Global Agricultural Adjuvants Market: By Type (Activator (Surfactants, Oil, Adjuvants), Utility Modifiers (Compatibility Agents, Buffers/ Acidifiers, Antifoam Agents, Water Conditioners, Drift Control Agents, Others), Spray Modifiers); Usage Type (Tank Mix Adjuvants and Adjuvants in Cans); Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Other Crops); Application (Insecticide, Herbicides, Fungicides, Others (e.g., Plant Growth Regulators, Fertilizers)); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Jun-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0624855 | Delivery: 2 to 4 Hours

| Report ID: AA0624855 | Delivery: 2 to 4 Hours

Market Scenario

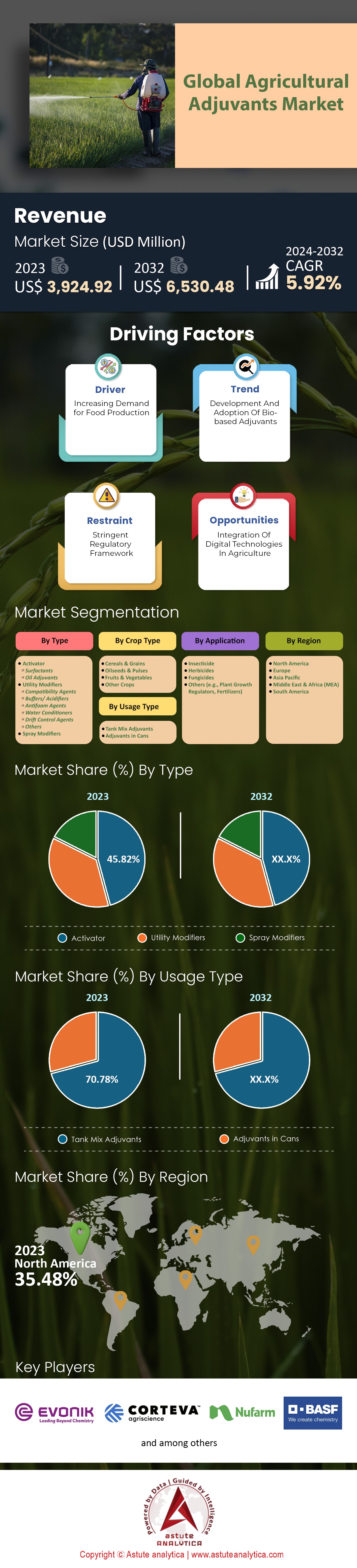

Global agricultural adjuvants market was valued at US$ 3,924.92 million in 2023 and is projected to hit the market valuation of US$ 6,530.48 million by 2032 at a CAGR of 5.92% during the forecast period 2024–2032.

Modern farming requires agricultural adjuvants which are vital in enhancing the efficiency of agrochemicals like herbicides, pesticides and fungicides. Such materials enable improved absorption, reducing drift as well as better coverage of crop protection products thereby maximizing their efficacy. There is an increasing need for efficient methods of production due to the rising global population and food demand. This has resulted into a strong surge towards this agricultural adjuvants market since more numbers are required for use in farms all over. The growth is fueled by high demand levels emanating from crop protection chemicals that ensure maximum agricultural productivity is achieved. Precision agriculture practices that need adjuvants for spray improvement coverage while minimizing drift also contribute significantly towards creating such demands. Therefore, these strategies have been widely adopted because they help to maximize yields on crops grown besides supporting sustainable farming.

According to several factors, the adoption rate of Agricultural Adjuvants continues to rise exponentially worldwide. More environmental regulations are being put in place concerning how safe pesticides should be used within our surroundings. This leads us realize that we need better adjuvant systems too. It also helps reduce wastage as well making it easier for farmers meet these requirements without violating any laws set forth by government agencies tasked with protecting nature from harmful substances unleashed into her bosom through human activities such agriculture amongst others. Moreover, people have started showing interest organic foods over conventional ones due health benefits associated with them thus creating demand green adjuvant products designed conserve environment while still achieving desired results. Another thing is that technological improvements have made certain types more effective than before where some can even increase absorption rates up fifty percent eighty five percent thereby greatly increasing overall performance levels.

Agricultural adjuvants market has seen significant expansion across many regions globally. Notably North America & Europe which account for most sales volume during 2023 alone. North American markets were mainly driven high consumption levels associated with agrochemical plus desire improve productivity within limited spaces available for farming activities. In terms of categories; utility adjuvants make up about three fifths share sold worldwide last year followed by activator adjuvant types while green adjuvants still occupied smaller percentages compared to other two groups mentioned earlier.

To Get more Insights, Request A Free Sample

Market Dynamics

Precision Agriculture: A Major Trend Shaping the Demand for Agricultural Adjuvants

There is a strong demand for agricultural adjuvants market because of growth in precision agriculture. This drive is motivated by the need for better efficiency and productivity in farming activities. The size of the global market for precision farming is estimated at US$ 22 billion by 2030, expanding at a CAGR of 13.1% from 2023. This fast development shows that more people are now using precise farming technologies. In precision agriculture, one of the most important things is how inputs such as water, fertilizers and pesticides are used optimally. Agricultural adjuvants help achieve this optimization by increasing the efficiency of agrochemicals’ performance. For example, they can make pesticides adhere better to surfaces or spread them over larger areas which makes them penetrate deeper into plants thus killing pests faster even if applied at lower rates than usual. Therefore, it saves money for farmers while protecting environment as well.

Moreover GPS/GIS technology-based site-specific crop management carried out through Precision Farming ensures that Adjuvants are only sprayed where necessary thereby reducing wastage significantly. According to USDA input costs can be cut by up to 20% while yields increase by between 10%-15% due increased efficiency brought about by this system which takes into account different factors affecting growth potentialities within given areas. These figures are key considering world population projected at reaching around 9.7 billion people before middle century (UN) hence necessitating huge amounts food production hence need for maximum output, adding fuel to the growth of the agricultural adjuvants market.

Also, according data published by International Society on Precision Agriculture (ISPA), it was reported that adoption rates for herbicides could fall down up-to thirty percent once again underlining modern day importance attached with adjuvants in agriculture today where we have variety sensing devices mounted atop drones capable doing infared scans simultaneously providing real time information concerning plant health status beside weather conditions prevailing at such point these can be used guide spraying decisions thus ensuring timely application rates against diseases or pest attack levels.

Increasing Demand for Crop Protection Chemicals: A Primary Driver of Agricultural Adjuvants Market Growth

Pesticides, herbicides and fungicides have gained popularity as global farming practices intensify to feed a growing population. The global use of pesticides was 4.3 million tons in 2023, marking continuous growth over the past ten years, according to the United Nations’ Food and Agriculture Organization (FAO). This need to improve yields and defend against pests and diseases underpins rising crop protection chemical sales worldwide. Over the next decade, global agricultural output is predicted to rise by 15% in line with the OECD-FAO Agricultural Outlook 2021-2030. In order to achieve this growth, farmers are using more agrochemicals that require higher performing adjuvants, adding fuel to the growth of the agricultural adjuvants market. They are considered necessary because they enhance how well plant care products work. For one thing, research has found that adjuvant application can raise pesticide efficiency by between 20% and 30%, allowing lower doses which save money.

Additionally, there is an increase in demand for agricultural adjuvants due to a shift towards high-value crops such as fruits, vegetables and nuts which are more susceptible to pests and diseases. According to figures from FAO data on global fruit production alone reached 2 billion tons last year while vegetable production hit just over half that figure at 700 million tons – both record highs. “This means we need even more protection than ever before,” says Dr Peter Holloway who heads up marketing strategy at Syngenta Crop Protection division based outside Basel Switzerland where he oversees product launches including those involving new types of adjuvants designed specifically for use with certain kinds of agrochemicals like fungicides used against blight on potatoes or mildew control sprays applied during rose cultivation.

Health Risks Associated with Agrochemical Exposure: A Significant Challenge

The agricultural adjuvants market is significantly challenged by health risks related to exposure to agrochemicals. The use of pesticides and other agrochemicals in farming is widely spread, which has raised concerns over their potential effects on human beings’ health. According to WHO (World Health Organization), there are about three million cases of pesticide poisoning reported every year thus leading to around 220,000 deaths mostly in the developing world.

One can be exposed to agrochemicals through different ways including inhalation, ingestion and skin contact. This means that farm workers and people living near farms are more vulnerable than others. Research published in Environmental Health Perspectives discovered that children who lived close to fields had high levels of pesticide metabolites in their urine indicating significant exposure. Prolonged contact with these chemicals has been associated with a variety of health problems such as respiratory tract infections; skin disorders like dermatitis or eczema; neurotoxicity among others, which are likely impact the growth of the agricultural adjuvants market to some extent. For instance, scientists from NIEHS found out that farmers who had been exposed to pesticides were at higher risk of getting Parkinson’s disease while IARC (International Agency for Research on Cancer) classified some commonly used pesticides such as glyphosate and malathion as probable carcinogens.

To address these challenges, there is a growing emphasis on developing safer and more sustainable adjuvant formulations. The global market for biopesticides, which are considered to be less harmful to human health and the environment, is projected to grow at a CAGR of 14.1% from 2023 to 2032. This shift towards biopesticides presents an opportunity for the development of compatible adjuvants that enhance their efficacy.

Segmental Analysis

By Type

Based on type, the demand for activator in the agricultural adjuvants market is increasing rapidly and is currently accounting for over 45.82% revenue share. There has been an increase in knowledge and acceptance towards sustainable agricultural practices. Farmers are now looking for eco-friendly solutions to improve crop protection as well as yield. In line with this sustainability trend, activator adjuvants align themselves by being able to enhance the performance of herbicides, fungicides and insecticides too. They make it possible for more specific and efficient utilization of crop protection products besides this fact alone; there has also been wider adoption of precision agriculture techniques globally where among others things they can be used together with other treatments during application on crops thus helping farmers optimize pesticide use.

Furthermore, activator adoption in the global agricultural adjuvants market is being driven by the necessity to control hard-to-manage weeds such as pigweed, marestail and kochia. These substances are known to significantly increase the efficiency of glyphosate-based herbicides against resistant weed species. The importance of activator adjuvants has never been more emphasized than in this era where there is widespread resistance to herbicides. In terms of consumption, North America is currently ranked as the largest market for agricultural adjuvants due to its vast and diverse agriculture industry. What is driving demand for activator adjuvants in this region is their aim at increasing crop yields through modern farming methods which involves utilization of advanced technologies hence improving efficiency levels associated with these chemicals.

By Usage Type

When it comes to usage type, Tank mix adjuvants are the most popular choice in the agricultural adjuvants market and it holds over a 70.78% market share. Primarily, this is because of their ability to greatly increase pesticide performance. They do this by improving active ingredient deposition, absorption and permeation on crop surfaces thereby enabling effective control of pests and reducing wastage of pesticides. It has been found that the correct use of adjuvants can enhance the efficiency of several agrochemicals when applied through foliage sprays.

The other reason why these products are widely used is their flexibility and convenience in application. Farmers have the freedom to combine different items like chemicals or adjuvants during one spraying session which saves time as well as labor since they will only be required to spray once instead of many times over if each chemical were sprayed separately. Tank mixes also address various challenges encountered in spraying operations such as drift control, rainfastness, wetting and spreading. Hence making them an essential part of efficient farm management systems in the agricultural adjuvants market. Additionally, there exists a wide variety of tank mix adjuvant options that can be tailored towards specific needs within agriculture. For example, oil-based ones enhance depositing while minimizing drifting plus foaming may require pH adjusters among others depending on what is mixed together inside tanks before application onto fields.

Beside effectiveness and ease-of-use considerations, safety enhancement forms another critical role played by these products towards crops’ welfare improvements. The right utilization methods safeguard plants from pesticide harm by creating moisture resistance shield on the leaves thus preventing wash-off. However, misuse sometimes results into crop damage too but leading manufacturers like Precision Laboratories are committed to sustainable tank mix adjuvant developments.

By Crop Type

Based on crop type, cereals & grains accounts for more than 40% revenue share of the global agricultural adjuvants market. They represent 50% global calorie intake hence require high-yielding systems to support food security. Pesticide efficiency can be improved by these substances leading to 15% increase in crop protection efficacy. Such crops often face various environmental stresses; therefore, they help in nutrient up take and water use efficiency that brings about 20% decrease on drought induced losses of crops. World cereal demand is expected to grow with 30% come 2050 thereby heightening adoption rates necessary for meeting production goals.

The fact that cereals and grains are grown in large scale monocultures also makes them highly susceptible to pests and diseases which can be controlled through the use of adjuvants acting as a defense mechanism against these problems. They enable better distribution as well as retention of pesticides thereby reducing application frequency by 25% in the agricultural adjuvants market. In North America alone weed populations resistant to herbicides affect over seventy percent of cereal farms while Europe has similar cases where adjuvants enhance penetration and effectiveness of herbicides used in controlling such weeds. Additionally, they aid compliance with regulations aimed at cutting down chemical inputs thus leading to reduction on pesticide runoffs plus environmental impacts estimated at 35%.

Economic and technological factors drive the adoption rate for adjuvants within cereals & grains sector too. 45% precision agriculture technologies are employed on cereal farms so that benefits brought about by targeted application may be maximized alongside other related advantages derived from this kind of farming method. For instance, specific types designed according to each crop needs have shown 10% increase in yields recorded on major wheat or maize varieties harvested annually all over the world. Furthermore, cost effectiveness ensures higher returns on investments since farmers get an additional twelve points rise in their profit margins.

By Application

The agricultural adjuvants market is heavily influenced by the dominance of herbicides, which account for the largest share (44.15%) of crop protection chemicals used in agriculture. Weeds compete with crops for nutrients like sunlight and water hence for increased productivity it is necessary to have good working herbicides since they can cause high crop yields decline when not controlled. Nonetheless, world-wide spread resistance among weed populations towards these chemicals has made them less effective thus creating more difficulties in fighting against harmful plants; therefore, this fact only strengthens again demand for agrochemicals that improve their efficiency such as agricultural adjuvants.

Adjuvants are substances added into herbicide formulations or spray tanks to overcome some barriers which hinder movement of these compounds from leaf surface through plant cells in the agricultural adjuvants market. Such additives may increase absorption rates between 50%-85% making them very important tools against weeds. Surfactants among other types of adjuvants are often used together with post-emergence herbicides so as to increase their ability penetrate into targeted plants where efficacy greatly depends on factors like size age and growing conditions among others related only with host species. Majority surfactant used have HLB values equal or greater than twelve (12). Another type known as crop oil concentrates contain about 15-20% emulsifier should be applied at least 1.25% per acre when spraying ten gallons per acre or less whereas higher rate is recommended if low volume application method were employed while dealing with high surfactant oil concentrate then half rate would do.

Herbicides segment leads in terms of its application while cereals and oilseeds dominate the market currently based on crop type. Utility adjuvants were the most popular ones among all other types in 2023 when it came to agricultural adjuvant usage rates. Farmers have to invest additional $0,75-$1,0 per acre for adding them into herbicide solution but this investment pays off because improved weed control leads higher yields.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Due to advanced agricultural practices and significant investment in agrochemical research, North America is the globe’s largest producer and consumer of agricultural adjuvants market which account for more than 35.48% of the world market revenue. The US alone holds about 30% market share of the globe as it strives to increase yields per acre while suppressing pest resistance which has become a major concern lately. With over 900 million acres of farmland, this continent has immense tracts that benefit from using adjuvants to enhance pesticide efficiency without harming environment so much because they regulate chemicals through agencies like EPA which ensures quality service delivery among others; also, technological advancement within precision farming has seen many farmers employ these substances with estimates indicating 70% adoption rate across United States’ crop protection strategies mainly due it covers large areas under cultivation. Besides having such a wide variety grown there are strategic companies situated within its borders such as Monsanto and DowDuPont thus making sure North America remains unbeatable globally when it comes to agrochemicals in the agricultural adjuvants market.

Asia Pacific region follows closely behind North America among other major world players in terms of agricultural adjuvant consumption owing mainly to rapid expansion coupled with increasing population numbers but still they manage establish themselves as key contenders within global rankings by producing large quantities needed worldwide annually. This can be attributed to factors like climate change affecting different parts differently hence creating demand for these inputs wherever necessary leading into improved utilization rates through effective performance management systems. Furthermore, governments provide funding support programs targeting modernization efforts along value chains including agriculture where Japan alone gives hefty sums each year towards R&D projects related with this field.

Europe sits at third place worldwide in the agricultural adjuvants market, which has very strict regulatory standards and places a strong emphasis on sustainable farming. The Common Agricultural Policy (CAP) of the European Union has significantly impacted how adjuvants are used by aiming to reduce chemical inputs and encourage environmentally friendly practices. France is among the countries that dominate this region’s industry, along with Germany; they account for more than half its consumption. About 75% of all land under cultivation in European Union’s largest agricultural producer is treated with these substances that help herbicides or fungicides work better – France alone uses them on over three quarters of such territories. Over last 5 years there has been an increase by twenty percent in German usage driven mainly due EU Pesticide Regulations’ need to comply while being aware about their own developed agrochemical sector which is one most advanced globally where BASF AG & Bayer CropScience represent few major players contributing steady growth as well as innovation within adjuvants market across Europe thereby ensuring continent stays center stage vis-à-vis global developments pertaining thereto.

Major Players in Global Agricultural Adjuvants Market

- BASF SE

- Bayer Crop Science (Bayer AG)

- Clariant AG

- Corteva

- Croda International Plc

- Evonik Industries

- GarrCo Products Inc.

- Helena Agri-Enterprises LLC

- Loveland Products Inc.

- Nufarm Ltd.

- Syensqo

- Wilbur-Ellis Company

- WinField Solutions LLC

- Other Prominent Players

Market Segmentation Overview:

By Type

- Activator

- Surfactants

- Oil Adjuvants

- Utility Modifiers

- Utility Modifiers

- Buffers/ Acidifiers

- Antifoam Agents

- Water Conditioners

- Drift Control Agents

- Others

- Spray Modifiers

By Usage Type

- Tank Mix Adjuvants

- Adjuvants in Cans

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Other Crops

By Application

- Insecticide

- Herbicides

- Fungicides

- Others (e.g., Plant Growth Regulators, Fertilizers)

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0624855 | Delivery: 2 to 4 Hours

| Report ID: AA0624855 | Delivery: 2 to 4 Hours

.svg)