Agricultural Tires Market: By Tire Type (Bias, Radial), By Application (Tractor (Front, Rear), Harvesters, Attachments/Implements, Sprayers/Irrigation, Forestry, MPT (Multi-purpose Tires), and Others), By End User (Distribution Channel) - OEMs, After Market (Online, Offline - Specialized/Tire Retail store), and Retread Tires, By Rim Size - <15’’, 15-24’’, 24-42’’ and >42’’and By Country/Region) - Industry Dynamics, Market Size and Opportunity Forecasts, 2025-2033

- Last Updated: 10-Jul-2025 | | Report ID: AA0922299

Market Snapshot

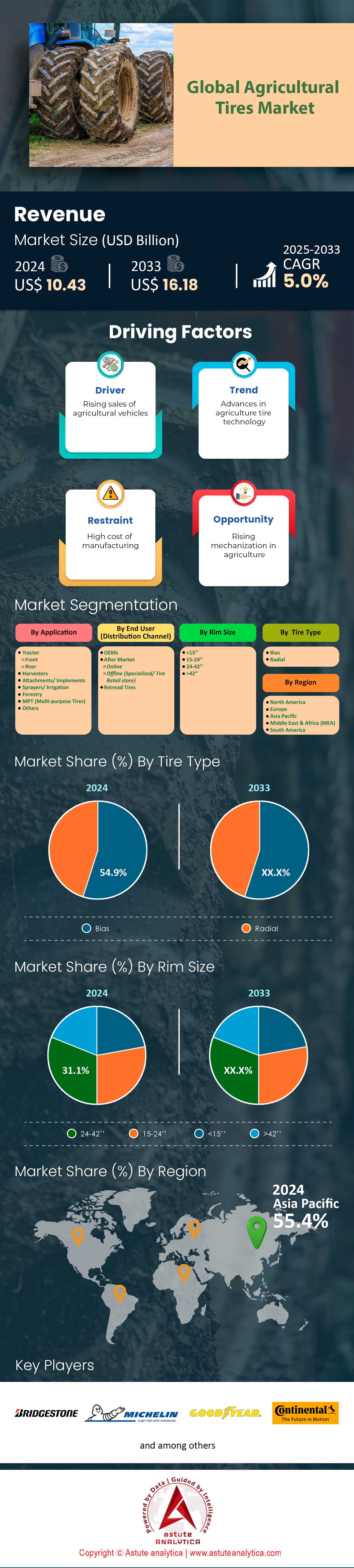

Agricultural tires market was valued at US$ 10.43 billion in 2024 and is projected to hit the market valuation of US$ 16.18 billion by 2033 at a CAGR of 5.0% during the forecast period 2025–2033.

The agricultural machinery sector experienced remarkable growth in 2024, directly catalyzing tire demand across global markets. The United States recorded sales of 217,200 tractors and 5,564 combines, with each unit requiring multiple specialized tires. India emerged as the world's largest tractor market, selling over 900,000 units in 2023-2024, while China's annual tractor sales exceeded 500,000 units in 2024, predominantly high-horsepower models requiring larger, advanced tires. This surge extends beyond major agricultural tires markets, with Brazil adding over 60,000 new tractors in 2023. North America maintains leadership in agricultural tire demand, with over 217,000 new tractors and 5,500 combines sold in 2024.

The Asia-Pacific region demonstrates the largest and fastest growth trajectory, with China and India together accounting for over 1.4 million new tractors sold in 2024. Europe's premium tire market continues expanding through strategic collaborations, exemplified by CEAT Specialty's partnership with Massey Ferguson to supply advanced tire models. This unprecedented equipment proliferation across continents creates sustained demand for agricultural tires, establishing a robust foundation for continued market expansion as mechanization accelerates globally.

Key Findings Shaping Dynamics of Agricultural Tires Market

- India leads global tractor sales with 900,000 units in 2023-2024, establishing itself as the world's largest agricultural tire consumer

- 1.4 million new tractors sold in China and India combined in 2024, driving Asia-Pacific tire demand explosion

- Over 100 new agricultural tire models launched globally in 2024, focusing on advanced technology integration

- 1.2 million used agricultural tires processed in U.S. recycling facilities in 2023, marking record sustainability efforts

- 65% of Agricultural tires market dominated by MFWD and 4WD tractors, with 5-year replacement cycles

To Get more Insights, Request A Free Sample

Market Dynamics

Tire Lifecycle Patterns and Replacement Dynamics Accelerating Market Growth Worldwide

Understanding tire usage patterns reveals the continuous replacement demand driving agricultural tires market growth. Radial agricultural tires typically last 3,000 to 5,000 hours, while bias-ply tires last 2,000 to 3,000 hours, creating predictable replacement cycles. Rear agricultural tires demonstrate varying lifespans, lasting up to 8 years under normal conditions, with high-end models reaching 14 years and lower-cost options averaging 8-10 years. Market segmentation shows MFWD and 4WD tractors accounting for 65% of the Agricultural tires market, with original equipment tires typically replaced every 5 years. Combine/harvester tires represent 10% of the market, featuring longer 10-year replacement cycles.

Application equipment including sprayers and spreaders comprises 15% of the market, requiring tire replacements every 1-2 years due to intensive road use. These replacement patterns, combined with increasing equipment utilization rates and expanding mechanized acreage, create consistent aftermarket demand. The varying replacement cycles across equipment types ensure steady market activity throughout the year, while increasing operational hours per machine accelerate replacement frequencies, further intensifying tire demand across all agricultural sectors globally.

Technological Innovation and Manufacturing Excellence Transforming Agricultural Tire Industry Standards

The Agricultural tires market witnessed unprecedented technological advancement in 2024, with over 100 new tire models launched globally, emphasizing high-flotation, self-cleaning, and puncture-resistant designs. Central Tire Inflation Systems (CTIS) technology extends tire life by up to 20% through on-the-fly pressure adjustments, while steel-belted construction and IF/VF technologies now feature in over 50% of new high-horsepower tractor tires. Manufacturing capabilities rely heavily on Southeast Asia, which supplies approximately 70% of the world's natural rubber. The global Agricultural tires market reached US$ 8.39 billion in 2024, supported by hundreds of dedicated distribution centers worldwide.

Major manufacturers operate dozens of regional distribution centers with integrated supply chains ensuring timely delivery. Innovation extends to equipment integration, with over 30% of new tractors featuring tire pressure monitoring systems as standard. More than 40% of large-scale U.S. and European farms utilize dual or triple tire configurations for reduced soil compaction. The adoption of autonomous and robotic field equipment increased by 15,000 units globally in 2024, each requiring specialized tires, further driving technological development and manufacturing expansion.

Distribution Networks and Sustainability Initiatives Reshaping Agricultural tires market Infrastructure

The agricultural tire distribution landscape transformed significantly in 2024, with North America's specialized tire dealers surpassing 3,500 locations. India established over 1,200 dedicated agricultural tire fitment centers, while Brazil's tire importers specializing in agricultural products grew to 150. Service capabilities expanded with over 2,000 tire service trucks equipped for on-field repairs in North America. Online platforms now list over 5,000 unique SKUs for farm equipment tires, increasing from fewer than 2,000 five years ago. Sustainability initiatives gained momentum, with U.S. tire recycling facilities processing over 1.2 million used agricultural tires in 2023. Environmental consciousness drove innovation, with at least 20 new tire models utilizing plant-based oils or recycled materials.

Europe sold over 100,000 agricultural tires certified for organic farming in 2024. Tire manufacturers published over 50 annual sustainability reports detailing eco-friendly development progress. Research and development intensified with over 200 agricultural tire technology patents filed globally in 2024, while more than 30 universities collaborate with manufacturers on sustainable tire development projects, establishing a comprehensive ecosystem supporting continued market growth through enhanced distribution, service, and environmental responsibility.

Segmental Analysis

By Application: Tractor Command Agricultural Equipment Tire Consumption

Tractors maintain their position as the largest consumer segment with 36.40% market share in the agricultural tires market, driven by their universal presence across farming operations worldwide. The dominance stems from tractors serving as primary workhorses for multiple agricultural activities including plowing, tilling, planting, cultivating, and harvesting. In 2024, global tractor sales exceeded 1.7 million units, with each unit requiring four to six tires depending on configuration. International Tractors Limited exemplified industry innovation by launching three new Solis tractor series in October 2023, including electric models with advanced tire requirements. The versatility factor significantly drives tractor tire consumption, as these machines operate across diverse terrains and weather conditions, accelerating tire wear and replacement needs.

The growth momentum in the agricultural tires market for tractor applications continues through several key factors. First, increasing farm mechanization in developing nations creates sustained demand for new tractors and replacement tires. Second, the trend toward larger, more powerful tractors requires specialized high-load capacity tires, particularly for MFWD and 4WD models that account for 65% of tire consumption. Third, intensive usage patterns with average annual operating hours exceeding 1,000 hours per tractor accelerate replacement cycles. Fourth, technological advancements like Central Tire Inflation Systems and tire pressure monitoring systems increase tire complexity and value. Finally, the expansion of contract farming and custom hiring services maintains high tractor utilization rates, ensuring consistent tire demand across seasonal variations.

By Distribution: Aftermarket Sales Drive Revenue Through Replacement Cycle Dynamics

The aftermarket segment generates 59.40% of revenue in the agricultural tires market, reflecting the critical importance of replacement tire sales versus original equipment installations. This dominance emerges from predictable replacement cycles across different agricultural machinery types. Application equipment like sprayers and spreaders require tire replacements every one to two years due to intensive road use between fields. Standard tractor tires typically need replacement every five years, while combine harvesters extend to ten-year cycles. The aftermarket thrives on serving an enormous installed base of agricultural equipment accumulated over decades. North America alone operates millions of tractors, combines, and specialized machinery, each requiring periodic tire replacements to maintain operational efficiency and safety standards.

The agricultural tires market aftermarket strength continues through multiple reinforcing factors. Farmers increasingly recognize tire condition's direct impact on fuel efficiency, soil health, and operational costs, prompting proactive replacement strategies. The expansion of specialized tire dealers, now exceeding 3,500 locations in North America, improves aftermarket accessibility and service quality. Online platforms listing over 5,000 unique agricultural tire SKUs enable farmers to source specific replacement tires matching exact equipment requirements. Additionally, tire recycling facilities processing over 1.2 million used agricultural tires annually in the United States demonstrate robust replacement activity. The aftermarket also benefits from farmers upgrading older equipment with modern tire technologies, seeking performance improvements without purchasing new machinery. This retrofit trend particularly applies to radial tire conversions and specialized application tires.

By Rim Size: Rim Size Specifications Define Equipment Compatibility and Performance

Agricultural tires with 24-42 inch rim sizes control over 31% market share due to their alignment with mainstream farming equipment specifications. This rim size range perfectly matches the requirements of mid-to-large tractors operating between 75-200 horsepower, representing the farming industry's operational sweet spot. Major tractor manufacturers design their equipment around these standardized rim sizes, ensuring widespread compatibility and parts availability. The 24-42 inch range accommodates both front and rear tire applications across diverse equipment types including tractors, combines, and large sprayers. Within the agricultural tires market, this size category offers optimal balance between load capacity, traction surface area, and maneuverability requirements essential for field operations.

The dominance of 24-42 inch rim sizes in the agricultural tires market reflects specific application area demands. Row-crop tractors extensively utilize these dimensions for navigating between planted rows while providing adequate flotation. Combine harvesters require this rim size range to support heavy grain loads during harvest operations. Large self-propelled sprayers depend on these tire dimensions to minimize crop damage while carrying substantial liquid loads. Additionally, this rim size category supports dual and triple tire configurations increasingly popular for reducing soil compaction. The standardization around 24-42 inch rims simplifies inventory management for dealers and reduces costs for farmers maintaining mixed equipment fleets. Tire manufacturers concentrate research and development efforts on this size range, introducing advanced features like IF/VF technology and improved tread patterns specifically optimized for these dimensions.

By Type: Bias Tire Dominance to Shifts Toward Radial Technology by 2033

Bias tires currently generate 54.9% of revenue in the agricultural tires market due to their robust construction and cost-effectiveness. Major manufacturers like Bridgestone Americas continue investing in bias tire technology, as evidenced by their March 2024 launch of the enhanced Regency Plus bias tire portfolio for Firestone Ag. This product line offers extensive options for fronts, implements, utility equipment, and lawn machinery. Leading producers include Titan International, BKT, Alliance Tire Group, and Trelleborg, which maintain large-scale production facilities across Asia. India and China dominate global bias tire consumption, leveraging their abundant natural rubber supplies and extensive small-farm operations requiring affordable tire solutions. The third major consumer is Southeast Asia, where traditional farming practices favor bias tire durability.

However, the agricultural tires market faces a technological transition by 2033 as radial tires gain prominence. This shift stems from radial tires offering superior fuel efficiency, reduced soil compaction, and extended operational hours ranging from 3,000 to 5,000 hours compared to bias tires' 2,000 to 3,000 hours. Advanced farming operations increasingly demand radial technology's benefits, including better traction, heat dissipation, and compatibility with precision farming equipment. The transition accelerates as large-scale farms in North America and Europe adopt radial tires for their improved performance metrics. Additionally, government initiatives promoting sustainable farming practices favor radial tires' lower environmental impact, driving manufacturers to expand radial production capabilities despite higher initial costs.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific Leads Global Agricultural Tire Demand Through Mechanization

Asia Pacific commands 55.40% market share in the agricultural tires market, driven by unprecedented mechanization across farming operations. The region's dominance stems from massive agricultural equipment adoption, with India selling over 900,000 tractors and China exceeding 500,000 units in 2024. Major manufacturers like Yokohama Rubber expanded production capacity through strategic investments, including the Visakhapatnam Plant in India, specifically targeting off-highway tire manufacturing. The region benefits from proximity to natural rubber sources in Southeast Asia, providing cost advantages and supply chain efficiency.

China and India emerge as primary contributors due to their vast farming populations transitioning from manual to mechanized operations. India's agriculture sector employs approximately 346 million people, creating enormous tire demand as farmers invest in tractors to address labor shortages and rising wages. China's agricultural modernization programs accelerate equipment purchases, particularly high-horsepower tractors requiring specialized tires. The combination of government subsidies, expanding farm sizes, and increasing crop production targets ensures Asia Pacific maintains its leadership position.

North America Sustains Strong Market Position Through Advanced Farming

North America represents the second-largest agricultural tires market, capitalizing on advanced farming practices and high equipment utilization rates. The region's farmers operate sophisticated machinery fleets, with the United States alone recording sales of 217,200 tractors and 5,564 combines in 2024. Canadian and Mexican agricultural sectors contribute substantial demand through expanding mechanized operations. The market benefits from North American farmers' preference for premium tire technologies, including radial construction and IF/VF specifications that enhance productivity. Large-scale farming operations dominate the landscape, requiring durable tires capable of supporting heavy loads across vast acreages.

The region's established distribution network, comprising over 3,500 specialized tire dealers, ensures efficient tire availability and service support. North American farmers prioritize tire performance metrics including fuel efficiency, soil compaction reduction, and extended operational hours. Contract farming and custom harvesting services maintain high equipment utilization rates throughout growing seasons. The region's focus on precision agriculture drives demand for specialized tires compatible with GPS-guided equipment and automated steering systems, reinforcing market strength.

United States Drives Continental Demand Through Technology Adoption

The United States emerges as North America's key consumer within the agricultural tires market through its technologically advanced farming sector. American farmers lead global adoption of smart tire technologies, with over 30 percent of new tractors featuring tire pressure monitoring systems as standard equipment. The country's corn belt and wheat-growing regions generate consistent tire demand through intensive mechanization and multiple annual cropping cycles. U.S. tire recycling facilities processed over 1.2 million used agricultural tires in 2023, demonstrating robust replacement activity across farming operations. American farmers increasingly utilize dual and triple tire configurations, particularly in Midwest states where soil compaction concerns drive equipment specifications.

The agricultural tires market benefits from strong aftermarket infrastructure, with over 2,000 mobile service trucks providing on-field tire repairs and replacements. Research partnerships between tire manufacturers and American universities accelerate innovation in sustainable tire compounds and advanced tread designs. Federal and state agricultural policies supporting farm mechanization and efficiency improvements maintain steady equipment investment levels, ensuring continued tire demand growth across diverse farming regions.

Top Companies in the Agricultural Tires Market:

- Alliance Tire Company Ltd.

- Balkrishna Industries Limited (BKT)

- Bridgestone Corporation

- CEAT ltd.

- China National Rubber Tire Co.

- Coker Tires

- Continental AG

- Duratread

- Michelin Group

- Mitas

- Nokian Tyres plc

- Pirelli & C. S.p.A.

- Salsons Impex Pvt. Ltd.

- Specialty Tires of America, Inc.

- Sumitomo Rubber Industries Ltd.

- Titan International, Inc.

- Trelleborg AB

- Goodyear India Ltd.

- Cheng Shin Rubber

- Zhongce Rubber Group Co., Ltd.

- Hankook Tire & Technology

- Giti Tire

- Toyo Tire Corporation

- Other Prominent Players

Market Segmentation Overview

By Tire Type

- Bias

- Radial

By Application

- Tractor

- Front

- Rear

- Harvesters

- Attachments/ Implements

- Sprayers/ Irrigation

- Forestry

- MPT (Multi-purpose Tires)

- Others

By End Users (Distribution Channel)

- OEMs

- After Market

- Online

- Offline (Specialized/ Tire Retail store)

- Retread Tires

By Rim Size

- <15’’

- 15-24’’

- 24-42’’

- >42’’

By Region/Country

- North America

- U.S.

- Canada

- Mexico

- Europe

- Western Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Myanmar

- South Korea

- Rest of Asia Pacific

Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 10.43 Billion |

| Expected Revenue in 2033 | US$ 16.18 Billion |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Bn) |

| CAGR | 5.0% |

| Segments covered | By Tire Type, By Application, By End-User (Distribution Channel), By Rim Size, By Region |

| Key Companies | Alliance Tire Company Ltd. , Balkrishna Industries Limited (BKT) , Bridgestone Corporation, CEAT ltd., China National Rubber Tire Co. , Coker Tires, Continental AG, Duratread , Michelin Group , Mitas, Nokian Tyres plc, Pirelli & C. S.p.A., Salsons Impex Pvt. Ltd., Specialty Tires of America, Inc. , Sumitomo Rubber Industries Ltd. , Titan International, Inc., Trelleborg AB, Goodyear India Ltd., Cheng Shin Rubber, Zhongce Rubber Group Co., Ltd., Hankook Tire & Technology, Giti Tire, Toyo Tire Corporation, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)