Active Optical Cable Market: By Connector Type (HDMI, DisplayPort, USB, QSFP, SFP); Application (High-Definition Tv (HDTV), Personal Computers, Medical Imaging Equipment, Airplane Video Entertainment Systems, Digital Signage, Led Signboards in Pedestrian & Stadium Environments, Home Theaters, Security Systems, Projectors, Game Consoles, Virtual Reality, Videoconferencing Systems, Blu-Ray, Others); Distribution Channel (Direct and Distributed); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025-2033

- Last Updated: 08-Dec-2025 | | Report ID: AA0823574

Market Snapshot

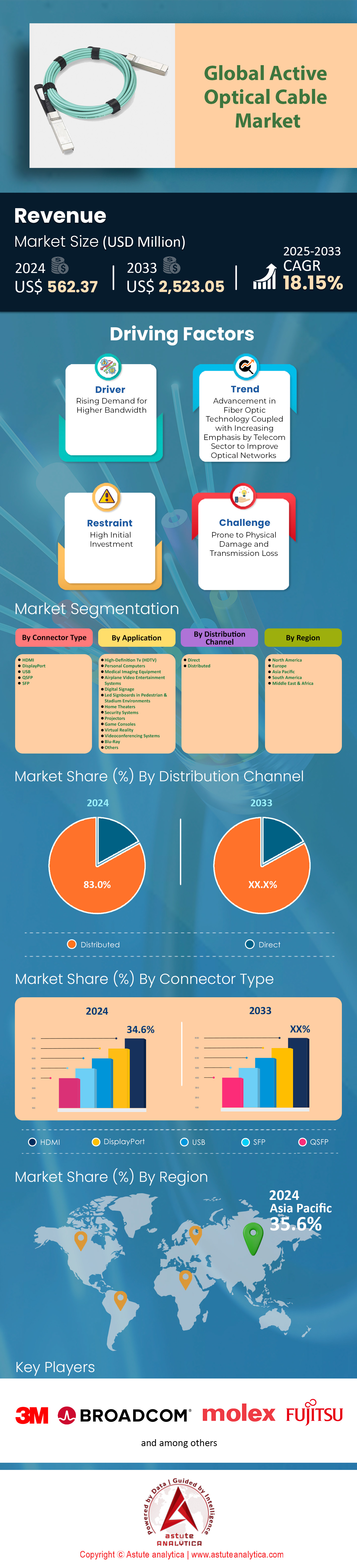

Active optical cable market was valued at US$ 562.37 million in 2024 and is projected to surpass the market valuation of US$ 2,523.05 million by 2033 at a CAGR of 18.15% during the projection period 2025–2033.

Key Findings in Active Optical Cables Market

- Based on connector type, HDMI (High-Definition Multimedia Interface) took up more than 34.6% revenue share of the market.

- Based on application, optical cables are heavily used in personal computers. In fact, the PC segment accounts for over 13.8% market share and is poised to grow at a CAGR of 18.58% in the years to come.

- When it comes to distribution channel, distributors, wholesalers, and resellers accounts for over 83.0% market share.

- Asia Pacific is the powerhouse in the market as it accounts for the highest 35.6% market share.

The active optical cable market has moved beyond steady growth and entered a period of intense urgency. The market is witnessing a "super-cycle" driven by the world’s biggest technology companies. The market is now valued at over USD 677.58 million, but the real story is the backlog of orders. Wherein, the demand is not coming from regular business upgrades, it is fueled by a desperate race among tech giants like Microsoft, Amazon, and Google to build Artificial Intelligence infrastructure. These companies are buying cables faster than factories can make them. For instance, a standard server rack used to need about 48 cables. Today, a new AI server rack needs more than 200 high-speed optical links. This has caused sales volumes for AI-related optics to jump by 137% in just one year. This is not a temporary spike. It is a permanent shift where optical cables are now as important as the computer chips they connect.

Which Cable Speeds Are Actually Generating Revenue Today?

When we look at what companies are actually ordering, the active optical cable market has clearly moved away from older 10G and 25G cables. Those are now seen as basic, low-profit items. The real money is flowing into 400G and 800G cables. Specifically, there is huge demand for "breakout" cables. These are special cables that split one massive 800G connection into several smaller 100G or 200G lines. It has been found that data center managers love these because they allow them to get more use out of their expensive network switches. Looking ahead, the industry is already placing pre-orders for 1.6 Terabit cables for late 2025. This shows that the appetite for speed is moving faster than the official industry standards can keep up. If you are selling or buying in this market, high-speed and complex breakout configurations are where the volume is.

To Get more Insights, Request A Free Sample

Why Are Data Centers Abandoning Cheap Copper for Expensive Optics?

The question is why companies are spending millions on optical cables when copper cables are much cheaper. The answer comes down to physics and electricity bills. Copper cables work well for short distances, but once data speeds go over 100 Gigabits, copper signals fail if the wire is longer than two meters. Since AI computer clusters span entire rows of cabinets, copper simply cannot reach far enough. This has given active optical cables a total monopoly on distances between 3 meters and 100 meters. The second factor is power. In massive AI centers, every watt of electricity matters. Active optical cables are becoming more power-efficient, which saves money in the long run. For these massive computing projects, using optical cables is the only way to make the system work economically and technically.

Where Is the Money Coming From and Where Are the Factories Moving?

There is a clear divide between who is buying these cables and who is making them in the active optical cable market. North America is the biggest buyer, responsible for about 30% of global revenue. This is because the biggest buyers—the Silicon Valley tech giants—are based there. However, the manufacturing map is changing fast. China is still the biggest producer, but trade wars and taxes are forcing companies to move. Vietnam and Thailand have become the top alternative manufacturing hubs for Western companies who want to avoid tariffs. Mexico is also rising quickly as a key producer because it is close to the US market. These four nations—China, Vietnam, Thailand, and Mexico—are now the primary factory floors for the global optical supply chain.

What Specific Workloads Are Driving the Massive Volume Growth?

The explosive growth in the active optical cable market is not coming from regular internet traffic, like streaming movies or browsing the web. It is coming from the "backend" of data centers. This is where computer chips talk to other computer chips to train Artificial Intelligence models. This specific type of traffic is growing three times faster than standard corporate networking. The protocols used here, like InfiniBand, are essential for training large AI models. While there is steady demand from scientific research centers and a small, growing niche in Virtual Reality headsets for consumers, these are tiny compared to the volume demanded by AI. If a cable is not being sold to connect a GPU cluster, it is likely part of a shrinking market segment.

Who Are the Four Giants Controlling the Global Supply Chain?

Four major companies currently hold the most power in the active optical cable market. Coherent Corp is a dominant leader because they make their own laser chips, which gives them control over supply and pricing. Amphenol is another giant, known for buying up smaller companies to offer the widest range of heavy-duty and high-speed cables. Innolight Technology is a powerhouse based in China that produces massive volumes of cables for cloud companies at very competitive prices. Finally, Nvidia has become a major player in the cable market. Their proprietary "LinkX" cables are effectively mandatory for their new computer systems, which locks out competitors and guarantees them a huge share of the market. These four companies define the rules of the game today.

What Recent Corporate Moves Will Impact Market Players’ Strategy in 2025?

Several recent events show just how aggressive active optical cable market has become. Coherent Corp recently proved they are ready for the future by demonstrating new 1.6 Terabit cables, showing they are ahead of the curve. Amphenol spent USD 2 billion to buy a company called Carlisle Interconnect, which secures their position in the high-reliability defense and aerospace sectors. Broadcom announced they can now mass-produce the specific laser chips needed for the next generation of cables, solving a major supply shortage. Meanwhile, Nvidia has made it harder for generic cable makers to compete by strictly enforcing certification rules for their new server racks. These moves tell us that the big players are consolidating power and preparing for even faster speeds.

Segmental Analysis

Unmatched Bandwidth Demands Propelling HDMI Connector Dominance in Global Connectivity

HDMI technology secures its leadership position with over 34.6% revenue share in the active optical cable market because modern display standards essentially outgrew copper's physical limits. Traditional copper wires struggle to transmit high-bandwidth signals beyond three meters, often resulting in complete signal loss or sparkling artifacts. In contrast, optical HDMI solutions effortlessly handle the massive 48 Gbps bandwidth required by the latest HDMI 2.1 specifications. Manufacturers now engineer these cables to support uncompressed 8K resolution at 60Hz and 4K at 120Hz without needing external power supplies. Such capabilities are vital for maintaining signal integrity over runs reaching 100 meters in custom home theaters.

- Hybrid construction combines four fiber strands with seven copper wires for stability.

- Enables dynamic HDR and eARC features absent in older long-distance cabling.

- Eliminates electromagnetic interference in complex setups involving multiple devices.

Professional and consumer sectors alike drive the active optical cable market as they adopt hardware requiring ultra-high-speed connectivity. Gaming enthusiasts rely on these interconnects for the PlayStation 5 and Xbox Series X to utilize Variable Refresh Rate features without lag. Commercial integrators install thousands of units in stadiums to power massive LED walls that demand synchronization. Medical facilities also depend on the clarity provided by optical HDMI for surgical imaging equipment. As legacy standards fade, the shift toward optical interconnects becomes the only viable path for high-fidelity video transmission.

Surging Personal Computer Shipments and High Performance Computing Drive Adoption

Personal computers hold a commanding presence in the active optical cable market, accounting for 13.8% of the share and projected to grow at a CAGR of 18.58% due to evolving hardware needs. Global PC shipments are on track to hit 273 million units in 2025, creating a massive baseline for peripheral connectivity. A significant portion includes 114 million AI-capable PCs, which require high-throughput connections for local neural processing tasks. Modern motherboards now universally adopt Thunderbolt 4 and USB4 standards, enabling data transfer speeds of 40 Gbps. Users increasingly swap stiff copper cords for flexible optical alternatives to declutter desktops.

- Gamers demand optical solutions to ensure near-zero latency for competitive play.

- Lightweight cables improve comfort for high-fidelity Virtual Reality headset users.

- Better airflow management in compact builds drives uptake of thinner optical cords.

Enterprise environments further accelerate the active optical cable market as workstations cluster together for data-heavy operations. Recent data indicates quarterly PC shipments held steady at 63.2 million units, reflecting a strong commercial refresh cycle. Esports arenas deploy hundreds of these cables to connect player rigs to central servers during tournaments. Additionally, high-performance server racks utilize these links to bridge communication between CPUs and GPUs for machine learning. The sheer volume of hardware entering the market guarantees sustained demand for advanced cabling solutions.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

Global Supply Chain Complexity and Bulk Volumetric Demand Empower Distributors

Distributors, wholesalers, and resellers control over 83% of the share because they effectively manage the logistical nightmare of global infrastructure expansion. Serving the 10,978 data centers currently operating worldwide requires a supply chain capable of holding massive local inventory. These intermediaries are crucial for large-scale solar projects, which make up 80% of new renewable capacity, by providing specialized outdoor-rated cabling on demand. Telecommunication giants building out networks for 1.6 billion 5G connections also rely on wholesalers for rapid bulk delivery. The active optical cable market depends on these channels to break down massive factory orders into usable quantities.

- Warehouses manage thousands of unique SKUs to support diverse installation needs.

- Wholesalers offer essential credit terms that manufacturers rarely provide directly.

- Contractors prioritize distributors who guarantee next-day delivery to job sites.

Fragmented markets like electric vehicle infrastructure, expanding from 4 million to 35 million charging stations, source components almost exclusively through established resellers. In dense digital hubs like China, managing connectivity for 2.39 million data center cabinets necessitates a robust distribution layer. These partners handle technical support and returns, bridging the gap between factory engineering and end-user reality. Without this layer, the active optical cable market would struggle to service the millions of smaller enterprise buyers effectively.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific Dominates Through Massive Manufacturing Scale and Rapid Digital Infrastructure Expansion

Asia Pacific controls the active optical cable market with a commanding 35% share because the region serves as both the world's primary manufacturing floor and its fastest-growing consumer base. China alone creates a self-sustaining ecosystem, now operating over 3.8 million 5G base stations that require high-speed optical backhaul to function. Beyond telecommunications, the sheer volume of consumer electronics produced here is staggering; regional factories are responsible for assembling 60% of the global supply of gaming monitors and consoles that rely on these cables.

India is aggressively altering the landscape of the regional active optical cable market as well, with its data center capacity projected to breach 1,800 MW in 2025 to support local digital initiatives. This localized boom means components don’t just pass through Asia; they are consumed there to connect millions of new internet users. The region's dominance is cemented by South Korea and Taiwan, where semiconductor foundries utilize active optical cables for interference-free connections within ultra-clean manufacturing environments.

North America Leads Innovation via Hyperscale Investments and AI Workload Acceleration

While Asia handles volume in the active optical cable market, North America drives the technological frontier, pushing the adoption of high-performance interconnects in hyperscale environments. The United States remains the epicenter of the AI revolution, with major tech giants collectively exceeding USD 200 billion in capital expenditure largely directed toward infrastructure upgrades in 2025. These investments focus on retrofitting data centers with 800G optical links to train Large Language Models, which demand bandwidth far beyond copper's reach.

North America currently hosts nearly 40% of the world's operational hyperscale data centers, creating a concentrated demand for premium, low-latency cabling. Furthermore, the rapid expansion of U.S. broadband access has pushed fiber-to-the-home penetration past 55%, stimulating residential demand for optical hardware. The market here isn't just growing; it's evolving toward higher specifications to support workloads that didn't exist five years ago.

Europe Secures Strong Position Driven by Industrial Automation and Data Sovereignty

Europe maintains its stronghold in the active optical cable market by integrating optical connectivity into its massive industrial sector and strictly regulated data landscape. Germany’s Industry 4.0 initiative is a major catalyst, deploying over 500,000 connected industrial robots that require active optical cables to resist heavy electromagnetic interference on factory floors. Simultaneously, strict GDPR laws force companies to build data centers within EU borders rather than outsourcing, fueling growth in the "FLAP-D" markets (Frankfurt, London, Amsterdam, Paris, Dublin). These hubs are adding over 600 MW of power capacity in 2025 alone to handle localized traffic.

Additionally, the European Union's push for sustainability encourages the switch to optical cables, which consume significantly less power over distance compared to copper equivalents. The region prioritizes reliability and compliance, ensuring steady adoption in sectors ranging from automotive manufacturing to aerospace engineering.

Recent Developments In Active Optical Cable Market

- Coherent Corp demonstrated 1.6T datacom pluggables and AOCs powered by 200G VCSELs, targeting the immediate bandwidth needs of next-generation AI clusters.

- Amphenol completed the acquisition of Carlisle Interconnect Technologies for USD 2 billion, significantly bolstering its portfolio for harsh-environment optical interconnects in aerospace and defense.

- Corning launched SMF-28 Contour, a new optical fiber with a reduced 190-micron outer diameter, designed specifically to alleviate cable congestion in high-density AI racks.

- Nvidia reportedly tightened LinkX certification mandates for its Blackwell GB200 NVL72 racks, locking in specific optical cabling partners and excluding generic vendors.

- Lumentum accelerated its penetration into the hyperscale market by fully integrating Cloud Light, expanding its manufacturing capacity for high-speed active optical cables.

- Prysmian Group finalized the USD 4.2 billion acquisition of Encore Wire, consolidating its North American footprint for industrial and data center hybrid cabling.

- Broadcom announced volume shipments of 200G-per-lane VCSELs, the critical laser components required to enable mass production of 1.6T Active Optical Cables.

- STL (Sterlite) achieved full operational capacity at its South Carolina "Palmetto" plant, focusing on producing Build America, Buy America (BABA) compliant fiber cables.

- Molex expanded its Active Electrical Cable (AEC) portfolio for 800G speeds, intensifying competition against short-reach optical cables in top-of-rack server applications.

- CommScope announced increased production capacity for Rollable Ribbon fiber cables, addressing the demand for extreme high-fiber-count interconnects in hyperscale campuses.

Top Players in the Global Active Cable Market

- 3M

- Amphenol

- AVAGOTECHNOLOGIES LIMITED (BROADCOMINC.)

- EMCORE (formerly Intel ICC)

- FUJITSU

- Hitachi Cable, Ltd.

- II-VI Incorporated

- Koincable

- Mellanox

- Molex

- Siemon Company

- Smiths Interconnect

- Sumitomo Electric Industries, Ltd.

- T&S Communication Co, Ltd.

- Zarlink Semiconductor

- Other Prominent Players

Market Segmentation Overview:

By Connecter Type

- HDMI

- DisplayPort

- USB

- QSFP

- SFP

By Application

- High-Definition Tv (HDTV)

- Personal Computers

- Medical Imaging Equipment

- Airplane Video Entertainment Systems

- Digital Signage

- Led Signboards in Pedestrian & Stadium Environments

- Home Theaters

- Security Systems

- Projectors

- Game Consoles

- Virtual Reality

- Videoconferencing Systems

- Blu-Ray

- Others

By Distribution Channel

- Direct

- Distributed

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)