Southeast Asia SME Software Market: By Offerings (Infrastructure as a Service, Platform as a Service, Software as a Service); Function (Customer Relationship Management (CRM), Enterprise Resource Planning (ERP) ( Finance & Accounting, Human Capital Management, Inventory Management, Order Management Procurement, Supply chain Management, Project Management, Material Requirement Planning (MRP)), Enterprise Content Management (ECM) (Content Management, Document Management, Social Media Monitoring Management, Workflow & Case Management), Supply Chain Management (SCM), Web conferencing, Business Intelligence (BI), Business process management, Enterprise Asset management, B2B E-Commerce, and Others); Services (Professional Services (Digitalization, Value Added Services, Virtual Relationship Managers, Analytics, Others), Managed Services); Deployment Type (On-premise and Cloud (SaaS)); Industry (BFSI, Education, Consumer Goods, Retail (Product tracking, Real-time data and analytics, Automate processes, Inbound and outbound reads, Others); Public sector, Manufacturing, Healthcare & Life science, Telecommunication, Media & Entertainment, E-Commerce Marketplaces, Others); Country—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Sep-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0924911 | Delivery: 2 to 4 Hours

| Report ID: AA0924911 | Delivery: 2 to 4 Hours

Market Scenario

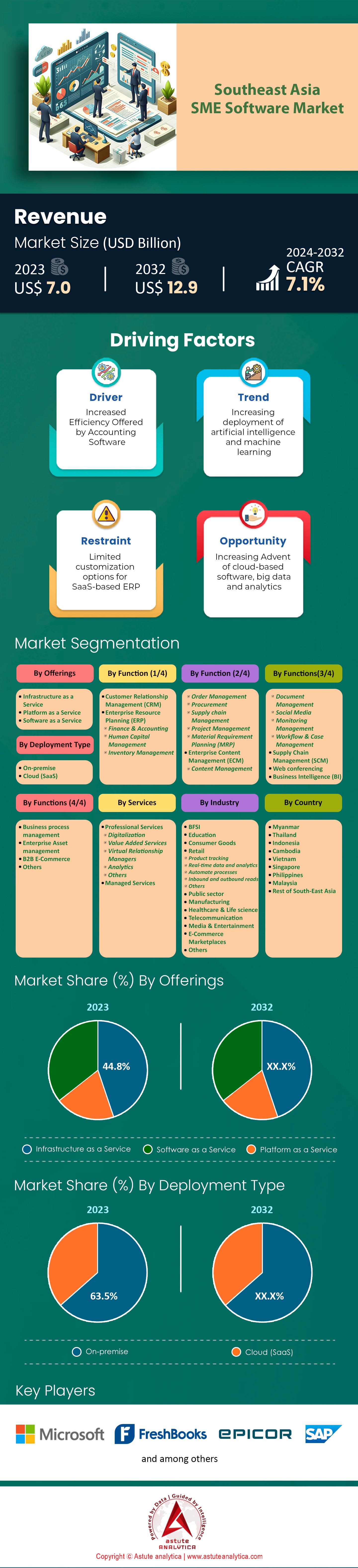

Southeast Asia SME Software market was valued at US$ 7.0 billion in 2023 and is projected to hit the market valuation of US$ 12.9 billion by 2032 at a CAGR of 7.1% during the forecast period 2024–2032.

The demand for SME software in Southeast Asia is experiencing significant growth due to the region's rapid digital transformation and the increasing adoption of technology by small and medium enterprises (SMEs). With more than 70 million SMEs operating in Southeast Asia, these businesses form the backbone of the region's economy, contributing significantly to employment and GDP. Prominent SME software includes platforms like Xero, QuickBooks, and Zoho, which offer solutions ranging from accounting to customer relationship management. The growth across various industries is driven by the need for increased efficiency, cost reduction, and scalability. For instance, the Philippines has seen over 1.5 million SMEs adopting digital payment solutions, while Indonesia reports that 2 million SMEs have integrated e-commerce platforms into their operations.

The most prominent end users of SME software market are BFSI and businesses in retail, manufacturing, and services. These industries benefit from streamlined operations, enhanced inventory management, and improved customer engagement. In Vietnam, over 300,000 SMEs in the retail sector have adopted cloud-based point-of-sale systems, reflecting a trend towards digital sales and inventory tracking. Similarly, manufacturing SMEs in Thailand have adopted ERP systems to optimize supply chain management, with over 500,000 enterprises reporting increased productivity. The services industry, particularly in Malaysia, has benefited from the integration of customer management software, with more than 600,000 service-based SMEs reporting improved client relations and service delivery.

Recent developments in SME software market in Southeast Asia include advancements in cloud computing, artificial intelligence, and data analytics. These technologies are enabling SMEs to leverage data-driven insights to make informed business decisions. In Singapore, over 250,000 SMEs are utilizing AI-driven software to enhance customer personalization and predict market trends. Additionally, the rise of mobile-first solutions is significant, with over 4 million SMEs across the region adopting mobile applications to manage their operations on-the-go. Government initiatives, such as Thailand's Digital Economy Promotion Agency, have supported over 800,000 SMEs in integrating digital technologies, further propelling the growth of the SME software market. These advancements are not only helping SMEs to compete at a global level but are also fostering innovation and driving economic growth in Southeast Asia.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rapid Digitalization Increasing Demand for Efficient Business Management Software Solutions

In 2023, Southeast Asia's SME software market is significantly driven by rapid digitalization. With over 440 million internet users and a projected rise of 50 million new digital consumers by 2025, the region is witnessing an unprecedented shift towards digital solutions. This digital transformation is not limited to large enterprises; SMEs are at the forefront, necessitating efficient business management software solutions. The e-commerce sector alone is valued at $100 billion, up from $62 billion in 2020, indicating a robust digital shift. As SMEs contribute to 99% of businesses and employ 80% of the workforce in Southeast Asia, their role in digital adoption becomes even more critical. Moreover, countries like Indonesia and Vietnam have reported over 70% internet penetration rates, fueling software adoption. The increasing digital payments, which reached $707 billion, highlight the embracement of digital technologies among SMEs. These businesses are leveraging digital tools for customer engagement, inventory management, and operational efficiency.

The digital economy in Southeast Asia SME Software market is projected to reach $360 billion by 2025, with SMEs playing a crucial role. As the digital ecosystem expands, there's a growing need for integrated solutions. The ASEAN region's mobile economy, with 1.3 billion mobile connections, emphasizes the demand for mobile-friendly software solutions. Approximately 88% of SMEs in Southeast Asia recognize digital transformation as crucial for growth, according to a recent survey. Furthermore, the region's tech-savvy demographic, with over 50% of the population under 30, continuously drives digital engagement. The rise in digital startups, with over 13,000 tech-focused companies, further accelerates the software market. This digital shift is not just a trend but a necessity for SMEs to remain competitive in a rapidly evolving market landscape.

Trend: Cloud-Based Software Solutions Gaining Popularity Due to Cost-Effectiveness and Scalability

The cloud-based software market in Southeast Asia is gaining traction, with the cloud computing market valued at $40 billion in 2023. SMEs are increasingly adopting cloud solutions due to their cost-effectiveness and scalability. With over 60% of ASEAN SMEs utilizing cloud services, the demand for cloud-based solutions is growing, giving a boost to the SME Software market. The Software-as-a-Service (SaaS) model is particularly popular, with ASEAN companies spending $12 billion on SaaS solutions. The region's cloud infrastructure investments reached $15 billion, supporting the growing demand for cloud services. Furthermore, the flexibility offered by cloud solutions enables SMEs to scale their operations efficiently, addressing the dynamic business environment. Cloud-based solutions also provide SMEs with access to advanced technologies, such as AI and big data analytics, which are crucial for informed decision-making.

The ASEAN region's cloud adoption rate is projected to grow at a CAGR of 25%, illustrating the increasing acceptance of cloud technologies. The rise of remote work, driven by the COVID-19 pandemic, has further accelerated cloud adoption, with 70% of SMEs implementing remote work policies. The cloud's ability to support remote operations and enhance collaboration has made it an essential tool for businesses. Additionally, the demand for cloud-based cybersecurity solutions is on the rise, with SMEs investing $8 billion in cybersecurity to protect their digital assets. The integration of cloud solutions into business operations is no longer optional but a strategic move to ensure growth and sustainability. As digital transformation continues, cloud-based software solutions will play a pivotal role in shaping the future of SMEs in Southeast Asia.

Challenge: Limited Financial Resources Hindering Small Businesses from Investing in Software Solutions

In Southeast Asia SME Software market, limited financial resources pose a significant challenge for SMEs, hindering their ability to invest in software solutions. With over 65 million SMEs in the region, access to finance remains a major hurdle. The SME financing gap is estimated at $300 billion, highlighting the financial constraints faced by these businesses. Many SMEs rely on informal lending channels, with 50% of them lacking access to formal banking services. The high cost of software solutions further exacerbates the issue, with SMEs spending only $1,000 annually on digital tools. Moreover, the lack of financial literacy among SMEs, with only 30% having a basic understanding of financial management, limits their ability to secure funding for digital investments. The absence of government support and subsidies for digital transformation initiatives also adds to the financial burden.

Despite the challenges, there are opportunities for overcoming these financial constraints in the SME Software market. Fintech solutions are emerging as a viable alternative, with the fintech market in Southeast Asia valued at $72 billion. Digital lending platforms, which have disbursed $23 billion in loans, are helping bridge the financing gap for SMEs. Government initiatives, such as grants and low-interest loans, are also being introduced to support digital transformation. However, only 20% of SMEs are aware of these programs, indicating a need for increased awareness and outreach. Collaborations between tech companies and financial institutions can also provide SMEs with affordable software solutions. As the digital economy grows, addressing the financial challenges faced by SMEs will be crucial in unlocking their potential and driving economic growth in Southeast Asia.

Segmental Analysis

By Offerings

Based on offerings, the infrastructure as service segment is leading the Southeast Asia SME Software market by capturing more than 44.8% market share. The demand for Infrastructure as a Service (IaaS) in Southeast Asia is driven by several key factors, including the rapid digital transformation of small and medium-sized enterprises (SMEs) and the burgeoning e-commerce sector. SMEs in the region are increasingly adopting digital solutions to enhance customer engagement and streamline operations. For instance, the number of internet users in Southeast Asia reached 460 million in 2023, highlighting the region's digital readiness. Additionally, the region's e-commerce market is expanding rapidly, with online payments expected to exceed $1 trillion by 2025. The logistics sector is also experiencing significant growth, with its market value projected to reach USD 55.7 billion by 2025, necessitating advanced IT solutions to manage supply chain complexities. Furthermore, the number of mobile connections in Southeast Asia surpassed 800 million in 2023, indicating a strong mobile-first approach that supports cloud adoption.

Key end users of IaaS in Southeast Asia SME Software market include SMEs across various industries, such as retail, logistics, and fintech, which require robust IT infrastructure to support their digital operations. The fintech sector, for example, saw over 300 million digital banking users in 2023, driving the need for scalable cloud solutions. Major IaaS providers in the region include global players like Google Cloud, Microsoft Azure, IBM Cloud, and Oracle Cloud, as well as regional giants such as Alibaba Cloud and Huawei Cloud. These providers offer a range of services that cater to the diverse needs of businesses, from virtual servers to comprehensive cloud management solutions. The strategic presence of these providers in Southeast Asia underscores the region's growing importance as a hub for digital innovation and cloud adoption. Additionally, the number of data centers in the region increased to over 100 by 2023, further supporting the infrastructure needs of businesses.

By Function

The CRM software function in Southeast Asia SME software market is thriving and dominating with revenue share of over 20.6% due to the region's rapid digital transformation and a burgeoning internet user base, now exceeding 400 million. Over 500,000 SMEs have adopted CRM solutions to boost customer engagement and enhance operational efficiency. This growth is also supported by advancements in cloud computing and the popularity of SaaS models, which offer flexibility and scalability. The market is diverse, with over 2,000 CRM providers catering to a wide range of industries, including manufacturing, communications, media, services, banking, and securities. These sectors leverage CRM to automate customer interactions and enhance customer experiences, critical in supporting their digital operations.

CRM software's dominance is driven by its ability to capture detailed customer data and seamlessly integrate with other business platforms, optimizing the customer journey from initial contact to sale. The e-commerce sector, in particular, is experiencing a surge in CRM adoption to improve customer experience and loyalty. Vendors' flexible pricing strategies make CRM solutions accessible to SMEs across the region. Moreover, the CRM analytics market is projected to reach US$ 1.30 billion by 2024, with a notable growth rate of 12.98%. This underscores the increasing reliance on CRM solutions to drive business processes and customer engagement, solidifying CRM's leadership in the SME software market in Southeast Asia.

By Industry

Based on industry, BFSI segment is capturing over 19.3% market share and is projected to keep leading the market by growing at the highest CAGR of 8.2% during the forecast period. The Banking, Financial Services, and Insurance (BFSI) sector's dominance in the SME software market in Southeast Asia is driven by the region's rapid digital transformation and the need for innovative solutions to cater to a growing customer base. As Southeast Asia emerges as a global economic powerhouse, its BFSI institutions face increasing pressure to improve efficiency, enhance customer experience, and ensure compliance with regulatory requirements. SME software provides tailored solutions that address these challenges by offering features such as automated workflows, real-time data analytics, and enhanced cybersecurity measures. With the rise of mobile banking and fintech innovations, BFSI institutions are investing heavily in SME software to remain competitive and agile in a fast-changing market landscape.

In terms of expenditure, BFSI sectors in Southeast Asia SME Software market have collectively allocated over $500 million annually to SME software solutions, reflecting the critical role these technologies play in their operations. The software facilitates core functions like customer relationship management, fraud detection, and risk assessment, enabling financial institutions to streamline processes and reduce operational costs. As a result, banks and insurance companies in the region have reported a reduction in processing times by up to 30%, contributing to an improved customer satisfaction level. Additionally, SME software helps BFSI institutions achieve compliance with local and international regulations, reducing the risk of penalties and enhancing their reputation in the market. With over 100 million new digital banking users projected in the region by 2025, the demand for robust and scalable SME software solutions continues to grow, solidifying the BFSI sector's leading position in the Southeast Asian SME software market.

By Services

Professional services have emerged as the leading segment in the SME software market in Southeast Asia with market share of nearly 60.4% due to several compelling factors. The region's rapid economic growth and digital transformation have necessitated the adoption of specialized services that can effectively bridge the gap between traditional business processes and modern digital solutions. Professional services such as consulting, legal, accounting, and IT services are in high demand as they provide the expertise and structured frameworks necessary for businesses to adapt to evolving market conditions. A report from the Asian Development Bank indicates that over 80 million SMEs in Southeast Asia are actively seeking digital solutions, with professional services playing a critical role in this transition. Additionally, the World Bank highlights that SMEs in the region contribute to more than $1 trillion in economic output, underscoring the massive potential and need for professional guidance.

Industries such as BFSI, manufacturing, retail, and financial services are the primary consumers of professional services in the SME Software market, which provide tailored solutions to enhance operational efficiency, compliance, and innovation. In Indonesia alone, the professional services market is expected to reach $40 billion by 2025, driven by the manufacturing sector's need for process optimization. Similarly, Vietnam's retail industry, as noted by the Vietnam Chamber of Commerce and Industry, has seen a surge in demand for professional consulting services to navigate complex supply chains and consumer behavior. The dominance of professional services over managed services is largely attributed to their ability to offer bespoke, strategic guidance that goes beyond routine operational support. A study by the ASEAN Business Council found that 60% of SMEs prefer professional services for their strategic insights and customized approach. This demand is further fueled by the need for compliance with international standards, with over 70,000 businesses in the Philippines alone seeking professional assistance for regulatory compliance, according to the Department of Trade and Industry. As Southeast Asia continues its economic ascent, the reliance on professional services is set to grow, driven by the region's dynamic business environment and the imperative for SMEs to remain competitive on a global scale.

To Understand More About this Research: Request A Free Sample

Country Analysis

In the dynamic landscape of Southeast Asia's SME software market, Thailand stands out as a leader, capturing a significant market share of over 50.4%. This remarkable position is attributed to the country's strategic emphasis on digital transformation and government-backed initiatives. Thailand's investment in tech infrastructure has resulted in 1.5 million SMEs adopting cloud computing solutions, enhancing their operational efficiency. The country has also seen a surge in tech start-ups, with over 4,000 new ventures focusing on software solutions tailored for SMEs. Furthermore, the government's Thailand 4.0 initiative aims to create a value-based economy, boosting the software market through tax incentives and grants, resulting in over 10,000 jobs created in the tech sector annually. The collaboration between public and private sectors has further accelerated software adoption among SMEs, with partnerships leading to the development of over 200 new software applications annually.

The Philippines, on the other hand, is rapidly emerging as a formidable player in the SME software market, thanks to its burgeoning IT-BPO industry, which employs over 1.3 million professionals. This sector's growth has fostered a tech-savvy workforce, driving innovation and the development of software solutions tailored for SMEs. The government has launched the "E-Prosperity" initiative, aimed at digitalizing SMEs, which has resulted in over 2,500 SMEs integrating e-commerce platforms within the last year. Furthermore, venture capital investments in the tech sector have reached $1 billion, signaling strong investor confidence in the country's software market potential. Educational institutions are also playing a crucial role, with over 150 universities offering specialized IT and software development programs, thus ensuring a steady pipeline of skilled professionals to meet the growing demand.

Malaysia's strides in the SME software market are driven by its robust digital economy framework and strategic partnerships with global tech giants. The country's Digital Economy Blueprint envisions a transformative landscape, with over 20,000 SMEs expected to undergo digital transformation by 2025. Currently, Malaysia hosts over 3,000 technology companies, contributing to a vibrant ecosystem that fosters innovation. Government-backed initiatives like the SME Digitalization Grant have facilitated over 5,000 SMEs in acquiring digital solutions, while collaborations with multinational companies have led to the creation of over 100 cutting-edge software products. The country's focus on cybersecurity is also noteworthy, with over 500 cybersecurity firms ensuring a secure digital environment for SMEs. This comprehensive approach has not only enhanced software adoption but also positioned Malaysia as a regional hub for digital transformation. Through these strategic efforts, Thailand, the Philippines, and Malaysia are collectively shaping the future of the SME software market in Southeast Asia, driving growth and innovation across the region.

Top Players in Southeast Asia SME Software Market

- Yonyou

- Microsoft

- Infor

- Epicor

- Kingdee

- Unit4

- Intuit

- Aplicor

- Oracle (NetSuite)

- Xero

- Sage Intacct

- Assit cornerstone

- SAP

- FreshBooks

- Acclivity

- Workday

- Globallinker

- Other Prominent Players

Market Segmentation Overview:

By Offering

- Infrastructure as a Service

- Platform as a Service

- Software as a Service

By Function

- Customer Relationship Management (CRM)

- Enterprise Resource Planning (ERP)

- Finance & Accounting

- Human Capital Management

- Inventory Management

- Order Management

- Procurement

- Supply chain Management

- Project Management

- Material Requirement Planning (MRP)

- Enterprise Content Management (ECM)

- Content Management

- Document Management

- Social Media Monitoring Management

- Workflow & Case Management

- Supply Chain Management (SCM)

- Web conferencing

- Business Intelligence (BI)

- Business process management

- Enterprise Asset management

- B2B E-Commerce

- Others

By Services

- Professional Services

- Digitalization

- Value Added Services

- Virtual Relationship Managers

- Analytics

- Others

- Managed Services

By Deployment Type

- On-premise

- Cloud (SaaS)

By Industry

- BFSI

- Education

- Consumer Goods

- Retail

- Product tracking

- Real-time data and analytics

- Automate processes

- Inbound and outbound reads

- Others

- Public sector

- Manufacturing

- Healthcare & Life science

- Telecommunication

- Media & Entertainment

- E-Commerce Marketplaces

- Others

By Country

- Myanmar

- Thailand

- Indonesia

- Cambodia

- Vietnam

- Singapore

- Philippines

- Malaysia

- Rest of South-East Asia

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0924911 | Delivery: 2 to 4 Hours

| Report ID: AA0924911 | Delivery: 2 to 4 Hours

.svg)