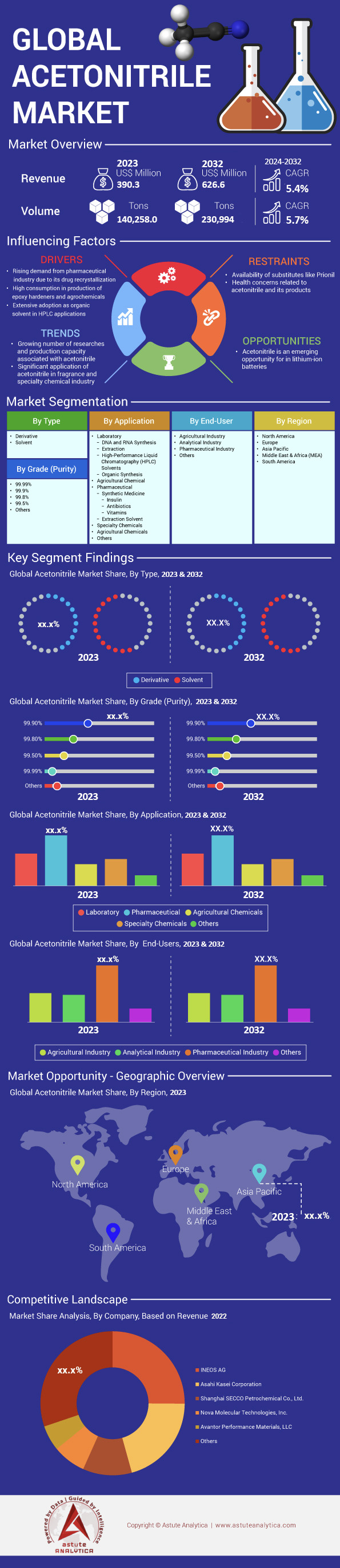

Global Acetonitrile Market- (By Type – Derivative and Solvent; By Grade (Purity) – 99.99%, 99.9%, 99.8% and others; By Application – Laboratory, Agricultural Chemical, pharmaceutical and others; By End User – Agricultural Industry, Analytical Industry, Agricultural Industry, and others; and By Region); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Jul-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0122128 | Delivery: 2 to 4 Hours

| Report ID: AA0122128 | Delivery: 2 to 4 Hours

Market Scenario

Global acetonitrile market was valued at US$ 390.3 million in 2023 and is projected to reach valuation of US$ 626.6 million by 2032 at a CAGR of 5.4% during the forecast period 2024-2032.

Diverse industries continue to drive the growth of the global acetonitrile market as the compound is clear and colorless acts as an essential solvent across various industries including pharmaceutical, petrochemical, and agrochemical. This is primarily attributed to low boiling point, low viscosity as well relatively low toxicity. As of 2024, there has been a record-breaking resilience shown by markets worldwide together with an unprecedented level of growth.

The pharmaceutical industry is responsible for most of the demand for acetonitrile, which they use in the production of antibiotics, drug recrystallization and laboratory analysis among other fields. It is used for high performance liquid chromatography (HPLC) and this has become more important over time as the global HPLC market value was estimated at US$4.5 billion. Furthermore, it has also found new applications such as DNA synthesis where its global consumption is expected to reach around US$2.7 billion by 2025 while at the same time being widely applied in peptide sequencing procedures too. Another significant customer group are agrochemical companies who make use of this chemical during pesticide manufacturing stages alone accounting for approximately 127,000 tons consumed annually since 2023. However, it is not limited to agrochemicals because there have been reports showing that it can be used as an electrolyte component in lithium-ion batteries. This is especially after considering how fast electric vehicle sales were growing, which according to records exceeded 14.2 million units globally by the end of 2023.

Despite its widespread use, the acetonitrile market faces challenges, including the availability of alternatives like Prionil and growing health concerns. However, innovations in sustainable manufacturing practices and the development of eco-friendly solvents present new opportunities for market expansion. Asia-Pacific emerged as the largest regional market, accounting for 50.4% of global consumption.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: The Booming Pharmaceutical Industry's Increasing Demand for Acetonitrile Solvent

The pharmaceutical industry is one of the main drivers for the acetonitrile market. The demand for acetonitrile is poised to increase with the growing global pharmaceutical industry, which is expected to reach $1.5 trillion in 2024, with a CAGR of 5.8%. In fact, pharmaceutical applications alone make up about 41.39$ of worldwide consumption showing just how important it is within this sector. From 2019 through 2024, there has been an annual increase in demand for acetonitrile by 6% each year. Additionally, the demand is fueled by biopharmaceuticals subsector anticipated at CAGR of 9.6%.

The acetonitrile market demand also is fueled by the rapidly expanding generic drugs market, which is expected to generate a revenue of over US$475 billion by the end of 2024. As of 2023, the pharmaceutical research and development spending reached over US$180 billion. The investment is expanding rapidly as more people are being diagnosed with chronic diseases each year. Also, during 2020–2024, the number of clinical trials that use acetonitrile as main ingredients have risen by 15%. Wherein, the US pharmaceutical market is projected to surpass $700 billion by 2024 and is expected to foster further demand for acetonitrile.

In 2023, China and India – two major hubs for drug manufacturing in Asia – saw a combined growth of 20% in the imports of acetonitrile. Wherein, the contract development and manufacturing organization (CDMO) emerged as the key end users in these countries as they rely heavily upon ACN during their operations. On the other hand, the analytical testing labs are projected to continue consuming acetonitrile at a CAGR of 7.2% driving its demand even higher given that they are key players within this sector.

Trend: Sustainable and Green Chemistry Practices in Acetonitrile Production

The chemical sector is progressively using sustainable and eco-friendly chemistry practices to reduce environmental damage, and the production of acetonitrile is not an exemption. This change massively influences how the acetonitrile market operates. Currently, it is estimated that the worldwide green chemistry industry will be worth US$120 billion by the end of 2024, with a CAGR of 10%. Over the years, there has been a rise in adoption numbers for sustainable acetonitrile production techniques, which increased by 25% in 2024 from 2020 due to stringent set by authorities like REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) from European Union which resulted into 15% more people engaging themselves in ecofriendly practices. The U.S. Environmental Protection Agency (EPA) reported a 30% increase in green chemistry awards for acetonitrile-related innovations. Wherein, companies that have implemented these strategies could save up to 20% money on their day-to-day operations in 2023. Bio-based acetonitrile production is expected to grow by 18% annually until 2024.

Furthermore, the use of renewable feedstocks for acetonitrile production has grown by 22% since 2019 in the global acetonitrile market. By 2025, waste-to-chemicals technologies are expected to attract US$2.5 billion investments including acetonitrile. The yearly reduction rate of carbon footprints produced during the making of acetonitrile is now at 10% because of eco-friendly measures. In the last 5 years, consumers’ love for sustainable goods pushed up demand for green acetonitrile by 35%. It is not only regulatory forces that prompt the shift to sustainable and ecological chemistry but also economic as well as environmental benefits associated with it. This change will, therefore, continue shaping the acetonitrile market through fostering innovation in production methods.

Challenge: Supply Chain Disruptions and Volatility in Raw Material Prices

Significant challenges are presented to the acetonitrile market by supply chain disruptions and raw material price volatilities. These factors have only been worsened by rising geopolitical tensions, the pandemic, and fluctuating oil prices. Availability and cost of acetonitrile have been greatly affected as seen in the 40% increase of global chemical supply chain disruptions between 2020-2024. Raw material shortages led to a surge in acetonitrile prices by 35% in 2023. Thus, showing how susceptible this industry is to supply chain instability. The global supply chain risk index for chemicals was recorded at an all-time high 75 in early 2023, which indicates heightened risk environment. Geopolitical conflicts especially those in oil-rich areas (Russia-Ukraine) account for about 25% fluctuation witnessed with respect to procurement strategy complexity on acetonitrile’s prices. Shipping expenses have risen 50% over the past 3 years on chemical products such as acetronitrole which adds more operational costs.

In 2023, the usual delivery time of acetonitrile grew longer by 30% therefore causing disturbances in the schedules of production. In 2023 alone, propylene which is one of the raw materials used in manufacturing acetonitrile had its costs increased by 15% in the acetonitrile market. Supply chain problems made operational costs rise by 10% within the global chemical industry. Moreover, import duties for acetonitrile especially between America and China hindered trade with such levies accounting for about one fifth (20%) of all traded volumes worldwide thereby making matters worse on this market’s complexity. The fluctuations seen in feedstock prices coupled with supply chain disruptions pose significant threats toward acetonitrile. They lead to unstable prices as well as shortages in availability prompting players within the sector to consider adopting more robust supply-chain strategies that are also diversified.

Segmental Analysis

By Type

The acetonitrile market is divided into two segments derivative and solvent. In 2023, the solvent segment was the dominant segment with revenue share of 57.8%. The growth of the solvent segment is driven by the increasing demand for solvents in high-performance liquid chromatography (HPLC). This utilization owes itself to the fact that acetonitrile has high dipole moment and dielectric properties, which make it a perfect solvent for this process. Another reason why the solvent industry is growing rapidly is due to rising demands for batteries, pharmaceuticals, and organic chemicals production all requiring acetonitrile. With regard to lithium-ion battery manufacturing, acetonitrile serves as a solvent during its production while in pharmaceutical industry very pure quality products are needed. Additionally, organic chemical synthesis needs highly polar solvents like acetonitrile as they are very reactive indeed. In the coming years, the demand for derivatives is expected to grow at the highest CAGR. Derivatives of acetonitrile are used extensively in the production of sulfa pyrimidine and Vitamin B1.

By Grade

The demand for acetonitrile of 99.90% purity is highest compared to other grades such as 99.99%, 99.80%, and 99.50%. The 99.90% purity grade accounted for over 40.9% share of the acetonitrile market as it strikes the best balance between high purity and cost-effectiveness. Thus, it is making it suitable for many uses, especially in high-performance liquid chromatography (HPLC). Acetonitrile at 99.90% purity is commonly known as HPLC gradient grade that must be used during any analytic process if one wants reliable reproducible results to be achieved where necessary. This level is clean enough not to interfere with fragile analytical methods while still being cheaper than ultra-purest grade which is usually 99,99%. The latter can only be applied in very demanding areas where even traces of impurities may affect findings greatly. Also, this particular quality improves much upon both the 99.50% and the 99.80% grades since these two could contain contaminants capable of jeopardizing accuracy as well as precision for any given method employed in analysis.

The popularity of the 99.90% grade in the global acetonitrile market is increasing rapidly. For example, the market for HPLC solvents worldwide which includes acetonitrile has shown continuous growth and is expected to grow with a CAGR of 5.8%. This is attributed to booming pharmaceutical and biotechnology sectors wherein it is majorly used for drug development and quality control. Furthermore, its application in liquid chromatography-mass spectrometry (LC-MS) systems only strengthens its position as one of the most widely used grades around different laboratories. This grade still maintains cost-effectiveness necessary for routine tests where stable performance should be guaranteed without paying extra costs associated with higher purities.

By Application

The acetonitrile market is segmented based on its application into laboratory, pharmaceutical, agricultural chemicals, specialty chemicals, and others. In 2023, the pharmaceutical industry held a significant 41.3% market share. This dominance is attributed to heavy applications of acetonitrile as a solvent in the production of antibiotics. It is mainly due to its prominent physical properties such as having low freezing point (-45°C), boiling point (81.6°C) and viscosity which are good for any kind of solvents. Low toxicity compared to other solvents such as dichloromethane has made it gain popularity over them, thereby, making it safer in terms of pharmaceutical applications too.

Acetone nitrile is used extensively in the production of vitamins, antibiotics, steroids and painkillers among other drug types in the acetonitrile market. According to reports, this demand is expected to grow significantly over the next few years especially in countries like China and India which are still developing rapidly. For example, it has been estimated that India’s pharmaceutical market will be worth about US$ 130 billion by 2030 with the increasing access to healthcare services and rising prevalence of chronic diseases. Similarly, the market forecast show that China’s pharmaceutical market could reach up to US$ 322 billion by 2025. Such growth patterns indicate that a lot more acetone nitrile would be needed in future hence making its use very important within the wider context of expanding healthcare systems worldwide.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia Pacific region generates more than 50.5% of the global revenue in the acetonitrile market due to its robust industrial growth, particularly in pharmaceuticals, agrochemicals, and chemical synthesis. The presence of huge manufacturing centers, rising R&D activities, and expanding end-use industries are among the main reasons behind this dominance in the market. For example, China accounts for approximately 35% of all acetonitrile consumed within this region alone due to strong presence of drug production facilities. Additionally, India witnessed a growth in the acetonitrile consumption by 12% in the past years each thanks to growing generic drugs production. The region’s chemical industry is also booming, with a projected 8% CAGR, further propelling acetonitrile demand. Japan’s advanced chemicals processing industry coupled with South Korea’s biotechnological sector also contribute greatly towards these regions’ domination.

As of 2024, Europe is the second largest acetonitrile market thanks to strict regulations in the pharmaceutical industry and an established chemical sector. For drug synthesis and purification, the European pharmaceutical industry – which accounts for 25% of worldwide output – relies heavily on this compound. With robust chemical and pharmaceutical sectors, Germany is the largest market in Europe consuming 30% of all European acetonitrile supplies. France and UK have a shared 40% market portion because they are making great strides in bioscience as well as chemical research fields. Additionally, there is a substantial need for it from European geochemists who see their market grow by 5% every year.

In North America, the main driving force behind the acetonitrile market is the large investments made in the pharmaceutical industry as well as biotechnology. Among these countries, United States takes 70% of the regional market share, which reflects its continuous growth rate of 6% per annum in demand for acetonitrile due to its wide range use in pharmaceuticals. The second largest country in terms of market size within this region is Canada accounting for about 15%. This figure shows how much emphasis they have put on developing their biotech sectors. In addition to that, agrochemicals industry also contributes greatly towards realization of these goals by growing at a rate of 4% every year. Similarly, chemicals produced by American companies are projected to grow steadily with a CAGR of equaling 3.5%. It is therefore through such innovations coupled with value added chemical production where North America can maintain its position as one among top global leaders.

Top Players in Global Acetonitrile Market:

- Asahi Kasei Corporation

- Avantor Performance Materials, LLC

- Concord Technology (Tianjin) Co., Ltd.

- Concord Technology (Tianjin) Co., Ltd.

- Formosa Plastic Corporation

- GFS Chemicals, Inc.

- Honeywell Research Chemicals

- Imperial Chemical Corporation

- INEOS AG

- Mitsubishi Chemical Corporation

- Nantong Acetic Acid Chemical Co., Ltd.

- Nova Molecular Technologies, Inc.

- Pharmco-Aaper

- Qingdao Shida Chemical Co., Ltd.

- Robinson Brothers

- Shanghai Secco Petrochemical Company Limited

- Standard Reagents Pvt. Ltd.

- Taekwang Industrial Co., Ltd

- Tedia Company, Inc

- Unicel

- Other Prominent Players

Market Segmentation Overview:

By Type:

- Derivative

- Solvent

By Grade (Purity):

- 99.99%

- 99.9%

- 99.8%

- 99.5%

- Others

By Application:

- Laboratory

- DNA and RNA Synthesis

- Extraction

- High-Performance Liquid Chromatography (HPLC) Solvents

- Organic Synthesis

- Agricultural Chemical

- Pharmaceutical

- Synthetic Medicine

- Insulin

- Antibiotics

- Vitamins

- Extraction Solvent

- Synthetic Medicine

- Specialty Chemicals

- Others

By End-User:

- Agricultural Industry

- Analytical Industry

- Pharmaceutical Industry

- Others

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Poland

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 390.3 Mn |

| Expected Revenue in 2032 | US$ 626.6 Mn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 5.4% |

| Segments covered | By Type, By Grade (Purity), By Application, By End-User, By Region |

| Key Companies | Asahi Kasei Corporation, Avantor Performance Materials, LLC, Concord Technology (Tianjin) Co., Ltd., Concord Technology (Tianjin) Co., Ltd., Formosa Plastic Corporation, GFS Chemicals, Inc., Honeywell Research Chemicals, Imperial Chemical Corporation, INEOS AG, Mitsubishi Chemical Corporation, Nantong Acetic Acid Chemical Co., Ltd., Nova Molecular Technologies, Inc., Pharmco-Aaper, Qingdao Shida Chemical Co., Ltd., Robinson Brothers, Shanghai Secco Petrochemical Company Limited, Standard Reagents Pvt. Ltd., Taekwang Industrial Co., Ltd, Tedia Company, Inc, Unicel, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0122128 | Delivery: 2 to 4 Hours

| Report ID: AA0122128 | Delivery: 2 to 4 Hours

.svg)