Global 5G FWA CPE Market: By Installation (Indoor and Outdoor); Branding (White Label and Brand); End Users (Commercial (BFSI, Telcom, IT, Healthcare, Media and Entertainment, Retail, Education, Others, Residential); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 26-Apr-2024 | | Report ID: AA0823565

Market Scenario

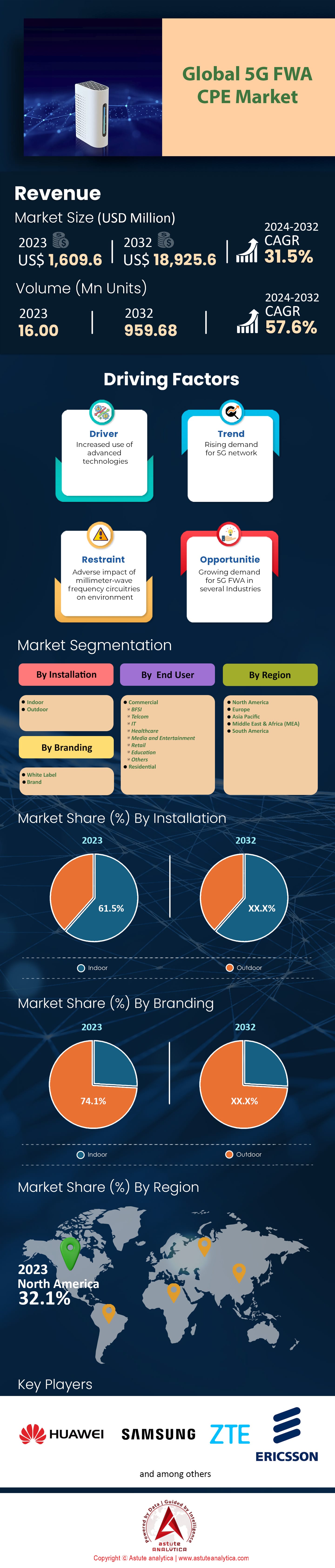

Global 5G FWA CPE market was valued at US$ 1,609.6 million in 2023 and is projected to surpass the valuation of US$ 18,925.6 million by 2032 at a CAGR of 31.5% during the forecast period 2024–2032. This growth is anticipated due to the shift from traditional broadband connections to 5G FWA CPE, providing more reliable and faster connectivity. It has been found that consumers, especially from semi-urban areas are willing to pay a premium for better services. Approximately 65% of consumers in developed markets have shown an interest in upgrading to 5G FWA CPE for its remarkable speed and reliability.

In the consumer base analysis, it's noted that by the end of 2023, the 5G FWA CPE market has expanded to reach an estimated 190 million users across the globe, particularly in urban areas where high-speed connectivity is paramount. The penetration rate is about 25% in developed countries, but it has a lower penetration of around 10% in developing markets. Wherein, the major producers of 5G FWA CPE, including companies like Huawei, Ericsson, and Nokia, have adopted various marketing and growth strategies. For instance, Huawei has invested roughly $2 billion in Research and Development in 2022, focusing on innovation and technology advancements. Ericsson's marketing strategy revolves around targeted customer engagement, with an investment of $1.5 billion in global marketing campaigns that highlight the benefits of 5G FWA CPE.

The study found that the government’s role is vital in supporting the last-mile connectivity. In the European Union, around €4 billion has been earmarked for the expansion of 5G FWA CPE from 2021 to 2025. Similarly, the U.S. government has invested $3 billion in the Rural Digital Opportunity Fund, aimed at promoting 5G FWA CPE in underserved areas.

With ongoing technological advancements, regulatory support, and targeted marketing strategies, the 5G FWA CPE market is poised for robust growth in the coming years. Attention to rural and semi-urban areas, coupled with consumer readiness to adopt new technologies, adds to the optimistic market outlook. The focus on emerging markets, where untapped potential could offer significant growth opportunities, emphasizes the multifaceted and promising nature of the 5G FWA CPE market. In this market, the players will have to carefully navigate this dynamic and evolving landscape, balancing technological innovation, consumer interest, government support, and competitive strategies to achieve sustainable success.

To Get more Insights, Request A Free Sample

Market Dynamics

Trend: Shift Towards Remote Work and IoT Integration

The widespread shift towards remote work and the integration of the Internet of Things (IoT) is one of the key trend in the global 5G FWA CPE market. The COVID-19 pandemic has catalyzed a move towards remote working across various industries, creating an urgent need for high-speed and reliable internet connectivity. 5G FWA CPE offers the required bandwidth and low latency to support multiple devices, enabling seamless video conferencing and data transfer even in the rural areas without needing fiber optics cable. Additionally, the growing popularity of smart homes and IoT devices that require robust connectivity further fuels the demand for 5G FWA CPE.

As per recent studies, the global number of IoT connected devices is expected to reach 30 billion by 2025, driving the need for efficient and dependable connectivity solutions like 5G FWA CPE. This trend highlights the broader applications of 5G technology, extending beyond mere internet access to a cohesive and interconnected digital ecosystem.

Challenge: Spectrum Allocation and Regulatory Compliance

A significant challenge in the global 5G FWA CPE market is the complexity related to spectrum allocation and regulatory compliance. The deployment of 5G technology requires specific radio frequency bands that need careful coordination and allocation by regulatory bodies. In some regions, the scarcity of available bands, coupled with high costs of auctioning, has hindered the seamless rollout of 5G FWA CPE. For instance, India auctioned its 5G spectrum at whooping cost of $19 billion in August 2022. Moreover, compliance with diverse regulatory frameworks across different countries adds layers of complexity. For instance, as of 2023, the delay in spectrum allocation in some European countries has slowed down the overall 5G adoption rate. Regulatory alignment and the efficient allocation of the spectrum are critical to ensure that the technology reaches its full potential.

Overcoming this challenge requires coordinated efforts by governments, regulatory bodies, and industry stakeholders to create a conducive environment for the growth and implementation of 5G FWA CPE.

Opportunity: India to Offer Lucrative Revenue Opportunity

The future of India's 5G FWA CPE market appears promising, characterized by substantial growth potential and numerous opportunities. India, with its vast population of over 1.3 billion and increasing urbanization, is witnessing a growing demand for high-speed internet connectivity. As of 2023, the 5G FWA CPE penetration rate in India stands at around 6%, which is relatively low compared to developed countries, but presents a vast untapped market for expansion. Recently, Bharti Airtel has launched India’s first 5G FWA services across National capital Delhi and Financial capital Mumbai. On the other hand, Reliance Jio is likely to launch its Air fiber service soon, which would further intensify the demand for 5G FWA CPEs in the country.

The Indian government has shown a strong commitment to promoting 5G technology. In the Union Budget 2021-22, an outlay of INR 12,000 crores was allocated for a three-year project to boost the 5G infrastructure. This project focuses on laying optical fiber cables and upgrading existing networks to ensure seamless connectivity. The Telecommunications Standards Development Society, India (TSDSI) has been actively working on setting standards for 5G technology, ensuring compliance with global norms.

Major telecom providers in India, such as Reliance Jio, Bharti Airtel, and Vodafone Idea, have been conducting trials and investing in 5G technology. Reliance Jio, for instance, announced an investment of $2 billion for the development of indigenous 5G technology, aiming to provide services across 1,000 cities by 2025. This aligns with the country's 'Make in India' initiative, promoting domestic manufacturing and reducing reliance on imports in the global 5G FWA CPE market. India's young and tech-savvy population, with approximately 65% of the population under the age of 35, signifies a huge consumer base ready to adopt advanced technologies like 5G. By 2025, the number of 5G connections in India is projected to reach around 70 million, growing at a Compound Annual Growth Rate (CAGR) of 22%. The urban areas, particularly the Tier 1 cities, are expected to lead this adoption due to better infrastructure and higher disposable incomes.

However, the cost of 5G FWA CPE equipment and services is a critical factor for the Indian market, where price sensitivity plays a vital role in consumer decisions. In line with this, Bharti Airtel in August 2023, launched its Xtreme Air fiber services and start offering its 5G FWA CPE at around $30. However, with a projected reduction in the cost of 5G-enabled devices by 30% over the next five years, affordability is likely to increase, further fueling the adoption rate. The development of infrastructure, especially in rural and semi-urban areas, is another critical area that requires attention, with only 31% of rural India having access to broadband connectivity.

Segmental Analysis

By Installation

The installation segment of the global 5G FWA CPE market is bifurcated into indoor and outdoor categories, with the indoor segment holding the highest share of 61.5%. This dominance can be attributed to the growing demand for high-speed internet connectivity within homes and businesses. Indoor installations often require less infrastructure and are more user-friendly, which further adds to their appeal. In addition, the indoor segment is projected to grow at an impressive CAGR of 32.1%, driven by the increased integration of smart devices, work-from-home trends, and the proliferation of IoT in residential and commercial spaces. The outdoor segment, though smaller, complements the indoor segment by providing broader connectivity options, especially in areas where indoor installations may be challenging.

By Branding

The branding segment is divided into white label and brand categories, with the brand segment holding the highest share at 74.1%. Established brands in the 5G FWA CPE market have built trust and recognition, which contribute to their significant market share. The quality assurance and consistent performance offered by renowned brands drive their preference among consumers. On the other hand, the white label segment is projected to grow at the fastest CAGR of over 32% in the coming years. This growth can be attributed to the flexibility and cost-effectiveness offered by white-label products. Small and medium enterprises (SMEs) are increasingly adopting white-label solutions to offer customized and affordable 5G FWA CPE to their clients, thus propelling this segment's growth.

By End Users

The end user segment of the global 5G FWA CPE market is classified into commercial (including industries such as BFSI, telcom, IT, healthcare, media and entertainment, retail, education, and others) and residential categories. The commercial segment holds the highest share at 71.8%, reflecting the critical role of 5G FWA CPE in modern business operations. With the rapid digitalization across various industries, the need for reliable and fast internet connectivity is paramount. Sectors like BFSI, Telcom, and Healthcare are leveraging 5G technology to enhance their services and operational efficiency. The commercial segment is also projected to keep growing at the highest CAGR of 32% during the forecast period, fuelled by the continuous technological advancements and the expansion of 5G networks in emerging markets. The residential segment, though smaller, is witnessing growth driven by the increasing adoption of smart home technologies and the demand for high-quality entertainment and remote work solutions.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The global 5G FWA CPE market showcases distinct regional variations, with North America dominating the market with over 32% market share. The North American region, particularly the United States and Canada, has been at the forefront of 5G FWA CPE adoption. In the United States, significant investments in 5G infrastructure, favorable government policies, and the presence of major telecom giants have driven the rapid growth. The Federal Communications Commission (FCC) has allocated substantial spectrum for 5G deployment, and approximately 20% of U.S. households are projected to adopt 5G FWA CPE by 2025. In Canada, the government has invested over CAD 1.7 billion in the Universal Broadband Fund to enhance connectivity across the country. The Canadian Radio-television and Telecommunications Commission (CRTC) has set ambitious targets to ensure that 90% of Canadian households have access to high-speed internet by 2030, significantly contributing to the 5G FWA CPE market's growth.

The Asia-Pacific region, though trailing behind North America, exhibits promising potential in the market, especially in countries like India, China, and Australia. China, with its robust manufacturing capabilities and substantial investments in 5G technology, is a major player. The Chinese government allocated CNY 400 billion for 5G infrastructure development in its 14th Five-Year Plan (2021-2025), with a goal to achieve 600 million 5G connections by 2025.

India's 5G FWA CPE market is still in its nascent stage but shows tremendous growth prospects. As mentioned earlier, the penetration rate stands at around 6%, with projections to reach 300 million 5G connections by 2025. The Indian government's investment of INR 12,000 crores for a three-year project to bolster 5G infrastructure and telecom operators spending of $19 billion will be a significant driving factor in this growth.

Australia, with its commitment to enhancing digital connectivity, especially in remote areas, is also contributing to the growth of the 5G FWA CPE market in the Asia-Pacific region. The Australian government's investment of AUD 3.5 billion in the National Broadband Network (NBN) aims to provide high-speed internet to 100% of Australian premises by 2023, including through 5G technology.

Top Players in the Global 5G FWA CPE Market

- Arqiva

- AT&T Inc.

- Cisco

- Cohere Technologies, Inc.

- Ericsson

- Hrvatski Telekom

- Huawei

- Samsung

- Nokia

- ZTE

- Other Prominent Players

Market Segmentation Overview:

By Installation

- Indoor

- Outdoor

By Branding

- White Label

- Brand

By End User

- Commercial

- BFSI

- Telcom

- IT

- Healthcare

- Media and Entertainment

- Retail

- Education

- Others

- Residential

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)