Global 3D NAND Flash Memory Market: By Type (Single-level cell, Multi-level cell, Triple-level cell, Quad-level cell, Penta-level cell); Application (Camera, Laptops & PCs, Smartphones & Tablets, Others); End Users (Automotive, Consumer Electronics, Enterprise, Healthcare, and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Mar-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA1023661 | Delivery: 2 to 4 Hours

| Report ID: AA1023661 | Delivery: 2 to 4 Hours

Market Scenario

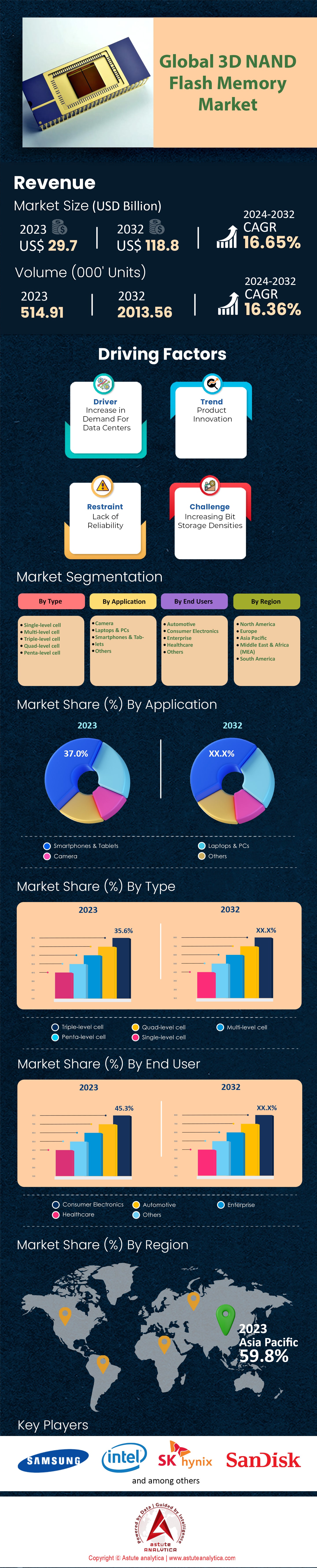

Global 3D NAND Flash Memory Market was valued at US$ 29.7 billion in 2023 and is projected to surpass the market valuation of US$ 118.8 billion by 2032 at a CAGR of 16.65% during the forecast period 2024–2032.

Rapid technological advancements and dynamic shifts in market dynamics have spurred the global demand for 3D NAND flash memory thanks to the aggressive adoption rate of the innovative technology. By 2022, over 75% of SSDs manufactured leveraged 3D NAND technology, a testament to its superior capabilities and cost-efficiency. This upsurge was further propelled by data centers and smartphone storage expansions, which together accounted for a significant chunk of the market demand. Notably, consumer electronics alone constituted 80% of 3D NAND usage in 2022.

The 3D NAND flash memory market landscape has been primarily characterized by the dominant presence of a few industry giants, notably Samsung, Micron, and SK Hynix. Samsung, in particular, emerged as the market leader, capturing the largest 34% share. This consolidation in market leadership has been accompanied by a series of strategic maneuvers, with major players actively engaging in mergers and acquisitions to fortify their positions. From a regional perspective, the Asia-Pacific region stood out, accounting for over 60% of the global 3D NAND demand in 2022. Within this region, South Korea and China have emerged as pivotal manufacturing hubs, driving innovations and setting industry benchmarks. However, the market grappled with supply constraints in 2019 and 2020, which inadvertently nudged prices upwards due to the COVID-19 pandemic. Additionally, the initial production of higher-layer 3D NAND variants, especially those with 128 layers and above, encountered yield issues, further impacting the supply chain.

Until 2023, the 3D NAND flash memory market has witnessed substantial investments, both in terms of capacity expansion and research & development. In 2022 alone, manufacturers committed over $3.3 billion towards expanding the production capacity for 3D NAND and R&D expenditures. This R&D focus has borne fruit, in 2022, Micron announced the commencement of large-scale production of its cutting-edge 3D NAND chips, featuring 232 layers. This positioned them ahead of competitors like SK Hynix and Samsung Electronics in delivering 3D NAND with over 200 layers. The cost per gigabyte of 3D NAND has seen a reduction of approximately 50% in the past half-decade, while the Average Selling Price (ASP) experienced a 20% year-on-year decline in 2022. As of early 2023, the cost of 3D NAND flash memory has stabilized at 6.2 cents per gigabyte. These favorable economics, coupled with the technology's inherent advantages such as lower power consumption aligning with green energy initiatives, position 3D NAND flash memory for sustained growth. By 2025, it's estimated that this technology will constitute over 95% of all NAND flash memory, a projection that encapsulates the industry's optimistic outlook.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Technological Advancements in Data Storage

The 3D NAND flash memory market is witnessing a transformative phase primarily due to the rapid technological advancements in data storage. As the world continues to digitize, the annual global data creation rate has skyrocketed by 20%, contributing significantly to this surge is the rise of the Internet of Things (IoT). Predictions suggest that by 2025, the world will be interconnected with over 75 billion devices. This digital revolution is not just confined to devices. Every smartphone user today generates a staggering 2GB of data daily. This has invariably led to a 30% growth in cloud storage solutions within just a year.

At the same time, video streaming services, another massive data generator, recorded a 40% spike in user subscriptions. Traditional storage solutions like hard drives are steadily becoming obsolete, experiencing a 15% sales decline. For instance, total HDD shipments in C3Q 2022 were down 13.9% compared with C2Q 2022 (38.4 M versus 44.6M) in the 3D NAND flash memory market. Conversely, the allure of 3D NAND flash memory chips, which boast up to ten times the storage density of their 2D counterparts, is ever-growing. This shift is fueled by a 25% surge in consumer demand for faster devices and the inherent reliability of flash storage, which has a 35% lower failure rate compared to HDDs.

Trend: Increasing Adoption in Consumer Electronics

Consumer electronics, especially devices like smartphones, tablets, and laptops, are increasingly embracing 3D NAND flash memory market. As per our latest findings and deeper analysis of the market, smartphone sales globally could touch 1.3 billion units by 2025. A considerable 70% of new laptop models introduced in the past year favored flash storage, sidelining traditional HDDs. Smart wearables, another booming sector growing at 15% annually, are integrating 3D NAND owing to its efficiency. The trend is not limited to wearable tech; 65% of tablets sold in 2022 featured 3D NAND flash memory. In the gaming world, consoles sales grew by 20%, and there's a discernible shift towards SSDs with 3D NAND to achieve quicker game load times. Devices like Ultra-HD and 4K recording cameras, whose market is growing at 10% annually, are also leaning towards efficient storage solutions like 3D NAND to cater to high-resolution content. Smart TVs, which experienced a 30% market growth, now demand efficient memory solutions due to their built-in apps and streaming capabilities. The 3D NAND market is also benefitting from a 5% reduction in the average cost per GB in the past year, coupled with a global 25% increased demand for faster data access.

Restraint: High Manufacturing Costs and Technical Challenges

The production of 3D NAND necessitates a capital investment that's approximately 10% higher than that for 2D NAND in the global 3D NAND flash memory market. Manufacturing these chips has its intricacies, with complexities rising by 15% due to the vertical layering of more cells. This also increases the risk of interference between cells by 20%. Furthermore, transitioning to more advanced nodes has presented yield issues, marking a 5% uptick. Research and development aren't cheap either; there's been a 30% rise in expenditure to tackle technical challenges unique to 3D NAND.

The switch from planar NAND to its 3D counterpart wasn't seamless, initially causing a 10% dip for manufacturers who grappled with the new technology. Producing 3D NAND mandates advanced lithography techniques, raising production costs by 20%. Although the gap is narrowing, initial failure rates for 3D NAND chips were about 15% higher than 2D NAND. In addition to this, the global semiconductor shortage played its part, causing a temporary 10% price surge for 3D NAND.

Apart from this, steep learning curve associated with its integration into existing systems is slowing down the 3D NAND flash memory market to some extent. For businesses accustomed to older storage technologies, migrating to 3D NAND demands an overhaul of both hardware and software components. This can incur additional costs in terms of training and system optimization, making the transition less appealing for smaller enterprises. As 3D NAND chips become denser with more layers, thermal management also becomes a critical concern. Excess heat can degrade the chip's performance and longevity, necessitating innovative cooling solutions.

Segmental Analysis

By Type

Based on type, the global 3D NAND flash memory market is dominated by the multi-level cell (MLC), holding a substantial 35.6% market share as of 2023 and is anticipated to grow further to reach 37.24% by 2032. This dominant position of MLCs is attributed to their balanced approach, offering both reliability and storage density, making them ideal for mainstream consumer applications such as smartphones, tablets, and SSDs.

However, the Triple-level cell (TLC) segment, which, although currently trailing the MLC with an 18.36% share in 2023, exhibits the most significant growth at a CAGR of 17.23%. This accelerated growth can be attributed to the optimal blend of higher storage capacity and competitive pricing, rendering TLCs increasingly favorable for high-capacity storage solutions.

By Application

Global 3D NAND flash memory market by application is dominated by the smartphones & tablets' segment, holding an impressive 37.0% of the market share, and it’s market share is poised to marginally increase to 38.1% by 2032. This robust prominence can be attributed to the exponential growth of the smartphone industry, coupled with consumers’ insatiable appetite for more storage capacity. As multimedia consumption and app-based activities become more intricate, the demand for 3D NAND flash memory in these devices escalates.

Following closely, the laptops & PCs segment secured the second largest position, with a 32.4% share in 2023. The digital transformation, buoyed by remote working and gaming trends, has propelled the demand for faster, more efficient storage solutions in computing devices. However, the incremental drop suggests a potential market saturation or a shift in data storage preferences within this sector. As a result, the segment is projected to lose it’s revenue to the smartphones and tablet segment.

By End Users

Global 3D NAND flash memory market by end users is led by the consumer electronics segment, capturing a staggering 45.3% of the market share. Its market share is projected to expand even further to 46.2% by 2032 due to the soaring demand for high-capacity and efficient storage in gadgets, from smartphones to smart home devices. As electronic devices grow more sophisticated and data-intensive, the intrinsic need for 3D NAND storage amplifies.

Simultaneously, the automotive segment showcases a burgeoning trend, registering the highest CAGR of 17.25% and is projected to remain the fastest growing segment during the forecast period 2024–2032. Modern vehicles are transitioning into data-centric hubs, equipped with enhanced computational capabilities and an array of sensors. The surge towards autonomous and electric vehicle technology necessitates robust and reliable NAND-flash storage solutions, given their pivotal role in mission-critical operations and advanced entertainment systems. While the consumer electronics sphere continues its robust leadership, the automotive arena is emerging as a dynamic and rapidly expanding segment, driven by technological evolutions in the automotive industry.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The global 3D NAND flash memory market is witnessing a pronounced shift in its regional contributions. The Asia Pacific (APAC) region is at the forefront of this burgeoning industry, largely owing to its technological prowess and extensive manufacturing capabilities. Several factors contribute to APAC's dominance, and to truly comprehend the magnitude. For instance, South Korea, Taiwan, and China together host over 45 major semiconductor manufacturing units specializing in NAND production. China alone has inaugurated 10 new state-of-the-art facilities for NAND flash memory production in the past three years, emphasizing its aggressive push for technological self-reliance. The region's edge is also evident in the sales figures: APAC recorded sales of over 300 million units of devices with integrated 3D NAND flash memory in the last year, signifying the immense consumer demand.

Contrastingly, North America 3D NAND flash memory market, holding over 32% of the market share, operates with a different set of strengths. It's not merely about production capacity but about pioneering next-level technological advancements. A testament to this is the presence of over 25 research and development centers dedicated to NAND technology in the U.S. and Canada. Furthermore, these centers have filed upwards of 2,000 patents related to 3D NAND advancements in the past two years alone. When we look at application, data centers in North America have incorporated 3D NAND solutions in more than 60% of their storage systems, a clear reflection of the region's thrust on efficiency and performance. Additionally, tech giants in the region have procured over 200 million units of 3D NAND flash memory chips in the recent fiscal year, indicating their commitment to integrating this technology across their products and services.

Thus, it is evident that while APAC capitalizes on its manufacturing capability and vast consumer base, North America leans into its innovation-driven ecosystem. Moreover, with the global demand for storage solutions such as smartphones, SSDs, and other electronic devices continually rising – APAC reported an annual consumption increase of 50 million units of such devices, and North America saw an uptick of 24.8 million units – the 3D NAND flash memory market is poised for sustained growth. Both regions, with their distinct strengths, are indispensable to the fabric of this global industry, and their roles are set to evolve as the technological landscape undergoes further shifts.

Top Players in the Global 3D NAND Flash Memory Market

- Advanced Micro Devices

- Apple Inc.

- Intel Corp.

- Lenovo Group Ltd.

- Micron Technology Inc.

- Samsung Electronics Co. Ltd

- SanDisk Corp.

- SK Hynix Inc

- ST Microelectronics

- Toshiba Corp.

- Other prominent players

Market Segmentation Overview:

By Type

- Single-level cell

- Multi-level cell

- Triple-level cell

- Quad-level cell

- Penta-level cell

By Application

- Camera

- Laptops & PCs

- Smartphones & Tablets

- Others

By End Users

- Automotive

- Consumer Electronics

- Enterprise

- Healthcare

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 29.7 Billion |

| Expected Revenue in 2032 | US$ 118.8 Billion |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 16.65% |

| Segments covered | By Type, By Application, By End Users, By Region |

| Key Companies | Advanced Micro Devices, Apple Inc., Intel Corp., Lenovo Group Ltd., Micron Technology Inc., Samsung Electronics Co. Ltd, SanDisk Corp., SK Hynix Inc, ST Microelectronics, Toshiba Corp., Other prominent players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA1023661 | Delivery: 2 to 4 Hours

| Report ID: AA1023661 | Delivery: 2 to 4 Hours

.svg)