the affordability and versatility of the tractors. There are large sales potentials of utility tractors in Africa too, as the continent imported over 150,000 units recently. The requirement for these tractors was reinforced with a $500 million investment from international development organizations to assist the continent in agricultural mechanization. India captured a large share of those sales, indicating the importance of the nation in the structure of global agriculture. In China, over 400,000 utility tractors have been utilized in the agricultural sector, underscoring the vast farming expansiveness in the country. Unfortunately, the U.S. market is considered more saturated, and as such, only around 300,000 units were sold in recent years owing to the need to substitute older units. More than 150,000 utility tractors have been sold with GPS and telematic systems, while precision agriculture and its related technologies have been critical to the farm machinery sales cycle.

Furthermore, there are increasingly more eco-friendly models being sold, with Europe’s strict emission limits leading to the sale of about 50,000 units that have reduced emission technology. Another important player, Brazil's agri- business, recorded the sale of approximately 200,000 units owing to maize and soybeans farmers looking to boost their production. There’s also a global shift toward sustainability, where 80,000 utility tractors operating on alternative fuels like biodiesel and CNG were sold illustrating a move towards sustainable farming methods.

By Product (Fuel) Analysis

Internal Combustion Engine (ICE) tractors remain the leaders in agricultural tractors market, with a market share of 80.1% in 2023. The U.S. is one of the largest markets for ICE tractors, where sales exceeded 250,000 units in the Midwest states due to the scale of farming activity. Unlike the midwestern states where ICE dominated, global sales of electric tractors reached over 120,000, showing a change towards environmentally friendly farming practices. Europe has quite clearly taken the lead in this transformation, Germany being at the forefront, partly because of government support. France is not lagging behind because the farmers are willing to improve eco-friendliness. Japan is an emerging power in electrification within Asia, having introduced around 25,000 electric tractors into its precision farming. In China, efforts to boost electric tractors to 15,000 units have been made due to the government’s focus on green technology to reduce pollution.

On the other hand, Australia agricultural tractors market has seen similar increases in electric tractor usage as over 5,000 electric tractors have been introduced in vineyards and orchards. Investment in battery development has improved the efficiency of operations by around 20% which allows electric tractors to remain usable for longer durations. In addition to this, the electric tractor market has also been fueled by the construction of rapid charging stations with 500 already built across Europe. The momentum is a reflection of a wider force as farmers go green without compromising the harvest levels.

By Engine Power Analysis

Speaking of engine power output, tractors within the range of 36-50 horsepower still remain crucial on achieving and covering over 20.62% share of the agricultural tractors market. The popularity of this segment is more profound in India where about 915,000 units of different types of tractors were sold during 2023, which indicates the degree of the country’s dependence on multipurpose machinery on the diverse farming activities. On the African continent, 300,000 units have been brought in with the help of development aid programs that seek to improve the local food situation through mechanization initiatives.

Southeast Asia is leading with Thailand and Vietnam collectively buying 200,000 units of the tractors, as part of efforts to increase efficiency in rice farming. Europe as the smallest market has bought or acquired 150,000 units, as farmers used these tractors for effective management of small and medium scale farms. In North America agricultural tractors market, the sales were 100,000 units with an emphasis on replacing obsolete facilities in order to stay competitive in productivity.

In this power range, the enhancement of technology has been remarkable. Approximately 50,000 units were sold alongside new transmission systems which enhanced farmers fuel economy and lowered their operating costs. The opportunity to integrate precision farming technologies such as automatic guidance has been appealing. This sector has also witnessed some thrust towards greenness spearheaded by biodiesel which shows the efforts of the agricultural industry to minimize the carbon footprint. The trend in these countries suggest that the usage of these tractors will continue to rise alongside the provision of government and international support as the economies advance.

By Wheel Type Analysis

In 2023, the 2-wheel drive tractor segment cemented its lead in the agricultural tractors market over other segments, with worldwide sales marking a 75.53% market share. This segment has particular dominance in India, therefore, explaining the demand for tractors that are cost-effective and efficient. In Africa, demand has increased greatly with most of the countries in the region importing them to aid smallholder farmer attain more output. The U.S. market even though it was relatively small, nevertheless registered sales of over 210,000 units as there was a demand for multi-purpose tools across varying agricultural backgrounds. In Europe, especially in France and Germany, the demand was robust as more farmers sought various measures to enhance their farming practices. In Southeast Asia, the demand mainly comes from rice and sugarcane plantation where cost and ability to maneuver are very important.

As technology progressed, the 2 wheel drive tractors in the agricultural tractors market also gained momentum as many of the 2 wheeled tractors sold had a power steering system and other ergonomic features which improved operators’ comfort and reduced fatigue. The installation of digital monitoring systems in 50,000 units allowed farmers to manage operations in the fields efficiently and scheduling maintenance was a more realistic target. Moreover, the surge of green models was also apparent as there were 30,000 units using alternative fuels, indicating the change to more environment friendly techniques. In the same way as the world agriculture grows, it is reasonable to predict that the demand for 2 wheel drive tractors will be stable taking into consideration low cost and high effectiveness of such equipment.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia Pacific region is indisputably at the forefront of the agricultural tractors market, generating over 57.7% of the global market revenue as of 2023. This supremacy of region is attributed to having the largest share of arable land, roughly making up 40% of the entire arable lands in the world. Additionally, Asia Pacific experienced a growth of 6% in agricultural production in the year 2023, resulting in an increase in tractor demand. Countries like India and China are at the forefront, with India being responsible for more than 30% of the region's tractor sales, owing to government forums on mechanization. The region also recorded a growth of 12% in the rate of small and medium sized farms mechanizing their farms, indicating a paradigm shift towards modern farming methods. A shift of focus to disposable income of farmers in the Southeast region coupled with increase in agricultural production scaled up sales of tractors by 9%, demonstrating the affluence of the region and its agricultural economy.

North America occupies the second place in the global agricultural tractors market. The main contribution comes from the United States and Canada, which account for about 75% of North America’s sales due to technological progress and the rapid use of precision farming. The figures were on an upward trend in the region, with the number of autonomous and electric tractors rising by 15% in 2023. Federal grants in support of agricultural innovations have increased by 10% in the last 2 years. It has further encouraged farmers in the region to upgrade their technologies. The trend towards large farming types results in a 7% growth in the market for high-horsepower tractors, which can perform many agricultural operations. Also, North American market expansion was further fueled by a 5% increase in the exports of agricultural machinery.

Both regions in the agricultural tractors market are propelled by strong economic and governmental support, yet their leading positions are bolstered by particular regional strengths. For example, Asia Pacific has a quite large agricultural labor force which even when mechanized considers manual work as an ingredient of the farming process appreciating this new farming integrated approach. On the other hand,, in North America, the strength rests on the technical and technological end of agriculture which is innovative.

Top Companies in Agricultural Tractors Market:

- John Deere

- Massey Ferguson

- Case IH

- Sonalika International

- Escorts Group

- Kubota

- Fendt

- Deutz Fahr

- Claas

- New Holland

- Universal(UTB)

- Big Bud

- Ford

- Mahindra & Mahindra

- Other Major Players

Market Segmentation Overview:

By Tractor Type

- Utility Tractors

- Row Crop Tractors

- Garden Tractors

- Orchard Type Tractors

- Rotary Tillers

- Implement Carrier Tractors

By Product (Fuel)

- Internal Combustion Engine (ICE)

- Electric Motor

By Wheel Type

- 2-wheeler

- 3-wheeler

- 4-wheeler

By Engine Power

- <20 Horsepower

- 21-35 Horsepower

- 36-50 Horsepower

- 51-90 Horsepower

- 91-120 Horsepower

- 121-150 Horsepower

- 151-180 Horsepower

- 181 HP-250 Horsepower

- >250 Horsepower

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Myanmar

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 66.15 Billion |

| Expected Revenue in 2032 | US$ 109.88 Billion |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 5.8% |

| Segments covered | By Tractor Type, By Product (Fuel), By Wheel Type, By Engine Power, By Region |

| Key Companies | John Deere, Massey Ferguson, Case IH, Sonalika International, Escorts Group, Kubota, Fendt, Deutz Fahr, Claas, New Holland, Universal(UTB), Big Bud, Ford, Mahindra & Mahindra, Other Major Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)